Summary Of the Markets Today:

- The Dow closed up 369 points or 1.09%,

- Nasdaq closed up 1.67%,

- S&P 500 up 1.46%,

- Gold 1944 up $4.60,

- WTI crude oil settled at 79 up 1.21,

- 10-year U.S. Treasury 3.503% down 0.048,

- USD $102.07 down $0.20,

- Bitcoin $22,971 up $183.84 – Session Low 22,631

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

The Conference Board Consumer Confidence Index® decreased in January following an upwardly revised increase in December 2022. The Index now stands at 107.1 (1985=100), down from 109.0 in December (an upward revision). The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell to 77.8 (1985=100) from 83.4 partially reversing its December gain. The Expectations Index is below 80 which often signals a recession within the next year. Both present situation and expectations indexes were revised up slightly in December. Ataman Ozyildirim, Senior Director, Economics at The Conference Board stated:

Consumer confidence declined in January, but it remains above the level seen last July, lowest in 2022. Consumer confidence fell the most for households earning less than $15,000 and for households aged under 35.

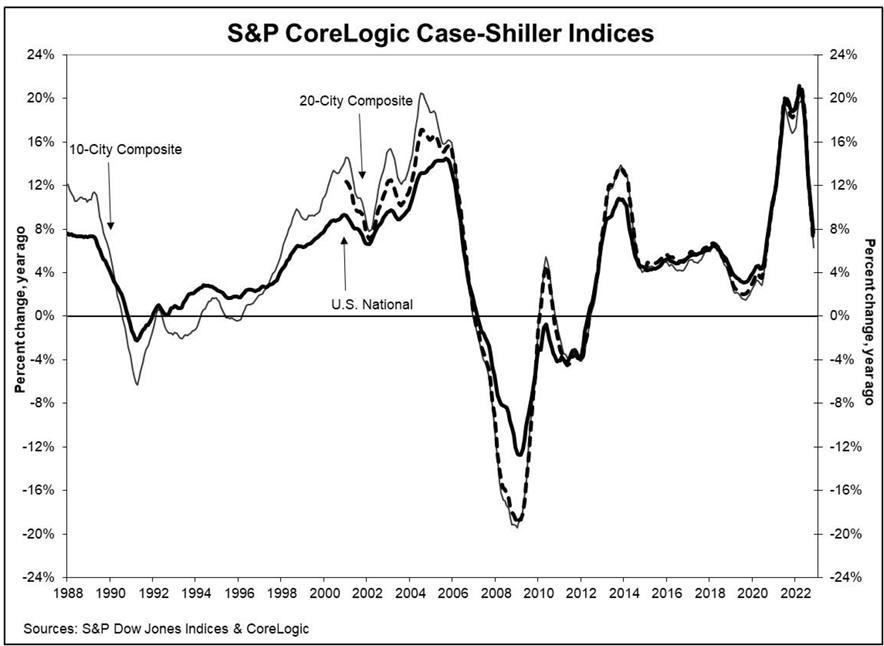

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 7.7% annual gain in November, down from 9.2% in the previous month. The 10-City Composite annual increase came in at 6.3%, down from 8.0% in the previous month. The 20-City Composite posted a 6.8% year-over-year gain, down from 8.6% in the previous month. CoreLogic Chief Economist Selma Hepp stated:

Housing market conditions deteriorated considerably at the end of 2022 as mortgage rates hit a 20-year high in November, wiping out a considerable portion of homebuyers purchase power. As a result, the November CoreLogic S&P Case-Shiller Index continued to cool off posting a 7.7% year-over-year increase, marking the seventh straight month of slowing home price growth and the slowest increase since September 2020.

San Francisco was first to post an annual decline with prices down about 2% year-over-year. At the same time, pandemic boomtowns, such as Phoenix, Las Vegas and Seattle are now experiencing the largest waning in price growth from last year, while home prices in cities in the Northeast and Midwest such as New York and Boston, Chicago and Detroit, are more resilient given a lesser upswing in price growth seen in those areas during the pandemic.

