Summary Of the Markets Today:

- The Dow closed down 1,123 points or 2.58%,

- Nasdaq closed down 716 points or 3.56%,

- S&P 500 closed down 179 points or 2.95%,

- Gold $2,608 down $54.70 or 2.09%,

- WTI crude oil settled at $70 down $0.09 or 0.13%,

- 10-year U.S. Treasury 4.506 up 0.121 points or 2.759%,

- USD index $108.08 down $1.13 or 1.05%,

- Bitcoin $100,753 up $5,400 or 5.36%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Market Summary

The Federal Reserve cut interest rates by 25 basis points on Wednesday, but stocks plummeted as the Fed signaled fewer rate cuts for 2025 than previously anticipated. All three major indices reversed earlier gains and closed with significant losses. The Fed’s updated projections now indicate only two interest rate cuts for 2025, down from the four cuts projected in September. This change reflects higher inflation readings and expectations of elevated inflation in the future. Fed Chair Jerome Powell stated that caution would be exercised in considering further cuts as long as the economy and labor market remain solid. The decision wasn’t unanimous, with Cleveland Fed president Beth Hammack objecting to the rate cut. In response to the Fed’s announcement: The 10-year Treasury yield rose nearly 11 basis points, approaching 4.5%. Rate-sensitive sectors experienced significant sell-offs, with the Russell 2000 index falling about 4%. The Real Estate sector in the S&P 500 also declined by almost 4%.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Federal Reserve has cut its benchmark interest rate by 0.25 percentage points, lowering the target range for the federal funds rate to 4-1/4 to 4-1/2 percent as expected. This marks the third consecutive rate cut in 2024, following reductions in September and November. The Fed’s statement notes that while job gains have moderated and the unemployment rate has increased slightly, it remains low overall. Inflation has eased over the past year but is still somewhat elevated, with recent months showing little progress towards the Fed’s 2% target. It’s worth noting that one member, Beth M. Hammack, voted against the rate cut, preferring to maintain the previous target range of 4-1/2 to 4-3/4 percent. This dissent reflects the ongoing uncertainty in the economic outlook and the careful balance the Fed must strike in its policy decisions. The following is the economic projections of Federal Reserve Board members and Federal Reserve Bank presidents. In the press conference following the FOMC meeting, Federal Reserve Chair Jerome Powell has indicated that the Fed will likely approach future interest rate cuts cautiously and gradually. He stated that the economy’s current strength allows policymakers to make decisions with caution, emphasizing that there is no need to rush into lowering rates. He suggested that inflation might hover slightly above the target in the near future, but expects it to decrease further, albeit potentially following an uneven course. The Fed Chair has also emphasized that the central bank can afford to be “a little more cautious” regarding the pace of easing, given the strong economic conditions.

| Variable | Median | Central Tendency | Range | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2024 | 2025 | Longer run | 2024 | 2025 | Longer run | 2024 | 2025 | Longer run | |

| Memo: Projected appropriate policy path | |||||||||

| Change in real GDP | 2.5 | 2.1 | 1.8 | 2.4-2.5 | 1.8-2.2 | 1.7-2.0 | 2.3-2.7 | 1.6-2.5 | 1.7-2.5 |

| September projection | 2.0 | 2.0 | 1.8 | 1.9-2.1 | 1.8-2.2 | 1.7-2.0 | 1.8-2.6 | 1.3-2.5 | 1.7-2.5 |

| Unemployment rate | 4.2 | 4.3 | 4.2 | 4.2 | 4.2-4.5 | 3.9-4.3 | 4.2 | 4.2-4.5 | 3.5-4.5 |

| September projection | 4.4 | 4.4 | 4.2 | 4.3-4.4 | 4.2-4.5 | 3.9-4.3 | 4.2-4.5 | 4.2-4.7 | 3.5-4.5 |

| PCE inflation | 2.4 | 2.5 | 2.0 | 2.4-2.5 | 2.3-2.6 | 2.0 | 2.4-2.7 | 2.1-2.9 | 2.0 |

