Summary Of the Markets Today:

- The Dow closed up 40 points or 0.12%,

- Nasdaq closed down 0.11%,

- S&P 500 closed up 0.07%,

- Gold $1852 down $2.60,

- WTI crude oil settled at $81 up $0.88,

- 10-year U.S. Treasury 3.977% up 0.014 points,

- USD $104.32 down $0.20,

- Bitcoin $22,411 – 24H Change down $77.58 – Session Low $22,330

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

New orders for manufactured goods in January 2023, down two of the last three months, decreased 1.6% following a 1.7% December increase. On a year-over-year basis, new orders increased by 4.3% (blue line on the graph below) but when inflation-adjusted has contracted by 3.2% (red line on the graph below).

A summary of headlines we are reading today:

- The Dark Side Of Europe’s Green Energy Transition

- WTI Crude Hits $80 Despite Disappointing Growth Plans From China

- U.S. Oil Producers Prioritize Short-Term Gains Over Future Output

- Natural Gas Plunges over 12% As Extreme Volatility Continues

- Oil Price Rally Unravels On China’s Underwhelming GDP Growth Target

- Dow closes higher Monday to notch four-day win streak: Live updates

- Bitcoin and Ether rise despite Silvergate suspending its crypto payments network: CNBC Crypto World

- Bloomberg Terminal Users Embrace ‘Cash Is No Longer Trash’

- Fed Study Shows Loose Monetary Policy Leads To Disaster And Financial Crisis

- Futures Movers: Oil prices settle higher as traders shake off demand concerns tied to China’s 5% growth target

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Dark Side Of Europe’s Green Energy TransitionAt the eleventh hour, Europe converted an energy crisis into a clean energy revolution. In the aftermath of Russia’s illegal invasion of Ukraine, there has been an urgent scramble to lessen the bloc’s dependency on Russian natural gas and on energy imports in general. As a result, the EU energy sector has made an incredible turnaround in a remarkably short time span. The EU’s use of Russian natural gas has plummeted from around 40% to less than 17% between 2021 and 2022. While some of this was offset by a regrettable… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/The-Dark-Side-Of-Europes-Green-Energy-Transition.html |

|

Iran Claims To Have Found World’s Second-Largest Lithium DepositA major lithium deposit that rises to the level of the world’s second-largest has been found in Iran, the country’s Ministry of Industry, Mines, and Trade said on Iranian state television on Saturday. “For the first time in Iran, a lithium reserve has been discovered in Hamedan,” the Ministry said, adding that it believes the deposit holds 8.5 million tons of lithium. Only Chile holds more lithium, with 9.2 million metric tons, according to the U.S. Geological Survey. Lithium is a critical part of electric vehicle batteries.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Claims-To-Have-Found-Worlds-Second-Largest-Lithium-Deposit.html |

|

Germany Is Still The Second-Largest Buyer Of Russian Fossil FuelsA year on from Russia’s initial invasion of Ukraine, Russian fossil fuel exports are still flowing to various nations around the world. As Visual Capitalist’s Niccolo Conte details below, according to estimates from the Centre for Research on Energy and Clean Air (CREA), since the invasion started about a year ago, Russia has made more than $315 billion in revenue from fossil fuel exports around the world, with nearly half ($149 billion) coming from EU nations. This graphic uses data from the CREA to visualize… Read more at: https://oilprice.com/Geopolitics/International/Germany-Is-Still-The-Second-Largest-Buyer-Of-Russian-Fossil-Fuels.html |

|

WTI Crude Hits $80 Despite Disappointing Growth Plans From ChinaWest Texas Intermediate (WTI) crude oil prices have broken above the $80 barrier despite disappointing growth plans coming out of China Monday. On Monday at 1:50 p.m. EST, WTI was trading up 0.64% at $80.19 per barrel, up 51 cents on the day, while Brent crude was up 13% at $85.94. Oil prices opened Monday lower on underwhelming data from China in terms of post-COVID economic recovery. The oil price pullback earlier on Monday following Beijing’s GDP growth target of “around 5%” for this year, which comes in lower… Read more at: https://oilprice.com/Latest-Energy-News/World-News/WTI-Crude-Hits-80-Despite-Disappointing-Growth-Plans-From-China.html |

