Summary Of the Markets Today:

- The Dow closed up 75 points or 0.23%,

- Nasdaq closed up 1.01%,

- S&P 500 closed up 0.30%,

- Gold $2000 up $50.20,

- WTI crude oil settled at $69 down $1.57,

- 10-year U.S. Treasury 3.402% down 0.098 points,

- USD $102.54 up $0.19,

- Bitcoin $28,226 – 24H Change up $1,209.30 – Session Low $26,834

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

Sales of new single‐family houses in February 2023 were 19.0% below February 2022. The median sales price of new houses sold in February 2023 was $438,200. The average sales price was $498,700. The seasonally‐adjusted estimate of new houses for sale at the end of February was 436,000. This represents a supply of 8.2 months at the current sales rate.

The Chicago Fed National Activity Index (CFNAI) 3-month moving average improved to -0.13 in February 2023 from -0.27 in January. This indicates that economic activity was below trend in February. The CFNAI is a monthly index that measures economic activity and related inflationary pressure. The index is constructed using data from 85 indicators, including production, income, employment, housing, sales, orders, and inventories. IMO this is the best coincident indicator of the US economy. The 3-month moving average is used for economic trends as it is less volatile than the monthly average. This index is now suggesting that the economy is expanding below the historical trend rate of growth – but well away from recession territory.

In the week ending March 18, the unemployment insurance initial claims 4-week moving average was 196,250, a decrease of 250 from the previous week’s unrevised average of 196,500. There is no evidence of growing unemployment.

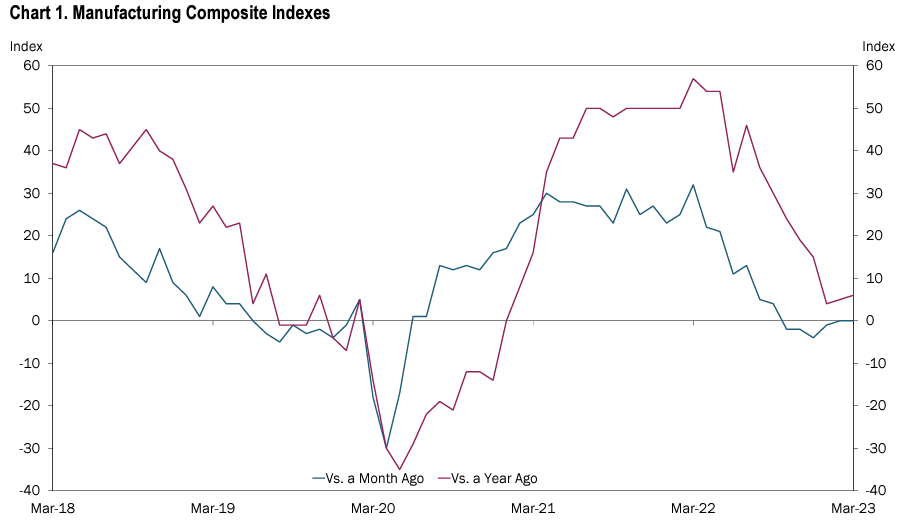

According to the Kansas City Fed, manufacturing activity in the Tenth District stayed flat in March 2023. The composite index was 0.0, unchanged from February. The index has been flat for three consecutive months. The Kansas City Fed’s manufacturing survey covers a wide range of industries in the Tenth District, which includes Kansas, Missouri, Nebraska, Oklahoma, and parts of Colorado and New Mexico. The survey asks manufacturers about their current production, new orders, and shipments. The flat reading in the composite index suggests that manufacturing activity in the Tenth District is not growing or contracting. However, the survey also found that manufacturers were optimistic about the future. The future expectations index rose to 19.0, up from 16.5 in February.