| September projection | 2.3 | 2.1 | 2.0 | 2.2-2.4 | 2.1-2.2 | 2.0 | 2.1-2.7 | 2.1-2.4 | 2.0 |

| Core PCE inflation4 | 2.8 | 2.5 | 2.8-2.9 | 2.5-2.7 | 2.8-2.9 | 2.1-3.2 | |||

| September projection | 2.6 | 2.2 | 2.6-2.7 | 2.1-2.3 | 2.4-2.9 | 2.1-2.5 | |||

| Federal funds rate | 4.4 | 3.9 | 3.0 | 4.4-4.6 | 3.6-4.1 | 2.8-3.6 | 4.4-4.6 | 3.1-4.4 | 2.4-3.9 |

| September projection | 4.4 | 3.4 | 2.9 | 4.4-4.6 | 3.1-3.6 | 2.5-3.5 | 4.1-4.9 | 2.9-4.1 | 2.4-3.8 |

Investor activity in the U.S. housing market is often associated with deep-pocketed institutional buyers. While institutional investors tend to dominate headlines, they account for only a small fraction of total investor activity. Most real estate investors are mom-and-pop landlords, who own three to 10 properties. The number of purchases that investors are making is declining.

Privately-owned housing units authorized by building permits in November 2024 is 0.2% below November 2023. Privately-owned housing starts is 14.6% below November 2023.

Privately-owned housing completions is 9.2% above November 2023. It is interesting that the number of completed housing units remains historically high with 481,000 new homes for sale in the representing about 9.5 months of supply at the current sales rate. Bottom line there are too many new homes being completed.

Here is a summary of headlines we are reading today:

- Copper Prices End 2024 Higher Despite Bearish Outlook

- EPA Approves California Ban Of Fossil-Fueled Cars Starting 2035

- Barclays Downgrades Energy Services Sector Amid Bearish Outlook

- EIA Confirms Smaller Than Expected Crude Inventory Draw

- World’s Coal Demand at Record High in 2024, IEA Says

- Revolutionary Guards Tighten Grip on Iran’s Oil Exports

- Dow tanks by 1,100 points, posts first 10-day losing streak since 1974: Live updates

- Fed cuts by a quarter point, indicates fewer reductions ahead

- Why Americans are outraged over health insurance — and what could change

- Bitcoin falls as Fed lowers rates by a quarter point in its final 2024 decision: CNBC Crypto World

- U.S. Supreme Court agrees to hear challenge to TikTok ban

- The Fed cut interest rates by another 25 basis points—here’s what will get cheaper

- Watch Live: Fed Chair Powell Explains Why He Cut Rates Again As Inflation Data Surges

- Long-dated Treasury yields end at nearly 7-month highs after Fed projects fewer rate cuts in 2025

- A Honda-Nissan merger would be a sign of things to come in auto industry, analyst says

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Copper Prices End 2024 Higher Despite Bearish OutlookVia Metal Miner Overall, the Copper Monthly Metals Index (MMI) remained bearish, with a 4.65% decline from November to December. Copper Prices to Close 2024 Up, But the Outlook is Down Often a bellwether for the global economy, the price of copper became a bellwether for market emotionality throughout 2024. Despite lackluster demand conditions, copper prices embarked on a volatile year, which had knock-on effects for the entire base metal category. Comex Copper Prices, Source: MetalMiner Insights Q1 2024 saw a rather auspicious start. Many believed… Read more at: https://oilprice.com/Metals/Commodities/Copper-Prices-End-2024-Higher-Despite-Bearish-Outlook.html |

|

UK’s Energy Transmission Gets a £35 Billion BoostNational Grid plans to nearly double the amount of energy it can transport across the country via an unprecedented £35bn investment over the next five years into its electricity transmission business. The grid operator on Wednesday said its business plan, which covers the period April 2026 to March 2031, would be the “most significant step forward in the UK’s transmission network for a generation.” “Through it we will nearly double the amount of energy that can be transported around the country, support the electrification… Read more at: https://oilprice.com/Energy/Energy-General/UKs-Energy-Transmission-Gets-a-35-Billion-Boost.html |

