Summary Of the Markets Today:

- The Dow closed down 57 points or 0.17%,

- Nasdaq closed down 0.63%,

- S&P 500 closed down 0.46%,

- Gold $2042 up $8.40,

- WTI crude oil settled at $73 up $0.33,

- 10-year U.S. Treasury 3.528% down 0.009 points,

- USD index $101.64 up $0.26,

- Bitcoin $27,722 up $46

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases:

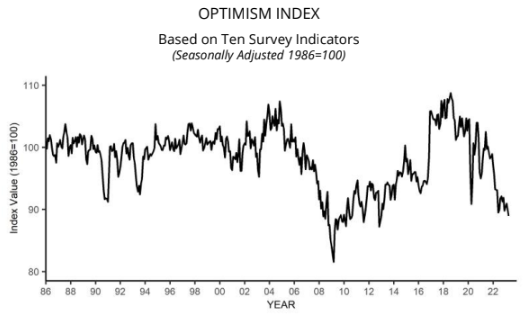

The National Federation of Independent Business (NFIB) released its Small Business Optimism Index for April 2023 on May 9, 2023. The index fell 1.1 points to 89.0, the lowest level since January 2013. This marks the 16th consecutive month that the index has been below the 49-year average of 98. The decline in the index was driven by a number of factors, including:

- Labor quality: The top business problem reported by small business owners was labor quality, with 45% of owners reporting job openings that they could not fill. This is up from 43% in March.

- Inflation: Inflation was the second top business problem, with 24% of owners reporting that inflation was their single most important business problem. This is down from 28% in March.

- Economic outlook: Small business owners are increasingly pessimistic about the near-term economic outlook. The share of owners expecting better business conditions over the next six months fell two points to a net negative 49%. This is the lowest level since April 2020, at the start of the COVID-19 pandemic.

A summary of headlines we are reading today:

- Iran Ramps Up Trade With BRICS Nations

- TotalEnergies Set To Start Drilling In Lebanon Later This Year

- The U.S. Needs To Double The Size Of Its Energy Grid

- Australia Looks To Become World’s Leading Green Hydrogen Producer

- Supertanker Rates Crash 75% After OPEC+ Cuts Oil Supply To Markets

- Jury says Trump must pay E. Jean Carroll $5 million for sexual abuse and defamation

- Fed’s John Williams says rates could be increased if inflation doesn’t come down

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

As Europe Turns To Morocco For Clean Energy, North Africa May Lose OutMorocco is at a crossroads. Its ecological conditions, with the sun of the Sahara and the wind of the Atlantic coast, make it a prime candidate for massive-scale solar and wind farms. Its numerous port cities and proximity to Europe also make it a prime candidate for becoming a major source of European energy as the continent pivots away from its dependence on Russian natural gas. But while this approach would undoubtedly be a boon to the Moroccan economy, it would come at a major cost to the African energy market. As much as North… Read more at: https://oilprice.com/Energy/Energy-General/As-Europe-Turns-To-Morocco-For-Clean-Energy-North-Africa-May-Lose-Out.html |

|

NextEra To Sell Natural Gas Pipelines In 100% Transition To RenewablesRenewable energy giant NextEra Energy Partners is planning to offload all of its natural gas pipelines to focus on clean energy expansion exclusively by 2025. NextEra CEO John Ketchum told investors on Monday that the sale of natural gas pipelines–which has been rejected in past years–would finance the company’s renewable energy growth plants over the next couple of years without assuming new high-interest debt. In a call with investors, Ketchum said “NextEra Energy Partners is better positioned than ever to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/NextEra-To-Sell-Natural-Gas-Pipelines-In-100-Transition-To-Renewables.html |

