It is obvious that the markets today shrugged off the banking crisis.

Summary Of the Markets Today:

- The Dow closed up 383 points or 1.20%,

- Nasdaq closed up 0.39%,

- S&P 500 closed up 0.89%,

- Gold $1984 up $10.60,

- WTI crude oil settled at $68 up $0.83,

- 10-year U.S. Treasury 3.492% up 0.095 points,

- USD $103.31 down $0.39,

- Bitcoin $27,954 – 24H Change down $457.65 – Session Low $27,276

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

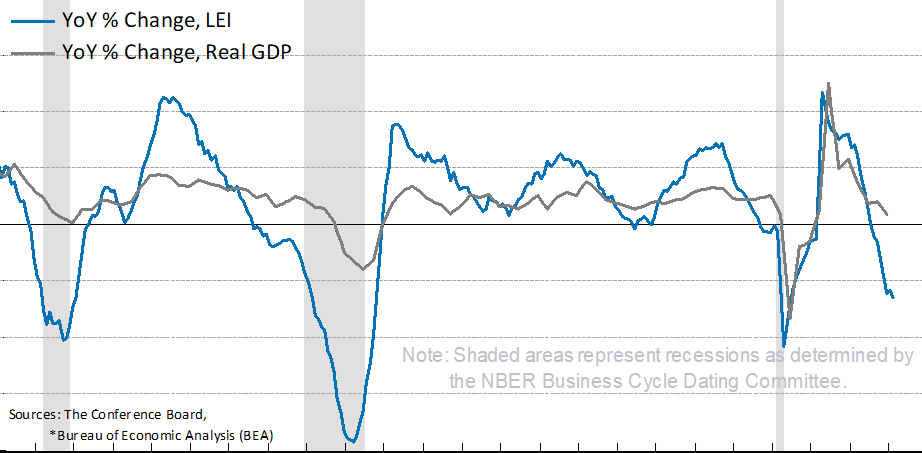

The Conference Board Leading Economic Index (LEI) fell again by 0.3 percent in February 2023 to 110.0 (2016=100), after also declining by 0.3 percent in January. The LEI is down 3.6 percent over the six-month period between August 2022 and February 2023—a steeper rate of decline than its 3.0 percent contraction over the previous six months (February–August 2022). Interesting that the Conference Board this month is not stating that their index looks recessionary (as they did last month). Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board stated:

The LEI for the US fell again in February, marking its eleventh consecutive monthly decline. Negative or flat contributions from eight of the index’s ten components more than offset improving stock prices and a better-than-expected reading for residential building permits. While the rate of month-over-month declines in the LEI has moderated in recent months, the leading economic index still points to the risk of recession in the US economy. The most recent financial turmoil in the US banking sector is not reflected in the LEI data but could have a negative impact on the outlook if it persists. Overall, The Conference Board forecasts rising interest rates paired with declining consumer spending will most likely push the US economy into recession in the near term.

A summary of headlines we are reading today:

- Economic Worries Weigh On Nickel Prices

- More Strikes: European Diesel Markets Could Tighten, Crude Market Weakens

- Gasoline Prices Buck The Trend Ahead Of Driving Season

- King Of Saudi Arabia Invites Iranian President For Historic Visit

- Oil Prices Head Lower As Credit Suisse Shares Plunge By 60%

- JPMorgan advising First Republic on strategic alternatives, including a capital raise, sources say

- Stocks close higher on Monday as banking crisis fears ease: Live updates

- Bitcoin soars to a nine-month high as investors weigh bank risks and interest rates: CNBC Crypto World

- Biden Kills Bill To Reverse ESG Investing Rule

- Outside the Box: Amazon didn’t make money for a decade, but those losses weren’t even close to what startup companies and their investors face now.

