Summary Of the Markets Today:

- The Dow closed up 336 points or 1.06%,

- Nasdaq closed up 2.14%,

- S&P 500 closed up 1.68%,

- Gold $1907 down $9.20,

- WTI crude oil settled at $71 down $3.31,

- 10-year U.S. Treasury 3.668% up 0.151 points,

- USD $103.62 up $0.02,

- Bitcoin $25,161 – 24H Change up $809.08 – Session Low $24,086

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4% in February on a seasonally adjusted basis, after increasing 0.5% in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased by 6.0% before seasonal adjustment. The index for shelter was the largest contributor to the monthly all-items increase, accounting for over 70% of the increase, with the indexes for food, recreation, and household furnishings and operations also contributing. The food index increased 0.4% over the month with the food at home index rising 0.3%. The energy index decreased 0.6% over the month as the natural gas and fuel oil indexes both declined. The question remains whether the Federal Reserve will raise the federal funds rate to fight inflation after the bank failures over the last few days. Honestly, the bank failures were a result of flawed investment strategies – and halting the federal fund rate increases is problematic in the fight to reduce inflation. I suspect if the federal fund rate increases are halted – it is a sign that there is an endemic problem throughout the banking system. And this should scare the crap out of you.

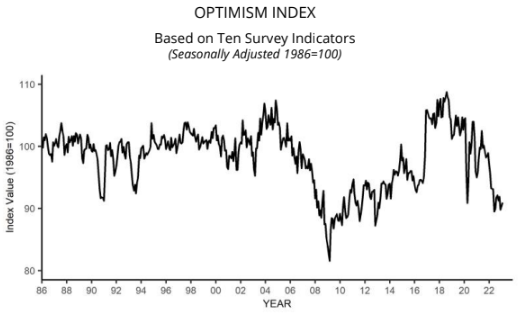

The NFIB Small Business Optimism Index increased 0.6 points in February to 90.9 but remains below the 49-year average of 98. Twenty-eight percent of owners reported inflation as their single most important business problem, up two points from last month. Owners expecting better business conditions over the next six months deteriorated by two points from January to a net negative 47%. NFIB Chief Economist Bill Dunkelberg added:

Small business owners remain doubtful that business conditions will get better in the coming months. They continue to struggle with historic inflation and labor shortages that are holding back growth. Despite their economic challenges, owners are working hard to create new jobs to strengthen the economy and their firms.

A summary of headlines we are reading today:

- Spain Takes 84% More Russian LNG Than Before Invasion

- Safeguard Your Savings: The Dangers Of Fractional Reserve Banking Systems

- SVB Fallout Spreads Through Energy Markets

- Goldman Betting On Fed To Skip March Rate Hike

- Brent Back Below $80 As Banking Fears Persist

- Charles Schwab CEO says firm is seeing significant inflows and that he bought the stock Tuesday

- Dow closes more than 300 points higher, snaps 5-day losing streak as bank shares rebound: Live updates

- Moody’s cuts outlook on U.S. banking system to negative, citing ‘rapidly deteriorating operating environment’

- Bitcoin jumps to highest since June as rally gathers pace

- Wall St rallies on rebound in banks, small rate-hike bets

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Why It’s Still Not Clear Who’s Behind The Nord Stream BlastsIn the first half of September 2022, a Greek-flagged tanker sailed eastward from the Dutch port of Rotterdam, into the Baltic Sea and a busy channel plied by dozens of ships weekly en route to major German, Russian, and other Baltic ports. Marine traffic tracking data showed the tanker stopped east of a Danish island, drifted for nearly week in the same location, then continued its journey east. About two weeks later, a series of undersea explosions erupted at nearly the same location, destroying parts of the Nord Stream 1 and 2 pipelines, major… Read more at: https://oilprice.com/Geopolitics/Europe/Why-Its-Still-Not-Clear-Whos-Behind-The-Nord-Stream-Blasts.html |

