Summary Of the Markets Today:

- The Dow closed up 124 points or 0.28%, (Closed at 44,293, New Historic high 44,903)

- Nasdaq closed up 119 points or 0.63%,

- S&P 500 closed up 35 points or 0.57%, (Closed at 6,001, New Historic high 6,021)

- Gold $2,632 up $13.10 or 0.50%,

- WTI crude oil settled at $69 down $0.29 or 0.42%,

- 10-year U.S. Treasury 4.296 up 0.035 points or 0.821%,

- USD index $106.95 up $0.13 or 0.12%,

- Bitcoin $91,333 down $2,325 or 3.79%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks showed resilience on Tuesday despite President-elect Donald Trump’s threat to impose new tariffs on China, Canada, and Mexico. Both the Dow and S&P500 closed at record levels. Markets initially reacted negatively to Trump’s late Monday announcement of plans to implement significant tariffs on the US’s largest trading partners on his first day in office. This announcement reignited trade war concerns and dampened Wall Street’s expectations that Treasury Secretary nominee Scott Bessent would moderate any extreme actions by the new administration. Carmaker stocks, both domestic and international, experienced declines following Trump’s “America First” stance. The Mexican peso and Canadian dollar dropped sharply as the US dollar rallied. Investors also analyzed the minutes from the recent Federal Open Market Committee meeting, which indicated a preference for gradual interest rate cuts if the economy remains stable. Some officials noted that persistent inflation or a labor market downturn could lead to a pause in the easing cycle.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Sales of new single-family houses in October 2024 were 9.4% below October 2023. The median sales price of new houses sold in October 2024 was $437,300. The average sales price was $545,800. The seasonally-adjusted estimate of new houses for sale at the end of October was 481,000. This represents a supply of 9.5 months at the current sales rate. New home sales are declining due to high mortgage rates and high home prices.

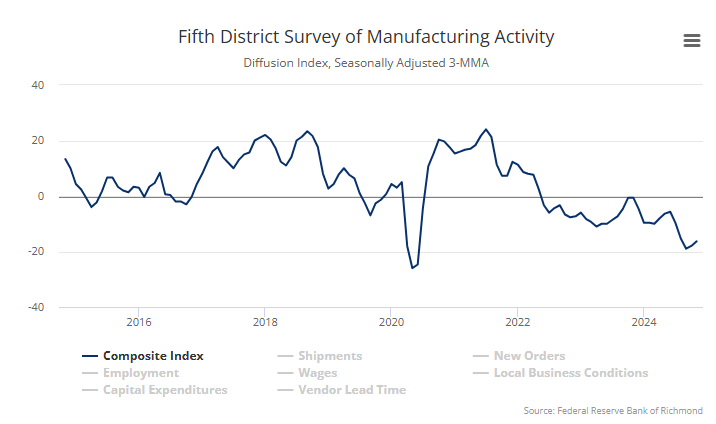

Richmond Fed manufacturing activity remained sluggish in November 2024. The composite manufacturing index remained at −14 in November. Of its three component indexes, shipments decreased from −8 to −12, new orders edged down from −17 to −19, and employment increased from −17 to −10. Manufacturing remains in a recession in the US.

The S&P CoreLogic Case-Shiller 20-City Composite posted a year-over-year increase of 4.6%, dropping from a 5.2% increase in the previous month. Home prices seem to be slightly moderating but home prices increasing do not make housing more affordable. I would expect further slowdown of existing home sales volumes.

