Summary Of the Markets Today:

- The Dow closed up 499 points or 1.18%,

- Nasdaq closed up 200 points or 1.03%,

- S&P 500 closed up 64 points or 1.09%,

- Gold $2,644 up $35.20 or 1.364%,

- WTI crude oil settled at $70 up $0.14 or 0.2303%,

- 10-year U.S. Treasury 4.528 down 0.042 points or 0.919%,

- USD index $107.77 down $0.64 or 0.59%,

- Bitcoin $96,359 down $771 or 0.08%, (24 Hours),

- Baker Hughes Rig Count: U.S. unchanged at 589 Canada -25 to 166

U.S. Rig Count is unchanged from last week at 589 with oil rigs up 1 to 483, gas rigs down 1 to 102 and miscellaneous rigs unchanged at 4.

*Stock data, cryptocurrency, and commodity prices at the market closing

Market Summary

U.S. stocks experienced a significant rebound on Friday, driven by inflation data showing a deceleration in price increases for November 2025. Despite the Friday recovery, the major indices still finished the week lower, with the Nasdaq down 1.8% and both the Dow and S&P 500 losing around 2%. The Federal Reserve’s preferred inflation metric, the core Personal Consumption Expenditures (PCE) index, showed a slowdown in price increases for November [We have a different view – see Today’s Economic Releases Compiled by Steven Hansen, Publisher]. Earlier in the week, the Fed signaled fewer anticipated rate cuts for 2025, which triggered a market sell-off. Potential government shutdown and Trump’s tariff threats on Europe added market pressure. All 11 S&P 500 sectors were in positive territory on Friday. Technology and semiconductor stocks saw notable gains.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Real Personal Consumption Expenditures (PCE) was up 2.9% year-over-year (down from last month’s 3.0%) while Real Disposable Personal Income (DPI) was up 2.6% year-over-year (down from last month’s 2.9%). Inflation (as measured by the PCE price index) rose from 2.3% to 2.4% year-over-year (the index less food and energy was little changed at 2.8%). These price indices are the favored measure of inflation by the Federal Reserve. And as I have been saying all along – inflation is FAR from being under control.

The December 2024 Livingston Survey, conducted by the Federal Reserve Bank of Philadelphia, provides updated economic forecasts from 24 economists regarding key macroeconomic indicators for the U.S. economy through 2026. Real GDP Growth is predicted to an annualized growth of 2.5% for the second half of 2024, with a decrease to 1.9% for both the first and second halves of 2025. The unemployment rate is expected to rise from 4.2% in December 2024 to 4.3% by June and remain at that level through December 2025, reflecting upward revisions from previous estimates. Consumer Price Index (CPI) inflation is projected at an annual average of 2.9% for 2024 and 2.3% for 2025, with expectations to hold steady at 2.3% in 2026. Producer Price Index (PPI) inflation is anticipated to be 1.0% in 2024, rising to 1.1% in 2025 and 2.1% in 2026. Short-term interest rates are expected to decline, with the three-month Treasury bill rate projected at 4.35% by the end of December 2024, decreasing to 3.40% by December 2025. The ten-year Treasury bond rate is also forecasted to fall from 4.30% in December 2024 to 4.00% by December 2025. As measured by the S&P 500 index, Stock Market Outlook prices are projected to increase significantly, reaching approximately 6050.0 at the end of December 2024 and rising to about 6920.9 by the end of 2026. Over the next decade, real GDP is expected to grow at an average annual rate of 2.05%, while CPI inflation is projected at 2.28%, both slightly revised upwards from previous forecasts. This survey reflects a cautious optimism among economists regarding steady growth but acknowledges potential challenges with rising unemployment and inflationary pressures in the coming years.

