There will be no newsletter on Thanksgiving. EconCurrents wishes all our readers and their families a Happy Thanksgiving. |

Summary Of the Markets Today:

- The Dow closed down 138 points or 0.31%,

- Nasdaq closed down 115 points or 0.60%,

- S&P 500 closed down 23 points or 0.38%,

- Gold $2,636 up $15.60 or 0.60%,

- WTI crude oil settled at $69 down $0.01 or 0.01%,

- 10-year U.S. Treasury 4.250 down 0.052 points or 1.209%,

- USD index $106.06 down $0.95 or 0.89%,

- Bitcoin $96,629 up $4,685 or 5.1%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The U.S. stock market experienced a bad day on Wednesday as investors analyzed new inflation data. The Federal Reserve’s preferred inflation gauge showed minimal progress towards the 2% target in October. Traders now estimate a 34% chance the Fed will maintain current interest rates, up from 24% a month earlier. The third-quarter GDP remained unchanged. Dell shares plummeted over 12% due to declining PC demand. HP stock also dropped more than 11% following its earnings report. The market mood was subdued ahead of the Thanksgiving holiday, with markets set to close on Thursday and have shortened hours on Friday.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods in October 2024 were up 2.7% year-over-year (increased from -1.7% year-over-year last month). This was a healthy increase which suggests consumers returned to the spending trough in October.

Real (inflation adjusted) personal income improved from 2.6% year-over-year last month to 2.7% in October 2024. Real personal consumption expenditures declined from 3.1% last month to 3.0% in October. Inflation worsened with the PCE price index worsened from 2.1% last month to 2.3% in October and this same price index excluding food and energy worsened from 2.7% last month to 2.8% in October. As predicted, inflation worsened and I see inflation worsening for at least the next 6 months. This is the inflation index the Federal Reserve prefers to gauge inflation.

The second estimate of Real gross domestic product (GDP) increased at an annual rate of 2.8% in the third quarter of 2024. In the second quarter, real GDP increased 3.0 percent. This was unchanged from the advance estimate. The inflation measure in GDP (implicit price deflator) improved from 2.6% in 2Q2024 to 2.2% in 3Q2024. Not much I can add but in the new normal, growth over 2% year-over-year is good.

Pending home sales (homes under a sales contract) increased 5.4% year-over-year in October 2024 according to NAR. The NAR can be likened to the fox watching the chicken coop. In the graph below shows data provided by realtor.com – a licensee of the NAR owned by News Corp which shows year-over-year gains of 9.9% in pending home sales. In any event, pending home sales is trending up. Chief Economist Lawrence Yun adds:

Homebuying momentum is building after nearly two years of suppressed home sales. Even with mortgage rates modestly rising despite the Federal Reserve’s decision to cut the short-term interbank lending rate in September, continuous job additions and more housing inventory are bringing more consumers to the market.

In the week ending November 23, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 217,000, a decrease of 1,250 from the previous week’s revised average. The previous week’s average was revised up by 500 from 217,750 to 218,250. This data is consistent with a strong economy.

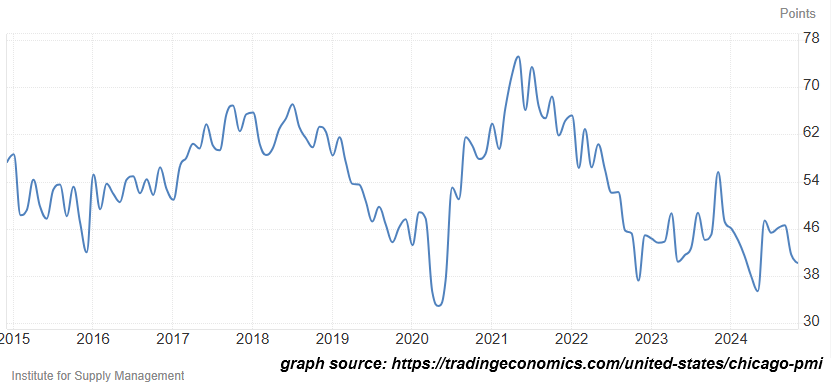

The Chicago Business Barometer™ eased 1.4 points to 40.2 in November 2024. This was the second consecutive monthly fall from 46.6 in September, leaving the index 2.7 points below the year-to-date average. The decline was due to four of the five subcomponents falling (Production, New Orders, Order Backlogs and Employment), with only Supplier Deliveries rising in October. The Chicago PMI is believed to be a window into the PMI manufacturing index which will be released next week. Manufacturing is in a recession in the US.

