Headlines:

Oil Prices Retreat As Biden Leaves Energy Out Of Sanctions Package.

The Russian Invasion Of Ukraine To Further Strain U.S. Chip Supply For Auto And Tech Industries.

Putin Pushes For Regime Change As Russian Forces Close In On Kyiv.

Ukraine Conflict: U.K. Sanctions Target Russian Banks And Oligarchs.

Bond Report: 2-Year Treasury Yield Sees Biggest Drop In Month After Russia Mounts Attack On Ukraine, And Biden Unveils Fresh Sanctions.

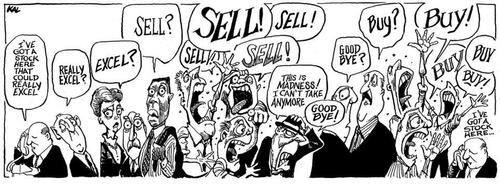

Investors on Wall Street panicked this morning after the Ruskies invaded Ukraine, gaping the DOW down 862 points and NASDAQ plunges 3% into bear-market territory. However, Fighting off enormous losses, BTFDers’ ever-present buying sent the major indexes to green by the closing bell. This upward trend may be good news for the bulls or just a dead-cat bounce, also known as a relief rally, followed by enhanced losses. However, regarding Russia’s attack on Ukraine: ‘Now is not a time to be buying the dip’ in stocks, warns Wells Fargo strategist.

This morning’s financial reporting probably was why the markets climbed out of the toilet to post gains for the session. The GDP Growth Rate QoQ 2nd Est Q4 was up significantly. In addition, the Initial Jobless Claims 19/FEB was down 17 K, Continuing Jobless Claims 12/FEB was also down, and Core PCE Prices QoQ 2nd Est Q4 posted higher at five percent. All in all, good news for the U.S. economy.

This morning WTI crude skyrocketed to 100.50, finally settling at 95.24. The U.S. dollar shot up to 97.74, then slipping to 96.28 and finally settling at 97.07. Gold had similar action reporting a high of 1975 and pausing at the 1898 level.

Bitcoin is sometimes called ‘digital gold,’; a safe-haven asset or ‘the ultimate risk asset’ when things fall into the toilet. Ukraine’s invasion put the crypto’s long-term value to the test this morning. Unfortunately, things got worse, and Bitcoin failed the test by falling from 40,000 to 34460 this morning. Bitcoin has recovered to the 38500 level.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Japan Sees Nuclear Energy As A Vital Piece Of Its Net-Zero PlanAs climate change becomes an increasingly pressing issue, governments worldwide have stepped up efforts towards decarbonization. Japan aims to reduce its greenhouse gas emissions by 26% from 2013 levels by 2030. Leveraging nuclear energy could help Japan meet this goal, a fact understood by the administration of Prime Minister Kishida Fumio. However, the government faces an uphill battle in the shadow of the 2011 Fukushima nuclear disaster. Japans Energy Ambitions Prior to the Fukushima disaster, nuclear power generation accounted for almost Read more at: https://oilprice.com/Energy/Energy-General/Japan-Sees-Nuclear-Energy-As-A-Vital-Piece-Of-Its-Net-Zero-Plan.html |

|

Oil Prices Retreat As Biden Leaves Energy Out Of Sanctions PackageCrude oil retreated on Thursday afternoon as U.S. President Joe Biden prepared yet another round of sanctions on Russia in order to punish Russia for its earlier attack on Ukraine. In a White House presser, President Joe Biden recapped existing sanctions and announced new ones. The sanctions are purposefully designed, President Biden said, to maximize the long-term pain inflicted on Russia, while minimizing the pain felt by American consumers. And its not just the United States. President Biden said he met with the G7 leaders earlier Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Retreat-As-Biden-Leaves-Energy-Out-Of-Sanctions-Package.html |

|

Could The Iran Nuclear Deal Bring Oil Back Down?On Thursday morning, the 24th of February 2022, Putin gave a short speech in which he ordered a special military operation in the eastern region of Ukraine. This came a day after he delivered an aggressive speech, denying Ukraine its sovereignty and recognizing the independence of the Donetsk and Luhansk regions, situated on the eastern side of Ukraine. At the time of writing, there are missiles being fired and reports are coming that troops are nearing Kyiv, the capital. In response to this invasion, oil prices breached $100 for Read more at: https://oilprice.com/Energy/Energy-General/Could-The-Iran-Nuclear-Deal-Bring-Oil-Back-Below-100.html |

