Summary Of the Markets Today:

- The Dow closed up 22 points or 0.07%,

- Nasdaq closed up 0.11%,

- S&P 500 closed up 0.09%,

- Gold $1,993 down $25.90,

- WTI crude oil settled at $78 up $0.42,

- 10-year U.S. Treasury 3.568% up 0.023 points,

- USD $101.71 down $0.13,

- Bitcoin $27,238 down $928,

- Baker Hughes Rig Count: U.S. +5 to 753 Canada -6 to 105

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

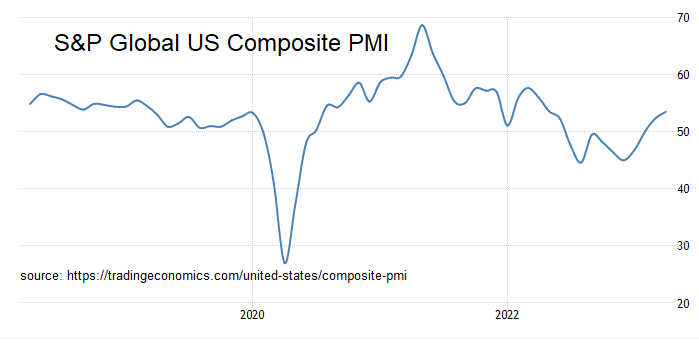

The Purchasing Managers’ Index (PMI) Composite Flash (a composite index of the manufacturing and services sectors) registered 53.5 in April 2023, up from 52.3 in the previous month, to signal the quickest upturn in business activity since May 2022. The faster rise in activity was broad-based, with the services activity growth hitting a 12-month high and manufacturing output expanding modestly but at the fastest rate since May 2022. New orders at US firms increased at the sharpest rate for 11 months, despite a continued decline in new export orders, amid new client wins, improved customer confidence and successful marketing strategies. In addition, employment growth was the quickest since last July, while backlogs of work increased for the second month running as companies mentioned further struggles finding suitable candidates and retaining staff amid rising wage costs. This is a data point that argues against a coming recession.

A summary of headlines we are reading today:

- EU Introduces New Tax To Push For Global Carbon Pricing

- Oilfield Services Company Schlumberger Beats Q1 Expectations

- Oil, Gas Drilling Activity In The U.S. Perks Up

- Chile Plans To Nationalize Lithium Extraction Industry

- Oil Prices Plunge As Bearish Sentiment Builds

- Economic Fears Put Oil Prices Under Pressure

- Stocks end Friday’s session little changed, Dow snaps 4-week win streak: Live updates

- A recession is coming — and stock markets won’t come through it unscathed, strategist says

- Ether drops to $1,900, and PitchBook research reveals ChatGPT’s impact on crypto: CNBC Crypto World

- “Brace” – JPMorgan Warns Debt-Ceiling Showdown Means “Non-Trivial Chance Of A Technical Default” On US Treasuries

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Guyana Refuses To Sell Discounted Oil To IndiaOne of the world’s growing hotspots for crude oil exploration has refused to sell discounted crude oil to India, Guyana’s Vice President Bharrat Jagdeo said this week. Guyana’s crude oil production has increased three-fold from a year ago, with the government of Guyana holding the rights to about 12.5% of the country’s vast oil riches. BP has a one-year contract to market those government-controlled barrels. India has lobbied Guyana for two years—well before Guyana’s oil boom took off, but the two have been unable… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Guyana-Refuses-To-Sell-Discounted-Oil-To-India.html |

|

EU Introduces New Tax To Push For Global Carbon PricingThe European Parliament has now approved legislation to phase in a levy on high-carbon imports based on the CO2 emitted in producing them. As Statista’s Martin Armstrong notes, the law is a world-first and awaits final approval from EU countries – expected within a few weeks. The tax aims to put pressure on countries outside of EU borders to put a price on CO2 emissions – while also countering the benefits to EU industries relocating to regions with weaker environmental laws. As reported by the Wall Street Journal: “The tax gives credit… Read more at: https://oilprice.com/Energy/Energy-General/EU-Introduces-New-Tax-To-Push-For-Global-Carbon-Pricing.html |