|

Iran Ramps Up Trade With BRICS NationsNon-oil trade between Iran and members of the BRICS alliance of emergent economies – Brazil, Russia, India, China, and South Africa – reached $38.43 billion in fiscal year 2022-23, according to data released by the Islamic Republic’s Customs Administration. This represents a 14 percent increase from the previous fiscal year. China remains Iran’s main trade partner in the BRICS alliance, with $30.32 billion in trade, an increase of 37 percent. India comes next with $4.99 billion, a 47 percent hike; Russia follows with $2.32… Read more at: https://oilprice.com/Energy/Energy-General/Iran-Ramps-Up-Trade-With-BRICS-Nations.html |

|

TotalEnergies Set To Start Drilling In Lebanon Later This YearFrench TotalEnergies is set to launch long-awaiting drilling offshore Lebanon in Q3 of this year, with the restive, energy-starved country now awaiting news of a potential first discovery by the end of 2023. The consortium drilling offshore Lebanon in Block 9 is led by TotalEnergies, with partners Italian Eni and QatarEnergy. Lebanon’s interim energy minister, Walid Fayyad, on Tuesday said the rig commissioned by the consortium would start working in September and “before the end of the year we will know if there is a discovery”,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Set-To-Start-Drilling-In-Lebanon-Later-This-Year.html |

|

Can Zinc Batteries Compete With Lithium Ion Batteries?ETH Zurich researchers think zinc batteries can be made cheap, efficient, durable, safe and environmentally friendly. All attributes combined would be a breakthrough for the zinc metal battery chemistry effort. The details about the study have been reported in the journal Energy & Environmental Science. Zinc batteries are considered promising alternatives to lithium-?ion batteries. Image Credit: Visualisations: ETH Zurich / Xin Zou. Click the press release link to see a larger unedited image. The world economy needs cheap and powerful batteries… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Can-Zinc-Batteries-Compete-With-Lithium-Ion-Batteries.html |

|

Church Of England Loses Faith In Shell’s Climate PlansThe Church of England (CofE) will vote against the reappointment of all directors at upcoming AGMs – starting with Shell later this month – in response to a perceived lack of progress over climate change objectives. The Church Commissioners, which manages the CofE’s £10bn endowment fund, will vote to oust Shell’s chief executive Wael Sawan and chairman Sir Andrew Mackenzie at the energy giant’s upcoming shareholder meeting on May 23. It will showcase similar defiance at rival AGMs including Exxon, Occidental… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Church-Of-England-Loses-Faith-In-Shells-Climate-Plans.html |

|

The U.S. Needs To Double The Size Of Its Energy GridIn order to keep up with the expansion of renewable energy production capacity, the United States will have to more than double the current size of the electric grid. Stimulus from both the public and private sectors are hitting their intended mark, and the clean energy sector is booming. However, much of the potential environmental benefits of electrification will be completely wasted if we don’t have the power lines and grid capacity to transmit that power from where it’s being produced to where the demand is concentrated. Meeting… Read more at: https://oilprice.com/Energy/Energy-General/The-US-Needs-To-Double-The-Size-Of-Its-Energy-Grid.html |

|

Russia’s Crude Oil Shipments Hit Highest Since At Least Early 2022Russia’s crude oil exports by sea hit a new high of 3.55 million barrels per day (bpd) in the four weeks to May 5, the highest shipments since at least early 2022, tanker-tracking data monitored by Bloomberg showed on Tuesday. Russian crude shipments have continued to rise over the past four weeks, according to the data reported by Bloomberg’s Julian Lee, despite Russia’s insistence that it is cutting oil production by 500,000 bpd and even more. Russia warned in February that it would cut its crude oil production by… Read more at: https://oilprice.com/Energy/Crude-Oil/Russias-Crude-Oil-Shipments-Hit-Highest-Since-At-Least-Early-2022.html |

