Summary Of the Markets Today:

- The Dow closed down 99 points or 0.22%,

- Nasdaq closed up 348 points or 1.77%, (New Historic high 20,056, Closed at 20,035)

- S&P 500 closed up 49 points or 0.82%,

- Gold $2,753 up $34.90 or 1.28%,

- WTI crude oil settled at $70 up $1.75 or 2.55%,

- 10-year U.S. Treasury 4.271 up 0.050 points or 1.185%,

- USD index $106.98 up $0.28 or 0.26%,

- Bitcoin $101,200 up $4,665 or 4.61%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The tech heavy NASDAQ experienced a significant rally on Wednesday, the S&P also rallied, but the Dow Jones Industrial Average saw a slight decline. Alphabet (Google) shares hit a record high, rising more than 5%. Tesla, Meta, and Amazon also reached record highs. The Bureau of Labor Statistics reported the Consumer Price Index (CPI) increased: 2.7% year-over-year in November (slightly up from October’s 2.6%). Core inflation rose 0.3% month-over-month. Market pumpers believe consistent inflation data, reinforces expectations that the Federal Reserve will likely cut interest rates by 25 basis points in its December meeting with most economists anticipating a potential pause in January. These figures align with economists’ expectations. Bitcoin soared, trading above $101,300. MicroStrategy and Coinbase stocks saw significant gains, rising about 6%.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Consumer Price Index for All Urban Consumers (CPI-U) rose 2.7% year-over-year in November 2024, after rising 2.6% year-over-year the previous month. The all items less food and energy index rose 3.3% over the last 12 months (unchanged from the previous month). Looking at the data, I do not see how the Federal Reserve believes the fight with inflation had gotten to the point the Federal Funds rate could be lowered. There remains significant inflationary pressures. On the other hand, I do not believe monetary policy is the controlling factor – and that it is fiscal policy which is inflationary and which is controlled by Congress.

Although the U.S. foreclosure rate stayed roughly the same as last year in September 2024, the share of loans 30 or more days past due increased year over year. The data shows that currently consumers are under some economic stress as the current loan performance data appears to be degrading.

Here is a summary of headlines we are reading today:

- AI and Chip Manufacturing Drive Japan’s Nuclear Energy Expansion

- U.S. Inflation Rises, But Falling Gas Prices Bring Holiday Relief

- Exxon to Increase Oil Production by 18% By 2030

- OPEC Cuts Oil Demand Projections A 5th Straight Month

- The Lithium Glut Could Persist Until 2027

- Germany’s Gas Use and Power Prices Jump Amid Weak Wind Generation

- Tesla shares climb to record, boosted by 69% pop since Trump election victory

- Nasdaq surges for first close above 20,000, lifted by Alphabet shares: Live updates

- ETFs cross $1 trillion of inflows in 2024, extending record year

- Here’s the inflation breakdown for November 2024 — in one chart

- T-bill rates fall below 4.4% after November CPI solidifies December rate cut

- U.S. oil prices top $70 for first time in over 2 weeks on concerns over tight supply

- Alphabet’s stock having best 2-day run in a decade as the good news keeps coming

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

AI and Chip Manufacturing Drive Japan’s Nuclear Energy ExpansionThe world continues to “warm” back up to nuclear, with the latest example coming out of Japan, where its Shimane nuclear power station in western Japan has been restarted for the first time since the 2011 Fukushima meltdown. Japan’s long-delayed restart of the 820 MW No. 2 reactor at the Shimane plant, shut down since January 2012, raises the number of operational reactors to 14, with a total capacity of 13,253 MW, according to Reuters. Tohoku Electric Power also recently resumed operations of its 825 MW No. 2 reactor at the Onagawa plant, reducing… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/AI-and-Chip-Manufacturing-Drive-Japans-Nuclear-Energy-Expansion.html |