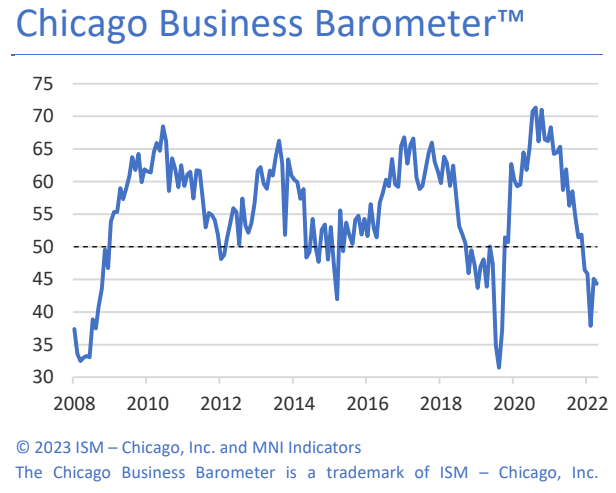

The Chicago Business Barometer moderated by -0.8 points to 44.3 in January; the fifth consecutive month below 50. This follows a December rebound to signal a softer downturn. This barometer is used by pundits to predict the national ISM manufacturing levels.

A summary of headlines we are reading today:

- BP Taps Deep Gas Reservoirs In Azerbaijan’s Caspian Sea

- China’s Low Aluminum Production Worsens Supply Chain Challenges

- Russian Oil Companies Told To Comply With Ban On Oil, Oil Product Exports

- Traders Turn Bullish On Oil As Majors Report Earnings

- Russia’s Pipeline Gas Exports To Europe Slump To Record Low

- General Motors doesn’t expect significant U.S. production of EVs until the second half of the year

- Dow closes more than 350 points higher, S&P 500 caps best January in four years

- PayPal to lay off 2,000 employees in coming weeks, about 7% of the workforce

- Market Extra: Coinbase stock poised to record the best month in history. Can the rally continue?

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China May Have Big Impact On European Gas Prices Next WinterNearly a month into 2023, Europe’s energy outlook is far more positive than many analysts predicted at the onset of winter. Unseasonably mild winter temperatures across the continent and a successful pivot by the European Union away from Russian pipeline gas have seen supplies stabilize and prices fall from a previous peak. Also helping to defy the gloomy predictions of energy shortages and stalled economic growth in the EU were increased imports of liquefied natural gas (LNG) and a new Baltic pipeline from Norway – developments… Read more at: https://oilprice.com/Energy/Natural-Gas/China-May-Have-Big-Impact-On-European-Gas-Prices-Next-Winter.html |

|

WoodMac: $100 Price Cap On Products Won’t Cripple Russian RefinersThe Western-invoked price cap on Russian refined products coming into effect on February 5 won’t “severely impact” Russian refiners, WoodMac said on Tuesday. Mark Williams, WoodMac’s Research Director of Short-Term Refining & Oil Products, said that the oil products cap would have a minimal impact on Russia’s refining runs and distillate exports. “With Russian Urals trading at US$40/bbl on a FOB basis, capping the price at US$100 per barrel and US$45/bbl respectively would still see Russian refining margins… Read more at: https://oilprice.com/Latest-Energy-News/World-News/WoodMac-100-Price-Cap-On-Products-Wont-Cripple-Russian-Refiners.html |

|

BP Taps Deep Gas Reservoirs In Azerbaijan’s Caspian SeaUK oil giant BP has started drilling two new exploration wells to search for gas deep beneath the Caspian Sea. The announcement comes as Azerbaijan imports gas from Iran and Russia to meet both growing domestic demand and existing export contracts. Baku has also pledged to double exports to Europe within five years. One of the wells will reach a depth of 7,000 meters, BP said this month, to tap a gas reservoir believed to lie below the existing Shah Deniz gas field, which currently provides the bulk of Azerbaijan’s gas exports. This well, which… Read more at: https://oilprice.com/Energy/Natural-Gas/BP-Taps-Deep-Gas-Reservoirs-In-Azerbaijans-Caspian-Sea.html |

|

Environmentalists: Steel Bailout Deal Should Come With Climate ConditionsBritish Steel and Tata Steel must be forced to commit to a host of green targets if they receive a bumper bailout from the UK taxpayer, green think tanks and campaign groups have said. Environmental think tank Green Alliance has urged Chancellor Jeremy Hunt to ensure the reported £600m in public funds that will be spent propping up both British Steel and Tata Steel is used to speed up the industry’s transition to clean steel production rather than just balance the books of a flagging sector. The think tank has called on the government… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Environmentalists-Steel-Bailout-Deal-Should-Come-With-Climate-Conditions.html |

