Summary Of the Markets Today:

- The Dow closed down 697 points or 2.06%,

- Nasdaq closed down 2.50%,

- S&P 500 closed down 2.00%,

- Gold $1845 down $5.50,

- WTI crude oil settled at $76 down $0.29,

- 10-year U.S. Treasury 3.958% up 0.013 points,

- USD $104.18 up $0.32,

- Bitcoin $24,503 – 24H Change down $276.45 – Session Low $24,331

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

Existing-home sales fell for the twelfth straight month in January – slid 0.7% from December 2022 to a seasonally adjusted annual rate of 4.00 million in January. Year-over-year, sales retreated 36.9% (down from 6.34 million in January 2022). NAR Chief Economist Lawrence Yun stated:

Home sales are bottoming out. Prices vary depending on a market’s affordability, with lower-priced regions witnessing modest growth and more expensive regions experiencing declines.

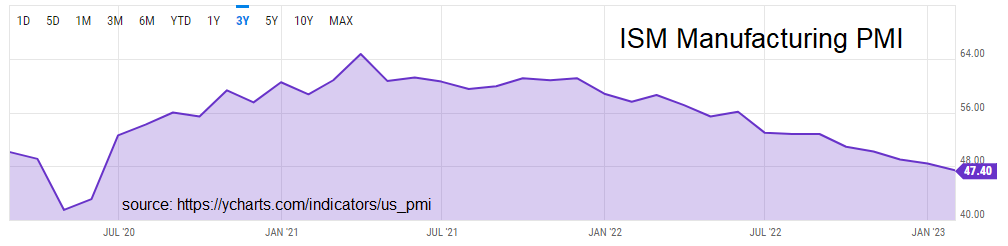

The January Manufacturing PMI registered 47.4%, 1 percentage point lower than the seasonally adjusted 48.4% recorded in December. Regarding the overall economy, this figure indicates a second month of contraction after a 30-month period of expansion. The Manufacturing PMI figure is the lowest since May 2020, when it registered a seasonally adjusted 43.5%. The New Orders Index remained in contraction territory at 42.5%.

CoreLogic’s Single-Family Rent Index (SFRI) shows rental price growth rose by 6.4% year over year in December 2022, compared with the 12.1% gain recorded in December 2021. Rental price gains have risen by about an average of $300 over the past two years.

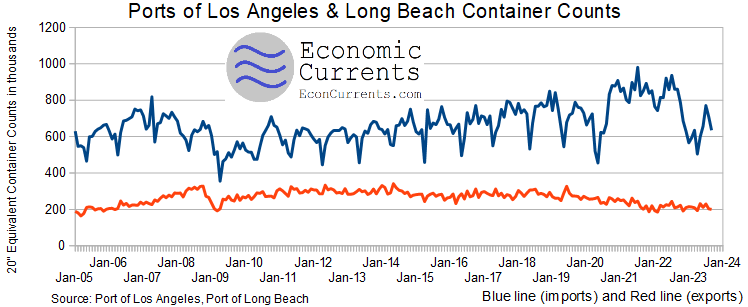

Container exports and imports into the Ports of Los Angeles and Long Beach in January 2023 continued their decline with imports falling 22% year-over-year (down from -20% last month) and exports falling -6% year-over-year (down from +15% last month). Imports declines are normally a negative economic signal – but a good portion of the decline can be attributed to port congestion one year ago where a ship waited months for offloading and elevated traffic above normal. Currently, port congestion has subsided. In my estimation, the amount of traffic going through the ports is not recessionary.

A summary of headlines we are reading today:

- EU To Ban Exports Of $12 Billion In Products Used By Russian Military

- Are Investors Too Relaxed About Hot CPI Data?

