Summary Of the Markets Today:

- The Dow closed up 15 points or 0.04%,

- Nasdaq closed down 20 points or 0.10%,

- S&P 500 closed down 5 points or 0.09%,

- Gold $2,612 down $40.90 or 1.54%,

- WTI crude oil settled at $70 down $0.73 or 1.03%,

- 10-year U.S. Treasury 4.570 up 0.072 points or 1.601%,

- USD index $108.37 up $0.34 or 0.32%,

- Bitcoin $95,904 down $4,546 or 4.74%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Market Summary

U.S. stocks stabilized on Thursday following a significant sell-off triggered by the Federal Reserve’s hawkish outlook on interest rates yesterday. The Dow Jones Industrial Average broke a ten-consecutive-day losing streak. The market decline yesterday stemmed from the Fed reducing their forecast for 2025 rate cuts from four to just two. Chair Jerome Powell described the rate cut decision as a “closer call” than anticipated. Looking ahead, investors are now focused on the upcoming Personal Consumption Expenditures (PCE) index report on Friday, which will provide further insights into inflation trends. The market’s volatility reflects ongoing uncertainty about the Fed’s monetary policy and the trajectory of inflation in 2025.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

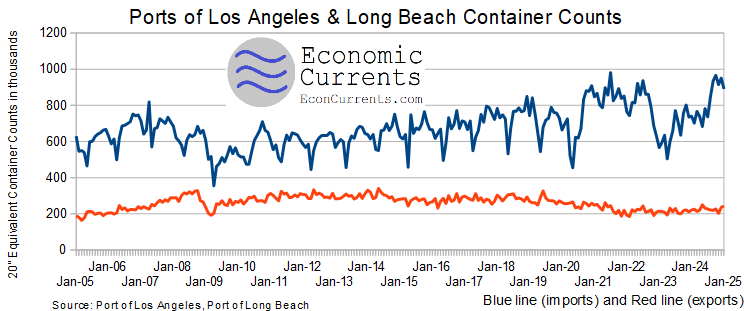

The Ports of Los Angeles and Long Beach are crucial economic drivers for the United States, playing a vital role in international trade and the national economy. These twin ports form the largest trade complex in North America, handling approximately 40% of all U.S. imports – and their data is released significantly earlier than other import data providing an early metric for trade. Loaded 20″ equivalent containers into the ports in November 2024 are up 20% year-over-year whilst exports are up 10% year-over-year. We can estimate that the trade balance will worsen in November 2024.

