Summary Of the Markets Today:

- The Dow closed up 440 points or 0.99%,

- Nasdaq closed up 51 points or 0.27%,

- S&P 500 closed up 18 points or 0.30%,

- Gold $2,629 down $84.30 or 3.12%,

- WTI crude oil settled at $69 down $2.17 or 3.05%,

- 10-year U.S. Treasury 4.265 down 0.147 points or 3.288%,

- USD index $106.88 down $0.67 or 0.63%,

- Bitcoin $94,959 down $1,700 or 1.79%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

U.S. stocks rose on Monday, driven by optimism over President-elect Donald Trump’s nomination of Scott Bessent for Treasury secretary. This announcement boosted investor sentiment, leading to significant gains across major indices: Dow Jones Industrial Average closing at a new record high. Russell 2000 surged over 2%, reaching a record high, as small-cap stocks rallied strongly. The market’s positive reaction was partly due to the perception that Bessent might moderate fiscal policies, which helped ease concerns about inflationary pressures. Additionally, investors are looking forward to the Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures price index, set for release on Wednesday. Bitcoin was attempting to reach the $100,000 mark but fell back below $95,000.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Chicago Fed National Activity Index (CFNAI) three-month moving average, CFNAI-MA3, decreased to –0.24 in October 2024 from –0.21 in September. This is my favorite coincident indicator although like all indicators – at times, it is wrong in trend and value. And the 85 individual indicators it monitors will be revised for decades. That is why the CFNAI looks like it parallels GDP – but in real time it missed the start of the Great Recession. Consider this a tea leaf to be read in conjunction with other tea leaves. According to the Chicago Fed: “a recession has historically been associated with a CFNAI-MA3 value below –0.70. Conversely, following a period of economic contraction, an increasing likelihood of an expansion has historically been associated with a CFNAI-MA3 value above –0.70 and a significant likelihood of an expansion has historically been associated with a CFNAI-MA3 value above +0.20.” Bottom line – there is little change in October which means the economy is not strong.

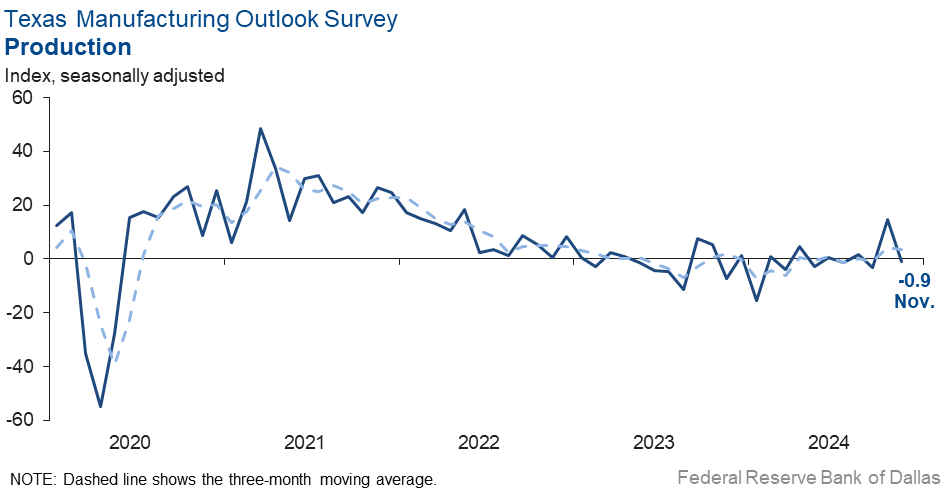

Texas Manufacturing Outlook Survey was flat in November 2024 falling to a -0.9 level after rising to 14.6 last month. The new orders index pushed further negative to -11.9, indicating continued declines in demand. The capacity utilization and shipments indexes slipped back into negative territory, coming in at -4.8 and -5.9, respectively. Not a question in my mind that the manufacturing recession continues.

