Summary Of the Markets Today:

- The Dow closed up 72 points or 0.22%,

- Nasdaq closed up 0.63%,

- S&P 500 closed up 0.31%,

- Gold $1824 up $7.00,

- WTI crude oil settled at $76 down $0.65,

- 10-year U.S. Treasury 3.926% down 0.023 points,

- USD $104.66 down $0.56,

- Bitcoin $23,347 – 24H Change down $275.47 – Session Low $23,166

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

New orders for manufactured durable goods in January 2023, down two of the last three months, decreased to 3.0% (0.1% inflation adjusted) year-over-year growth from 11.2% (5.6% inflation adjusted) in December 2022. It appears that this decrease was caused by a significant fall in new orders for civilian aircraft. Hold on to the seat of your pants as next month’s (February 2023) civilian aircraft new orders should explode with Air India’s 210 plane order to Boeing.

The Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — improved 8.1% to 82.5 in January. Year-over-year, pending transactions dropped by 24.1%. An index of 100 is equal to the level of contract activity in 2001. NAR Chief Economist Lawrence Yun stated:

Buyers responded to better affordability from falling mortgage rates in December and January.

A summary of headlines we are reading today:

- Inflation Reduction Act: Opening Up Green Hydrogen Possibilities

- U.S. Gasoline Prices 26 Cents Lower Than Last Year

- Top Energy Trader Expects Oil Prices To Enter The $90-$100 Range

- A rush of homes go under contract in January, but it’s unlikely to last

- The negative market turnaround is all about one thing: Rates

- Bitcoin drops 1% to start the week, and Texas regulators oppose Voyager deal: CNBC Crypto World

- Ukraine war live updates: Putin warns NATO’s nuclear capability can’t be ignored; future world order is being decided, Russia says

- Peter Schiff: History Shows It’s Impossible To Put The Inflation Genie Back In The Bottle

- Bond Report: 2-year Treasury yield edges down from nearly 16-year high

- Market Snapshot: U.S. stocks attempt to bounce back after worst week of 2023

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Gold Reserves May Be Double What Official Reports SuggestAccording Jan Nieuwenhuijs, of Gainesville Coins, the Chinese central bank owned 4,309 tonnes of gold on December 31, 2022, which is more than double than what is officially disclosed. My estimate would make China the second-largest gold reserve country after the US. The Chinese private sector holds 23,745 tonnes, bringing the total amount of gold in China to 28,054 tonnes. China and European countries are in agreement to equalize their ratios of monetary gold relative to GDP in order to prepare for a global gold standard. Introduction For estimating… Read more at: https://oilprice.com/Metals/Gold/Chinas-Gold-Reserves-May-Be-Double-What-Official-Reports-Suggest.html |

|

Kazakhstan Enters New Era Amid Strong Demand For Its CommoditiesKazakhstan’s president Kassym-Jomart Tokayev believes “Never let a crisis go to waste.” Tokayev has been on a roll since January 2022, when the government requested assistance from the Collective Security Treaty Organization (CSTO) to suppress deadly fuel price riots Tokayev claimed were hijacked by “terrorist groups” that had “received extensive training abroad.” He then secured the resignation of former president Nursultan Nazarbayev as head of the Security Council and took the seat himself. In June,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakhstan-Enters-New-Era-Amid-Strong-Demand-For-Its-Commodities.html |

|

Inflation Reduction Act: Opening Up Green Hydrogen PossibilitiesIf 2022 turbocharged the green hydrogen economy, then 2023 is the start of a long slog for this nascent sector that is set to be the backbone for decarbonization, transition and energy security strategies. Rystad Energy research has found that electrolyzer capacity is expected to grow by 186% from 2022 to 2023. Attention is therefore turning to the supply chain capacity necessary for electrolyzer production. Even though many of the raw materials needed for the sector’s growth have seen high price tags in recent years, Rystad Energy expects… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Inflation-Reduction-Act-Opening-Up-Green-Hydrogen-Possibilities.html |

|

Rio Tinto Signs Iron Deal With One Of China’s Top SteelmakersVia AG Metal Miner New developments continue to signal coming improvements in Chinese steel production. Among these is a forecast of prospects for the country’s vehicle sector and shipyards. This would ultimately thaw out the Sino-Australian relationship. One of the world’s biggest steelmakers, China’s Baowu Steel Group Corp., is keen to seek closer ties with Aussie iron ore miner Rio Tinto. This comes as Chinese iron ore continues to rebound. In fact, a report from Bloomberg detailed Baowu Chairman Chen Derong’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rio-Tinto-Signs-Iron-Deal-With-One-Of-Chinas-Top-Steelmakers.html |