|

Oil Spill Devastates Russian Coastline After Tanker AccidentDozens of kilometers of Black Sea coastline in Russia’s Krasnodar region have been covered in heavy fuel oil, local authorities and residents reported on December 17, after two oil tankers were heavily damaged during a storm in the Kerch Strait. Regional Governor Veniamin Kondratyev said cleanup crews were being dispatched to the area as high winds helped spread large amounts of spilled oil along the coastline, raising concerns of an impending environmental disaster in the Black Sea. Social media photos and video showed wildlife covered in dark… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Spill-Devastates-Russian-Coastline-After-Tanker-Accident.html |

|

Nigeria Approves Shell’s $2.4 Billion Asset SaleNigeria’s oil minister has finally approved Shell Plc’s (NYSE:SHEL) sale of $2.4 billion in assets to Renaissance Group, Renaissance has revealed. The greenlight comes just two months after Africa’s biggest crude producer declined to approve the sale of Shell’s onshore and shallow-water oil and gas in the Niger Delta region to a consortium of local companies. The rejection marked a setback for Shell, which has sought to exit the West African oil sector that’s currently plagued by significant oil spills and theft. The Nigerian assets… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Approves-Shells-24-Billion-Asset-Sale.html |

|

Will Trump’s Second Term Bring Lasting Peace to the Red Sea?Yemen’s Houthi rebels have sparked turmoil across the Southern Red Sea and Gulf of Aden for over a year, targeting Western-linked container ships, tankers, and military vessels. The resulting supply chain snarls have had major implications on global trade, causing a surge in container rate prices and shipping diversions around the Cape of Good Hope. However, early indications suggest that President-elect Trump’s strongman image could help de-escalate tensions and alleviate bottlenecks across this critical maritime chokepoint. The incoming… Read more at: https://oilprice.com/Energy/Crude-Oil/Will-Trumps-Second-Term-Bring-Lasting-Peace-to-the-Red-Sea.html |

|

EPA Approves California Ban Of Fossil-Fueled Cars Starting 2035The Environmental Protection Agency (EPA) has approved California’s bid to enforce a rule to end sales of new gasoline-powered vehicles in the state by 2035. California Gov. Gavin Newsom has applauded the decision, saying it will improve public health by slashing harmful air pollution as residents adopt cleaner electric or hybrid vehicles. “Clean cars are here to stay,” Newsom said in a written statement. “Automakers have made it clear they stand with California and consumers as we move toward clean cars that save money.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EPA-Approves-California-Ban-Of-Fossil-Fueled-Cars-Starting-2035.html |

|

China’s Push for 7% Growth Faces Big ChallengesAmid ongoing domestic and international concern over the scale and sustainability of China’s economic rebound from its Covid years, Beijing announced on 9 December that it will adopt an “appropriately loose” monetary policy next year, the first such easing in 14 years, and a more proactive fiscal policy to boost economic growth. Although the measures already put into place earlier this year should enable China to achieve its growth target of “around 5%” for 2024, these new measures are aimed at recapturing the 7%+… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Push-for-7-Growth-Faces-Big-Challenges.html |

|

Barclays Downgrades Energy Services Sector Amid Bearish OutlookAnalysts at Barclays have downgraded the energy services sector on Wednesday, giving it a Neutral rating from Positive amid a bearish oil macro environment. The analysts have highlighted the absence of investor capital influx into the sector despite stable service and equipment markets and disciplined pricing, and see a potential risk for another cut to 2025 earnings. After posting three years of double-digit growth, the energy services sector is now facing a mid-cycle plateau in spending. “It’s very difficult to see any of the “beta-driven”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Barclays-Downgrades-Energy-Services-Sector-Amid-Bearish-Outlook.html |