|

Rare Earth Elements: What They Are And Why They MatterRare earth elements (REEs) are a group of 17 metallic elements essential in many modern technologies. Despite their name, they are not actually rare, but they are difficult to extract and refine. In recent years, the importance of REEs has grown due to their role in energy production and storage and their impact on geopolitics. What Are Rare Earth Elements? The 17 rare earth elements include: Scandium Yttrium Lanthanum Cerium Praseodymium Neodymium Promethium Samarium Europium Gadolinium Terbium Dysprosium Holmium Erbium Thulium Ytterbium Lutetium… Read more at: https://oilprice.com/Metals/Commodities/Rare-Earth-Elements-What-They-Are-And-Why-They-Matter.html |

|

Russia Remains India’s Top Oil Supplier For Fifth Month In A RowIndia keeps on taking major volumes of Russian oil, as the latest data suggests. Moscow supplies at present around 35% of India’s total oil imports, in stark contrast to less than 1% before the Ukraine war. Based on data provided by consultancy Vortexa, India imported around 1,62 million bpd in February from Russia. These record levels are almost the same as India’s imports from Iraq (940,000 bpd) and Saudi Arabia (648,000 bpd) combined. The UAE (Abu Dhabi) is India’s 4th largest supplier, with around 404,000 bpd. All these figures… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Remains-Indias-Top-Oil-Supplier-For-Fifth-Month-In-A-Row.html |

|

Africa’s Oil Industry Is Set To Flourish In 2023Several energy firms have developed oil and gas projects in Africa and the Caribbean in recent years as they shift to focus on low-carbon oil and future-proofing their operations. With mounting pressure to decarbonize, many oil and gas majors have moved away from aging, carbon-intensive operating sites in favor of developing new projects in non-traditional oil regions. Meanwhile, African countries are determined to claim their piece of the global energy pie, unwilling to give up valuable natural resources without taking a stake in operations. So,… Read more at: https://oilprice.com/Energy/Crude-Oil/Africas-Oil-Industry-Is-Set-To-Flourish-In-2023.html |

|

Iraq’s Risky Reliance On Oil RevenuesIraq managed to collect a lot of revenues from oil exports last year due to higher prices, but the Iraqi economy remains heavily reliant on oil income, which represents a massive 95% of the country’s federal budget revenue. Higher oil prices led to a budget surplus for Iraq, OPEC’s second-largest producer after Saudi Arabia, last year, according to the financial statements of the federal government reported by news outlet Shafaq News. Oil revenues accounted for an overwhelming 95% of Iraq’s federal budget, the data showed, raising… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraqs-Risky-Reliance-On-Oil-Revenues.html |

|

U.S. Oil Producers Prioritize Short-Term Gains Over Future OutputU.S. oil companies have prioritized shareholder returns over future output, resulting in a $128 billion windfall for investors and marking the first time in a decade that drillers spent more on share buybacks and dividends than on capital projects. According to Bloomberg calculations, shareholders in US oil companies reaped a $128 billion windfall in 2022 thanks to a combination of global supply disruptions such as Russia’s war in Ukraine and intensifying Wall Street pressure to prioritize returns (dividends and buybacks) over… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Oil-Producers-Prioritize-Short-Term-Gains-Over-Future-Output.html |

|

Tesla Slashes Prices Of Luxury ModelsTesla has announced yet another price cut for its high-end electric vehicles in North America, according to the company’s website. The move comes after Tesla CEO Elon Musk stated that previous price cuts had led to increased demand for more affordable models during an Investor Day event last week. The starting prices of Model S and X in the US have been lowered by 5.3% and 9.1%, respectively, to $89,990 and $99,990. The Plaid versions of these models have also been reduced by 4.3% and 8.3%, respectively, with the new cost of $109,990 representing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tesla-Slashes-Prices-Of-Luxury-Models.html |

|

Natural Gas Plunges over 12% As Extreme Volatility ContinuesForecasts for milder weather and lower heating demand have seen natural gas prices plummeting by over 12% on Monday, after a strong rally on Friday to five-week high. At 10:07 a.m. EST on Monday, front-month gas futures for April delivery were down 12.30% to $2.639 per million British thermal units, the biggest drop since January 30th, when nat gas prices shed 14%. The large drop comes only days after Freeport LNG boosted exports at its Texas plant after reopening last month following a shutdown that had lasted for eight months. At… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Natural-Gas-Plunges-over-12-As-Extreme-Volatility-Continues.html |

