Summary Of the Markets Today:

- The Dow closed down 80 points or 0.23%,

- Nasdaq closed up 0.03%,

- S&P 500 closed down 0.01%,

- Gold $2,007 down $12.50,

- WTI crude oil settled at $79 down $1.70,

- 10-year U.S. Treasury 3.602% up 0.028 points,

- USD $101.96 up $0.21,

- Bitcoin $29,256 down $984,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

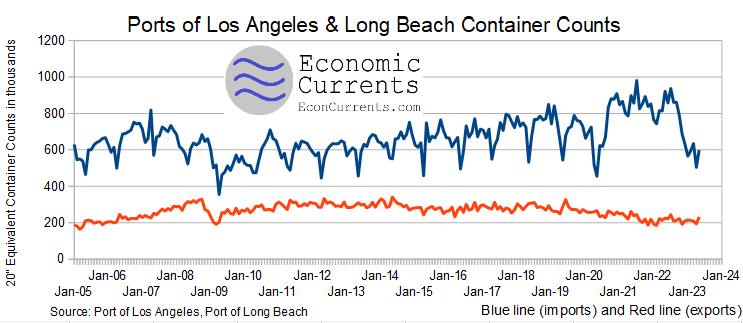

The Ports of Los Angeles and Long Beach are the busiest seaports in the United States, handling over 40% of all inbound containers for the entire United States. In March 2023, imports declined 35% year-over-year whilst exports increased 3% year-over-year. Imports are an economically important data point as it provides a view into personal consumption in the US. However, a year ago, the ports were working off a backlog caused by a supply recovery from the COVID-related logistics surge. I do suspect if one can rationalize away the last year’s surge, that imports are soft in March 2023.

The Beige Book for April 19, 2023, reported that economic activity continued to expand in all 12 Federal Reserve districts. However, the pace of growth slowed in some districts, as businesses reported rising costs and labor shortages. The report noted that

- Manufacturing activity expanded in all 12 districts, but the pace of growth slowed in some districts. Businesses reported rising input costs, including energy, raw materials, and labor. Some businesses also reported difficulty finding qualified workers.

- Retail sales expanded in all 12 districts, but the pace of growth slowed in some districts. Businesses reported rising sales, but they also reported rising costs and labor shortages.

- Residential real estate activity expanded in all 12 districts, but the pace of growth slowed in some districts. Businesses reported rising home prices and demand, but they also reported rising construction costs and labor shortages.

- Nonresidential real estate activity expanded in all 12 districts, but the pace of growth slowed in some districts. Businesses reported rising demand for commercial and industrial space, but they also reported rising construction costs and labor shortages.

- The Beige Book also reported that labor markets remained tight in all 12 districts. Businesses reported difficulty finding qualified workers, and they were raising wages to attract and retain workers.

Overall, the Beige Book reported that economic activity continued to expand in all 12 Federal Reserve districts, but the pace of growth slowed in some districts. Businesses reported rising costs and labor shortages, which were weighing on growth.

A summary of headlines we are reading today:

- Wind Power Has A Profitability Problem

- Investors Turn To Precious Metals Amid Recessionary Fears

- MIT Study: Nuclear Power Shutdown Could Lead To Increased Deaths

- Oil Prices Fall Despite Crude Inventory Draw

- Baker Hughes Q1 Earnings Beat Expectations

- DeSantis and allies ramp up Disney’s fight as more Republicans criticize his tactics

- Sell-off hits bitcoin, and SEC Chair Gensler grilled on crypto in House hearing: CNBC Crypto World

- Earnings Outlook: Derailments, and paid sick leave loom over railroad earnings reports