- Higher-For-Longer Interest Rate Fears Weigh On Oil

- Attacks On The U.S. Power Grid Are Surging

- Putin Issues A New Nuclear Warning To The West

- Dow closes nearly 700 points lower in broad selloff, as all indexes cap their worst day of 2023: Live updates

- Bitcoin slides below $25,000, and the crypto venture capital outlook for 2023: CNBC Crypto World

- Credit Suisse Crashes To All-Time Low After Regulators Probe If Chairman Lied About “Stabilizing” Outflows

- US stocks slide at open as Walmart, Home Depot forecasts disappoint

- Economic Report: Existing home sales fell for the 12th straight month in January, lowest since 2010

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Clean Energy Workers See Spike In Recruiter InterestGreen energy is having a banner year. In the European Union, policymakers have effectively “turbocharged the green transition” in response to the growing threat of an all-out energy crisis due to the Russian war in Ukraine and its associated sanctions. In the United States, the Inflation Reduction Act, which represents the largest single step that Congress has ever taken to address climate change, is just beginning to create a major clean energy gold rush thanks to billions in incentives. Meanwhile, China is spending more on clean energy… Read more at: https://oilprice.com/Energy/Energy-General/Clean-Energy-Workers-See-Spike-In-Recruiter-Interest.html |

|

EU To Ban Exports Of $12 Billion In Products Used By Russian MilitaryThe European Union is preparing another sanctions package on Russia to coincide with the anniversary of the invasion of Ukraine on February 24. EU ambassadors had a first discussion on the measures prepared by the European Commission last week and, according to diplomats familiar with the discussion who are not authorized to speak on the record, there is every chance that the 27 member states will reach the necessary unanimous agreement on the sanctions package soon. That agreement is likely because, just as in the previous round of sanctions agreed… Read more at: https://oilprice.com/Geopolitics/International/EU-To-Ban-Exports-Of-12-Billion-In-Products-Used-By-Russian-Military.html |

|

Russia Calls UN Meeting On Nordstream SabotageRussia called a UN Security Council meeting on Tuesday on the subject of the Nord Stream pipeline sabotage of last September, the AP said. The Security Council reviewed Russia’s draft resolution on Monday, but said there was opposition to the resolution. The meeting request comes after asking for a resolution that calls for a UN investigation of the sabotage. Denmark, Germany, and Sweden issued a letter to the Security Council member with its conclusion of the sabotage. According to their investigations, the Nord Stream 1 and 2 gas pipelines… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Calls-UN-Meeting-On-Nordstream-Sabotage.html |

|

China’s “Wolf Warrior” Diplomacy Is Pushing The UK AwayIn early 2018, UK Prime Minister Theresa May visited China with a British business delegation, seeking a free trade deal and expressing optimism over Beijing’s “one country, two systems” formula for governing Hong Kong (Global Times, January 31, 2018; Zaobao, January 31, 2018). On her first foreign trip since moving to 10 Downing Street, she promised that the “golden era of relations” between the UK and China would be even better after Brexit (Xinhua, February 1, 2018). Since May’s visit, however, a great deal… Read more at: https://oilprice.com/Geopolitics/International/Chinas-Wolf-Warrior-Diplomacy-Is-Pushing-The-UK-Away.html |

|

Turkish Steel Mills Halt Operations To Assess Earthquake DamageVia AG Metal Miner Several steel mills in central and southern Turkey have suspended operations, declaring force majeure. The decision comes after two earthquakes struck those areas and Syria on February 6. Flats and longs producer Isdemir, in Iskenderun, Hatay Province, said in a February 13 announcement that it is currently performing assessments. “Production has been suspended until the work is completed,” plant representatives stated. They later added “developments on the subject will be shared with the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Turkish-Steel-Mills-Halt-Operations-To-Assess-Earthquake-Damage.html |

|

Are Investors Too Relaxed About Hot CPI Data?Despite the hotter-than-expected CPI report, the mainstream still seems convinced that the Federal Reserve can get inflation under control and bring the economy to a soft landing. But Peter Schiff argues that the central bank can’t win this fight – at least not without crashing the economy. Since the Fed isn’t willing to do that, it won’t go all-in. In effect, the Fed brought a knife to an inflation gunfight. Even with CPI numbers coming in higher than anticipated, the stock market held up pretty well last week. Some of… Read more at: https://oilprice.com/Finance/the-Economy/Are-Investors-Too-Relaxed-About-Hot-CPI-Data.html |

|

BHP Takes $3.1 Billion Hit Due To China’s Pandemic RestrictionsThe world’s largest mining company BHP Group (BHP) has suffered a heavy decline in profits, following a dip in iron ore prices and heavy pandemic restrictions in China last year – its biggest customers. BHP reported a 32 percent fall in half-year profits – recording underlying earnings of £5.5bn ($6.6bn), down from £8.1bn ($9.7bn) a year earlier – as China’s strict zero-COVID-19 policy curtailed economic activity and dented demand. This weighed down iron ore prices, while miners grappled with surging costs… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BHP-Takes-31-Billion-Hit-Due-To-Chinas-Pandemic-Restrictions.html |

