Summary Of the Markets Today:

- The Dow closed up 272 points or 0.80%,

- Nasdaq closed up 0.69%,

- S&P 500 closed up 0.83%,

- Gold $1,998 down $1.30,

- WTI crude oil settled at $77 up $1.88,

- 10-year U.S. Treasury 3.422% down 0.104 points,

- EUR/USD $1.102 down $0.001,

- Bitcoin $29,381 down $325,

- Baker Hughes Rig Count: U.S. +2 to 755 Canada -12 to 93

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases:

Inflation-adjusted disposable personal income increased 4.0 percent year-over-year (blue line on the graph below) while inflation-adjusted consumer spending increased 1.9% year-over-year (red line on the graph below). The important price indices (which reflect the amount of inflation) is 4.2% year-over-year (green line on the graph below) – 4.6% excluding food and energy).t). This data is not recessionary.

The University of Michigan’s April 2023 Consumer Sentiment Index was 63.5, and it was below the consensus forecast of 65.0. The decline in consumer sentiment was driven by a sharp drop in expectations for the future. The Index of Consumer Expectations fell to 64.7 from 70.7 in March. This was the lowest reading since December 2021. The Index of Current Economic Conditions was also lower in April, falling to 70.7 from 73.0 in March. This was the lowest reading since January 2022. This data is considered recessionary.

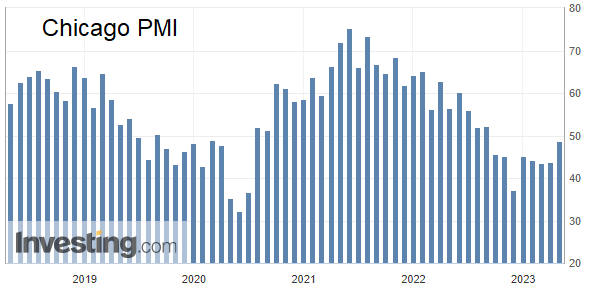

Chicago Purchasing Managers Index (PMI) increased to 48.6 – a reading below 50 implies a contraction of the manufacturing sector. The manufacturing sector has been in contraction for over 6 months.

A summary of headlines we are reading today:

- U.S. House To Vote To Repeal Biden’s Solar Panel Tariff Waivers

- Chevron Beats Profit Estimates As Refining Margins Jump

- Permian Rig Count Inches Higher As WTI Recoups Some Losses

- Analysts See Oil Prices Rising To $90 By End-2023

- Oil Set For Sixth Straight Monthly Loss

- Senators Call For Seizure Of Iran Oil Cargos

- Dow gains more than 250 points Friday as index finishes best month since January: Live updates

- Key inflation gauge for the Fed rose 0.3% in March as expected

- Cybersecurity stocks are getting battered. Here’s how the Silicon Valley Bank failure is to blame.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Europe’s Largest Gas Producer Is Set To Nationalize Its Gas PipelinesNorway will nationalize all of its natural gas pipelines within the next five years, the country’s oil and energy ministry said on Friday. The nationalization plan would provide Norway with greater control over its critical infrastructure. Standing in the way of an immediate nationalization are existing concessions, which aren’t due to expire until 2028. After that, Norway will be able to move forward with its plan. Norway became Germany’s single-largest natural gas supplier last year, overtaking Russia, with Germany’s gas… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Largest-Gas-Producer-Is-Set-To-Nationalize-Its-Gas-Pipelines.html |

|

Will The EU Sanction Russia’s Nuclear Industry?In February 2022, the EU imposed sanctions on Russia in response to the Russian invasion of Ukraine. The sanctions at this point included restrictive measures (individual sanctions), economic sanctions, and visa measures. The sanctions aimed to disrupt the country’s economy to prevent Russia from continuing its conflict with Ukraine. Throughout the year, the EU and other parts of the world increased the number and types of sanctions on Russia as they decreased their reliance on Russian energy. In December 2022, the EU banned… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Will-The-EU-Sanction-Russias-Nuclear-Industry.html |

|

U.S. House To Vote To Repeal Biden’s Solar Panel Tariff WaiversThe U.S. House of Representatives, led by Republicans, is set to vote later on Friday on legislation to repeal the Biden Administration’s two-year pause on tariffs of imports from several Southeast Asian solar panel producers. President Biden announced in June 2022 a two-year pause in import tariffs on solar panels manufactured in Southeast Asia in an attempt to kickstart the American solar industry supply chain. The tariff exemption for solar panels imported from Cambodia, Malaysia, Thailand, and Vietnam came after the Department of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-House-To-Vote-To-Repeal-Bidens-Solar-Panel-Tariff-Waivers.html |