|

Can Geothermal Power Solve Europe’s Energy Crisis?Back in 2020, the European Union gave the go-ahead to a project looking into the viability of extracting geothermal energy from oil wells. The idea: diversify low-carbon energy sources beyond wind and solar. Now, they are doubling down on heat from the ground. Reuters reported this week that the 27 members of the bloc had drafted a document demanding a commitment to the reduction of emissions from cooling and heating systems, and with it, a commitment to explore the potential of geothermal energy as a replacement for hydrocarbons in power generation… Read more at: https://oilprice.com/Alternative-Energy/Geothermal-Energy/Can-Geothermal-Power-Solve-Europes-Energy-Crisis.html |

|

U.S. Inflation Rises, But Falling Gas Prices Bring Holiday ReliefThe U.S. consumer price index (CPI) jumped 0.3% in November, the largest gain since April after increasing by 0.2% for four straight months. Most of the increase in inflation came from higher food prices as well as more expensive motel and hotel rooms. Meanwhile, rents defied their recent trend after increasing at the slowest pace since July 2021. Food prices increased 0.4% in November, up from 0.2% in October while grocery store food prices surged 0.5%, with the cost of eggs soaring 8.2% amid an avian flu outbreak. However, prices of cereals and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Inflation-Rises-But-Falling-Gas-Prices-Bring-Holiday-Relief.html |

|

Trump’s “America First” Agenda Threatens Global Trade StabilityPresident-elect Donald Trump’s plan to hit imports from China, Canada and Mexico with tariffs could deal a blow to companies across North America and trigger negative consequences for the global supply chain, according to experts. Trump said that on his first day back in office on Jan. 20, he will impose 25% tariffs on goods from Mexico and Canada. The tariffs are aimed at pressuring those countries to stop drugs and illegal migrants from crossing into the U.S., Trump posted on Truth Social on Nov. 25. He has also said he’ll impose… Read more at: https://oilprice.com/Finance/the-Economy/Trumps-America-First-Agenda-Threatens-Global-Trade-Stability.html |

|

Assad’s Downfall Sends Ripples Through BeijingThe full effects from the swift collapse of Bashar al-Assad’s regime in Syria is still playing out on the ground, but his sudden fall is set to shake up the Middle East and beyond. Here’s what it means for China. Finding Perspective: China has been aligned with Assad since Syria’s civil war began in 2011 but largely through its close ties to Russia and Iran, which backed the Syrian leader. At the United Nations, Beijing has often voted with Moscow, blocking condemnations of Assad as well as cross-border aid. Beijing supported the Assad regime with… Read more at: https://oilprice.com/Geopolitics/International/Assads-Downfall-Sends-Ripples-Through-Beijing.html |

|

Exxon to Increase Oil Production by 18% By 2030U.S. oil and gas giant Exxon Mobil Corp. (NYSE:XOM) has unveiled plans to increase spending to $28-$33 billion annually with a goal of lifting oil and gas output by 18% by 2030. Exxon has set a target to increase overall oil and gas output to 5.4 million bpd by 2030, up about 18% from 4.58 million bpd currently. According to Exxon CEO Darren Woods, the increased project spending is expected “to generate returns of more than 30% over the life of the investments.” Woods says that Exxon is focusing on growing production from low-cost fields… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-to-Increase-Oil-Production-by-18-By-2030.html |

|

OPEC’s Oil Production Rose in November as Libyan Output JumpedCrude oil production from all OPEC members rose by 104,000 barrels per day (bpd) in November compared to October, the organization’s Monthly Oil Market Report (MOMR) showed on Wednesday. Total OPEC-12 crude oil production averaged 26.66 million bpd last month, as output in Libya, Iran, and Nigeria increased, according to OPEC’s secondary sources used to track supply to the market. Of the three countries where production rose the most in November from the previous month, two – Libya and Iran – are exempted from the OPEC+… Read more at: https://oilprice.com/Energy/Energy-General/OPECs-Oil-Production-Rose-in-November-as-Libyan-Output-Jumped.html |