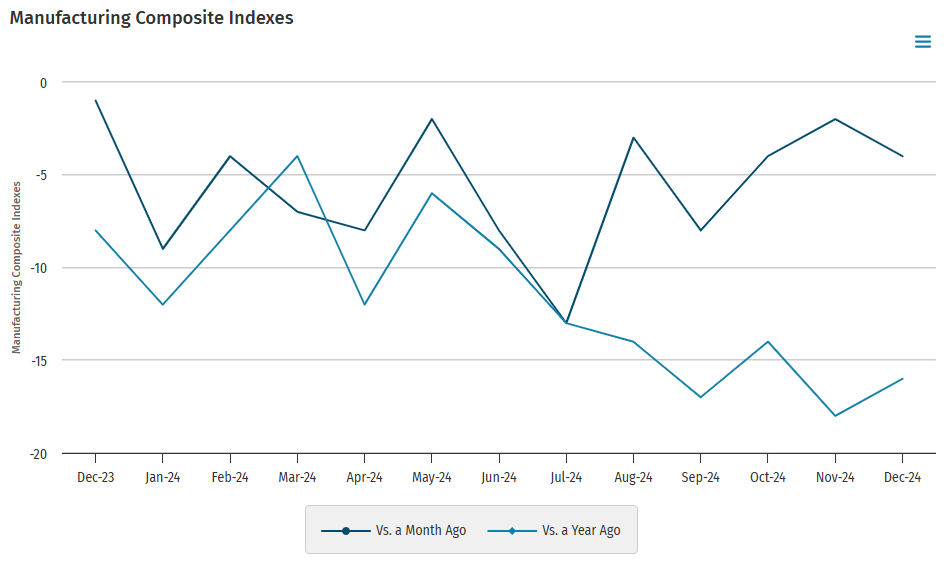

December 2024 Philly Fed Manufacturing Business Outlook Survey shows the current general activity remained negative declining from -5.5 to -16.4 and fell further and the indices for new orders and shipments declined and turned negative. The employment index edged down but continued to suggest increases in employment overall. The prices paid index moved higher, while the prices received index declined; both indices continue to indicate overall increases in prices. Manufacturing in the US remains in a recession.

Kansas City Fed’s manufacturing survey for December 2024 shows manufacturing declined to -4 from a -2 in November (a negative number is a decline from the previous month. Manufacturing in the US remains in a recession.

The third estimate of 3Q2024 Real gross domestic product (GDP) increased 2.7% year-over-year and the implicit price deflator (inflation) was 2.3% year-over-year. There was little change from the second estimate when looking at year-over-year change. In January 2025, we will get our first look at 4Q2024 GDP.

Annual U.S. rent growth registered a 1.7% increase in October 2024, down from the 2.3% year-over-year growth rate seen at the same time last year and marking the lowest rate since June 2020. Prior to 2020, single-family rent growth increased in the range of 2% to 4% for nearly a decade and averaged 3.5%. This decline is good for inflation growth but is not good for investment in rental real estate.

Total existing-home sales improved to 6.1% year-over-year. The median existing-home sales price rose 4.7% from November 2023 to $406,100, the 17th consecutive month of year-over-year price increases. I would expect a few more months of gain but the gain in median home prices will hinder overall sales growth.

In the week ending December 14, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 225,500, an increase of 1,250 from the previous week’s unrevised average of 224,250. Unemployment levels are consistent with an expanding economy.

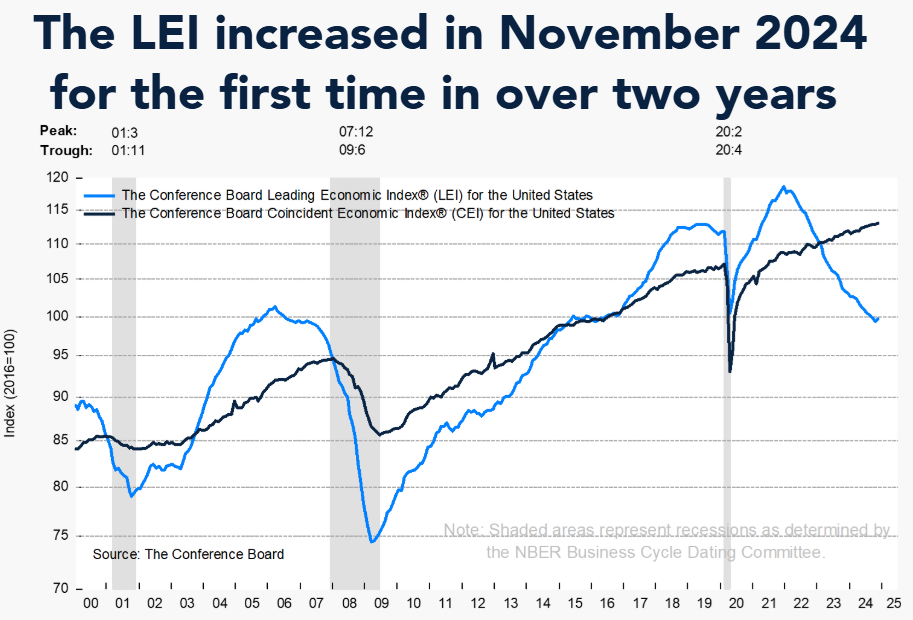

The Conference Board Leading Economic Index® (LEI) for the US increased by 0.3% in November 2024 to 99.7 (2016=100), nearly reversing its 0.4% decline in October. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board view:

The US LEI rose in November for the first time since February 2022. A rebound in building permits, continued support from equities, improvement in average hours worked in manufacturing, and fewer initial unemployment claims boosted the LEI in November. It’s worth noting that gains in building permits were not widespread geographically or by building type; they were concentrated mainly to the Northeast and Midwest, and on buildings with 5+ units rather than single-family dwellings. Overall, the rise in LEI is a positive sign for future economic activity in the US. The Conference Board currently forecasts US GDP to expand by 2.7% in 2024, but growth to slow to 2.0% in 2025.

Here is a summary of headlines we are reading today:

- Precious Metals Prices Mixed Amidst Market Volatility

- North Dakota Crude Output Cut By 520,000 b/d After October Wildfires

- Argentina’s YPF and Shell Strike $50 Billion Deal

- Israel Strikes Yemen Energy Targets in Latest Middle East Flare-Up

- China Connects One of World’s Biggest Solar Projects to the Grid

- Dow ekes out narrow gain to snap 10-day losing streak, its longest in 50 years: Live updates

- House Republicans say they have deal to avert government shutdown

- Tom Lee says ‘back up the truck’ after Wednesday’s panic selling

- Senate expected to hold final vote on bill to change Social Security rules. Here’s what leaders have said

- November home sales surged more than expected, boosted by lower mortgage rates

- Billionaire DOGE Insider Teases Musk’s ‘Really Bold’ Plans To Drain Swamp: ‘A Lot of Stuff Ready For Day One’

- Oil prices settle at lowest in over a week after Fed rattles markets

- Treasury yield curve steepens as 10-, 30-year yields end at almost 7-month highs

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Precious Metals Prices Mixed Amidst Market VolatilityVia Metal Miner The Global Precious Metals MMI (Monthly Metals Index) dropped month-over-month by 7.66%. Precious metals prices showed mixed trends over the past month, shaped by central bank decisions, geopolitical uncertainties and shifts in market demand. While gold and silver continued to rise, platinum and palladium encountered declining momentum. Precious Metals Prices: Palladium Palladium prices have faced downward pressure as the growing popularity of electric vehicles diminishes the need for palladium-based catalytic converters and mining… Read more at: https://oilprice.com/Metals/Commodities/Precious-Metals-Prices-Mixed-Amidst-Market-Volatility.html |

|

North Dakota Crude Output Cut By 520,000 b/d After October WildfiresNorth Dakota, the third-largest producing state in the U.S., saw its crude production fall by 520,000 barrels per day in October after operators shut in wells to protect against wildfire damage. October production declined to 1.178 million barrels per day (bpd), with production yet to return to pre-crisis levels. According to Mark Bohrer, assistant director of the oil and gas division at the North Dakota Department of Mineral Resources, the state’s rig count is currently steady at 37 in December, but could increase to the mid-40s over the next… Read more at: https://oilprice.com/Latest-Energy-News/World-News/North-Dakota-Crude-Output-Cut-By-520000-bd-After-October-Wildfires.html |

|

Will Trump’s Energy Dominance Policy Reshape U.S. Shale Production?Following his election victory in early November, US President-elect Donald Trump has filled key positions in his upcoming administration with figures that he hopes will propel a policy of “energy dominance” for the country. If confirmed by the Senate, the second iteration of the Trump administration will include Chris Wright, the chief executive officer of frac services company Liberty Energy, as Secretary of Energy. In addition, Doug Burgum, the Governor of oil-rich North Dakota, will assume the role of Secretary of the Interior and… Read more at: https://oilprice.com/Energy/Crude-Oil/Will-Trumps-Energy-Dominance-Policy-Reshape-US-Shale-Production.html |