Here is a summary of headlines we are reading today:

- Data Centers Are Eating the Grid Alive

- No Change to U.S. Drilling Activity Heading Into Holiday Week

- EU Ready to Discuss Closer Energy Ties with US under Trump

- Oil Prices Under Pressure as Weak Demand and Economic Uncertainty Persist

- Israel Strikes Multiple Targets in Yemen

- Bearish Sentiment Takes Hold in Oil Markets

- Dow closes nearly 500 points higher on cooler inflation data, but index posts third straight losing week: Live updates

- CFPB sues JPMorgan Chase, Bank of America and Wells Fargo over Zelle payment fraud

- Key Fed inflation measure shows 2.4% rate in November, lower than expected

- Warren Buffett’s Berkshire Hathaway scoops up Occidental and other stocks during sell-off

- Bitcoin falls to $96,000 as volatility hits crypto assets: CNBC Crypto World

- As Congress works to avoid a shutdown, here’s what’s next for a bill to increase Social Security benefits for public pensioners

- Treasury yields end with second week of advances, with interest rates set to stay elevated in 2025

- FedEx’s freight-unit spinoff offers ‘early Christmas’ to Wall Street

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Romanian Steel Industry Feels the Pinch of Economic SlowdownVia Metal Miner Difficult market conditions have prompted Romanian steel industry leader ArcelorMittal Hunedoara to reduce production until year’s end. According to a notice provided to the Bucharest Stock Exchange, the longs producer’s board of directors decided to reduce production from December 9-31 and pay 75% of salaries to employees impacted by the steps. The December 6 notice also cited the “economic difficulties faced by the company due to the lack of orders and implicitly of the production volume, as well as a… Read more at: https://oilprice.com/Metals/Commodities/Romanian-Steel-Industry-Feels-the-Pinch-of-Economic-Slowdown.html |

|

Data Centers Are Eating the Grid AliveThe future of data centers is about to make a huge draw on the power grid. According to a DOE-backed report from Lawrence Berkeley National Lab, U.S. data center energy use could nearly triple by 2028, eating up as much as 12% of the country’s electricity. Why? Blame AI and its insatiable hunger for powerful chips and energy-guzzling cooling systems. Currently, data centers are responsible for a modest 4% of U.S. power demand. But with AI servers becoming the star of the show, the power draw has already doubled since 2017. The GPU chips that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Data-Centers-Are-Eating-the-Grid-Alive.html |

|

No Change to U.S. Drilling Activity Heading Into Holiday WeekThe total number of active drilling rigs for oil and gas in the United States stayed the same again this week, according to new data that Baker Hughes published on Friday, after seeing no change in the week prior. The total rig count remained flat at 589 total rigs, according to Baker Hughes, down 31 from this same time last year. The number of oil rigs rose by 1 to 483—down by 15 compared to this time last year. The number of gas rigs fell by one rig, landing at 102, a loss of 18 active gas rigs from this time last year. Miscellaneous rigs… Read more at: https://oilprice.com/Energy/Energy-General/No-Change-to-US-Drilling-Activity-Heading-Into-Holiday-Week.html |

|

Russian Oil Flows Through Druzhba Pipeline Halted AgainIt’s happened again. The Druzhba pipeline—Russia’s aging oil lifeline to Europe—has gone silent, leaving Hungary, Slovakia, and the Czech Republic without their usual crude oil fix. According to sources, the culprit is a “technical issue” at a Russian pumping station in the Bryansk region. Transneft, the pipeline’s operator, has yet to speak on the issue, but Belarus has confirmed the disruption, saying its refineries are dipping into reserves to keep running. This pipeline, capable of carrying 2 million… Read more at: https://oilprice.com/Energy/Crude-Oil/Russian-Oil-Flows-Through-Druzhba-Pipeline-Halted-Again.html |

|

EU Ready to Discuss Closer Energy Ties with US under TrumpThe European Union is prepared to discuss with U.S. President-elect Trump boosting economic ties, including in the energy sector, an EU spokesperson told Reuters on Friday, hours after Trump threatened to impose “tariffs all the way” on the bloc if it doesn’t buy large volumes of American oil and gas. The EU is ready to discuss common interests in the energy sector with the U.S. as Europe is looking to phase out imports of Russian energy and diversify its sources of supply, the EU spokesperson told Reuters. Earlier on Friday,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Ready-to-Discuss-Closer-Energy-Ties-with-US-under-Trump.html |