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Role In Uzbekistan’s Green Energy BoomAgainst the backdrop of the Russo-Ukrainian war and fluctuating relations between Kazakhstan and Russia, Uzbekistan is gaining strategic importance for China as a potential stable emerging market in Central Asia. As a result, Beijing has made more concerted efforts to expand its soft power throughout the country (Eurasianet, March 22). Since the beginning of the war, Chinese investment in Uzbekistan has been steadily growing. Two sectors in particular, the automotive and green energy sectors, reflect Beijing’s overall growing economic power… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Role-In-Uzbekistans-Green-Energy-Boom.html |

|

Alberta Releases New Climate Plan Through 2050Canada’s main oil province, Alberta, released on Wednesday a plan to reach net-zero emissions by 2050. Missing from Alberta’s net-zero emissions plan are targets set for any time between now and 2050. Canada’s federal government created its Canadian Net-Zero Emissions Accountability Act, which became law on June 29, 2021, and serves as the framework for reaching Net-Zero by 2050. But part of Canada’s Accountability Act calls for “milestone years”—2035, 2040, and 2045—for which the country must also… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Alberta-Releases-New-Climate-Plan-Through-2050.html |

|

Wind Power Has A Profitability ProblemDespite the strong push to shift to green by installing more renewable energy capacity, many are asking whether the wind energy industry will be able to bounce back quickly from huge losses last year to develop the wind power needed to fuel the green transition. In 2022, several major wind energy firms reported billions in losses due to a plethora of challenges that have made it harder to develop new wind farms worldwide. Now the fear is that companies around the globe may be unwilling to invest in the wind projects needed to accelerate the movement… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Wind-Power-Has-A-Profitability-Problem.html |

|

Investors Turn To Precious Metals Amid Recessionary FearsVia AG Metal Miner The Global Precious Metals MMI (Monthly Metals Index) enjoyed its largest month-over-month increase in a year. Between March and April, the index broke out of its tight sideways range and rose by 6.93%. The current talk of the town for precious metal prices today centers around recessionary fears. Indeed, investors are increasingly turning to precious metals, a classic recession safe haven. Due to these investment changes, all silver, platinum, and gold parts of the index either rose or moved sideways with a slight upward movement.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Investors-Turn-To-Precious-Metals-Amid-Recessionary-Fears.html |

|

MIT Study: Nuclear Power Shutdown Could Lead To Increased DeathsA Massachusetts Institute of Technology new study shows that if U.S. nuclear power plants are retired, the burning of coal, oil, and natural gas to fill the energy gap could cause more than 5,000 premature deaths. The MIT team took on the questions in the text following in a new study appearing in Nature Energy. Nearly 20 percent of today’s electricity in the United States comes from nuclear power. The U.S. has the largest nuclear fleet in the world, with 92 reactors scattered around the country. Many of these power plants have run for more… Read more at: https://oilprice.com/Energy/Energy-General/MIT-Study-Nuclear-Power-Shutdown-Could-Lead-To-Increased-Deaths.html |

|

Russia’s Flagship Crude Sees Near-Record April LoadingsBuoyed by OPEC+ surprise production cuts, the price of Russia’s flagship Urals crude is threatening to reach beyond the $60 per barrel price cap set by the G7, with reports now emerging that oil loadings from western Russian ports in April are likely to reach their highest level since 2019.Despite a 500,000 barrel-per-day output cut announced by Moscow in alleged retaliation for the G7 price cap of $60, Urals crude loadings from Russia’s western ports is set to be more than 2.4 million bpd for the month of April, Reuters reports, citing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Flagship-Crude-Sees-Near-Record-April-Loadings.html |

|

Raw Materials Supply Present A Challenge In Meeting EPA TargetsThe Environmental Protection Agency (EPA) has proposed a new set of historically strict tailpipe emissions standards which would provide a massive boost to electric vehicle (EV) sales in coming months and years. The new proposed standards, which were introduced last week, would require that more than half and at least two-thirds of vehicle sales will need to be EVs by just 2032 – less than a decade from now. This is a massive shift; last year, EVs made up just 5.8 percent of the total auto market in the United States. While it’s… Read more at: https://oilprice.com/Energy/Energy-General/Raw-Materials-Supply-Present-A-Challenge-In-Meeting-EPA-Targets.html |