|

Spain Takes 84% More Russian LNG Than Before InvasionSpain has imported 84 percent more Russian LNG since Russia’s invasion of Ukraine, highlighting the persistent reliance the EU has on Russian energy. According to Bloomberg, Spain’s intake of Russian-derived LNG have climbed 84 percent since early last year after it had a falling out with another of its gas suppliers—Algeria. Spain received 14 percent of its LNG needs from Russia in the period from March of last year to February of this year—a 6.2 percentage point increase. And it’s not just Spain. Russia’s LNG exports to Europe last… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spain-Takes-84-More-Russian-LNG-Than-Before-Invasion.html |

|

The Environmental Implications Of A Hydrogen EconomyOften heralded as the clean fuel of the future, new hydrogen research suggests that a leaky hydrogen infrastructure could end up increasing atmospheric methane levels. Hydrogen’s potential as a clean fuel could be limited by a chemical reaction in the lower atmosphere, which would cause decades-long climate consequences. The research from Princeton University and the National Oceanic and Atmospheric Association has been published in Nature Communications, in which researchers modeled the effect of hydrogen emissions on atmospheric… Read more at: https://oilprice.com/Energy/Energy-General/The-Environmental-Implications-Of-A-Hydrogen-Economy.html |

|

Safeguard Your Savings: The Dangers Of Fractional Reserve Banking SystemsThe failure of Silicon Valley Bank and Signature Bank reminds us of a very important truth — if you can’t hold it in your hand, you don’t really own it… That’s why it’s wise to hold at least some of your wealth in hard assets like gold and silver that are in your direct possession or at least stored in a secure, allocated, segregated, and insured storage facility. The FDIC insures bank deposits up to $250,000. If you have more than that in a financial institution, you could lose everything above that limit… Read more at: https://oilprice.com/Finance/the-Economy/Safeguard-Your-Savings-The-Dangers-Of-Fractional-Reserve-Banking-Systems.html |

|

Republicans Make U.S. Energy Production Top Priority With New LegislationRepublicans are set to catapult its energy security agenda in the most critical issue, aiming to unveil legislation on Tuesday designed to boost energy production at home. The Lower Energy Costs Act will be filed as H.R. 1, thereby assigning it the highest priority for this congress. The House expects to pass the package later in March, which focuses on increasing domestic oil and gas production, as well as the production of clean energy. For the people, the message sent by the package is this: we are making lower energy prices a priority by increasing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Republicans-Make-US-Energy-Production-Top-Priority-With-New-Legislation.html |

|

India’s Opportunistic Pursuit Of Cheaper Oil From RussiaVia AG Metal Miner As the old saying goes, “one man’s crisis is another’s opportunity.” Russia’s invasion of Ukraine and the subsequent sanctions and ruined trade relationships with the U.S. and Europe represent a tremendous crisis. But for the country’s long-term ally, India – and to an extent, China – it represents opportunity. From cheap Russian oil and coking coal to steel, India continues to benefit from its close ties to Moscow. Russia, India, and China form a triumvirate of sorts… Read more at: https://oilprice.com/Energy/Crude-Oil/Indias-Opportunistic-Pursuit-Of-Cheaper-Oil-From-Russia.html |

|

OPEC Is More Optimistic On China’s Oil Demand Growth In 2023China’s reopening is set to add momentum to global economic growth, OPEC said on Tuesday, revising up its forecast for Chinese oil demand growth this year. “In the emerging economies, China’s reopening, following the lifting of the strict zero-COVID-19 policy, will add considerable momentum to global economic growth,” OPEC said in its closely-watched Monthly Oil Market Report (MOMR) today. China’s oil demand is expected to average 15.56 million barrels per day (bpd) in 2023, up by 710,000 bpd compared to last… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Is-More-Optimistic-On-Chinas-Oil-Demand-Growth-In-2023.html |

|

SVB Fallout Spreads Through Energy MarketsInvestor Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.Chart of the Week- The 50-day implied volatility rate of oil jumped some 16% amidst the ongoing chaos surrounding the collapse of SVB and Signature Bank, the most since the beginning of the Russia-Ukraine war. – With U.S. headline CPI coming in at… Read more at: https://oilprice.com/Energy/Energy-General/SVB-Fallout-Spreads-Through-Energy-Markets.html |