- Market Snapshot: Dow rallies more than 300 points, even as bank woes muddle outlook for Fed decision

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Economic Worries Weigh On Nickel PricesVia AG Metal Miner The Stainless Monthly Metals Index (MMI) dropped 4.68% from February to March. Meanwhile, the price of Nickel also fell significantly. Stainless Spot Pricing for Buyers U.S. cold rolled stainless steel import licenses remain depressed. Indeed, many importers appear apprehensive, as it remains too risky to bring in materials due to recessionary concerns. Meanwhile, the U.S. cold-rolled market needs some imports, as U.S. flat-rolled production will not be sufficient to meet demand. Some items, such as light gauges… Read more at: https://oilprice.com/Metals/Commodities/Economic-Worries-Weigh-On-Nickel-Prices.html |

|

Reopening Of Chinese Economy Spurs Gold Buying SpreeAfter ending 2022 on an upward trend that continued into January, Chinese gold demand surged again in February as the economy continues to rebound from government-imposed COVID policies. Gold withdrawals from the Shanghai Gold Exchange (SGE) totaled 169 tons in February. This is a reflection of strong wholesale demand and signals an ongoing rebound in the world’s biggest gold market. SGE withdrawals in February were up by 30 tons month-on-month and by a healthy 76 tons year-over-year. It was the strongest February for wholesale gold demand… Read more at: https://oilprice.com/Metals/Gold/Reopening-Of-Chinese-Economy-Spurs-Gold-Buying-Spree.html |

|

More Strikes: European Diesel Markets Could Tighten, Crude Market WeakensStriking action in France’s refineries is poised to tighten European diesel markets, while crude oil markets are looking weaker, traders who spoke to Reuters said on Monday. France has been battling strikes in its crude oil refineries as union members’ pension system is due to be overhauled. The strikes have so far blocked shipments of refined products from France’s Donges and La Mede refineries and have reduced the throughput at the Normandy and Feyzin refineries. The curtailments have resulted in less feedstock demand—i.e., weaker crude… Read more at: https://oilprice.com/Latest-Energy-News/World-News/More-Strikes-European-Diesel-Markets-Could-Tighten-Crude-Market-Weakens.html |

|

Air Pollution Is An $8 Trillion ProblemAir pollution is the greatest environmental health hazard to humankind, leading to over six million deaths a year and an economic cost that equates to over $8 trillion dollars. That’s according to the World Air Quality Report 2022 released Tuesday by Swiss air quality technology company IQAir. Statista’s Anna Fleck reports that the analysis found that out of a surveyed 131 countries, regions and territories, only 13 met World Health Organization air guidelines of annual PM2.5 concentrations at or below 5 μg/m3 in 2022, many… Read more at: https://oilprice.com/The-Environment/Global-Warming/Air-Pollution-Is-An-8-Trillion-Problem.html |

|

Gasoline Prices Buck The Trend Ahead Of Driving SeasonWith U.S. gasoline prices trending about 3 cents lower than the same time last week, analysts are now speculating that the banking crisis and broader financial markets concerns may prevent prices at the pump from ticking upwards as they would normally do ahead of the summer driving season. “The broad concern over recent failures of the U.S. and global banking system has put enough downward pressure on oil prices that we saw a reprieve in rising gasoline prices in the national average last week,” said Patrick DeHaan, the senior petroleum analyst… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gasoline-Prices-Buck-The-Trend-Ahead-Of-Driving-Season.html |

|

Decarbonizing China’s Steel IndustryOn February 6, the China Meteorological Association (CMA) published the 2022 China Climate Bulletin (??????) (China Climate Bulletin, February 7). The annual report provides an overall analysis of China’s climate conditions and tracks significant meteorological disasters and major climate events from the previous year (CMA, February 24). The newly released China Climate Bulletin noted that the country recorded its second-highest annual mean temperature in history last year. In fact, last year’s spring, summer and autumn temperatures… Read more at: https://oilprice.com/Metals/Commodities/Decarbonizing-Chinas-Steel-Industry.html |

|

Rhode Island Is Struggling To Realize Its Offshore Wind PotentialRhode Island is making strides in the renewable energy sector, with plans to develop offshore wind energy. Governor McKee recently announced a Request for Proposals (RFP) for 600 to 1,000 megawatts of newly developed offshore wind capacity. This move is part of the state’s commitment to reduce greenhouse gas emissions and increase its use of renewable energy sources. The first offshore wind farm in the US was built off Block Island in 2016, and it has been providing clean energy to the area ever since. The proposed Revolution… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rhode-Island-Is-Struggling-To-Realize-Its-Offshore-Wind-Potential.html |

