Summary Of the Markets Today:

- The Dow closed down 111 points or 0.25%,

- Nasdaq closed up 247 points or 1.24%, (New Historic high 20,205, Closed at 20,704)

- S&P 500 closed up 23 points or 0.38%,

- Gold $2,671 down $5.20 or 0.19%,

- WTI crude oil settled at $71 down $0.68 or 0.95%,

- 10-year U.S. Treasury 4.397 down 0.002 points or 0.046%,

- USD index $106.88 down $0.13 or 0.12%,

- Bitcoin $106,014 up $2,958 or 2.79%, (24 Hours), (New Bitcoin Historic high 107,705)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The Nasdaq Composite achieved a fresh record high on Monday, driven by strong performances from major tech stocks and the cryptocurrency market. Big Tech stocks hitting new record highs include Alphabet (GOOGL), Tesla (TSLA), Amazon (AMZN), Apple (AAPL), and Broadcom (AVGO). MicroStrategy’s stock surged ahead of its inclusion in the Nasdaq 100 whilst Super Micro Computer Inc. shares fell due to its upcoming removal from the Nasdaq 100. The Dow Jones Industrial Average declined for its eighth consecutive session of losses. Investors are anticipating the Federal Reserve’s final meeting of the year on Tuesday, with a 97% likelihood of a 25 basis point rate cut. The key focus is on the Fed’s potential outlook for rate cuts in 2025, considering persistent inflation and potential policy challenges. Bitcoin reached an all-time high above $107,000. Healthcare stocks (CVS, UnitedHealth, Cigna) declined after comments from President-elect Donald Trump about pharmacy benefit managers.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

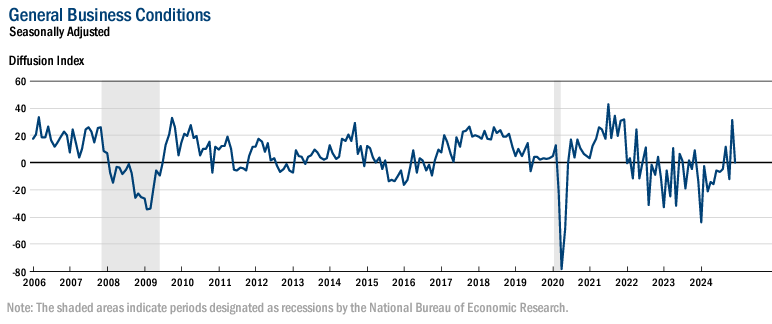

New York Fed’s Empire State Manufacturing Survey declined thirty-one points to 0.2. Last month I rode my high horse telling you this is a survey and I do not like surveys. When I was in the industry – I had my admin assistant fill out these survey forms (telling him or her not to bother me with questions – just get it done). How many people out there think that in November manufacturing was screaming good and in December things now suck. Bottom line is that I see no real end to the manufacturing recession in the USA.

Here is a summary of headlines we are reading today:

- Copper: The Driving Force Behind the Clean Energy Revolution

- Indonesia’s Growing Nickel Production Disrupts Global Market

- Forget Short-Term Noise: Oil Prices Are All About the Long-Term Trend

- What Does The Fall Of Assad’s Syria Mean To The Key Players In The Middle East?

- Russia’s $10 Billion Shadow Armada Exposed by Ukrainian Intelligence

- Nvidia falls into correction territory, down more than 10% from its record close

- Dow falls for an eighth day ahead of Fed, but Nasdaq notches another record: Live updates

- Broadcom jumps 11%, extending record run as Goldman expresses ‘higher conviction’

- Bitcoin rises to new record above $107,000 ahead of this week’s Fed decision

- How Will Apple Compete With $168 AI Smartphones From China?