A summary of headlines we are reading today:

- It Will Take Years To Replenish Strategic Petroleum Reserve: Granholm

- The New ‘Wild West’ In Oil Shipping

- U.S. Jobs Data Provides Support For Oil After Volatile Week

- LNG Shipping Rates Fall To A 7-Month Low As Gas Prices Drop

- Yellen says Treasury is ready to take ‘additional actions if warranted’ to stabilize banks

- Stocks close higher Thursday following a volatile trading session: Live updates

- Block shares plunge 16% after short seller Hindenburg says Jack Dorsey’s company facilitates fraud

- Bitcoin’s market dominance is climbing. Here’s what that says about interest rate expectations

- Crypto rebounds from post-Fed sell-off, investors shake off regulatory concerns

- Walmart Layoffs At Fulfillment Centers Signals Ominous Sign For Economy

- The Tell: The Fed has it wrong: Corporate greed is to blame for inflation, not rising wages, SocGen analyst says

- Futures Movers: Oil futures end lower on recession worries

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Real Reason Xi Jinping Is Making A Long-Term Bet On PutinChinese leader Xi Jinping finished up a high-profile, three-day visit to Moscow that could have consequences for the future direction of the war in Ukraine. But as I reported here, there are extensive layers to this summit that go far beyond Russia’s invasion and will ripple into the future. Finding Perspective: As with much of China’s foreign policy, Xi is playing the long game with his Russia trip. It’s a very strong message to the world that despite everything that’s happened in the last year, from Moscow invading its neighbor, the death… Read more at: https://oilprice.com/Geopolitics/International/The-Real-Reason-Xi-Jinping-Is-Making-A-Long-Term-Bet-On-Putin.html |

|

The Path To True EV SustainabilityElectric vehicles are taking off. As an essential part of any viable pathway to reaching global emissions targets, the EV industry is currently the focus of a massive global acceleration, with massive backing from both the public and private sectors. But there is a major problem with this breakneck growth. Although electric cars are majorly beneficial for the environment as compared to conventional combustion engines, they pose a major threat to the environment in other ways. EV batteries rely on finite metals and minerals such… Read more at: https://oilprice.com/Energy/Energy-General/The-Path-To-True-EV-Sustainability.html |

|

It Will Take Years To Replenish Strategic Petroleum Reserve: GranholmOil prices may be trading in a sweet spot for buyers, but it will take years to replenish the nation’s Strategic Petroleum Reserves, U.S. Energy Secretary Jennifer Granholm said. When the Biden Administration sold off 221 million barrels of crude oil from the SPR last year, the idea was to buy oil to replace what was withdrawn. In October of last year, the Administration announced that it would repurchase crude oil for the reserve when prices were at or below about $67-$72 per barrel. The move would be dual purpose in that not only… Read more at: https://oilprice.com/Latest-Energy-News/World-News/It-Will-Take-Years-To-Replenish-Strategic-Petroleum-Reserve-Granholm.html |

|

The Case Against Massive Investments In Natural GasDespite the fact it’s a fossil fuel, natural gas is still getting a lot of attention, with companies and governments continuing to fund new large-scale gas operations as the world begins its transition to green. Several factors have helped create the hype around natural gas. Firstly, several governments and regional bodies, such as the EU, have included natural gas in their green energy taxonomies as a sustainable source of energy that is expected to support the transition away from dirtier fossil fuels. Second, the demand… Read more at: https://oilprice.com/Energy/Natural-Gas/The-Case-Against-Massive-Investments-In-Natural-Gas.html |

|

Russia: Nord Stream Blast Findings Won’t Be Made PublicRussia does not expect that findings on the Nord Stream blast investigations will be made public, Russia’s Foreign Minister Sergei Lavrov said on Thursday, according to Reuters. Russia has repeatedly claimed that it has been left out of various investigations conducted by Denmark, Germany, and Sweden. “I do not expect these investigations to be transparent, nor do I expect the results to be made available to the general public,” Lavrov said at a news conference, Reuters said. In January, Russia said that Sweden’s refusal to share information about… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Nord-Stream-Blast-Findings-Wont-Be-Made-Public.html |

|

The New ‘Wild West’ In Oil ShippingThe Russian invasion of Ukraine has not only led to an increase in the shipment of sanctioned crude oil and petroleum products by a shadow fleet, but it is also escalating overall maritime security risks. A report by consultancy Vortexa indicates a renewed increase in Greek-owned vessels transporting sanctioned Russian crudes and products. Simultaneously, tanker experts are warning of a Wild West situation in maritime traffic, as a shadow fleet of uninsured tankers is sailing in international waters. Reuters reports that maritime security is under… Read more at: https://oilprice.com/Energy/Energy-General/The-New-Wild-West-In-Oil-Shipping.html |

