EconCurrents is transitioning to Substack in 2025. The existing newsletter will be discontinued no later than 01February2025 . |

Summary Of the Markets Today:

- The Dow closed down 178 points or 42%,

- Nasdaq closed down 375 points or 1.89%,

- S&P 500 closed down 66 points or 1.11%,

- Gold $2,665 up $17.30 or 0.065%,

- WTI crude oil settled at $74 up $0.71 or 0.95%,

- 10-year U.S. Treasury 4.693 up 0.077 points or 1.668%,

- USD index $108.67 up $0.42 or 0.38%,

- Bitcoin $96,810 down $5,363 or 5.54%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

US stocks closed lower on Tuesday, reversing early gains as investors reassessed economic data and Federal Reserve rate cut expectations. The 10-year Treasury yield rose about 7 basis points to just below 4.7%. Key economic data releases influenced market sentiment: The ISM manufacturing PMI showed continued expansion, but the prices paid index jumped to a nearly two-year high of 64.4, raising inflation concerns. JOLTS job openings increased more than expected in November, while hiring slowed and the quits rate decreased. These reports led investors to push back expectations for Fed rate cuts, with traders now placing a less than 50% chance of a cut before June 2025. NVIDIA, which had reached a record close on Monday, reversed course and fell over 6%, becoming the Dow’s worst performer despite CEO Jensen Huang’s CES keynote unveiling new AI products. The labor market showed signs of cooling, with the hiring rate falling to 3.3% and the quits rate dropping to 1.9%, both now lower than pre-pandemic levels. This data suggests a “no hire, no fire” labor market environment, according to Oxford Economics. Investors are now looking ahead to Friday’s December jobs report for further insights into the labor market and potential implications for Fed policy.

Click here to read our current Economic Forecast – January 2025 Economic Forecast: Little Change And Still Indicating a Weak Economy – One Recession Flag Removed

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

November 2024 exports were up 5.7% year-over-year while imports were up 8.1% year-over-year – the trade balance worsened by 20.8% year-over-year. The trend lines continue to show a an ever worsening trade balance with no end in sight.

The number of private job openings grew modestly from 6.9 million to 7.2 million on the last business day of November 2024. Studies by the Philly Fed have shown no correlation to economic or jobs growth with the hires and separations portion of JOLTS. I would expect a reasonably good jobs report (compared to the growth seen in 2024) this Friday based on this JOLTS data.

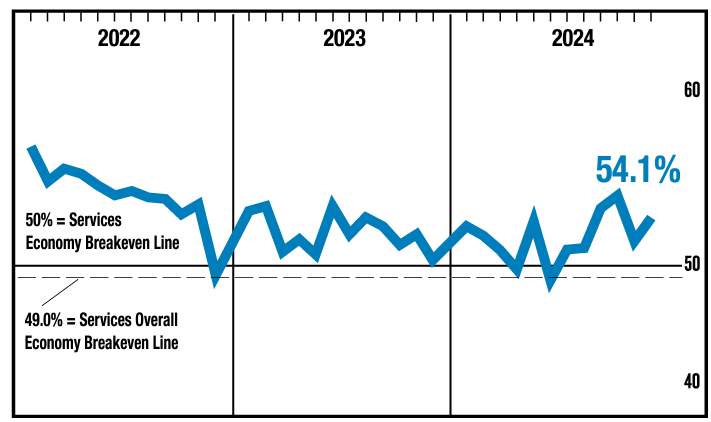

In December 2024, the ISM Services PMI® registered 54.1%, 2 percentage points higher than November. The Business Activity sub-index registered 58.2% in December, 4.5 percentage points higher than November. The New Orders sub-index recorded a reading of 54.2% , 0.5 percentage point higher than November. For the last 2 years, this index has generally remained in a tight band. As the U.S. is a services economy – this reading suggests little change in economic growth.

Home prices nationwide, including distressed sales, increased year over year by 3.4% in November 2024 compared with November 2023. On a month-over-month basis, home prices increased by 0.06% in November 2024 compared with October 2024. The CoreLogic HPI Forecast indicates that home prices will increase by 3.8% on a year-over-year basis from November 2024 to November 2025.