- Intrinsic Value Of Crypto: What Is It & How To Calculate It

- 2-year Treasury yield ends at almost three-week high after strong services-sector data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

What Would Peace in Ukraine Actually Look Like?Behind closed doors in Moscow, Kyiv, Brussels, Washington, and other capitals, diplomats, elected leaders, and military officers are gearing up for what will likely be a full-court press to find a resolution to Europe’s largest land war since World War II. On the battlefield, momentum has shifted decisively toward Russia, its forces grinding down Ukrainian troops across the 1,100-kilometer front line. It’s pummeling Ukraine’s energy infrastructure, trying to black out and freeze an exhausted population. In Western negotiating rooms, sentiment has… Read more at: https://oilprice.com/Geopolitics/International/What-Would-Peace-in-Ukraine-Actually-Look-Like.html |

|

Two Russian Oil Tankers Spill Oil Into Black Sea After Running AgroundTwo Russian oil tankers believed to have drifted before running aground offshore have spilt oil in the Black Sea in the Kerch Strait, which separates Russia from Crimea. According to Russian officials quoted by Tass news agency, the tankers were carrying around 4,300 dead weight tonnes of oil each, with Russian authorities investigating the incidents for criminal negligence. Oil accidents due to negligence are pretty common in Russia. Last year, two oil tankers collided in the Irkutsk region in Russia thanks to a captain operating under the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Two-Russian-Oil-Tankers-Spill-Oil-Into-Black-Sea-After-Running-Aground.html |

|

Copper: The Driving Force Behind the Clean Energy RevolutionIn 2021, Goldman Sachs declared copper “the new oil”, highlighting its essential role in clean energy technologies. Two years later, the IMF forecasted that copper demand will rise by over 66% from 2020 to 2040 as the world transitions away from oil. In this graphic, Visual Capitalist’s Marcus Lu illustrates how copper demand is projected to increase over the coming decades, while oil consumption is expected to decrease. The data was compiled by the International Monetary Fund as of October 2024. Rising Copper Demand Copper is critical for a wide… Read more at: https://oilprice.com/Metals/Commodities/Copper-The-Driving-Force-Behind-the-Clean-Energy-Revolution.html |

|

Germany To Shut Down Key LNG Terminal In 2025Germany will shut down its Wilhelmshaven LNG terminal in the first quarter of 2025, with government-owned operator Deutsche Energy Terminal GmbH (DET) announcing there will be no regasification activity at the terminal between Jan. 5 and April 1, 2025. The terminal is owned by energy giant Uniper, with the German government being the majority shareholder. “During the gas crisis, our capacities have already made a significant contribution to calming the market, the gas supply has been stabilized and gas prices have since fallen significantly,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-To-Shut-Down-Key-LNG-Terminal-In-2025.html |

|

UK Energy Policy: How to Make Green Energy AffordableThe government’s clean power 2030 action plan is looking to ensure the economic benefits of clean energy and net zero are felt by people across the country. Slashing red tape for grid connections, overturning the onshore wind ban in England and allowing more special offers to reduce energy bills are steps in the right direction. But we need to keep our eye on the ball. Any policies need to help deliver cheaper energy bills and put new infrastructure like wind farms in the right places. This comes at a poignant time – and couldn’t… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/UK-Energy-Policy-How-to-Make-Green-Energy-Affordable.html |

|

ADNOC’s XRG Hits the Market with British JV in EgyptAbu Dhabi’s financially backed group XRG and British oil and gas major BP have closed a deal to set up a new natural gas joint venture in Egypt. The new JV will be called Arcius Energy, 51% owned by BP and 40% by XRG, with Egypt as its main focus. In statements to the press, BP CEO Murray Auchincloss said, “Arcius Energy brings together the strengths of our two companies to create a dynamic new platform for international growth in natural gas in the region.” The British major indicated that Arcius Energy has been assigned a 10% interest in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ADNOCs-XRG-Hits-the-Market-with-British-JV-in-Egypt.html |

|

Indonesia’s Growing Nickel Production Disrupts Global MarketVia Metal Miner Overall, the Stainless Monthly Metals Index (MMI) steadied, with a modest 0.3% increase from November to December. Stainless, Nickel Prices to Depart 2024 on a Low Note Stainless distributors had nothing good to say about 2024 on the heels of the new year. To many, 2024 was mostly characterized by soft demand conditions and an oversupplied market. Mills largely managed to stabilize base prices and lead times. However, doing so required both capacity discipline and transactional discounts, which gave buyers increasing leverage in… Read more at: https://oilprice.com/Metals/Commodities/Indonesias-Growing-Nickel-Production-Disrupts-Global-Market.html |

