Summary Of the Markets Today:

- The Dow closed down 123 points or 0.28%,

- Nasdaq closed up 159 points or 0.81%, (New Historic high 19,863, Closed at 19,860)

- S&P 500 closed up 15 points or 0.25%, (New Historic high 6,090, Closed at 6,001)

- Gold $2,655 up $6.80 or 0.26%,

- WTI crude oil settled at $67 down $1.13 or 1.65%,

- 10-year U.S. Treasury 4.153 down 0.029 points or 0.694%,

- USD index $106.00 up $0.29 or 0.27%,

- Bitcoin $101,440 up $2,3223 or 2.29%, (24 Hours),

- Baker Hughes Rig Count: U.S. +7 to 589 Canada -11 to 194

U.S. Rig Count is up 7 from last week to 589 with oil rigs up 5 to 482, gas rigs up 2 to 102 and miscellaneous rigs unchanged at 5

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

U.S. stocks were mixed on Friday, with the S&P 500 and Nasdaq Composite gaining while the Dow Jones Industrial Average declined slightly. Tech giants Amazon, Apple, and Meta reached new all-time intraday highs, contributing to the NASDAQ’s strong performance. For the week, the Dow shed 0.6%, while the S&P 500 gained close to 1%, and the NASDAQ climbed more than 3%. The U.S. economy added 227,000 jobs in November, slightly surpassing expectations. The unemployment rate unexpectedly increased to 4.2%. This jobs report was seen as a “Goldilocks” scenario, strong enough to alleviate economic concerns but soft enough to keep the Federal Reserve’s options open regarding interest rate cuts. Following the report, market expectations for a Fed rate cut in December increased significantly. The odds of a quarter-percentage point rate cut on December 18 rose to nearly 90%, up from about 70% before the report. Bitcoin continued its rally in the cryptocurrency market, trading around $101,000 on Friday afternoon. The surge was partly attributed to expectations of support for digital currencies from President-elect Donald Trump, who named David Sacks as his “White House AI & Crypto Czar”. In corporate news, Lululemon and Ulta Beauty saw their shares rise after both retailers increased their profit forecasts. Looking ahead to next week, the Consumer Price Index (CPI) report on Wednesday will be a key data point for the Federal Reserve’s decision on interest rates. The economic calendar also includes wholesale inventories and the import price index. Notable companies reporting earnings include GameStop, Macy’s, Costco, and Broadcom.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

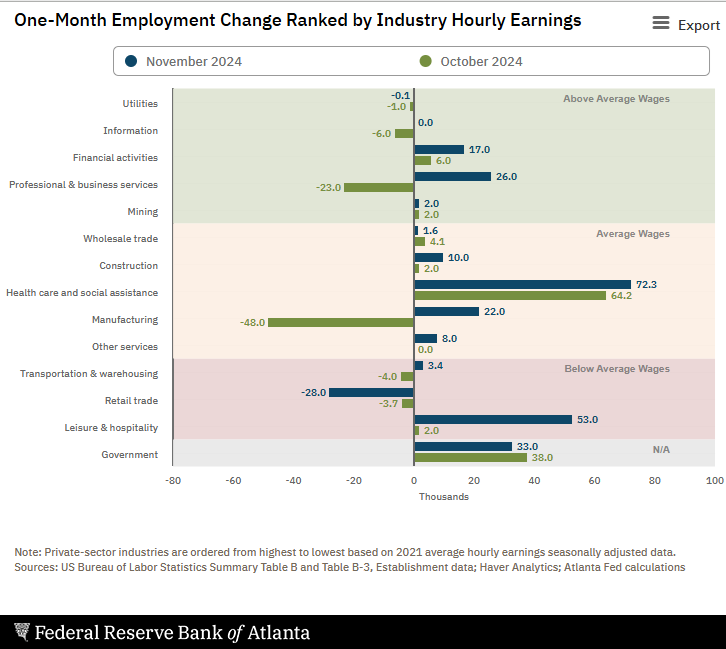

Total nonfarm payroll employment rose by 227,000 in November 2024 with unemployment rate rising an insignificant 0.1 points to 4.2%. Big gainers this month were in health care, leisure and hospitality, government, and social assistance. Retail trade lost jobs. The household survey which provides the unemployment numbers shows a DECLINE in the number of employed by 355,000 whilst the headline employment numbers from the establishment survey show employment gain of 227,000. When you have this large difference between a survey and a half-assed data-gathering system, I would believe neither. At least we have the ADP numbers earlier this week which showed employment gains of slightly less than 150,000. The U-6 unemployment rate (Total Unemployed, Plus All Persons Marginally Attached to the Labor Force, Plus Total Employed Part Time for Economic Reasons, as a Percent of the Civilian Labor Force Plus All Persons Marginally Attached to the Labor Force) continues to trend up which does not usually happen unless a recession is coming.

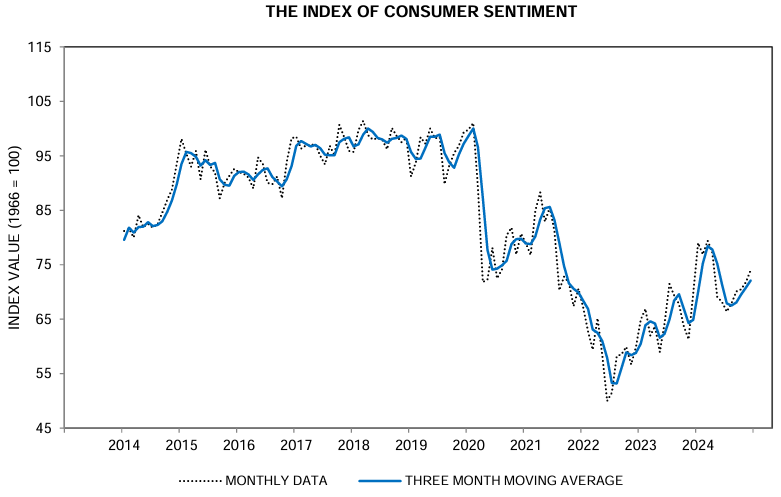

The University of Michigan Consumer sentiment rose in December 2024 for the 5th consecutive month. This survey is politically biased and doubt it reflects the real levels of consumer sentiment – but I am passing it along.

For the first time since the fourth quarter of 2022, the share of negative equity rose in the U.S. on a quarterly basis. Just compared to last quarter, the number of residential properties that fell into negative equity increased by 30,000 homes or 1.8%. This CoreLogic Homeowner Equity Report shows that U.S. homeowners with mortgages (which account for roughly 62% of all properties) saw home equity increase by $425 billion since the third quarter of 2023, a gain of 2.5% year over year, bringing the total net homeowner equity to over $17.5 trillion in the third quarter of 2024.

Here is a summary of headlines we are reading today:

- Putin’s Gazprombank Move Creates Ripple in EU-U.S. Sanctions Strategy

- Stellantis CEO Resignation Sends Shockwaves Through U.S. Auto Industry

- U.S. Oil Rig Count Rises Despite Falling Crude Prices

- Solar Panel Importers Face Tariff Deadline Crunch

- U.S. Solar Cell Production Resumes After a 5-Year Break

- Assad in Serious Trouble as Middle East War Shifts Back to Syria

- Here’s where the jobs are for November 2024 — in one chart

- Appeals court upholds law ordering China-based ByteDance to sell TikTok or face U.S. ban

- DOGE’s Musk, Ramaswamy want Congress to pass huge spending cuts. That’s a tough sell

- Next week’s inflation data could derail a market that’s priced for perfection

- Unemployment rate jumps more than a percentage point for Black women in November

- “Cancel Me… I’m For America”: NYC Mayor Eric Adams Hints At Switch To Republican Party

- Tech View: Nifty forms long bull candle with minor shadow. What should traders do on Monday?

- Treasury yields end at lowest levels since October as jobs data reinforce December rate-cut expectations

- U.S. consumer credit jumps in October as credit cards drive purchases

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Putin’s Gazprombank Move Creates Ripple in EU-U.S. Sanctions StrategyThe European Union is working with the United States to soften the blow without undermining their shared stance against Moscow. Gazprombank, pivotal for Russian natural gas transactions, has become a focal point of geopolitical and energy strategy since the U.S. imposed sanctions last month. While President Vladimir Putin’s decision to scrap the requirement for foreign buyers to rely solely on Gazprombank offers some flexibility, it’s done little to untangle the legal and logistical challenges facing the EU. The current discussions… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putins-Gazprombank-Move-Creates-Ripple-in-EU-US-Sanctions-Strategy.html |

|

Stellantis CEO Resignation Sends Shockwaves Through U.S. Auto IndustryVia Metal Miner The Automotive MMI (Monthly Metals Index) remained sideways, only moving down 2.58%. There are currently no significant factors within the US automotive market causing much movement in price action, and automotive sector as a whole remains slow. Despite this, concern about incoming tariffs from the new Trump administration remains palpable. While Trump hasn’t threatened tariffs on large automotive manufacturing nations like Japan or Germany, any hot-dipped galvanized steel products coming out of China will be subject… Read more at: https://oilprice.com/Finance/the-Markets/Stellantis-CEO-Resignation-Sends-Shockwaves-Through-US-Auto-Industry.html |

|

U.S. Oil Rig Count Rises Despite Falling Crude PricesThe total number of active drilling rigs for oil and gas in the United States rose this week, according to new data that Baker Hughes published on Friday, after falling in the two weeks prior. The total rig count rose by 7, landing at 589 total rigs, according to Baker Hughes, down 37 from this same time last year. The number of oil rigs rose by five this week to 482—down by 21 compared to this time last year. The number of gas rigs rose by two rigs, landing at 102, a loss of 17 active gas rigs from this time last year. Miscellaneous stayed… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Oil-Rig-Count-Rises-Despite-Falling-Crude-Prices.html |

|

Russian Oil Flows to China via Kazakhstan Remain Flat in 2024Russia’s oil deliveries to China via Kazakhstan have stayed essentially flat this year, according to data by Kazakhstan’s pipeline operator KazTransOil. Between January and November this year, oil transit from Russia to China on KazTransOil’s network stood at 9,117,000 tons of oil, the company said on Friday in an overview of its export and transit oil deliveries for the first 11 months of the year. The volume is slightly down, by 0.25%, compared to the 9,140,000 tons of Russian oil transit along this route in the same period… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-Flows-to-China-via-Kazakhstan-Remain-Flat-in-2024.html |

|

Solar Panel Importers Face Tariff Deadline CrunchCompanies that imported millions of Southeast Asian solar panels could have to pay tariffs on them “ranging from 30% to more than 230%”, according to a new report from Bloomberg. Companies have until December 3rd to install the panels, and U.S. Customs and Border Protection has pledged strict enforcement to prevent stockpiling, potentially exposing importers to audits, inspections, and billions in backdated tariff costs. Tom Beline, a trade attorney and partner in Cassidy Levy Kent’s Washington office, told Bloomberg: “That bill… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Solar-Panel-Importers-Face-Tariff-Deadline-Crunch.html |

|

Saudi Minister: OPEC+ Move to Delay Output Hike Was a Reality CheckThe OPEC+ group faced a “reality check” in discussions about its production policy and had the double task of attending to fundamentals and at the same time putting together something to assuage the negative market sentiment, Saudi Energy Minister, Prince Abdulaziz bin Salman, told CNBC in an exclusive interview on Friday. The OPEC+ alliance decided on Thursday to delay the start of the easing of the 2.2 million barrels per day (bpd) cuts to April 2025. OPEC+ has already postponed twice the beginning of the output increase. January… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Minister-OPEC-Move-to-Delay-Output-Hike-Was-a-Reality-Check.html |

|

U.S. Solar Cell Production Resumes After a 5-Year BreakSolar cell manufacturing in the United States resumed in the third quarter as silicon cells were manufactured in the country for the first time since 2019, a pivotal moment for America’s surging solar manufacturing sector. The U.S. added a record-breaking 9.3 gigawatts (GW) of new solar module manufacturing capacity in the quarter. According to the U.S. Solar Market Insight Q4 2024 report released by Solar Energy Industries Association (SEIA) and Wood Mackenzie, five new or expanded factories in three states were added, bringing U.S. solar… Read more at: https://oilprice.com/Energy/Energy-General/US-Solar-Cell-Production-Resumes-After-a-5-Year-Break.html |

|

Morgan Stanley Raises Brent Oil Forecast for Late 2025 After OPEC+ MoveMorgan Stanley expects Brent Crude prices to average $70 per barrel in the second half of 2025, up from a $66-$68 a barrel range expected previously, after OPEC+ delayed the beginning of its production increase and slowed the pace of the output hikes into 2026. The OPEC+ alliance decided on Thursday to delay the start of the easing of the 2.2 million barrels per day (bpd) cuts to April 2025, from January 2025. The group also extended the period in which it would unwind all these cuts until September 2026. The delay and the slower ramp-up in OPEC+’s… Read more at: https://oilprice.com/Energy/Energy-General/Morgan-Stanley-Raises-Brent-Oil-Forecast-for-Late-2025-After-OPEC-Move.html |

|

Is Oil’s Gloom Overblown? Barclays Thinks SoThe oil market is bracing for a tough 2025, but Barclays believes the industry’s pessimism might be overdone. Brent crude hovered around $71 per barrel this week, raising chatter of a potential dip into the $50-$60 range next year. But Barclays’ analysts argue that the market’s fixation on oversupply could be cloaking the inevitable tightening of supply-demand dynamics. Current projections–even without OPEC+ reversing its production cuts–point to a surplus in 2025. Understandably, this has spooked investors away from energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Is-Oils-Gloom-Overblown-Barclays-Thinks-So.html |

|

Oman’s State Oil Firm Plans More Unit Listings After Record IPOOQ, the national oil company of Gulf producer Oman, plans to put more of its subsidiaries up for stock listing, following the record-breaking IPO of its OQ Exploration and Production Company earlier this year, a senior executive told Bloomberg in an interview. In October, OQ Exploration and Production Company (OQEP), Oman’s wholly-state-owned upstream oil and gas operator, raised $2.03 billion from its IPO which was the largest ever for the Gulf oil nation and the biggest in the region so far this year. OQEP sold 2 billion shares in the IPO… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Omans-State-Oil-Firm-Plans-More-Unit-Listings-After-Record-IPO.html |

|

Oil Prices Under Pressure Despite OPEC+ DecisionDespite OPEC+ postponing its planned production increases until 2025, oil prices remain under pressure due to demand uncertainty. In a widely anticipated move, OPEC+ postponed its planned supply increases by another quarter, now pledging to start unwinding output cuts from April 2025 onwards. This, however, was not enough to convince oil markets of a bullish narrative lurking out there, not even the postponement of the UAE’s baseline quota increase could stop ICE Brent from dipping back below $72 per barrel. OPEC+ Delays Unwinding of… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-Despite-OPEC-Decision.html |

|

Assad in Serious Trouble as Middle East War Shifts Back to SyriaAmid the tentative ceasefire in Lebanon, the fighting has shifted to Syria, where the Syrian rebels have now taken their second city from Assad’s forces in two weeks. Hezbollah has shifted more attention to Syria, backing Assad’s forces. On Thursday, Syrian rebel forces captured Homs, in the country’s central region, after an unexpectedly large offensive last week that saw them capture Hama city and close in on and capture Aleppo, Syria’s second-largest city. The Syrian rebels have been emboldened by Israel’s recent… Read more at: https://oilprice.com/Energy/Energy-General/Assad-in-Serious-Trouble-as-Middle-East-War-Shifts-Back-to-Syria.html |

|

Why It’s Still a Good Time to Buy MLPsWhen I sat down to write this piece, I intended to start with “There has never been a better time to buy MLPs”, then I realized that that isn’t true. About six weeks ago, before the US election results were known, was almost certainly a better time. But if you didn’t have access to a crystal ball back then and missed the opportunity, don’t worry. Now may not be the best time, but it is still a very good one. MLPs, or Master Limited Partnerships to give them their full name, are listed on exchanges, and they can be… Read more at: https://oilprice.com/Energy/Energy-General/Why-Its-Still-a-Good-Time-to-Buy-MLPs.html |

|

Libyan Oil Production Hits an 11-Year HighPolitics, Geopolitics & Conflict Libyan oil production has hit an 11-year high at 1.422 million bpd, recovering (at least for now) from the Central Bank control battle that saw oil once again taken hostage, with production cut in half earlier this year. At the same time, Libya’s NOC has announced it will put up for exploration 22 new onshore and offshore areas in a public tender, though no exact date for presenting the blocs to international oil companies has yet been announced. The seemingly smooth sailing for Libyan oil production right… Read more at: https://oilprice.com/Energy/Energy-General/Libyan-Oil-Production-Hits-an-11-Year-High.html |

|

China and OPEC+ Provide Support for Oil PricesCrude oil prices have found some support this week, driven by China’s economic recovery and OPEC+ production strategies. China, the world’s second-largest oil consumer, reported its fastest factory activity growth in five months, reinforcing optimism about future crude demand. Analysts view Beijing’s targeted stimulus measures as a potential catalyst for stabilizing global oil markets. OPEC+ has already acted to stabilize prices by extending its voluntary production cuts of 2.2 million barrels per day (bpd) until March 2025. These… Read more at: https://oilprice.com/Energy/Energy-General/China-and-OPEC-Provide-Support-for-Oil-Prices.html |

|

Here’s where the jobs are for November 2024 — in one chartHealth care and social assistance led the way yet again last month, seeing 72,300 new positions added in that area, per the Bureau of Labor Statistics. Read more at: https://www.cnbc.com/2024/12/06/heres-where-the-jobs-are-for-november-2024-in-one-chart.html |

|

Appeals court upholds law ordering China-based ByteDance to sell TikTok or face U.S. banMembers of Congress had raised national security concerns about TikTok due to its ownership by ByteDance, which is based in China. Read more at: https://www.cnbc.com/2024/12/06/tiktok-divestment-law-upheld-by-federal-appeals-court.html |

|

UnitedHealthcare CEO killing spurs Centene to hold virtual meeting and insurers to pull exec photosUnitedHealthcare CEO Brian Thompson was fatally shot on his way to an investor meeting by a masked gunman on a New York City street. Read more at: https://www.cnbc.com/2024/12/06/unitedhealthcare-ceo-killing-health-insurers-photos-centene-meeting.html |

|

DOGE’s Musk, Ramaswamy want Congress to pass huge spending cuts. That’s a tough sellCongress’ enthusiasm for smaller government is tempered by the difficulty of agreeing on what to cut. Read more at: https://www.cnbc.com/2024/12/06/doges-musk-ramaswamy-try-to-sell-congress-on-huge-spending-cuts.html |

|

Next week’s inflation data could derail a market that’s priced for perfectionA surprisingly hot report could curtail hopes for a December rate cut from the Fed and put inflation back at the forefront of investors’ minds. Read more at: https://www.cnbc.com/2024/12/06/stock-market-next-week-outlook-for-dec-9-13-2024.html |

|

UnitedHealthcare CEO killing: Police believe person of interest left New York, report saysUnitedHealthcare CEO Brian Thompson was fatally shot Wednesday in midtown Manhattan. His company is one of the largest health insurers in the United States. Read more at: https://www.cnbc.com/2024/12/06/unitedhealthcare-ceo-killing-police-believe-person-of-interest-left-new-york-report.html |

|

Unemployment rate jumps more than a percentage point for Black women in NovemberThe unemployment rate jumped significantly for Black women in November. Read more at: https://www.cnbc.com/2024/12/06/unemployment-rate-jumps-more-than-a-percentage-point-for-black-women-in-november.html |

|

Bitcoin hovers near $100,000 after week of pro-crypto Trump administration picks: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Adam Sullivan, CEO of Core Scientific, discusses the company’s Q3 earnings and potential regulation in the next Trump administration. Read more at: https://www.cnbc.com/video/2024/12/06/bitcoin-hovers-near-100000-pro-crypto-trump-administration-picks-crypto-world.html |

|

Trump may cancel U.S. Postal Service electric mail truck contract: Reuters sourcesThe move is in line with Donald Trump’s campaign promises to roll back President Joe Biden’s efforts to decarbonize U.S. transportation to fight climate change. Read more at: https://www.cnbc.com/2024/12/06/trump-may-cancel-us-postal-service-electric-mail-truck-contract-reuters-sources-say.html |

|

Trump’s pick for IRS commissioner, former congressman Billy Long, receives mixed response from Washington, tax communityPresident-elect Donald Trump will nominate former Missouri congressman Billy Long for IRS commissioner, which has received a mixed response. Read more at: https://www.cnbc.com/2024/12/06/trumps-nominee-irs-commissioner.html |

|

AI startups are snatching up San Francisco offices, using Zoom fatigue to recruit talentWith the Covid pandemic approaching its five-year anniversary, a growing number of startups in San Francisco are ditching remote work. Read more at: https://www.cnbc.com/2024/12/06/ai-startups-snatch-san-francisco-offices-use-zoom-fatigue-to-recruit.html |

|

Notre Dame’s resurrection: Its chief architect on rebuilding France’s ‘heart’ in 5 yearsPhilippe Villeneuve is the architect behind the most ambitious restoration in modern French history. Read more at: https://www.cnbc.com/2024/12/06/notre-dames-resurrection-its-chief-architect-on-rebuilding-frances-heart-in-5-years.html |

|

Here’s what to know before taking your first required minimum distributionMost retirees must begin required minimum distributions at age 73. Here’s what to know before making your first withdrawal. Read more at: https://www.cnbc.com/2024/12/06/first-required-minimum-distribution.html |

|

Biden Regime Quietly Revokes Veterans Hiring Preference For Civil Service JobsAuthored by Debra Heine via American Greatness, The Biden regime has quietly revoked the veterans hiring preference for civil service jobs and promotions, which since the 1944 Veterans Act gave eligible veterans preference over others for appointments in federal civil service selection, a memorandum obtained by American Greatness shows.

The goal of the veterans’ preference law was to “provide a uniform method by which qualified veterans [could] receive special consideration for federal employment,” according to Read more at: https://www.zerohedge.com/political/biden-regime-quietly-revokes-veterans-hiring-preference-civil-service-jobs |

|

The Naughty List: Former Obama Aides & Liberal Influencers Sell Antifa Line Of Holiday GiftsAuthored by Jonathan Turley, It appears no liberal Christmas is complete without the ultimate stocking stuffer: an actual stocking to wear over your face while rioting. While not yet selling face coverings for anonymous violence, Crooked Media, co-founded by former Obama staffers Jon Favreau, Jon Lovett, and Tommy Vietor, is selling a line of Antifa items for liberals wanting to make a statement against any “Peace on Earth.” (As of this posting, Antifa items were still being sold on the “Crooked Store” site). You can now proudly wear your “Antifa Dad” hat to signal your support for political violence and deplatforming. It is the ultimate naughty gift list for putting the slay back into your Sleigh Bells. Read more at: https://www.zerohedge.com/political/naughty-list-former-obama-aides-liberal-influencers-sell-antifa-line-holiday-gifts |

|

“Cancel Me… I’m For America”: NYC Mayor Eric Adams Hints At Switch To Republican PartyNew York City Mayor Eric Adams, a Democrat, has left the door open to returning to the Republican Party – a move that would upend the political dynamics in the nation’s largest city. In a pair of Friday morning interviews, Adams – who was a member of the GOP from 1995 to 2002, refused to rule out a switch back to the Republican Party.

“I’m a part of the American party,” Adams told NY1 when asked directly about his political future. He reiterated the sentiment in a subsequent interview on PIX11, emphasizing that his allegiance lies with “American values” over partisan lines. “No matter what party I’m on or vote on, I’m going to push for American values,” he declared, urging leaders to work beyond political affiliations to solve voters’ problems.

|

|

Jurors In Daniel Penny Trial Say They Can’t Reach Unanimous Verdict On Manslaughter ChargeAuthored by Michael Washburn via The Epoch Times (emphasis ours), A judge on Dec. 6 directed the jury in the Daniel Penny trial to continue deliberating after jurors said they were unable to reach a unanimous verdict on the top charge of manslaughter.

Daniel Penny arrives at Manhattan Criminal Court in New York on Jan. 17, 2024. Frank Franklin II/AP Photo Penny was charged with manslaughter in the second degree and criminally negligent homicide in last year’s subway choking death of Jordan Neely. “At this time, we are unable to come to a unanimous vote on Count One, manslaughter in the second degree,” the jurors said in a note to the judge. The jurors had been deliberating since Tuesday. In response, Judge Maxwell Wil … Read more at: https://www.zerohedge.com/political/jurors-daniel-penny-trial-say-they-cant-reach-unanimous-verdict-manslaughter-charge |

|

Nightclub stickers over smartphone rule divides the dancefloorA new nightclub is opening and introducing a strict no phones on the dancefloor policy. Read more at: https://www.bbc.com/news/articles/c4gpn44pyz9o |

|

Boohoo bosses stalking allegations investigated by policeThe retailer has also told the information watchdog about surveillance equipment outside its head office. Read more at: https://www.bbc.com/news/articles/c938qzz25xgo |

|

TikTok set to be banned in the US after losing appealThe app – which faces being banned in a matter of weeks – says it will now take its case to the Supreme Court. Read more at: https://www.bbc.com/news/articles/c2ldnq5095xo |

|

Tech View: Nifty forms long bull candle with minor shadow. What should traders do on Monday?Indian markets ended lower on Friday, breaking a five-day winning streak. Bank and IT stocks weighed on the indices. The Nifty closed marginally lower, but the overall trend remains positive. The next resistance level is at 24,850. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-long-bull-candle-with-minor-shadow-what-should-traders-do-on-monday/articleshow/116048417.cms |

|

Board of Paytm’s Singapore arm approves stake sale in Japanese firm PayPay CorporationPaytm’s sale aligns with its strategy to offload non-core assets and bolster its capital base as it prioritizes scaling its core payments business after a tough year. Recently, the fintech firm sold its entertainment ticketing arm, Paytm Insider, to Zomato for Rs 2,048 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/board-of-paytms-singapore-arm-approves-stake-sale-in-japanese-firm-paypay-corporation/articleshow/116046535.cms |

|

FIIs fixing billion-dollar blunder, bank stocks on top of buying listForeign institutional investors are returning to the Indian stock market after a period of selling. They’ve invested heavily in financials, particularly HDFC Bank, boosting its market cap. While some analysts are optimistic about this revival, others remain cautious due to high valuations and slowing growth. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fiis-fixing-billion-dollar-blunder-bank-stocks-on-top-of-buying-list/articleshow/116028909.cms |

|

David Sacks and the coming crypto war over national securityThe crypto industry and GOP will have to navigate thorny issues related to terrorism and international crime. Read more at: https://www.marketwatch.com/story/david-sacks-and-the-coming-crypto-war-over-national-security-cc22c486?mod=mw_rss_topstories |

|

Treasury yields end at lowest levels since October as jobs data reinforce December rate-cut expectationsTreasury yields finished broadly lower on Friday, led by a drop in the 1-month Treasury-bill rate, after November’s stronger-than-expected jobs data reinforced the view of many market participants that the Federal Reserve will cut borrowing costs this month. Read more at: https://www.marketwatch.com/story/treasury-yields-mostly-higher-ahead-of-november-jobs-data-ac0e2375?mod=mw_rss_topstories |

|

U.S. consumer credit jumps in October as credit cards drive purchasesTotal U.S. consumer credit surged in October, rising by $19.2 billion — the fastest pace since July. Read more at: https://www.marketwatch.com/story/u-s-consumer-credit-jumps-in-october-as-credit-cards-drive-purchases-e4d367e0?mod=mw_rss_topstories |