Summary Of the Markets Today:

- The Dow closed up 331 points or 1.00%,

- Nasdaq closed up 2.66%,

- S&P 500 up 1.89%,

- Gold $1930 up $5.90,

- WTI crude oil settled at $81 up $1.07,

- 10-year U.S. Treasury 3.488% up 0.089 points,

- USD $101.99 down $0.07,

- Bitcoin $22,264 up $1,179 – Session Low $20,904

- Baker Hughes Rig Count: U.S. -4 to 771 Canada +14 to 241

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for January 2023

Today’s Economic Releases:

Total existing-home sales declined 34.0% year-over-year. The median existing-home price for all housing types in December was $366,900, an increase of 2.3% from December 2021. Per NAR Chief Economist Lawrence Yun:

December was another difficult month for buyers, who continue to face limited inventory and high mortgage rates. However, expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.

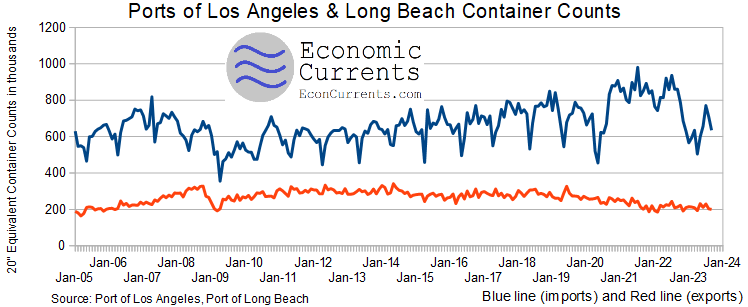

Container imports into the USA declined 20% year-over-year whilst exports improve 15% year-over-year according to data analyzed by EconCurrents from the Ports of Los Angeles and Long Beach. These ports account for the majority of containers moved in and out of the USA. The year-over-year comparison may not be totally comparable as there were issues last year with a huge backlog of ships waiting to offload a year ago. Our analysis is that exports continue to slowly moderate whilst imports are trending modestly up. Rising imports normally signal an improving economy.

A summary of headlines we are reading today:

- Recession Fears Could Send Precious Metals Higher

- U.S. Oil Rig Count Sees Largest Single Week Drop In 16 Months

- GM, LG end plans for fourth U.S. battery cell plant as the automaker seeks new partner

- Existing home sales fell for the 11th consecutive month in December, hitting the slowest pace since November 2010

- Banking Institutions Quietly Admit To Inevitable Recession Implosion In 2023

- Market Snapshot: S&P 500 rises sharply, Nasdaq erases weekly losses as Netflix, Alphabet jump

- Crypto: Crypto lender Genesis claims $5.1 billion liabilities as of November, blames ‘bank run’

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Recession Fears Could Send Precious Metals HigherVia AG Metal Miner The Global Precious Metals MMI (Monthly MetalMiner Index) traded upwards by 3% as precious metal prices advanced. Gold, silver, and palladium all began a rally coming into 2023. However, that rally has solid potential for both a short and long-term downturn. The surge in the index price was mainly due to silver and gold bullions rising more steeply than palladium, which was the only outlier. After dropping steadily since November of 2022, it currently shows signs of turning upward. But with recession fears building Read more at: https://oilprice.com/Metals/Gold/Recession-Fears-Could-Send-Precious-Metals-Higher.html |

|

Germany Eyes 30GW In Wind Power For 2030Germany has come up with development plans for offshore wind turbine sites, eyeing 30 GW of installed power capacity by 2030, the Economy Ministry said in a Friday statement, according to Reuters. The Federal Maritime and Hydrographic Agency’s (BSH) plan allows for even more wind power capacity, with adequate space for 40GW or even 50GW by 2035although the details of the plan have not yet been shared. One snippet that has been shared is its plans to integrate Germanys wind turbines into the offshore network of its neighbors bordering Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Eyes-30GW-In-Wind-Power-For-2030.html |

|

Automakers See EV Sales Soar Despite Lagging Car MarketWhile it may have taken trillions of dollars in government subsidies and the suspension of most logic and critical thinking about how EV batteries are made and the power used to charge such vehicles, EVs have still hit a milestone. Sales globally now make up 10% of the global market of auto sales, according to a new report from the Wall Street Journal. The global growth has been helped along by massive adoption in places like China and Europe, while sales in the U.S. still lag. Data from LMC Automotive and EV-Volumes.com confirms that global Read more at: https://oilprice.com/Energy/Energy-General/Automakers-See-EV-Sales-Soar-Despite-Lagging-Car-Market.html |