|

Venture Global’s New Plaquemines Plant Begins LNG ProductionVenture Global has reached first LNG production at its second facility, Plaquemines LNG, in Port Sulphur, Louisiana, the U.S. LNG plant developer says. The 20-million-mtpa Plaquemines LNG plant achieved the first production milestone 30 months after its Final Investment Decision (FID), Venture Global said. “Between current and planned facilities, Venture Global is prepared to invest $50 billion in energy projects based in the United States which will create jobs, support local economies, strengthen the balance of trade and unleash much needed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Venture-Globals-New-Plaquemines-Plant-Begins-LNG-Production.html |

|

Forget Short-Term Noise: Oil Prices Are All About the Long-Term TrendWell, it is year end 2024, time for all respectable pundits to earn their keep by making predictions or by bloviating on the latest topic somebody has latched onto. So, we approached our favorite pundit, Mr. Question Man, to make his contribution to popular seasonal wisdom. Here is the interview.Q: What is the direction of oil prices and does it matter? A: You remember the comment by John Kenneth Galbraith about economists making projections? He said that their only value was to make astrologers look good. However, I will answer. Oil prices will… Read more at: https://oilprice.com/Energy/Oil-Prices/Forget-Short-Term-Noise-Oil-Prices-Are-All-About-the-Long-Term-Trend.html |

|

PetroChina Plans to Launch Trading of Energy Transition MetalsChinese oil and gas giant PetroChina is building a team to begin a business of trading with copper, lithium, and other metals critical to the energy transition. Richard Fu, a Trading Manager, has said in a post on LinkedIn that he had been hired by PetroChina International (London) Co., Limited. “I am honoured to start the green energy transition metals and minerals business for PetroChina, trading physical and paper copper, lithium and others,” Fu wrote in the post without elaborating further. The Chinese giant could also include… Read more at: https://oilprice.com/Latest-Energy-News/World-News/PetroChina-Plans-to-Launch-Trading-of-Energy-Transition-Metals.html |

|

What Does The Fall Of Assad’s Syria Mean To The Key Players In The Middle East?The lightning-quick removal on 8 December of Syria’s President Bashar al-Assad after 53 years of Assad family rule will have seismic effects on the Middle East for years to come. Geographically, it holds a vital strategic position in the region, bordering Iraq to the East, Jordan to the South, Israel and Lebanon to the West, and Turkey to the North, with a long Mediterranean coastline as well. It critical geopolitical importance reflects this, beginning with a crucial role in the resurgence of pan-Arabism under Bashar’s father, Hafez,… Read more at: https://oilprice.com/Geopolitics/Middle-East/What-Does-The-Fall-Of-Assads-Syria-Mean-To-The-Key-Players-In-The-Middle-East.html |

|

Russia’s $10 Billion Shadow Armada Exposed by Ukrainian IntelligenceUkraine has identified 238 tankers it said belong to a shadow fleet of ships that Russia is using to keep its oil and fuels moving around the world, with hopes this information (which the west has had for years) will force western authorities to sanction the carriers. Ukraine has identified this shadow fleet as having a total deadweight of over 100 million tons, approximately 17% of the world’s oil tanker fleet. It has included a number of vessels that it says have been switched from the “Iranian ghost armada” to carry Russian… Read more at: https://oilprice.com/Energy/Crude-Oil/Russias-10-Billion-Shadow-Armada-Exposed-by-Ukrainian-Intelligence.html |

|

India to Supply LNG to Sri LankaIndia plans to deliver LNG to Sri Lanka as part of efforts to boost bilateral cooperation in the energy sector, the Indian foreign ministry said on Monday as Sri Lanka’s newly elected president visited India. Indian Prime Minister Narendra Modi welcomed Sri Lanka’s President Anura Kumara Dissanayake on his first visit to India since Dissanayake won the presidential election in September. The two countries also continue discussions on establishing a high-capacity power grid interconnection between India and Sri Lanka, and trilateral… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-to-Supply-LNG-to-Sri-Lanka.html |