|

Argentina’s YPF and Shell Strike $50 Billion DealArgentina’s YPF has hooked Shell for a $50 billion LNG project that could put the country’s energy game on the global map. Announced Thursday, the deal sees Shell stepping in to kick off the first phase of Argentina LNG, aiming to churn out 10 million metric tons of liquefied natural gas per year. That’s a lot of gas and a big leap for a country that’s been itching to cash in on its vast reserves. The project, drawing from the mammoth Vaca Muerta shale formation—the world’s second-largest unconventional gas reserve—plans… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Argentinas-YPF-and-Shell-Strike-50-Billion-Deal.html |

|

Azerbaijan Demands EU Mission Exit for Armenia Peace TreatyAzerbaijani President Ilham Aliyev’s chief policy adviser, Hikmet Hajiyev, has stated that Baku is demanding the withdrawal of the European Union monitoring mission before a peace treaty can be signed with Armenia. The EU deployed the monitoring mission in early 2023 along the Armenian-Azerbaijani border following an escalation of gunfire exchanges. Subsequently, Azerbaijani forces overran the last Armenian-held areas of the hotly contested Nagorno-Karabakh territory in September 2023, spurring the mass exodus of the Karabakh Armenian… Read more at: https://oilprice.com/Geopolitics/International/Azerbaijan-Demands-EU-Mission-Exit-for-Armenia-Peace-Treaty.html |

|

Venezuela Sends Crude to India in New DealA high-seas oil tango is back on between Venezuela’s state oil company PDVSA and India’s Reliance Industries, rekindling a swap arrangement paused by U.S. sanctions. This revival, greenlit by a U.S. license in July, signals a cautious step forward for both players. But onlookers shouldn’t break out the champagne just yet. Earlier this month, a supertanker brimming with 1.9 million barrels of Venezuela’s Merey heavy crude set sail for India’s Sikka port. In return, Reliance delivered 500,000 barrels of heavy naphtha to PDVSA—a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Venezuela-Sends-Crude-to-India-in-New-Deal.html |

|

Tanker Ships Set Sail for Greener Future with Wind-Powered TechnologyEver seen a massive tanker ship…with wind sails? You might soon. That’s because the Sohar Max, a 400,000-deadweight-ton vessel, was just retrofitted with five 35-meter rotor sails at China’s COSCO Zhoushan shipyard, according to Bloomberg. The purpose is to reduce fuel use by 6% and cut annual carbon emissions by 3,000 tons. Bloomberg reported that the shipping industry already faces regulatory pressure to reduce emissions. Rotor sails remain uncommon, and the adoption of wind technologies hinges on cost savings. Their appeal may grow as… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Tanker-Ships-Set-Sail-for-Greener-Future-with-Wind-Powered-Technology.html |

|

Industry Pushes Back on LNG Export PauseIndustry groups are doubling down on calls for the U.S. Administration to lift the pause on LNG export permits, a day after Biden’s Department of Energy urged caution in approvals and a month ahead of the inauguration of President-elect Donald Trump. The DOE study on the energy, economic, and environmental impact of U.S. LNG exports comes nearly a year after the Biden Administration halted in January all pending decisions on U.S. LNG export projects until the Department of Energy can update the underlying analyses for authorizations.… Read more at: https://oilprice.com/Energy/Natural-Gas/Industry-Pushes-Back-on-LNG-Export-Pause.html |

|

Israel Strikes Yemen Energy Targets in Latest Middle East Flare-UpIsrael carried out airstrikes on a port city and energy infrastructure in Yemen on Thursday after a missile targeting central Israel was shot by the Iran-aligned Houthi rebels in Yemen. The Israeli airstrikes killed at least nine people, local officials told AP, after Israel targeted with fighter jets the port city of Hodeida, the Salif port, and the oil terminal Ras Isa on the Red Sea. Another wave of Israeli strikes targeted energy infrastructure in the Houthi-controlled capital of Yemen, Sanaa. The Iran-aligned Houthis have been targeting Israel… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Israel-Strikes-Yemen-Energy-Targets-in-Latest-Middle-East-Flare-Up.html |