Here is a summary of headlines we are reading today:

- Russia’s Uranium Gambit: A Wake-Up Call for U.S. Energy Independence

- Oil for Troops: Russia’s Barter System with North Korea Exposed

- Oil Prices Fall On Possible Mid-East Peace Deal

- UK Slaps Largest Sanctions Package Yet on Russia’s Shadow Tanker Fleet

- IMF’s Proposed Carbon Restrictions Could Have Major Economic Repercussions

- U.S. stock and bond markets love Trump’s pick of Bessent for Treasury — here’s why

- Dow jumps 400 points to new record close, Russell 2000 hits all-time high as investors cheer Trump’s Treasury pick

- Warren Buffett speaks out against creating family wealth dynasties, gives away another $1.1 billion

- MicroStrategy acquires 55,500 more bitcoin amid stock volatility: CNBC Crypto World

- Arabica Futs “Bull Run” Surges To 13-Year High Amid Panic About Brazilian Stockpiles

- Gold tumbles 3% on reports of Israel-Hezbollah ceasefire, US Treasury pick

- Long-term Treasury bonds log biggest rally in nearly 4 months after Trump picks Bessent

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Russia’s Uranium Gambit: A Wake-Up Call for U.S. Energy IndependenceLast week the United States authorized the use of American-made long-range missiles by Ukraine against Russia which the Russian government says risks escalation to a nuclear conflict in the almost three-year-old war. The Russian government reacted by announcing an unnerving shift in nuclear doctrine. It also announced reductions in uranium exports to the United States. By how much and for how long, the government did not say. In light of what can only be seen as a proxy war in Ukraine between the United States along with its NATO allies and the… Read more at: https://oilprice.com/Metals/Commodities/Russias-Uranium-Gambit-A-Wake-Up-Call-for-US-Energy-Independence.html |

|

Natural Gas Set To Win Big Under TrumpNow that elections are over in the US, we thought it would be useful to review some of the broader policy implications of the changing administration for the electric utility industry. There are four themes we want to cover here: environment regulations, prospects for natural gas usage, power generation, new nuclear-powered generation. The incoming Trump administration has made no secret of the fact that they believe climate change is a hoax or a non-issue. As a result we should assume that the mandate of the Environmental Protection Agency will… Read more at: https://oilprice.com/Energy/Energy-General/Natural-Gas-Set-To-Win-Big-Under-Trump.html |

|

BP CEO: Global Oil Demand Keeps Exceeding ExpectationsGlobal oil demand continues to surprise on the upside, BP Plc (NYSE:BP) Chief Executive Murray Auchincloss told the Energy Intelligence forum in London on Monday, saying that oil demand kept rising on average by more or less 1% each year, with BP predicting robust oil consumption for the next 5-10 years. Commodity analysts at Standard Chartered have reported that global oil demand hit an all-time high of 103.79 million barrels per day (mb/d) in August, marking the third successive month in which a new all-time demand high has been set. According… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-CEO-Global-Oil-Demand-Keeps-Exceeding-Expectations.html |

|

Oil for Troops: Russia’s Barter System with North Korea ExposedSouth Korea has said that in return for sending thousands of troops to assist Russia in fighting Ukraine, North Korea has received missiles from Moscow, along with other defense equipment. South Korea’s national security adviser Shin Won-sik was asked by a reporter Friday what Pyongyang stands to gain from deploying an estimated 10,000 troops to Russia, to which he responded: “It is understood that North Korea has been provided with related equipment and anti-aircraft missiles to strengthen Pyongyang’s weak air defense system.” Central Pyongyang,… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-for-Troops-Russias-Barter-System-with-North-Korea-Exposed.html |

|

Oil Prices Fall On Possible Mid-East Peace DealOil prices fell more $2 per barrel on Monday after reports emerged that Israel and Lebanon have agreed to the terms of a deal to end the Israel-Hezbollah conflict. Brent crude for January delivery fell 2.75% to trade at $73.10 per barrel at 11.45 am ET while WTI crude fell 2.70% to $69.36 per barrel. Reuters reported on Monday that a senior Israeli official said the country’s cabinet would meet on Tuesday to approve a ceasefire deal with Hezbollah, while a Lebanese official said Beirut had been told by Washington that an accord could… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Fall-On-Possible-Mid-East-Peace-Deal.html |