Here is a summary of headlines we are reading today:

- Electric Capital Spending Has Skyrocketed, and It’s Only the Start

- Reuters: Exxon Lobbyist Investigated Over Leak Of Environmentalist Emails

- Lebanon Cease-Fire Deal Is a Major Victory For Israel

- China’s Industrial Sector Posts Large Profit Decline In October

- UAE’s Oil Giant Launches $80-Billion Chemicals and Green Energy Firm

- Russia’s Fuel Exports Jump to 8-Month High

- Russia’s Shadow Fleet Has Moved Its Oil Smuggling Operations to New Waters

- Goldman Sachs: OPEC+ Cuts Provide Near-Term Upside to Oil Prices

- Homebuyer demand for mortgages jumps 12% after first interest rate drop in over 2 months

- U.S. Court Could Reopen Bidding for Oil Refiner Citgo After Failed Deal

- ‘Europe’s Detroit’ built a thriving car industry. Trump tariffs now threaten to unravel its success

- Is Reviving Keystone XL More Than Just A Pipe Dream?

- Russia Reveals 2 Dead, Radar Site Damaged, After US-Supplied Missiles Struck Kursk

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Electric Capital Spending Has Skyrocketed, and It’s Only the StartAlmost five years ago we predicted that electricity sales would start to grow again and that utility capital expenditures would soar. And we said that the industry was not spending enough. Apart from patting ourselves on the back, here are the latest numbers confirming our long-held view. Figure 1 shows the five-year spending of investor-owned utilities (IOUs) on electric plants in current dollars. Note how the numbers peaked in the early eighties, fell off, and finally picked up in this century. More meaningfully, Figure 2 shows the five-year… Read more at: https://oilprice.com/Energy/Energy-General/Electric-Capital-Spending-Has-Skyrocketed-and-Its-Only-the-Start.html |

|

Reuters: Exxon Lobbyist Investigated Over Leak Of Environmentalist EmailsThe FBI has been investigating a longtime Exxon Mobil (NYSE:XOM) consultant over the contractor’s alleged role in a hack-and-leak operation that targeted emails by environmentalists critical of Exxon Mobil’s role in climate change, Reuters has reported exclusively. The multi-year operation involved hackers who breached email accounts of environmental activists and others. The scheme allegedly began in late 2015, when U.S. authorities contended that the names of the hacking targets were compiled by the DCI Group, a public affairs and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Reuters-Exxon-Lobbyist-Investigated-Over-Leak-Of-Environmentalist-Emails.html |

|

Lebanon Cease-Fire Deal Is a Major Victory For IsraelA cease-fire deal has ended over a year of fighting between Israel and Hezbollah, the Lebanese armed group and political party. The U.S.-brokered agreement is a major victory for Israel, which has achieved its key war aims, experts say. Israel has eroded Hezbollah as a military power as well as a political and economic force in Lebanon. Israel has also succeeded in decoupling Hezbollah’s rocket and missile attacks on Israel from the Gaza war. The Iran-backed group began its attacks soon after Israel’s air and ground invasion… Read more at: https://oilprice.com/Geopolitics/Middle-East/Lebanon-Cease-Fire-Deal-Is-a-Major-Victory-For-Israel.html |

|

China’s Industrial Sector Posts Large Profit Decline In OctoberChina’s large industrial firms reported a 10 % Y/Y decline in profits in October, with the property and retail sectors hit the hardest, the National Bureau of Statistics in Beijing said on Wednesday. Total profits for the first 10 months of the current year fell 4.3% Y/Y to 5.87 trillion yuan (US$810.9 billion), worse than the 3.5 per cent drop recorded in the first nine months. China’s oil and steel industries are deeply in the red: the cumulative losses in the world’s biggest steel industry hit 34 billion yuan (S$4.76 billion)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Industrial-Sector-Posts-Large-Profit-Decline-In-October.html |

|

UK Government May Relax Rules On EV TargetsThe UK government is set to review electric vehicle (EV) sales rules through a “fast track” consultation, following pressure from carmakers who argue that current sales targets are too ambitious given weaker-than-expected demand, according to the BBC. Business Secretary Jonathan Reynolds is expected to announce the consultation at the Society of Motor Manufacturers and Traders’ annual dinner on Tuesday. Under existing rules, EVs must account for 22% of car sales and 10% of van sales this year, with non-compliance resulting in £15,000… Read more at: https://oilprice.com/Energy/Energy-General/UK-Government-May-Relax-Rules-On-EV-Targets.html |

