Summary Of the Markets Today:

- The Dow closed down 280 points or 0.87%,

- Nasdaq closed up 0.05%,

- S&P 500 closed down 0.7%,

- Gold $1924 up $12.50,

- WTI crude oil settled at $68 down $3.09,

- 10-year U.S. Treasury 3.479% down 0.157 points,

- USD $104.72 up $1.12,

- Bitcoin $24.412 – 24H Change down $804.42 – Session Low $24,047

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

The Producer Price Index for Final Demand decreased 0.1% in February. Final demand prices advanced 0.3 percent in January and declined 0.2 percent in December 2022. On an unadjusted basis, the final demand index rose 4.6% for the 12 months ended in February (blue line on graph below). No question inflation is moderating – but remains very high. Note that at the current rate of decline, it will take almost one year for inflation to reach 2%.

Advance estimates of U.S. retail and food services sales for February 2023 down 0.4% from the previous month, but up 5.4% year-over-year. When adjusted for inflation, retail and food services sales were up 0.6% year-over-year. At this point retail sales is not driving an increase in GDP.

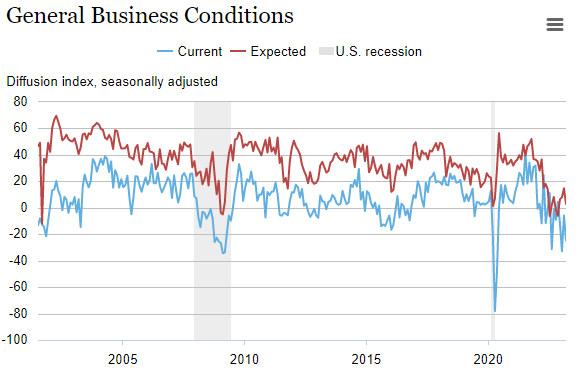

Business activity continued to decline in New York State according to the March 2023 Empire State Manufacturing Survey. The headline general business conditions index fell nineteen points to -24.6. New orders dropped significantly, and shipments declined modestly. Delivery times shortened for a second consecutive month, suggesting supply availability improved, and inventories were steady. Both employment and hours worked declined for a second consecutive month. Input and selling price increases slowed somewhat. Looking ahead, businesses expect little improvement in conditions over the next six months. Not good news for manufacturing or the economy moving forward. This index is near levels associated with recessions.

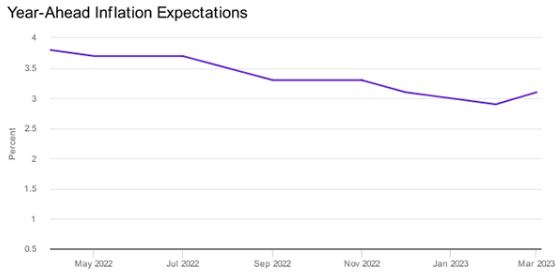

Business Inflation Expectations Increase to 3.1%. Sales levels compared to “normal times” decreased, though firms’ profit margins compared to normal remain unchanged, according to the Atlanta Fed’s latest Business Inflation Expectations survey.

A summary of headlines we are reading today:

- U.S. Steel Prices Surge As Supply Fails To Meet Demand

- Oil Giants Shed 5-8% Amid Plunging Oil Prices

- Did High-Interest Rates Break Silicon Valley Bank?

- Auto Industry In Turmoil: Car Dealers Crushed By Price Squeeze

- Oil Prices Crash Below $70 As Credit Suisse Shares Tumble

- Dow closes more than 250 points lower Wednesday as bank crisis spreads to Europe: Live updates

- Goldman Sachs cuts GDP forecast because of stress on small banks, which are key to U.S. economy

- Oil tumbles to the lowest level since December 2021 as banking crisis routs markets

- Bitcoin retreats to $24,000, and NYDFS says Signature closure not tied to crypto: CNBC Crypto World

- Chip stocks fall as delivery times shrink, Samsung plans to build world’s largest chip complex