|

Equipment Failure Disrupts UK Natural Gas Exports To EuropeA major natural gas export pipeline from the UK this weekend halted supply to Belgium and other EU customers following an equipment failure that is expected to be fixed by Wednesday. Exports via the UK-Belgium Interconnector were interrupted, the pipeline operator said in a notice this weekend, just as the UK is experiencing a cold snap driving demand for natural gas higher. Flows via the interconnector were already lower at the end of last week due to the higher gas demand in Britain. On Saturday, natural gas generated 53.6% of British… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Equipment-Failure-Disrupts-UK-Natural-Gas-Exports-To-Europe.html |

|

Oil Price Rally Unravels On China’s Underwhelming GDP Growth TargetOil prices pulled back on Monday morning after China set a GDP growth target of “around 5%” for 2023, lower than last year’s target of 5.5% and also lower than the average forecast of 5.24% by a cross-section of economic experts. Last year, China’s GDP expanded by just 3% but experts were optimistic that this year’s target could be set as high as 6% after the country relaxed its strict covid-19 rules. Additionally, China set a goal of 3% for the consumer price index (CPI), with Beijing keen to maintain… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Price-Rally-Unravels-As-China-Fails-To-Impress.html |

|

Poland’s Top Refiner To Sue Russia For Halting Oil SupplyPKN Orlen, the biggest refiner in Poland, will seek compensation from Russia after Moscow cut off crude oil deliveries to Poland via the Druzhba pipeline at the end of last month, the refiner’s chief executive Daniel Obajtek said on Monday. Crude oil deliveries from Russia to Poland were suspended on February 25, PKN Orlen said at the time. Russia claims that incomplete paperwork prevented the supply of Russian oil to Poland, and Polish refineries were cut off, Russian media reported. According to a spokesperson for Russian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Polands-Top-Refiner-To-Sue-Russia-For-Halting-Oil-Supply.html |

|

The EIA Vows To Improve The Accuracy Of Its Oil DataThe EIA has baffled the market and analysts with high adjustments in its weekly and monthly U.S. oil data in recent years. The so-called adjustment in weekly and monthly crude oil data, or “Unaccounted For Crude Oil” as it was previously referred to, has been used to balance the difference between oil supply entering the market and oil disposition, or oil leaving the market. In the latest weekly petroleum status report, the data from the Energy Information Administration showed last week that the adjustment – the balancing… Read more at: https://oilprice.com/Energy/Energy-General/The-EIA-Vows-To-Improve-The-Accuracy-Of-Its-Oil-Data.html |

|

Dow closes higher Monday to notch four-day win streak: Live updatesWall Street is coming off a positive week for the major averages, where the Dow Jones Industrial Average snapped a four-week losing streak. Read more at: https://www.cnbc.com/2023/03/05/stock-market-today-live-updates.html |

|

Fed’s Powell heads to Capitol Hill this week, and he’s going to have his hands fullFederal Reserve Chairman Jerome Powell appears before Congress with a tall task. Read more at: https://www.cnbc.com/2023/03/06/fed-chair-powell-heads-to-capitol-hill-and-hes-got-his-hands-full.html |

|

Google CEO defends desk-sharing policy, says some offices are like a ‘ghost town’In responding to employee criticism of Google’s new desk-sharing policy for the cloud unit, CEO Sundar Pichai reminded staffers that real estate is pricey. Read more at: https://www.cnbc.com/2023/03/06/google-ceo-defends-desk-sharing-policy-says-offices-like-ghost-town.html |

|

Norfolk Southern makes broad safety adjustments after third train derailmentA Norfolk Southern spokesman told CNBC the train carrier is now mandating that any trains over 10,000 feet use distributed power. Read more at: https://www.cnbc.com/2023/03/06/norfolk-southern-adjusts-train-safety-after-third-derailment.html |

|

All-weather stocks that can outperform in any economic ‘landing,’ according to Evercore ISIIf the U.S. enters a recession or the Fed achieves a soft landing, these names should outperform in either scenario, Evercore ISI said in a note to clients. Read more at: https://www.cnbc.com/2023/03/06/all-weather-stocks-that-can-outperform-in-any-economic-landing-according-to-evercore-isi.html |

|

Paramount Global considers selling a majority stake of BET Media Group, sources sayParamount Global is exploring a majority stake sale of BET Media Group but isn’t looking to sell off other parts of the business, sources say. Read more at: https://www.cnbc.com/2023/03/06/paramount-bet-media-majority-stake-sale.html |