|

Can China Really Be An Unbiased Broker Of Peace?A position paper unveiled by Beijing pushing for a cease-fire in Ukraine has been met skeptically by many experts and Western officials who question China’s ability to broker a truce given its growing ties with Russia. Released by China on February 24 to coincide with the one-year anniversary of Russia’s invasion, the 12-point proposal calls for an end to Western sanctions against Moscow, setting up humanitarian corridors for the evacuation of civilians, ensuring the regular export of Ukrainian grain, security guarantees for Russia,… Read more at: https://oilprice.com/Geopolitics/International/Can-China-Really-Be-An-Unbiased-Broker-Of-Peace.html |

|

Mexico’s Oil Giant Reports Staggering LossesThe past several days have been devastating ones for Mexico’s state-run Pemex, which reported three refinery fires last week that have left two dead and more injured, followed by quarterly reporting that downs a tripling of losses against an impossible level of debt and a stark failure to revive output. Pemex released Q4 2022 results on Monday, reporting $9.4 billion in losses in a single quarter, more than triple the losses of the previous quarter. According to Bloomberg, Pemex output fell to 1.62 million barrels per day in 2022,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mexicos-Oil-Giant-Reports-Staggering-Losses.html |

|

The EV Boom Has A Logistics ProblemOwners of electric vehicles are finally admitting that recharging away from home is a total “logistical nightmare,” between finding charging stations, and the fact that in the best case scenarios, it takes 30 to 40 minutes, and up to two hours, to recharge. “We’re going through the planning process of how easily Maddie can get from Albany to Gettysburg [College] and where she can charge the car,” said YouTube personality Steve Hammes, who leased a Hyunday Kona Electric SUV for his 17-year-old daughter, Maddie. “It makes me a little nervous. We want… Read more at: https://oilprice.com/Energy/Energy-General/The-EV-Boom-Has-A-Logistics-Problem.html |

|

U.S. Gasoline Prices 26 Cents Lower Than Last YearU.S. national average gas prices have fallen by over 26 cents since this time last year, and drivers are set for more reprieve as the usual seasonal increase in prices could be delayed. GasBuddy data released on Sunday shows that national average prices for a gallon of gas are declining once again, after a week of no movement in either direction, falling 4.3 cents from a week ago, 17.6 cents month-on-month. Diesel prices have also fallen 7.7 cents in the past week, according to GasBuddy, now selling for an average of $4.38 per gallon. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Prices-26-Cents-Lower-Than-Last-Year.html |

|

Fossil Fuel Emissions Projected To Peak In 2025The inflection point for fossil fuel carbon dioxide (CO2) emissions is nigh, with emissions on track to peak by 2025, according to Rystad Energy research and analysis. On the current global pathway of announced policies, projects, industry trends and expected technological advancements, global CO2 emissions are poised to hit about 39 gigatonnes per year (Gtpa) in 2025 before settling into a steady annual decline as industries clean up their carbon footprint. Emissions hit a record high in 2022 as countries scrambled to secure… Read more at: https://oilprice.com/Energy/Energy-General/Fossil-Fuel-Emissions-Projected-To-Peak-In-2025.html |

|

Russia’s Lukoil Looks To Sell Stake In Offshore Oil And Gas FieldRussian oil firm Lukoil is in direct talks with Indian companies to sell its 38% stake in a deepwater oil and gas field offshore Ghana, Reuters reported on Monday, quoting Russian and Ghanaian sources with knowledge of the matter. The potential sale could unblock the suspension of the field development plan, which the operator of the Pecan field, Norway’s Aker Energy, hasn’t submitted yet. Aker Energy holds a 50% participating interest in the Deepwater Tano Cape Three Points block in Ghana, including the Pecan development project.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Lukoil-Looks-To-Sell-Stake-In-Offshore-Oil-And-Gas-Field.html |

|

Turkmenistan Is Falling Back Into Russia’s Energy OrbitAt a time when gas-rich Turkmenistan could be pushing to diversify its export paths, it is instead allowing itself to be pulled back into Moscow’s energy orbit, experts say. Russia is no longer the top buyer of natural gas from Turkmenistan, a country that is believed to depend on the fuel for three-quarters of its state revenues. The main purchaser is China, which displaced Russia more than a decade ago and currently imports around four times as much gas from Turkmenistan as Russia does. But if Beijing has traditionally been businesslike… Read more at: https://oilprice.com/Energy/Natural-Gas/Turkmenistan-Is-Falling-Back-Into-Russias-Energy-Orbit.html |