|

Developing Nations Outraged as COP29 Climate Funding Falls ShortThe Azerbaijani hosts had hoped at the outset of COP29 that it would go down as one of the more successful meetings in the annals of the annual UN climate conference. Instead, the early view is that COP29 will go down as one of the more disappointing COPs to date. Environmentalists are departing Baku feeling underwhelmed with the outcome, as COP29 negotiators backed away from an ambitious climate financing target and continued to bicker among themselves even over the significantly scaled back dollar goal. On November 22, the last scheduled… Read more at: https://oilprice.com/Energy/Energy-General/Developing-Nations-Outraged-as-COP29-Climate-Funding-Falls-Short.html |

|

Kazakhstan Set to Raise Oil Exports Through Turkey, Bypassing RussiaKazakhstan could sharply increase its crude oil exports out of Turkey’s port of Ceyhan, and dramatically reduce the more than 80% share of flows it currently sends via Russia, Reuters has reported. According to Kazakhstan Energy Minister Almasadam Satkaliyev, exports via the Baku-Tbilisi-Ceyhan (BTC) pipeline could increase to 20 million metric tons a year from the current 1.5 million as the country increases oil production. “There is interest in developing and gradually increasing the volume of Kazakh oil shipments in this direction both… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakhstan-Set-to-Raise-Oil-Exports-Through-Turkey-Bypassing-Russia.html |

|

Russia-Ukraine Escalation Reignites Oil’s War PremiumFor most of this year, the geopolitical premium in oil prices was coming from the Middle East flare-ups amid the Israel-Iran escalation. At the end of 2024, the other major conflict, between Russia and Ukraine, is grabbing headlines with an escalation of hostilities, Ukraine’s first use of long-range missiles provided by Western powers for strikes within Russia, a new missile type Moscow is using to hit Ukraine, and Putin’s new nuclear doctrine. The end of this year is set to see wild swings in oil prices amid rising geopolitical tensions… Read more at: https://oilprice.com/Energy/Crude-Oil/Russia-Ukraine-Escalation-Reignites-Oils-War-Premium.html |

|

TotalEnergies Halts Investment to India’s Adani Amid US Bribery ProbesTotalEnergies, which is a partner of India’s Adani group in renewable energy projects, will not make any new financial contribution as part of its investments in the group of companies until the ongoing U.S. investigations into Adani executives for corruption are clarified, the French supermajor said on Monday. Last week, the U.S. Attorney’s Office for the Eastern District of New York and the Securities and Exchange Commission (SEC) separately charged executives of the Adani group of companies, including billionaire founder Gautam Adani… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Halts-Investment-to-Indias-Adani-Amid-US-Bribery-Probes.html |

|

UK Slaps Largest Sanctions Package Yet on Russia’s Shadow Tanker FleetThe UK on Monday sanctioned as many as 30 tankers identified as belonging to Russia’s shadow fleet that circumvents the Western oil sanctions, in the single largest sanctions package aimed at Russia’s dark fleet and at stifling Putin’s oil revenues. The UK imposed sanctions on 30 ships in Russia’s shadow fleet today. These vessels have been responsible for transporting billions of UK pounds worth of oil and oil products in the last year alone. With half of the ships targeted today transporting more than $4.3 billion worth… Read more at: https://oilprice.com/Energy/Energy-General/UK-Slaps-Largest-Sanctions-Package-Yet-on-Russias-Shadow-Tanker-Fleet.html |

|

EQT and Blackstone Create $3.5-Billion Joint VentureEQT Corporation has agreed to sell minority interests in two of its pipelines, plus transmission and storage assets, to funds managed by Blackstone Credit & Insurance in a $3.5 billion cash deal to form a midstream joint venture. Under the terms of the transaction, Blackstone will provide EQT $3.5 billion of cash consideration in exchange for a non-controlling common equity interest in the joint venture, the U.S. natural gas giant said on Monday, in the latest midstream deal in the U.S. energy sector. The joint venture will consist of EQT’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EQT-and-Blackstone-Create-35-Billion-Joint-Venture.html |