Here is a summary of headlines we are reading today:

- Trump Pledges Swift Reversal of Biden’s Offshore Drilling Ban

- Is U.S. Nuclear Power at Risk? Russia’s Uranium Restrictions Explained

- Trump’s Trade Policies Spark Rare Earth Uncertainty

- Trump Considers Executive Order to Protect Natural Gas Appliances

- Dollar Dominance Dwindles as Central Banks Diversify Reserves

- Dow falls more than 170 points, Nasdaq loses nearly 2% as Nvidia leads tech selloff: Live updates

- Howard Marks sees cautionary signs of a bubble, says investors shouldn’t ignore today’s high market valuation

- Meta employees criticize Zuckerberg decisions to end fact-checking, add Dana White to board

- Trump warns ‘all hell will break out’ if Gaza hostages not released by his inauguration

- Trump won’t rule out using U.S. military to control Panama Canal or Greenland

- 159 Democrats Voted Against Laken Riley Bill To Detain Criminal Illegals

- Intel On The Brink Of Death Due To Culture Rot Says Scathing Report

- 10-year Treasury yield ends at highest since April as inflation worries grow

- Tech stocks are getting slammed because economic data sparked jump in bond yields

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Oil Price Volatility: A Major Challenge for National Oil Companies in 2025The global energy landscape is undergoing a profound transformation. The oil and gas sector continues to play a dominant role in the energy mix, but renewable sources are rapidly gaining ground. The next decade offers both significant opportunities and formidable challenges for national oil companies (NOC), which find themselves at a pivotal crossroads as oil prices fluctuate, geopolitical tensions rise and the global energy transition accelerates. How they respond to these complex dynamics will determine their ability to maintain leadership, stay… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Price-Volatility-A-Major-Challenge-for-National-Oil-Companies-in-2025.html |

|

Trump Pledges Swift Reversal of Biden’s Offshore Drilling BanPresident-elect Donald Trump wasted no time declaring his intentions to overturn outgoing President Joe Biden’s ban on offshore oil and gas drilling. Speaking at Mar-a-Lago on Tuesday, Trump vowed to “reverse it immediately” upon taking office on January 20. Biden announced earlier in the week that he had banned drilling on the entire eastern U.S. Atlantic coast and the Eastern Gulf of Mexico, the Pacific Coast along California, Oregon, and Washington, and the remaining portion of the Northern Bering Sea Climate Resilience Area in Alaska.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Pledges-Swift-Reversal-of-Bidens-Offshore-Drilling-Ban.html |

|

Transdniester Gas Crisis: Moldova Steps In as Russia Cuts SupplyThe Moldovan government on January 6 said it would provide natural gas to 14 localities in the Moscow-backed Transdniester breakaway region as residents there suffer through the brutal winter after Russian supplies were cut off on New Year’s Day. The settlements are those that are already connected to Moldovan networks. Moldova’s Premier Energy Distribution firm said it would supply electricity to two localities that are technically connected to the western — or government-controlled — bank of the Dniester River. The cutoff was the result of… Read more at: https://oilprice.com/Energy/Natural-Gas/Transdniester-Gas-Crisis-Moldova-Steps-In-as-Russia-Cuts-Supply.html |

|

Is U.S. Nuclear Power at Risk? Russia’s Uranium Restrictions ExplainedNuclear power accounts for 19% of electricity generation in the U.S. This graphic, via Visual Capitalist’s Bruno Venditti, illustrates the top sources of enriched uranium for U.S. civilian nuclear power reactors in 2023, based on data from the U.S. Energy Information Administration. The calculation is based in Separative Work Unit (SWU), a unit that defines the effort required in the uranium enrichment process. U.S. Suppliers of Enriched Uranium Uranium production in the United States peaked in 1980, while purchases of uranium by U.S. nuclear power… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Is-US-Nuclear-Power-at-Risk-Russias-Uranium-Restrictions-Explained.html |

|

Oil CEO John Hess: Oil Markets Close To Being BalancedSpeaking at the Goldman Sachs Energy, CleanTech, and Utilities Conference in Miami, Hess CEO John Hess shared his perspective on the oil market, suggesting it is closer to being balanced rather than oversupplied in 2025. This outlook comes despite concerns over demand from China and increased production by U.S. and non-OPEC producers. Hess expressed optimism about the shale oil market and the company’s growing prospects in Guyana. However, he also warned that political risks, particularly involving Iran and Venezuela, could contribute to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-CEO-John-Hess-Oil-Markets-Close-To-Being-Balanced.html |