|

Australia Looks To Become World’s Leading Green Hydrogen ProducerAustralia’s government is allocating $1.35 billion (AUS$2 billion) in the 2023- 24 budget to accelerate large-scale renewable hydrogen projects, aiming to become a world leader in green hydrogen production. The Australian government will invest the sum in the so-called Hydrogen Headstart, a new program to support hydrogen production, it said in the budget unveiled on Tuesday. “Australia already has the largest pipeline of renewable hydrogen projects in the world. Hydrogen Headstart will bridge the commercial gap for early-stage projects,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australia-Looks-To-Become-Worlds-Leading-Green-Hydrogen-Producer.html |

|

Supply Disruptions Fail To Break Bearish SentimentSupply-side disruptions and promising fundamentals appear to be unable to shake the recession fears that continue to weigh oil prices down. While several banks and analysts believe oil prices are set to climb later this year, economic uncertainty continues to be the main factor for oil markets this week.Investor Alert: Whether you are new to the oil and gas industry or an energy market veteran, Global Energy Alert is an absolute must-read. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis,… Read more at: https://oilprice.com/Energy/Energy-General/Supply-Disruptions-Fail-To-Break-Bearish-Sentiment.html |

|

Canada Wildfires Shut In Nearly 4% Of Oil And Gas ProductionWildfires in Canada have so far resulted in the shut-in of 319,000 barrels of oil equivalent per day (boepd) from the country’s oil and natural gas production, or 3.7% of all output, as operators shut down producing fields and processing plants. Alberta, the main energy-producing province in Canada, declared this weekend a state of emergency, with tens of thousands forced to evacuate amid raging wildfires in Canada’s oil country. On Saturday, there were 110 active wildfires in the province, of which 36 were out of control.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canada-Wildfires-Shut-In-Nearly-4-Of-Oil-And-Gas-Production.html |

|

What’s Next For The World’s Largest Oil Company As Profits Decline?Saudi Aramco, the world’s largest oil company, has made headlines once again with its lower Q1 profits of $31.9bn, which is a 19.25% decrease compared to the same period a year earlier when it made $39.5bn. This drop in profits can be attributed to global market developments, such as reduced oil prices and production cuts. Despite this, Aramco’s overall profits remain staggering when compared to its peers. In its report, the Saudi company revealed that the decrease in profits was primarily due to lower crude oil prices, although this was partially… Read more at: https://oilprice.com/Energy/Energy-General/Whats-Next-For-The-Worlds-Largest-Oil-Company-As-Profits-Decline.html |

|

Supertanker Rates Crash 75% After OPEC+ Cuts Oil Supply To MarketsFreight rates for supertankers have plunged by 75% in a month since several large OPEC+ producers announced a new round of oil production cuts that will lead to lower volumes shipped between May and December this year. Daily rates on the Middle East to China route for the very large crude carriers (VLCC) capable of shipping up to 2 million barrels of oil have crashed from nearly $100,000 per charter day in March to just $24,000 a day at the end of last week, per data from the Baltic Exchange cited by Bloomberg. The key reason for the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Supertanker-Rates-Crash-75-After-OPEC-Cuts-Oil-Supply-To-Markets.html |

|

Ford To Trial Hydrogen Fuel Cell Transit VanFord is launching a three-year hydrogen fuel cell trial to see if a hydrogen-powered version of its E-Transit van can work, the carmaker said on Tuesday. Ford will be joined by UK oil and gas supermajor BP in a consortium focusing on trials of hydrogen and infrastructure. The research will be funded by the UK’s Advanced Propulsion Centre (APC), which will see Ford design, develop, and build a fleet of 8 hydrogen fuel cell powered Transit vans, with the latest advances in technology, as part of the 22nd funding round from APC. The Ford-led… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ford-To-Trial-Hydrogen-Fuel-Cell-Transit-Van.html |

|

Saudi Aramco’s Q1 Profit Slips By 19% Year-Over-YearSaudi oil giant Aramco on Tuesday reported a first-quarter net income of $31.9 billion, down by 19% from the first quarter of 2022 as macroeconomic concerns dragged down oil prices between January and March 2023. Aramco still beat a median analyst estimate of $30.8 billion in net profit compiled by Refinitiv. The company’s average realized crude oil price dropped to $81.0 per barrel in the first quarter of 2023, down from $97.7 a barrel in the same period of 2022. Capital expenditures rose to $8.746 billion from $7.583 billion, driven by… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Aramcos-Q1-Profit-Slips-By-19-Year-Over-Year.html |