|

OPEC Cuts Oil Demand Projections A 5th Straight MonthOPEC has cut oil demand growth forecasts for 2024 and 2025 for a fifth straight month, with the latest cut so far the deepest. OPEC has cut 2024 demand growth by 210,000 barrels a day to 1.6 million barrels a day, 27% below its first estimate made in July, Bloomberg reported. The OPEC secretariat said the revision takes “into account recently received bearish data” for the third quarter,” including “downward revisions to OECD Americas and OECD Asia Pacific.” Different energy agencies have been issuing varying… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Cuts-Oil-Demand-Projections-A-5th-Straight-Month.html |

|

Oil Wobbles on Crude Inventory Draw, Large Fuel BuildsCrude oil prices fluctuated today after the Energy Information Administration reported an estimated inventory decline of 1.4 million barrels for the week to December 6. In fuels, however, the EIA estimated sizable builds. The crude oil inventory figure compared with a draw of 5.1 million barrels for the previous week that pushed prices higher for a while but the gains soon got erased by the now chronic perception of weak global demand growth prospects. A day before the EIA, the American Petroleum Institute had estimated inventory changes at a positive… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Wobbles-on-Crude-Inventory-Draw-Large-Fuel-Builds.html |

|

Russian Gas Flows to Europe Remain Stable Days Before Ukraine Transit Deal EndsRussian pipeline natural gas supply to Europe via Ukraine remained stable on Wednesday, three weeks before the deal for transiting the gas via Ukrainian territory expires on December 31. Gazprom is sending 42.4 million cubic meters of gas to Europe via Ukraine on Wednesday, flat compared to Tuesday, Reuters quoted the Russian gas giant as saying. Gas supply to Austria, Slovakia, and the Czech Republic remains stable compared to the previous few days. The volumes Gazprom has been sending to Europe via Ukraine have been more or less flat since the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Gas-Flows-to-Europe-Remain-Stable-Days-Before-Ukraine-Transit-Deal-Ends.html |

|

The Lithium Glut Could Persist Until 2027This year’s plunge in lithium prices has forced curtailments in production in China and Western Australia as lithium miners look to limit losses and reduce the oversupply hanging over the market and prices. However, the lithium glut has not gone away and the market could remain oversupplied until 2027, analysts say. One of the reasons for a persistent glut could be the fact that while producers in Australia and, to some extent, in China, are curtailing output and delaying project ramp-ups, lithium mines in Africa owned by Chinese… Read more at: https://oilprice.com/Energy/Energy-General/The-Lithium-Glut-Could-Persist-Until-2027.html |

|

Russia’s Yamal LNG Deploys New Tanker for Barents Sea TransshipmentsYamal LNG, the plant of Russian LNG developer and exporter Novatek, has begun using the Axios II tanker for ship-to-ship transfers in the Barents Sea, Reuters reports, citing vessel-tracking data from LSEG. Transshipments are used to free ice-class tankers by unloading LNG to conventional LNG vessels. But these STS operations are also often used to attempt to make cargo and vessel tracking more difficult. The Axios II is now moored near the island of Kildin in the area of Russia’s Murmansk, together with the Arc7 ice-class tanker Nikolay Urvantsev,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Yamal-LNG-Deploys-New-Tanker-for-Barents-Sea-Transshipments.html |

|

Acadia and Microsoft Plan $9 Billion Worth of U.S. Renewable Energy ProjectsU.S. clean energy investor Acadia Infrastructure Capital is launching a coalition with tech giant Microsoft as an anchor investor as part of plans to develop $9 billion worth of clean energy projects in the United States, Acadia’s Vice President Brian O’Callaghan told Reuters. Acadia is leading the Climate and Communities Investment Coalition (CCIC) to which other companies apart from Microsoft will join. Acadia is also in talks with firms active in other sectors, including retail and consumer goods, the executive told Reuters. The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Acadia-and-Microsoft-Plan-9-Billion-Worth-of-US-Renewable-Energy-Projects.html |