|

Yearly Gas Flows to U.S. LNG Export Plants Set for First-Ever DeclineThe annual average natural gas demand at U.S. LNG export plants is on track to inch down this year for the first decline since America began exporting LNG in 2016, according to data from LSEG cited by Reuters. Outages at some LNG facilities and delays to the construction of new plants are likely to slightly reduce feedgas to the eight large LNG export plants this year compared to 2023. Feedgas volumes have now eased to an average of 13.0 billion cubic feet per day (bcfd) as of December 20, down from an average of 13.1 bcfd last year, per the LSEG… Read more at: https://oilprice.com/Energy/Energy-General/Yearly-Gas-Flows-to-US-LNG-Export-Plants-Set-for-First-Ever-Decline.html |

|

Turkey Gets Waiver to Pay for Russian Gas via Sanctioned GazprombankTurkey has obtained a waiver from the United States to pay for natural gas to Russia via the now-sanctioned Russian Gazprombank, Turkish Energy Minister Alparslan Bayraktar told Reuters on Friday. In November, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Gazprombank in what the Treasury said was “another major step in implementing commitments made by G7 leaders to curtail Russia’s use of the international financial system to further its war against Ukraine.” The latest… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Turkey-Gets-Waiver-to-Pay-for-Russian-Gas-via-Sanctioned-Gazprombank.html |

|

A Shipbuilding Boom in 2024Wary of Worsening Export Economics, Chinese Refiners Flushes Out Stocks – Chinese companies maximized their exports of oil products in November, ahead of an increase in government levies after Beijing reduced the country’s VAT rebate for product exports from 13% to 9%. – The combined exports of gasoline, diesel, and jet fuel accounted for 920,000 b/d last month, according to Chinese GAC statistics, a whopping 28% month-on-month increase as oil companies flushed out their stocks. – Slashing the tax rebate would result in… Read more at: https://oilprice.com/Energy/Energy-General/A-Shipbuilding-Boom-in-2024.html |

|

Oil Prices Under Pressure as Weak Demand and Economic Uncertainty PersistLight crude oil futures are facing bearish sentiment, largely driven by concerns over global economic growth and oil demand. Weak consumer spending data from China, the world’s largest oil importer, has cast doubt on the resilience of its economic recovery. Despite signs of improvement in industrial production, the broader outlook for Chinese demand remains subdued, as Beijing struggles to implement effective stimulus measures. Energy transition policies in China are also expected to cap long-term petroleum consumption, further dampening… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-as-Weak-Demand-and-Economic-Uncertainty-Persist.html |

|

Israel Strikes Multiple Targets in YemenPolitics, Geopolitics & Conflict Venezuela’s PDVSA and India’s Reliance Industries have resumed a cautious oil-for-naphtha swap arrangement paused under U.S. sanctions, signaling a recalibration of geopolitical oil strategies. With a U.S. license in hand since July, the swap delivered 1.9M barrels of Merey crude to India and 500,000 barrels of naphtha to Venezuela, reflecting mutual economic necessity as Venezuela leverages barter deals to sustain its oil sector while India cautiously tests the limits of U.S. tolerance. The market… Read more at: https://oilprice.com/Energy/Energy-General/Israel-Strikes-Multiple-Targets-in-Yemen.html |

|

Turkey Mediates Major Deal Between Ethiopia and SomaliaTurkey has mediated a deal between Ethiopia and Somalia to grant the former access to the Red Sea and the Indian Ocean, ending a year-long dispute that threatened to spark a regional conflict. But the new deal voids an earlier deal with Somalia’s breakaway region of Somaliland, which would have given Ethiopia a naval base in Somaliland in return for recognition of independence. The Turkish deal, dubbed the “Ankara Declaration” would give Ethiopia alternative access to the Red Sea, without undermining Somalia’s sovereignty… Read more at: https://oilprice.com/Energy/Energy-General/Turkey-Mediates-Major-Deal-Between-Ethiopia-and-Somalia.html |

|

Iran’s Floating Oil Storage Jumps Amid Tighter SanctionsIran’s oil is increasingly finding its way into floating storage offshore Southeast Asia instead of at customers as a recent raft of U.S. sanctions on tankers shipping Iranian oil has made Chinese buyers more careful. The volumes of Iranian oil stored on tankers at sea, predominantly offshore Malaysia’s eastern coasts, have swelled to their highest levels since the end of July, per data from Kpler cited by Bloomberg. As of December 15, a total of 16.82 million barrels of Iranian oil were sitting on tankers at sea without going anywhere.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Irans-Floating-Oil-Storage-Jumps-Amid-Tighter-Sanctions.html |