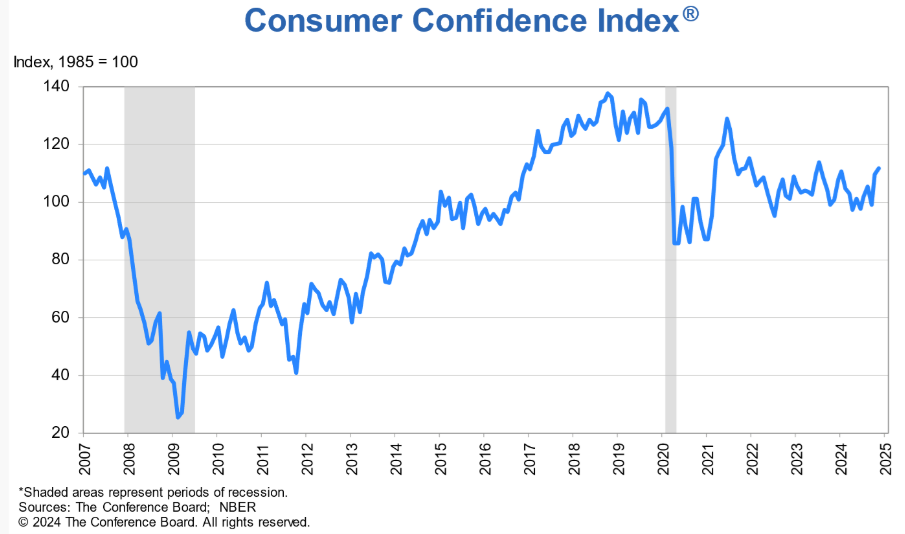

The Conference Board Consumer Confidence Index® increased in November 2024 to 111.7 (1985=100), up 2.1 points from 109.6 in October. Likely the results of the election pushed this OPINION index higher but I am not a fan of opinion. In the case of consumer confidence, it is generally believed that higher consumer confidence results in consumers spending more. Dana M. Peterson, Chief Economist at The Conference Board added:

Consumer confidence continued to improve in November and reached the top of the range that has prevailed over the past two years. November’s increase was mainly driven by more positive consumer assessments of the present situation, particularly regarding the labor market. Compared to October, consumers were also substantially more optimistic about future job availability, which reached its highest level in almost three years.

The Federal Reserve issued meeting minutes for the Federal Open Market Committee meeting on November 6–7, 2024. I did not find any surprises in the meeting minutes. The following are a summary of the participants’ observations and evaluations:

- Inflation has significantly decreased from its peak, although core inflation remains elevated. Most participants believe that inflation is on track to return sustainably to 2% despite expected month-to-month volatility. Disinflationary trends are evident across a broad range of core goods and services, with price increases now closer to historical stability rates. Participants noted increased consumer price sensitivity and reluctance from firms to raise prices.

- While housing service prices are still high, expectations are that these will slow as rent increases for new tenants stabilize.

- Recent data indicates solid labor market conditions, although temporary fluctuations have occurred due to strikes and natural disasters. Job vacancies and turnover rates are declining, suggesting easing labor demand. Nominal wage growth is decreasing, with job switchers facing a reduced wage premium. Participants noted that wage increases are unlikely to contribute to inflationary pressures in the near term. Businesses are becoming more selective in hiring due to a larger pool of qualified applicants willing to accept moderate wages.

- Economic activity remains strong, supported by a robust labor market and rising household wealth. However, low-income households face financial strains, which could impact their spending behavior.

- Favorable supply developments continue to support business expansion. However, there is uncertainty regarding the sustainability of recent productivity gains attributed to various factors including technology integration.

- Participants agreed to lower the federal funds rate target range by 25 basis points to 4.5%-4.75%. This adjustment aims to sustain economic strength while progressing toward inflation goals. Future monetary policy decisions will depend on economic data trends and risks associated with employment and inflation goals. Participants emphasized the need for a balanced approach in adjusting policies based on evolving economic conditions.

- Participants noted vulnerabilities in the financial system, particularly concerning commercial real estate (CRE) and potential risks from unrealized losses on bank assets. Cyber risks and rising delinquency rates among low-income households were also highlighted as areas needing close monitoring.

Here is a summary of headlines we are reading today:

- Don’t Underestimate Trump’s Impact on U.S. LNG

- U.S. Gas Drillers Saddle Up for Data Center-Fueled Demand Ride

- U.S. Oil Output Hits Record High in August

- Exxon: Don’t Expect ‘Drill, Baby, Drill’ Under Trump

- China Set to Import Record-High Volume of Coal in November

- Fed officials see interest rate cuts ahead, but only ‘gradually,’ meeting minutes show

- Israel-Lebanon permanent ceasefire has been accepted, Biden says

- Stocks rise Tuesday, Dow and S&P 500 close at records: Live updates

- Small caps historically outperform even the Santa Claus rally, starting before Thanksgiving

- Senate report slams airlines for raking in billions in seat fees

- Bitcoin drops to $91,000 level as crypto markets slump: CNBC Crypto World

- FOMC Minutes Show “Many” Members Suddenly Favor More Gradual Rate-Cutting-Cycle