|

IMF’s Proposed Carbon Restrictions Could Have Major Economic RepercussionsAt the height of the covid lockdowns and mandates a massive portion of the global economy was shut down, leading to supply chain instability, huge job losses and a stagflationary crisis. However, climate change propagandists argued that the event was actually a positive for the planet when it was revealed that emissions fell by 5.4%. They asserted that the covid lockdowns were a practice run for what they called “climate lockdowns” – Presenting a plan for scheduled disruptions to global economic activity as a means to slow the effects… Read more at: https://oilprice.com/Energy/Energy-General/IMFs-Proposed-Carbon-Restrictions-Could-Have-Major-Economic-Repercussions.html |

|

Austria’s OMV Seizes Gazprom Gas Supply in Deliveries DisputeAustria’s energy firm OMV has seized $241 million (230 million euros) of Gazprom natural gas deliveries for October as a means to recover the arbitration award, which prompted Gazprom to cut off supply, sources close to OMV and Gazprom have told Reuters. Earlier this month, OMV said that it had been awarded 230 million euros, plus interest and costs, in an arbitration case against Gazprom’s irregular German gas supplies and would take “the necessary next steps to enforce the arbitral award with immediate effect.” In… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Austrias-OMV-Seizes-Gazprom-Gas-Supply-in-Deliveries-Dispute.html |

|

Trump Plans Major Boost to U.S. Oil Drilling and LNG ExportsThe transition team of incoming U.S. President Donald Trump is drafting an energy package to expand domestic oil and gas drilling on federal lands and offshore lease sales, in addition to expediting LNG export permits, Reuters reported on Monday, citing sources with knowledge of the plans. President-elect Trump has vowed on the campaign trail to support the oil, gas, and coal industries and repeal some of President Biden’s environmental-oriented measures, including a pause on new LNG permitting and the minimum possible offshore oil and gas… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Plans-Major-Boost-to-US-Oil-Drilling-and-LNG-Exports.html |

|

Anglo American to Sell Australian Coal Business for $3.8 BillionAnglo American on Monday said it would sell its remaining portfolio of steelmaking coal mines in Australia to Peabody Energy for up to US$3.775 billion in cash, as the mining giant has embarked on a major restructuring of its business. With the deal announced today, Anglo American expects to generate up to US$4.9 billion in aggregate gross cash proceeds from its coal assets, including the already announced sale of Anglo American’s interest in Jellinbah for about US$1.1 billion. After rejecting takeover offers from mining giant BHP, Anglo… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Anglo-American-to-Sell-Australian-Coal-Business-for-38-Billion.html |

|

U.S. stock and bond markets love Trump’s pick of Bessent for Treasury — here’s whyTrump said he will pick the Wall Street figure to take on his administration’s most important economic role. Read more at: https://www.cnbc.com/2024/11/25/markets-cheer-bessents-credentials-to-lead-trumps-treasury-department.html |

|

Dow jumps 400 points to new record close, Russell 2000 hits all-time high as investors cheer Trump’s Treasury pickU.S. stocks climbed Monday as investors cheered President-elect Donald Trump’s choice for Treasury secretary ahead of a shortened Thanksgiving trading week. Read more at: https://www.cnbc.com/2024/11/24/stock-futures-are-flat-sunday-ahead-of-shortened-trading-week-live-updates.html |

|

Jack Smith files to drop all federal charges against Donald TrumpPresident-elect Trump faced charges over his handling of classified documents and his efforts to overturn his 2020 election loss, which culminated in the U.S. Capitol attack. Read more at: https://www.cnbc.com/2024/11/25/jack-smith-files-to-drop-jan-6-charges-against-donald-trump.html |