|

Sunergy Announces $475M SPAC Merger DealAs blank-check SPAC mergers attempt a comeback after a volatile year, solar outfit Sunergy Renewables has announced plans to go public and list on the NASDAQ in a $475-million deal that is expected to close in the fourth quarter of this year. The black-check merger with ESGEN Acquisition Corp (ESAC.O) is intended to help Sunergy expand its solar power, battery power and energy storage business which is currently operating in Florida, Texas and Arkansas. “Proceeds to provide growth capital to Sunergy for expansion of customer offerings and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sunergy-Announces-475M-SPAC-Merger-Deal.html |

|

Sudan Descends Into Chaos As Military Factions Fight For ControlIn the Sudanese capital, civilians cower behind interior walls, fearing flying window glass and stray bullets. Commerce in Khartoum has ground to a halt. Water and electricity outages are widespread. Pitched battles have broken out near the airport and other parts of the city of 5 million, with fighter jets roaring overhead. Two military factions — once political allies, now battlefield adversaries — are wrestling for control over the city and over the country’s lucrative mineral resource exports, especially gold. Violence is erupting in… Read more at: https://oilprice.com/Geopolitics/International/Sudan-Descends-Into-Chaos-As-Military-Factions-Fight-For-Control.html |

|

Russia’s Gas Giant To Set Up Middle East UnitA regulatory disclosure revealed on Tuesday that Gazprom is setting up a unit in the Middle East, according to Reuters. Russia’s state-controlled gas company did not provide details, but those details could be a critical factor in determining influence in the Middle East—be that Russia’s or the United States’. The news comes after an exclusive report by Oilprice.com made shortly after the recent Iran/Saudi Arabia deal, who cited a Kremlin official who said, “By keeping the West out of energy deals in Iraq – and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Gas-Giant-To-Set-Up-Middle-East-Unit.html |

|

Oil Prices Fall Despite Crude Inventory DrawCrude oil prices inched lower today, after the U.S. Energy Information Administration reported an inventory draw of 4.6 million barrels for the week to April 14. This compared with a modest build in crude oil inventories for the previous week, at 600,000 barrels. For the week before that, however, the EIA had estimated a sizeable draw of 3.7 million barrels. In fuels, the EIA estimated mixed changes in inventories for the week ending April 14. Gasoline inventories added 1.3 million barrels during that week, according to the EIA, with… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Price-Fall-Despite-Crude-Inventory-Draw.html |

|

Nuclear Troubles Send French Winter Power Prices SoaringFrance’s power prices for early 2024 are double the German prices for next winter as the huge French nuclear fleet continues to show signs of weak output and availability. The French power price for the first quarter of 2024 was at $455 (416 euros) per megawatt-hour (MWh) on Wednesday. That’s more than double the price for the same period in Germany, where the power price was at $185 (169 euros) per MWh for early 2024, according to data compiled by Bloomberg. France has had troubles at many of its nuclear reactors, half of which… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nuclear-Troubles-Send-French-Winter-Power-Prices-Soaring.html |

|

Germany Moves To Ban Most Oil And Gas Heating Systems From 2024The German government voted on a bill on Wednesday to ban most oil and gas heating boilers in new and oil buildings from 2024 as part of a plan to reduce emissions. The ruling coalition in Germany has decided that nearly all new heating systems should run on 65% renewable energy, with exemptions for homeowners aged over 80 and for households with the lowest incomes. Industry associations and the German public disagree with the planned ban. A Forsa survey commissioned by RTL and ntv showed this week that 78% of Germans do not approve of the… Read more at: https://oilprice.com/Energy/Energy-General/Germany-Moves-To-Ban-Most-Oil-And-Gas-Heating-Systems-From-2024.html |

|

Libya’s Oil Production Hits 1.2 Million BpdLibya’s National Oil Corporation (NOC) has said that the country’s crude oil production has reached 1.2 million barrels per day (bpd), the Libyan News Agency reported on Wednesday. According to secondary sources in OPEC’s latest Monthly Oil Market Report (MOMR), Libyan crude oil production averaged 1.161 million bpd in March, down by 2,000 bpd compared to February. Libya is exempted from the OPEC+ agreement for the reduction of oil supply to the market because of the African OPEC member’s volatile security situation in recent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-Oil-Production-Hits-12-Million-Bpd.html |