|

Could Gravity Batteries Win The Energy Storage War?As renewable energy operations continue to expand worldwide, governments and energy companies are racing to develop battery storage capacity to ensure that people have access to clean energy at all hours of the day and night. The inconsistency of many renewable energy sources has made the need for battery storage greater than ever, which has spurred a huge amount of investment into new battery technologies around the globe. Now, gravity batteries may help us harness the power of wind and solar farms even when the wind isn’t blowing and the… Read more at: https://oilprice.com/Energy/Energy-General/Could-Gravity-Batteries-Win-The-Energy-Storage-War.html |

|

United Airlines Launches Fund To Support Sustainable Fuel Start-UpsOn Tuesday, United Airlines launched a $100-million investment vehicle to support start-ups developing and exploring the production of sustainable aviation fuel in an effort to accelerate the research, production, and technologies associated with SAF. United announced the creation of the United Airlines Ventures Sustainable Flight Fund, which starts with more than $100 million in investments from United and its partners Air Canada, Boeing, GE Aerospace, JPMorgan Chase, and Honeywell. The partners, and potentially additional corporations,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/United-Airlines-Launches-Fund-To-Support-Sustainable-Fuel-Start-Ups.html |

|

Higher-For-Longer Interest Rate Fears Weigh On OilInvestor Alert: With markets reopening after U.S. President’s day, our oil & gas investment specialist David Messler has identified a major opportunity. U.S. shale giant Devon Energy saw its share price tank last week after an earnings miss. David writes that Investors who understand the continued importance of oil and gas to the world’s economy may have just been handed a gift. Don’t miss out on his latest research, and try out our premium Global Energy Alert service for less than a cup of coffee per week.Chart of the WeekChina… Read more at: https://oilprice.com/Energy/Energy-General/Higher-For-Longer-Interest-Rate-Fears-Weigh-On-Oil.html |

|

More Than Half Of Bitcoin Mining Is Fueled By Sustainable PowerThis article provides a look at my latest research, revealing how it came to be that a 2022 Cambridge Centre For Alternative Finance’s (CCAF) study on Bitcoin’s environmental impact underestimates the amount of sustainable Bitcoin mining going on. I also address why we can be very confident that the actual sustainable energy usage is at least 52.6% of Bitcoin WHY THIS MATTERS Whatever your position on ESG investment, the reality is that it’s soaring, on track to reach $10.5 trillion in the U.S. alone. What’s also true… Read more at: https://oilprice.com/Energy/Energy-General/More-Than-Half-Of-Bitcoin-Mining-Is-Fueled-By-Sustainable-Power.html |

|

Norway’s Oil Production Dropped In JanuaryOil production in Norway, the biggest oil producer in Western Europe, slipped in January compared to December and was 3% below official forecasts, the Norwegian Petroleum Directorate said on Tuesday. Last month, Norway pumped 1.754 million barrels per day (bpd) of crude oil, 200,000 bpd of natural gas liquids (NGL), and 25,000 bpd of condensate. Total oil production in January was 3.0% lower than the NPD’s forecast, while crude oil output was 1.2% below forecasts and 1% lower than in December 2022. Norway’s natural gas production also… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norways-Oil-Production-Dropped-In-January.html |

|

Israel’s Giant Natural Gas Field Is Preparing For An LNG TerminalFunding for a new floating LNG terminal off Israel’s coast has been approved by the partners in the Leviathan gas field, the companies said on Tuesday, according to Reuters. The expansion of the Leviathan field, which includes a new LNG terminal, will boost Leviathan’s production to allow for increased exports to Europe, which is looking to disentangle itself from the shackles of Russian energy. The Leviathan field currently produces around 12 bcm per year, which is sold to Israel, Egypt, and Jordan. The partners in the Leviathan field… Read more at: https://oilprice.com/Energy/Energy-General/Israels-Giant-Natural-Gas-Field-Is-Preparing-For-An-LNG-Terminal.html |