|

Oil Tankers Rerouted To Rotterdam As Strikes In France ContinueOil tankers are being rerouted to Rotterdam to avoid the French port of Le Havre as intensifying strikes disrupt the industry and protesters block airports and trains and clash with police against presidential plans to raise the pension age. According to Bloomberg, two crude oil tankers anchored off Le Havre were diverted to Rotterdam on Thursday, while several other tankers carrying refined fuel have also been diverted in recent days. Diesel and jet fuel vessels have also been diverted this week. France is on track to lose 500,000 barrels… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Tankers-Rerouted-To-Rotterdam-As-Strikes-In-France-Continue.html |

|

Hydropower Plant At Center Of National Security Controversy In GeorgiaThe leaders of Georgia’s ruling party have been pushing a seemingly paradoxical allegation: that Western-funded NGOs supported what the party calls a Russia-sponsored protest movement against the construction of the Namakhvani hydropower plant (HPP) in western Georgia. After the protests mired the project in controversy in mid-2021 the Turkish investor pulled out and it was shelved. It was a setback for the Georgian Dream government, which had argued that the dam would have served to secure the country’s “energy independence,” reducing… Read more at: https://oilprice.com/Energy/Energy-General/Hydropower-Plant-At-Center-Of-National-Security-Controversy-In-Georgia.html |

|

French Strikes Disrupt Power InfrastructureStrikes over the French government’s controversial pension reform plan have now entered their 16th day and are weighing on the power sector, refineries, LNG terminals and even disrupting nuclear reactor maintenance. The ongoing protests are in response to President Emmanuel Macron’s proposed changes to the pension system, including raising the retirement age by two years to 64. Macron aims to move past the pension reform and focus on other measures. On Thursday, operator Fluxys (FLUX.BR) declared force majeure at the Dunkirk LNG… Read more at: https://oilprice.com/Latest-Energy-News/World-News/French-Strikes-Disrupt-Power-Infrastructure.html |

|

U.S. Jobs Data Provides Support For Oil After Volatile WeekOil prices managed to stabilize on Thursday, recovering from their lowest levels since late 2021 earlier this week, as encouraging U.S. employment data balanced out negative indicators from Federal Reserve Chair Jerome Powell, who underscored risks in the banking sector and rising U.S. crude inventories. As of 9:15 CST, Brent Crude sat at $76.96 per barrel, while U.S. West Texas Intermediate Crude rose to $71.14. On Wednesday, Powell warned the banking blip could lead to a credit crunch, which could have “significant” repercussions… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Jobs-Data-Provides-Support-For-Oil-After-Volatile-Week.html |

|

China To Launch New Renewable Energy Pilot Scheme For Rural AreasChina is pressing ahead with plans to accelerate the already rapid rollout of renewable energy by developing clean energy in rural areas under a new action plan unveiled by authorities on Thursday. China’s provincial governments are expected to identify ‘pilot counties’, areas they consider suitable for renewable energy deployment, and submit plans for development to the National Energy Administration (NEA) by the end of May, the NEA said in a statement carried by Reuters. China is unmatched in renewable energy spending globally,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-To-Launch-New-Renewable-Energy-Pilot-Scheme-For-Rural-Areas.html |

|

EU Ban On Russian Fuel Leads To Diesel Glut In AsiaGasoil stocks held in Asia have jumped since the EU’s ban on imports of Russian diesel came into effect on February 5 as Asian refiners now have to compete with Russia for diesel sales in Africa, traders and analysts have told Reuters. Ahead of the EU ban on Russian petroleum products, Russia began to divert its oil product cargoes to North Africa and Asia. At the same time, Europe has started to buy more diesel and other fuels from the Middle East, Asia, and North America to replace the lost Russian barrels. Weekly gasoil inventories at… Read more at: https://oilprice.com/Energy/Energy-General/EU-Ban-On-Russian-Fuel-Leads-To-Diesel-Glut-In-Asia.html |

|

LNG Shipping Rates Fall To A 7-Month Low As Gas Prices DropLNG freight rates for Atlantic Basin spot LNG cargoes slid to below $50,000 per day on Thursday, the lowest level in over seven months, as natural gas prices in Europe drop with peak winter demand behind us. The Spark30S Atlantic LNG freight rates, assessed by Spark Commodities, slid to below $50,000 per day today and were down by 65% year to date, according to Spark Commodities data quoted by Montel. LNG freight rates have been falling since January and are now at their lowest level for this year, Spark Commodities says. In… Read more at: https://oilprice.com/Latest-Energy-News/World-News/LNG-Shipping-Rates-Fall-To-A-7-Month-Low-As-Gas-Prices-Fall.html |