|

Starbucks baristas can’t view their schedules after ransomware attack on vendorStarbucks baristas are not able to view and manage their schedules because of a ransomware attack on one of the company’s vendors. Read more at: https://www.cnbc.com/2024/11/25/starbucks-vendor-hit-by-ransomware-attack-affecting-pay-and-schedules.html |

|

Wall Street launches new ways to bet on bitcoinWall Street launches new trading tools to bet on the price of bitcoin Read more at: https://www.cnbc.com/2024/11/25/wall-street-launches-new-ways-to-bet-on-bitcoin.html |

|

Pro Talks: Top Washington analyst Dan Clifton on which stocks could be turbocharged by TrumpCNBC’s Dominic Chu speaks with Dan Clifton, partner and head of policy research for Strategas, to look beyond the postelection rally and find out which businesses could get a boost in Trump’s next term. Plus, he takes stock-specific questions from Pro subscribers. Read more at: https://www.cnbc.com/video/2024/11/25/pro-talks-top-washington-analyst-dan-clifton-on-which-stocks-could-be-turbocharged-by-trump.html |

|

Warren Buffett speaks out against creating family wealth dynasties, gives away another $1.1 billion“I’ve never wished to create a dynasty or pursue any plan that extended beyond the children,” Buffett wrote in a lengthy letter Monday. Read more at: https://www.cnbc.com/2024/11/25/warren-buffett-speaks-out-against-creating-family-wealth-dynasties-gives-away-another-1point1-billion.html |

|

MicroStrategy acquires 55,500 more bitcoin amid stock volatility: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Bruno Caratori, Hashdex co-founder and chief operating officer, discusses post-election crypto investment trends and his outlook for the industry under the incoming Congress. Read more at: https://www.cnbc.com/video/2024/11/25/microstrategy-acquires-55500-bitcoin-amid-stock-volatility-crypto-world.html |

|

Analyst Dan Clifton breaks down why the stock market rallied the way it did after the electionThere’s one key reason the stock market rallied after this month’s presidential election, and it wasn’t necessarily because of the outcome, according to Dan Clifton. Read more at: https://www.cnbc.com/2024/11/25/washington-analyst-dan-clifton-explains-why-stocks-rallied-after-election.html |

|

Intel and Commerce Department close to finalizing roughly $8 billion CHIPS Act grant, source saysThe struggling chipmaker has cut jobs and pared back expansion plans as it grapples with its worst downturn ever, making the CHIPS Act money a welcome boost. Read more at: https://www.cnbc.com/2024/11/25/intel-close-to-8-billion-chips-act-grant-source.html |

|

Formula 1 approves GM-Cadillac as an 11th team starting in 2026, bringing an American car maker on the gridThe announcement by F1 and GM is a breakthrough for the sport. Mario Andretti, whose racing team led the initial application, will serve as board director. Read more at: https://www.cnbc.com/2024/11/25/formula-1-approves-gm-cadillac-as-an-11th-team-starting-in-2026.html |

|

Warren Buffett suggests all parents do one thing before they die, whether they have ‘modest or staggering wealth’Warren Buffett has advice for all parents, regardless of their wealth: let your adult children read your will before you sign it. Read more at: https://www.cnbc.com/2024/11/25/warren-buffett-one-thing-all-parents-should-do-with-their-estate-plan.html |

|

Deutsche Bank sees the S&P 500 hitting 7,000 in 2025 on the back of rising risk appetiteBinky Chadha, Deutsche Bank chief global strategist, set a year-end 2025 target for the S&P 500 of 7000, which would translate into a 17% gain. Read more at: https://www.cnbc.com/2024/11/25/deutsche-bank-sees-the-sp-500-hitting-7000-amid-rising-risk-appetite.html |

|

Trump’s Popularity Surges Among Young AmericansAuthored by Paul Joseph Watson via Modernity.news, Donald Trump’s popularity has surged among young Americans, jumping nearly 20 per cent with those aged 18-29 in the space of just over a week.