|

Mali Arrests Four Canadian Mining Reps Over Tax RowThe military regime in Mali has arrested four senior employees of a Canadian mining company as it continues to detain workers to pressure companies in the West African mining sector to pay millions in additional taxes. Barrick Gold (NYSE:GOLD) has revealed that four employees of its Loulo-Gounkoto mining complex in Mali have been detained pending trial, as a dispute over its local mining operations escalates. The giant gold miner says it will continue to engage with Mali’s government to find an amicable settlement and ensure sustainable operations… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mali-Arrests-Four-Canadian-Mining-Reps-Over-Tax-Row.html |

|

Why Energy Giants Won’t Turn Their Backs on OilAs governments worldwide put increasing pressure on oil and gas companies to decarbonize, many have responded by pledging to expand their renewable energy portfolios and cut emissions in fossil fuel operations. However, despite big promises, little progress is being seen by most oil and gas majors, which suggests some might have so far overstated their commitment to a green transition. In 2020, during the COVID-19 pandemic, when the global demand for oil sunk to a record low, several oil and gas companies turned their attention to renewable… Read more at: https://oilprice.com/Energy/Energy-General/Why-Energy-Giants-Wont-Turn-Their-Backs-on-Oil.html |

|

UAE’s Oil Giant Launches $80-Billion Chemicals and Green Energy FirmAbu Dhabi’s oil company ADNOC is launching a new firm, XRG, which will be an international lower-carbon energy and chemicals investment company with an enterprise value of over $80 billion, the company pumping nearly all the oil of the United Arab Emirates (UAE) said on Wednesday. XRG will formally commence activities in the first quarter of 2025. Initially, XRG will focus on transformational global investments that create value across natural gas, chemicals, and lower-carbon energy solutions, ADNOC said in a statement. The independently… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UAEs-Oil-Giant-Launches-80-Billion-Chemicals-and-Green-Energy-Firm.html |

|

Oil Inches Higher after EIA Confirms Crude Inventory DrawCrude oil prices moved higher today, after the U.S. Energy Information Administration reported an inventory draw of 1.8 million barrels for the week to November 22. The change compared with a draw of 5.9 million barrels for the reported week as estimated by the American Petroleum Institute. It also followed an estimated inventory build of a modest half a million barrels for the previous week. The partial confirmation of the API estimate will likely push prices higher but it would be countered by fuel inventory changes. In these, the EIA estimated… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Inches-Higher-after-EIA-Confirms-Crude-Inventory-Draw.html |

|

Russia’s Fuel Exports Jump to 8-Month HighFollowing the end of autumn maintenance season at refineries, Russia’s shipments of refined petroleum products have surged so far in November to their highest level in eight months, data compiled by Bloomberg showed on Wednesday. During the first 20 days of November, Russian fuel exports by sea averaged 2.3 million barrels per day (bpd), up by 18% compared to October, according to Bloomberg’s estimates on data compiled from analytics firm Vortexa. The surge in refined product exports came as several refineries returned from maintenance,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Fuel-Exports-Jump-to-8-Month-High.html |

|

Russia’s Shadow Fleet Has Moved Its Oil Smuggling Operations to New WatersFor much of the past three years, tankers carrying Russian crude oil – usually in violation of Western embargo – skirted Western sanctions and oversight by engaging in so-called Ship-to-Ship (STS) transfers somewhere in the open sea far from prying eyes and even further from hostile coast guard supervision. The practice, usually carried out in secret with digital tracking beacons switched off or falsified, can help to obscure the origins of the oil, helping to beat sanctions. It also creates another layer of separation between the buyers and… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Shadow-Fleet-Has-Moved-Its-Oil-Smuggling-Operations-to-New-Waters.html |

|

Goldman Sachs: OPEC+ Cuts Provide Near-Term Upside to Oil PricesThe ongoing OPEC+ oil production cuts and the improved compliance with quotas from some producers are supporting Brent Crude, offering a modest upside to oil prices in the near term, according to Goldman Sachs. The U.S. investment bank expects the OPEC+ cuts to be rolled over again and the easing of the output curbs could begin gradually in April 2025, after the first quarter of next year ends. “Saudi Arabia is more likely to extend oil production cuts because of the recent price drop and we now think that oil production cuts will last until… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-Sachs-OPEC-Cuts-Provide-Near-Term-Upside-to-Oil-Prices.html |