- 10-year Treasury yield logs biggest gain in 2 weeks after Fed minutes point to slower rate cuts

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

What Will Trump’s Approach Be To Saudi Arabia And OPEC+?One of President-elect Donald Trump’s key achievements when first in office was keeping the benchmark oil prices within a very carefully managed range – ‘The Trump Oil Price Range’. The lower part of this is US$40-45 per barrel of the Brent benchmark, which is the price at which the bulk of U.S. shale oil producers can breakeven and make a good profit on top. The upper part is US$75-80 per barrel, which ties into historical data showing that a gasoline price of under US$2 per gallon has been most advantageous for U.S. economic… Read more at: https://oilprice.com/Energy/Energy-General/What-Will-Trumps-Approach-Be-To-Saudi-Arabia-And-OPEC.html |

|

Oil Producers Balk at Team Trump’s Tariff Plan for Canadian ImportsWhen Donald Trump floated the idea of slapping 25% tariffs on Canadian and Mexican imports, it was more than just a shot across the bow—it was a cannonball aimed squarely at North America’s deeply entwined trade ecosystem. U.S. oil producers are warning that a tariff on heavy oil imported from Canada would raise consumer prices at the pump. Some pundits are dismissing these threats as political bluster, while others are cautioning not to shrug off the notion entirely. If enacted, these tariffs could strain trilateral relations built… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Producers-Balk-at-Team-Trumps-Tariff-Plan-for-Canadian-Imports.html |

|

Don’t Underestimate Trump’s Impact on U.S. LNGTriggered by incoming US President Donald Trump, the next four years could prime the liquefied natural gas (LNG) markets for a golden era. Based on his campaign pledge, the returning president’s expected policies are likely to accelerate US LNG infrastructure expansion through deregulation and faster permitting, bolstering global supply. This could strengthen the sentiment around global LNG supply after years of uncertainty, helping to unleash long-term demand. Even so, an untimely supply boost will heighten the risk of a medium-term market… Read more at: https://oilprice.com/Energy/Natural-Gas/Dont-Underestimate-Trumps-Impact-on-US-LNG.html |

|

U.S. Gas Drillers Saddle Up for Data Center-Fueled Demand RideU.S. natural gas producers are preparing for stronger demand and higher prices for their product as data center proliferation accelerates further and years of depressed gas prices become a thing of the past. They are not letting it all happen by itself either—gas executives are in talks with data center developers to build them where the gas is. “Expectation of a step change in power demand has created opportunities for increasing dialogue around the potential for power generation and data projects within the Permian Basin,” the… Read more at: https://oilprice.com/Energy/Gas-Prices/US-Gas-Drillers-Saddle-Up-for-Data-Center-Fueled-Demand-Ride.html |

|

Russia Targets Ukraine’s Power Grid With Record Number of ProjectilesRussia overnight launched 188 drones and four cruise missiles at targets in Ukraine — a record number of projectiles in a single attack, Kyiv’s air force said, as NATO and Ukrainian envoys prepared to gather in Brussels to assess Moscow’s launching last week of an experimental missile at a Ukrainian city. Ukrainian air-defense systems “tracked 192 air targets — four Iskander ballistic missiles and 188 enemy drones,” the air force said in a message on Telegram. It added that 76 Russian drones were shot down over 17 Ukrainian regions, while another… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Targets-Ukraines-Power-Grid-With-Record-Number-of-Projectiles.html |

|

U.S. Oil Output Hits Record High in AugustThe United States set a new crude oil production record in August 2024, averaging 13.4 million barrels per day (bpd), according to the Energy Information Administration (EIA). This figure eclipsed the previous peak of 13.3 million bpd in December 2023 and solidified the U.S.’s position as the world’s top oil producer—a title it has held since 2018. Through the first eight months of 2024, monthly production only dipped below 13 million bpd once, reflecting a consistent upward trend. According to the EIA, the United States’ average… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Oil-Output-Hits-Record-High-in-August.html |

|

Does China Have the Upper Hand in Energy Deals With Russia?In May of 2014, during President Vladimir Putin’s state visit to Beijing on May 21, China and Russia signed a 30-year gas supply agreement worth $400 billion. At the time, Russia was staging a war with Ukraine and faced increasing economic sanctions from the West. Then, in 2022, Russia signed yet another 30-year agreement to supply natural gas to China just before launching its invasion of Ukraine. At the time of the initial 30-year agreement, Putin claimed that the $80 billion worth of new production and pipeline infrastructure needed to… Read more at: https://oilprice.com/Energy/Energy-General/Does-China-Have-the-Upper-Hand-in-Energy-Deals-With-Russia.html |