|

Goldman Betting On Fed To Skip March Rate HikeSpeculation is growing among traders that the US Federal Reserve could refrain from hiking interest rates later this month for fear of triggering another Silicon Valley Bank-style collapse. Turmoil in financial markets sparked by the tech-focused lender’s collapse has raised the likelihood Fed chair Jerome Powell and co may hold off raising rates any further. Up until last week, investors had expected the world’s most influential central bank to return to steeper moves and increase rates 50 basis points higher on 22 March. A batch of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-Betting-On-Fed-To-Skip-March-Rate-Hike.html |

|

LNG Market Could Become Too Saturated By 2027A wave of new liquefied natural gas (LNG) export terminals is set to come online in the next few years, and it could have a significant impact on global gas prices. The projects could face stiff competition from cheaper renewable energy and a resurgence of nuclear power, potentially creating instability in the market and putting some projects on shaky ground, analysts say. By 2030, LNG supplies will increase by 67%, or 636 million tonnes per annum (mtpa), compared to 2021 levels. enough to completely flood the global market. Cheniere Energy CEO… Read more at: https://oilprice.com/Energy/Natural-Gas/LNG-Market-Could-Become-Too-Saturated-By-2027.html |

|

OPEC Remains Cautious Despite Bullish Chinese Demand ForecastOPEC increased its projection for China’s oil demand growth in 2023 due to the country’s COVID-19 restrictions being relaxed. OPEC forecast that global demand will rise by 2.32 million barrels per day (bpd) in 2023, equal to a 2.3% increase. The bullish news was overshadowed by the collapse of Silicon Valley Bank, leading investors to fear another financial crisis may be on the horizon. Oil prices fell after the report’s release, with Brent falling below $80 per barrel. OPEC noted in the report… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Remains-Cautious-Despite-Bullish-Chinese-Demand-Forecast.html |

|

Brent Back Below $80 As Banking Fears PersistBrent crude oil prices sank back below the $80 threshold on Tuesday as the markets remained unsteady following the Silicon Valley Bank collapse. The price of the Brent crude oil benchmark fell below to $79.00 on Tuesday morning in volatile trade—a more than 2% drop on the day. Oil prices began a hefty slide on Monday, losing $2 per barrel, as the market feared a wave of bank failures in light of the SVB shutdown as it helped to highlight possible economic sinkholes that were created by continued rate hikes. The oil industry’s pricing… Read more at: https://oilprice.com/Energy/Energy-General/Brent-Back-Below-80-As-Banking-Fears-Persist.html |

|

India Has Not Committed To Buy Russian Oil Below The G7 Price CapIndia has not committed to and is not obligated to buy Russian crude oil only below the $60 price cap of the Western nations, a source at the Indian oil ministry told Reuters on Tuesday. Russia has been redirecting most of its crude oil exports to China and India since the EU and the G7 announced plans to embargo seaborne oil imports from Russia and set a price cap on the crude if it is to be shipped to third countries using Western tankers and insurers. India does not have any agreement signed with the West to follow the G7 price cap,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Has-Not-Committed-To-Buy-Russian-Oil-Below-The-G7-Price-Cap.html |

|

Four Reasons For Europe’s Record-Breaking Drop-In Natural Gas DemandEurope’s natural gas demand fell by the most on record last year, with the decline equivalent to the gas volumes required to supply more than 40 million homes, the International Energy Agency (IEA) said in a commentary on Tuesday. Natural gas consumption in OECD Europe fell by an estimated 13% in 2022, its steepest decline in absolute terms in history, IEA said in its quarterly gas report at the end of February. Demand in Europe fell amid mild winter weather and demand reduction in industry due to high prices. Significant changes… Read more at: https://oilprice.com/Energy/Energy-General/Four-Reasons-For-Europes-Record-Breaking-Drop-In-Natural-Gas-Demand.html |

|

TotalEnergies’ Mozambique Facility Won’t Export LNG Before 2027TotalEnergies’ $20-billion project for an LNG export facility in Mozambique is not expected to start operations until 2027 at the earliest, even if the French supermajor quickly decides to lift the force majeure on the works and proceed with development. “From the time we restart to production, we need another four years to build the facility,” Stephane Le Galles, project director at TotalEnergies, told Bloomberg while on a visit to the construction site in northeastern Mozambique. Exports from the plant could start “2027… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Mozambique-Facility-Wont-Export-LNG-Before-2027.html |