|

Humanity On Thin Ice, Says Latest UN Climate ReportIn its latest climate report, the United Nations warns that “humanity is on thin ice” and “ice is melting fast” as greenhouse gas emissions continue to increase. From 2010 to 2019, we saw a 12% increase in greenhouse gas emissions, according to the UN climate report. From 1990 to 2019, we saw a 54% increase, with fossil fuel production, industrial activities and methane emissions as the main contributors. The report, released on Monday, warns that climate change is already having a clear negative impact across the… Read more at: https://oilprice.com/Energy/Energy-General/Humanity-On-Thin-Ice-Says-Latest-UN-Climate-Report.html |

|

Vitol Revenue Skyrocketed 80% In 2022Swiss commodities trading giant Vitol has reported $500 billion in revenues for 2022, an 80% increase year-on-year, thanks largely to last year’s surging oil prices courtesy of Russia’s war on Ukraine and the Western sanctions response. In total, Vitol delivered 7.4 million barrels per day of crude and crude oil products in 2022, and while this was lower than 2021’s deliveries of 7.6 million bpd, prices still led to an 80% jump in revenues. As reported by Reuters, Vitol expects 2 million bpd demand growth for this year, banking… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Vitol-Revenue-Skyrocketed-80-In-2022.html |

|

King Of Saudi Arabia Invites Iranian President For Historic VisitAfter striking their historic peace deal which was mediated by China in Beijing over a week ago, Iran and Saudi Arabia continue to make strides toward full normalization of ties, after being archenemies for decades – and before that their peoples had been rivals for centuries when it comes to the religious Shia-Sunni divide. An Iranian official announced Sunday that the King of Saudi Arabia has issued a formal invitation to Iranian President Ebrahim Raisi to visit Riyadh in an unprecedented move. Raisi is said to have “welcomed”… Read more at: https://oilprice.com/Geopolitics/International/King-Of-Saudi-Arabia-Invites-Iranian-President-For-Historic-Visit.html |

|

UK Strikes To Cause A ‘Tsunami’ Of Unrest For North Sea Oil And GasDozens of oil and gas platforms in the UK North Sea could come to a standstill in the coming weeks after 1,400 offshore workers at five contractor companies have voted to initiate strikes to demand better pay and working conditions, Unite the union said on Monday. The industrial action is expected to hit platforms of major companies operating on the UK Continental Shelf including BP, Shell, TotalEnergies, CNRI, EnQuest, Harbour Energy, and Ithaca Energy, the union said in a statement. The prospective action includes electrical, production, and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Strikes-To-Cause-A-Tsunami-Of-Unrest-For-North-Sea-Oil-And-Gas.html |

|

EU Looks To Extend Natural Gas Consumption Cuts For Another YearThe European Commission on Monday proposed extending the emergency measure which targets a 15% reduction in the bloc’s natural gas consumption by another 12 months to the end of the 2023/2024 winter heating season. The existing regulation to have natural gas demand cut by 15% expires at the end of this month. Today’s proposal from the European Commission for another year of gas savings will be discussed by energy ministers at the Transport, Telecommunications and Energy Council (TTE) Council on March 28. EU Commissioner for Energy Kadri… Read more at: https://oilprice.com/Energy/Energy-General/EU-Looks-To-Extend-Natural-Gas-Consumption-Cuts-For-Another-Year.html |

|

Oil Prices Head Lower As Credit Suisse Shares Plunge By 60%The selloff in oil continues on Monday, with Brent falling to the $72 a barrel mark and U.S. crude down to the $65 per barrel handle, as traders are cutting long positions amid the banking sector turmoil of the past week. The market rout saw Credit Suisse’s stock plummet by 60% on Monday in Europe after the announced takeover by UBS. As of 8:26 a.m. ET on Monday, the U.S. oil benchmark WTI Crude was down by 1.15% at $65.95, and Brent Crude, the international benchmark, was falling by 1.08% at $72.09. During the weekend, UBS said it plans… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Head-Lower-As-Credit-Suisse-Shares-Plunge-By-60.html |