|

Stocks close lower as investors eye inflation data, White House meeting on debt ceiling: Live updatesStocks closed lower Tuesday, with regional bank shares retreating, as investors readied for key inflation reports due later in the week and progress on the U.S. debt limit. Read more at: https://www.cnbc.com/2023/05/08/stock-market-today-live-updates.html |

|

McCarthy rejects short-term debt limit fix ahead of pivotal meeting with Biden, congressional leadersCongress is at an impasse over hiking the debt ceiling, as the U.S. stands only weeks away from a potential default. Read more at: https://www.cnbc.com/2023/05/09/debt-ceiling-biden-to-meet-mccarthy-schumer-jeffries-and-mcconnell.html |

|

Jury says Trump must pay E. Jean Carroll $5 million for sexual abuse and defamationFormer President Donald Trump called the verdict in New York a “disgrace.” A lawyer for E. Jean Carrol said “we are very happy.” Read more at: https://www.cnbc.com/2023/05/09/trump-rape-defamation-trial-jury-gets-instructions-from-judge-.html |

|

Fed’s John Williams says rates could be increased if inflation doesn’t come downThe current problems in the banking industry and their impact will factor into Williams’ policy outlook. Read more at: https://www.cnbc.com/2023/05/09/feds-john-williams-says-it-will-take-time-before-inflation-gets-back-to-2percent-target.html |

|

Stanley Druckenmiller says A.I. could win big coming out of a recession, and he’s bullish on NvidiaStanley Druckenmiller said he believes artificial intelligence could be a fruitful opportunity for investors, especially post-recession. Read more at: https://www.cnbc.com/2023/05/09/stanley-druckenmiller-says-ai-could-win-big-coming-out-of-a-recession-likes-nvidia.html |

|

Confused about the debt ceiling? Here’s what you need to knowThe White House and Republicans in Congress are at an impasse over the debt limit, risking a potential sovereign default. Read more at: https://www.cnbc.com/2023/05/09/debt-ceiling-explained.html |

|

Novavax surges after biotech company unveils job cuts, positive vaccine dataNovavax still reported bleak first-quarter earnings and revenue that missed Wall Street’s estimates. Read more at: https://www.cnbc.com/2023/05/09/novavax-nvax-q1-earnings-report-2023.html |

|

Bittrex files for bankruptcy, and Irish official equates crypto to ‘Ponzi schemes’: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Timothy Tully, the CEO of ZelCore, warns the current heavy-handed regulatory approach might force most blockchain innovation overseas. Read more at: https://www.cnbc.com/video/2023/05/09/bittrex-bankruptcy-irish-official-equates-crypto-ponzi-schemes-cnbc-crypto-world.html |

|

These are the 2023 CNBC Disruptor 50 companiesCNBC reveals the 2023 Disruptor 50 list, breakthrough companies chasing the market’s biggest opportunities amid a challenging global economy. Read more at: https://www.cnbc.com/2023/05/09/these-are-the-2023-cnbc-disruptor-50-companies.html |

|

Dianne Feinstein set to return to Senate after nearly 3-month absenceThe California Democrat has missed 91 floor votes while recovering from shingles. Read more at: https://www.cnbc.com/2023/05/09/dianne-feinstein-set-to-return-to-senate-after-nearly-3-month-absence.html |