|

Oilfield Services Company Schlumberger Beat Q1 ExpectationsHouston-based oilfield services provider Schlumberger beat analyst estimates for Q1 profits, the company reported on Friday but offered a lowered outlook for its North American growth in 2023. Higher crude oil prices and tight supplies boosted the demand for SLB’s services and equipment for the first quarter, SLB said, boosting its bottom line. Schlumberger’s first quarter revenue came in at $7.7 billion. For its international segment, revenue rose 29% compared to the first quarter last year, to $5.97 billion. The company’s North… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oilfield-Services-Company-Schlumberger-Beast-Q1-Expectations.html |

|

Oil, Gas Drilling Activity In The U.S. Perks UpThe total number of total active drilling rigs in the United States rose by 5 this week, according to new data from Baker Hughes published Friday, after falling 3 last week. The total rig count rose to 753 this week—58 rigs higher than the rig count this time in 2022—still 322 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States increased by 3 this week after two weeks of declines, landing at 591. Gas rigs rose by 2 to 159. Miscellaneous rigs stayed the same. The rig count in the… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Gas-Drilling-Activity-In-The-US-Perks-Up.html |

|

Another Strike Could Result In UK Oil, Gas ShutdownsThe United Kingdom’s oil and gas industry is bracing for another strike, after the British labor union Union announced that more than a thousand offshore workers would begin a 2-day strike starting on Monday. The 1,300 offshore workers that are set to walk off the job for 48 hours starting on Monday could disrupt oil and gas production for BP, CNRI, EnQuest, Harbour, Ithaca, Shell, TAQA, and TotalEnergies. The UK’s Unite Union called the strike, set to go into effect on Monday, earlier last month over pay issues. The prospective action… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Another-Strike-Could-Result-In-UK-Oil-Gas-Shutdowns.html |

|

ADNOC Aims To Grow Energy Market Share In EuropeADNOC, the national oil company of Abu Dhabi, is expanding its natural gas production capacity and increasing investments to target Europe’s gas markets. As one of the Middle East’s largest energy producers, ADNOC aims to meet the growing international demand for LNG by becoming a net-exporter of gas. The company is constructing additional LNG capacity and expanding its international natural gas production footprint in other regions, including the East Med region. ADNOC has taken a strategic stake in Israeli offshore gas producer NewMed… Read more at: https://oilprice.com/Energy/Natural-Gas/ADNOC-Aims-To-Grow-Energy-Market-Share-In-Europe.html |

|

Chile Plans To Nationalize Lithium Extraction IndustryThe world’s second-largest lithium producer, Chile, plans to nationalize the lithium extraction industry, Chilean President Gabriel Boric said this week, adding that future contracts would be given only to public-private partnerships with state control. The announcement sent shares in the world’s biggest lithium producers, Albemarle Corporation and SQM, tumbling on Thursday and early Friday. Chile produces lithium from brine, similar to the production in Argentina and China. The world’s top lithium supplier, Australia, produces lithium… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chile-Plans-To-Nationalize-Lithium-Extraction-Industry.html |

|

Chinese Refiners Snap Up Discounted ESPO And Urals CrudesChina imported the highest-ever volumes of Russian crude oil in March, which kept Russia on top of the Chinese crude suppliers’ list ahead of Saudi Arabia, government data from China showed on Friday. Russian crude arrivals to China surged to a record high of 2.26 million barrels per day (bpd) in March, up by 50% compared to 1.50 million bpd in March 2022, per data from China’s General Administration of Customs cited by Reuters. Crude arrivals to China from Saudi Arabia also increased last month, but were still below the record volumes… Read more at: https://oilprice.com/Energy/Crude-Oil/Chinese-Refiners-Snap-Up-Discounted-ESPO-And-Urals-Crudes.html |