|

California City Gives Up On 100% Renewable PlanAs California goes, so goes the nation, or so they say. If that rings true, the nation is set for a reversal of some of its strictest renewable energy plans, after the Huntington Beach City Council voted to dump its plan for 100% renewable energy. Huntington Beach, California, is changing the plan it had in place with the Orange County Power Authority (OCPA)a nonprofit offering clean energy. But its recent history in a rather unfavorable media limelight has given the city council pause. And Huntington Beach wasn’t the first municipality Read more at: https://oilprice.com/Latest-Energy-News/World-News/California-City-Gives-Up-On-100-Renewable-Plan.html |

|

U.S. Oil Rig Count Sees Largest Single Week Drop In 16 MonthsThe total number of total active drilling rigs in the United States fell by 4 this week, according to new data from Baker Hughes published on Friday. The total rig count fell to 771 this week167 rigs higher than the rig count this time in 2022, and 304 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States fell by 10 this week, to 613. It is the largest single-week drop in the number of oil rigs since September 2021. Gas rigs rose by 6, to 156. Miscellaneous rigs stayed the same at 2. Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Rig-Count-Sees-Largest-Single-Week-Drop-In-16-Months.html |

|

Octopus Energy Tops UK Consumer SurveyOctopus Energy has topped a well-known annual customer survey, after winning over households with its customer service and value for money. The supplier was named a Which? recommended provider for the sixth year in a row, with consumer advocates calling for energy firms to do more to support customers in a cost-of-living crisis. Which surveyed over 10,000 members of the public in October 2022, to rate the performance of suppliers since the energy crisis. It also conducted an in-depth assessment of suppliers’ practices and procedures in Read more at: https://oilprice.com/Latest-Energy-News/World-News/Octopus-Energy-Tops-UK-Consumer-Survey.html |

|

GM, LG end plans for fourth U.S. battery cell plant as the automaker seeks new partnerGM is expected to continue with its plans to build the plant but is searching for another partner, according to a person familiar with the decision. Read more at: https://www.cnbc.com/2023/01/20/gm-lg-indefinitely-shelve-plans-for-fourth-us-battery-cell-plant.html |

|

Bed Bath & Beyond beefs up legal team ahead of possible bankruptcy filing in New JerseyBed Bath & Beyond has hired another legal advisor as it preps a potential bankruptcy filing in New Jersey, according to people familiar with the matter. Read more at: https://www.cnbc.com/2023/01/20/bed-bath-weighs-bankruptcy-filing-in-new-jersey-beefs-up-legal-team.html |

|

Fanatics is in talks to acquire BetParx sportsbookFanatics, the sports merchandising company with a $31 billion valuation, is in talks to buy sportsbook BetParx, sources said. Read more at: https://www.cnbc.com/2023/01/20/fanatics-in-talks-to-acquire-betparx-sportsbook.html |

|

Wayfair stock climbs after online retailer lays off 1,750 workersWayfair said Friday it will lay off 1,750 employees to support company-wide restructuring and cost-cutting efforts. Read more at: https://www.cnbc.com/2023/01/20/wayfair-stock-climbs-after-online-retailer-lays-off-1750-workers.html |

|

GM to invest $918 million in new V-8 gas engines and EV componentsAbout $579 million will go toward GM’s sixth-generation family of small-block V-8 gas engines that are used in highly profitable vehicles. Read more at: https://www.cnbc.com/2023/01/20/gm-investing-new-v8-engines-ev-components.html |

|

In the fight against slowing growth, Netflix and its rivals are all in this togetherNetflix shares jumped after hours after beating subscriber estimates, and that’s good news for its legacy media competitors such as Disney. Read more at: https://www.cnbc.com/2023/01/19/netflix-rivals-fight-slow-growth.html |

|

Existing home sales fell for the 11th consecutive month in December, hitting the slowest pace since November 2010Home sales have fallen for 11 consecutive months as mortgage rates weigh on the market. Read more at: https://www.cnbc.com/2023/01/20/existing-home-sales-drop-in-december-to-slowest-pace-since-2010.html |