|

Baker Hughes Q1 Earnings Beat ExpectationsBaker Hughes (NASDAQ: BKR) on Wednesday reported adjusted earnings per share for the first quarter, beating analyst estimates, reiterating a view in the oilfield services industry that the current oil and gas spending cycle could last for years. Baker Hughes, the first of the top three oilfield services to report Q1 earnings, said today that its adjusted diluted earnings per share stood at $0.28, down by 25% on the quarter, but an increase of 85% compared to the first quarter of 2022. The past quarter’s EPS beat the analyst consensus estimate… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Baker-Hughes-Q1-Earnings-Beat-Expectations.html |

|

Meta has started its latest round of layoffs, focusing on technical employeesMeta has begun saying goodbye to some technical workers, following plans announced in March to lay off 10,000 employees. Read more at: https://www.cnbc.com/2023/04/19/meta-started-latest-round-of-layoffs-focusing-on-technical-employees.html |

|

Tesla set to report first-quarter earnings after the bellHeading into first-quarter earnings, Tesla shares have rebounded this year after a dismal 2022 Read more at: https://www.cnbc.com/2023/04/19/tesla-tsla-earnings-q1-2023.html |

|

DeSantis and allies ramp up Disney’s fight as more Republicans criticize his tacticsFormer President Donald Trump, now a major DeSantis critic, wrote that the governor is getting “absolutely destroyed by Disney.” Read more at: https://www.cnbc.com/2023/04/19/ron-desantis-disney-fight-intensifies-despite-criticism.html |

|

ESPN to begin layoffs early next week as part of Disney cost cuts, sources sayESPN will lay off both on-air talent and management as part of Disney’s cost-cutting efforts, sources say. Read more at: https://www.cnbc.com/2023/04/19/espn-layoffs-disney-cost-cuts.html |

|

Supreme Court maintains full access to abortion pill mifepristone until at least FridayA complex legal battle over access to the abortion pill mifepristone has landed at the Supreme Court. Read more at: https://www.cnbc.com/2023/04/19/supreme-court-rules-on-abortion-pill-mifepristone.html |

|

Parking your cash in these investments is paying off: 3 ways to find the best place to hideFor now, it’s paying off to keep cash idle. Read more at: https://www.cnbc.com/2023/04/19/parking-your-cash-here-pays-off-3-ways-to-find-the-best-place-to-hide.html |

|

Fox faces a similar defamation case from Smartmatic after Dominion settlementSmartmatic wants to compel Fox to “reproduce all relevant documents and depositions from the Dominion actions.” Read more at: https://www.cnbc.com/2023/04/19/fox-smartmatic-defamation-case-dominion.html |

|

How to apply for your share of Facebook’s $725 million settlement in privacy suitFacebook users who maintained an account between May 2007 and Dec. 2022 can submit a claim for their share of a $725 million class action settlement. Read more at: https://www.cnbc.com/2023/04/19/how-facebook-users-can-apply-for-part-of-725-million-settlement.html |

|

Ukraine war live updates: U.S. ‘can cheat at any moment,’ Russia says; Kremlin rejects allegations over North Sea spyingRussian Foreign Minister Sergei Lavrov said “the United States can cheat at any moment,” claiming Russia had experienced this when NATO expanded eastward. Read more at: https://www.cnbc.com/2023/04/19/ukraine-live-war-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Abortion pill company GenBioPro asks U.S. court to keep generic mifepristone on marketThe Supreme Court is considering whether to maintain a court order that would severely restrict access to the abortion drug mifepristone. Read more at: https://www.cnbc.com/2023/04/19/abortion-pill-company-genbiopro-seeks-mifepristone-order.html |

|

Why U.S. vacation policies are so much worse than Europe’sEven though a majority of American workers do have some kind of paid time off, nearly half of them report not using all of their vacation time. Read more at: https://www.cnbc.com/2023/04/19/why-us-vacation-policies-are-so-much-worse-than-europes.html |