|

China’s Low Aluminum Production Worsens Supply Chain ChallengesVia AG Metal Miner As with many base metals, aluminum prices rose at the beginning of January. While it is true that China raising aluminum export taxes could have impacted aluminum prices, the market has witnessed somewhat volatile conditions since late September of 2022. And though prices are nowhere near their March 2022 historic rally levels, they still remain at historic highs. Aluminum Prices: Trend Reversal, or No? Considering the breakout of resistance in aluminum prices, action should continue to the upside for the time being. This… Read more at: https://oilprice.com/Metals/Commodities/Chinas-Low-Aluminum-Production-Worsens-Supply-Chain-Challenges.html |

|

UK Oil Boss: Fighting Windfall Tax Led To Missed OpportunitiesThe UK’s oil and gas industry should have taken the chance to invest in new projects instead of fighting the windfall tax, the boss of a North Sea oil and gas producer has said. Steve Brown, chief executive of Orcadian Energy, told City A.M. that the Energy Profits Levy (EPL) created a “big incentive to invest” with the 91 percent tax relief for fossil fuel producers prepared to develop new projects in the North Sea. This includes Orcadian’s proposed Pilot development in the central North Sea, which is projected to produce… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Oil-Boss-Fighting-Windfall-Tax-Led-To-Missed-Opportunities.html |

|

New Carbon Conversion Tech Could Boost Net-Zero InitiativeThe Ames Laboratory at Iowa State University has announced a new hybrid catalyst that converts carbon dioxide into ethylene in one pot. The catalyst was developed by scientists from Ames National Laboratory, Iowa State University, University of Virginia, and Columbia University. This catalyst supports the world net-zero carbon initiative by using carbon dioxide (CO2) and recycling it as a feedstock for efficient ethylene production powered by electricity. The team’s reporting paper has been published in the Journal of the American Chemical Society.… Read more at: https://oilprice.com/Energy/Energy-General/New-Carbon-Conversion-Tech-Could-Boost-Net-Zero-Initiative.html |

|

Russian Oil Companies Told To Comply With Ban On Oil, Oil Product ExportsRussian Prime Minister Mikhail Mishustin has signed an agreement demanding that all Russian oil companies comply with a previous order that disallows any exports of Russian crude oil or crude oil products to any buyer that adheres to the price cap mechanism. It should be noted that Russian companies failing to comply will face no penalties, according to Upstream. Mishustin’s resolution, signed this week, bans Russian oil producers from signing sales contracts with any buyer engaged in the price cap clause imposed by the G7. The resolution… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-Companies-Told-To-Comply-With-Ban-On-Oil-Oil-Product-Exports.html |

|

South Africa’s Energy Crisis Could Spark A Political And Economic DisasterSouth Africa’s energy crisis is teetering on the edge of a major political and economic crisis. Bogged down by inefficiency, ineptitude, and severe levels of corruption, the country’s power utility Eskom has proven incapable of providing sufficient and reliable energy to the nation’s grid, despite the domestic abundance of coal. Once one of the most reliable utilities in Africa, Eksom now exists in a state of constant emergency which is currently threatening to push the country into civil disarray and economic catastrophe. Eksom desperately… Read more at: https://oilprice.com/Energy/Energy-General/South-Africas-Energy-Crisis-Could-Spark-A-Political-And-Economic-Disaster.html |

|

Libyan Oil Ministry Rejects $8 Billion Gas Deal With EniLibya’s Oil Ministry has rejected the huge $8-billion deal that the Italian energy giant signed with the Libyan National Oil Corporation (NOC) this weekend, saying that the agreement violated legislation and was not approved by the ministry prior to the signing. Eni’s chief executive Claudio Descalzi and the CEO of the National Oil Corporation of Libya, Farhat Bengdara, agreed on Saturday on the development of “Structures A&E”, a strategic project aimed at increasing gas production to supply the Libyan domestic… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyan-Oil-Ministry-Rejects-8-Billion-Gas-Deal-With-Eni.html |

|

Traders Turn Bullish On Oil As Majors Report EarningsOil majors are rounding up the 2022 financial year with outstanding profit numbers, a development that faces strong backlash from the Biden Administration. Chart of the Week China’s Generous Export Quotas Might End Soon – Absent a strong domestic rebound in oil consumption, Beijing has provided oil refiners with massive import quotas and huge product export quotas to stimulate China’s industrial activity. – Despite some promising signs, Chinese oil imports are set for a 1.5 million b/d decline month-on-month, plunging back to lockdown-era… Read more at: https://oilprice.com/Energy/Energy-General/Traders-Turn-Bullish-On-Oil-As-Majors-Report-Earnings.html |