|

Turkey Seeks U.S. Waiver to Continue Paying for Its Russian Energy ImportsTurkey is seeking a U.S. sanctions waiver to continue using a now-sanctioned Russian bank for paying for its energy imports from Russia, while also talking with Russian officials about the future of energy trade and payments. Last week, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Gazprombank in what the Treasury said was “another major step in implementing commitments made by G7 leaders to curtail Russia’s use of the international financial system to further its war against Ukraine.”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Turkey-Seeks-US-Waiver-to-Continue-Paying-for-Its-Russian-Energy-Imports.html |

|

The OPEC+ Meeting Is Looming Large Over Oil MarketsOil markets are fully focused on this Sunday’s OPEC+ meeting after top officials from the three biggest producers in the alliance met on Tuesday.- European gas prices have surged almost 45% this year and forecasts for cold weather threaten to add pressures on gas supply, further aggravated by US sanctions on Gazprom’s very own banking subsidiary, Gazprombank.- For most of November temperatures in Northwest Europe have been trending along the 30-year average line or below, marking the first cold winter since 2021, and leading to gas inventories… Read more at: https://oilprice.com/Energy/Energy-General/The-OPEC-Meeting-Is-Looming-Large-Over-Oil-Markets.html |

|

Russia: Gazprom Unlikely to Sell Nord Stream 2 to U.S. InvestorIt is unlikely that Russian gas giant Gazprom, a shareholder in Nord Stream 2, would agree to hand over ownership of the pipeline to a U.S. investor, Kremlin spokesman Dmitry Peskov said on Tuesday, commenting on a report that a U.S. businessman plans to bid for the pipeline. U.S. businessman Stephen P. Lynch, who has lived in Russia for two decades and has done business there, has sought a U.S. license to try to buy Nord Stream 2, The Wall Street Journal reported last week. Lynch has sought a license from the U.S. Treasury to negotiate buying… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Gazprom-Unlikely-to-Sell-Nord-Stream-2-to-US-Investor.html |

|

Exxon: Don’t Expect ‘Drill, Baby, Drill’ Under TrumpU.S. oil and gas supermajor Exxon does not expect American producers to gear up in a “drill, baby, drill” mode once Donald Trump becomes U.S. President, as companies will maintain the spending discipline of the past few years. “We’re not going to see anybody in ‘drill, baby, drill’ mode,” ExxonMobil Upstream President Liam Mallon said at the Energy Intelligence Forum conference in London, as carried by Reuters. “A radical change (in production) is unlikely because the vast majority, if not everybody, is focused on the economics… Read more at: https://oilprice.com/Energy/Energy-General/Exxon-Dont-Expect-Drill-Baby-Drill-Under-Trump.html |

|

High Energy Costs Continue to Plague European IndustryEurope is losing and will continue to lose competitiveness and jobs if it doesn’t tackle its high energy costs compared to other regions, Morten Wierod, chief executive of Switzerland-based engineering giant ABB, told Bloomberg. “The cost for energy intense industries like chemical, steel production, cement is a challenge, and investments will go elsewhere than Europe if this continues,” Wierod told Bloomberg in an interview published on Tuesday. This predicament would hinder job creation in Europe, which, the executive said,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/High-Energy-Costs-Continue-to-Plague-European-Industry.html |

|

OPEC+ Heavyweights Discuss Oil Market Ahead of Key MeetingTop officials from the three biggest producers in the OPEC+ alliance – Saudi Arabia, Russia, and Iraq – met on Tuesday to discuss the state of the global oil market, days before the group is set to meet on December 1 to decide how to proceed with the production cuts. Iraq’s Prime Minister Mohammed S. Al-Sudani held on Tuesday a joint meeting with Russian Deputy Prime Minister Alexander Novak and Saudi Arabia’s Minister of Energy, Prince Abdulaziz bin Salman Al Saud, the Iraqi Prime Minister Media Office said. “The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Heavyweights-Discuss-Oil-Market-Ahead-of-Key-Meeting.html |