|

Chevron Beats Profit Estimates As Refining Margins JumpDespite a drop in oil and gas prices, Chevron Corporation (NYSE: CVX) beat analyst expectations in its first-quarter earnings, which rose on the back of higher margins on refined product sales. Chevron on Friday reported earnings of $6.6 billion, or $3.46 per diluted share, for the first quarter of 2023. This compares with $6.3 billion in earnings, or $3.22 per diluted share, for the first quarter of 2022. Chevron’s total earnings were also higher than the $6.35 billion profit for the fourth quarter of 2022. The Q1 2023 earnings… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Beats-Profit-Estimates-As-Refining-Margins-Jump.html |

|

Permian Rig Count Inches Higher As WTI Recoups Some LossesThe total number of total active drilling rigs in the United States rose by 2 this week, according to new data from Baker Hughes published Friday, after rising by 5 last week. The total rig count rose to 755 this week—57 rigs higher than the rig count this time in 2022—still 320 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States stayed the same this week, at 591. Gas rigs rose by 2 for the second week in a row, to 161. Miscellaneous rigs also stayed the same. The rig count in… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Rig-Count-Unchanged-As-WTI-Recoups-Some-Losses.html |

|

How Cheap Can EVs Actually Get?As governments worldwide push a shift away from internal combustion engine (ICE) vehicles to electric vehicles (EV) to help decarbonise, the race to manufacture a wide range of EV models is well underway. As well as electric car companies, most major automakers are now investing in the development of their EV business, all too aware that the ICE vehicles market will dwindle in the coming decades. But as companies hurry to source the components needed for production and the metals and minerals needed for EV batteries, they must contend with supply… Read more at: https://oilprice.com/Energy/Energy-General/How-Cheap-Can-EVs-Actually-Get.html |

|

Exxon Posts Record Q1 Earnings Beating ForecastsExxonMobil (NYSE: XOM) easily beat the consensus estimates as it reported on Friday record first-quarter earnings that were more than double compared to a year ago as higher oil and gas production offset lower commodity prices. Exxon reported record first-quarter earnings of $11.4 billion, double from the $5.48 billion for the first quarter of 2022 and down from $12.75 billion for the fourth quarter of 2022. The per-share earnings of $2.79 for the first quarter of 2023 beat The Wall Street Journal consensus estimate of $2.60. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Posts-Record-Q1-Earnings-Beating-Forecasts.html |

|

Analysts See Oil Prices Rising To $90 By End-2023Oil prices are set to rise toward $90 per barrel by the end of this year, driven by Chinese demand and a tightening market following OPEC+’s latest production cuts, a Reuters survey of 40 analysts and economists showed on Friday. According to the experts, Brent Crude prices are expected to average $87.12 per barrel this year, a higher average forecast than in the previous poll in March. So far this year, Brent prices have averaged around $82, while they traded at just above $79 early on Friday. The U.S. benchmark, WTI… Read more at: https://oilprice.com/Energy/Oil-Prices/Analysts-See-Oil-Prices-Rising-To-90-By-End-2023.html |

|

U.S. Venture Global Signs 20-Year Deal To Supply LNG To JapanVenture Global LNG has signed a 20-year deal to sell 1 million tons per year of liquefied natural gas from its upcoming CP2 LNG export facility in Louisiana to Japanese customer JERA, the U.S. LNG exporter said on Friday. The CP2 LNG export terminal will be located on a site adjacent to Venture Global LNG’s operating Calcasieu Pass LNG facility in Cameron Parish, Louisiana. CP2 LNG, Venture Global’s third export project, is expected to commence construction later this year. Venture Global has already announced Sales and Purchase Agreements… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Venture-Global-Signs-20-Year-Deal-To-Supply-LNG-To-Japan.html |

|

Exxon Greenlights New Multibillion-Dollar Guyana ProjectExxon will go ahead with a $12.7-billion oil development off the coast of Guyana after the country’s government gave its final approval to the project. The Uaru project is expected to boost the company’s production in Guyana by a quarter of a million barrels daily. Startup is scheduled for 2026. According to Reuters, this would be Exxon’s and Hess’s most expensive project. The Uaru field is estimated to hold more than 800 million barrels of crude oil. Exxon and its partner Hess Corp. have made some 30 discoveries offshore… Read more at: https://oilprice.com/Energy/Crude-Oil/Exxon-Greenlights-New-Multibillion-Dollar-Guyana-Project.html |