|

Charles Schwab CEO says firm is seeing significant inflows and that he bought the stock Tuesday“What we’re seeing is asset inflows to the firm in significant numbers,” Bettinger told CNBC. Read more at: https://www.cnbc.com/2023/03/14/charles-schwab-ceo-says-firm-is-seeing-significant-inflows-even-as-stock-gets-hit-during-banking-selloff.html |

|

Dow closes more than 300 points higher, snaps 5-day losing streak as bank shares rebound: Live updatesInvestors pushed up some bank stocks while watching the latest inflation data. Read more at: https://www.cnbc.com/2023/03/13/stock-market-today-live-updates.html |

|

Private equity firms Apollo and KKR among those reviewing Silicon Valley Bank loansPrivate equity firms Apollo Global Management and KKR are among the parties reviewing a book of loans held by Silicon Valley Bank, CNBC has learned. Read more at: https://www.cnbc.com/2023/03/14/private-equity-firms-apollo-and-kkr-among-those-reviewing-silicon-valley-bank-loans-.html |

|

Carl Icahn says our economy is breaking because of inflation and poor corporate leadershipFamed activist and raider Carl Icahn believes the U.S. economy is in trouble because of poor corporate leadership and stubbornly high inflation. Read more at: https://www.cnbc.com/2023/03/14/icahn-says-economy-breaking-due-to-inflation-poor-corporate-guidance.html |

|

History of financial shocks shows this banking tumult could be a buying opportunityFinancial events like the collapse of Silicon Valley Bank could present an attractive buying opportunity for investors in the months ahead. Read more at: https://www.cnbc.com/2023/03/14/history-of-financial-shocks-shows-this-could-be-a-buying-opportunity.html |

|

Russian jet downs U.S. drone over Black SeaThe U.S. called the downing of the drone by a Russian jet part of a pattern of reckless behavior by Russia. Read more at: https://www.cnbc.com/2023/03/14/russian-jet-downs-us-reaper-drone-over-black-sea.html |

|

Moody’s cuts outlook on U.S. banking system to negative, citing ‘rapidly deteriorating operating environment’The firm, part of the big three rating services, said it was making the move in light of key bank failures. Read more at: https://www.cnbc.com/2023/03/14/moodys-cuts-outlook-on-us-banking-system-to-negative-citing-rapidly-deteriorating-operating-environment.html |

|

Meta to lay off 10,000 more workers after initial cuts in NovemberMeta is laying off 10,000 more employees following a major round of job cuts in November. Read more at: https://www.cnbc.com/2023/03/14/meta-layoffs-10000-more-workers-to-be-cut-in-restructuring.html |

|

Apple reportedly delaying some employee bonuses as the company cuts costsThe shift is the latest example that Apple is cutting costs and watching corporate expenses closely during a rough patch for the tech industry. Read more at: https://www.cnbc.com/2023/03/14/apple-delaying-some-employee-bonuses-as-the-company-cuts-costs-report.html |

|

Ukraine war live updates: Russian plane collides with U.S. drone; Poland may send fighter jets to UkrainePresident Volodymyr Zelenskyy insisted his forces must win the battle for Bakhmut as doubts continue over whether Ukraine should continue defending the city. Read more at: https://www.cnbc.com/2023/03/14/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

OpenAI announces GPT-4, claims it can beat 90% of humans on the SATGPT-4 performed at the 90th percentile on a simulated bar exam, the 93rd percentile on an SAT reading exam, and the 89th percentile on the SAT Math exam, OpenAI claimed. Read more at: https://www.cnbc.com/2023/03/14/openai-announces-gpt-4-says-beats-90percent-of-humans-on-sat.html |

|

Here’s the inflation breakdown for February — in one chartThe annual inflation rate continues to cool gradually, according to the February inflation report issued Tuesday. But it remains high by historical standards. Read more at: https://www.cnbc.com/2023/03/14/heres-the-inflation-breakdown-for-february-in-one-chart.html |