|

Wind Power Costs Challenge UK Energy GoalsThe UK’s aging power grid is facing mounting challenges as wind power becomes a dominant force in the nation’s energy mix, with British consumers projected to shoulder over £1.8 billion ($2.3 billion) in grid management costs, up from £1.5 billion in 2024. These so-called constraint payments arise when grid limitations prevent wind energy from reaching demand centers, forcing operators to pay wind farms to shut down and fossil fuel plants closer to cities to ramp up. Scotland, home to some of Europe’s strongest winds,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Wind-Power-Costs-Challenge-UK-Energy-Goals.html |

|

Trump’s Trade Policies Spark Rare Earth UncertaintyVia Metal Miner The Rare Earths MMI (Monthly Metals Index) displayed bearish sentiment as it entered 2025, dropping by 3.08%. Weak Chinese demand for metals across the board had at least some impact on the downward direction of the index month-over-month. Considering major changes are underway in the global rare earth industry, this created downward short-term price pressure. As far as the U.S. is concerned, the incoming Trump administration could impose tariffs that would impact any raw materials imported from China, which could potentially… Read more at: https://oilprice.com/Metals/Commodities/Trumps-Trade-Policies-Spark-Rare-Earth-Uncertainty.html |

|

South Sudan To Restart Oil Production As Force Majeure Is LiftedDar Petroleum Operating Company (DPOC), the largest oil operator in South Sudan, will resume oil production on Wednesday after Sudan lifted the force majeure on the pipeline route through Sudan and onto Port Sudan on the Red Sea, South Sudan’s Minister of Petroleum, Puot Kang Chol, said on Tuesday. Earlier this month, Sudan lifted the 10-month-long force majeure on the oil flows from landlocked South Sudan through its neighbor to the north, Sudan, following new security arrangements and improved security conditions. In March 2024, Sudan declared… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Sudan-To-Restart-Oil-Production-As-Force-Majeure-Is-Lifted.html |

|

Trump Slams UK Energy Policy’s ‘Very Big Mistake’U.S. President-elect Donald Trump has weighed in on the UK’s energy policy to hike the windfall tax on North Sea oil and gas operators and become a clean energy superpower by boosting offshore wind development. In a typical Trump fashion, the President-elect last week took to social media to blast the Energy Profits Levy (EPL), as the windfall tax is officially known, and to call for “getting rid of” the windmills. Trump’s barb at the UK’s government comes as his current best buddy, Elon Musk, is trolling the UK Prime… Read more at: https://oilprice.com/Energy/Energy-General/Trump-Slams-UK-Energy-Policys-Very-Big-Mistake.html |

|

Trump Considers Executive Order to Protect Natural Gas AppliancesIncoming U.S. President Donald Trump is considering issuing an executive order to save natural gas-powered appliances from federal, state, and city regulations seeking to phase these out of new buildings on environmental concerns, sources with knowledge of the matter told Reuters on Tuesday. The President-elect has attacked incumbent President Joe Biden for many environmental and climate regulations of the current Administration and has vowed to rescind many of these to protect consumer choice. The Biden Administration was mulling over restricting… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Considers-Executive-Order-to-Protect-Natural-Gas-Appliances.html |

|

Wind Became UK’s Largest Power Source in 2024 for First Year EverWind power overtook natural gas to become – for the first time ever – the UK’s largest source of electricity generation for a full year, the National Energy System Operator (NESO) said on Tuesday. Last year, wind was the largest source of electricity generation for the first year ever, accounting for 30%, NESO said in its 2024 electricity review. In addition, renewables generated more than 50% of Britain’s electricity for four consecutive quarters to the third quarter of 2024 for the first time, averaging 51% during 2024,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Wind-Became-UKs-Largest-Power-Source-in-2024-for-First-Year-Ever.html |

|

Biden Doubles Down on Sanctions in His Final DaysOil markets have spent the first days of 2025 focused on storms and sanctions, with Biden doubling down on sanctions in his final days in office as oil prices climb.- Winter Storm Blair has hit the US Midwest, Plains, and Atlantic Coast with snowstorms and freezing temperatures, canceling nearly 2,000 flights across the country and sending oil and gas prices climbing.- Wholesale electricity prices across the US Northeast skyrocketed into triple-digit territory as the cold snap ratcheted up demand for power with ISO New England Massachusetts… Read more at: https://oilprice.com/Energy/Energy-General/Biden-Doubles-Down-on-Sanctions-in-His-Final-Days.html |