|

Russia Looks for Ways To Boost Oil IncomeRussia’s government is mulling over fuel subsidy cuts or a windfall tax for the oil industry in a bid to offset the sharp drop in oil and gas revenues amid the Western sanction push following Moscow’s invasion of Ukraine. Bloomberg cited unnamed sources as saying one of the options to boost income was to change the formula that the authorities use to calculate the level of subsidies that Russian refiners receive for supplying fuels to the domestic market. The subsidies last year came in at some $26.6 billion—quite a substantial sum. In order… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Looks-for-Ways-To-Boost-Oil-Income.html |

|

Oil Set For Sixth Straight Monthly LossWith earnings season in full swing, big players like Exxon, Halliburton, and Baker Hughes have posted strong results despite lower crude prices in Q1. Friday, April 28, 2023 Oil prices have stabilized around $78 per barrel for ICE Brent and $74 per barrel for WTI after Wednesday’s double whammy of bad macroeconomic data. The decline in US capital goods spending confirmed fears that economic growth is slowing down in the United States, whilst refinery margins continued their descent this week as downstream players are finding it ever harder… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Set-For-Sixth-Straight-Monthly-Loss.html |

|

Senators Call For Seizure Of Iran Oil CargosTwo Senators have urged President Biden to give the Department of Homeland Security powers to resume the seizure of Iranian oil cargo. In a letter cited by Reuters, Senators Joni Ernst (R) and Richard Blumenthal (D) wrote that the DHS’s Homeland Security Investigations office has been unable to seize Iranian cargo of crude oil for more than a year. The reason for this long lull in Iranian cargo seizures was a set of policy limitations imposed on the Department of Treasury’s Executive Office for Asset Forfeiture, the report noted. Before… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Senators-Call-For-Seizure-Of-Iran-Oil-Cargos.html |

|

Oil Prices Head For Second Consecutive Weekly LossOil prices were on course early on Friday to post a second consecutive weekly loss as concerns about the economy trumped a larger-than-expected draw in U.S. commercial oil stocks.Brent Crude prices fell this week below the $80 per barrel threshold as negative sentiment in the market prevailed due to concerns about a recession with rising interest rates in major developed economies. The Fed, the European Central Bank (ECB), and the Bank of England are all expected to continue raising the key interest rates at their upcoming policy meetings. The Fed’s… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Head-For-Second-Consecutive-Weekly-Loss.html |

|

The Brent Oil Benchmark Is About To Change ForeverWest Texas Intermediate Midland crude is about to be added to the Brent benchmark contract this June. This would be the first time a non-North Sea crude has been added to the benchmark basket. And it will change the oil market forever. First, however, why is WTI being added to the Brent basket? It’s really simple. There has been more U.S. crude oil going into Europe since Russia’s invasion of Ukraine. At the same time, the output of the grades making up the Brent basket has been falling consistently, and so has trade in these grades. “We’re really… Read more at: https://oilprice.com/Energy/Crude-Oil/The-Brent-Oil-Benchmark-Is-About-To-Change-Forever.html |

|

First Republic most likely headed for FDIC receivership, sources say; shares drop 40%The stock has fallen more than 90% this year as investors have lost confidence in the bank after two regional lenders failed in March. Read more at: https://www.cnbc.com/2023/04/28/first-republics-stock-poised-to-rise-for-second-day-as-regional-bank-searches-for-rescue-deal.html |

|

Dow gains more than 250 points Friday as index finishes best month since January: Live updatesInvestors digested the latest round of corporate earnings, including Amazon’s. Read more at: https://www.cnbc.com/2023/04/27/stock-market-today-live-updates.html |

|

Fed report on SVB collapse faults bank’s managers — and central bank regulatorsThe Fed blamed failures on mismanagement and supervisory missteps, compounded by a dose of social media frenzy. Read more at: https://www.cnbc.com/2023/04/28/fed-report-on-svb-collapse-faults-banks-managers-and-central-bank-regulators.html |

|

Carl Icahn calls Illumina Q1 results ‘very disappointing,’ slams cost-cutting planActivist investor Carl Icahn accused Illumina CEO Francis deSouza of trying to downplay the company’s “decidedly mediocre” Q1 2023 results this week. Read more at: https://www.cnbc.com/2023/04/28/carl-icahn-slams-illumina-q1-results-and-cost-cutting-plan.html |

|

These stocks reporting next week have a history of beating earnings expectationsInvestors looking for ways to play the next batch of earnings may want to look at names with a history of outperforming expectations. Read more at: https://www.cnbc.com/2023/04/28/these-stocks-reporting-next-week-have-a-history-of-beating-earnings-expectations.html |