|

Bearish Sentiment Takes Hold in Oil MarketsSentiment in oil markets is decidedly bearish as the year draws to a close, with the Federal Reserve making it clear that it will not be aggressively cutting interest rates any time soon.Slower and shallower were the two key takeaways for the Federal Reserve’s 2025 rate policy outlook, with a suggested prolonged pause in rate-cutting next year adding insult to the oil market’s injury. China remains a bearish factor for oil with almost all 2025 outlooks trying to outcompete one another in terms of bearishness, all this leading to a dip in… Read more at: https://oilprice.com/Energy/Energy-General/Bearish-Sentiment-Takes-Hold-in-Oil-Markets.html |

|

Trump: “Tariffs All The Way” if EU Fails to Buy More U.S. Oil and GasThe European Union should buy more oil and gas from the United States or risk tariffs, U.S. President-elect Donald Trump said on Friday. “I told the European Union that they must make up their tremendous deficit with the United States by the large scale purchase of our oil and gas,” Trump posted on the social media platform Truth Social. “Otherwise, it is TARIFFS all the way!!!” The U.S., the world’s largest LNG exporter ahead of Qatar and Australia, is a major supplier of LNG to Europe, which is looking to boost alternative… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Tariffs-All-The-Way-if-EU-Fails-to-Buy-More-US-Oil-and-Gas.html |

|

Mining Giant BHP: Trump Tariffs Will Hold Back the Energy TransitionPresident-elect Trump’s proposed tariffs and the heightened risk of trade wars would be major challenges to the global energy transition, Mike Henry, the chief executive of mining giant BHP, told the Financial Times. Escalating trade tensions and tariffs on many products could delay decision-making about investment in the supply of the minerals that would be crucial to advance the energy transition, Henry told FT in an interview published on Friday. Protectionism from the United States is likely to ease “the aggressiveness with… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mining-Giant-BHP-Trump-Tariffs-Will-Hold-Back-the-Energy-Transition.html |

|

Dow closes nearly 500 points higher on cooler inflation data, but index posts third straight losing week: Live updatesAll three major averages posted weekly losses, despite seeing a rebound in Friday’s session. Read more at: https://www.cnbc.com/2024/12/19/stock-market-today-live-updates.html |

|

CFPB sues JPMorgan Chase, Bank of America and Wells Fargo over Zelle payment fraudZelle, a peer-to-peer payments network run by bank-owned fintech firm Early Warning Services, allows for instant payments to other consumers and businesses. Read more at: https://www.cnbc.com/2024/12/20/cfpb-sues-jpmorgan-chase-bank-of-america-wells-fargo-over-zelle-fraud.html |

|

Key Fed inflation measure shows 2.4% rate in November, lower than expectedThe PCE price index was expected to show a 2.5% annual inflation rate in November after rising 0.2% monthly. Read more at: https://www.cnbc.com/2024/12/20/pce-inflation-november-2024-.html |

|

OpenAI is done with Shipmas and staring down daunting challenges for 2025OpenAI on Friday wrapped up “12 Days of Shipmas,” closing out a marketing blitz for new features, products and demos, including Sora. Read more at: https://www.cnbc.com/2024/12/20/openai-is-done-with-shipmas-faces-daunting-challenges-for-2025-.html |

|

These stocks that were big losers in 2024 could rebound early next year, Wolfe saysCompanies that tanked this year may enjoy a short-lived jump in 2025, the researcher found. Read more at: https://www.cnbc.com/2024/12/20/these-big-losers-in-2024-could-rebound-early-next-year-wolfe-says.html |

|

Warren Buffett’s Berkshire Hathaway scoops up Occidental and other stocks during sell-offBerkshire Hathaway bought more than $560 million worth of stocks over the last three sessions. Read more at: https://www.cnbc.com/2024/12/20/warren-buffetts-berkshire-hathaway-scoops-up-occidental-and-other-stocks-during-sell-off.html |

|

Bitcoin falls to $96,000 as volatility hits crypto assets: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Kristin Smith of the Blockchain Association breaks down which crypto regulations she expects lawmakers to prioritize in 2025. Read more at: https://www.cnbc.com/video/2024/12/20/bitcoin-falls-to-96000-as-volatility-hits-crypto-assets-cnbc-crypto-world.html |