|

Exxon Posts Highest Profits In Western Oil Company HistoryExxonMobil (NYSE: XOM) reported on Tuesday $55.7 billion in earnings for 2022 in a record-breaking earnings tally for any Western oil supermajor ever. Exxon said today it generated earnings of $55.7 billion and $76.8 billion of cash flow from operating activities in 2022 “by leveraging an advantaged portfolio and delivering strong operational performance.” High oil and gas prices were the key reasons for higher profits at Exxon, which beat its own annual earnings record of $45.2 billion from 2008 – when oil prices hit a record… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Posts-Highest-Profits-In-Western-Oil-Company-History.html |

|

Germany’s $2 Trillion Economic Miracle at RiskBack in August 2022, repo plumbing guru Zoltan Pozsar published a fascinating chart showing how “$2 Trillion Of German Value Depends On $20 Billion Of Russian Gas” or, specifically, how Germany had applied some 100x leverage – much more than Lehman – on cheap commodities, and mostly Russian gas, to cheaply run its export-driven economic miracle for decades. And with Russia’s cheap gas now gone for the foreseeable future, so is Germany’s tremendous operating leverage. Which means profit margins will be hammered for years to come. As proof,… Read more at: https://oilprice.com/Energy/Energy-General/Germanys-2-Trillion-Economic-Miracle-at-Risk.html |

|

Russia’s Oil Exports Rebound Ahead Of The EU Ban On Fuel ImportsThe upcoming EU ban on fuel imports from Russia, as well as Germany and Poland halting pipeline imports of Russian crude at the start of January, pushed Russian seaborne crude oil exports higher in the week to January 27, according to vessel tracking data monitored by Bloomberg. In the week to January 20, Russian crude oil shipments from its key export terminals slumped by 22%, or by 820,000 barrels per day (bpd), compared to the previous week, Bloomberg data showed. But the following week, to January 27, saw Russian crude shipments increase by… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Exports-Rebound-Ahead-Of-The-EU-Ban-On-Fuel-Imports.html |

|

Russia’s Pipeline Gas Exports To Europe Slump To Record LowRussia’s pipeline gas exports to Europe slumped to a new monthly record-low in January, falling by nearly 30% from December due to lower prices on the spot market, according to Reuters calculations. Russia’s gas giant Gazprom has seen exports to Europe decline since the Russian invasion of Ukraine last year as Russia cut off gas supplies to a number of countries in Europe. Russia cut off supply to Poland, Bulgaria, and Finland in April and May, slashed gas deliveries via Nord Stream to Germany in June, then off Nord Stream supply in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Pipeline-Gas-Exports-To-Europe-Slump-To-Record-Low.html |

|

General Motors doesn’t expect significant U.S. production of EVs until the second half of the yearGeneral Motors executives blamed U.S. battery cell plants for the company’s slow rollout of EVs. Read more at: https://www.cnbc.com/2023/01/31/general-motors-ev-production.html |

|

Dow closes more than 350 points higher, S&P 500 caps best January in four yearsTraders wrapped up what had been a strong month for equities. Read more at: https://www.cnbc.com/2023/01/30/stock-market-futures-open-to-close-news.html |

|

Snap shares plunge on weak revenue as company again declines to provide a forecastSnap missed on revenue in its fourth-quarter earnings report. Read more at: https://www.cnbc.com/2023/01/31/snap-earnings-q4-2022.html |

|

PayPal to lay off 2,000 employees in coming weeks, about 7% of workforceThe payments giant PayPal adds to the spate of January tech layoffs with plans to cut 7%, CEO Dan Schulman announced Tuesday. Read more at: https://www.cnbc.com/2023/01/31/paypal-to-lay-off-2000-employees-in-coming-weeks-about-7percent-of-workforce.html |

|

Cathie Wood’s Innovation ETF notches best month ever as beaten-down tech stocks roar backCathie Wood notched her best month ever as her beaten-down innovation darlings staged a big comeback in the new year. Read more at: https://www.cnbc.com/2023/01/31/cathie-woods-innovation-etf-is-set-for-best-month-ever-as-beaten-down-tech-stocks-roar-back.html |