|

Ukraine war live updates: Zelenskyy says Russia intensifying attacks out of frustration; Moscow holds Victory Day military paradeAll eyes are on Russia’s Victory Day parade on Tuesday, an annual event marking the Soviet Union’s victory over Nazi Germany in 1945. Read more at: https://www.cnbc.com/2023/05/09/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Russia’s Victory Day in pictures: Putin watches on during scaled-back paradeRussia’s annual Victory Day parade is underway in Moscow with thousands of military personnel and weaponry filing past Russia’s President Vladimir Putin. Read more at: https://www.cnbc.com/2023/05/09/russia-victory-day-photos-show-putin-watching-on-during-annual-parade.html |

|

Wheels Up founder abruptly steps down as losses mount, potential bankruptcy loomsLike many private jet startups, Wheels Up was dogged by high costs and operating issues. Read more at: https://www.cnbc.com/2023/05/09/wheels-up-founder-abruptly-steps-down-as-losses-mount-bankruptcy-looms.html |

|

Top Adidas Investor Will Ask Execs To Turn Over Kanye West Misconduct Probe DetailsAs criticism from shareholders about its failed partnership with a former US rapper mounts, Adidas faces pressure from Germany’s third-largest asset manager to reveal its investigation into how it handled accusations of misconduct against Kanye West. According to Financial Times, Janne Werning, head of ESG at Union Investment, will request the German sportswear maker to disclose the results of its internal investigation over inappropriate behavior by its former business partner Kayne West, also known as “Ye,” who was terminated last year over antisemitic remarks.

Werning wants results of the investigation “here and now,” emphasizing that shareholders are entitled to know about the company’s handling of misconduct allegations. There are reports Adidas executives turned a blind eye to inappropriate behavior by Ye at meetings. In one s … Read more at: https://www.zerohedge.com/markets/top-adidas-investor-will-ask-execs-turn-over-kayne-west-probe-misconduct-allegations |

|

Battles Rage Over Biden’s Clean Energy Projects As The Size And Cost JumpAuthored by Mike Shedlock via MishTalk.com, A NIMBY backlash has begun as the scope of the Inflation reduction act is too much for local communities…

Backlash Builds Against $3 Trillion Clean-Energy PushThe Wall Street Journal notes the Ballooning Size of Wind and Solar Projects Draws Local Ire

|

|

Americans’ Confidence In Fed Chair Hits Record Low As Inflation Batters HouseholdsAmerican households, battered with two years of negative real wage growth and observing a flurry of news headlines about regional bank failures and increasing recession risk, are losing faith in Federal Reserve Chair Jerome Powell’s ability to ‘do the right thing for the US economy.’ The skepticism is driven by their increasing belief that the economy might be headed for turmoil. A new Gallup poll published Tuesday shows only 36% of respondents had a “great deal” or “fair amount” of confidence in Powell to do the right thing for the economy – the lowest rating in his six years as the captain of the world’s largest economy (also the lowest rating of any Fed Chair). This figure is below Yellen’s 37% in 2014 and Ben Bernanke’s 39% in 2012. Someone grab Powell a liferaft because he’s sinking quickly in the eyes of the American people. Powell’s confidence with respondents peaked at 58% when he unleashed trillions of dollars in stimulus checks for Americans. His confidence rating has since tumbled precipitously as the free money expired more than a year ago and inflation emerged, causing tremendous pain for households. Read more at: https://www.zerohedge.com/markets/americans-confidence-jerome-powell-sinks-inflation-batters-households |

|

Blinken Contest: House Committee Prepares To Hold Secretary Of State In ContemptAuthored by Jonathan Turley, The House of Representatives and the Biden Administration appear in a staring contest waiting for any sign of Blinken. Rep. Michael McCaul (R-TX) warned Secretary of State Antony Blinken that the House Foreign Affairs Committee is moving to hold him in contempt of Congress for refusing to comply with subpoena requests related to the U.S. withdrawal from Afghanistan. There is no question that the Committee has a legitimate oversight interest in the disastrous withdrawal from Afghanistan at a huge loss of life, abandonment of thousands of allies, and seven billion dollars in military equipment. The committee specifically wants to review a full copy of a dissent cable that had been signed by nearly two dozen State Department officials warning Blinken of a Taliban insurgency in Afghanistan a month before the terrorist group’s takeover occurred. The Wall Street Journal reported that the cable undermines the claims of the Biden Administration that it had no forewarning of the chaos that would unfold in the country. … Read more at: https://www.zerohedge.com/political/blinken-contest-house-committee-prepares-hold-secretary-state-contempt |