|

EIA Confirms Smaller Than Expected Crude Inventory DrawCrude oil prices ticked higher today after the U.S. Energy Information Administration reported an inventory decline of 900,000 barrels for the week to December 13. The number compares with an inventory draw of 4.7 million barrels estimated by the American Petroleum Institute for the same week on Tuesday. A week ago, the EIA estimated a crude oil inventory draw of a much more moderate 1.4 million barrels, coupled with sizable builds in fuel stocks that dampened the potential bullish effect of the crude inventory move. For the week to December 13,… Read more at: https://oilprice.com/Energy/Crude-Oil/EIA-Confirms-Smaller-Than-Expected-Crude-Inventory-Draw.html |

|

Saudi Crude Oil Exports Jumped to Three-Month High in OctoberSaudi Arabia’s crude oil exports rose to a three-month high in October, the latest data from the Joint Organizations Data Initiative (JODI) showed on Wednesday. Saudi Arabia, the world’s largest crude oil exporter, shipped 5.92 million bpd of crude to customers in October, up by 174,000 bpd compared to September. This was the highest average export volume from Saudi Arabia for three months, according to the JODI database which compiles self-reported figures from individual countries. Meanwhile, Saudi Arabia continues to stick to its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Crude-Oil-Exports-Jumped-to-Three-Month-High-in-October.html |

|

Germany’s Natural Gas Consumption Rose by 3.3% in 2024Germany’s natural gas demand rose by 3.3% in 2024, due to lower prices compared to last year, preliminary estimates by the association of the German utilities, BDEW, showed on Wednesday. Despite subdued economic growth, the German industry raised its natural gas consumption this year from very low levels seen in 2023, the industry group said. Natural gas sales to the industry rose by 5.8% in 2024 from a year earlier, and sales for gas-fired power generation increased by 1.9%, BDEW said. Norway, Western Europe’s top oil and gas producer,… Read more at: https://oilprice.com/Energy/Energy-General/Germanys-Natural-Gas-Consumption-Rose-by-33-in-2024.html |

|

World’s Coal Demand at Record High in 2024, IEA SaysGlobal coal demand has surged to another record high this year, the International Energy Agency (IEA) said on Wednesday, expecting the world’s coal consumption to level off through 2027. The year 2024 saw another all-time high consumption of coal globally, beating the previous record set last year, the IEA said in its Coal 2024 report with analysis and forecast to 2027. Last year, coal demand grew by 2.6% to hit an all-time high, the IEA said in a July overview of the coal markets. Back then, the agency expected coal demand for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Worlds-Coal-Demand-at-Record-High-in-2024-IEA-Says.html |

|

Fitch Sees Oil at $70 in 2025 on Moderating Demand GrowthOil demand growth next year is likely to be in line with this year’s tepid increase and the slower pace of growth compared to 2022 and 2023 would result in oil prices averaging $70 per barrel in 2025, Fitch Ratings said on Wednesday. This year, oil prices have averaged about $80 per barrel. “Fitch expects oil prices to decrease to USD70/bbl in 2025 from an average of USD80/bbl in 2024, due to moderating demand growth and higher production from non-OPEC+ countries, leading to oversupply,” the rating agency said in a report. Geopolitical… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fitch-Sees-Oil-at-70-in-2025-on-Moderating-Demand-Growth.html |

|

Revolutionary Guards Tighten Grip on Iran’s Oil ExportsThe Islamic Revolutionary Guard Corps (IRGC), Iran’s most powerful armed force defending the regime, has increased their influence over Iranian oil exports and is estimated to control half of these, Western officials and Iranian insiders have told Reuters. Despite U.S. sanctions on the Iranian oil industry and exports, the Islamic Republic continues to export an estimated more than 1 million barrels per day (bpd) of oil, mostly to China. During his first term in office, U.S. President-elect Donald Trump tore up the so-called Iran nuclear… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Revolutionary-Guards-Tighten-Grip-on-Irans-Oil-Exports.html |

|

Ineos Energy Warns UK Windfall Tax Makes North Sea Investment ImpossibleThe UK windfall tax on North Sea oil and gas operators has made economics in the basin impossible for companies to invest, according to Brian Gilvary, the chairman of Ineos Energy. “In our initial strategy we wanted to expand in the UK, particularly gas. And what has happened is that the tax regime makes that impossible,” Gilvary told the Financial Times, commenting on the prospects of the oil and gas arm that UK-based chemicals group Ineos created four years ago. The UK windfall tax, which was initially introduced by the previous Conservative… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ineos-Energy-Warns-UK-Windfall-Tax-Makes-North-Sea-Investment-Impossible.html |

