Summary Of the Markets Today:

- The Dow closed up 426 points or 0.97%,

- Nasdaq closed up 31 points or 0.16%,

- S&P 500 closed up 21 points or 0.35%,

- Gold $2,708 up $33.10 or 1.23%,

- WTI crude oil settled at $71 up $1.05 or 1.50%,

- 10-year U.S. Treasury 4.416 down 0.016 points or 0.361%,

- USD index $107.53 up $0.56 or 0.52%,

- Bitcoin $99,411 up $1,402 or 1.41%, (24 Hours), (New Bitcoin Historic high 99,789)

- Baker Hughes Rig Count: U.S. -1 to 583 Canada +1 to 201

U.S. Rig Count is down 1 from last week to 583 with oil rigs up 1 to 479, gas rigs down 2 to 99 and miscellaneous rigs unchanged at 5.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The U.S. stock markets closed near its session highs on Friday, with the major indices showing positive momentum. The major indices closed the week with gains exceeding 1%, despite a sluggish start following the post-election rally. Market participants re-calibrated after Nvidia’s earnings, which raised questions about AI’s continued impact on stock prices. For the week, Tesla shares rose almost 4%, while Nvidia experienced a more than 3% dip. Wall Street continues to anticipate President-elect Donald Trump’s cabinet selections, particularly the Treasury secretary position, which could significantly impact market dynamics. Bitcoin maintained its upward trajectory, approaching the $100,000 milestone. The cryptocurrency briefly surpassed $99,500 early Friday, buoyed by expectations of favorable crypto regulations under the incoming Trump administration. Finally, the market awaits a shortened trading week due to Thanksgiving with oil prices increasing amid escalating tensions in the Russia-Ukraine war.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

No releases today

Here is a summary of headlines we are reading today:

- Iran Escalates Nuclear Tensions with Advanced Centrifuge Installation

- U.S. Drilling Activity Slips Further As Market Volatility Remains

- Texas Pacific Land Replaces Marathon Oil in S&P 500 After ConocoPhillips Deal

- Geopolitical Risk and Supply Outages Underpin Oil Prices

- Is the Russia-Ukraine War Really Escalating?

- ‘I have no money’: Thousands of Americans see their savings vanish in Synapse fintech crisis

- Dow rises more than 400 points for record close, Wall Street posts weekly gain: Live updates

- The case for altcoins and memes as bitcoin, now approaching $100,000, faces a potential correction

- Bitcoin tests $100,000 heading into the weekend: CNBC Crypto World

- Egg Prices Surge Again As Grocers Face Shortages Amid Bird Flu Outbreak

- 2-year Treasury yield has 8th straight week of gains on improved U.S. outlook

- U.S. oil prices score a more than 6% weekly gain on supply risks tied to the Russia-Ukraine war

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Nigeria’s Local Currency Crude Oil Plan Hits RoadblocksNigeria’s ambitious strategy to price crude oil in naira for local refineries has encountered significant setbacks just two months after its rollout. Spearheaded by the Nigerian National Petroleum Company (NNPC), the plan’s goal was to stabilize the country’s dollar reserves while ensuring sufficient crude supply for domestic refining. But the initiative appears to be faltering. Major players like Dangote Oil Refinery are receiving only a fraction of what it was promised. According to Edwin Devakumar, the Dangote refinery’s executive… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigerias-Local-Currency-Crude-Oil-Plan-Hits-Roadblocks.html |

|

Iran Escalates Nuclear Tensions with Advanced Centrifuge InstallationIran has vowed to respond to a resolution adopted by the United Nations’ nuclear watchdog that criticizes the Islamic republic for what it says is poor cooperation by installing a number of “new and advanced” centrifuges. The resolution, which comes shortly after the return of International Atomic Energy Agency (IAEA) chief Rafael Grossi from a trip to Iran, reportedly says it is “essential and urgent” for Tehran to “act to fulfill its legal obligations.” A joint statement by Iran’s Foreign Ministry and Atomic Energy Organization said on November… Read more at: https://oilprice.com/Geopolitics/International/Iran-Escalates-Nuclear-Tensions-with-Advanced-Centrifuge-Installation.html |

|

U.S. Drilling Activity Slips Further As Market Volatility RemainsThe total number of active drilling rigs for oil and gas in the United States fell again this week, according to new data that Baker Hughes published on Friday, after falling in the week prior. The total rig count fell by a single rig for the second week in a row, landing at 583 total rigs, according to Baker Hughes, down by nearly 7% from this same time last year. The number of oil rigs rose by one this week to 479—down by 26 compared to this time last year. The number of gas rigs fell by two rigs, landing at 99, a loss of 17 active gas… Read more at: https://oilprice.com/Energy/Energy-General/US-Drilling-Activity-Slips-Further-As-Market-Volatility-Remains.html |