|

Thames, Yorkshire and South West Water bosses refuse bonuses over sewage spillThe CEOs of Thames, Yorkshire and South West Water will not take their bonuses this year. Read more at: https://www.bbc.co.uk/news/business-65533482?at_medium=RSS&at_campaign=KARANGA |

|

Goldman Sachs to pay $215m in sex discrimination caseThe bank will pay a “substantial” sum after facing claims it underpaid female staff in the US. Read more at: https://www.bbc.co.uk/news/business-65538014?at_medium=RSS&at_campaign=KARANGA |

|

Tesco chairman denies inappropriate touchingJohn Allan refutes allegations he touched women during events at the supermarket and CBI. Read more at: https://www.bbc.co.uk/news/business-65532230?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: RIL may trigger next leg of rally in Nifty. What should traders do on WednesdayThe Nifty formed a small-bodied bearish candle on Tuesday and remained indecisive between bulls and bears. The hourly Nifty time frame chart showed a negative divergence formation in RSI. However, the index needs to hold above the 18181 zones to see an up-move towards the 18350 and 18500 zones, while support is at 18181 and 18081 marks. India VIX increased from 12.64 to 12.67 levels, resulting in a muted market movement, while options suggest a broader trading range of 17800 to 18500 zones. Experts suggest that the Nifty outlook is positive, and trade should take place between 18150 to 18350 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-ril-may-trigger-next-leg-of-rally-in-nifty-what-should-traders-do-on-wednesday/articleshow/100103321.cms |

|

Can Q4 earnings be a game changer for this beaten-down pack?Indian metal stocks suffered a drop of nearly 15% in CY23, making it the second-worst performer after the Nifty Media. Despite many analysts and brokerage firms highlighting that the drop provided an excellent buying opportunity, there was enough negative sentiment to overshadow the positive news. Headwinds such as China’s slowing economy, the imposition of heavy export duty, and rising raw material prices have caused the decline. Due to this challenging environment, earnings for metal stocks will be a crucial factor in deciding the industry’s fate. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/can-q4-earnings-be-a-game-changer-for-this-beaten-down-pack/articleshow/100092781.cms |

|

Mukesh Ambani’s Reliance has stock analysts most bullish in 7 yearsThe stock is down 3% so far in 2023 compared with a gain of 1.5% in the S&P BSE Sensex Index, hurt in part by a decline in crude prices. Thirty-three of the 38 analysts that cover the conglomerate have buy ratings, with many citing attractive valuations as well as optimism for its various oil-related, consumer and telecom businesses. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/billionaire-mukesh-ambanis-reliance-has-stock-analysts-most-bullish-in-7-years/articleshow/100095727.cms |

|

The Tell: Stocks may be about to lose the secret to their success in 2023Highflying U.S. stocks could be headed for an uncomfortable descent as the wash of central-bank liquidity that has given equity markets a boost this year begins to ebb, according to one longtime Wall Street strategist. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B70A56091-6FD5-4422-8BD5-05E62A383408%7D&siteid=rss&rss=1 |

|

Warner Music’s stock heads for worst drop on record, but CEO hopes Ed Sheeran can help turn things aroundShares of Warner Music Group were headed for their worst day on record Tuesday after the recording and publishing company reported that earnings dove. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7BE13EA42C-C6BC-4B11-A7D3-38EEDDB91DE0%7D&siteid=rss&rss=1 |

|

The Ratings Game: Shopify stock looks ‘relatively expensive’ after strong rally, analyst says in downgradeShopify shares have rallied 36% since the company an |