|

Saudi Sovereign Wealth Fund Considers Sale Of $90 Billion Aramco StakeSaudi Arabias sovereign wealth fund is reportedly looking into ways to monetise its around $90 billion (66.7 billion) stake in Aramco, the worlds largest oil company. The Public Investment Fund is weighing its options, Bloomberg first reported, as Saudi Aramco seeks funds to pursue its ambitious investment plans. The Fund, which currently owns around a four percent stake in Aramco, has been inviting advisers to pitch options. Avenues currently on the table include a full or partial sale of the holding or raising capital by Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Sovereign-Wealth-Fund-Considers-Sale-Of-90-Billion-Aramco-Stake.html |

|

Putin Pushes For Regime Change As Russian Forces Close In On KyivPutins declared intent at this point is to ensure a pro-Russian government in Ukraine, and the only question now is how long the Ukrainians will fight. Speaking on Bloomberg TV, Former CIA Director Gen. David Petraeus said Putins aim now is to topple the Ukrainian government, replace it with a pro-Russian regime, control the capital and control everything east of the Dnieper, as well as the southern portion of the country to cut Ukraine off from the Black Sea and connect up with a Russian unit in the eastern part Read more at: https://oilprice.com/Geopolitics/Europe/Putin-Pushes-For-Regime-Change-As-Russian-Forces-Close-In-On-Kyiv.html |

|

Is Big Oil Overselling Its Energy Transition Efforts?February has been a month marked by explosive reports revealing sweeping greenwashing campaigns by the fossil fuels industry. As the dust settles from the first waves of the novel coronavirus pandemic, investigative watchdogs are taking stock of which institutions made what promises for curbing their carbon footprints, and how their actual measures and action plans measure up. As the world scrambled to establish a pathway toward a new normal during the first wave of Covid-29 in 2020, hope for a better, greener future blossomed. Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Is-Big-Oil-Overselling-Its-Energy-Transition-Efforts.html |

|

Shares of EV start-up Nikola surge on earnings beat, plans to generate revenue in 2022Nikola said it expects to generate revenue of between $90 million and $150 million in 2022 on deliveries of between 300 and 500 of EV semitrucks. Read more at: https://www.cnbc.com/2022/02/24/shares-of-ev-start-up-nikola-surge-on-earnings-beat-revenue-in-2022.html |

|

Satellite imagery shows Russian attack on Ukraine from spaceSatellite imagery gives another perspective on the developing situation in Ukraine, as Russian troops move in and strikes occur in multiple cities. Read more at: https://www.cnbc.com/2022/02/24/satellite-imagery-shows-russian-attack-on-ukraine-from-space.html |

|

Moderna says Covid is entering an endemic phase, but annual vaccines will be neededModerna Chief Medical Officer Paul Burton said Covid is entering an endemic phase in the Northern Hemisphere. Read more at: https://www.cnbc.com/2022/02/24/moderna-says-covid-is-entering-an-endemic-phase-but-annual-vaccines-will-be-needed.html |

|

Walmart kicks off exclusive sales event to try to win and retain Walmart+ membersThe deals event, which runs for three weeks, will include a rotating mix of items from air fryers to exercise bikes. Read more at: https://www.cnbc.com/2022/02/24/walmart-kicks-off-exclusive-sales-event-for-walmart-members.html |

|

Food and drink prices are going up. CEOs say consumers aren’t changing their shopping behavior yetFood and drink prices are rising, but CEOs say consumers aren’t balking yet at paying more for their Lay’s chips and Tyson chicken nuggets. Read more at: https://www.cnbc.com/2022/02/24/grocery-prices-keep-rising-but-ceos-say-shoppers-are-still-buying.html |

|

Investing Club: We’re buying in health care again, a sector insulated from geopolitical upheavalWe like drug stocks and health care here because these are companies that can continue to grow earnings even if there’s an economic slowdown. Read more at: https://www.cnbc.com/2022/02/24/investing-club-were-buying-in-health-care-again-a-sector-insulated-from-geopolitical-upheaval.html |

|

Russian invasion of Ukraine to further strain U.S. chip supply for auto, tech industriesRussia and Ukraine are critical suppliers of neon gas and palladium that are used to produce semiconductor chips. Read more at: https://www.cnbc.com/2022/02/24/russian-invasion-of-ukraine-to-further-strain-us-chip-supply.html |

|

Biden pauses new oil and gas leases amid legal battle over cost of climate changeThe leasing pause comes after a Louisiana federal judge blocked officials from using higher cost estimates of climate change. Read more at: https://www.cnbc.com/2022/02/24/biden-administration-pausing-new-oil-and-gas-leases-amid-legal-battle-.html |