|

Banking app Dave, back from the brink, is this year’s biggest gainer among financials with 934% surgeDave, which makes money by extending loans to cash-strapped Americans, is emblematic of a larger shift that’s still in its early stages, analysts say. Read more at: https://www.cnbc.com/2024/12/20/dave-robinhood-biggest-financial-stock-gainers.html |

|

Biden forgives $4.28 billion in student debt for 54,900 borrowersThe Biden administration announced on Friday that it would forgive another $4.28 billion in student loan debt for 54,900 borrowers who work in public service. Read more at: https://www.cnbc.com/2024/12/20/biden-forgives-4point28-billion-in-student-debt-for-54900-pslf-borrowers.html |

|

As Congress works to avoid a shutdown, here’s what’s next for a bill to increase Social Security benefits for public pensionersThe Senate may soon consider a bill that would increase Social Security benefits for individuals who also receive public pensions. Read more at: https://www.cnbc.com/2024/12/20/social-security-fairness-act-government-shutdown.html |

|

What a government shutdown could mean for air travelA government shutdown could mean thousands of air traffic controllers and TSA agents would go without paychecks. Read more at: https://www.cnbc.com/2024/12/20/government-shutdown-air-travel-airports-holidays.html |

|

Party City to close all of its stores, report saysParty City on Friday announced it will close all of its stores and has initiated corporate layoffs effective immediately, according to a CNN report. Read more at: https://www.cnbc.com/2024/12/20/party-city-to-close-all-of-its-stores-report-says.html |

|

Syrian Leader With $10M Bounty On His Head Meets With Delegation From Country That Put The $10M Bounty On His HeadOn Friday for the first time top Biden administration envoys met with Abu Mohammed al-Jolani in Damascus. Ironically the Hayat Tahrir al-Sham (HTS) leader, who has reverted to going by his birth name of Ahmad al-Sharaa, is wanted by the FBI for terrorism and still has a $10 million bounty on his head. That didn’t stop Barbara A. Leaf, Assistant Secretary of State for Near Eastern Affairs, and a Biden admin delegation from meeting with the HTS leader in Damascus, where they discussed sanctions, the thorny issue of the $10 million reward, and locating missing US citizens in Syria (specifically journalist Austin Tice).

Jolani is trying to present himself as a “moderate”. Perhaps this is why for one of the first times he allowed himself to be photographed alongside a woman without a head-covering. He and HTS are trying to attract West … Read more at: https://www.zerohedge.com/geopolitical/syrian-leader-10m-bounty-his-head-meets-delegation-country-put-10m-bounty-his-head |

|

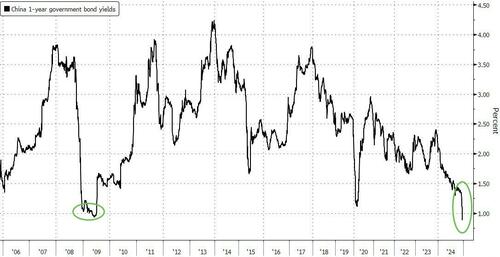

Trump Effect? China’s 1Y Yield Crashes Below 1% For First Time Since GFCFor the first time since the Great Financial Crisis (2008/9), short-dated Chinese bond yields have plunged back below 1%. In fact they are now at record lows…

Source: Bloomberg As we head into the end of the year, impatient investors are left waiting for a real plan to underwrite consumption (as yields melt inexorably lower), and capital flight accelerates (spurred by concerns about yuan weakness). China suffered a record fund exit last month under the category of securities investment, according to official data released this week. Read more at: https://www.zerohedge.com/markets/trump-effect-chinas-1y-yield-crashes-below-1-first-time-gfc |

|

Car Rams Into German Christmas Market, 60 To 80 Injured; Shocking Video ReleasedCar Rams Into German Christmas Market, 60 To 80 Injured; Shocking Video Released Watch Live German News Watch Live UK News * * * Update (1556ET): AFP News reports that 60 to 80 people were injured when a car rammed through a Christmas market in Germany. There is no official word regarding fatalities.