|

Germany’s Gas Use and Power Prices Jump Amid Weak Wind GenerationIntraday power prices in Germany jumped and natural gas-fired electricity generation rose to a two-year high this week as low wind speeds continue to depress wind power output. Natural gas use for power generation rose on Wednesday to its highest level since December 2022, as a wider power supply gap had to be filled by fossil fuels amid very weak wind power generation. Intraday power prices have jumped for the peak Wednesday hours, according to EEX data cited by Bloomberg. Germany’s power margin, the available electricity supply to meet… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germanys-Gas-Use-and-Power-Prices-Jump-Amid-Weak-Wind-Generation.html |

|

Nigeria’s Oil Production Hit a 2024 High of 1.7 Million Bpd in NovemberNigeria’s oil production has been recovering in recent months and hit its highest level for 2024 in November with a total of 1.7 million barrels per day (bpd) of crude oil and condensate output, the latest data from the upstream regulator showed. Nigerian production of crude oil and condensates rose in November by 13.3% compared to the 1.5 million bpd output in the same month of 2023, according to data from the monthly output report by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC). The recent recovery of Nigeria’s oil… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigerias-Oil-Production-Hit-a-2024-High-of-17-Million-Bpd-in-November.html |

|

Tesla shares climb to record, boosted by 69% pop since Trump election victoryTesla’s stock topped its 2021 high on Wednesday, as investor optimism increases heading into Donald Trump’s return to the White House. Read more at: https://www.cnbc.com/2024/12/11/tesla-reaches-record-boosted-by-64percent-pop-since-trump-election-victory.html |

|

Nasdaq surges for first close above 20,000, lifted by Alphabet shares: Live updatesThe Nasdaq Composite rose Wednesday after November’s inflation report met economists’ projections. Read more at: https://www.cnbc.com/2024/12/10/stock-market-today-live-updates.html |

|

Murder suspect Luigi Mangione’s notebook called ‘wack’ of CEO ‘targeted, precise’Luigi Mangione has refused to waive extradition to New York, where the Penn grad is charged with murdering UnitedHealthcare CEO Brian Thompson. Read more at: https://www.cnbc.com/2024/12/11/luigi-mangione-notebook-unitedhealthcare-ceo-brian-thompson-murder-.html |

|

FBI Director Christopher Wray to resign before Trump takes officePresident-elect Donald Trump has said he intends to nominate Kash Patel to replace FBI Director Christopher Wray. Read more at: https://www.cnbc.com/2024/12/11/fbi-director-christopher-wray-to-resign-before-trump-takes-office.html |

|

Tom Lee, who nailed 2024’s rally, is out with his 2025 outlook. What he sees nextStocks should rise in 2025, but expect a “tale of ‘two years,'” according to Fundstrat’s head of research. Read more at: https://www.cnbc.com/2024/12/11/tom-lee-who-nailed-2024s-rally-is-out-with-his-2025-outlook-what-he-sees-next.html |

|

Supreme Court rejects Nvidia appeal of investor lawsuit tied to crypto mining: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Gracy Chen of Bitget explains why she believes MicroStrategy’s bitcoin buying could pose a risk for the company if the crypto market slides. Read more at: https://www.cnbc.com/video/2024/12/11/supreme-court-rejects-nvidia-appeal-investor-lawsuit-tied-to-crypto-mining-crypto-world.html |

|

ETFs cross $1 trillion of inflows in 2024, extending record yearBroad stock funds and bitcoin ETFs have been big asset gatherers this year. Read more at: https://www.cnbc.com/2024/12/11/etfs-cross-1-trillion-of-inflows-in-2024-extending-record-year.html |

|

Budget deficit swells in November, pushing fiscal 2025 shortfall 64% higher than a year agoFor the month, the deficit totaled $366.8 billion, 17% higher than November 2023 Read more at: https://www.cnbc.com/2024/12/11/budget-deficit-swells-in-november-pushing-fiscal-2025-shortfall-64percent-higher-than-a-year-ago.html |