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Steel Prices Surge As Supply Fails To Meet DemandVia AG Metal Miner The Raw Steels Monthly Metals Index (MMI) rose by 8.74% from February to March. The growth was largely due to the massive increase in the U.S. HRC Futures contract, which jumped by nearly 49%. Because of this, steel prices reacted accordingly. HRC prices continue to show bullish strength in the short term, even breaking out of their December 2022 highs. However, as prices begin to breach the $950-1000/ton resistance zone, price action would need to form a new higher low to confirm the potential uptrend. Should they continue higher,… Read more at: https://oilprice.com/Metals/Commodities/US-Steel-Prices-Surge-As-Supply-Fails-To-Meet-Demand.html |

|

Tensions Mount Between Azerbaijan And IranAzerbaijan’s strained relations with Iran aren’t getting any better. Baku has sent two protest notes to Tehran in recent days. On March 11, Azerbaijan’s foreign and defense ministries said in a joint statement that a military aircraft belonging to Iran flew non-stop along much of the length of the Azerbaijan-Iran state border from the direction of Zangilan district to Bilasuvar district and back. The route included several districts that Azerbaijan retook from Armenian forces in the 2020 Second Karabakh War. “Contrary… Read more at: https://oilprice.com/Geopolitics/International/Tensions-Mount-Between-Azerbaijan-And-Iran.html |

|

Oil Giants Shed 5-8% Amid Plunging Oil PricesAfter losing between 6-7% on Wednesday, oil prices are taking a toll on energy equities, with European giants shedding 6-8% and American oil companies down 5-7%. As the markets attempt to digest two bank failures in the U.S., a plunge in shares of Credit Suisse and plummeting bank stocks on two continents, fears mount that a banking collapse could lead to a sustained economic downturn and cap demand for oil. “It is hard to look past Credit Suisse and the obvious crisis of confidence,” Craig Erlam, senior market analyst at Oanda, told Reuters. “We… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Giants-Shed-5-8-Amid-Plunging-Oil-Prices.html |

|

Unlocking A New Low-Cost BiofuelMichigan State University researchers have solved a puzzle that could help switchgrass realize its full potential as a low-cost, sustainable biofuel crop and divert some of our dependence on fossil fuels. The new knowledge has been published in the journal Frontiers in Plant Science. Among switchgrass’s attractive features are that it’s perennial, low maintenance and native to many states in the eastern U.S., including Michigan. But it also has a peculiar behavior working against it that has stymied researchers – at least until… Read more at: https://oilprice.com/Energy/Energy-General/Unlocking-A-New-Low-Cost-Biofuel.html |

|

UK Considers Easing Windfall Tax Pressure On Oil And GasThe government is weighing up plans to bring in a price floor for the windfall tax amid fears Equinor could pull out of the proposed Rosebank oil and gas project, City A.M. understands. The Norwegian energy giant is concerned about the lack of stability in the tax regime compared to its home market, which has higher taxes but an established investment allowance and a calmer political climate. Rosebank is an oil and gas field 130km off the coast of the Shetland Isles, and is 80 per cent owned by Equinor – with the remaining 20 per… Read more at: https://oilprice.com/Energy/Crude-Oil/UK-Considers-Easing-Windfall-Tax-Pressure-On-Oil-And-Gas.html |

|

Algeria: Western Price Caps On Russian Crude Could Lead To Supply DisruptionAlgerian Energy Minister Mohamed Arkab also warned that Western price caps on Russian crude oil could lead to uncertainty and supply disruption. While Arkab suggested that the OPEC+ decision to cut output by 2 million barrels per day from November 2022 until the end of this year brought stability to oil markets, he warned that unilateral measures such as price caps were distortions that could upset OPEC+ efforts to balance oil markets, Reuters reported. Arkab’s comments followed comments to Energy Intelligence by Saudi Arabia’s energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Algeria-Western-Price-Caps-On-Russian-Crude-Could-Leas-To-Supply-Disruption.html |

|

Did High-Interest Rates Break Silicon Valley Bank?The Federal Reserve is in the unenviable position of achieving its mandate by crashing the economy. It’s not something it wants to do, as Fed Chair Jerome Powell meekly admitted in his exchange with Sen. Elizabeth Warren (D–Mass.) last week. But it’s something that happens as an unavoidable outcome of slowing down an economy littered with excess money and inflation. Broad money growth has been negative since late November, and interest rate expenses on everything from corporate borrowing to credit cards… Read more at: https://oilprice.com/Finance/the-Economy/Did-High-Interest-Rates-Break-Silicon-Valley-Bank.html |