|

Putin And Saudi Crown Prince Discuss OPEC+ Oil Output DealVladimir Putin and Saudi Arabia’s Crown Prince Mohammed bin Salman discussed the OPEC+ agreement in a telephone conversation on Friday, the Kremlin says, as Russia and Saudi Arabia continue to coordinate a common approach to oil supply to the market. “The conversation proceeded in a friendly manner, was constructive and informative. With this in mind, it was agreed to build up contacts in specific areas of cooperation,” according to a statement from the Kremlin quoted by Reuters. Saudi Arabia, OPEC’s de facto leader and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-And-Saudi-Crown-Prince-Discuss-OPEC-Oil-Output-Deal.html |

|

Oil Prices Plunge As Bearish Sentiment BuildsU.S. West Texas Intermediate crude oil futures plunged on Thursday, reaching their lowest point since late March. The move also turned the market lower for the week. Crude oil is also testing an area not visited since the unexpected announcement of an OPEC+ production cut. Essentially, one of the primary drivers of the decline in oil prices is the widespread apprehension surrounding the possibility of an economic recession. Early in the week as prices fell, some analysts thought the weakness was attributed to the market pricing in the OPEC+ output… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Plunge-As-Bearish-Sentiment-Builds.html |

|

The Permian Is Set For A Wave Of Massive Deals1. Recession Worries Wipe Out Most of OPEC+ Upside- Oil prices have been sliding for most of this week as weakening US labor market data play into wider fears of an oil demand slowdown in the US, aggravated by what many believe to be a technical gap-fill correction. – With WTI trading around $77 per barrel, it is truly a sign of times that there was no mid-week increase following a 4.5 MMbbls build in US crude inventories and a 1.5 p.p. rise in refinery utilization, as slowing gasoline demand grabbed most of the attention. – Whilst shrinking oil… Read more at: https://oilprice.com/Energy/Energy-General/The-Permian-Is-Set-For-A-Wave-Of-Massive-Deals.html |

|

Sudan On The Brink Of Civil WarPolitics, Geopolitics & Conflict Fighting continues to rage in Sudan (it’s been a week) in what is looking increasingly likely to descend into a civil war, with a powerful paramilitary group clashing with the Sudanese army on the streets of the capital Khartoum and across the country. According to the World Health Organisation, more than 290 civilians are dead and thousands more are injured. The Pentagon is said to be readying forces in Djibouti to potentially evacuate embassy staff there. The clashes could threaten landlocked South Sudan’s… Read more at: https://oilprice.com/Energy/Energy-General/Sudan-On-The-Brink-Of-Civil-War.html |

|

How To Trade Earnings SeasonOver the next week or so, we will see quite a few significant energy companies’ Q1 earnings reports, culminating in the big two, Exxon Mobil (XOM) and Chevron (CVX), who will report on Friday, April 27th. Earnings season is in full swing and at that time each quarter, one of the questions that I am most frequently asked by retail investors is how best to handle it. Now seems like a good time to talk about just that. When I tell people the answer to their questions about a strategy for earnings season, they are usually not happy. That is because,… Read more at: https://oilprice.com/Energy/Energy-General/How-To-Trade-Earnings-Season.html |

|

Can Natural Gas Keep Erdogan In Power?Turkish President Recep Tayyip Erdogan hit the jackpot with a recent natural gas discovery in the Black Sea. Now he is offering up free gas in the biggest vote-buying scheme of the century. Losing ground in the polls due to corruption and mismanagement of a disastrous earthquake in February, the incumbent president needs all the help he can get ahead of the general elections on May 14th. Free gas is a pretty good start. If it were gasoline and we were in America, any candidate with the ability to offer it would be an instant shoo-in. The… Read more at: https://oilprice.com/Energy/Energy-General/Can-Natural-Gas-Keep-Erdogan-In-Power.html |