|

Biden Pledges 61% Emissions Cut by 2035 Ahead of Trump PresidencyA month ahead of President-elect Donald Trump’s return to the White House, the Biden Administration on Thursday set a bold new target of reducing net greenhouse emissions by between 61% and 66% below 2005 levels by 2035. The so-called U.S. Nationally Determined Contribution (NDC) is a pledge under the Paris Agreement, from which Trump could withdraw, again, as he did in his first term in office. Trump is expected to undo a lot of the climate policies of President Biden, and the Paris Agreement and many current policies to cut emissions are… Read more at: https://oilprice.com/Energy/Energy-General/Biden-Pledges-61-Emissions-Cut-by-2035-Ahead-of-Trump-Presidency.html |

|

Chevron and Woodside Reshuffle Australia LNG Portfolios With Asset SwapU.S. supermajor Chevron and Australia’s energy group Woodside have agreed to an asset swap deal that will allow them to focus on their operated LNG assets in Australia. Under the agreement the companies announced on Thursday, Chevron Australia Pty Ltd will transfer to Woodside its 16.67% non-operated interest in the North West Shelf (NWS) Project, NWS Oil Project, and its 20% non-operated interest in the Angel Carbon Capture and Storage (CCS) Project. At the same time, Chevron Australia will obtain Woodside’s 13% non-operated interest… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-and-Woodside-Reshuffle-Australia-LNG-Portfolios-With-Asset-Swap.html |

|

Cold Snap Exposes Iran’s Energy Infrastructure WoesDespite sitting atop the world’s second-largest natural gas reserves, energy shortages have become a feature of winters in Iran. Iran grapples with air pollution all year, but air quality significantly worsens during winter when power plants are forced to burn low-quality heavy fuel oil — mazut — to compensate for the lack of gas. A rare cold snap in recent weeks has exposed the extent of Iran’s struggles to meet the rising demand for gas, with school classes forced to go online and government offices ordered shut to conserve energy. Highlighting… Read more at: https://oilprice.com/Energy/Energy-General/Cold-Snap-Exposes-Irans-Energy-Infrastructure-Woes.html |

|

China Connects One of World’s Biggest Solar Projects to the GridChina has connected one of the world’s largest solar power projects by capacity to the grid as the country continues to boost renewable energy installations. The Ruoqiang PV project is a giant 4-gigawatt (GW) solar project in the southeastern part of the Taklamakan Desert, developed and operated by China Green Electricity Investment. The project was connected to the grid this week, Chinese media report. The capacity of Ruoqiang PV is so massive that it is equal to the entire installed solar capacity in Canada, according to data from BloombergNEF… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Connects-One-of-Worlds-Biggest-Solar-Projects-to-the-Grid.html |

|

EU and Zelensky Discuss Ukraine Natural Gas TransitEuropean Union leaders are discussing with Ukrainian President Volodymyr Zelensky the transit of Russian natural gas to the EU via Ukraine as the end of the current transit deal expires on December 31. The EU leaders and Zelensky are meeting in Brussels to negotiate alternatives to Russian gas deliveries. The gas transit deal for Russian flows to Europe via Ukraine expires on December 31, 2024. Ukraine has said multiple times that it would not pursue talks about renewing the agreement with Russia. The EU officials and the Ukrainian president are… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-and-Zelensky-Discuss-Ukraine-Natural-Gas-Transit.html |

|

BP and Iraq Agree Technical Terms for Redeveloping Kirkuk Oil FieldsBP and the federal government of Iraq have agreed on the key technical terms in the plan to redevelop the oil and gas fields in Kirkuk which still hold billions of barrels of recoverable oil remaining in place. BP and the Iraqi government signed a preliminary deal on the technical terms, which is a step forward to a fully termed contract, Bloomberg quoted BP Executive Vice President William Lin as saying in a statement on Thursday. The UK-based supermajor and Iraq expect to complete negotiations by early next year, according to BP. “We are… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-and-Iraq-Agree-Technical-Terms-for-Redeveloping-Kirkuk-Oil-Fields.html |