|

Dollar Dominance Dwindles as Central Banks Diversify ReservesThe US dollar lost further ground as global reserve currency among many reserve currencies held by central banks. Its share has been zigzagging lower for many years as central banks have been diversifying their holdings to assets denominated in currencies other than the dollar. And they’ve also been diversifying into gold. But the dollar remains by far the dominant global reserve currency. The share of USD-denominated foreign exchange reserves fell to 57.4% of total exchange reserves the lowest since 1994, according to the IMF’s COFER… Read more at: https://oilprice.com/Finance/the-Economy/Dollar-Dominance-Dwindles-as-Central-Banks-Diversify-Reserves.html |

|

Key Chinese Ports Ban Oil Tankers Sanctioned by the U.S.Shandong Port Group, operator of key oil ports used by China’s independent refiners, has prohibited access and services to tankers sanctioned by the U.S. Treasury, a move that could curb Chinese oil imports and raise costs for local refiners, trade sources have told Reuters. Shandong Port Group has issued a notice, seen by the trade sources, banning ports from allowing tankers on the U.S. Treasury’s designated list to dock, unload, or use ship services. The ports where the ban is in effect include Qingdao, Rizhao, and Yantai on China’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Key-Chinese-Ports-Ban-Oil-Tankers-Sanctioned-by-the-US.html |

|

Russia Claims Compliance With OPEC+ Oil Output Cuts in DecemberRussian crude oil production fell in December to below Moscow’s output cap under the OPEC+ agreement, anonymous sources with knowledge of Russian production data told Bloomberg on Tuesday. Russia produced 8.971 million barrels per day (bpd) of crude oil last month, down from previous months and about 7,000 bpd below the country’s production target under the OPEC+ deal, according to the sources. Russia stopped releasing oil and gas output data shortly after the invasion of Ukraine in 2022. The market and analysts have to rely on sources… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Claims-Compliance-With-OPEC-Oil-Output-Cuts-in-December.html |

|

Dow falls more than 170 points, Nasdaq loses nearly 2% as Nvidia leads tech selloff: Live updatesThe major averages fell on Tuesday as investors sold out of Big Tech names and Treasury yields spiked. Read more at: https://www.cnbc.com/2025/01/06/stock-market-today-live-updates.html |

|

Howard Marks sees cautionary signs of a bubble, says investors shouldn’t ignore today’s high market valuation“[I]nvestors clearly shouldn’t be indifferent to today’s market valuation,” Howard Marks wrote in his latest memo. Read more at: https://www.cnbc.com/2025/01/07/howard-marks-sees-cautionary-signs-of-bubble-says-investors-shouldnt-ignore-todays-high-valuation.html |

|

Trump announces $20 billion foreign investment to build new U.S. data centersBillionaire Hussain Sajwani, a Trump associate and founder of the property development company DAMAC Properties, is pledging the money. Read more at: https://www.cnbc.com/2025/01/07/trump-investment-hussain-sajwani-damac-data-centers.html |

|

Anthropic in talks to raise funding at $60 billion valuationAI startup Anthropic is in late-stage talks to raise as much as $2 billion at a $60 billion valuation, according to a person familiar with the deal. Read more at: https://www.cnbc.com/2025/01/07/anthropic-in-talks-to-raise-funding-at-60-billion-valuation.html |

|

Meta employees criticize Zuckerberg decisions to end fact-checking, add Dana White to boardMeta employees internally criticized the company’s decision to end third-party fact-checking two weeks before President-elect Donald Trump’s inauguration. Read more at: https://www.cnbc.com/2025/01/07/meta-employees-criticize-companys-new-speech-policy-board-additions.html |

|

These midcap utilities are a play on data center demand – and offer generous dividends, Morningstar saysLarge cap utilities had a stunning performance in 2024, but investors might consider turning to midcaps if they’re searching for opportunities. Read more at: https://www.cnbc.com/2025/01/07/these-midcap-utilities-are-a-play-on-data-center-demand-morningstar-says.html |

|

Trump warns ‘all hell will break out’ if Gaza hostages not released by his inaugurationTrump’s Middle East envoy, Steve Witkoff, said he is flying back to Doha, Qatar, for negotiations between Hamas and Israel. Read more at: https://www.cnbc.com/2025/01/07/trump-threatens-hell-if-gaza-hostages-not-released.html |