|

Companies that give up stock buybacks for 5 years will get preferential treatment in $52 billion CHIPS program, Commerce Secretary Raimondo saysRaimondo said stock buybacks is one factor being taken into consideration as part of a $39-billion manufacturing subsidy program. Read more at: https://www.cnbc.com/2023/03/06/companies-that-give-up-stock-buybacks-for-5-years-will-get-preferential-treatment-in-52-billion-under-chips-program-commerce-secretary-raimondo-says.html |

|

Bitcoin and Ether rise despite Silvergate suspending its crypto payments network: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Caitlin Long, founder and CEO of Custodia Bank, which aims to bridge traditional finance and digital assets, discusses the uncertainty at Silvergate Bank. Read more at: https://www.cnbc.com/video/2023/03/06/bitcoin-ether-rise-despite-silvergate-suspending-crypto-payments-network-cnbc-crypto-world.html |

|

Ukraine war live updates: Ukraine likely staging ‘tactical withdrawal’ in Bakhmut; Russian mercenary chief’s rift with officials deepensIt’s unclear how much of Bakhmut is controlled by Russian forces, and whether Ukrainain forces are starting to withdraw from parts of the city. Read more at: https://www.cnbc.com/2023/03/06/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Risky feedback loops are accelerating climate change, scientists warnA group of international scientists reviewed climate literature to identify 41 climate feedback loops, 27 of which are accelerating global warming. Read more at: https://www.cnbc.com/2023/03/06/risky-feedback-loops-are-accelerating-climate-change-scientists-warn.html |

|

Toblerone chocolate to cut iconic Matterhorn logo from packaging due to ‘Swissness’ lawsSwitzerland requires milk-based products promoting themselves as Swiss to be made entirely within the country. Read more at: https://www.cnbc.com/2023/03/06/toblerone-to-drop-matterhorn-from-packaging-due-to-swissness-laws.html |

|

Senators call for two changes to help encourage Social Security beneficiaries to claim retirement benefits laterMany retirees claim Social Security at age 62, even though their benefit checks would be bigger if they waited. Now some lawmakers hope to help change that. Read more at: https://www.cnbc.com/2023/03/06/senators-call-for-changes-to-help-retirees-claim-social-security-later.html |

|

Marlboro maker Altria agrees to buy e-cigarette startup NJOY for nearly $2.8 billionAltria’s deal to buy NJOY comes after the Marlboro maker exited its position in Juul Labs. Read more at: https://www.cnbc.com/2023/03/06/marlboro-maker-altria-to-buy-njoy.html |

|

Anger As Djokovic Withdraws From US Open; Still Banned From Entering Country Due To Vaxx StatusAuthored by Steve Watson via Summit News, The world’s number one tennis player Novak Djokovic has withdrawn from the Miami Open and the U.S. Open because he is still banned from entering the country owing to his vaccination status.

While the news is being reported as a “visa dispute,” the reason Djokovic cannot complete is because he refuses to take the COVID vaccine. Djokovic has appealed for a special dispensation to play in the tournaments, given that the rest … Read more at: https://www.zerohedge.com/political/anger-djokovic-withdraws-us-open-still-banned-entering-country-due-vaxx-status |

|

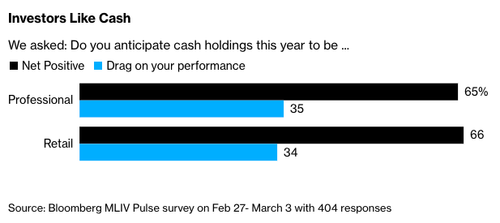

Bloomberg Terminal Users Embrace ‘Cash Is No Longer Trash’In a new survey, Bloomberg Terminal users have overwhelmingly agreed that cash in their portfolios would be a net positive this year, supporting the case ‘cash is no longer trash’ amid signs that higher-than-expected inflation data indicates global central banks will continue their ultra-hawkish stance to keep aggressively raising interest rates. Over 400 professional and retail investors participated in the latest MLIV Pulse survey. Two-thirds of professional respondents believe cash will be a net positive on their portfolios, while only 35% answered that cash holdings would drag on performance. Retail traders gave similar responses.