|

Attacks On The U.S. Power Grid Are SurgingThe number of attacks with gunfire or vandalism on the U.S. power grid infrastructure surged last year and is likely to continue rising this year, too, a confidential analysis seen by The Wall Street Journal has shown. Last year, the number of physical attacks – including intrusion, vandalism, and gunfire – jumped by 71% from 2021, according to the Electricity Information Sharing and Analysis Center, or E-ISAC, a division of North American Electric Reliability Corporation (NERC). The number of attacks on power grid infrastructure soared… Read more at: https://oilprice.com/Energy/Energy-General/Attacks-On-The-US-Power-Grid-Are-Surging.html |

|

Putin Issues A New Nuclear Warning To The WestIn his latest speech, Vladimir Putin blamed Ukraine and the West for “provoking” Russia into invading Ukraine. Putin also issued a new warning to the West by suspending Russia’s participation in a major nuclear arms control treaty with the U.S. In his two-hour-long state of the nation address today, Putin accused the West and Ukraine of starting the war by provoking Russia with NATO’s expansion and new European anti-rocket defense systems. Putin also used the speech to announce that Russia is suspending its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Issues-A-New-Nuclear-Warning-To-The-West.html |

|

Dow closes nearly 700 points lower in broad selloff, as all indexes cap their worst day of 2023: Live updatesThe Dow Jones Industrial Average at one point dropped 700 points, or 2.1%, its worst downturn since Jan. 18, when it fell 1.8%. Read more at: https://www.cnbc.com/2023/02/20/stock-market-today-live-updates.html |

|

Why it’s so hard to build new electrical transmission lines in the U.S.Building transmission lines in the U.S. is a slow process with many stakeholders, and the delays are holding back the country’s clean energy transition. Read more at: https://www.cnbc.com/2023/02/21/why-its-so-hard-to-build-new-electrical-transmission-lines-in-the-us.html |

|

Amazon employees push CEO Andy Jassy to drop return-to-office mandateAmazon tech workers created an internal petition and Slack channel to share their grievances about the return to work mandate. Read more at: https://www.cnbc.com/2023/02/21/amazon-employees-push-ceo-andy-jassy-to-drop-return-to-office-mandate.html |

|

Nvidia supports Microsoft, Activision merger after Xbox deal to add games to cloud serviceThe Nvidia deal might help Microsoft remove one hurdle for its largest acquisition to date, video-game publisher Activision Blizzard. Read more at: https://www.cnbc.com/2023/02/21/microsoft-will-bring-xbox-games-to-nvidias-cloud-gaming-service.html |

|

Ed Yardeni sees four economic outcomes, with one being the most likelyThe U.S. is still in a good position — 40% probability — to manage a soft landing, Yardeni said. Read more at: https://www.cnbc.com/2023/02/21/ed-yardeni-sees-four-economic-outcomes-with-one-being-the-most-likely.html |

|

GOP lawmakers vilify ESG moves at BlackRock, Vanguard but take their money nonethelessRepublican House lawmakers that are tasked with taking on ESG investment standards have seen campaign contributions from ESG-focused BlackRock and Vanguard. Read more at: https://www.cnbc.com/2023/02/21/gop-lawmakers-esg-blackrock-vanguard.html |

|

Bitcoin slides below $25,000, and the crypto venture capital outlook for 2023: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Crypto World explores where venture capital money is flowing into the crypto space after the industry meltdown in 2022. Read more at: https://www.cnbc.com/video/2023/02/21/bitcoin-below-25k-crypto-venture-capital-outlook-crypto-world.html |

|

Biden says Russia will ‘never’ win as he pledges support for war-weary UkraineBiden’s speech in Poland followed a surprise visit to Kyiv, days before the one-year mark since Russia invaded Ukraine. Read more at: https://www.cnbc.com/2023/02/21/ukraine-russia-war-joe-biden-to-speak-in-poland.html |

|

Married filing jointly vs. separately: How to know when filing apart makes senseMarried couples have the choice to file income taxes jointly or separately every year. Here’s how to pick the best option for your return. Read more at: https://www.cnbc.com/2023/02/21/married-filing-jointly-vs-separately-how-to-pick-the-best-option.html |