|

Kazakhstan Could Suspend Natural Gas Exports Next WinterKazakhstan could halt natural gas exports next winter to prevent a domestic gas supply crisis, QazaqGaz deputy chief executive Arman Kasenov was quoted as saying by Russian media on Monday. Kazakhstan, the biggest oil producer in Central Asia, exports natural gas to Russia and China. QazaqGaz manages Kazakhstan’s natural gas transportation infrastructure, provides international transit, and sells gas on the domestic and foreign markets. There will be no deficit of gas in Kazakhstan next winter, but only if there are no exports, QazaqGaz’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakhstan-Could-Suspend-Natural-Gas-Exports-Next-Winter.html |

|

Top Energy Trader Expects Oil Prices To Enter The $90-$100 RangeOil prices could hit the $90-$100 per barrel range in the second half of this year as global demand is set to reach record levels amid constrained supply, Russell Hardy, CEO at the world’s largest independent oil trader, Vitol Group, told Bloomberg Television on Monday. “The prospect of higher prices in the second half of the year, in the sort of $90-$100 range, is a real possibility,” Hardy told Bloomberg in an interview. According to Hardy, global oil demand will rise by 2.2 million barrels per day (bpd) in 2023… Read more at: https://oilprice.com/Energy/Energy-General/Top-Energy-Trader-Expects-Oil-Prices-To-Enter-The-90-100-Range.html |

|

Kazakh Oil Starts Flowing To Germany Via Russian Pipeline NetworkCrude oil from Kazakhstan started flowing via the Russian pipeline network to Poland for further delivery to Germany, Russian pipeline monopoly operator Transneft said on Monday. Kazakh crude oil began flowing to Germany via transit through Poland, Transneft’s representative Igor Demin told Russian news agency TASS. This weekend, Kazakhstan’s oil pipeline operator KazTransOil delivered 20,000 tons of Kazakhstani oil to Transneft’s system of oil pipelines in the direction of the Adamova Zastava oil delivery point for further… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakh-Oil-Starts-Flowing-To-Germany-Via-Russian-Pipeline-Network.html |

|

UK Oil And Gas Industry Warns Windfall Tax Will Hurt Energy SecurityThe windfall tax on UK North Sea producers is hitting all companies operating on the UK Continental Shelf with firms already announcing lower investments and deferring drilling plans, the new head of trade body Offshore Energies UK (OEUK) has warned. Last autumn, the UK raised the windfall tax on the profits of oil and gas operators by 10 percentage points to 35% from January 1, 2023. The UK also extended the so-called Energy Profits Levy to the end of March 2028, from December 31, 2025, as originally planned when the levy was 25%. The… Read more at: https://oilprice.com/Energy/Energy-General/UK-Oil-And-Gas-Industry-Warns-Windfall-Tax-Will-Hurt-Energy-Security.html |

|

Why Goldman’s consumer ambitions failed, and what it means for CEO David SolomonAs Goldman’s Marcus morphed from a side project to a focus for investors, the business expanded and ultimately buckled under the weight of Solomon’s ambitions. Read more at: https://www.cnbc.com/2023/02/27/why-goldmans-marcus-project-failed-and-what-it-means-for-ceo-solomon.html |

|

A rush of homes go under contract in January, but it’s unlikely to lastSigned contracts on existing homes jumped 8.1% last month compared with December, according to the National Association of Realtors. Read more at: https://www.cnbc.com/2023/02/27/january-pending-home-sales.html |

|

Fisker confirms Ocean EV deliveries will begin in spring, it’s on track to build more than 40,000 in 2023Fisker had “approximately 65,000” reservations for the Ocean SUV, up slightly from “over 62,000” as of its prior earnings report. Read more at: https://www.cnbc.com/2023/02/27/fisker-fsr-q4-2022-results-production-reservations.html |

|

Palantir to cut about 2% of employees, roughly 75 jobsPalantir confirmed that it’s cutting about 2% of its workforce, as layoffs continue to hit the tech industry. Read more at: https://www.cnbc.com/2023/02/27/palantir-layoffs-75-employees-2percent-of-workforce.html |

|

The negative market turnaround is all about one thing: Rates“The recent reset by the equity market feels more of a byproduct of rates higher, rather than a [simple] reset,” said one chart analyst. Read more at: https://www.cnbc.com/2023/02/27/the-negative-market-turnaround-is-all-about-one-thing-rates.html |