|

Trump Set to Reverse Biden’s EV Support and Tailpipe Emissions RulesTeam Trump is proposing radical changes to the U.S. policy toward electric vehicles and tailpipe emissions, including axing the EV incentives and the government mandate for federal EV fleets, and rolling back the Biden Administration’s rules on tailpipe emissions and fuel economy standards, Reuters reports, citing a draft document it has seen. During the campaign, President-elect Trump has repeatedly slammed the “crazy” EV mandate of President Joe Biden, whose Administration has sought to support EV sales with incentives and mandates… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Set-to-Reverse-Bidens-EV-Support-and-Tailpipe-Emissions-Rules.html |

|

Shell Approves Deepwater Oil Project Offshore NigeriaShell’s Nigerian subsidiary has approved the Bonga North deep-water project off the coast of Nigeria, the UK-based supermajor said on Monday, announcing the final investment decision for the development. The Bonga North project will be a subsea tie-back to the Shell-operated Bonga Floating Production Storage and Offloading (FPSO) facility which Shell operates with a 55% interest. The project will sustain oil and gas production at the Bonga facility, Shell said. Bonga North currently has an estimated recoverable resource volume of more than… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Approves-Deepwater-Oil-Project-Offshore-Nigeria.html |

|

Nvidia falls into correction territory, down more than 10% from its record closeNvidia shares slumped more than 2% on Monday, putting shares of the AI chip darling in correction territory. Read more at: https://www.cnbc.com/2024/12/16/nvidia-falls-into-correction-territory-down-more-than-10percent-from-its-record-close.html |

|

Dow falls for an eighth day ahead of Fed, but Nasdaq notches another record: Live updatesThe technology-heavy index advanced to a record on Monday, aided by gains in Alphabet and Broadcom. Read more at: https://www.cnbc.com/2024/12/15/stock-futures-are-little-changed-as-wall-street-gears-up-for-potential-fed-rate-cut-this-week.html |

|

SoftBank CEO and Trump announce $100 billion investment in U.S. by firmThe money will be deployed before the end of Trump’s term. Read more at: https://www.cnbc.com/2024/12/16/softbank-ceo-to-announce-100-billion-investment-in-us-during-visit-with-trump.html |

|

Broadcom jumps 11%, extending record run as Goldman expresses ‘higher conviction’After topping $1 trillion in market cap last week, Broadcom rallied further on Monday, driven by increased price targets from Wall Street. Read more at: https://www.cnbc.com/2024/12/16/broadcom-shares-rise-goldman-sachs-has-higher-conviction.html |

|

These stocks are still a bargain relative to the expensive S&P 500There are still stock market bargains to be found heading into 2025, despite the S&P 500’s lofty valuation. Read more at: https://www.cnbc.com/2024/12/16/these-stocks-are-still-a-bargain-relative-to-the-expensive-sp-500-.html |

|

Trump says he would consider pardoning NYC Mayor Eric AdamsPresident-elect Donald Trump made the remarks about NYC Mayor Eric Adams at Mar-a-Lago after an announcement by Softbank CEO Masayoshi Son. Read more at: https://www.cnbc.com/2024/12/16/trump-consider-pardon-nyc-mayor-eric-adams.html |

|

Bitcoin rises to new record above $107,000 ahead of this week’s Fed decisionBitcoin rallied to a new all-time high Sunday evening as investors awaited the Federal Reserve’s final interest rate decision of the year. Read more at: https://www.cnbc.com/2024/12/16/crypto-market-today.html |

|

MicroStrategy’s Michael Saylor says bitcoin is ‘cyber Manhattan’ — a ‘good investment’ even at the topMichael Saylor compared bitcoin to New York City and its economy on Monday as the cryptocurrency rose to new records. Read more at: https://www.cnbc.com/2024/12/16/microstrategys-michael-saylor-says-bitcoin-is-cyber-manhattan.html |