|

Iran Says It Would Welcome Any Investments In Its Oil And Gas SectorIran would welcome any new investment in its oil industry, especially from OPEC+ producers, the Iranian Ministry of Petroleum said this weekend, days after Saudi Arabia signaled that the Kingdom could start investing “very quickly” in Iran. Earlier this month, Saudi Arabia and Iran agreed to resume diplomatic relations and re-open embassies and missions, Saudi Arabia, Iran, and China said in a joint statement, following a week of Saudi-Iranian talks in Beijing. The rift between Saudi Arabia and Iran has shaped… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Says-It-Would-Welcome-Any-Investments-In-Its-Oil-And-Gas-Sector.html |

|

Kuwait Oil Company Declares State Of Emergency After Onshore Oil SpillKuwait Oil Company, the state-owned firm of one of OPEC’s largest producers, on Monday declared a state of emergency following an oil spill on land. No people have been injured and oil production has not been disrupted after the incident, the company was quoted as saying by AFP. An oil leak has occurred in the west of the country, Kuwait Oil Company said. Kuwait’s Al Rai newspaper published a photo of oil gushing out of an oil well, also saying that there have not been injuries reported or any disruption to production. No toxic fumes… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kuwait-Oil-Company-Declares-State-Of-Emergency-After-Onshore-Oil-Spill.html |

|

JPMorgan advising First Republic on strategic alternatives, including a capital raise, sources sayJPMorgan Chase is advising embattled First Republic Bank on strategic alternatives, sources tell CNBC’s David Faber. Read more at: https://www.cnbc.com/2023/03/20/jpmorgan-advising-first-republic-on-strategic-alternatives-including-a-capital-raise-sources-say.html |

|

The $17 billion wipeout of Credit Suisse bondholders has not gone down well in EuropeCredit Suisse’s additional tier one bonds are set to be wiped out following the struggling bank’s takeover by UBS. Read more at: https://www.cnbc.com/2023/03/20/17-billion-of-credit-suisse-bonds-worthless-following-ubs-takeover.html |

|

Stocks close higher on Monday as banking crisis fears ease: Live updatesStocks closed higher as regional banks rose, rebounding from big losses in the past week in the wake of the Silicon Valley Bank collapse. Read more at: https://www.cnbc.com/2023/03/19/stock-market-today-live-updates.html |

|

Amazon to lay off 9,000 more workers in addition to earlier cutsAmazon will lay off 9,000 more employees, CEO Andy Jassy said in a memo to staff Monday. Read more at: https://www.cnbc.com/2023/03/20/amazon-layoffs-company-to-cut-off-9000-more-workers.html |

|

CNBC Special Pro Talks: How award-winning fund manager David Giroux is navigating and investing in this volatile marketThe market has been treacherous to navigate due to extreme volatility in the financial sector. Investors are looking for cover as fears of further bank collapses mount. T. Rowe Price’s David Giroux is a two-time winner of Morningstar’s Outstanding Portfolio Manager of the Year award and was just nominated again. He joins CNBC Pro to share how he is handling the turmoil and answer your questions. Read more at: https://www.cnbc.com/search/?query=CNBC%20Special%20Pro%20Talks:%20How%20award-winning%20fund%20manager%20David%20Giroux%20is%20navigating%20and%20investing%20in%20this%20volatile%20market |

|

Mortgage giant Fannie Mae tackles climate risk, but changes to underwriting may take several yearsThe mortgage industry is now trying to factor climate risk into its residential underwriting, but the task is enormous and complicated. Read more at: https://www.cnbc.com/2023/03/20/mortgage-giant-fannie-mae-tackles-climate-risk.html |

|

Trump grand jury live updates: Expected indictment in payoff to porn star Stormy DanielsFormer President Donald Trump said he expects to be charged over a hush money payoff to porn star Stormy Daniels. Follow live updates on the grand jury probe. Read more at: https://www.cnbc.com/2023/03/20/live-updates-of-trump-grand-jury-expected-indictment-in-payoff-to-porn-star-stormy-daniels.html |