|

Europe installed a record amount of wind power last year. But industry says it’s not enoughWindEurope points to permitting as being a hurdle for the sector’s expansion going forward, describing it as “the main bottleneck.” Read more at: https://www.cnbc.com/2022/02/24/europe-installed-a-record-amount-of-wind-power-in-2021.html |

|

Planet Fitness CEO says Gen Zers are signing up for gym memberships at higher rates than pre-CovidPlanet Fitness is seeing more pre-teens and teens sign up for their first gym memberships during the coronavirus pandemic. Read more at: https://www.cnbc.com/2022/02/24/planet-fitness-ceo-gen-z-is-fueling-overall-membership-growth.html |

|

Authentic Brands Group takes majority stake in David Beckham’s brand management firmAuthentic Brands Group announced it has entered into a partnership to co-own and manage David Beckham’s global brand management firm, DB Ventures. Read more at: https://www.cnbc.com/2022/02/24/authentic-brands-group-takes-majority-stake-in-david-beckhams-firm.html |

|

5 things to know before the stock market opens ThursdayGlobal markets plunged Thursday after Russia launched an invasion of Ukraine in the early morning hours. Read more at: https://www.cnbc.com/2022/02/24/5-things-to-know-before-the-stock-market-opens-thursday-february-24.html |

|

Stocks making the biggest moves premarket: Live Nation, SeaWorld, Gannett and othersThese are the stocks posting the largest moves before the bell. Read more at: https://www.cnbc.com/2022/02/24/stocks-making-the-biggest-moves-premarket-live-nation-seaworld-gannett-and-others.html |

|

Massive Roundtrips Across Global Markets As Russia Sanctions Fears AbateMassive Roundtrips Across Global Markets As Russia Sanctions Fears AbateWell that was a night and a day…

As Goldman’s Chris Hussey summarized today, “the Russia-Ukraine conflict transitioned from a ‘known unknown’ to a ‘known known’ today, in the parlance of Wall Street, and markets may be showing some signs of embracing a bit of the diminishing ‘uncertainty’.” The most devastating package of sanctions ever in the history of the world, avoided touching any commodity product and did not include SWIFT restrictions and that was all the excuse that was needed for traders to lift hedges, punching stocks higher.

Today’s rebound (from down 4% to up 3.5%) was the biggest intraday jump in NQ futs since 3.13.2020 as The Fed unleashed hell on the bears. All the US … Read more at: https://www.zerohedge.com/markets/massive-roundtrips-across-global-markets-russia-sanctions-fears-abate |

|

China Embassy In Ukraine Preparing Flights To Evacuate CitizensChina Embassy In Ukraine Preparing Flights To Evacuate CitizensPrompting questions “why now”, the Chinese Embassy in Kiev issued a notice on Thursday in preparation for the evacuation of Chinese nationals from Ukraine. As China’s Global Times writes, “Given the rapidly deteriorating situation in Ukraine, Chinese nationals and companies are facing high security risks. For this reason, the embassy is preparing charter flights and is asking all Chinese nationals to voluntarily register their information.” The charter flights will be dispatched according to the safety situation and will be notified in advance, the embassy said. In response to the quickly evolving events, the Chinese Embassy in Ukraine issued two security alerts for Chinese citizens and companies in the country in one day. The embassy said that, although activities have been affected, there was no panic. The embassy also asked all Chinese nationals to monitor the evolution of the situation. If they have to travel long distances, they should make sure gas stations are open along the route to refuel their vehicles. The statement also reminded Chinese nationals to put the Chinese national flag on their cars. Currently, there are about 6,000 Chinese nationals in Ukraine, mainly in Kiev, Lvov, Kharkov, Odessa and Sumy. The evacuation notice comes as Beijing is strongly hinting that it is siding with Russia, after foreign ministry spokeswoman Joanne Ou denounced the attack on Ukraine’s sove … Read more at: https://www.zerohedge.com/geopolitical/china-embassy-ukraine-preparing-flights-evacuate-citizens |