|

Auto Industry In Turmoil: Car Dealers Crushed By Price SqueezeAuto dealerships are encountering a major problem where auction (wholesale) prices are increasing while real book values stagnate, squeezing profitability. To make sense of this, auto-guru CarDealershipGuy expanded on our tweet, pointing out that Manheim wholesale auto prices are re-accelerating while other indexes tracking prices were flat. Here’s what was revealed in the conversation as per the auto expert: Manheim is tracking auctions. Dealers ARE paying more for cars. A LOT more. But the issue dealers are running… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Auto-Industry-In-Turmoil-Car-Dealers-Crushed-By-Price-Squeeze.html |

|

Relations Sour Between China And Russia As Ukraine War ContinuesThe Russian army’s ongoing struggle to capture Bakhmut might appear to be primarily a tactical episode in the larger geo-strategic picture of Russia’s war against Ukraine. However, it also affects the key political interactions shaping this picture, including the formally cordial, but in fact rather uneasy, relations between Moscow and Beijing. Chinese President Xi Jinping, who these days is basking in the well-prepared triumph of securing a third presidential term, knows well the value of symbolism and comprehends the Kremlin’s… Read more at: https://oilprice.com/Geopolitics/International/Relations-Sour-Between-China-And-Russia-As-Ukraine-War-Continues.html |

|

Saudi Arabia Says Oil Prices Won’t Dictate Its Budget In The FutureSaudi Arabia plans to disentangle itself so thoroughly from the crude oil industry that oil prices won’t play a significant role in shaping the country’s fiscal policies, Saudi’s Finance Minister Mohamed Al-Jadaan said Wednesday at a conference in Riyadh. “Our aim is within the period to 2030 we don’t even look at the oil price,” Al-Jadaan said. Saudi Arabia is currently heavily reliant on crude oil revenues, and oil prices play a major role in dictating the country’s budget and fiscal policies. But per… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Says-Oil-Prices-Wont-Dictate-Its-Budget-In-The-Future.html |

|

Oil Falls Despite Large Draws In Fuel InventoriesCrude oil prices moved lower today after the U.S. Energy Information Administration reported an inventory build of 1.6 million barrels for the week to March 10. This compared with an inventory decline of 1.7 million barrels estimated for the previous week and the first decline in crude oil inventories since the start of the year. At 480.1 million barrels, crude oil inventories are 7 percent above the five-year seasonal average, the EIA said. In gasoline, the EIA estimated an inventory draw of 2.1 million barrels for the week to March 10, with production… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Falls-Despite-Large-Draws-In-Fuel-Inventories.html |

|

Oil Prices Crash Below $70 As Credit Suisse Shares TumbleCrude oil prices continued their slide on Wednesday as yet another banking catastrophe unsteadied the market further. WTI plunged 4.21% on Wednesday, falling below $70 for the first time since December 2021 to $68.33 per barrel at 10:10 a.m. ET. Brent Crude fell over 3.94% to $74.40, for a loss of $3.05 per barrel. This is a sharp loss on the day, and just an extension of the previous losses seen earlier in the week, as Credit Suisse’s largest backer—the Saudi National Bank—said it would not give the bank any more assistance… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Crash-Below-70-As-Credit-Suisse-Shares-Tumble.html |

|

Russia Expects Its Oil And Natural Gas Production To Drop In 2023Russia expects its oil and gas production to fall this year compared to 2022, partly due to the production cuts announced for March, Russian Energy Minister Nikolai Shulginov told lawmakers on Wednesday. “For 2023, we expect oil production levels to be slightly lower, also because of the voluntary reduction in output,” Shulginov was quoted as saying by Russian news agency Interfax. “Gas production volumes will continue to decline both due to the abandonment of the European market and the timing of the re-routing of energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Expects-Its-Oil-And-Natural-Gas-Production-To-Drop-In-2023.html |