|

Ukraine war live updates: Biden says ‘Kyiv stands strong;’ Putin suspends nuclear arms treaty with U.S.Putin provided an assessment of Moscow’s so-called “special military operation” in Ukraine when he delivers his state of the nation address Tuesday. Read more at: https://www.cnbc.com/2023/02/21/russia-ukraine-live-updates.html |

|

Spring break gets pricey as travelers return to old booking habitsTravelers can save hundreds of dollars if they book outside of peak travel days like holidays. Read more at: https://www.cnbc.com/2023/02/21/spring-break-travel-flights.html |

|

The wedding boom is winding down but inflation is still driving up the cost to say ‘I do’The average cost of a 2023 wedding is expected to be $29,000 as vendors say inflation is forcing them to raise their prices, according to data from Zola. Read more at: https://www.cnbc.com/2023/02/21/2023-wedding-costs-inflation.html |

|

Oil and gas industry could slash methane emissions by 75% with barely a hit to income, says IEAThe energy sector contributed 40% of human-generated methane emissions in 2022, second only to agriculture, a new report from the IEA says. Read more at: https://www.cnbc.com/2023/02/21/energy-industry-slammed-by-iea-for-not-doing-enough-to-curb-methane.html |

|

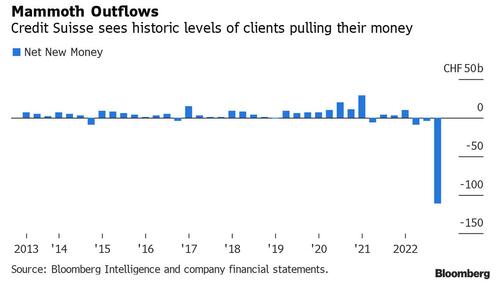

Credit Suisse Crashes To All-Time Low After Regulators Probe If Chairman Lied About “Stabilizing” OutflowsTwo weeks ago, we reported that Credit Suisse stock suffered one of its biggest drop ever after it i) warned of continued losses for 2023 and beyond, and ii) revealed that it had suffered a record CHF110.5BN in outflows in the quarter, an amount which KBW analysts called “quite staggering.”

And, as we noted at the time, this was rather problematic because in late 2022, right after reports of the record bank run first hit, the company’s management team and Chairman, Axel Lehmann, said in various media interviews that outflows had stopped – hoping this would relieve pressure on the bank and in the process, contain the outflows – when in reality the bank run was only just getting started. Well, two months later, the regulators have gotten involved, and according to Reuters, regulators are reviewing unfoundedly cheerful comments the chairman – and other Credit S … Read more at: https://www.zerohedge.com/markets/credit-suisse-crashes-fresh-record-lows-after-regulators-probe-if-chairman-lied-about |

|

The War On Musk: Washington Post Slammed Over Twitter Hit PieceAuthored by Jonathan Turley, Last week, there was another bombshell story by the Washington Post on the purported evil that is Elon Musk. Quickly amplified by MSNBC and other media, it was another hit job on Musk and could be viewed as what many in the media love to call “disinformation.” Musk himself noted that the premise of the piece (that his tweets were artificially boosted during a recent period) was demonstrably false. Yet, the countervailing facts found little space in the long Post piece. None of that is particularly surprising. Musk became a hunted man when he sought to restore free speech protections to social media. The media regularly offers him little quarter or consideration. However, what was most striking was that the underlying controversy may have been Musk’s targeting of “bots” in his restructuring of Twitter.

The Post story was written … Read more at: https://www.zerohedge.com/political/war-musk-washington-post-slammed-over-twitter-hit-piece |

|

HBSC And JPMorgan Tighten Belts, As Layoffs And Bonus-Slashing Continue Across Wall StreetThe trend of plunging bonuses and job cuts on Wall Street continues – now it has hit HSBC and JP Morgan. For about 6 months, we have been covering both increasing layoffs and how bonuses across Wall Street have suffered at the hands of 2022 being a terrible year for dealmaking. And the bad news doesn’t look like it’s about to stop anytime soon. This week we learned that HSBC bonuses are falling nearly 4% to $3.4 billion for the year, with the bank also blaming dealmaking. The bank’s junior banker bonuses rose on average, Bloomberg wrote, due to inflationary and cost of living factors. Commercial banking, as well as wealth and personal banking saw the strongest outcomes for bonuses, however, the firm’s global banking and markets division took a cut. JP Morgan, on the other hand, is laying off about 30 of its investment bankers in Asia, with a majority of them in Greater China, this week. Bloomberg attributed the layoffs to “deal flows in its biggest growth market in the region struggl[ing] to rebound”. It marks the largest cuts to Hong Kong and China-based bankers in years, as employees in the area only make up less than 5% of the company’s headcount in the region. Read more at: https://www.zerohedge.com/markets/hbsc-and-jp-morgan-tighten-their-belts-layoffs-and-bonus-slashing-continue-be-theme-wall |