|

UK Advances EV Charging Rollout With New PledgeOn Thursday, Surrey County Council and EV infrastructure company Connected Kerb announced plans to install 10,000 public EV charging points by 2030 in what would be the largest deployment of EV chargers by a UK local authority. Surrey County and Connected Kerb will have charge points installed at more than 1,500 locations across streets and public car parks in Surrey to accelerate EV uptake in the area. The contract will release up to $74 million (£60 million) of investment from Connected Kerb to install public EV charging points.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Advances-EV-Charging-Rollout-With-New-Pledge.html |

|

WoodMac: Oil Prices Could Surprise To The Upside With China’s ReopeningChina’s economic growth could exceed official targets and consumer mobility and spending could surge after the reopening to super-charge a renewed increase in energy commodity prices, especially crude oil, Wood Mackenzie said in a new report on Thursday. “Our scenario is bullish for all commodities. Finely balanced markets for oil, LNG, and coal are leveraged to a super-charged Chinese bounce,” WoodMac’s analysts wrote. Crude oil will be a big winner of the Chinese reopening, with prices set to increase, they noted.… Read more at: https://oilprice.com/Energy/Energy-General/WoodMac-Oil-Prices-Could-Surprise-To-The-Upside-With-Chinas-Reopening.html |

|

Yellen says Treasury is ready to take ‘additional actions if warranted’ to stabilize banksEmergency federal actions to back up customers of Silicon Valley Bank and Signature Bank could be used again if necessary, Treasury Secretary Janet Yellen said. Read more at: https://www.cnbc.com/2023/03/23/yellen-says-treasury-is-ready-to-take-additional-actions-if-warranted-to-stabilize-banks.html |

|

Stocks close higher Thursday following a volatile trading session: Live updatesStocks were little changed Thursday as traders struggled to recover from a steep selloff in the prior session. Read more at: https://www.cnbc.com/2023/03/22/stock-market-today-live-updates.html |

|

Block shares plunge 16% after short seller Hindenburg says Jack Dorsey’s company facilitates fraudBlock shares plunged after noted short seller Hindenburg Research said the company’s flagship Cash App facilitates crime and lacks strong compliance controls. Read more at: https://www.cnbc.com/2023/03/23/block-shares-plunge-after-hindenburg-says-jack-dorseys.html |

|

TikTok CEO says China-based ByteDance employees still have access to some U.S. dataTikTok CEO Shou Zi Chew told U.S. lawmakers that China-based employees at its parent company ByteDance may still have access to some U.S. data from the app. Read more at: https://www.cnbc.com/2023/03/23/tiktok-ceo-china-based-bytedance-employees-can-still-access-some-us-data.html |

|

Bitcoin’s market dominance is climbing. Here’s what that says about interest rate expectationsBitcoin’s market dominance has been climbing in March and is now up to levels not seen since June. Read more at: https://www.cnbc.com/2023/03/23/bitcoins-market-dominance-is-climbing-heres-what-that-says-about-interest-rate-expectations.html |

|

Walmart lays off hundreds of workers at e-commerce facilitiesWalmart joins a growing list of retailers, including Amazon and Target, that are cutting costs. Read more at: https://www.cnbc.com/2023/03/23/walmart-lays-off-hundreds-of-workers-at-e-commerce-facilities-.html |

|

Ex-Google employees’ A.I. chatbot startup valued at $1 billion after Andreessen Horowitz fundingThe founders of Character.AI helped create the architecture that used in popular AI chat products Read more at: https://www.cnbc.com/2023/03/23/characterai-valued-at-1-billion-after-150-million-round-from-a16z.html |

|

Sanofi, Regeneron shares pop more than 6% after data shows asthma drug Dupixent may also treat COPDSanofi and Regeneron unveiled data on their jointly developed drug for a difficult-to-treat chronic lung disorder that analysts say “exceeded expectations.” Read more at: https://www.cnbc.com/2023/03/23/sanofi-regeneron-shares-pop-after-data-shows-asthma-drug-dupixent-may-also-treat-copd.html |