|

Watch live: Biden announces new plans to curb gun violence, months after Lunar New Year mass shootingThough President Joe Biden signed the first major gun legislation passed in nearly 30 years last summer, he said it did not go as far as he’d like. Read more at: https://www.cnbc.com/2023/03/14/watch-live-biden-announces-new-plans-to-curb-gun-violence-.html |

|

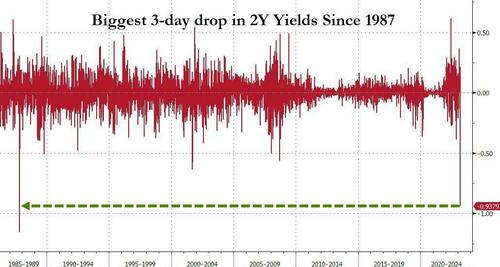

Mismatch Of The DecadeBy Michael Every of Rabobank Total panic, with 2-year US bond yields falling the most in one day since Volcker, eclipsing declines seen post-2008, 9/11, and 1987. That’s what we got yesterday despite President Biden saying the banking system was fine, the Fed saying the same, the FDIC backstopping depositors, and every bank analyst saying there is no systemic risk. Regardless, small banks were hammered not just in the US but globally, large banks given a kicking to boot, and everyone bought bonds.

The utter chaos we are seeing is ostensibly because of an asset-liability mismatch at a few small US banks, which regularly fail without garnering any attention. Then again, Ken Griffin of Citadel says “US capitalism is breaking down before our eyes.” Ironically, given the ostensible crisis trigger is the Fed raising rates while certain CFOs opted not to hedge, bond yields are now tumbling at such a pace that anyone short now faces a bloodbath. Do they get a bailout by not having to mark to market? If not, why not? One starts to see what Citadel are talk … Read more at: https://www.zerohedge.com/markets/mismatch-decade |

|

Kremlin Blames US For Crashed Drone: ‘Flying With Transponders Off Towards Russian Border’Update(1510ET): After nearly two hours since the story first broke in the international press, the Kremlin has issued its version of events concerning the US drone crash in the Black Sea Tuesday. The Russian Defense Ministry said nothing about the Pentagon’s allegations that a Russian Su-27 aircraft dumped fuel on the MQ-9 drone, but instead blamed the pair of Russian jets’ erratic maneuvering for the collision. “US drone MQ-9 fell into the Black Sea on Tuesday morning due to its own sharp maneuvering, Russian fighters did not come into contact with it and did not use weapons, the Russian Defense Ministry said,” according to Russian media. The statement is as follows [emphasis ours]:

The Russian fighters had been scrambled in response to the drone being picked up on radar: “The ministry clarified that on the morning of March 14, the airspace control of the Russian Aerospace Forces had recorded the flight of US unmanned aerial vehicle MQ-9 over the Black Sea in the region of the Crimean p … Read more at: https://www.zerohedge.com/geopolitical/us-reaper-drone-downed-over-black-sea-incident-russian-jet |

|

After SVB Rout, Traders Hope Fed Gets The MemoBy Michael Msika, Bloomberg Markets Live reporter and strategist US banking sector turmoil is sounding a warning that central banks’ monetary tightening may have gone too far too fast. Markets want to see if policymakers have got the memo. The collapse of SVB and Signature Bank is fanning worries about the health of regional US banks, but it is also sending shockwaves across Europe, where fears of contagion have fueled heavy selling. Unsurprisingly, bank shares are bearing the brunt. There’s a silver lining, however. Traders’ nerves are being soothed by expectations that the banking troubles will finally bring about that long-awaited Federal Reserve pivot. Goldman Sachs economists, for instance, have dropped calls for a March interest rate hike. And swaps markets, are wagering there may be no more rate hikes at all. A soft inflation print later on Tuesday would encourage such bets. “March Fed hike should now be off the table,” Crossbridge Capital CIO Manish Singh says. “If we get signs that the Fed has got the message that rates have been tightened too far, then the equity market will remain bid and get in dip buyers.” Read more at: https://www.zerohedge.com/markets/after-svb-rout-traders-hope-fed-gets-memo |

|

Schiff: And Then Something Broke…Authored by Peter Schiff via SchiffGold.com, Over the past several months, Mike Maharrey and I have posted numerous articles that conclude the same way… the Fed is bluffing and when something breaks, they will fold. On every podcast, Mike has walked through exactly why this is inevitable. Back in September, I laid out the math that showed why the Fed would fold and laid out a series of risks that may cause such an event. One of those risks was “What if the financial markets freeze because there is a credit event somewhere?”.