* * * Update (1540ET): There are a lot of casualty numbers being thrown out on X. According to German news outlet MDR News: Read more at: https://www.zerohedge.com/geopolitical/terror-or-accident-car-plows-germany-christmas-market |

|

Big Lots Announces It Will Start Going-Out-Of-Business Sale At All StoresBig Lots Announces It Will Start Going-Out-Of-Business Sale At All StoresAuthored by Jack Phillips via The Epoch Times, Discount retail store chain Big Lots announced Thursday that it will initiate “going out of business” sales at all its remaining locations after it was unable to reach an agreement with an investment firm.

Big Lots CEO Bruce Thorn said in a statement that Big Lots attempted to complete a sale of the company to Nexus Capital Management but it fell through. He said the company will, in the meantime, attempt to close the deal with Nexus or another party by early next month.

|

|

Call for extension to winter fuel payment deadlineThe Lib Dems warn tens of thousands of pensioners risk missing Saturday’s deadline to get help with energy costs. Read more at: https://www.bbc.com/news/articles/c93gxyv7wlyo |

|

Volkswagen agrees deal to avoid German plant closuresVW and a union have, however, agreed to cut more than 35,000 jobs across the country by 2030. Read more at: https://www.bbc.com/news/articles/cje9kv3q94po |

|

Christmas getaway: Tips to avoid disruptionSome 14 million drivers are expected to hit the road in the last weekend before Christmas, according to the RAC. Read more at: https://www.bbc.com/news/articles/cwy3nk7enqqo |

|

Unique Stocks: These counters held by only one MF scheme surged 50-150% in CY24 so farIn November 2024, the list initially included 130 stocks. To refine the selection, only those with a market value exceeding Rs 20 crore and a share price increase of over 50% during CY24 were considered. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/unique-stocks-these-counters-held-by-only-one-mf-scheme-surged-50-150-in-cy24-so-far/slideshow/116507450.cms |

|

Rupee dips to record intraday low of 85.10 vs US dollar, closes moderately stronger at 85.01The Indian rupee depreciated to an all time low during the day, but ended slightly stronger at 85.01 per US dollar on a closing basis, due to the rebalancing of FTSE’s equity index and interventions from the Reserve Bank of India, traders said. Read more at: https://economictimes.indiatimes.com/markets/forex/rupee-dips-to-record-intraday-low-of-85-10-vs-us-dollar-closes-moderately-stronger-at-85-01/articleshow/116511132.cms |

|

Sebi simplifies offer document requirement for AMCsMarkets regulator Sebi on Friday simplified the framework for asset management companies (AMCs) by reducing the requirement to upload draft SIDs to 8 working days from 21 days earlier. This is aimed at streamlining the process, reducing timelines, and enhancing investor protection while simplifying compliance for AMCs. Read more at: https://economictimes.indiatimes.com/mf/mf-news/sebi-simplifies-offer-document-requirement-for-amcs/articleshow/116509987.cms |

|

Treasury yields end with second week of advances, with interest rates set to stay elevated in 2025Yields on U.S. government debt finished with their second consecutive weekly advances on Friday, as traders positioned for the likelihood of fewer 2025 rate cuts from the Federal Reserve than they had expected a month ago. Read more at: https://www.marketwatch.com/story/treasury-yields-fall-as-market-awaits-u-s-inflation-data-potential-government-shutdown-80eb1660?mod=mw_rss_topstories |

|

Oil prices score weekly losses on strong dollar, China demand worriesOil futures settled little changed on Friday but tallied losses for the week after feeling pressure from a surging U.S. dollar and continued concerns about the demand outlook, particularly from China, the world’s largest crude importer. Read more at: https://www.marketwatch.com/story/oil-prices-head-for-weekly-losses-on-strong-dollar-china-demand-worries-a2d3a525?mod=mw_rss_topstories |

|

FedEx’s freight-unit spinoff offers ‘early Christmas’ to Wall StreetStifel, TD Cowen and Susquehanna analysts praised the move and boosted their price targets for the delivery giant’s stock. Read more at: https://www.marketwatch.com/story/fedexs-freight-unit-spinoff-offers-early-christmas-to-wall-street-00b27bf9?mod=mw_rss_topstories |