|

Treasury yields retreat after 2-year note reaches highest level since July 2007U.S. Treasury yields pulled back Monday as investors continue to monitor the outlook for inflation and the economy. Read more at: https://www.cnbc.com/2023/02/27/treasury-yields-fall-slightly-as-caution-returns-over-inflation.html |

|

Bitcoin drops 1% to start the week, and Texas regulators oppose Voyager deal: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Linda Jeng, visiting scholar on financial technology and adjunct professor of law at Georgetown University Law Center’s Institute for International Economic Law, discusses the SEC’s enforcement action on crypto. Read more at: https://www.cnbc.com/video/2023/02/27/bitcoin-drops-texas-regulators-oppose-voyager-deal-cnbc-crypto-world.html |

|

Supreme Court will hear case challenging Consumer Financial Protection Bureau fundingThe funding of the consumer watchdog by the Federal Reserve is the key issue in the case that the Supreme Court has agreed to hear. Read more at: https://www.cnbc.com/2023/02/27/supreme-court-will-hear-case-challenging-consumer-financial-protection-bureau-funding.html |

|

DeSantis told ex-Disney CEO Bob Chapek to stay out of Florida’s fight over ‘Don’t Say Gay’ bill, book saysThe excerpt came on the same day DeSantis, an expected 2024 presidential candidate, signed a bill stripping Disney of its self-governing status. Read more at: https://www.cnbc.com/2023/02/27/disney-ex-ceo-chapek-called-desantis-over-dont-say-gay-book.html |

|

Ukraine war live updates: Putin warns NATO’s nuclear capability can’t be ignored; future world order is being decided, Russia saysRussia’s Vladimir Putin said Moscow has to take into account NATO’s nuclear capabilities as he again falsely claimed that the West wants to eliminate Russia. Read more at: https://www.cnbc.com/2023/02/27/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

The small European nation of Switzerland beat sky-high inflation. Here’s howInflation in Switzerland hit a 29-year high of 3.5% in 2022, well below the double-digit rates of other advanced economies. Read more at: https://www.cnbc.com/2023/02/27/how-switzerland-beat-high-inflation-why-the-swiss-economy-is-strong.html |

|

McDonald’s expands Krispy Kreme test to more Kentucky locationsThe Krispy Kreme doughnuts will be available all day and can be ordered in the drive-thru lane, in the restaurant, through the McDonald’s app and for delivery. Read more at: https://www.cnbc.com/2023/02/27/mcdonalds-krispy-kreme-test-expanded.html |

|

‘Bond ladders are cool again,’ says advisor. Here’s how to capture higher Treasury bill yieldsIf you’re eager to capture higher yields amid rising interest rates, you may consider a Treasury bill, or T-bill, ladder, experts say. Here’s what to know. Read more at: https://www.cnbc.com/2023/02/27/how-to-build-a-treasury-bill-ladder-to-capture-higher-yields.html |

|

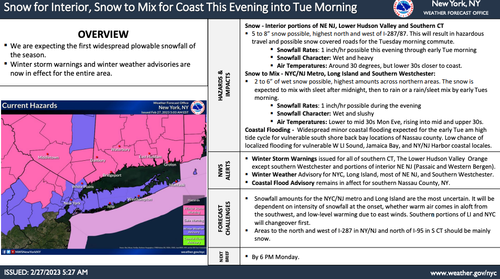

“Winter May Finally Arrive”: New York City Braces For SnowstormWith only three weeks until the spring season, the National Weather Service forecasts a winter storm could blanket Manhattan’s Central Park with as much as 5 inches. A nearly yearlong “snow drought” would end for the metro area if frozen precipitation accumulates on Tuesday morning. NWS has posted winter storm advisories for New York City and Long Island. Forecasts show between 3-5 inches of snow is expected. There could be times snow transitions to sleet and rain. Warnings are posted for interior areas that could see 5-8 inches.

NWS expects the snow to begin around Monday evening and last through Tuesday morning. Here are the latest snowfall accumulation forecasts. Read more at: https://www.zerohedge.com/weather/winter-may-finally-arrive-new-york-city-braces-snowstorm |

|

Peter Schiff: History Shows It’s Impossible To Put The Inflation Genie Back In The BottleVia SchiffGold.com, The markets basically shrugged off the hotter-than-expected inflation data for January. Most people remain convinced that the Fed can easily get price inflation back to 2% without wrecking the economy. But in his podcast, Peter explains that stuffing that inflation genie back into the bottle is a lot harder than most people seem to think.