“Conducted from November 17 to 19, the survey revealed that 57 percent of Americans aged 18 to 29 now hold a favorable view of Trump, marking a net favorability increase of 19 points in that demographic since the YouGov poll on November 9 and 12,” reports Newsweek. This segment of the demographic represented 16 per cent of the 2024 voting electorate A video posted to TikTok by a young woman underscores the enthusiasm towards Trump being expressed by Gen Z and younger millennials.

|

|

‘Meme’ Stock AMC Reports Pre-Thanksgiving Revenue RecordAMC Entertainment Holdings announced on Monday that it achieved the highest domestic revenue in its 104-year history during the pre-Thanksgiving weekend – mainly because millions of Americans flocked to theaters nationwide to watch WICKED and GLADIATOR II. In a press release, AMC reported its “highest domestic revenue (admissions revenue plus food and beverage, including merchandise) on the weekend before Thanksgiving in AMC’s 104-year history.” It also noted this marked “highest domestic admissions revenue on the weekend before Thanksgiving since 2019, and the third highest domestic admissions revenue on the weekend before Thanksgiving in AMC’s history.” AMC recorded 4.6 million moviegoers across its US and international theaters from Thursday to Sunday. The world’s largest movie theater chain operates 900 theaters with 10,000 screens globally, including 660 theaters and 8,200 screens in the US. “Naturally, we are pleased that at our US theatres, AMC just recorded our highest revenues for a pre-Thanksgiving weekend in AMC’s entire history. Similarly, it is thoroughly satisfying that fully 4.6 million people graced our AMC Theatres in the US and Odeon Cinemas abroad over the just completed four days Thursday to Sunday. What a wonderful way to head into what we expect will be a busy and entertai … Read more at: https://www.zerohedge.com/markets/meme-stock-amc-reports-pre-thanksgiving-revenue-record |

|

Watch: ‘The View’ Hosts Forced To Read Four ‘Legal Notes’ On Friday For Lying, And It Was GloriousAuthored by Rick Moran via PJ Media, The hosts of “The View” were forced to eat a little crow and correct the record after they casually smeared three of Donald Trump’s cabinet picks and former Rep. George Santos.

ABC’s legal team thought that the anti-Trump harridans were exposing the network to several potential libel suits and hurriedly told the hosts to read the “legal notes” on air. During a segment discussing the 23 charges against former Rep. Santos, including wire fraud, Joy Behar “forgot” to mention that Santos pled guilty to wire fraud and identity theft. Behar left the impression that Santos’s case had yet to be adjudicated. That brought a quick legal disclaimer from ABC legal. “One min … Read more at: https://www.zerohedge.com/political/view-hosts-forced-read-four-legal-notes-friday-lying-and-it-was-glorious |

|

Arabica Futs “Bull Run” Surges To 13-Year High Amid Panic About Brazilian StockpilesArabica futures in New York surged to 13-year highs amid concerns about inventory stockpiles this season in Brazil, the world’s top producer. With next year’s harvest still eight months away, supply fears are beginning to spook agricultural traders. Carlos Santana Jr., a Brazil-based commercial director at trader Ecom Group, told Bloomberg, “There are about eight months before the start of the next season, and the percentage of coffee sold by Brazilian growers is very high.” “We might not have enough coffee to get to the next season,” Santana warned. Consultancy Safras e Mercado calculated that 70% of the current harvest has been sold, much of which pours into international markets. That compares with 64% in the previous season. The strong stream of exports led the US Department of Agriculture’s Foreign Agricultural Service to estimate a reduction in Brazil’s coffee stockpiles. Inventories are expected to reach only 1.2 million bags when the current season ends in June. That is a 26% decrease compared to the previous year. The outlook for next year’s harvest is also rather dire. Skyrocketing prices have been fuelled by trees in Brazil that have an ultra-low number of cherries containing coffee beans, a byproduct of adverse weather conditions, such as drought, this year. Simultaneously, consumers have ramped demand for brews that require additional beans. Arabica futures in New York have touched the highest levels si … Read more at: https://www.zerohedge.com/commodities/arabica-futs-bull-run-surges-13-year-high-amid-panic-about-brazilian-stockpiles |