|

Three killed in Wisconsin school shooting, including shooter, police sayA juvenile student killed two people at a Wisconsin school before police found the suspect dead, authorities said. Read more at: https://www.cnbc.com/2024/12/16/wisconsin-school-shooting.html |

|

Family offices face hidden risks in making direct investmentsFamily offices, the in-house investment and service firms of high-net-worth families, have increasingly been making direct investments in private companies. Read more at: https://www.cnbc.com/2024/12/16/family-offices-risks-direct-investments-private-companies.html |

|

There’s still time to slash your 2024 tax bill with these last-minute movesYou still have time to lower your 2024 tax bill or boost your refund before January, according to financial advisors. Here’s what investors need to know. Read more at: https://www.cnbc.com/2024/12/16/reduce-your-2024-tax-bill-last-minute-moves.html |

|

Biden’s student loan forgiveness ‘Plan B’ is in its ‘last step,’ expert says. What borrowers need to knowThe Biden administration is still taking steps to deliver sweeping student loan forgiveness to millions of Americans. Read more at: https://www.cnbc.com/2024/12/16/biden-is-still-looking-to-forgive-student-loan-debt-in-final-weeks.html |

|

How Will Apple Compete With $168 AI Smartphones From China?Chinese brands are targeting Apple iPhone users with low-cost, AI-equipped smartphones in the world’s largest handset market. Apple’s delayed rollout of “Apple Intelligence” has resulted in a very uninspiring launch of the iPhone 16 in China, while domestic brands are ramping up new low-cost AI-powered smartphones to seize market share from Apple in 2025. Goldman’s Allen Chang and Verena Jeng wrote in a note to clients over the weekend that an increasing number of Chinese handset brands are releasing AI smartphones for the mid-end market for as low as $168. “While AI features powered by Large Language Model (LLM) were only available for high-end models in the beginning (Read more in our initial AI smartphone report in Nov 2023), in the past 12 months, Chinese smartphone brands have actively expanded the AI coverage to mid-end segment,” the analysts said. How can Apple compete with $168 models, with the one featured below from the Chinese brand Honor? Read more at: https://www.zerohedge.com/markets/how-will-apple-compete-168-ai-smartphones-chinese-brands |

|

Intrinsic Value Of Crypto: What Is It & How To Calculate ItAuthored by Onkar Singh via CoinTelegraph.com, Key takeaways

Intrinsic value refers to the actual worth of an asset based on its fundamental characteristics, rather than its market price. For example, in traditional finance, the intrinsic value of a stock is often derived from factors such as earnings, cash flow and growth potential. Read more at: https://www.zerohedge.com/crypto/intrinsic-value-crypto-what-it-how-calculate-it |

|

Trudeau Considering Quitting After Canadian FinMin Freeland Unexpectedly Resigns: ReportUpdate (2:30pm ET): Canada’s CTV News reports that Prime Minister Justin Trudeau is considering interrupting Parliament (prorogation) or resignation according to unnamed sources. The sources say he has spoken to his cabinet and plans to address Parliament later on Monday. This comes after finance minister Chrystia Freeland resigned earlier on Monday citing disagreements over how to deal with tariff threats from US president-elect Donald Trump.

If confirmed, it would mean government collapse in 4 of the staunchest, and most developed “non-banana republic” Western democracies: France, Germany, South Korea and now Canada. And, of course, we use the term “non-banana republic” sarcastically. As for Turdeau, his odds of being Tru-done just spiked to 88% on Polymarket.

|

|

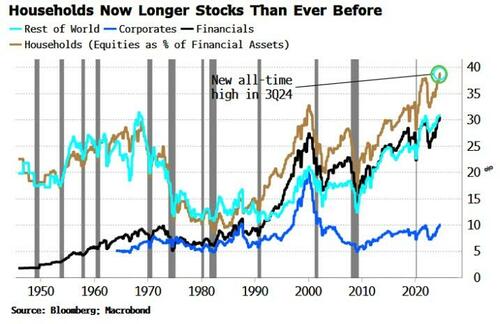

The Biggest Owner Of US Stocks Has Never Been So LongAuthored by Simon White, Bloomber macro strategist, The latest Federal Flow of Funds data for the third quarter was released Thursday and shows that US households are now as long equities as they ever have been, with data going back to the 1940s. This is another indication of the zeal for US stocks, and points to poor long-term returns. The household sector’s stock ownership is now at 39% of financial assets, exceeding the high reached in 2021.