|

Russian Crude Exports Drop as Shipments to India SlumpRussia’s crude oil exports by sea fell in the four weeks to November 24 compared to the previous four-week average by the steepest volume since July, amid lower shipments to India, tanker-tracking data monitored by Bloomberg showed on Tuesday. Russia is estimated to have shipped from its oil export terminals an average of 3.12 million barrels per day (bpd) of crude oil during the four weeks to November 24, down by 150,000 bpd compared to the previous four-week average to November 17, according to the data reported by Bloomberg’s Julian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Crude-Exports-Drop-as-Shipments-to-India-Slump.html |

|

China Set to Import Record-High Volume of Coal in NovemberChina is on track to import this month the highest volume of thermal coal, the one used in power generation, since at least 2017, as electricity demand is rising with the colder weather. Chinese thermal coal imports are set to be at 37.5 million metric tons for November, according to data by commodity analysts Kpler cited by Reuters’s columnist Clyde Russell. This estimated volume would be significantly higher than the 32.12 million tons of thermal coal imported in October and the highest level in data compiled by Kpler going back to 2017.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Set-to-Import-Record-High-Volume-of-Coal-in-November.html |

|

Fed officials see interest rate cuts ahead, but only ‘gradually,’ meeting minutes showFederal Reserve officials expressed confidence that inflation is easing and the labor market is strong, allowing for further interest rate cuts albeit at a gradual pace. Read more at: https://www.cnbc.com/2024/11/26/fed-officials-see-interest-rate-cuts-ahead-but-only-gradually-minutes-show-.html |

|

Israel-Lebanon permanent ceasefire has been accepted, Biden saysIsrael and Lebanon’s Hezbollah agreed to a permanent ceasefire in cross-border hostilities, following a year-long conflict. Read more at: https://www.cnbc.com/2024/11/26/israel-lebanon-permanent-ceasefire-has-been-accepted-biden-says-.html |

|

Stocks rise Tuesday, Dow and S&P 500 close at records: Live updatesThe Dow Jones Industrial Average and the S&P 500 rallied to fresh highs on Tuesday. Read more at: https://www.cnbc.com/2024/11/25/stock-market-today-live-updates.html |

|

Trump vows an additional 10% tariff on China, 25% tariffs on Canada and MexicoThe president-elect plans to raise tariffs by an additional 10% on all Chinese goods coming into the U.S., according to a post on his social media platform Truth Social. Read more at: https://www.cnbc.com/2024/11/26/trump-vows-an-additional-10percent-tariff-on-china-25percent-tariffs-on-canada-and-mexico.html |

|

Databricks closes in on multibillion funding round at $55 billion valuation to help employees cash outDatabricks is raising at least $5 billion in cash — though it could raise as much as $8 billion — pegging its new valuation at $55 billion, sources say. Read more at: https://www.cnbc.com/2024/11/26/databricks-closes-in-on-multibillion-funding-round-at-55-billion-valuation.html |

|

Small caps historically outperform even the Santa Claus rally, starting before ThanksgivingThe weeks heading into year-end often mark a bullish time for stocks, and smaller companies especially might be poised for outperformance. Read more at: https://www.cnbc.com/2024/11/26/small-caps-historically-outperform-even-the-santa-claus-rally-starting-now.html |

|

Senate report slams airlines for raking in billions in seat feesThe Senate panel is calling airline executives to testify next week about their carriers’ fees. Read more at: https://www.cnbc.com/2024/11/26/senate-report-slams-airlines-for-raking-in-billions-in-seat-fees.html |

|

Amgen says obesity drug caused up to 20% weight loss after a year, with no plateauThe results shed light on how MariTide may measure up to weight loss injections from Novo Nordisk and Eli Lilly and other experimental treatments. Read more at: https://www.cnbc.com/2024/11/26/amgen-says-weight-loss-drug-maritide-caused-up-to-20percent-weight-loss-after-a-year.html |

|

Bitcoin drops to $91,000 level as crypto markets slump: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Transform Venture CEO Michael Terpin discusses the different stages of bitcoin market cycles, and whether he believes the post-U.S. election rally is sustainable. Read more at: https://www.cnbc.com/video/2024/11/26/bitcoin-drops-91000-level-crypto-markets-slump-crypto-world.html |