|

Bitcoin soars to a nine-month high as investors weigh bank risks and interest rates: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Dan Ashmore of CoinJournal discusses why bitcoin is still correlated with stocks, despite the recent rally. Read more at: https://www.cnbc.com/video/2023/03/20/bitcoin-nine-month-high-investors-weigh-bank-risks-interest-rates-crypto-world.html |

|

JPMorgan Chase can be sued by Virgin Islands over Jeffrey Epstein sex-trafficking claimsJeffrey Epstein, whose former friends included Donald Trump and Bill Clinton, was a JPMorgan Chase client and owner of property in the Virgin Islands. Read more at: https://www.cnbc.com/2023/03/20/jpmorgan-chase-can-be-sued-by-virgin-islands-over-jeffrey-epstein-sex-trafficking-claims.html |

|

Ukraine war live updates: Xi and Putin hold talks on Ukraine, deeper ties between China and RussiaAll eyes are on Chinese President Xi Jinping’s state visit to Moscow that begins Monday. How deep Beijing and Moscow’s relationship goes will be under scrutiny. Read more at: https://www.cnbc.com/2023/03/20/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Biden issues his first veto, nixing measure blocking new investment ruleThe bill passed with slim majorities in each chamber, making it unlikely Congress will override the veto. Read more at: https://www.cnbc.com/2023/03/20/biden-issues-his-first-veto-nixing-measure-blocking-new-investment-rule.html |

|

Virgin Orbit scrambles to avoid bankruptcy as deal talks continueVirgin Orbit senior leadership held daily talks with potential investors through the weekend, people familiar with the matter told CNBC. Read more at: https://www.cnbc.com/2023/03/20/virgin-orbit-looming-bankruptcy-deal-talks.html |

|

Biden Kills Bill To Reverse ESG Investing RuleThe woke industrial complex scored a win on Monday after President Biden issued his first veto since taking office, rejecting a bill that would have reversed a Labor Department rule permitting fiduciaries to consider environmental, social, and governance (ESG) factors when making investment decisions for retirement portfolios.

“I just vetoed my first bill,” Biden tweeted. “This bill would risk your retirement savings by making it illegal to consider risk factors MAGA House Republicans don’t like. Your plan manager should be able to protect your hard-earned savings — whether Rep. Marjorie Taylor Greene likes it or not,” he added.

|

|

FedNow Instant Payments Are Coming And CBDCs Will FollowAuthored by Daisy Luther via The Organic Prepper blog, There’s absolutely no doubt that our financial system is in flux right now. We’re watching a storm approach, and it’s about to envelop the entire nation in chaotic conditions. If you think things are crazy now, just hang on to your halo…it’s about to get a whole lot worse. Remember how we talked about CBDCs a few weeks ago, and lots of people in the comments said never, no way, and heck no? Well, unfortunately, it’s being rolled out and soon. Of course, they’re not calling it CBDCs. Not yet. It’s under another name, and it’s not quite a federal digital currency. I’m sure this, too, will be called a conspiracy theory, but the Federal Reserve is launching FedNow, an instant digital payment system. This in itself is not a Central Bank Digital Currency, but it puts into place the framework needed to make the idea a reality. FedNow will be launched in July, according to a press release from the Federal Reserve. Read more at: https://www.zerohedge.com/political/fednow-instant-payments-are-coming-and-cbdcs-will-follow |

|

Macron (Barely) Survives ‘No Confidence’ Vote Amid French Pension Reform ProtestsMacron (Barely) Survives ‘No Confidence’ Vote Amid French Pension Reform ProtestsUpdate (1400ET): French President Emmanuel Macron’s government narrowly survived a no-confidence vote in the National Assembly on Monday, fending off an effort to kill his contentious pension overhaul and topple his administration. As The Wall Street Journal reports, the no-confidence motion spearheaded by a group of centrists won the support of 278 lawmakers in the lower house of parliament, a mere nine votes short of a majority. Lawmakers are expected to vote later Monday on a second no-confidence motion filed by Marine Le Pen’s National Rally. That measure is unlikely to pass because conservative and left-leaning lawmakers have said they won’t back a no-confidence motion put forward by the far-right party. As Remix News’ John Cody detailed earlier, after French President Emmanuel Macron pushed through pension reform without a vote in parliament, the backlash has been fierce, and there is now a good chance that a no-confidence vote this week could collapse his government. Even if he survives the vote, commentators say that Marine Le Pen has never been in a better position, with the conservative populist emerging as the “victor” in the fierce debate over pension reform. Read more at: https://www.zerohedge.com/political/french-protests-violently-escalate-will-macrons-government-fall |