|

Ukraine war live updates: Ukraine signals counterattack to come ‘very soon’ as Wagner mercenaries suffer large lossesUkraine is recovering from a barrage of missile and drone strikes unleashed on the country Wednesday after China’s Xi Jinping left Moscow following talks. Read more at: https://www.cnbc.com/2023/03/23/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Montenegro officials announce Do Kwon arrest, and Coinbase’s potential SEC charges: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, James Lavish, managing partner at The Bitcoin Opportunity Fund, discusses crypto price moves following the Fed’s latest rate hike. Read more at: https://www.cnbc.com/video/2023/03/23/montenegro-do-kwon-arrest-coinbase-sec-cnbc-crypto-world.html |

|

How Ford plans to turn a profit on EVs in under four yearsFord forecast a drastic turnaround for its electric vehicle unit, reiterating that it expects its EV business to be solidly profitable by the end of 2026. Read more at: https://www.cnbc.com/2023/03/23/fords-plan-for-2026-ev-profitability.html |

|

Crypto rebounds from post-Fed sell-off, investors shake off regulatory concernsInvestors digested the outlook for the Federal Reserve’s rate hiking campaign and the ongoing crisis in the banking system. Read more at: https://www.cnbc.com/2023/03/23/crypto-rebounds-from-post-fed-sell-off-investors-shake-off-regulatory-concerns.html |

|

These eight charts show why climate change matters right nowThese 8 charts are a visual guide to the story of climate change right now. Read more at: https://www.cnbc.com/2023/03/23/these-eight-charts-show-why-climate-change-matters-right-now.html |

|

After Sparking Rout, Yellen Changes Key Part Of Prepared Testimony, Says “Prepared For Additional Deposit Action”After sparking a market rout on Wednesday and even prompting Bill Ackman to call her out for sparking a new bank run, moments ago the senile, 76-year-old Treasury Secretary Janet Yellen emerged for her second day of testimony on the Hill and, realizing that blowing up the market in addition to sparking a recession and destroying the US banking system may not be the look her just as senile boss is going for, changed a key section of her testimony. One day after her prepared remarks to the Senate Financial Services Committee sent stocks plunging when she said that she had neither considered nor examined the possibility of expanding federal insurance temporarily to all US bank deposits without congressional approval – as such a move would require legislation, although regulators were prepared to repeat depositor rescues if an individual bank failure threatened to provoke a wider contagion of bank runs – in the process nullifying everything Powell said in hopes of stabilizing the relentless bank selloff, Yellen now plans to tell US lawmakers that regulators would be prepared for further steps to protect deposits if warranted, in new language that differs from her prepared remarks to the Senate a day earlier. Here is the paragraph that graced her speech yesterday:

|

|

Resumption Of New START Unlikely Due To ‘Hostile’ US As “Fewer & Fewer Steps” Toward Nuclear Collision Remain: KremlinMoscow this week warned that there remain “fewer and fewer steps” toward nuclear collision after the UK announced it is sending depleted uranium ammunition to the Ukrainians for use in their Challenger II main battle tanks. President Putin also in the wake of London’s decision said Russia will “respond accordingly” if the Ukrainians do indeed receive a “nuclear component”. On Wednesday the Kremlin followed by pointing to New START’s collapse, and that the nuclear treaty is unlikely to resume do to the “hostile actions” of the Untied States. Deputy Foreign Minister Sergei Ryabkov said there’s really no point in resuming talks between the world’s biggest nuclear powers, describing its suspension as “almost inevitable” given the “cumulative circumstances of the destructive and hostile actions of the U.S.” Read more at: https://www.zerohedge.com/geopolitical/resumption-new-start-unlikely-due-hostile-us-fewer-fewer-steps-toward-nuclear |

|

Texas Senator Ted Cruz Introduces Anti-CBDC BillAuthored by BTCCasey via BitcoinMagazine.com, Ted Cruz has joined a myriad of politicians in demonstrating their contempt for CBDCs in America… but what about pro-Bitcoin legislation?