|

EU Dismisses Nord Stream 2 Challenge Against Gas Pipelines RulesThe EU’s General Court on Wednesday dismissed a case brought by Gazprom-led Nord Stream 2, the company behind the gas pipeline that was never put into operation, challenging the EU’s unbundling rules on gas transmission pipelines. These rules include extending the rules of the EU’s internal gas market to apply to natural gas pipelines to and from third countries, which would have included Nord Stream 2. The main elements of the gas market rules in the EU include ownership unbundling, giving access to third parties, non-discriminatory… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Dismisses-Nord-Stream-2-Challenge-Against-Gas-Pipelines-Rules.html |

|

U.S. Court Could Reopen Bidding for Oil Refiner Citgo After Failed DealA court adviser has proposed that the court-ordered auction of assets of Venezuela’s PDV Holding, the parent company of refiner Citgo, should be restarted after the current winning bid has failed to gather enough support from the creditors of the Venezuelan group. The sale process of shares to pay creditors and claimants against Venezuela’s oil asset appropriation and debts owed by Citgo was launched by the Delaware court in October 2023. Overall, creditors and claimants have sought to recoup at courts in Delaware a total… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Court-Could-Reopen-Bidding-for-Oil-Refiner-Citgo-After-Failed-Deal.html |

|

Australia Set to Meet Its 2030 Emissions Reduction TargetAustralia is on track to deliver its 2030 emissions reduction target, the federal government said ahead of a report on the country’s path to curbing its carbon footprint. Chris Bowen, Australia’s Minister for Climate Change and Energy, is expected to reveal in his annual climate statement to Parliament on Thursday that Australia is set to cut emissions by 42.6% by 2030 compared to 2005 levels under current policy settings. That’s in line with the Labor government’s target of a 43% emissions reduction, and a much larger… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australia-Set-to-Meet-Its-2030-Emissions-Reduction-Target.html |

|

Fed’s preferred inflation gauge rises to 2.3% annually, meeting expectationsThe personal consumption expenditures price index was expected to show inflation at 2.3% in October. Read more at: https://www.cnbc.com/2024/11/27/pce-inflation-october-2024.html |

|

Shares of drone maker Unusual Machines soar after Donald Trump Jr. joins advisory boardDonald Trump Jr., the son of President-elect Donald Trump, said “the need for drones is obvious” as he joined the advisory board of Unusual Machines. Read more at: https://www.cnbc.com/2024/11/27/unusual-machines-shares-soar-donald-trump-jr-joins-advisory-board.html |

|

Bitcoin bounces back above $96,000 as investors eye $100,000 milestone heading into Thanksgiving holidayBitcoin climbed back over $96,000 on Wednesday following a pullback this week from its recent record. Read more at: https://www.cnbc.com/2024/11/27/crypto-market-today.html |

|

Homebuyer demand for mortgages jumps 12% after first interest rate drop in over 2 monthsWhile the drop in rates wasn’t exactly huge, there was a fair amount of pent-up demand among homebuyers. Read more at: https://www.cnbc.com/2024/11/27/homebuyer-demand-for-mortgages-jumps-12percent-after-first-interest-rate-drop-in-over-2-months.html |

|

Trump wants to cut corporate taxes to as low as 15%. These stocks could benefit the most, Wolfe saysThe firm screened for names that could see a boost to their earnings if corporate taxes come down to 15%. Read more at: https://www.cnbc.com/2024/11/27/trump-aims-to-cut-corporate-taxes-to-15percent-these-stocks-could-benefit-wolfe-says.html |

|

U.S. Treasury overstepped authority in Tornado Cash sanctions, court rules: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Securitize co-founder and CEO Carlos Domingo discusses the upcoming regulatory shift in Washington and the latest in its tokenization partnership with BlackRock. Read more at: https://www.cnbc.com/video/2024/11/27/us-treasury-overstepped-authority-tornado-cash-sanctions-court-rules-crypto-world.html |

|

Donald Trump selects Kevin Hassett to lead National Economic CouncilThe appointment came as Donald Trump renewed his vow to raise tariffs on imports from China, Mexico and Canada. Read more at: https://www.cnbc.com/2024/11/26/donald-trump-selects-kevin-hassett-to-lead-national-economic-council-.html |

|

2 things we always learn about a company before we decide whether to buy its stockWe do two things right off the bat after identifying a stock that we might want to buy. Read more at: https://www.cnbc.com/2024/11/27/2-things-we-always-learn-about-a-company-before-we-decide-whether-to-buy-its-stock.html |