|

Climate change thaws world’s northernmost research stationWhile the Arctic is warming about four times faster than the rest of the world, in Svalbard temperatures are climbing up to seven times the global average. Read more at: https://www.cnbc.com/2023/04/19/climate-change-thaws-worlds-northernmost-research-station.html |

|

Sell-off hits bitcoin, and SEC Chair Gensler grilled on crypto in House hearing: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, ARK Invest crypto lead Yassine Elmandjra breaks down his long-term outlook for bitcoin. Read more at: https://www.cnbc.com/video/2023/04/19/sell-off-hits-bitcoin-sec-gensler-grilled-crypto-cnbc-crypto-world.html |

|

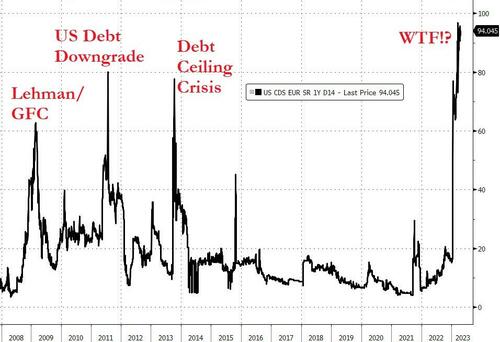

As US Debt-Ceiling Debacle Looms, Goldman Warns Of Stock & Bond Yield Declines, Dollar BidUS Sovereign credit risk protection has never cost so much as it currently does…

Source: Bloomberg …but Goldman Sachs’ Dominic Wilson believes that systemic risk threat is overdone:

While their central expectation is that lawmakers reach some compromise before the X-date, Goldman does warn that the risks of failure to reach an agreement are the highest that they have been since at least 2011. Wilson notes that the more persistent growth risks from the fiscal tightening that we saw in the 2011 debt limit deal are less likely now, we can look at the shifts seen in that period for some sense of how 2023’s debacle could play out: To mitigate the r … Read more at: https://www.zerohedge.com/markets/us-debt-ceiling-debacle-looms-goldman-warns-stock-bond-yield-weakness-dollar-boost |

|

Bomb Squad Called To Seattle Apartment Building After Reports Of ExplosionThe Seattle Fire Department (SFD) evacuated an apartment building on 1st Avenue North on Wednesday morning after reports of an explosion.

SFD said one person is in serious condition. There are no active fires in the building.

SFD said:

|

|

WaPo Belatedly Admits ‘Proxy War’ Nature Of Ukraine Conflict In Wake Of LeaksBelow is how Defense Secretary Lloyd Austin responded when asked by The Washington Post whether the Ukraine conflict is a proxy war…

But then WaPo points out the obvious: “That may be true, but the administration has given Ukraine more than $40 billion in military and economic aid, along with real-time targeting assistance and sophisticated weapons systems on which it has trained Kyiv’s forces.”

Read more at: https://www.zerohedge.com/geopolitical/wapo-belatedly-admits-proxy-war-nature-ukraine-conflict-after-pentagon-leaks |

|

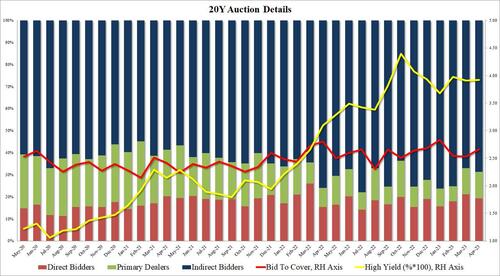

Solid Demand For Tailing 20Y Auction As Kink PersistsA week after several mediocre coupon auctions, today the Treasury tested market demand for 20Y paper with average results. Today’s sale a 20Y reopening (technically 19-Y, 10-Monthy CUSIP TQ1), priced at a high yield of 3.920%, up from last month’s 3.906% and tailing the When Issued 3.918% by 0.2bps, the third consecutive tailing 20Y auction in a row (following 3 stop throughs). The Bid to Cover of 2.66 was solid, above last month’s 2.53 and also above the six-month average of 2.62. The internals were ok, with Indirects awarded 68.7%, and with Directs taking down 19.2% of the auction, slightly above the recent average of 18.2%, that meant that Dealers were left holding 12.0% of the auction, the most since last October, perhaps as the big banks start loading up on duration ahead of the next QE.