|

U.S. Steel CEO calls for Trump to take fresh look at Nippon deal, slams Biden decision as corruptTrump opposes U.S. Steel’s sale to Nippon, but CEO David Burritt believes he can convince the president-elect that the deal is in the interest of U.S. workers. Read more at: https://www.cnbc.com/2025/01/07/us-steel-ceo-calls-for-trump-to-take-fresh-look-at-nippon-deal-slams-biden-decision-as-corrupt.html |

|

Trump won’t rule out using U.S. military to control Panama Canal or GreenlandPresident-elect Donald Trump has repeatedly said the U.S. should control the Panama Canal and Greenland, and has also expressed a desire to make Canada a state. Read more at: https://www.cnbc.com/2025/01/07/trump-panama-canal-greenland-military-canada.html |

|

Meta scraps fact-checking, brings back political content in latest Trump-friendly moveMeta announces intent to “restore free expression” on its platforms Read more at: https://www.cnbc.com/2025/01/07/meta-eliminates-third-party-fact-checking-moves-to-community-notes.html |

|

Honda reveals two new ‘0 Series’ EVs to be produced in OhioThe vehicles are the Honda 0 Saloon, which is an updated version of a concept car revealed last year at CES, and the Honda 0 SUV. Read more at: https://www.cnbc.com/2025/01/07/honda-0-series-evs-electric-vehicles.html |

|

Puma challenges Tiger Woods’ Sun Day Red logoThe German sneaker and apparel company says the Sun Day Red logo is too similar to the logo that Puma has been using since 1969. Read more at: https://www.cnbc.com/2025/01/07/puma-challenges-tiger-woods-sun-day-red-logo.html |

|

How a Silicon Valley financial backer orchestrated a plot to take down a rising startupFinancial backer Denis Grosz thought he was going to generate big returns from his bet on a company called Toptal, until he got sued for his actions. Read more at: https://www.cnbc.com/2025/01/07/tech-investor-denis-grosz-orchestrated-takedown-plot-of-startup-toptal.html |

|

159 Democrats Voted Against Laken Riley Bill To Detain Criminal IllegalsAuthored by Stacey Robinson via The Epoch Times, The House of Representatives has passed the Laken Riley Act with a vote of 264–159. Almost all Republicans and 48 Democrats united to push the bill through the lower chamber of Congress.

The legislation requires the Department of Homeland Security to detain illegal immigrants who have committed certain crimes, such as theft, burglary, or shoplifting. It also allows states to sue the federal government for injunctive relief over “certain immigration-related decisions or alleged failures” if they resulted in harm to that state. These can include the failure to detain an individual who has already been ordered to be deported, or neglecting to fulfill vetting requirements for immigrants seeking to enter the United States. Read more at: https://www.zerohedge.com/political/159-democrats-voted-against-laken-riley-bill-detain-criminal-illegals |

|

Sam Altman: OpenAI Is “Losing Money”, Shares 2025 Agentic AI OutlookThe road to profitability for OpenAI remains uncertain as the CEO, Sam Altman, revealed on Sunday on X, “Insane thing: We are currently losing money on OpenAI Pro Subscriptions!” He blamed the high usage of ChatGPT.

“I personally chose the price,” Altman told one X user, adding, “and thought we would make some money.”

OpenAI launched ChatGPT Pro last year and charges $2,400 for unlimited access to the company’s top model, OpenAI o1, as well as to o1-mini, GPT-4o, and Advanced Voice. “While this problem demonstrates the product’s popularity, it’s not clear how OpenAI is meant to turn a profit, much less operate its costly business sustainably,” Goldman Sean Johnstone told clients on Tuesday. … Read more at: https://www.zerohedge.com/technology/sam-altman-openai-losing-money-shares-2025-agentic-ai-outlook |

|

The Truth About America’s Crumbling InfrastructureAuthored by Michael Snyder via TheMostImportantNews.com, Signs that we were once a truly great nation are all around us. Previous generations of Americans handed us the keys to the most magnificent domestic infrastructure that the world had ever seen, but now it is literally falling apart all around us. Thousands of bridges are structurally deficient and there have already been some very high profile collapses. Hundreds of thousands of miles of highways and roads in the United States are in very poor shape. Aging sewer systems are leaking raw sewage all over the place, and children are being slowly poisoned by lead pipes that desperately need to be replaced. The power grid is hopelessly overloaded and is extremely vulnerable. Meanwhile, our ports, our dams, our subway systems, our bus terminals and our airports are crumbling right in front of our eyes. The truth is that our nation’s infrastructure says a lot about who we are. Read more at: https://www.zerohedge.com/political/truth-about-americas-crumbling-infrastructure |