|

Facebook, Instagram and other Meta apps go down due to ‘technical issue’Facebook, Instagram and other Meta apps are down due to a “technical issue.” Read more at: https://www.cnbc.com/2024/12/11/metas-facebook-instagram-go-down-due-to-technical-issue.html |

|

Here’s the inflation breakdown for November 2024 — in one chartIncreases in prices for groceries and gasoline outweighed disinflation in categories such as shelter, according to the consumer price index. Read more at: https://www.cnbc.com/2024/12/11/inflation-cpi-bls-november-2024-in-one-chart.html |

|

Greece’s ghost towns offer a glimpse of a country struggling with ‘existential’ population collapseYears of declining births, economic hardship and mass emigration have left huge swathes of Greece vacant, creating fresh concerns for the country. Read more at: https://www.cnbc.com/2024/12/11/ghost-towns-show-greeces-battle-with-falling-birth-rate-depopulation.html |

|

The 3 most expensive ZIP codes in every U.S. state—see how yours comparesHomes in the wealthiest ZIP codes in the U.S. will cost you a median of $1.55 million. Read more at: https://www.cnbc.com/2024/12/11/most-expensive-zip-codes-in-every-us-state.html |

|

The new hottest trade on Wall Street: Quantum computing stocksInvestors looking for the next big technology trend may want to keep an eye on quantum computing stocks. Read more at: https://www.cnbc.com/2024/12/11/the-new-hottest-trade-on-wall-street-quantum-computing-stocks.html |

|

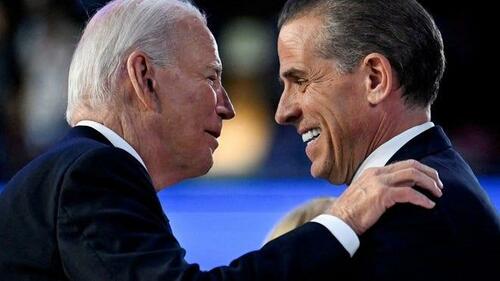

Despite Media Spin, Only 2 Out Of 10 Americans Support Hunter Biden PardonAuthored by Jonathan Turley, As Democratic politicians and pundits rush to defend President Joe Biden’s unethical pardon of his son, Hunter, the public is expressing overwhelming opposition to his abuse of office.

The latest poll, by The Associated Press-NORC Center for Public Affairs Research, found that only two out of ten Americans support the pardon despite weeks of media spin. The poll shows that Biden is no longer even garnering a majority among Democrats. Only 38 percent sought the pardon. As discussed in my New York Post c … Read more at: https://www.zerohedge.com/political/despite-media-spin-only-2-out-10-americans-support-hunter-biden-pardon |

|

Beijing Considering Yuan Devaluation In Response To Trump TariffsTwo days ago, when China reported another month of dismal import and export activity, with both missing estimates…

… we reminded readers that at a time when China is scrambling – and failing – to convince the world that it will unleash a historic fiscal and monetary stimulus (just not right now, and not tomorrow, but maybe some time next year so start buying Chinese stonks or something), it will also have to devalue the yuan if it hopes to actually kickstart its mercantlist economy.

Turns out … Read more at: https://www.zerohedge.com/markets/beijing-considering-yuan-devaluation-response-trump-tariffs |

|

Pentagon Denies Congressman’s Claim Of Iranian ‘Mothership’ Launching Drones Off US CoastUpdate (1523ET): “There is not any truth to that,” Pentagon Deputy Press Secretary Sabrina Singh told reporters Wednesday afternoon, hours after Republican Congressman Jefferson Van Drew of New Jersey claimed on Fox News that Iranian drones were flying over New Jersey skies. Singh said: “There is no Iranian ship off the coast of the United States … and there is no so-called ‘mothership’ launching drones towards the United States.” “They were not US military drones,” she continued, adding, “These are not drones or activities from a foreign entity or foreign adversary.”