US households are the largest owners of stocks, owning 44% of the outstanding supply. It’s not just households though, the cross-sector (households, corporates, financials and foreigners) ownership of equities also hit an all-time high compared to financial assets held. When everybody is already long, it’s harder for prices to keep appreciating indefinitely. Read more at: https://www.zerohedge.com/markets/biggest-owner-us-stocks-has-never-been-so-long |

|

Alan Bates hopes ‘real baddies’ are held to accountBates hopes sub-postmasters can get closure as the inquiry’s evidence hearings come to an end. Read more at: https://www.bbc.com/news/articles/c8ew42nd42lo |

|

What do we know about Royal Mail’s new owner?The sale of Royal Mail’s parent company to the Czech billionaire Daniel Křetínský has been cleared by the UK government. Read more at: https://www.bbc.com/news/articles/ckg85vdk874o |

|

Royal Mail takeover by Czech billionaire approvedThe £3.6bn deal by Daniel Kretinsky is cleared after agreeing “legally binding” undertakings. Read more at: https://www.bbc.com/news/articles/ckg93390808o |

|

Tech view: Nifty closes below 100 DEMA; uptrend intact. How to trade tomorrowAccording to Nagaraj Shetti of HDFC Securities, Nifty remains in an uptrend on long-term weekly charts, with further consolidation presenting a potential buy-on-dip opportunity. Key levels to watch include immediate support at 24,550 and overhead resistance at 24,800. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-closes-below-100-dema-uptrend-intact-how-to-trade-tomorrow/articleshow/116370938.cms |

|

Vedanta, Infosys among 6 largecap stocks that outperformed Nifty50Data from StockEdge reveals that several large-cap stocks within the Nifty200 index outperformed the benchmark Nifty50 over 1-week and 3-month periods as of December 13. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/vedanta-infosys-among-6-largecap-stocks-that-outperformed-nifty50/slideshow/116362819.cms |

|

GK Energy files DRHP with Sebi, plans to raise Rs 500 crore via fresh issueThe IPO will comprise a fresh issue of shares worth ₹500 crore (face value ₹2) and an OFS of 84 lakh shares, as per the DRHP. The OFS includes 80 lakh shares by Gopal Rajaram Kabra and 4 lakh by Mehul Ajit Shah. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/gk-energy-files-drhp-with-sebi-plans-to-raise-rs-500-crore-via-fresh-issue/articleshow/116368406.cms |

|

Trump is attacking the wrong deficit if he hopes to right the economyThe federal budget deficit is a more dangerous threat to Americans’ wealth than the trade deficit. Read more at: https://www.marketwatch.com/story/trump-is-attacking-the-wrong-deficit-ec72f19b?mod=mw_rss_topstories |

|

‘She has two financially stable children’: Does it make sense for my wealthy mother, a recent widow, to take out a $100,000 life-insurance policy?“It was generous of our mom to offer.” Read more at: https://www.marketwatch.com/story/she-has-two-financially-stable-children-does-it-make-sense-for-my-wealthy-mother-a-recent-widow-to-take-out-a-100-000-life-insurance-policy-858444e8?mod=mw_rss_topstories |

|

2-year Treasury yield ends at almost three-week high after strong services-sector dataThe policy-sensitive 2-year Treasury yield carved out a nearly three-week high on Monday after a stronger-than-expected U.S. services-sector reading for this month. Read more at: https://www.marketwatch.com/story/treasury-yields-slip-from-highest-levels-since-november-as-buyers-emerge-92493472?mod=mw_rss_topstories |