Well, that just happened. Silicon Valley Bank (SVB) and now Signature Bank has collapsed. Sure enough, the Fed folded within 48 hours. They stood with the Treasury and FDIC and explained how they are stepping in to prevent systemic risks from spreading. They have established a new Bank T … Read more at: https://www.zerohedge.com/markets/schiff-and-then-something-broke |

|

Budget: Pensions to get boost as tax-free limit to risePersuading workers to work longer is part of plans to boost growth, but critics say very few will benefit. Read more at: https://www.bbc.co.uk/news/business-64949083?at_medium=RSS&at_campaign=KARANGA |

|

What do we know about the Silicon Valley and Signature Bank collapse?Two US banks have collapsed and shares tumbled. So how serious is this and what does it mean for you? Read more at: https://www.bbc.co.uk/news/business-64951630?at_medium=RSS&at_campaign=KARANGA |

|

Strikes Update: How Wednesday 15 March’s strikes affect youWhat you need to know about the various strikes in England by the BBC’s Zoe Conway. Read more at: https://www.bbc.co.uk/news/business-64951613?at_medium=RSS&at_campaign=KARANGA |

|

Traders worldwide herald end to rate hikes after US bank runThe Reserve Bank of Australia, meanwhile, is already done hiking, according to pricing, after traders erased bets for two additional increases. Even in Europe, which kicked off its tightening cycle much later than peers, traders have wiped off around 80 basis points from terminal-rate wagers, and another half-point hike on Thursday — all but certain last week — is no longer guaranteed Read more at: https://economictimes.indiatimes.com/markets/stocks/news/traders-worldwide-herald-end-to-rate-hikes-after-us-bank-run/articleshow/98639595.cms |

|

Bitcoin jumps to highest since June as rally gathers paceU.S. authorities’ action helped stabilize the major USDC stablecoin, whose issuer Circle had deposits of $3.3 billion at SVB. The steadying of USDC, the second-biggest stablecoin and a key cog in digital token trading was seen as positive for the crypto sector as a whole. Read more at: https://economictimes.indiatimes.com/markets/commodities/news/bitcoin-jumps-to-highest-since-june-as-rally-gathers-pace/articleshow/98637980.cms |

|

Wall St rallies on rebound in banks, small rate-hike betsAt 11:46 a.m. ET, the Dow Jones Industrial Average was up 422.41 points, or 1.33%, at 32,241.55, the S&P 500 was up 75.20 points, or 1.95%, at 3,930.96, and the Nasdaq Composite was up 263.75 points, or 2.36%, at 11,452.59. Data showed U.S. Consumer Price Index (CPI) rose 0.4% in February from 0.5% in January as Americans faced persistently higher costs for rents and food Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-stocks-open-higher-as-inflation-data-boosts-smaller-rate-hike-bets/articleshow/98636775.cms |

|

Market Extra: Bank ETFs bounce as this regional banking fund sees ‘record’ trading volume over recent daysExchange-traded funds focused on bank stocks are bouncing as investors appear to be wading back into the beleaguered banking sector amid strong trading volume in the ETFs. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B5-1984525DC13F%7D&siteid=rss&rss=1 |

|

Market Extra: 6 charts show how SVB’s collapse sent shock waves through global marketsHere’s a look at how SVB’s collapse rippled through global financial and commodity markets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B4-D4550BDC6827%7D&siteid=rss&rss=1 |

|

Help My Career: Women are more likely to report ‘toxic’ workplaces that are disrespectful, lack diversity, cut-throat and even abusiveNew research published in the MIT Sloan Management Review makes for depressing reading on Equal Pay Day on March 14. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B5-10AB4BAA87E4%7D&siteid=rss&rss=1 |