Texas Governor Ted Cruz has joined a growing group of politicians who have come out in support of anti-CBDC bills, reintroducing legislation to the Senate that would prohibit a direct-to-consumer Federal Reserve-issued CBDC. Recent weeks have seen several U.S. state politicians at the center of these actions. The trend was seemingly kicked off by the introduction of Congressman Tom Emmer’s “CBDC Anti-Surveillance State Act,” a bil … Read more at: https://www.zerohedge.com/crypto/texas-senator-ted-cruz-introduces-anti-cbdc-bill |

|

Walmart Layoffs At Fulfillment Centers Signals Ominous Sign For EconomyOver the next three months, hundreds of workers at five Walmart warehouses handling e-commerce orders will be laid off. This situation could be a worrisome indication that consumers are tapped out. A Walmart spokesperson told Reuters about 200 warehouse workers in Pedricktown, New Jersey, and hundreds of others at Fort Worth, Texas; Chino, California; Davenport, Florida; and Bethlehem, Pennsylvania locations were asked to find new jobs before summer due to the need to reduce headcount.

Layoffs at Walmart are considered an indicator of retail trends due to its size in the retail space, and might serve as a warning sign of potential economic turbulence ahead. Read more at: https://www.zerohedge.com/markets/walmart-layoffs-fulfillment-centers-signals-ominous-sign-economy |

|

Interest rate rise: Bank of England more hopeful on UK economyAndrew Bailey’s comments come as the Bank raises interest rates to 4.25% to try to combat inflation. Read more at: https://www.bbc.co.uk/news/business-65048756?at_medium=RSS&at_campaign=KARANGA |

|

UK interest rates: What the rise means for youThe Bank of England has raised the rate from 4% to 4.25%, creating higher mortgage costs. Read more at: https://www.bbc.co.uk/news/business-57764601?at_medium=RSS&at_campaign=KARANGA |

|

Loans firm Amigo to halt lending and wind downThe struggling high-cost firm has immediately halted all lending after failing to secure cash from investors. Read more at: https://www.bbc.co.uk/news/business-65052000?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty charts indicate sell on rise pattern. What should traders do on FridayNifty today formed a small red candle with a long upper shadow on the daily charts. Chart readers said this pattern indicates that the market is on a sell on rise mode from near the crucial overhead resistance of 17200 levels.On the daily charts, 17,180-17,210 acted as a stiff resistance, and Nifty was unable to surpass it.“The market could find a range of around 17,200-16,950 levels in the next few sessions. The lower area of 16,950-16,900 is expected to offer support for the market during the present weakness. A decisive move above 17200-17250 levels is likely to bring strength in upside bounce,” said Nagaraj Shetti, Technical Research Analyst, HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/live-blog/bse-sensex-today-live-nifty-stock-market-updates-23-march-2023/tech-view-nifty-charts-indicate-sell-on-rise-pattern-what-should-traders-do-on-friday/articleshow/98945070.cms |

|

These 7 commodity stock slipped to their new 52-week lows, fell up to 20% in a monthAs the market experienced a decline, 7 stocks from the BSE commodities index fell to their lowest levels in 52 weeks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-7-commodity-stocks-slipped-to-their-new-52-week-lows-fell-up-to-20-in-a-month/articleshow/98951104.cms |

|

How has health insurance changed over time? When should you go for riders?Many health insurance companies are offering innovative features to increase the attractiveness of buying health insurance. These features include lock-in premium, no claim bonuses, and treatment for critical illnesses abroad. A four-year waiting period for senior citizens has been reduced, and coverage now includes ABCD illnesses, such as diabetes. Health insurance companies are also offering day one cover and more coverage after 30 days, which are more expensive than a basic policy with a longer waiting period. Read more at: https://economictimes.indiatimes.com/markets/expert-view/how-has-health-insurance-changed-over-time-when-should-you-go-for-riders/articleshow/98938539.cms |

|

The Tell: The Fed has it wrong: Corporate greed is to blame for inflation, not rising wages, SocGen analyst saysFederal Reserve Chairman Jerome Powell has repeatedly said undercutting wage growth for American workers is essential for tamping down the worst bout of inflation in the U.S. in more than 40 years. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C0-4A0A1FCE1641%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil futures end lower on recession worriesOil futures finish lower on Thursday after a three-session run higher, as traders weigh the prospects for an economic recession. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BF-95EFBA38E73E%7D&siteid=rss&rss=1 |

|

More Americans are using ‘buy now, pay later’ services to pay for groceriesBNPL has traditionally been used to spread out bigger bills over a period of weeks or months. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BF-63DE22ACC0B2%7D&siteid=rss&rss=1 |