In summary, a medicore, modestly tailing sale of 20Y bonds, one which failed to benefit from today’s concession which pushed the 10Y yield over 3.63%; the reaction to the auction was clear: slight disappointment, with 10Y … Read more at: https://www.zerohedge.com/markets/solid-demand-tailing-20y-auction-kink-persists |

|

UK inflation: Supermarkets say price rises will ease soonThe retail industry body said there was a three to nine-month lag to see price falls reflected in shop prices. Read more at: https://www.bbc.co.uk/news/business-65312127?at_medium=RSS&at_campaign=KARANGA |

|

Facebook owner Meta sees latest layoffs beginThe social media giant is under pressure after a sharp slowdown in its ads business last year. Read more at: https://www.bbc.co.uk/news/business-65330301?at_medium=RSS&at_campaign=KARANGA |

|

Heathrow security staff and passport workers announce May strikesIt comes amid a wave of industrial action by hundreds of thousands of workers in different sectors. Read more at: https://www.bbc.co.uk/news/uk-65329441?at_medium=RSS&at_campaign=KARANGA |

|

Q4 Results: ICICI Securities profit falls 23%; Tata Com PAT down 11%Revenue from operations during the quarter stood at Rs 885 crore, also down marginally as against Rs 892 crore in the year-ago period.The income from interest for the quarter came in at Rs 287 crore, up 35% year-on-year, while brokerage income stood at Rs 310 crore Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/q4-results-icici-securities-profit-falls-23-to-rs-337-cr-tata-communications-pat-down-11/articleshow/99619274.cms |

|

Norwegian Government Pension Fund picks up 1.7% stake in Bajaj Electricals in bulk dealNorwegian Government Pension Fund Global has increased its stake in Bajaj Electricals by 1.73% on 11 August via open market transactions, bringing its total shareholding in the electrical appliances company up to 3.03%. Meanwhile, California-based venture capitalist firm Small Cap World Fund has reduced its stake to 3.36%, down from 5.3%. Bajaj’s shares rose 3.23% to INR1,077 ($16.80) on the news. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/norwegian-government-pension-fund-picks-up-1-7-stake-in-bajaj-electricals-in-bulk-deal/articleshow/99618560.cms |

|

Crisil declares 700% interim dividend for CY23For the March quarter, Crisil’s consolidated income from operations rose 20% to Rs 715 crore, compared with Rs 595 crore in the corresponding quarter of the previous year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/crisil-declares-700-interim-dividend-for-cy23/articleshow/99618221.cms |

|

Why Starbucks launched another 5,000 NFTs todayStarbucks launches 5,000 nonfungible tokens just a month after it released 2,000 NFTs. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DA-162BDC9D5687%7D&siteid=rss&rss=1 |

|

Earnings Outlook: Derailments, paid sick leave loom over railroad earnings reportsThe February derailment of a Norfolk Southern train in East Palestine, Ohio, has been described as a ‘PR nightmare’ for the rail industry. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DA-1C01E97C77D1%7D&siteid=rss&rss=1 |

|

Financial Crime: Call 1-800-I-AM-A-FRAUD: Florida man jailed after years of evading millions in fines in telecom schemePatrick Hines claimed bankruptcy after his 1-800 scam collapsed, but kept living large after hiding his millions in others’ names. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DA-31FAC6195A6A%7D&siteid=rss&rss=1 |

DoD photo as US forces trained Ukrainian troops in 2019 as part of the Joint Multinational Training Group.The repor …

DoD photo as US forces trained Ukrainian troops in 2019 as part of the Joint Multinational Training Group.The repor …