|

IEA: Global Oil Demand Will Outstrip Supply In Late 2023The oil market is set to swing from a comfortable supply overhang in the first half of 2023 to a deficit in the latter part of the year as the economic rebound in China will push global oil demand to a record high, the International Energy Agency (IEA) said on Wednesday. World oil demand growth is set for a sharp acceleration over the course of this year, from an estimated increase of 710,000 barrels per day (bpd) in the first quarter to a growth of 2.6 million bpd in the fourth quarter of 2023, the IEA said in its Oil Market Report… Read more at: https://oilprice.com/Energy/Energy-General/IEA-Global-Oil-Demand-Will-Outstrip-Supply-In-Late-2023.html |

|

IEA: Russia’s Oil Revenues Are Dwindling Due To SanctionsRussian revenues from oil fell in February as exports declined after the EU embargo on oil product imports from Russia by sea, the International Energy Agency (IEA) said on Wednesday. Last month, Russia’s total oil exports dropped by 500,000 barrels per day (bpd) to 7.5 million bpd as the EU embargo on refined oil products came into effect, the agency said in its Oil Market Report for March. “Revenues are already dwindling,” the IEA noted, adding that Russia’s estimated oil export revenues fell to $11.6 billion in February,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Russias-Oil-Revenues-Are-Dwindling-Due-To-Sanctions.html |

|

Dow closes more than 250 points lower Wednesday as bank crisis spreads to Europe: Live updatesPressure on the financial sector grew with shares of Credit Suisse, a Swiss Bank with large U.S. operations, tumbling 15%. Read more at: https://www.cnbc.com/2023/03/14/stock-market-today-live-updates.html |

|

One of the best ways to figure out what the Fed will do next is to look at regional bank stocksMarkets have changed their mind — again — about what they think the Federal Reserve will do next week regarding interest rates. Read more at: https://www.cnbc.com/2023/03/15/one-of-the-best-ways-to-figure-out-what-the-fed-will-do-next-is-to-look-at-reginal-bank-stocks.html |

|

In client call, SVB’s new CEO focuses on keeping the firm’s venture and startup relationships aliveSilicon Valley Bank’s new CEO Tim Mayopoulos pitched venture and startup clients hard to help keep the bank alive in a 30-minute call. Read more at: https://www.cnbc.com/2023/03/15/in-client-call-svb-new-ceo-focuses-on-venture-startup-relationships.html |

|

Goldman Sachs cuts GDP forecast because of stress on small banks, which are key to the U.S. economyGoldman on Wednesday lowered its 2023 economic growth forecast, citing a pullback in lending from small- and medium-sized banks. Read more at: https://www.cnbc.com/2023/03/15/goldman-sachs-cuts-gdp-forecast-because-of-stress-on-small-banks.html |

|

There’s been one big beneficiary of the banking crisis so far: Cathie WoodCathie Wood’s flagship Ark Innovation ETF reeled in $397 million in new money just Tuesday alone, notching the biggest one-day inflow since April 2021. Read more at: https://www.cnbc.com/2023/03/15/theres-been-one-big-beneficiary-of-the-banking-crisis-so-far-cathie-wood.html |

|

Financial shares fall as Credit Suisse becomes the latest crisis for the sectorWells Fargo, Citigroup, and key regional bank stocks were among the names under pressure on Wednesday. Read more at: https://www.cnbc.com/2023/03/15/financial-shares-fall-as-credit-suisse-becomes-latest-crisis-for-the-sector.html |

|

Oil tumbles to the lowest level since December 2021 as banking crisis routs marketsWest Texas Intermediate futures fell more than 6% to $66.85 per barrel. That would be WTI’s biggest one-day drop since July 12, 2022. Read more at: https://www.cnbc.com/2023/03/15/oil-sells-off-heads-for-worst-day-in-six-months-as-banking-crisis-routs-markets.html |

|

Airline stocks slide despite CEOs’ upbeat demand outlookPricy vacations have helped revive airline profits in recent months. Read more at: https://www.cnbc.com/2023/03/15/airline-stocks-slide-despite-ceos-upbeat-demand-outlook.html |

|

Trump extends lead over DeSantis in new poll of possible GOP primary fieldDeSantis, who has not yet announced his widely expected presidential campaign, has recently come under fire from Trump and other presidential contenders. Read more at: https://www.cnbc.com/2023/03/15/2024-gop-primary-polls-trump-grows-lead-over-desantis.html |