|

Philip Esformes, whose prison sentence Trump commuted, loses appeal and faces retrial on health-care fraud chargesDonald Trump, while president, commuted the sentence of Florida nursing home operator Philip Esformes. The DOJ plans to retry him on deadlocked fraud counts. Read more at: https://www.cnbc.com/2023/01/20/philip-esformes-whose-prison-sentence-trump-commuted-loses-appeal.html |

|

Here’s what you need to know about a blockbuster court fight over Cuba’s debtIf Cuba loses in the U.K.’s High Court, it could ultimately cost the island nation billions in long overdue payments. Read more at: https://www.cnbc.com/2023/01/20/cuba-debt-court-fight-what-you-need-to-know.html |

|

Netflix founder Reed Hastings is giving up his CEO roleHastings co-founded Netflix in 1997. Ted Sarandos was promoted to co-CEO alongside Hastings in July 2020. Read more at: https://www.cnbc.com/2023/01/19/netflixs-reed-hastings-is-giving-up-ceo-role.html |

|

Netflix blows away expectations on subscriber numbersNetflix reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2023/01/19/netflix-nflx-earnings-q4-2022.html |

|

Trump drops lawsuit against New York AG after a judge in case sanctions him almost $1 million for Clinton suitA lawsuit by Donald Trump against Hillary Clinton was dismissed as frivolous, leading to monetary sanctions against the former president. Read more at: https://www.cnbc.com/2023/01/20/trump-drops-lawsuit-against-new-york-attorney-general-james.html |

|

Vice Media restarts sale process at lower valuation, may fetch less than $1 billionVice Media is restarting its sale process and lowering its price expectations after previous bidders balked, according to people familiar with the matter. Read more at: https://www.cnbc.com/2023/01/19/vice-media-restarts-sale-process-at-lower-valuation.html |

|

Car Rams Barricade Outside Sam Bankman-Fried’s HouseSam Bankman-Fried, the former CEO of FTX, has received a mountain of death threats since being released on bail in December. He’s been hiding out, playing video games at his parent’s Stanford home, which is heavily guarded by a private security force. The first major “security incident” was reported by his lawyers on Thursday when a car rammed a barricade outside the home. Reuters said Christian Everdell from the New York law firm Cohen & Gresser submitted a filing in Manhattan federal court to Judge Lewis Kaplan, indicating that SBF and his parents were targeted by “actual efforts to cause them harm.”

The filing said three men exited the vehicle after ramming the metal security barricade outside SBF’s parent’s Palo Alto home.

|

|

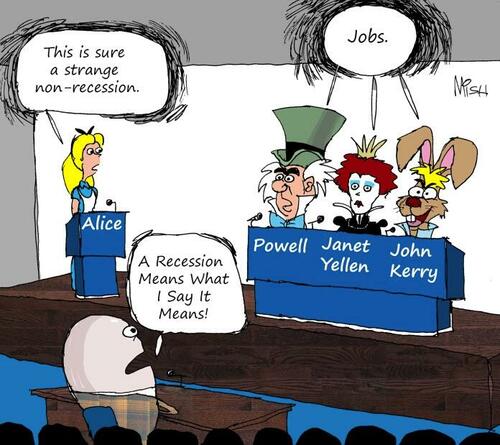

Banking Institutions Quietly Admit To Inevitable Recession Implosion In 2023Authored by Brandon Smith via Alt-Market.us, As the Federal Reserve continues its fastest rate hike cycle since the stagflation crisis of 1980, a couple vital questions linger in the minds of economists everywhere – When is recession going to strike and when will the Fed reverse course on tightening?