|

Reeves tells firms no more tax rises as she defends BudgetChancellor Rachel Reeves tells the CBI conference she is “not coming back with more borrowing or more taxes”. Read more at: https://www.bbc.com/news/articles/c33ek51rx57o |

|

Macy’s says worker hid more than $130m in costsAn employee “intentionally” concealed expenses related to package deliveries, the retailer says. Read more at: https://www.bbc.com/news/articles/c937vnd26p2o |

|

Barclays fined £40m over ‘reckless’ Qatar fundraisingThe UK’s financial watchdog says investors did not have all the information they should have had. Read more at: https://www.bbc.com/news/articles/cgqydn4qe0no |

|

Gold tumbles 3% on reports of Israel-Hezbollah ceasefire, US Treasury pickGold prices tumbled nearly 3% on Monday. A possible Israel-Hezbollah ceasefire eased geopolitical worries. Scott Bessent’s Treasury nomination also impacted gold. The precious metal lost its safe-haven allure. Traders now eye the Federal Reserve’s November meeting minutes and economic data. These will offer clues about future interest rate decisions. Other precious metals like silver, platinum, and palladium also declined. Read more at: https://economictimes.indiatimes.com/markets/commodities/news/gold-tumbles-3-on-reports-of-israel-hezbollah-ceasefire-us-treasury-pick/articleshow/115667659.cms |

|

Macy’s shares drop 3.5% after it delays quarterly results on finding employee hid millions in delivery expensesMacy’s delayed its third-quarter results after uncovering an employee’s concealment of $132 million to $154 million in delivery expenses. Preliminary sales figures missed Wall Street expectations, and the company’s stock dipped. An internal investigation is underway, with full results and a revised outlook expected by December 11. Despite this, Macy’s CEO expressed optimism about the upcoming holiday season. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/macys-shares-drop-3-5-after-it-delays-quarterly-results-on-finding-employee-hid-millions-in-delivery-expenses/articleshow/115667686.cms |

|

Why is Gary Dugan cautiously optimistic on US equities; “Magnificent 7” saw P/E expansion of about 10%The S&P 500’s 25% YTD gain has raised concerns about its valuation. The market is priced for perfection, relying on falling interest rates, resilient earnings, and sustained investor confidence. The tech sector, while resilient, shows a divergence in valuations between the broader space and the “Magnificent 7” mega-cap stocks. While the market’s outlook remains positive, investors should exercise caution and consider potential risks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/why-is-gary-dugan-cautiously-optimistic-on-us-equities-magnificent-7-saw-p/e-expansion-of-about-10/articleshow/115664909.cms |

|

Long-term Treasury bonds log biggest rally in nearly 4 months after Trump picks BessentLonger-term Treasury yields ended sharply lower Monday, sending prices higher on optimism that President-elect Donald Trump’s choice of Scott Bessent as Treasury secretary could help lower budget deficits. Read more at: https://www.marketwatch.com/story/treasury-yields-drop-after-bessent-picked-for-treasury-1915ef76?mod=mw_rss_topstories |

|

This market-timing model nailed the 2022 meltdown. Now it’s warning that stocks are a ‘dead cold sell.’Value Line’s Median Appreciation Potential predicts where stock prices will be in three to five years. Read more at: https://www.marketwatch.com/story/this-little-known-timing-model-nailed-the-2022-bear-market-now-its-warning-that-stocks-are-a-dead-cold-sell-5090a2b8?mod=mw_rss_topstories |

|

Oil prices drop as talk of Israel-Hezbollah cease-fire cuts ‘security premium’Oil futures ended lower Monday, with talk of a potential cease-fire deal between Israel and Lebanon-based Hezbollah leading prices to shrink their ”security premium,” pulling global benchmark crude prices down by nearly 3%. Read more at: https://www.marketwatch.com/story/oil-prices-consolidate-after-surging-on-rising-geopolitical-jitters-5a6cab61?mod=mw_rss_topstories |