|

Economic Fears Put Oil Prices Under PressureWhile oil prices rebounded slightly on Friday morning, they remain on course for a weekly decline. Worrying economic data in the U.S. and the expectation of another interest rate hike have added significant downward pressure to oil markets this week. While promising signs of oil demand in China and a report of inventories declining gave oil prices some support, bearish sentiment appears to be driving the market.Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global… Read more at: https://oilprice.com/Energy/Energy-General/Economic-Fears-Put-Oil-Prices-Under-Pressure.html |

|

Elon Musk had a rough week across his empire — Tesla, Twitter, and SpaceXElon Musk’s week was capped on Friday when institutional shareholders in Tesla admonished the company’s board of directors to rein in the “over-committed” CEO. Read more at: https://www.cnbc.com/2023/04/21/elon-musk-had-a-rough-week-across-tesla-twitter-and-spacex.html |

|

Stocks end Friday’s session little changed, Dow snaps 4-week win streak: Live updatesInvestors evaluated earnings results and the major averages headed for a losing week. Read more at: https://www.cnbc.com/2023/04/20/stock-market-today-live-updates.html |

|

Google’s 80-acre San Jose mega-campus is on hold as company reckons with economic slowdownConstruction of Google’s 7.3 million square foot campus in San Jose, California, has been halted as the company’s cost-cutting efforts stifle development. Read more at: https://www.cnbc.com/2023/04/21/googles-80-acre-san-jose-mega-campus-on-hold-amid-economic-slowdown-.html |

|

A recession is coming — and stock markets won’t come through it unscathed, strategist saysThe latest U.S. economic data suggests a recession is coming, according to the chief executive of financial advisory firm Longview Economics. Read more at: https://www.cnbc.com/2023/04/21/a-recession-is-coming-and-equity-markets-may-incur-some-pain-strategist-says.html |

|

What to watch for in the markets in the week ahead: Monster tech earnings, then sell in May?One investor is worried about the outlook the rest of 2023. “Valuations are already so high, I think a lot [optimism] is already in the price,” he says. Read more at: https://www.cnbc.com/2023/04/21/what-to-watch-for-in-the-markets-in-the-week-ahead-monster-tech-earnings-then-sell-in-may.html |

|

Lyft’s new CEO begins tenure with layoffs, reportedly cutting 1,200 jobsA week after assuming the role of CEO at Lyft, David Risher said on Friday that “we will significantly reduce the size of the team.” Read more at: https://www.cnbc.com/2023/04/21/lyfts-new-ceo-begins-tenure-with-layoffs-reported-cutting-1200-jobs.html |

|

Biden to order all federal agencies to prioritize environmental justiceBiden’s new Office of Environmental Justice in the White House will coordinate all environmental justice efforts across the federal government. Read more at: https://www.cnbc.com/2023/04/21/biden-to-order-federal-agencies-to-prioritize-environmental-justice.html |

|

‘Utterly irresponsible’: SVB failure was caused by a banking — not tech — crisis, top VC saysAnne Glover, CEO and co-founder of Amadeus Capital, said Friday that the SVB crisis was caused by “utterly irresponsible” practices by Silicon Valley Bank. Read more at: https://www.cnbc.com/2023/04/21/svb-failure-was-caused-by-a-banking-not-tech-crisis-top-vc-says.html |

|

Ether drops to $1,900, and PitchBook research reveals ChatGPT’s impact on crypto: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, PitchBook’s Robert Le breaks down how ChatGPT can positively and negatively impact crypto. Read more at: https://www.cnbc.com/video/2023/04/21/ether-drops-chatgpt-impact-crypto-cnbc-crypto-world.html |

|

Ukraine war live updates: Western allies meet in Germany, Russia accidentally strikes own cityUkraine’s Western allies are set to meet at the Ramstein Air Base in Germany to discuss further aid to Kyiv, which reiterated its call for NATO membership. Read more at: https://www.cnbc.com/2023/04/21/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