|

Dow ekes out narrow gain to snap 10-day losing streak, its longest in 50 years: Live updatesThe Dow managed a slim gain on Thursday, ending a 10-day losing run. Read more at: https://www.cnbc.com/2024/12/18/stock-market-today-live-updates.html |

|

House Republicans say they have deal to avert government shutdownHouse Republicans fell into chaos after President-elect Donald Trump and Elon Musk panned a bipartisan deal which would have averted a government shutdown. Read more at: https://www.cnbc.com/2024/12/19/house-republicans-say-they-have-deal-to-avert-government-shutdown.html |

|

Micron shares suffer steepest drop since 2020 after disappointing guidanceMicron’s stock plummeted Thursday following the company’s earnings report and its weaker-than-expected guidance for the second quarter. Read more at: https://www.cnbc.com/2024/12/19/micron-headed-for-worst-day-since-2020-after-disappointing-guidance.html |

|

Amazon workers strike across seven facilities at peak of holiday shopping seasonAmazon workers at seven facilities in New York, Georgia, California and Illinois went on strike Thursday. Read more at: https://www.cnbc.com/2024/12/19/amazon-workers-strike-across-seven-facilities-during-holiday-shopping.html |

|

Tom Lee says ‘back up the truck’ after Wednesday’s panic sellingIn a Wednesday note, Fundstrat Global Advisors’ Tom Lee predicted the ‘panicked reaction’ would prove ‘short lived.’ Read more at: https://www.cnbc.com/2024/12/19/tom-lee-says-back-up-the-truck-after-wednesdays-panic-selling.html |

|

Luigi Mangione hit with federal murder, stalking charges in UnitedHealthcare CEO killingLuigi Mangione is charged with first-degree murder and other counts in the fatal shooting of UnitedHealthcare CEO Brian Thompson in New York. Read more at: https://www.cnbc.com/2024/12/19/luigi-mangione-extradition-unitedhealthcare-ceo-murder-.html |

|

Nike will report earnings after the bell. Here’s what Wall Street expectsNike will report its first quarterly earnings since its new CEO, Elliott Hill, took the helm of the company in October. Read more at: https://www.cnbc.com/2024/12/19/nike-nke-earnings-q2-2025.html |

|

Senate expected to hold final vote on bill to change Social Security rules. Here’s what leaders have saidAs the Senate wraps up its final legislative days for the year, it is expected to vote on a bill affecting Social Security benefits for about 3 million people. Read more at: https://www.cnbc.com/2024/12/19/senate-to-hold-final-vote-on-social-security-bill-what-leaders-are-saying.html |

|

Bitcoin falls below $100K after Fed signals fewer rate cuts in 2025: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, SEC Commissioner Hester Peirce discusses the agency’s role in crypto under the incoming leadership, as well as where some of the enforcement actions against crypto firms may stand. Read more at: https://www.cnbc.com/video/2024/12/19/bitcoin-falls-below-100k-after-fed-signals-fewer-rate-cuts-in-2025-cnbc-crypto-world.html |

|

November home sales surged more than expected, boosted by lower mortgage ratesSales of previously owned homes rose 4.8% in November compared with October, according to the National Association of Realtors Read more at: https://www.cnbc.com/2024/12/19/november-home-sales-surged-more-than-expected.html |

|

What the top 75 college sports programs are worthThe top of the list is dominated by SEC and Big Ten schools, due largely to each conference’s massive media rights deals. Read more at: https://www.cnbc.com/2024/12/19/college-sports-programs-valuations.html |

|

Trump calls for abolishing the debt ceilingIn a phone interview with NBC News, Trump said getting rid of the debt ceiling entirely would be the “smartest thing it [Congress] could do. I would support that entirely.” Read more at: https://www.cnbc.com/2024/12/19/trump-calls-for-abolishing-the-debt-ceiling.html |

|

“There Is An Agreement”: Johnson To Whip Out Latest Attempt To Avert Friday ShutdownUpdate (1350ET): Republican lawmakers have reportedly struck a new short-term deal to keep the lights on in Washington, according to Politico, citing two GOP lawmakers meeting in Speaker Mike Johnson’s office Thursday afternoon.