The appeal of cash stems from increasing nervousness as higher-than-expected inflation data means central banks will continue to raise interest rates through at least June, dashing hopes for a full-blown risk-on rally in equity markets. The Federal Reserve clearly has more work to do as the economy still runs hot. The Fed’s benchmark rate implied by … Read more at: https://www.zerohedge.com/markets/bloomberg-terminal-users-embrace-cash-no-longer-trash |

|

Fed Study Shows Loose Monetary Policy Leads To Disaster And Financial CrisisAuthored by Mike Shedlock via MishTalk.com, A Fed study shows the obvious… But Fed presidents never believe the few studies that ever make any sense…

Please consider the San Francisco Fed paper, Loose Monetary Policy and Financial Instability. Much of the Fed report is truly Geek stuff and incomprehensible formulas. But the conclusions and many snippets ring home. Snips That Make Sense

|

|

Germany’s Scholz Signals ‘Assurances’ That China Won’t Arm RussiaAuthored by Dave DeCamp via AntiWar.com, German Chancellor Olaf Scholz said Sunday that China “declared” it will not provide Russia with weapons for its war in Ukraine despite US claims, signaling that the German leader received some sort of assurance from Beijing. “We all agree that there should be no arms deliveries, and the Chinese government has declared that it will not deliver any either,” Scholz said at a press conference with European Commission President Ursula von der Leyen, according to POLITICO. “We insist on this, and we are monitoring it.”

Read more at: https://www.zerohedge.com/geopolitical/germanys-scholz-signals-assurances-china-wont-arm-russia |

|

CBI boss Tony Danker steps aside after misconduct allegationsTony Danker said he was “mortified” to hear that he had caused “offense or anxiety to any colleague”. Read more at: https://www.bbc.co.uk/news/business-64861370?at_medium=RSS&at_campaign=KARANGA |

|

Costa Coffee follows Pret a Manger with third staff pay rise in a yearThe High Street coffee chain joins others in increasing wages as firms struggle to recruit staff. Read more at: https://www.bbc.co.uk/news/business-64861175?at_medium=RSS&at_campaign=KARANGA |

|

Elon Musk’s Tesla cuts prices again as tries to boost salesTesla boss Elon Musk has previously said he hoped price cuts would help the firm avoid the hit from a “pretty difficult recession” in 2023. Read more at: https://www.bbc.co.uk/news/business-64867287?at_medium=RSS&at_campaign=KARANGA |

|

Gold outlook: Fed commentary on the rate hike to keep bullion on edge this weekCorrection in the dollar index from resistance levels was one of the major reasons for the recovery in gold and silver, currency and commodity expert Anuj Gupta said. Bullion is also taking positive cues from stronger-than-expected business activity in China which is the largest commodity importer in the world, Gupta said. Read more at: https://economictimes.indiatimes.com/markets/commodities/news/gold-outlook-fed-commentary-on-rate-hike-to-keep-bullion-on-edge-this-week/articleshow/98444727.cms |

|

ETMarkets Smart Talk: Stay invested! The market can play like Shane Warne on a good day: Arun ChulaniI think one needs to keep a long-term perspective when it comes to investing. The market has seen many who have been bowled out clean trying to second guess near-term events and trends. Read more at: https://economictimes.indiatimes.com/markets/expert-view/etmarkets-smart-talk-stay-invested-the-market-can-play-like-shane-warne-on-a-good-day-arun-chulani/articleshow/98440465.cms |

|

Foreign funds bullish on capex theme, also buy into IT, healthcareAbout 80% of the foreign portfolio investor (FPI) inflows into Indian equities in February 2023 went into capital goods, services, information technology, and healthcare. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/foreign-funds-bullish-on-capex-theme-also-buy-into-it-healthcare/articleshow/98437733.cms |

|

Dick’s Sporting Goods will sidestep retail spending weakness, analysts sayRetailers have seen a pullback in discretionary spending this earnings season. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71AC-25E0ABEE9914%7D&siteid=rss&rss=1 |

|

Market Extra: What stock-market investors want to hear when Fed’s Powell testifies before Congress this weekA modest U.S. stock-market recovery from last year’s carnage will be again put to the test this week, as investors closely watch Powell’s testimony to Congress for clues to whether the recent market discussion of interest rates going “higher for longer” is justified. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71AB-F94B98AC4AAA%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices settle higher as traders shake off demand concerns tied to China’s 5% growth targetOil futures settle higher on Monday, giving up early declines, as traders shake off demand concerns tied to the growth target set by China. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71AB-6B7C52A7CCF4%7D&siteid=rss&rss=1 |

Image source: dpa/picture allianceVon der Leyen said that the US has provided “no evid …

Image source: dpa/picture allianceVon der Leyen said that the US has provided “no evid …