|

Angry Rudy Giuliani argues with judge overseeing defamation payout: ‘I can’t pay my bills’The former New York City mayor was chastised by the judge for failing to comply with court orders to turn over his assets to the two former Georgia election workers he defamed. Read more at: https://www.cnbc.com/2024/11/26/angry-rudy-giuliani-argues-with-judge-overseeing-defamation-payout-i-cant-pay-my-bills.html |

|

32-year-old American in Denmark, one of the world’s happiest countries: The No. 1 thing I’ve learned about building a rich lifeIn late 2018, Chloé Skye Weiser and her Czech partner moved to Odense, a city of 187,000 on the Danish island of Funen. Here’s how she built a rich life there. Read more at: https://www.cnbc.com/2024/11/26/32-year-old-american-in-denmark-the-no-1-thing-ive-learned.html |

|

59% of Americans consider this the No. 1 sign of success — it’s not wealthAbout 59% of surveyed U.S. adults say the ability to spend money on things and activities that make them happy is the top sign of success, a report found. Read more at: https://www.cnbc.com/2024/11/26/59percent-of-americans-say-this-a-top-sign-of-success-its-not-wealth.html |

|

Black Friday trades: These retail stocks typically gain the most during the holiday seasonA subset of retail stocks outperform their peers and have historically posted sharp gains in December. Read more at: https://www.cnbc.com/2024/11/26/black-friday-trades-these-retailers-could-gain-during-holiday-season.html |

|

Nothing But Blue Skies Do I See: Times Reporter Finds Happiness In Social Media Safe SpacesAuthored by Jonathan Turley via jonathanturley.org, The recent election produced an outpouring of anger and angst on the left, from pledging to leave the country to not having sex with men for four years. For others, the response was to retreat deeper into the echo chamber of the left. Many liberals are leaving X for a Bluesky, which promises the censorship and monitoring that was reduced after Elon Musk’s purchase of Twitter.

Despite having most of the media and social media as allies, the opposing views of X have become intolerable for many after the election. One such aggrieved user appears to be New Yor … Read more at: https://www.zerohedge.com/political/nothing-blue-skies-do-i-see-times-reporter-finds-happiness-social-media-safe-spaces |

|

Ben & Jerry’s Sues Parent Company Over Censorship Of Leftist IdeologyAuthored by Dmytro “Henry” Aleksandrov via Headline USA Infamous leftist ice cream brand Ben & Jerry’s recently sued its parent company, Unilever, for allegedly censoring the woke company’s pro-Palestinian and anti-Israel rhetoric.

The Daily Wire reported that the company constantly pushed far-left talking points. This time, Unilever allegedly pushed back against Ben & Jerry’s supporting anti-Semitic protests on American college and university campuses, with the students urging the … Read more at: https://www.zerohedge.com/political/ben-jerrys-sues-parent-company-over-censorship-leftist-ideology |

|

FOMC Minutes Show “Many” Members Suddenly Favor More Gradual Rate-Cutting-CycleIn summary: all of a sudden we go from basically no dissents about slashing rates (pre-election) to “many” thinking slow-down and some thinking “pause” the cutting cycle completely?

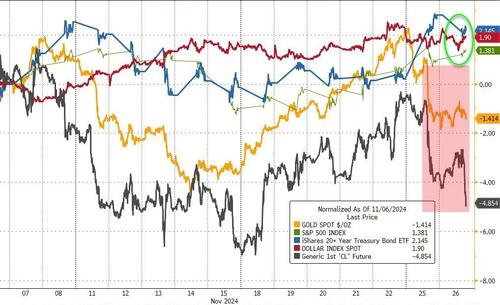

* * * Since the last FOMC meeting – just days after the election on November 7th – bonds, the dollar,m and stocks have rallied (excluding the election reaction before the Fed) and crude oil and gold have been dumped (hit most recently amid ‘peace’ headlines and Bessent’s appointment)…

Source: Bloomberg And while that has been going on, US Macro data has serially un-impressed… having soared higher since before the big cut in September… Read more at: https://www.zerohedge.com/markets/fomc-22 |

|

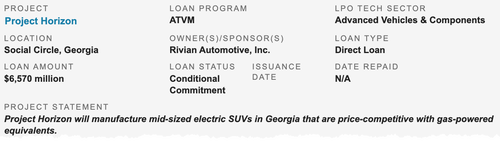

Biden Throws Struggling Rivian $6 Billion Lifeline For EV FactoryThe Biden-Harris administration is rushing to spend taxpayer funds before President-elect Trump takes office. To start the week, the administration directed nearly $8 billion to Intel and now billions more to save struggling electric vehicle manufacturer Rivian Automotive. On Tuesday, the US Department of Energy announced it would offer a direct loan of up to $6.57 billion (including $5.975 billion of principal and $592 million of capitalized interest) to finance Rivian’s EV factory in Stanton Springs North, near the City of Social Circle, Georgia. The project was shelved in early March over the urgent need to reduce costs.