|

Meta technology chief Bosworth implies company has lost focusMeta CTO Andrew “Boz” Bosworth is wistful for the days when Facebook was a startup and had a clearer focus. Read more at: https://www.cnbc.com/2023/01/31/meta-cto-andrew-bosworth-writes-facebook-of-old-had-focus-in-blog-post.html |

|

Workday cuts about 525 jobs but says it’s not the result of overhiringCloud software provider Workday layoff hits 3% of its employees, but co-CEOs told the remaining staff that the company would continue to hire. Read more at: https://www.cnbc.com/2023/01/31/workday-lays-off-employees-but-will-grow-head-count.html |

|

Ukraine war live updates: Kyiv pushes for fighter jets despite U.S., German refusal; Russia makes ‘concerted assault’ on DonetskThere’s likely to be disappointment in Kyiv this morning after its biggest military supporter, the U.S., ruled out sending fighter jets to Ukraine. Read more at: https://www.cnbc.com/2023/01/31/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Ether nears $1,600, and FTX sues Voyager to claw back 2022 loan payments: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Chen Arad, one of the founders and the COO of Solidus Labs, discusses the digital asset monitoring firm’s new research on crypto enforcement action. Read more at: https://www.cnbc.com/video/2023/01/31/ether-rises-ftx-sues-voyager-2022-loan-payments-cnbc-crypto-world.html |

|

The Covid pandemic drives Pfizer’s 2022 revenue to a record $100 billionSales of Paxlovid surged to $18.9 billion in 2022, which was the first full year the antiviral pill was available. Read more at: https://www.cnbc.com/2023/01/31/the-covid-pandemic-drives-pfizers-2022-revenue-to-a-record-100-billion.html |

|

James Gunn unveils DC’s new film and TV plan, including fresh spins on Supergirl, BatmanJames Gunn announced a new slate of DC Extended Universe film and TV content including Superman, Batman and Supergirl projects. Read more at: https://www.cnbc.com/2023/01/31/james-gunn-dc-film-tv-plans-batman-superman-supergirl.html |

|

Luxury developers in Los Angeles bet someone will pay record prices for these condosTwo Los Angeles developers hope to find buyers who will pay between $50 and a $100 million for a condo. Read more at: https://www.cnbc.com/2023/01/31/los-angeles-luxury-condos-record-prices.html |

|

Sam Stovall says 2023 will be a bullish year, with one sector set to see large gainsThe long-time strategist tells investors the stock market will see gains in 2023, and points to the energy sector as a promising pick for a second year. Read more at: https://www.cnbc.com/2023/01/31/sam-stovall-sees-a-bullish-2023-with-one-notably-promising-sector.html |

|

Freeport LNG Makes Progress Towards Partial Restart With Key FERC RequestFreeport LNG, the second largest US liquefied natural gas exporter, reported Tuesday afternoon to the Federal Energy Regulatory Commission (FERC) that it has “successfully and safely progressed the cooldown of the Loop 1 transfer piping and reinstatement of BOG management.” Freeport LNG asked FERC for approval to begin “(1) the nitrogen cooldown of the LNG rundown piping system and (2) the introduction of hydrocarbons to Unit 13 (Train 3) for LNG train commissioning and cooldown.” They also asked for a response from the federal energy agency by tomorrow. Combing through Freeport’s letter to FERC, Houston-based energy firm Criterion Research told clients, “the key part of this request is that it would allow Freeport to begin flowing natural gas into the pretreatment facility and then permit the initial production of LNG to flow into LNG Tanks 1 and 2 onsite.” Freeport also said that “subsequent approvals will be necessary to commence Loop 1 LNG circulation and ship loading to Dock 1, as well as the transition of Unit 13 into full, commercial operations.”

|

|

Cosmetics Brand Accused Of “Erasing Women” With Bearded Lipstick AdsAuthored by Steve Watson via Summit News, Cosmetics company NYX Professional Makeup has received backlash on social media after featuring ads for a lipstick with bearded men.

The company appears to be finding out that going woke eventually equates to going broke, as respondents accused them of “erasing women” with the ads for Smooth Whip lip cream. In an Instagram post, the company wrote the caption “[itsmechrxs] making us whip out our Smooth Whip in Pom Pom REAL quick. #nyxcosmetics #nyxprofessionalmakeup #crueltyfree.” Read more at: https://www.zerohedge.com/political/cosmetics-brand-accused-erasing-women-bearded-lipstick-ads |

|

IMF Upgrades Global Growth Forecast As Inflation CoolsThe International Monetary Fund published its latest World Economic Outlook on Monday, painting a slightly less gloomy picture than three and a half months ago, as inflation appears to have peaked in 2022, consumer spending remains robust and the energy crisis following Russia’s invasion of Ukraine has been less severe than initially feared.