NFL suspends five players for violating gambling policyQuintez Cephus and C.J. Moore of the Detroit Lions, and Shaka Toney of the Washington Commanders were suspended indefinitely for gambling-policy violations. Read more at: https://www.cnbc.com/2023/04/21/nfl-suspends-five-players-for-violating-gambling-policy.html |

|

Big drug company CEOs to testify at Senate Health committee on insulin pricesEli Lilly, Novo Nordisk and Sanofi control 90% of the insulin market in the U.S, where a quarter of all health-care spending is on people with diabetes. Read more at: https://www.cnbc.com/2023/04/21/insulin-eli-lilly-sanofi-novo-nordisk-testify-to-senate-on-prices.html |

|

72-Hour Ceasefire Declared In Sudan As Death Toll Surpasses 400One of Sudan’s two warring factions, the paramilitary Rapid Support Forces (RSF), has on Friday declared a 72-hour ceasefire following almost a week of fighting to take control of the country. But there are reports that despite the truce declaration, armed clashes have persisted north of the capital of Khartoum. The other side, the Sudan Armed Forces (SAF), had not immediately confirmed whether it recognizes the ceasefire.

Read more at: https://www.zerohedge.com/geopolitical/72-hour-ceasefire-declared-sudan-death-toll-surpasses-400-killed |

|

Watch: Bill Maher Blasts “Intellectual Cowardice” Of Those Who “Just Fall In Line” With Woke MadnessAuthored by Steve Watson via Summit News, Comedian Bill Maher has labeled those who choose to go along with woke nonsense as “intellectual cowards.”

Maher made the comments in an interview with Piers Morgan, noting “Nobody ever get canceled for being too woke.” “So you can say the craziest thing, like ‘men can have babies’ and then nobody will — even though people are thinking, ‘well, that’s kind of nuts,’ nobody will say it. They’ll just fall in line,” Maher noted. “‘Uh, yeah, exactly, that’s what I’ve always thought,’” Maher said, mocking those who know what they are agreeing with is insane. “‘Sure. I saw a dude who was glowing yesterday.’ And that’s the problem.” … Read more at: https://www.zerohedge.com/markets/watch-bill-maher-blasts-intellectual-cowardice-those-who-just-fall-line-woke-madness |

|

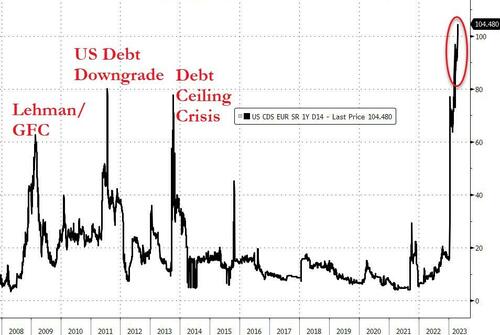

“Brace” – JPMorgan Warns Debt-Ceiling Showdown Means “Non-Trivial Chance Of A Technical Default” On US Treasuries‘Be afraid, be very afraid’ – that is the message from the markets (well, every market that isn’t US equities) with regard the debt-ceiling debacle in the US. US Sovereign risk has soared to record highs in recent days, far above previous debt-related periods of crisis…

We have been warning of the imminence (and immensity) of the threat for weeks, and now even the mainstream media is starting to recognize some of the signals being flashed of just how dire the situation is for Washington (and implicitly the rest of us)…

Read more at: https://www.zerohedge.com/markets/brace-jpmorgan-warns-debt-ceiling-showdown-means-non-trivial-chance-technical-default-us |

|

State Department Fails To Comply With House GOP Subpoena To Turn Over Afghan Dissent CableAuthored by Jackson Richman via The Epoch Times (emphasis ours), Secretary of State Antony Blinken has failed to comply with a congressional subpoena, which required the State Department to hand over by April 19 a dissent cable from the time of the U.S. withdrawal from Afghanistan, the Epoch Times has learned.