|

Ukraine, Russia Agree To Extend Black Sea Grain DealAuthored by Dave DeCamp via AntiWar.com, Turkish President Recep Tayyip Erdogan announced Saturday that the deal between Russia and Ukraine allowing the export of grain from Ukraine’s Black Sea ports has been extended. “This deal is of vital importance for the global food supply,” Erdogan said. “I thank Russia and Ukraine, who didn’t spare their efforts for a new extension, as well as the United Nations secretary general.” The deal was first signed in July and was brokered by Turkey and the UN. It has been a success in allowing safe passage for grain ships through Ukraine’s Black Sea ports that had been heavily mined when Russia first launched its invasion. According to Al Jazeera, over 11 million tons of agricultural products shipped from three of Ukraine’s Black Sea ports under the deal. Read more at: https://www.zerohedge.com/commodities/ukraine-russia-agree-extend-black-sea-grain-deal |

|

Investor fears appear to ease as UK and US share prices riseInvestors appear largely reassured after Credit Suisse rescue, but First Republic shares plunge. Read more at: https://www.bbc.co.uk/news/business-65012275?at_medium=RSS&at_campaign=KARANGA |

|

Sri Lanka: $2.9bn IMF bailout for struggling economyThe deal is a lifeline for the country which is facing its worst economic crisis in over 70 years. Read more at: https://www.bbc.co.uk/news/business-65010560?at_medium=RSS&at_campaign=KARANGA |

|

Strike averted as nurses and midwives accept pay offerMembers of nursing and midwifery unions vote to accept the Scottish government’s 6.5% pay deal. Read more at: https://www.bbc.co.uk/news/uk-scotland-65019788?at_medium=RSS&at_campaign=KARANGA |

|

SVB like collapse unlikely to occur in India as banking system robust: Anand Rathi reportThe failure of two US banks has no material effect on the earnings outlook of Indian publicly traded companies, the report stressed, while observing that the SVB saga will have a positive impact on the Indian stock markets. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/svb-like-collapse-unlikely-to-occur-in-india-as-banking-system-robust-anand-rathi-report/articleshow/98822931.cms |

|

Tale of two banks: How UBS & Credit Suisse stack upBanking giant UBS is buying troubled rival Credit Suisse for almost $3.25 billion, in a deal orchestrated by regulators in an effort to avoid further market-shaking turmoil in the global banking system. Read more at: https://economictimes.indiatimes.com/markets/web-stories/tale-of-two-banks-how-ubs-amp-credit-suisse-stack-up/articleshow/98806976.cms |

|

Small-cap sugar stock that has risen over 160% in last 2 yrs, declares 200% dividendThe company has fixed March 31 as the record date to determine the eligibility of shareholders for the said dividend payment. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/small-cap-sugar-stock-that-has-risen-over-160-in-last-2-yrs-declares-200-dividend/articleshow/98828973.cms |

|

Outside the Box: Amazon didn’t make money for a decade, but those losses weren’t even close to what startup companies and their investors face now.Startup losses, which have been cumulating for years, are a problem for venture capitalists, stockholders and lenders like SVB. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BB-17596AF5736A%7D&siteid=rss&rss=1 |

|

Market Extra: European bank CoCos under pressure after Credit Suisse sale to UBS triggers historic loss on specialty bondsRisky debt issued by several European banks is under pressure in New York trading on Monday after Credit Suisse, UBS merger triggers a historic bond write down. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BB-C4B688093C4E%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow rallies more than 300 points, even as bank woes muddle outlook for Fed decisionU.S. stocks resume their rally as investors assess what bank woes mean for the Fed’s rate path. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BB-1EF26032EA54%7D&siteid=rss&rss=1 |