|

Ukraine war live updates: Moscow says it’ll try to retrieve U.S. drone; British and German fighter jets intercept Russian aircraftThe fallout from an encounter between a U.S. drone and Russian fighter jets on Tuesday continues to be monitored closely. Read more at: https://www.cnbc.com/2023/03/15/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Nevada considers plan to restrict water use for Las Vegas residentsThe bill would allow water managers to shut off water use for single-family residences in Las Vegas using more than half an acre-foot of water per year. Read more at: https://www.cnbc.com/2023/03/15/nevada-considers-plan-to-restrict-water-use-for-las-vegas-residents-.html |

|

Four days of panic: How startup execs navigated SVB’s meltdown and prepared for the worstWhen SVB failed last week, tech CEOs had a lot to worry about, most immediately how they would make payroll for March 15. Read more at: https://www.cnbc.com/2023/03/15/svb-crisis-sparked-four-day-panic-as-startup-execs-sought-capital.html |

|

Bitcoin retreats to $24,000, and NYDFS says Signature closure not tied to crypto: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Gilbert Verdian of Quant reacts to the closure of Signature and Silvergate and what it means for crypto businesses. Read more at: https://www.cnbc.com/video/2023/03/15/bitcoin-retreats-and-nydfs-signature-closure-not-tied-to-crypto-crypto-world.html |

|

Investor Carl Icahn Issues Grim Warning On US Economy “Breaking Down”Authored by Tom Ozimek via The Epoch Times, Billionaire investor Carl Icahn said that the U.S. economy is at a breaking point, blaming “worse than mediocre” leadership and warning that soaring inflation threatens to topple America’s position on the world stage.

Icahn made the remarks during an interview on CNBC’s “Closing Bell” program on Tuesday.

The renowned investor then warned about the dangers of persistently high inflation in the United States, which at last count Read more at: https://www.zerohedge.com/markets/investor-carl-icahn-issues-grim-warning-us-economy-breaking-down |

|

Stocks Soar After Swiss Authorities Hold “Stabilizing” Talks With Credit Suisse, To Make Statement ShortlyShort Summary:

* * * Update (1430ET): Rather unsurprisingly, given its SIFI nature and the external pressure already reported, Bloomberg reports that, according to people familiar with the matter, that Swiss authorities and Credit Suisse Group AG are discussing ways to stabilize the bank

The firm’s leaders and government officials have reportedly talked about options that Read more at: https://www.zerohedge.com/markets/credit-suisse-sparks-global-de-risking-after-top-investor-bails |

|

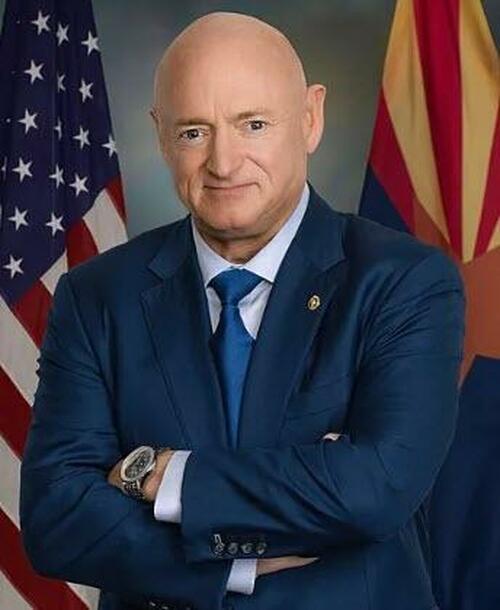

Banking On Censorship: Sen. Kelly Becomes Latest Dem To Suggest Barring Opposing Views On Social MediaAuthored by Jonathan Turley, Below is my column in the New York Post on the suggested censorship of bank critics by Sen. Mark Kelly (D., Ariz.). It was only the latest example of how censorship has become a reflexive response of many Democrats to opposing views. It is now increasingly common for certain views to be declared as simply too dangerous to be tolerated or allowed on social media, including (it seems) questioning the solvency of banks.