But, as Statista’s Felix Richter notes, that’s not to say the outlook is rosy, as the global economy still faces major headwinds. However, the IMF predicts the slowdown to be less pronounced than previously anticipated. Global growth is now expected to fall from 3.4 percent in 2022 to 2.9 percent this year, before rebounding to 3.1 percent in … Read more at: https://www.zerohedge.com/economics/imf-upgrades-global-growth-forecast-inflation-cools |

|

Pro-Life Father Acquitted In Trial Over Abortion Clinic ConfrontationAuthored by Jonathan Turley via jonathanturley.org, Mark Houck, 48, was acquitted yesterday in a high-profile prosecution by the Biden Administration under the Freedom of Access to Clinic Entrances (FACE) Act. Houck was accused of pushing a Planned Parenthood escort during a clash outside an abortion clinic. It is a rare victory for Houck and the Thomas More Society (which represented Houck) under the act. Houck insisted that he was trying to protect his twelve-year-old son in the encounters with Love. There is also an interesting wrinkle in the jury deliberations.

The FACE Act prohibits “violent, threatening, damaging, and obstructive conduct in … Read more at: https://www.zerohedge.com/political/turley-pro-life-father-acquitted-trial-over-abortion-clinic-confrontation |

|

Strikes Update: How Wednesday 1 February’s walkouts will affect youWith school teachers, trains drivers, and civil servants all striking, what do you need to know? Read more at: https://www.bbc.co.uk/news/business-64467973?at_medium=RSS&at_campaign=KARANGA |

|

ExxonMobil posts record profit as oil prices surgeThe bumper gains are likely to renew political pressure on the oil and gas industry. Read more at: https://www.bbc.co.uk/news/business-64472806?at_medium=RSS&at_campaign=KARANGA |

|

Paperchase: Tesco buys stationery brand but not its shopsThe supermarket buys the Paperchase brand but not its shops, leaving the future of 820 staff in doubt. Read more at: https://www.bbc.co.uk/news/business-64457502?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms small-bodied bearish candle. What traders should do on Budget dayThe index is heading towards the level of 17,800, which holds the key for further course of action from a short-term perspective. If the index manages to surpass 17,800, it will be poised for a larger up move. Till then consolidation in the range of 17,400-17,800 is possible. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-small-bodied-bearish-candle-what-traders-should-do-on-budget-day/articleshow/97491421.cms |

|

Most traders lose money by overtrading. Zerodha’s Nithin Kamath explains howKamath, also known to regularly share educational content and stock market learnings on Twitter and other social media platforms, said people forget that trading costs are charged as a percentage of every trade and can compound very quickly. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/most-traders-lose-money-by-overtrading-zerodhas-nithin-kamath-explains-how/articleshow/97491250.cms |

|

BPCL shares surge 5% after Q3 results. What should investors do?“Sharp correction in international diesel prices to ~$115 from the recent peak of USD 170/bbl has improved the marketing segment profitability outlook. Also, ban on the import of Russian oil products from Feb-23 will likely support refining product spreads. Global recessionary pressure along with high-interest rates will keep oil prices range-bound, despite increased demand from China,” he said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bpcl-shares-surge-5-after-q3-results-what-should-investors-do/articleshow/97483765.cms |

|

Futures Movers: Oil prices gain for the session, but post a January lossOil futures end higher on Tuesday, but post a loss for the month, as investors await this week’s Federal Reserve decision on interest rates. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-718B-19C1B162973F%7D&siteid=rss&rss=1 |

|

Market Extra: Coinbase stock poised to record best month in history. Can the rally continue?The stock of crypto exchange Coinbase is on track to record its strongest month in history, despite the implosion of its former competitor FTX in November which shook investor confidence in digital currency markets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-718B-E114AFC96AE3%7D&siteid=rss&rss=1 |

|

The Moneyist: My wealthy in-laws pay for us to attend family vacations and big events. Should we pay them back?‘We are in our early 30s and are still renting a place and paying off debt, student loans, etc.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7174-3D7A0AA00745%7D&siteid=rss&rss=1 |