The answers to these queries are at the same time simple and complex: First, the recession has already arrived. Second, the Fed is NOT going to reverse course, though they will probably stop tightening for a time. The technical definition of a recession in the US is two consecutive quarters of negative GDP growth. We already experienced that in 2022, which led the Biden White House and puppet economists within the mainstream media to change the definition. The Federal Reserve also ignored deflationary signals throughout the … Read more at: https://www.zerohedge.com/markets/banking-institutions-quietly-admit-inevitable-recession-implosion-2023 |

|

“What About The Sudden Deaths?”: Pfizer CEO Confronted At Davos Over COVID-19 VaccineWhile attention is now firmly shifting towards the scandalous Covid-19 vaccine rollout (and top-down censorship campaign), Pfizer CEO Albert Bourla has been largely insulated from criticism by legacy media outlets. Until now. Canadian outlet Rebel News caught up with Bourla this week on the streets of Davos, where they peppered him with a list of uncomfortable questions. As Rebel CEO Ezra Lavant writes:

|

|

Friday Fun: Alice Debates Mad Hatter And Red Queen On Timing The RecessionAuthored by Mike Shedlock via MishTalk.com, Alice challenged the Mad Hatter, the Red Queen, and the March Hare to a debate on whether or not the economy was in a recession…

Setting the Stage for a Debate While traveling through Wonderland, Alice met Humpty Dumpty. He was reading the dictionary that he wrote. Alice asked Humpty if he would discuss recession. “Sure, I will discuss anything,” said Humpty. Alice quipped, “This sure seems like a strange non-recession.” “Oh,” said Humpty. “In Wonderland, when you hint there may be a recession, you automatically agree to a debate”. “Wonderland loves nothing more than a debate on recession,” said Humpty, adding “I will moderate and keep score.” With that, Humpty blew a horn signifying an unscheduled debate. Cast of C … Read more at: https://www.zerohedge.com/economics/friday-fun-alice-debates-mad-hatter-and-red-queen-timing-recession |

|

UK poised to give £300m in rescue funding to British SteelThe government is poised to help the struggling steelmaker secure thousands of jobs. Read more at: https://www.bbc.co.uk/news/business-64351964?at_medium=RSS&at_campaign=KARANGA |

|

Lloyds and Halifax to close 40 more bank branchesAs more people bank online, footfall in physical branches has dropped, says Lloyds Banking Group. Read more at: https://www.bbc.co.uk/news/business-64348697?at_medium=RSS&at_campaign=KARANGA |

|

Christmas cutbacks cause shock drop in shop salesSales fell in December, as shoppers reined in spending in the face of rising prices. Read more at: https://www.bbc.co.uk/news/business-64334048?at_medium=RSS&at_campaign=KARANGA |

|

Upto 1,400% surge! 7 large-caps that have risen over 25% in the last 3 fiscalsETMarkets.com found seven large-cap stocks that have given at least 25% returns in each of the last 3 fiscal years, including the current FY23. Read more at: https://economictimes.indiatimes.com/markets/web-stories/upto-1400-surge-7-largecaps-that-have-risen-over-25-in-last-3-fiscals/articleshow/97170035.cms |

|

Infra, BFSI: Key themes and stocks to focus ahead of the BudgetAxis Securities is positive on KNR Constructions, PNC Infratech, RITES, KEC International, and PSP Projects to do well among infra stocks. These stocks have given returns in the range of 2.35-12.63% so far this year on a year-to-date (YTD) basis. KEC International has offered negative 1.52% returns this year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/infra-bfsi-key-themes-and-stocks-to-focus-ahead-of-the-budget/articleshow/97169129.cms |

|

Rs 10,000 crore-blow! 2 biggies faced most of FII outflow bruntAmid impressive credit growth, banks remain the top pick of most brokerages despite the FII selling. On IT, however, many analysts have a cautious stance saying they expect more pain ahead due to global macro factors. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/rs-10000-crore-blow-2-biggies-faced-most-of-fii-outflow-brunt/articleshow/97159282.cms |

|

Market Snapshot: S&P 500 rises sharply, Nasdaq erases weekly losses as Netflix, Alphabet jumpU.S. stocks move higher Friday afternoon, but the S&P 500 and Dow remain on track for weekly declines. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7182-1F4DDA130DC5%7D&siteid=rss&rss=1 |

|

Crypto: Crypto lender Genesis claims $5.1 billion liabilities as of November, blames ‘bank run’Crypto lender Genesis reports a total of $5.1 billion worth of liabilities shortly after it stopped allowing customer withdrawals in November, according to the company’s bankruptcy filings. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7182-AC007D1C0EE5%7D&siteid=rss&rss=1 |

|

The Margin: What is Lunar New Year, and when does it start?What you need to know as we enter the Year of the Rabbit Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7182-5F5DF063D777%7D&siteid=rss&rss=1 |