|

Apple employee who defrauded company of millions sentenced to three years in prisonDhirendra Prasad defrauded Apple and the IRS out of millions of dollars in a yearslong conspiracy to double-bill the company for parts it had already paid for. Read more at: https://www.cnbc.com/2023/04/28/apple-worker-who-bilked-company-of-millions-sentenced-to-three-years-in-prison.html |

|

Key inflation gauge for the Fed rose 0.3% in March as expectedThe personal consumption expenditures price index excluding food and energy increased 0.3% for the month. Read more at: https://www.cnbc.com/2023/04/28/key-inflation-gauge-for-the-fed-rose-0point3percent-in-march-as-expected.html |

|

Mastercard announces new blockchain standards, and Coinbase responds to the SEC: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Raj Dhamodharan of Mastercard and Paul Grewal of Coinbase Read more at: https://www.cnbc.com/video/2023/04/28/mastercard-expanded-products-coinbase-responds-sec-crypto-world.html |

|

Ukraine war live updates: Russian airstrikes in Ukrainian cities kill at least 23; Kyiv says it’s planning a counteroffensiveA wave of Russian missile attacks hit several cities across Ukraine, killing at least 23 people and injuring others, according to Ukrainian officials. Read more at: https://www.cnbc.com/2023/04/28/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

House votes to restore solar panel tariffs, Biden vows to veto bill if it passes SenateThe president’s tariff moratorium was imposed as a bridge to boost U.S. solar manufacturing capacity while accelerating clean energy development. Read more at: https://www.cnbc.com/2023/04/28/house-votes-to-restore-solar-panel-tariffs-biden-vows-veto.html |

|

These are the top Senate races to watch in 2024Democrats are defending multiple Senate seats in states that voted for former President Donald Trump over President Joe Biden in the last presidential race. Read more at: https://www.cnbc.com/2023/04/28/top-senate-races-manchin-sinema-feinstein.html |

|

How A.I. could change the future of workWith artificial intelligence tools becoming more and more accessible, will companies use the new technology to increase productivity–or to reduce labor costs? Read more at: https://www.cnbc.com/2023/04/28/how-ai-could-change-the-future-of-work.html |

|

Actively managed funds come with unique risks and rewards. Here’s how investors can pick a winnerActively managed funds can outperform during periods of volatility, but investors will have to do their due diligence. Read more at: https://www.cnbc.com/2023/04/28/avoid-these-mistakes-when-picking-an-actively-managed-fund-.html |

|

Jim Jordan Slaps Biden Censorship Operatives With Subpoenas Following ‘Twitter Files’ RevelationsThe heads of three federal agencies involved in Big Tech censorship of non-establishment narratives were slapped with subpoenas by Rep. Jim Jordan (R-OH), according to the Washington Examiner’s Gabe Kaminsky, who has reviewed the subpoenas.

Dr. Rochelle Walensky, director of the Centers for Disease Control and Prevention, Jen Easterly, who heads the Cybersecurity and Infrastructure Security Agency, and James Rubin, coordinator of the Global Engagement Center, a State Department-housed interagency, were all subpoenaed by Jordan as part of his Weaponization of the Federa … Read more at: https://www.zerohedge.com/political/jim-jordan-slaps-biden-censorship-operatives-subpoenas-following-twitter-files |

|

Watch: Kamala Harris Cites ‘Squid Game’ As Example Of “Intertwined History” Of US And South KoreAuthored by Steve Watson via Summit News, In a speech made while hosting South Korean President Yoon Suk Yeol, Kamala Harris, the Vice President of the United States, cited the Netflix show Squid Game as an example of cultural ties between the countries.

Yes, really. Unable to contain laughter as usual, Harris stated “South Korea and the United States, as the Secretary [Blinken] has mentioned, also shared strong cultural and people to people ties. K-pop fans, they topped the billboards in the United States, including BTS, who I had the great pleasure of meeting and inviting to my office in the West Wing and to the great pleasure of my niece, I must tell you.” She added, “I also think of the Emmy Award-winning TV shows like ‘Squid Games,’ which I will confess, Doug and I bin … Read more at: https://www.zerohedge.com/political/watch-kamala-harris-cites-squid-game-example-intertwined-history-us-and-south-korea |

|

“Time To Act:” Lazard To Cut 10% Of Jobs Amid M&A SlowdownInvestment bank Lazard Ltd on Friday announced plans to shrink its workforce by 10% this year, following a decline in dealmaking activity in the first quarter.