|

Dow tanks by 1,100 points, posts first 10-day losing streak since 1974: Live updatesThe Federal Reserve lowered the overnight borrowing rate by a quarter point on Wednesday, but its rate outlook rocked the market. Read more at: https://www.cnbc.com/2024/12/17/stock-market-today-live-updates.html |

|

Fed cuts by a quarter point, indicates fewer reductions aheadThe Federal Reserve on Wednesday announced its decision on interest rates. Read more at: https://www.cnbc.com/2024/12/18/fed-rate-decision-december-2024-.html |

|

10-year Treasury yield leaps to 4.5% as Fed signals caution on future rate cutsThe Fed cut rates by a quarter point at its final 2024 policy meeting. Read more at: https://www.cnbc.com/2024/12/18/us-treasurys-fed-rate-decision-time-nears.html |

|

Here’s what a blockbuster Nissan-Honda merger could mean for the auto industryNissan and Honda are understood to be exploring a blockbuster merger as the two rival companies seek to stay competitive on the road to full electrification. Read more at: https://www.cnbc.com/2024/12/18/what-a-potential-nissan-honda-merger-could-mean-for-the-auto-industry.html |

|

This chip play is up nearly 40% in December, and its dividend is growingThis semiconductor stock offers investors a combination of capital appreciation, income and dividend growth – and it’s having a hot month. Read more at: https://www.cnbc.com/2024/12/18/one-chip-play-is-up-40percent-in-december-and-its-dividend-is-growing.html |

|

Why Americans are outraged over health insurance — and what could changeThe shooting of Brian Thompson has unleashed a torrent pent-up of anger towards insurers, renewed calls for reform and reignited a debate over U.S. health care Read more at: https://www.cnbc.com/2024/12/18/unitedhealthcare-ceo-killing-why-health-insurance-upsets-americans.html |

|

Bitcoin falls as Fed lowers rates by a quarter point in its final 2024 decision: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. In today’s show, Arkansas Representative French Hill, who was selected as the incoming Financial Services Committee chair, discusses his crypto lawmaking priorities for 2025. Read more at: https://www.cnbc.com/video/2024/12/18/bitcoin-falls-fed-lowers-rates-by-quarter-point-final-2024-decision-crypto-world.html |

|

OpenAI makes ChatGPT available for phone calls and textsOpenAI on Wednesday rolled out a new way to talk to its viral chatbot: 1-800-CHATGPT. Read more at: https://www.cnbc.com/2024/12/18/openai-makes-chatgpt-available-for-phone-chats.html |

|

U.S. Supreme Court agrees to hear challenge to TikTok banPresident-elect Donald Trump has said, “I have a warm spot in my heart for TikTok,” and said that he will look at the potential ban of the social media app. Read more at: https://www.cnbc.com/2024/12/18/tiktok-ban-supreme-court-will-hear-arguments.html |

|

Merck to develop weight loss pill from Chinese drugmaker in up to $2 billion licensing dealMerck will pay Hansoh $112 million upfront for rights to the drug, with the potential for an additional $1.9 billion in payments and royalties on sales. Read more at: https://www.cnbc.com/2024/12/18/merck-weight-loss-pill-licensing-deal-hansoh-pharma.html |

|

The Federal Reserve cuts interest rates by another quarter point. Here’s what that means for youThe central bank has now shaved a full percentage off its benchmark rate since September. Here’s what it means for your borrowing costs. Read more at: https://www.cnbc.com/2024/12/18/the-fed-cut-rates-by-another-quarter-point-what-that-means-for-you.html |

|

The Fed cut interest rates by another 25 basis points—here’s what will get cheaperThe Fed has cut its benchmark interest rate by 1% since September, making borrowing cheaper for credit cards, loans and auto financing. Read more at: https://www.cnbc.com/2024/12/18/fed-cuts-interest-rates-by-25-basis-points-what-will-get-cheaper.html |