|

Intel On The Brink Of Death Due To Culture Rot Says Scathing ReportAuthored by Mike Shedlock via MishTalk.com, SemiAnalysis has a scathing report on critical mistakes made by Intel. Let’s investigate…

Please consider Intel on the Brink of Death | Culture Rot, Product Focus Flawed, Foundry Must Survive

|

|

Shein lawyer refuses to say if it uses Chinese cottonYinan Zhu declined to say whether it retailer’s suppliers used Chinese cotton amid concerns over forced labour. Read more at: https://www.bbc.com/news/articles/clyg7n1d85go |

|

McDonald’s boss says 29 people fired over abuseIt comes after workers at the fast-food chain told the BBC they are still facing sexual abuse and harassment. Read more at: https://www.bbc.com/news/articles/ckg8mk6dze8o |

|

Faisal Islam: Soaring UK borrowing costs are a problem for Rachel ReevesThe Chancellor may face the prospect of breaking her own Budget rules Read more at: https://www.bbc.com/news/articles/c62zpregm2mo |

|

NSE adds NBCC, Torrent Power, 4 more stocks into F&O segment. Contracts to trade from January 31The NSE of India will include six new stocks in the Futures and Options segment from January 31, 2025. The stocks are Castrol India, Gland Pharma, NBCC, Phoenix, Solar Industries India, and Torrent Power. Details about market lot and scheme of strikes will be announced on January 30, 2025. Read more at: https://economictimes.indiatimes.com/markets/options/nse-adds-nbcc-torrent-power-4-more-stocks-into-fo-segment-contracts-to-trade-from-january-31/articleshow/117031111.cms |

|

Tech View: Nifty forms Inside Bar Candle, can correct below 23,600. How to trade on WednesdayTechnical indicators sent mixed signals on Tuesday, with the RSI at 43 indicating bearish momentum, while a bullish crossover in the Stochastic RSI hinted at a potential short-term recovery. This divergence highlights the need for caution as the market remains directionally uncertain, said Mandar Bhojane of Choice Broking. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-inside-bar-candle-can-correct-below-23600-how-to-trade-on-wednesday/articleshow/117027063.cms |

|

Centrum Broking picks LIC among 5 insurance stocks with upside potential of up to 39%Centrum Broking’s latest report on India’s life insurance sector remains bullish on LIC, SBI Life, HDFC Life, ICICI Prudential Life, and Max Life. Among these, SBI Life and HDFC Life stand out as the brokerage’s top picks due to their consistent market share growth and innovative product strategies, outperforming LIC in key metrics. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/centrum-broking-picks-lic-among-5-insurance-stocks-with-upside-potential-of-up-to-39/articleshow/117021295.cms |

|

10-year Treasury yield ends at highest since April as inflation worries growU.S. government debt sold off aggressively on Tuesday, pushing the benchmark 10-year rate to its highest level in more than eight months, after an ISM services-sector reading contained signs of rising inflation. Read more at: https://www.marketwatch.com/story/ten-year-treasury-yields-hold-near-7-month-highs-as-traders-eye-auctions-and-raft-of-jobs-data-d70d226f?mod=mw_rss_topstories |

|

Active mutual funds struggle to beat large-cap stock benchmarks — againProfessional stock pickers in the mutual-fund industry had a tough time in 2024 beating indexes that passively track U.S. large-cap equities, according to BofA Global Research. Read more at: https://www.marketwatch.com/story/active-mutual-funds-struggle-to-beat-large-cap-stock-benchmarks-again-ba4a2f6d?mod=mw_rss_topstories |

|

Tech stocks are getting slammed because economic data sparked jump in bond yieldsData on job openings and service-sector activity sent markets into “good news is bad news” mode on Tuesday. Read more at: https://www.marketwatch.com/story/tech-stocks-are-getting-slammed-because-economic-data-sparked-jump-in-bond-yields-caac16e8?mod=mw_rss_topstories |