“Today’s announcement reinforces the Biden-Ha … Read more at: https://www.zerohedge.com/markets/biden-throws-struggling-rivian-6-billion-lifeline-ev-factory |

|

Vauxhall owner to close Luton plant putting 1,100 jobs at riskMotor giant Stellantis says it is closing the van making plant in the context of the UK’s rules on electric vehicle sales. Read more at: https://www.bbc.com/news/articles/cy8n3n62wq4o |

|

Youth to get ‘guaranteed’ training in jobs overhaulThe government wants more young people in work as it aims to boost the overall employment rate. Read more at: https://www.bbc.com/news/articles/cqxwv3n87g4o |

|

‘I want to get a job but I don’t know how’The BBC speaks to young people yet to enter the workforce as well as those who have chosen to leave it. Read more at: https://www.bbc.com/news/articles/c4g2ywrw42eo |

|

FIIs reverse selling trend with purchase of domestic equities worth Rs 11,100 crore in two sessionsForeign investors have reversed their selling trend and bought Indian equities worth Rs 11,100 crore in the last two sessions. This comes after 38 consecutive sessions of selling. The BJP’s victory in Maharashtra elections and a possible pause in US Fed rate hikes have boosted investor sentiment. However, domestic institutional investors (DIIs) remain net sellers. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fiis-reverse-selling-trend-with-purchase-of-domestic-equities-worth-rs-11100-crore-in-two-sessions/articleshow/115702551.cms |

|

Morgan Stanley buys shares worth Rs 3.74 crore in this smallcap stock via block dealMorgan Stanley bought 6.7 lakh shares in Niyogin Fintech at Rs 55.65 per share via a block deal. Think India Opportunities Master Fund LP was the seller. The stock surged 15% on the news. Niyogin Fintech has a market cap of Rs 591.87 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/morgan-stanley-buys-shares-worth-rs-3-74-crore-in-this-smallcap-stock-via-block-deal/articleshow/115704391.cms |

|

Looking for predictable returns in fluctuating interest rate market? Check out target maturity fundsTarget maturity funds (TMFs) are gaining popularity in 2024 as investors seek predictable returns in a fluctuating interest rate market. TMFs, often holding govt securities, offer lower credit risk and tax efficiency. Experts recommend aligning investment horizons with the fund’s maturity for optimal results. These funds are particularly attractive to conservative investors seeking stable yields. Read more at: https://economictimes.indiatimes.com/mf/analysis/looking-for-predictable-returns-in-fluctuating-interest-rate-market-check-out-target-maturity-funds/articleshow/115683895.cms |

|

10-year Treasury yield logs biggest gain in 2 weeks after Fed minutes point to slower rate cutsTreasury yields ended mixed on Tuesday, with the benchmark 10-year rate landing on higher ground after minutes from the Federal Reserve’s November policy meeting pointed to a more gradual pace of interest-rate cuts next year. Read more at: https://www.marketwatch.com/story/treasury-yields-rise-after-trump-threatens-tariffs-and-ahead-of-fed-minutes-35c08eef?mod=mw_rss_topstories |

|

Trump’s oil-drilling plans may pose a big problem for OPEC+OPEC+ is facing a dilemma as the group of major oil producers meets this Sunday, thanks to expectations for a surplus in global oil supplies next year — and as U.S. President-elect Donald Trump’s “drill, baby, drill” agenda makes matters even worse. Read more at: https://www.marketwatch.com/story/trumps-oil-drilling-plans-may-pose-a-big-problem-for-opec-f8162e7a?mod=mw_rss_topstories |

|

GameStop stock continues its climb amid squeeze chatterGrowing sentiment on Stocktwits that ‘a new squeeze is building’ Read more at: https://www.marketwatch.com/story/gamestop-stock-continues-its-climb-amid-squeeze-chatter-d8035641?mod=mw_rss_topstories |