|

Paying down debt is Americans’ top financial goal for 2025. Here are some tips that can helpMore Americans expect their finances will improve in the New Year, a new Bankrate survey finds. A popular financial goal in 2025 is to pay down debts. Read more at: https://www.cnbc.com/2024/12/18/paying-down-debt-is-a-top-financial-goal-for-2025-these-tips-can-help.html |

|

Supreme Court Agrees To Hear TikTok AppealSupreme Court Agrees To Hear TikTok AppealBy Catherine Yang of Epoch Times The U.S. Supreme Court on Dec. 18 agreed to hear TikTok’s case challenging a law requiring its China-based parent company to divest of the app by Jan. 19, 2025.

The court will hear oral arguments on Jan. 10, 2025. TikTok had challenged the divestment law as unconstitutional under the First Amendment, and a three-judge panel in federal court had upheld the law earlier this month. TikTok then appealed to the high court asking for a pause of the Jan. 19 deadline and asking it to treat its petition as one for review. The Supreme Court wrote on Dec. 18 that it will hear arguments in the case before deciding whether to pause the deadline. When President Joe Biden signed the Protecting Americans from Foreign Adversary Controlled Applications Act (PAFACA) into law, it started a 270-day countdown for ByteDance to divest of TikTok or els … Read more at: https://www.zerohedge.com/political/supreme-court-agrees-hear-tiktok-appeal |

|

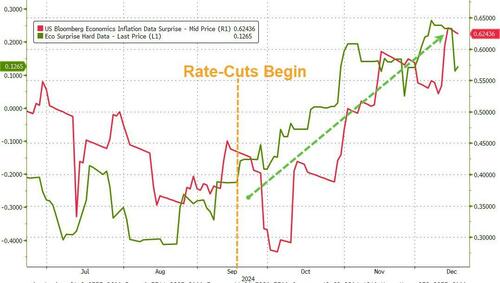

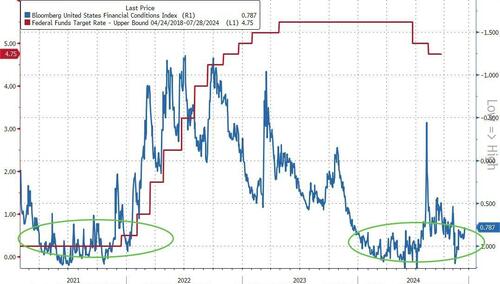

Watch Live: Fed Chair Powell Explains Why He Cut Rates Again As Inflation Data SurgesWatch Live: Fed Chair Powell Explains Why He Cut Rates Again As Inflation Data SurgesThis should be good… How is Fed Chair Powell going to explain why The Fed just cut rates AGAIN, despite inflation and growth (hard data) surprising dramatically to the upside? (with one dissent seeing sense and urging no cuts).

…and if they claim that “rates are still restrictive” – show them this… financial conditions are at their loosest since before The Fed started hiking rates…

Read more at: https://www.zerohedge.com/markets/watch-live-fed-chair-powell-explains-why-he-cut-rates-again-inflation-data-surges |

|

Hawkish Fed Cut Rates As Expected; Signals Dramatically Less Aggressive Rate-Cut CycleHawkish Fed Cut Rates As Expected; Signals Dramatically Less Aggressive Rate-Cut CycleTl;dr: The Fed has clearly decided that Trump’s policies will be inflationary – ignoring for a moment the forced-hand of a rate-cut today, they hiked their inflation and interest rate forecasts dramatically, with the latter catching up to the hawkish market’s perception. But despite the hawkish shift, they see the unemployment rate basically unchanged from where it is now… We’ll see which of those is wrong soon…