Both the CPI and the PPI came in hotter than expected in January. “In my opinion, it indicated a trough in so-called disinflation,” Peter said. Jerome Powell hung his hat on declining price inflation numbers. It was the thing he could point to in order to claim he was winning Read more at: https://www.zerohedge.com/markets/peter-schiff-history-shows-its-impossible-put-inflation-genie-back-bottle |

|

DeSantis Signs Bill Killing Disney World’s “Corporate Kingdom”Florida Governor Ron DeSantis on Monday signed a bill that takes control of a special tax district surrounding Walt Disney World that, as Reuters reports, for half a century allowed Walt Disney Co. to operate with an almost unprecedentedly high degree of autonomy.

The legislation, titled HB 9-B, ends Disney’s self-governing status, establishes a new state-controlled district and imposes a five-member state control board, which is appointed by the governor. The board will also be confirmed by the state Senate. “Today is the day the corporate kingdom finally comes to an end,” DeSantis said.

|

|

Curious Case Of Grayscale & The Big Bitcoin DiscountAuthored by Fan Yu via The Epoch Times, Anyone who watched television during 2022 saw the ubiquitous TV commercials for Grayscale, which manages the world biggest Bitcoin investment fund. Those ads touted Bitcoin as “the future” and should be part of a retiree’s portfolio. But investors in Grayscale Bitcoin Trust (GBTC) are facing both a problem and an opportunity.

The problem? GBTC trades at a 46 percent discount to its underlying holdings, as of Feb. 24. This means the per-share value of the fund is 46 percent less than the Bitcoins held in the fund’s portfolio. Read more at: https://www.zerohedge.com/crypto/curious-case-grayscale-big-bitcoin-discount |

|

New energy price cap prompts call for help on billsThe regulator’s new cap shows the cost of government help will be less than initially thought. Read more at: https://www.bbc.co.uk/news/business-64748135?at_medium=RSS&at_campaign=KARANGA |

|

Lidl limits sales of tomatoes, cucumbers and peppersThe discount supermarket follows rivals by restricting sales of certain fruit and vegetables. Read more at: https://www.bbc.co.uk/news/business-64785676?at_medium=RSS&at_campaign=KARANGA |

|

Canada bans TikTok on government devicesThe federal government says the video app is an “unacceptable” risk to privacy and security. Read more at: https://www.bbc.co.uk/news/world-us-canada-64792894?at_medium=RSS&at_campaign=KARANGA |

|

JPMorgan investment arm purges its ESG funds of Adani stocksThe JPMorgan Global Emerging Markets Research Enhanced Index Equity ESG UCITS ETF offloaded the more than 70,000 shares in cement manufacturer ACC Ltd., exiting a stake it’s held since May 2021, according to a data review by Bloomberg that looked at movements following the Jan. 24 publication of the Hindenburg report. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/jpmorgan-investment-arm-purges-its-esg-funds-of-adani-stocks/articleshow/98276006.cms |

|

Stocks to buy or sell today: 7 short-term trading ideas by experts for 27 February 2023Amid weak global cues and stress over the trajectory of future rate hikes by central banks, the domestic equity market continued its downward trajectory of last week on Monday. While bank stocks showed resilience in morning, IT stocks were the worst affected. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/stocks-to-buy-or-sell-today-7-short-term-trading-ideas-by-experts-for-27-february-2023/articleshow/98263712.cms |

|

Nifty oversold, can consolidate at 17,200-17,900: AnalystsBased on the rollover analysis and chart setup, we expect midcap IT, defence, and CPSE space to outperform with long build-up visible in names such as UltraTech, ONGC, Siemens, IGL and Polycab, and short build-up in banking, oil & gas, metals, auto, and real estate with stocks like M&M, JSW Steel, Jindal Steel, Hindalco, HPCL, Godrej Properties, DLF, and Canara Bank. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-oversold-can-consolidate-at-17200-17900-analysts/articleshow/98259547.cms |

|

AMC’s stock jumps more than 20% on eve of earningsAMC Entertainment Holdings Inc.’s stock jumped more than 21% Monday on the eve of the meme-stock darling’s fourth-quarter earnings. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71A4-C27A839DFDF6%7D&siteid=rss&rss=1 |

|

Bond Report: 2-year Treasury yield edges down from nearly 16-year highU.S. bond yields turn mostly lower Monday morning, though the policy-sensitive 2-year rate remains near a 16-year high, as buyers return to Treasurys. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71A4-20D392D87D75%7D&siteid=rss&rss=1 |

|

Market Snapshot: U.S. stocks attempt to bounce back after worst week of 2023Stocks attempt to bounce off their lowest levels in several months as some investors appear to brush aside recent hot inflation data. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71A4-15EE8064A628%7D&siteid=rss&rss=1 |