Here is the column: Concerned about your money after recent bank failures? You might want to keep those thoughts to yourself. While some rushed to get their money after the collapses, at least one leading Democrat is pushing for censorship of those who do not have faith in the banking industry. The Democr … Read more at: https://www.zerohedge.com/political/banking-censorship-sen-kelly-becomes-latest-dem-suggest-barring-opposing-views-social |

|

FDIC Seeks Help To Restart Sale Of Silicon Valley Bank After First Attempt FaltersUS banking regulators have been placed in a challenging situation following the collapse of Silicon Valley Bank, as they are now responsible for protecting depositors and preventing further bank runs. Regulators are now facing the daunting task of attempting to auction off the failed bank for a second time, but this time have sought the assistance of an investment bank to explore potential options. Regulators at the US Federal Deposit Insurance Corp (FDIC) tapped advisors at the investment bank Piper Sandler Companies to relaunch a failed auction of SVB, according to Reuters, citing people familiar with the matter. Officials from the FDIC seized SVB last Friday after $42 billion of deposit withdrawals one day prior caused the bank to fail. A weekend auction of the bank to top institutions proved to be unsuccessful. On Monday, sources informed about the situation told WSJ that FDIC officials had told Senate Republicans that they now had more flexibility to sell the bank after it was declared a failure and threat to the US financial system. Fast forward to Wednesday, these latest updates reveal that the FDIC is making arrangements for a potential second sale, with the possibility of considering selling the bank as a whole or explor … Read more at: https://www.zerohedge.com/markets/fdic-seeks-help-restart-sale-silicon-valley-bank-after-first-attempt-falters |

|

‘I may still have to move back in with my parents’Young people tell the BBC what they think of the help announced in the Spring Budget. Read more at: https://www.bbc.co.uk/news/business-64824078?at_medium=RSS&at_campaign=KARANGA |

|

Builders added to UK skills shortage listConstruction workers are added to list but hospitality sector not included in government review. Read more at: https://www.bbc.co.uk/news/business-64969468?at_medium=RSS&at_campaign=KARANGA |

|

People face biggest fall in spending power for 70 yearsThe gloomy forecast came as Chancellor Jeremy Hunt delivered his Budget in the Commons. Read more at: https://www.bbc.co.uk/news/business-64963869?at_medium=RSS&at_campaign=KARANGA |

|

Collapse of Silicon Valley Bank: An opportunity for IFSC, GIFT City?IFSC, GIFT City, which houses many private and public sector banks, global MNC banks, have been in operation for a long time now Read more at: https://economictimes.indiatimes.com/markets/stocks/news/collapse-of-silicon-valley-bank-an-opportunity-for-ifsc-gift-city/articleshow/98670791.cms |

|

Only this Mukesh Ambani Group co gave positive returns in last 6 months>> For more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/only-this-mukesh-ambani-group-co-gave-positive-returns-in-last-6-months-/articleshow/98672614.cms |

|

Promoter Sumitomo Wiring likely to sell 3.4% stake in Samvardhana Motherson via block deal on ThursdaySumitomo Wiring will sell about 230 million shares in the company in a deal that is valued at Rs 1,607 crore. The promoter company held about 17.55% stake in Samvardhana Motherson as of December quarter Read more at: https://economictimes.indiatimes.com/markets/stocks/news/promoter-sumitomo-wiring-likely-to-sell-3-4-stake-in-samvardhana-motherson-via-block-deal-on-thursday/articleshow/98670645.cms |

|

Market Snapshot: Dow down 400 points in final hour of trade after Credit Suisse woes reignite bank-sector angstU.S. stocks are lower in the final hour of trade Wednesday, but off the session’s worst levels, after concerns over the health of Credit Suisse sparked renewed banking-sector anxiety. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B5-F11529DD8D7C%7D&siteid=rss&rss=1 |

|

The Moneyist: ‘There was a prenuptial agreement, but our lawyers said it was poorly written’: My father married his caregiver, 40 years his junior. She’ll inherit millions.‘To complicate things, my father now is very worried that she might harm him to get money.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B3-6ED1B5D7BFF8%7D&siteid=rss&rss=1 |

|

Chip stocks fall as delivery times shrink, Samsung plans to build world’s largest chip complexSemiconductor stocks lagged the broader market Wednesday after South Korea announced plans for the world’s largest chip-making complex. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B6-D26DC549C3FC%7D&siteid=rss&rss=1 |