Just a reminder – The Fed slashed rates by a dramatic 50bps (crisis-like move) less than 3 months ago!! And now – post-election – things are completely different. * * * Since the last FOMC meeting – on November 7th – the dollar and stocks have rallied while gold and oil have lagged as the dollar flatlined (amid significant volatility on the way from various macro data surprises)… Read more at: https://www.zerohedge.com/markets/fomc-23 |

|

J6 Cmte Legal Cover? Censorship Cartel Funding? Spending Package Riddled With Weaponized PorkJ6 Cmte Legal Cover? Censorship Cartel Funding? Spending Package Riddled With Weaponized PorkUpdate (1308ET): The new spending package isn’t just riddled with pork as detailed below, it’s packed full of weaponized pork. For starters, it gives the Global Engagement Center – the government’s censorship juggernaut, additional funding.

|

|

US makes third interest rate cut despite inflation riskThe Federal Reserve has been cutting rates since September, even as inflation progress stalls. Read more at: https://www.bbc.com/news/articles/clyj3ym3e55o |

|

Hundreds of driving examiners to be recruited to cut wait timesThe government says there is a “huge” backlog for tests, with instructors branding the system a “nightmare”. Read more at: https://www.bbc.com/news/articles/cwyd9e8dzr4o |

|

UK inflation – will prices keep rising?Inflation has hit its highest level for eight months, will prices continue to rise at a faster rate? Read more at: https://www.bbc.com/news/articles/c6230y85k06o |

|

Tech view: Nifty forms red candle; 24,360 holds key for further upside. How to trade on ThursdayIf Nifty holds Wednesday’s low of 24,150, a rebound to 24,350 is possible. However, sustaining above 24,360 (100-DEMA) is crucial for further gains. Below this level, traders should remain cautious, advises Hrishikesh Yedve of Asit C. Mehta Investment Intermediates. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-red-candle-24360-holds-key-for-further-upside-how-to-trade-on-thursday/articleshow/116440852.cms |

|

ITC acquires 2.44% stake in EIH and 0.53% in Leela MumbaiEIH, the flagship company of The Oberoi Group, holds a 2.44% stake, amounting to over 1.5 crore equity shares. Meanwhile, HLV, closely associated with The Leela Mumbai, owns 0.53% equity, translating to 34.60 lakh equity shares. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/itc-acquires-2-44-stake-in-eih-and-0-53-in-leela-mumbai/articleshow/116441932.cms |

|

SEBI board meeting today: SME IPO listing rules, Insider trading on the agendaThe Securities and Exchange Board of India (SEBI) convened a board meeting on December 18, 2024, to deliberate on key regulatory changes. These include stricter regulations for SME listings, broadening insider trading norms by encompassing additional categories under Unpublished Price Sensitive Information (UPSI), and establishing a framework for specified digital platforms (SPFs). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-board-meeting-today-sme-ipo-listing-rules-insider-trading-on-the-agenda/articleshow/116417717.cms |

|

Long-dated Treasury yields end at nearly 7-month highs after Fed projects fewer rate cuts in 2025Yields on 10- and 30-year U.S. government debt finished at their highest levels since May on Wednesday, after the Federal Reserve pulled back on the number of interest-rate cuts it foresees for 2025 and delivered its final reduction in borrowing costs this year. Read more at: https://www.marketwatch.com/story/treasury-yields-steady-ahead-of-fed-decision-that-may-bring-fewer-2025-rate-cuts-996f4f4f?mod=mw_rss_topstories |

|

Here are the 4 stocks this pro trader would buy if the market crashesSteve Burns: Stocks are in the ‘greatest bubble in the history of civilization.’ He blames the Fed. Read more at: https://www.marketwatch.com/story/stocks-are-in-the-greatest-bubble-in-the-history-of-civilization-this-market-pro-warns-blame-the-fed-ef53fd06?mod=mw_rss_topstories |

|

A Honda-Nissan merger would be a sign of things to come in auto industry, analyst saysShares of Nissan Motor Co. closed 23.7% higher on Wednesday, following reports that the Japanese automaker was planning merger discussions with Honda Motor Co, Read more at: https://www.marketwatch.com/story/a-honda-nissan-merger-would-be-a-sign-of-things-to-come-in-auto-industry-analyst-says-71424d47?mod=mw_rss_topstories |