|

Meta, Rabbit and Bee AI have Black Friday deals, but there’s no must-have AI gadget yetMeta, Rabbit and Bee AI are offering Black Friday deals for their devices that incorporate AI, but there aren’t many other generative AI gadgets on the market. Read more at: https://www.cnbc.com/2024/11/27/why-there-are-few-generative-ai-gadgets-this-holiday-season.html |

|

‘Europe’s Detroit’ built a thriving car industry. Trump tariffs now threaten to unravel its successA small landlocked country in the heart of Europe appears to be uniquely exposed to President-elect Donald Trump’s “America First” economic agenda. Read more at: https://www.cnbc.com/2024/11/27/trump-tariffs-threaten-to-hobble-slovakias-thriving-car-industry.html |

|

Early retirement comes as a surprise for many workers, study finds. Here’s how to manage that financial shockRetiring early is the dream for many workers. But many individuals find themselves forced to call it quits because of health, career or family circumstances. Read more at: https://www.cnbc.com/2024/11/27/early-retirement-comes-as-a-surprise-for-many-workers-study-finds.html |

|

In-N-Out turned a simple $4 burger into a cult favorite and now brings in $2 billion a year—here’s howKnown for its fresh ingredients, straightforward menu, and passionate following, California-based In-N-Out Burger brings in $2 billion a year. Read more at: https://www.cnbc.com/2024/11/27/in-n-out-turned-burgers-into-a-cult-fave-bringing-in-billions.html |

|

56% of Americans say their parents never discussed money with them. How experts recommend getting the conversation startedThe holiday season can be an opportunity to discuss estate planning with aging parents, experts say. Read more at: https://www.cnbc.com/2024/11/27/56percent-of-americans-say-their-parents-never-discussed-money-with-them.html |

|

Is Reviving Keystone XL More Than Just A Pipe Dream?Authored by Riley Donovan via The Epoch Times, Both Alberta Premier Danielle Smith and U.S. President-elect Donald Trump want to revive the long-dead cross-border Keystone XL pipeline project, but is that feasible?

A major challenge in resuscitating the project will be ginning up enough political will and corporate determination to wade through the legal and regulatory requirements to begin construction, not to mention tackling the growing anti-fossil fuel advocay across the continent. Former owner TC Energy terminated the project in June 2021. The pipeline system is now part of the spinoff company So … Read more at: https://www.zerohedge.com/political/reviving-keystone-xl-more-just-pipe-dream |

|

Celebrations Across Lebanon As Ceasefire Holds, Thousands Return To Homes In SouthCelebrations have broken out across Lebanon as the ceasefire between Hezbollah and Israel has held since early this morning. Heavy traffic returned to Beirut, after months of constant aerial bombings mainly of the southern suburbs. A main north-south highway, the Sidon-Tyre highway, has been jammed with cars as Lebanese civilians from the southern region can finally return to their homes. “Enough wars, tragedies and catastrophes,” Lebanese Prime Minister Najib Mikati said, hailing the ceasefire deal. “Today begins the thousand-mile road to reconstruct what was destroyed, and to continue to strengthen the role of the legitimate institutions, led by the military, who we place great hopes in to enforce authority on the country,” Mikati told the population in a televised speech. Read more at: https://www.zerohedge.com/geopolitical/celebrations-across-lebanon-ceasefire-holds-thousands-return-homes-south |

|

“Reimagining” The Resistance: Lawfare Warriors Express Regret But Not Remorse After ElectionAuthored by Jonathan Turley, Below is my column on Fox.com on the new effort to “reimagine” the resistance to Trump, including the recognition of the failure of lawfare. While some figures on the left are expressing doubts over the efficacy of weaponizing the legal system, it is doubtful that we have seen the end of it. They are only regretting that it did not work. The center of gravity of lawfare will now likely shift to the states and Democratic attorneys general and District Attorneys. “Reimagination” is rarely a form of self-examination, let alone self-criticism. That is evident in some of the most recent writings of lawfare warriors. They are like wandering Ronin samurai, warriors who lost not just their master but their purpose. What they seem to lack most, however, is principle. Whatever “reimagining” occurs, it should start with a recognition that lawfare was an abuse of the legal system for political ends. Read more at: https://www.zerohedge.com/political/reimagining-resistance-lawfare-warriors-express-regret-not-remorse-after-election |

|

Russia Reveals 2 Dead, Radar Site Damaged, After US-Supplied Missiles Struck KurskThe Russian Investigative Committee announced Wednesday that is has opened a formal probe into a ‘terrorist act’ launched from Ukraine which resulted in the deaths of two Russians in the Kursk region. “A criminal case has been initiated over the deaths of two individuals in Russia’s Kursk Region after the Ukrainian military struck the area with ATACMS missiles on November 23,” a statement in Moscow-funded media said. Crucially this is the first time Russian authorities have acknowledged that the US-supplied long range system has killed Russians. It is a rare and unexpected admission, and is likely geared toward showing the Russian population and Moscow’s allies that it faces an existential threat from NATO.