The first quarter of 2023 was the slowest start to global dealmaking since 2013, as rising interest rates and elevated inflation soured the mood in capital markets. According to Bloomberg data, on Wall Street, investment-banking fees across the top five firms plunged 49% last year. This resulted in a first-quarter financial-advisory revenue decline of 29% from a year ago, to 274 million, which missed analysts’ estimates of $296 million. Asset-management revenue slid 15% to $265 million. There was also a surprise first-quarter loss of 22.2 million, or 27 cents a share, compared with a profit of $113.9 million, or $1.05 a share, in the same period a year earlier. Analysts surveyed by FactSet were expecting a profit of 32 cents a share. Lazard incurred a $21 charge in the first quarter, and the investment bank expects an additional $95 million in charges.

|

|

Watch: Spirit Airlines Duct Tapes Plane Before TakeoffA viral TikTok video shows a Spirit Airlines employee using duct tape to secure an exterior panel of an airplane engine. The short video was posted on the Chinese-owned social media platform earlier this week.

TikTok user @myhoneysmacks, who is from Alabama, said:

She reaffirmed:

Here’s the video.

|

|

Fed says it failed to take forceful action on SVBThe US central bank issues a review of its failures ahead of the collapse of Silicon Valley Bank. Read more at: https://www.bbc.co.uk/news/business-65428206?at_medium=RSS&at_campaign=KARANGA |

|

Households in debt time-bomb, says Citizens AdviceThe charity says those struggling with negative budgets can face a “wild west” when seeking debt advice. Read more at: https://www.bbc.co.uk/news/business-65429067?at_medium=RSS&at_campaign=KARANGA |

|

Eurovision 2023: What fans affected by train strikes travelling to Liverpool can doTwo train strikes are now scheduled which may cause disruption for those travelling to Liverpool. Read more at: https://www.bbc.co.uk/news/entertainment-arts-65423800?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty OI data hints runaway rally unlikely. What should traders do next weekNifty crossed the 18,000 mark and formed a green candle with minor lower shadow, indicating a continuation of upside momentum. The momentum oscillator RSI (14) readings on the daily charts reached 70 and are now in the overbought zone. The short-term uptrend of Nifty remains intact with the market expected to reach the next resistance of 18,200-18,300 levels in the next week. The Open Interest data of Nifty indicates the Nifty Index still has a lot of open interest at the 18000 straddle level, so a runaway rally may not take place from here. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-oi-data-hints-runaway-rally-unlikely-what-should-traders-do-next-week/articleshow/99846478.cms |

|

Wipro share buyback may hide weak FY24 outlook. Should you buy, sell or hold?Wipro’s Rs 12,000 crore share buyback program overshadowed weak Q1 FY24 revenue guidance, leading to a 3.6% surge in its shares on Friday. Analysts opined that the stock may remain stable in the short-term due to the large buyback program but may impact payout over FY24/25E, thereby not warranting a re-look. The Q1 revenue guidance cut to 1-3% implied no growth in FY24, indicating divergence between revenue and deal intake. Several analysts lowered their price targets and EPS estimates, and expect Wipro to underperform peers in revenue growth over FY24-25E. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/wipro-share-buyback-may-hide-weak-fy24-outlook-should-you-buy-sell-or-hold/articleshow/99835381.cms |

|

This is the time to accumulate IT, valuations are in our favor: Varun SabooMidcap IT companies are doing well in comparison to their largecap counterparts, which were affected by Infosys’ weak performance. They have reported positive outcome, shown by the strong total contract value (TCV) and guidance. Hence, it is an opportune time for investors to accumulate them as valuations are currently attractive, trading below 20 times earnings. Read more at: https://economictimes.indiatimes.com/markets/expert-view/this-is-the-time-to-accumulate-it-valuations-are-in-our-favour-varun-saboo/articleshow/99832659.cms |

|

Cybersecurity stocks are getting battered. Here’s how the Silicon Valley Bank failure is to blame.Shares of cybersecurity companies Cloudflare and Tenable had a bad week as the Silicon Valley Bank failure turned a strength into a liability. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E4-D75D35AE0FB4%7D&siteid=rss&rss=1 |

|

Is your credit score driving up your car-insurance premium? Black and Latino New Yorkers face an ‘illogical and deeply unfair’ pricing model, a new report says.New York remains among the 47 states that allow credit information to be used in auto-insurance pricing and underwriting. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E4-C49EF8B51FCE%7D&siteid=rss&rss=1 |

|

Mutual Funds Weekly: These money and investing tips give you a tailored fit for this mismatched marketMoney and investing stories popular with MarketWatch readers over the past week. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E4-F866FCE14F45%7D&siteid=rss&rss=1 |