|

Biden Vows Ukraine Will Never Be A “Victory” For “Dictator” Putin In Poland SpeechPresident Biden delivered a major speech from Warsaw, Poland Tuesday night fresh off his surprise visit to neighboring Ukraine where he met with President Zelensky. “I have just come from a visit to Kyiv, and I can report that Kyiv stands strong. Kyiv stands proud. It stands tall. And most importantly, it stands free,” Biden said at the opening of his remarks. Just hours prior, Russia’s President Vladimir Putin delivered his own address wherein he vowed his country will continue unbending toward fulfilling military objectives in Ukraine. Biden addressed the “dictator” – as he referenced Putin, while vowing to never let Ukraine fall to the Russians.

|

|

British Steel to cut jobs amid fears for industryThe Chinese-owned firm will cut 300 jobs at its Scunthorpe plant. Read more at: https://www.bbc.co.uk/news/business-64725229?at_medium=RSS&at_campaign=KARANGA |

|

Asda and Morrisons limit sales of some fruit and vegetablesSupermarkets face shortages of some fresh produce, but Tesco and others are not limiting sales. Read more at: https://www.bbc.co.uk/news/business-64718823?at_medium=RSS&at_campaign=KARANGA |

|

Pret A Manger to scrap smoothies, frappes and milkshakesIt means customers paying £25 a month for a subscription will have fewer drinks to choose from. Read more at: https://www.bbc.co.uk/news/business-64721251?at_medium=RSS&at_campaign=KARANGA |

|

US stocks slide at open as Walmart, Home Depot forecasts disappointAt 10:02 a.m. ET, the Dow Jones Industrial Average was down 424.64 points, or 1.26%, at 33,402.05, the S&P 500 was down 47.46 points, or 1.16%, at 4,031.63, and the Nasdaq Composite was down 165.27 points, or 1.40%, at 11,622.00 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-stocks-slide-at-open-as-walmart-home-depot-forecasts-disappoint/articleshow/98128024.cms |

|

Tech View: Nifty charts hint at weakening selling pressure. What should traders do on WednesdayOption data suggests a broader trading range between 17,650 and 18,100 zones while a shift in immediate trading range between 17,700 and 18,000 zones Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-charts-hint-at-weakening-selling-pressure-what-should-traders-do-on-wednesday/articleshow/98123600.cms |

|

At multi-year highs: These 5 stocks gave 5-year breakoutsIn the NSE list of stocks with a market cap of over Rs 1000 crore, five stocks crossed their previous five-year high value at the close on February 20 Read more at: https://economictimes.indiatimes.com/markets/web-stories/at-multi-year-highs-these-5-stocks-gave-5-year-breakouts/articleshow/98114266.cms |

|

Market Snapshot: Dow falls over 650 points, S&P 500 heads for worst day since December on worries about higher peak ratesDow tumbles more than 600 points on Tuesday as Treasury yields hold near highs of the year as investors weigh risks of higher interest rates for longer. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-719E-32B11D5C131C%7D&siteid=rss&rss=1 |

|

Economic Report: Existing home sales fell for the 12th straight month in January, lowest since 2010The 12-month losing streak is the longest since NAR began tracking sales in 1999. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-719E-2D2F816DFF22%7D&siteid=rss&rss=1 |

|

Help My Career: A four-day workweek is less stressful — and just as productiveA shorter week improves job satisfaction and doesn’t come at the cost of productivity, according to one study. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7180-21921482035D%7D&siteid=rss&rss=1 |

Image: APAppearing to directly answer Putin, Biden said while in front of the Royal Warsaw Castle Gardens in Warsaw:

Image: APAppearing to directly answer Putin, Biden said while in front of the Royal Warsaw Castle Gardens in Warsaw: