Summary Of the Markets Today:

- The Dow closed down 76 points or 0.17%,

- Nasdaq closed up 77 points or 0.40%,

- S&P 500 closed up 3 points or 0.05%,

- Gold $2,665 up $6.60 or 0.24%,

- WTI crude oil settled at $70 up $1.87 or 2.75%,

- 10-year U.S. Treasury 4.230 up 0.036 points or 0.86%,

- USD index $106.34 down $0.11 or 0.1%,

- Bitcoin $95,818 down $30 or 0.03%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks closed mixed on Tuesday as investors processed new jobs data and Federal Reserve commentary on interest rates. The S&P 500 (^GSPC) and NASDAQ Composite (^IXIC) reached new record highs. The Dow Jones Industrial Average (^DJI) ended down despite recovering from earlier lows. Job openings in October increased by 372,000 to 7.74 million, surpassing estimates of 7.52 million. The Job Openings and Labor Turnover Survey (JOLTS) revealed fewer hires but a rise in the quits rate from 1.9% to 2.1%, indicating increased worker confidence [note: there is no correlation of jobs growth to either hires or quits]. Fed policymakers Mary Daly, Austan Goolsbee, and Adriana Kugler suggested continued rate cuts as the central bank moves towards a more neutral policy stance. Following these comments, Treasury yields increased, with the 10-year note yield rising about 3 basis points. Market expectations for a quarter-point rate cut at the Fed’s December 18 meeting increased to 72%, up from 62% the previous day. In corporate news, US Steel (X) shares fell about 8% after President-elect Donald Trump vowed to block its $15 billion takeover by Japan’s Nippon Steel.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

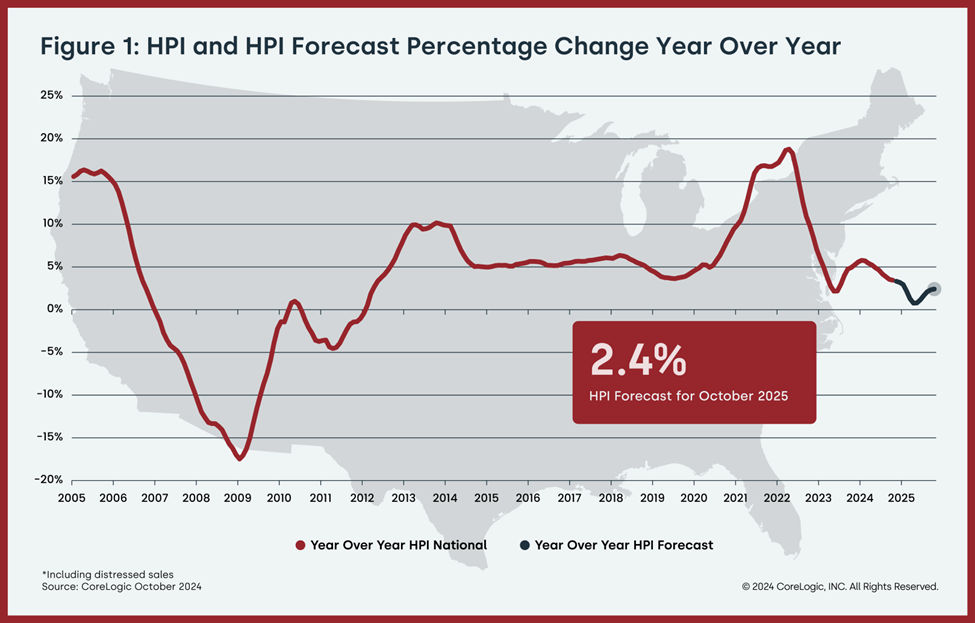

On an annual basis, home prices rose by 3.4% in October 2024. Note that in the chart below CoreLogic projects home prices will continue to decline until the middle of next year – and then will begin increasing reaching the 2.4% in October 2025. For the majority of Americans, homes are the most valuable asset owned. A decline in home prices would slow consumer spending.

Historically there has been a correlation between Job Openings and employment growth. In October 2024. job opening modestly grew which suggests modest improvement in employment growth in the coming months. I would not be surprised no matter the results of December’s employment report but note both employment gain and job openings have been trending down (which suggests employment growth should slow).

Here is a summary of headlines we are reading today:

- Uncertainty Looms Over Aluminum Prices as Chinese Exports Face New Tariff

- US Treasury Tightens Focus on Iran’s Oil Networks

- Jaguar’s Electric Ambitions Take Shape with Type 00 Reveal

- Putin’s War Effort Strains Russian Economy

- Why No One Wants California’s Orphaned Oil Wells

- Oil Prices Rise as OPEC+ Prepares to Extend Production Cuts

- EU Commission Earmarks $4.8 Billion for Clean Tech and EV Batteries

- NATO Chief Cautions Trump Against ‘Bad’ Ukraine Peace Deal

- Russia’s ESPO Crude Prices Jump to 2022 High on Strong Chinese Demand

- Intel considers an outside CEO, taps headhunters, sources say

- Mike Bloomberg warns making RFK Jr. HHS secretary risks killing Americans, urges Senate to reject him

- US Steel Takeover By Japanese Company Will Be Blocked, Says Trump

- Will Microsoft Ride $5 Trillion Bitcoin Wave (Or Avoid Risk); PolyMarket Betters Skeptical

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Uncertainty Looms Over Aluminum Prices as Chinese Exports Face New TariffVia Metal Miner A much-reported but little-understood development in the aluminum market this month has the potential to significantly alter the supply chain landscape for aluminum semi-finished metals in the year ahead. Beyond that, it could have serious repercussions for the price of aluminum around the globe. As my colleague Nichole already reported, China’s Ministry of Finance canceled the 13% VAT refund or rebate on exported aluminum and copper semi-finished products effective December 1. The summary of HS codes covered appears below.… Read more at: https://oilprice.com/Metals/Commodities/Uncertainty-Looms-Over-Aluminum-Prices-as-Chinese-Exports-Face-New-Tariff.html |

|

US Treasury Tightens Focus on Iran’s Oil NetworksThe U.S. Treasury Department announced a new wave of sanctions on Iran’s energy sector, focusing on oil exports and financial networks that enable Tehran to bypass existing restrictions. These measures are aimed at addressing the country’s continued “destabilizing behavior” in the Middle East, according to a new statement made Tuesday by the U.S. Treasury Department. In Tuesday’s statement, the Treasury emphasized its commitment to constraining Iran’s ability to fund activities that undermine regional stability. “Iran… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Treasury-Tightens-Focus-on-Irans-Oil-Networks.html |

|

Jaguar’s Electric Ambitions Take Shape with Type 00 RevealJaguar has revealed the first look at its new luxury electric car following a backlash over its recent rebranding. The iconic Britich carmaker sparked criticism last month after switching up its logo to ‘JaGUar’ and launching an ad which included slogans such as “delete ordinary” and “copy nothing.” The move led to accusations Jaguar was ditching its old followers and even a wild claim from Nigel Farage the brand would go bust. Jaguar’s managing director Rawdon Glover has since hit back at what he called… Read more at: https://oilprice.com/Energy/Energy-General/Jaguars-Electric-Ambitions-Take-Shape-with-Type-00-Reveal.html |

|

Brazil’s Hydropower Generation Returns as Historic Drought EasesOne of the biggest hydropower plants in South America is ramping up electricity generation as the historic drought in the Amazon in September and October has eased and the rainy season has begun. The Santo Antonio hydropower plant on the Madeira River in the Amazon has even managed to generate some electricity during the drought this year after lessons learned from last year’s drought, the plant’s president Caio Pompeu Neto has told Reuters. Santo Antonio, operated by Latin America’s biggest power utility Eletrobras, has created… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazils-Hydropower-Generation-Returns-as-Historic-Drought-Eases.html |

|

Putin’s War Effort Strains Russian EconomyPresident Vladimir Putin has approved a new, multiyear budget that sets defense spending for next year at record-high levels, signaling no let-up in Russia’s determination to defeat Ukraine. The approved budget, which was published on the government’s main website on December 1, calls for 35.5 percent of all spending to be allocated for national defense in 2025. That’s up from a reported 28.3 precent this year.The spending plan had been approved by both houses of Russia’s parliament over the previous 10 days. At 13.5 trillion… Read more at: https://oilprice.com/Geopolitics/International/Putins-War-Effort-Strains-Russian-Economy.html |

|

UK Cancels Electricity Market Notice Amid Narrow MarginsThe UK’s National Energy System Operator (ESO) took the industry on a brief rollercoaster today, issuing and then swiftly canceling an electricity capacity margin notice within hours. The ESO initially raised concerns about power availability and warned consumers that the grid was nearing its margin with an expected capacity of 47,166 MW against a transmission demand of 46,717 MW. The notice, active for less than a workday, was rescinded by evening, restoring a semblance of calm. At least for now. Capacity margin notices, while not uncommon,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Cancels-Electricity-Market-Notice-Amid-Narrow-Margins.html |

|

Why No One Wants California’s Orphaned Oil WellsNone of the three dozen sales of oil wells proposed in California this year has materialized due to the considerable clean-up costs for the wells estimated by the state’s oil and gas regulator. Last year, California sought to prevent a rise in the already high number of so-called orphan oil wells. The state also looked to keep from passing off to taxpayers the liability for plugging and abandoning oil wells should operators not have sufficient funds to plug and decommission non-producing or marginal wells and clean up the sites. That’s… Read more at: https://oilprice.com/Energy/Crude-Oil/Why-No-One-Wants-Californias-Orphaned-Oil-Wells.html |

|

Enbridge Expects Its Core Profit to Rise in 2025Canada’s pipeline giant Enbridge Inc. expects its core profit to be higher in 2025 compared to 2024 levels, thanks to the expected strong utilization of its assets and the contribution of recently acquired U.S. natural gas assets. Enbridge on Tuesday announced its first guidance for the core profit – or adjusted earnings before interest, income taxes, and depreciation (EBITDA) – for 2025. The guidance of adjusted EBITDA of US$13.8 billion to US$14.2 billion (C$19.4 billion to C$20.0 billion) is 17% higher than the original guidance… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Enbridge-Expects-Its-Core-Profit-to-Rise-in-2025.html |

|

Oil Prices Rise as OPEC+ Prepares to Extend Production CutsOil prices were moving higher early on Tuesday morning ahead of the latest OPEC+ meeting as members of the group aligned behind plans to extend production cuts into 2025.- US President-elect Donald Trump threatened to slap a 100% tariff on BRICS if the respective countries decide to create a new currency alternative to the dollar, promising to block them from the ’wonderful US economy’.- China has already been trading Iranian crude in Chinese yuan, whilst Brazil’s President Lula da Silva proposed creating a common currency in… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Rise-as-OPEC-Prepares-to-Extend-Production-Cuts.html |

|

EU Commission Earmarks $4.8 Billion for Clean Tech and EV BatteriesThe European Commission on Tuesday said it is earmarking $4.83 billion (4.6 billion euros) in funds to support net-zero technologies, including electric vehicle battery cell manufacturing. The new Commission, which took office on December 1 for a five-year term until 2029, is now launching two new calls for proposals with a budget of $3.6 billion (3.4 billion euros) to accelerate the deployment of innovative decarbonization technologies in Europe, including electric vehicle batteries. The Commission also plans $1.26 billion (1.2 billion euros)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Commission-Earmarks-48-Billion-for-Clean-Tech-and-EV-Batteries.html |

|

NATO Chief Cautions Trump Against ‘Bad’ Ukraine Peace DealNATO’s new secretary-general is trying to talk tough ahead of Donald Trump taking office. Surely he knows Brussels is in for a rough ride, given that during the first Trump administration the president (rightly) ripped NATO member states for not paying their fair share in defense spending, while relying on Washington to shoulder the burden. Mark Rutte has warned Trump in a Financial Times interview that if Ukraine is pressured into a ‘bad’ peace deal that is favorable to Moscow, then the United States and Europe would face a “dire threat” from… Read more at: https://oilprice.com/Geopolitics/International/NATO-Chief-Cautions-Trump-Against-Bad-Ukraine-Peace-Deal.html |

|

Russia’s Crude Oil Shipments Surge Ahead of OPEC+ MeetingRussia’s crude oil shipments jumped by 570,000 barrels per day (bpd) last week, to 3.36 million bpd, just ahead of the OPEC+ meeting which will discuss on Thursday the group’s production plans for early next year. More vessels loading from Russia’s western ports drove the surge in seaborne shipments in the week to December 1, according to tanker-tracking data monitored by Bloomberg. The four-week average crude oil exports by sea also rose, for the first time in three weeks, per the data reported by Bloomberg’s Julian Lee… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Crude-Oil-Shipments-Surge-Ahead-of-OPEC-Meeting.html |

|

Russia’s ESPO Crude Prices Jump to 2022 High on Strong Chinese DemandStrengthening winter demand from China and higher prices of Iran’s crude has pushed the spot premiums of Russia’s ESPO blend from the Far East to its highest level against ICE Brent since the Russian invasion of Ukraine in 2022, anonymous trading sources told Reuters. Cargoes of the ESPO Blend set to load in January are now trading at a premium of between $1.30 and $1.50 per barrel over the ICE Brent on delivered ex-ship (DES) China basis, the trade sources told Reuters. That’s higher than the spot premiums of ESPO of $1 per barrel… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-ESPO-Crude-Prices-Jump-to-2022-High-on-Strong-Chinese-Demand.html |

|

Russian Crude and LNG Exports to Asia Set for Small Drop in 2024Russia’s crude oil and LNG exports to Asia are on track to see only small declines this year compared to 2023 as major buyers in Asia continue to buy Russian energy commodities that are either banned or under restrictions in the West. The Western sanctions on Russia haven’t been felt too much in Asia, where China continues to import oil and gas at prices it sees fit, regardless of what Beijing dismisses as unilateral U.S. sanctions. This year, Asia is set to import about 3.22 million barrels per day (bpd) of crude from Russia, which… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Crude-and-LNG-Exports-to-Asia-Set-for-Small-Drop-in-2024.html |

|

Exxon Hasn’t Given Up on Shallow-Water Block Offshore GuyanaExxonMobil and its partners in Guyana continue to discuss with the local government terms to develop a shallow-water block won in a 2022 auction, a spokesperson for the U.S. supermajor has told Reuters. The consortium of ExxonMobil and its partners, U.S. Hess Corp and China’s CNOOC has been pumping all the crude oil in Guyana, with production currently exceeding 600,000 barrels per day (bpd) from one offshore block—the Stabroek Block. The consortium is also interested in developing a shallow-water block offshore the South American country,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Hasnt-Given-Up-on-Shallow-Water-Block-Offshore-Guyana.html |

|

South Korean stocks rebound from lows in chaotic trading as president says he’s lifting martial lawThe iShares MSCI South Korea ETF (EWY), which tracks more than 90 large and mid-sized companies in South Korea, at one point tumbled to a 52-week low. Read more at: https://www.cnbc.com/2024/12/03/south-korean-stocks-rocked-after-martial-law-declared.html |

|

Donald Trump Jr. joins PSQ Holdings’ board, sending shares skyrocketing 235%PSQ is a microcap stock with a market capitalization of only $72 million as of Monday’s close. Read more at: https://www.cnbc.com/2024/12/03/psq-holdings-doubles-in-latest-stock-to-rip-higher-on-news-of-donald-trump-jrs-involvement.html |

|

S&P 500 is little changed as 2024’s relentless rally takes a pause: Live updatesStocks were little changed Tuesday as a rally to record levels took a pause. Read more at: https://www.cnbc.com/2024/12/02/stock-market-today-live-updates.html |

|

Intel shares slide as Gelsinger exit leaves chipmaker without a ‘quick fix’Intel shares fell more than 5% on Tuesday, a day after the chipmaker announced the ouster of CEO Pat Gelsinger. Read more at: https://www.cnbc.com/2024/12/03/intel-slides-as-gelsinger-exit-leaves-chipmaker-without-a-quick-fix.html |

|

Intel considers an outside CEO, taps headhunters, sources sayIntel is considering tapping an outside hire as CEO, a nearly unprecedented occurrence, as the company reels from the ouster of Pat Gelsinger. Read more at: https://www.cnbc.com/2024/12/03/intel-outside-ceo-candidates.html |

|

Ramp up tax savings for the holiday season with these strategiesDon’t forget your favorite charities as you splurge on the holidays. Read more at: https://www.cnbc.com/2024/12/03/ramp-up-tax-savings-for-the-holiday-season-with-these-strategies.html |

|

This is the biggest AI winner two years after ChatGPT’s debut — and it’s not NvidiaIn the two years since the debut of ChatGPT, stocks have soared and chipmaker Nvidia has become the largest company in the U.S. Read more at: https://www.cnbc.com/2024/12/03/nvidia-isnt-the-biggest-ai-winner-two-years-after-chatgpts-debut-.html |

|

OpenAI hires first marketing chief from CoinbaseOpenAI said on Tuesday that it’s hired Kate Rouch from Coinbase as its first chief marketing officer. Read more at: https://www.cnbc.com/2024/12/03/openai-hires-first-marketing-chief-from-coinbase.html |

|

Mike Bloomberg warns making RFK Jr. HHS secretary risks killing Americans, urges Senate to reject himRobert F. Kennedy Jr. is President-elect Donald Trump’s pick to lead the Department of Health and Human Services. Read more at: https://www.cnbc.com/2024/12/03/mike-bloomberg-rfk-jr-hhs-trump.html |

|

Blockchain Association CEO discusses hopes for 2025 crypto legislation: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Blockchain Association CEO Kristin Smith discusses what she hopes President-elect Trump and the incoming Congress will prioritize in regards to crypto. Read more at: https://www.cnbc.com/video/2024/12/03/blockchain-association-ceo-discusses-hopes-2025-crypto-legislation-crypto-world.html |

|

Jaguar reveals ‘Type 00’ concept car, first under controversial new brand identityFamed British carmaker Jaguar revealed its new vehicle design direction Monday night with the introduction of an all-electric concept car called “Type 00.” Read more at: https://www.cnbc.com/2024/12/02/jaguar-concept-car-type-00-car-new-brand.html |

|

The top books and experiences for the wealthy this holiday seasonJ.P. Morgan Private Bank’s “NextList2025” includes four museums, two wineries, four Broadway shows and 10 books. Read more at: https://www.cnbc.com/2024/12/03/jp-morgan-private-bank-holiday-recommendations-for-the-wealthy.html |

|

Beware these retailers that increased promotions more than expected throughout Black Friday weekend, BMO saysSome companies relied more on deals over the major shopping weekend than was expected based on historical moves, the firm said. Read more at: https://www.cnbc.com/2024/12/03/beware-these-retailers-that-leaned-heavily-on-black-friday-promotions-bmo-says.html |

|

US Steel Takeover By Japanese Company Will Be Blocked, Says TrumpAuthored by Naveen Athrappully via The Epoch Times (emphasis ours), President-elect Donald Trump said on Dec. 3 that he would prevent the acquisition of U.S. Steel Corp. by Japan’s Nippon Steel Corporation. “I am totally against the once great and powerful U.S. Steel being bought by a foreign company,” the president-elect said in a post on the social media platform Truth Social. “Through a series of Tax Incentives and Tariffs, we will make U.S. Steel Strong and Great Again, and it will happen FAST! As President, I will block this deal from happening. Buyer Beware!!!”

Read more at: https://www.zerohedge.com/commodities/us-steel-takeover-japanese-company-will-be-blocked-says-trump |

|

Will Microsoft Ride $5 Trillion Bitcoin Wave (Or Avoid Risk); PolyMarket Betters SkepticalMicrosoft’s shareholders will soon vote on adding Bitcoin to its balance sheet. Will Michael Saylor’s pitch Orange Pill the tech giant? What are the stakes and risks?

CoinTelegraph’s Daniel Ramirez-Escudero reports that next week, Dec. 10 will mark a key date for Microsoft and the Bitcoin community because the tech giant’s shareholders will vote on whether to add BTC to its balance sheet. The results will show whether shareholders are attracted by the current Bitcoin bull market or wish to stick to Microsoft’s pragmatic and profitable approach to tech development. On Oct. 24, before the United States presidential election, Microsoft’s 14a filing with the US Securities and Exchange Commission included a … Read more at: https://www.zerohedge.com/crypto/will-microsoft-ride-5-trillion-bitcoin-wave-or-avoid-risk-polymarket-betters-skeptical |

|

South Korean President Announces Plan To Lift Martial Law In TV Address To NationSouth Korean President Announces Plan To Lift Martial Law In TV Address To Nation Watch Live:Update (1115ET): President Yoon Suk Yeol announced on local television that he would lift martial law hours after being rejected by South Korea’s National Assembly. This marks the largest flare-up in political turmoil in South Korea since full-scale martial law was declared in the spring of 1980. Read more at: https://www.zerohedge.com/geopolitical/south-korea-declares-emergency-martial-law |

|

Why Government Intervention Is Fueling The Housing DisasterVia SchiffGold.com, The United States is grappling with a severe housing affordability crisis that has persisted for years, leaving millions of Americans struggling to keep a roof over their heads. While some argue for increased government intervention, free market principles offer the most effective solution the issue. According to the National Alliance to End Homelessness, a record-high 653,104 people were experiencing homelessness on a single night in January 2023. This crisis has been exacerbated by a severe shortage of affordable housing, with the National Low-Income Housing Coalition reporting a deficit of 7.3 million affordable rental homes for low-income renters. At first glance, these statistics might seem to call for more government intervention. Read more at: https://www.zerohedge.com/personal-finance/why-government-intervention-fueling-housing-disaster |

|

South Western Railway to be renationalised by LabourThe rail operator will be renationalised in May, as part of the government’s manifesto promise. Read more at: https://www.bbc.com/news/articles/ceqlnrgjr79o |

|

Stunning or rubbish? Jaguar’s new concept car divides opinionThe carmaker’s new look is praised as “exciting” but others say it should “go back to the drawing board”. Read more at: https://www.bbc.com/news/articles/czen5y97yjzo |

|

Bank boss takes pay cut after employee ‘tried to kill clients’The bank apologised after the former worker was charged with robbery of clients, attempted murder and arson. Read more at: https://www.bbc.com/news/articles/clyv3vgw2lxo |

|

Sebi cancels Trafiksol SME IPO, asks company to refund investors’ moneyMarket regulator Securities and Exchange Board of India (Sebi) on Monday cancelled the SME IPO of Trafiksol ITS Technologies, which was earlier put on hold by BSE pending investigation, and asked the company to refund the money to the investors. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/sebi-cancels-trafiksol-sme-ipo-asks-company-to-refund-investors-money/articleshow/115936995.cms |

|

Sebi tackles tech glitches with new online monitoring mechanism for system audits of brokersThe paper addresses the growing complexities of trading systems and the rising risks of technological glitches. The proposals aim to enhance audit practices, fostering a stronger regulatory framework. Public comments are invited until December 26. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-tackles-tech-glitches-with-new-online-monitoring-mechanism-for-system-audits-of-brokers/articleshow/115940070.cms |

|

11 stocks with consistent sales and profit growth turned multibaggers in FY25In volatile market conditions, 11 fundamentally strong stocks have shown impressive double-digit sales and profit growth, with significant price surges, doubling investors’ wealth in FY25. Stocks include PG Electroplast, Balu Forge, and others. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/11-stocks-with-consistent-sales-and-profit-growth-turned-multibaggers-in-fy25/slideshow/115933872.cms |

|

Fewer shoppers turned out for Thanksgiving-weekend deals, retail group says. Here’s why.The five-day period between Thanksgiving and Cyber Monday saw fewer shoppers than a year ago, a major retail-industry group said Tuesday, due in part to the later timing of the holiday this year and an avalanche of deals through October. Read more at: https://www.marketwatch.com/story/fewer-shoppers-turned-out-for-thanksgiving-weekend-deals-retail-group-says-heres-why-bc0b4f05?mod=mw_rss_topstories |

|

Treasury yields finish mostly higher ahead of no-confidence vote in FranceInvestors sold off long- and intermediate-term U.S. government debt on Tuesday, pushing corresponding yields to slightly higher closing levels ahead of a vote in France that could topple that country’s government. Read more at: https://www.marketwatch.com/story/treasury-yields-rise-ahead-of-labor-market-updates-092a339b?mod=mw_rss_topstories |

|

Oil sees biggest daily gain in 2 weeks on bets OPEC+ will extend production cutsOil futures settled higher Tuesday, scoring their largest one-day gains in about two weeks as some traders expect the Organization of the Petroleum Exporting Countries and its allies to further delay a partial unwinding of production cuts when they meet Thursday. Read more at: https://www.marketwatch.com/story/oil-prices-rise-ahead-of-opec-decision-this-week-on-production-cuts-ac4d5c79?mod=mw_rss_topstories |

U.S. Steel Edgar Thomson Steel Works in Braddock, Pa., on March 10, 2018. Drew Angerer/Getty Ima …

U.S. Steel Edgar Thomson Steel Works in Braddock, Pa., on March 10, 2018. Drew Angerer/Getty Ima …