“There is an agreement,” said Rep. Stephanie Bice (R-OK). “The plan is to put a bill on the floor that we think is a reasonable step forward.” Rep. Tom Cole (R-OK), who was also in Johnson’s office, didn’t say whether congressional Democrats or the White House had agreed to it. Late Wednesday afternoon, President-elect Trump demanded Johnson abandon the previous revision he’d worked out with Democratic congressional leaders. * * * ‘With Friday’s government shutdown looming – and odds spiking after everyone figured out that the 1,547-page Continuing Resolution (CR) was full of Read more at: https://www.zerohedge.com/political/johnson-meets-trump-team-throw-federal-funding-hail-mary |

|

Intel Shortlists Suitors For Chip Division Altera Amid Turnaround EffortsAbout a month after Bloomberg reported that Lattice Semiconductor had offered to purchase Intel’s Altera, the financial media outlet revealed that several private equity firms had also entered the bidding game for the company, which specializes in designing low-power programmable chips. Sources told Bloomberg that Francisco Partners and Silver Lake Management have joined Lattice in a second bidding round for Altera. Additionally, Apollo Global Management and Bain Capital are considered potential suitors.

The people said Lattice and the PE firms have until the end of January to formalize their offers, adding other PE firms could enter the mix, or the process could end with no sale. More from Bloomberg:

|

|

Ron Paul: Trump Is Right, What Are We Doing In Syria?Authored by Ron Paul via The Mises Institute, My first reaction to news earlier this month that the Syrian government had been overthrown was, how much did we have to do with it; how involved was the CIA; and how much is it going to cost.

As with Saddam and Gaddafi before him, we know that Assad was no libertarian hero. But unleashing an army dedicated to establishing an Islamic state in once-secular Syria hardly seems like a good idea to me. As with President George W. Bush’s “Mission Accomplished” moment after Saddam’s overthrow, getting rid of Assad will prove to be the easy part. Rebuilding Syrian society after the destruction of the country will cost billions and will likely be about as successful as our “liberation” of Libya, which is still a failed, terrorist-dominated state more than a decade later. In 2017 the Los Angeles Times published an article that, sadly, speaks volumes about the i … Read more at: https://www.zerohedge.com/geopolitical/ron-paul-trump-right-what-are-we-doing-syria |

|

Billionaire DOGE Insider Teases Musk’s ‘Really Bold’ Plans To Drain Swamp: ‘A Lot of Stuff Ready For Day One’Billionaire entrepreneur and investor Joe Lonsdale expressed strong optimism for the Department of Government Efficiency (DOGE) initiative during his appearance on the Shawn Ryan Show. The Palantir co-founder highlighted the “very bold” reforms being planned by co-heads Elon Musk and Vivek Ramaswamy, revealing that the DOGE team is already hard at work on strategic priorities. With over 100 people on board, the team is preparing to enact immediate changes, including staff removals and regulatory rollbacks. SHAWN RYAN: We’re both pretty fired up about the [Trump administration]. Who are you most excited about? Do you have anybody in particular? JOE LONSDALE: I’m most excited about Elon, Vivek and the DOGE effort because this is something I’ve wanted to see for forever. I’m probably like one of the only guys in tech that’s done a lot in policy on the right, on the small government side for the last 10-20 years, and it’s like the world just shifted this way—like the vibe shift is exactly in line with stuff I’ve been thinking and talking about for a decade. I’m so excited about this. SHAWN RYAN: How fast do you think they’re … Read more at: https://www.zerohedge.com/political/billionaire-doge-insider-teases-musks-really-bold-plans-drain-swamp-lot-stuff-ready-day |