Read more at: https://www.zerohedge.com/geopolitical/russia-reveals-2-dead-radar-site-damaged-after-us-supplied-missiles-struck-kursk |

|

Ford calls for incentives to buy electric cars as backlash growsThe government faces pressure from the industry to make changes to electric vehicle sales quotas. Read more at: https://www.bbc.com/news/articles/c98dzyy850jo |

|

Loyalty cards offer genuine savings, watchdog saysSupermarket customers can save money with loyalty cards but should still shop around. Read more at: https://www.bbc.com/news/articles/cew2ejj7lkvo |

|

‘It’s going to be hard’: US firms race to get ahead of Trump tariffsThe US president-elect’s import taxes may be just talk until he takes office – but they are having an impact anyway. Read more at: https://www.bbc.com/news/articles/c3rxe1wv9ero |

|

Tech view: 24,500 crucial resistance in Nifty, buy on dips recommended above 24,000. How to trade on ThursdayThe 24,500 level serves as a key resistance, and a sustained breakout above it could lead to further gains. Amid current volatility, traders are encouraged to adopt a buy-on-dips approach, provided the index stays above 24,000, according to Hardik Matalia, Derivative Analyst at Choice Broking. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-24500-crucial-resistance-in-nifty-buy-on-dips-recommended-above-24000-how-to-trade-on-thursday/articleshow/115735145.cms |

|

Adani stocks jump up to 7.5% after group issues clarification on US bribery allegationsAdani Group stocks rallied after the company clarified that its chairman, Gautam Adani, and other executives are not facing bribery charges as per the US Department of Justice. Moody’s, however, revised its outlook on seven Adani companies to negative, citing governance concerns and potential operational disruptions amid ongoing legal proceedings. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/adani-stocks-in-focus-after-moodys-changes-rating-outlook-on-7-companies-to-negative/articleshow/115715581.cms |

|

Hyundai Motor shares surge 2% after Morgan Stanley and JPMorgan initiate coverageHyundai Motor India shares rose nearly 2% to Rs 1,926 after Morgan Stanley and JPMorgan initiated coverage with an overweight rating. Both brokerages highlighted the company’s strong growth potential, strategic positioning in the SUV and electric vehicle segments, and attractive valuation metrics as key factors for their positive outlook. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/hyundai-motor-shares-surge-2-after-morgan-stanley-and-jpmorgan-initiate-coverage/articleshow/115719168.cms |

|

Yield on 10-year Treasury ends at lowest in a month despite rebound in Fed’s preferred inflation gaugeTreasury yields fall after pre-Thanksgiving economic data points to resilience, gradual Fed rate cuts in 2025 Read more at: https://www.marketwatch.com/story/treasury-yields-fall-as-traders-await-pce-inflation-data-7144f3a0?mod=mw_rss_topstories |

|

Oil prices end mixed as attention turns to OPEC+ decision on crude productionU.S. and global benchmark crude prices settled mixed after a cease-fire between Israel and Iran-backed Hezbollah eliminated much of the remaining risk premium around a wider Middle Eastern conflict. Read more at: https://www.marketwatch.com/story/oil-prices-tick-higher-as-attention-turns-to-opec-decision-on-crude-production-1567135e?mod=mw_rss_topstories |

|

Trump’s economic picks form a ‘team of rivals.’ What it means for tariffs and more.President-elect Donald Trump has assembled what might be called a team of rivals on economic policy. But investors should look no further than Trump himself when it comes to a key part of his agenda: tariffs. Read more at: https://www.marketwatch.com/story/trumps-economic-picks-form-a-team-of-rivals-what-it-means-for-tariffs-and-more-d4662795?mod=mw_rss_topstories |

Fragment of a U.S.-made ATACMS missile on Rus …

Fragment of a U.S.-made ATACMS missile on Rus …