U.S. Secretary of State Antony Blinken attends a press conference at State Department in Washington on April 11, 2023. (Madalina Vasiliu/The Epoch Times)Yimmi Fontenot, the press secretary for Republicans on the House Foreign Affairs Committee, which issued the subpoen … Read more at: https://www.zerohedge.com/geopolitical/state-department-fails-comply-house-gop-subpoena-turn-over-afghan-dissent-cable |

|

CBI suspends key activities after rape and sex assault allegationsThe group vows to “rebuild trust” following recent revelations which led major firms to quit as members. Read more at: https://www.bbc.co.uk/news/business-65355466?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail pay offer accepted by Communication Workers Union leadersThe CWU will recommend its members accept a deal to end the long-running dispute, Royal Mail’s owner says. Read more at: https://www.bbc.co.uk/news/uk-65346232?at_medium=RSS&at_campaign=KARANGA |

|

TransPennine Express worst for train cancellationsThe troubled rail operator canceled around one in six of its trains last month, the regulator says. Read more at: https://www.bbc.co.uk/news/business-65346831?at_medium=RSS&at_campaign=KARANGA |

|

Ace investor Vijay Kedia raises stake in this multibagger stockAffordable Robotic and Automation shares have given multibagger returns to investors in the last six months, rising over 100%. As of March 2023, Vijay Kedia and his firm Kedia Securities hold a combined stake of 13.30%, up from 12.25% in September 2022. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ace-investor-vijay-kedia-raises-stake-in-this-money-spinner-multibagger-stock/articleshow/99675325.cms |

|

These 4 consumer discretionary stocks touch their new 52-week highThe Sensex experienced a slight increase on Friday, gaining 23 points to reach the 59,655 mark. As a result of this minor upswing, 4 stocks from the BSE consumer discretionary index reached new 52-week highs, which is a critical technical indicator for many traders and investors. This indicator helps them to assess a stock’s current value and predict its future price movements. The “52-week high” refers to the highest price at which a stock has been traded in the past year.” Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-4-consumer-discretionary-stocks-touch-their-new-52-week-high-gaining-up-to-42-in-a-month/on-a-roll-/articleshow/99674161.cms |

|

Reliance Jio Q4 Results: PAT jumps 13% YoY to Rs 4,716 cr; beats estimatesReliance Jio, the telecom arm of Reliance Industries, reported a net profit of INR47.16bn ($635m) in Q4 2019, a 13% YoY increase. Jio, which added 29.2 million subscribers in FY2023, also showed a 12% YoY revenue rise with income from operations of INR233.94bn. However, revenue and profit growth was weaker than in previous quarters due to increased expenses and lack of recent tariff hikes. Mukesh Ambani, the chairman and managing director of Reliance Industries, said Jio continued to extend “True 5G reach to 2,300+ cities and towns”. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/reliance-jio-q4-results-pat-jumps-13-yoy-to-rs-4716-cr-beats-estimates/articleshow/99669544.cms |

|

: First Republic bond prices suggest rocky road ahead for bank as it readies Q1 resultsTrading in First Republic bonds signals lower expectations for the stressed regional lender, which received a $30 billion deposit injection last month. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DB-422A05870CA9%7D&siteid=rss&rss=1 |

|

Washington Watch: Biden aims to take on ‘environmental racism’ with executive actionPresident Biden is expected to pledge new policies toward environmental justice and attack GOP plans to strip green initiatives as part of debt-crisis fight. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DC-E65A6D8E8B82%7D&siteid=rss&rss=1 |

|

Commodities Corner: Here’s what the U.S. plan for EV sales means for critical metals such as copper and lithiumThe U.S. government’s plan to have electric vehicles make up the majority of new vehicle sales in less than a decade will have ripple effects across markets for so-called “green” metals, those used to achieve cleaner energy goals, such as lithium, cobalt, nickel, and copper. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DC-EBF1747DE4A3%7D&siteid=rss&rss=1 |

Via Reuters

Via Reuters