|

Interest rates held as Bank says economy doing worseThe Bank considered a rate cut as it thinks the economy has performed worse than it expected. Read more at: https://www.bbc.com/news/articles/cd75yq1zlzqo |

|

Post Office spent £132m defending itself at inquiryThe money relates to legal costs for the inquiry into the wrongful conviction of sub-postmasters. Read more at: https://www.bbc.com/news/articles/cewxn8e8x21o |

|

Amazon hit by ‘strike’ during holiday season scrambleOne of America’s most powerful labour unions is staging a protest against the e-commerce giant. Read more at: https://www.bbc.com/news/articles/cy8yrgezmp5o |

|

Concord Enviro offers exposure to high potential water treatment sectorConcord Enviro, a water and wastewater management solutions provider, is launching an IPO to raise Rs 500 crore. The company has a strong international presence and a growing order book. However, its financial performance has been inconsistent. Investors should carefully assess the company’s future prospects before making an investment decision. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/concord-enviro-offers-exposure-to-high-potential-water-treatment-sector/articleshow/116477199.cms |

|

Inventurus Knowledge Solutions block deal: Norges Bank buys 34 lakh shares worth Rs 652 croreNorges Bank, on behalf of the Government Pension Fund Global, acquired 16.59 lakh and 17.50 lakh shares of Inventurus Knowledge Solutions at Rs 1,923.92 and Rs 1,899.67 per share, respectively. IKS stock debuted at Rs 1,900, a 43% premium to its issue price of Rs 1,329, and closed at Rs 2,030 on Thursday, up 6.84% or Rs 130 over the listing price. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/inventurus-knowledge-solutions-block-deal-norges-bank-buys-34-lakh-shares-worth-rs-652-crore/articleshow/116477345.cms |

|

Blackstone-backed Ventive Hospitality raises Rs 719 cr from 26 anchor investorsVentive Hospitality, a luxury hospitality asset owner, has raised over Rs 719 crore from 26 anchor investors ahead of its IPO. The anchor book was oversubscribed 2X, with significant participation from mutual funds, insurance companies, and sovereign funds. The IPO opens on Friday. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/blackstone-backed-ventive-hospitality-raises-rs-719-cr-from-26-anchor-investors/articleshow/116478775.cms |

|

Oil prices settle at lowest in over a week after Fed rattles marketsOil futures declined on Thursday, pulling prices for U.S. and global crude benchmarks to their lowest settlement in over a week, a day after the Federal Reserve signaled it would go much slower in cutting interest rates next year. Read more at: https://www.marketwatch.com/story/oil-prices-edge-lower-after-fed-rattles-markets-3ec7d431?mod=mw_rss_topstories |

|

Treasury yield curve steepens as 10-, 30-year yields end at almost 7-month highsYields on long-dated U.S. government debt jumped on Thursday to their highest levels since late May as traders factored in the prospects of higher-for-longer interest rates, inflation risks, continued economic strength and the impacts of incoming President Donald Trump’s policies. Read more at: https://www.marketwatch.com/story/treasury-yields-mixed-after-huge-spike-morgan-stanley-says-january-fed-rate-cut-still-possible-8ee73487?mod=mw_rss_topstories |

|

Traders brace for volatility with a record $6.6 trillion in options due to expire in Friday’s ‘triple witching’It’s “triple-witching” time again, and Friday’s expiration promises to be the biggest ever, with options tied to more than $6 trillion in stocks, ETFs and indexes set to expire. Read more at: https://www.marketwatch.com/story/traders-brace-for-volatility-with-a-record-6-6-trillion-in-options-due-to-expire-in-fridays-triple-witching-44613b9f?mod=mw_rss_topstories |