Good question.

|

|

Still ‘Stupid In America’Authored by Larry Sand via American Greatness, America’s government-run school system is failing…

In a memorable April 1995 video, Apple founder Steve Jobs declared, “The unions are the worst thing that ever happened to education because it’s not a meritocracy. It turns into a bureaucracy, which is exactly what has happened. The teachers can’t teach, and administrators run the place, and nobody can be fired. It’s terrible….” Then in January 2006, John Stossel’s eye-opening documentary, Stupid in America, was aired. The investigative ABC show was billed as “a nasty title for a program about public education, but some nasty things are going on in America’s pub … Read more at: https://www.zerohedge.com/political/still-stupid-america |

|

‘Dozens’ being investigated over Post Office scandalCriminal trials aren’t expected to begin until 2027, almost 30 years after concerns were first raised. Read more at: https://www.bbc.com/news/articles/cvgr19lwgv0o |

|

‘I’m more confident’ despite rise in US inflationProgress stabilising prices in the US may be stalling, just as public opinion brightens. Read more at: https://www.bbc.com/news/articles/cvgneqwj5eqo |

|

Elon Musk’s Tesla lobbied UK to charge petrol drivers moreMusk’s firm backed the government’s green stance, despite its maverick chief executive’s social media attacks. Read more at: https://www.bbc.com/news/articles/cd0en9mn8mko |

|

Tech View: What expansion of outer Bollinger band in Nifty indicates for Thursday’s tradeThe index trades above the 50-day SMA, with expanding Bollinger bands signaling bullishness. Options data shows strong call and ITM put writing at 24,800, reinforcing a bullish outlook, said Praveen Dwarakanath. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-what-expansion-of-outer-bollinger-band-in-nifty-indicates-for-thursdays-trade/articleshow/116216901.cms |

|

Being a mutual fund distributor is a good career option, says Zerodha’s Nithin KamathNithin Kamath highlighted the lack of an advisory ecosystem in India, particularly RIAs and MFDs, as a major hurdle for the mutual fund industry’s growth. He emphasized the importance of MFDs in reaching smaller cities and towns. Despite the growth in SIP investments, the industry needs a stronger advisory network for further expansion. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/being-a-mutual-fund-distributor-is-a-good-career-option-says-zerodhas-nithin-kamath/articleshow/116216337.cms |

|

Investors pull back from debt mutual funds: 7 categories see outflowsDebt mutual funds saw a decline in inflows by 92% at Rs 12,915 crore in November against Rs 1.57 lakh crore in October. Around 7 debt mutual fund categories saw outflow in November. Here’s the breakup (Source: AMFI). Read more at: https://economictimes.indiatimes.com/mf/analysis/7-debt-mutual-fund-categories-see-outflow-in-november-heres-the-breakup/heavy-outflow/slideshow/116202993.cms |

|

T-bill rates fall below 4.4% after November CPI solidifies December rate cutYields on short-term Treasury bills dropped on Wednesday after November’s consumer-price index cemented expectations for a quarter-point interest-rate cut by the Federal Reserve next week. Read more at: https://www.marketwatch.com/story/treasury-yields-rise-ahead-of-cpi-report-c7977bd2?mod=mw_rss_topstories |

|

U.S. oil prices top $70 for first time in over 2 weeks on concerns over tight supplyCrude-oil prices ended higher for a third straight session on Wednesday, with China’s plans to boost its economy expected to lift energy demand and as talk of potential new U.S. oil sanctions on Russia raised prospects for tighter global supplies. Read more at: https://www.marketwatch.com/story/crude-climbs-as-u-s-reportedly-considers-oil-sanctions-on-russia-43554852?mod=mw_rss_topstories |

|

Alphabet’s stock having best 2-day run in a decade as the good news keeps comingGoogle parent Alphabet’s stock is having its best two-day run in nine years amid good news on the quantum-computing and Waymo fronts. Read more at: https://www.marketwatch.com/story/alphabets-stock-having-best-2-day-run-in-a-decade-as-the-good-news-keeps-coming-284b1a74?mod=mw_rss_topstories |