|

These Are The Companies Most Exposed To Russia And UkraineThese Are The Companies Most Exposed To Russia And UkraineNow that military action in Ukraine is reality, a development which has caught much of the market by surprise, investors are digging through the data to uncover which companies are most exposed to the deadly escalation in Ukraine. The good news is that for the most part, corporate exposure to Russia/Ukraine is limited and focused in a handful of sectors (mostly commodities and energy). Despite the relatively low exposure however, energy costs are at the heart of the Fed’s anti-inflation crusade, and as JPMorgan writes, the Russia/Ukraine crisis could force a reassessment of the Fed tightening path resulting in central banks turning less hawkish, while policymakers may consider additional fiscal stimulus (e.g. US gas tax reduction). That said, Russia is a major producers of PGMs, nickel, aluminium and diamonds In 2021, Russia accounted for: ~35% of global palladium mine supply, ~10% of platinum, ~6% of primary aluminium, 7% of nickel, 4% of copper and ~30% of rough diamonds. Metal prices have already reacted to the risk of supply disruptions, but sanctions on exports on any of these metals/commodities could send prices even higher; global visible inventories are already depleted meaning metal prices will respond quickly to any supply shocks. Russia’s importance to the global autos industry is particularly high (platinum and palladium) and the recent experience of sanctions on major aluminium producer Rusal in 2018 show the potential disruption effects on global supply chains. Given the importance of Russian gas to Europe, Deutsche Bank warns that power prices could remain elevated or mov … Read more at: https://www.zerohedge.com/markets/these-are-companies-most-exposed-russia-and-ukraine |

|

SEC Is Probing Both Kimbal And Elon Musk’s Stock Sales From November 2021SEC Is Probing Both Kimbal And Elon Musk’s Stock Sales From November 2021We now know why Elon Musk has been so cranky when it comes to regulators lately: the SEC is investigating whether or not Musk or his brother violated insider trading rules, the Wall Street Journal reported today. Shares of Tesla briefly dipped on the news before recovering.

The investigation began one day after Kimbal Musk sold $108 million in stock – which occurred one day before the Tesla CEO polled his Twitter users, on November 7 – just as the Russell and cryptos peaked – asking whether or not he should sell 10% of his stake in the company. That vote then set Musk in motion to sell far in excess of $10 billion in stock, representing about 10% of his stake in Tesla. The Tesla CEO claimed the sale was a way to cover taxes for potential new capital gains laws. After Elon started selling stock, Tesla’s stock price fell 33%. Regulators are reportedly probi … Read more at: https://www.zerohedge.com/markets/sec-probing-both-kimbal-and-elon-musks-stock-sales-november-2021 |

|

Ukraine crisis: Warning UK energy bills could top £3,000 a yearThe conflict in Ukraine could push the energy price cap to £3,238 a year from October, a report warns. Read more at: https://www.bbc.co.uk/news/business-60506940?at_medium=RSS&at_campaign=KARANGA |

|

Ukraine conflict: UK sanctions target Russian banks and oligarchsRussia’s major banks will have their assets frozen following the invasion of Ukraine, Boris Johnson says. Read more at: https://www.bbc.co.uk/news/uk-60515626?at_medium=RSS&at_campaign=KARANGA |

|

Oil hits seven-year high and shares sink as Russia invades UkrainePetrol hits another record as crude prices reach their highest level for more than seven years. Read more at: https://www.bbc.co.uk/news/business-60502451?at_medium=RSS&at_campaign=KARANGA |

|

Day Trading Guide: 2 stock recommendations for FridayIf bulls manage to maintain the Nifty50 index above this key support of 16,200 a short covering rally may play out taking the Index higher to levels of 16,400-16,700. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/day-trading-guide-2-stock-recommendations-for-friday/articleshow/89803335.cms |

|

Trade setup: Creating fresh shorts at current levels won’t offer safe risk-reward propositionThe pattern analysis shows that while Nifty has violated a couple of extended trend line supports, it has also violated the all-important 200-DMA on a closing basis. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-creating-fresh-shorts-at-current-levels-wont-offer-safe-risk-reward-proposition/articleshow/89805595.cms |

|

Oil producers set to benefit from soaring crude pricesCrude oil price has returned to triple digits for the first time since 2014 which was unimaginable a year ago when the oil market was recovering from the pandemic. Read more at: https://economictimes.indiatimes.com/markets/commodities/oil-producers-set-to-benefit-from-soaring-crude-prices/articleshow/89804090.cms |

|

The Margin: CNN slammed for awkward Applebee’s ad that aired during its live Russia-Ukraine coverageThe juxtaposition of a twerking cowboy next to live footage of Kyiv under attack went viral Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-79B8-5BD6D72F17AF%7D&siteid=rss&rss=1 |

|

: Biden’s new sanctions against Russia: Blocking more banks and cutting off tech imports, but no SWIFT movePresident Joe Biden talks Thursday about the additional U.S. sanctions against Russia in response to the country’s invasion of Ukraine. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-79AF-FEE2464E1220%7D&siteid=rss&rss=1 |

|

Bond Report: 2-year Treasury yield sees biggest drop in month after Russia mounts attack on Ukraine and Biden unveils fresh sanctionsTreasury rates are mostly lower Thursday as President Joe Biden unveils new sanctions on Russia. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-79A8-56F91722BD8A%7D&siteid=rss&rss=1 |