|

Czech Republic to End Russian Oil Imports by Next SummerThe Czech Republic will phase out Russian oil imports by July 2025, Deputy chairman of the statement pipeline company MERO suggested on Friday. The move is part of the country’s energy diversification journey, although it hinges on the completion of a $60 million upgrade to the Trans Alpine (TAL) pipeline. The upgrade will double TAL’s capacity to 8 million tonnes per year, enabling increased shipments of alternative crude blends from Latin America, Saudi Arabia, and the North Sea–making the shift away from Russian oil simpler. The move is… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Czech-Republic-to-End-Russian-Oil-Imports-by-Next-Summer.html |

|

Libya a New Instrument in Moscow’s European Strategy?North Africa’s main oil producer, Libya, is again making headlines, mainly in light of OPEC’s ongoing market struggles. At the same time, Europeans are looking at the OPEC member as a potential source for their energy-hungry industries. After Europe’s energy crisis, mainly caused by Russia’s invasion of Ukraine, the Southern Mediterranean is back on the books of politicians and investors. However, amid the ongoing civil war, which has split the country into two main warring factions, international powers have their… Read more at: https://oilprice.com/Geopolitics/Africa/Libya-a-New-Instrument-in-Moscows-European-Strategy.html |

|

Russia to Lift Gasoline Export Ban Earlier Than PlannedRussia’s government plans to lift the gasoline export ban earlier than current plans at the end of the year, Russian Deputy Prime Minister Alexander Novak told reporters on Friday. The ban will be lifted, documents are now being drafted and will be ready within days, he said. “It is difficult to say whether the export restrictions will be lifted on December 1 or [from another date],” Novak said, as quoted by Russian news agency TASS. In the middle of August, the Russian government said that Moscow is extending its ban on… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-to-Lift-Gasoline-Export-Ban-Earlier-Than-Planned.html |

|

Miami Financier’s Bold Bid for Nord Stream 2 Sparks ControversyUS investor Stephen P. Lynch, who has decades of business dealings in Moscow, has reportedly asked US officials for permission to bid on the sabotaged Nord Stream 2 pipeline if it is auctioned off in a Swiss bankruptcy court, according to a report by the Wall Street Journal. Lynch has discussed with US senators, Treasury officials, and State officials the possibility of American ownership of the sabotaged NS2 pipeline, which runs from Russia to Germany through the Baltic Sea. “The bottom line is this: This is a once-in-a-generation… Read more at: https://oilprice.com/Energy/Energy-General/Miami-Financiers-Bold-Bid-for-Nord-Stream-2-Sparks-Controversy.html |

|

Texas Pacific Land Replaces Marathon Oil in S&P 500 After ConocoPhillips DealTexas Pacific Land, a large owner of acreage in the Permian basin, will replace Marathon Oil in the S&P 500 index on November 26, as Marathon Oil is being acquired by ConocoPhillips in a deal expected to close on November 22, S&P Dow Jones Indices said. Texas Pacific Land Corporation has a company-level market capitalization that is more representative of the large-cap market space, according to S&P Dow Jones Indices. Texas Pacific Land Corporation is one of the largest landowners in the State of Texas with approximately 873,000 acres… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Texas-Pacific-Land-Replaces-Marathon-Oil-in-SP-500-After-ConocoPhillips-Deal.html |

|

Geopolitical Risk Underpins Oil PricesGeopolitical risk has pushed oil prices back up this week, but traders are likely to refocus on fundamentals as the month draws to an end and the next OPEC+ meeting looms.Friday, November 22nd, 2024Brent futures have been trading within a narrow bandwidth of $73-74 per barrel, but the return of geopolitical risk has pushed oil prices higher – recouping most of November’s losses to date. Whilst Russia’s launch of hypersonic missiles into Ukraine is keeping the markets busy for now, the contours of an OPEC+ meeting taking place… Read more at: https://oilprice.com/Energy/Energy-General/Geopolitical-Risk-Underpins-Oil-Prices.html |

|

Oil Majors Slash Renewables and Boost BiofuelsOil Majors Give Up the Renewable Ghost – European oil majors are winding down investments into renewable energy projects after the double whammy of low returns and skyrocketing costs prompted them to look towards more profitable deals. – BP has halted 18 potential hydrogen projects already and is set to divest several existing wind and solar operations, similarly Shell which cut back on its 2030 carbon reduction target, leaving TotalEnergies the only major to stick to its initial commitments. – At the end of 2023, BP and Shell had 2.7 GW and 3.2… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Majors-Slash-Renewables-and-Boost-Biofuels.html |

|

Geopolitical Risk and Supply Outages Underpin Oil PricesCrude oil prices moved higher this week, supported by escalating geopolitical tensions. The Russia-Ukraine conflict has intensified, with Ukraine using long-range missiles supplied by the U.S. and Britain to strike targets within Russian territory. In response, Russia launched an intercontinental ballistic missile for the first time since the war began, raising fears of further escalation. Market participants are closely monitoring the conflict for any potential threats to global energy supplies. While Russian oil exports have remained largely… Read more at: https://oilprice.com/Energy/Energy-General/Geopolitical-Risk-and-Supply-Outages-Underpin-Oil-Prices.html |

|

Shootout in South Sudan Casts Doubt on ElectionsPolitics, Geopolitics & Conflict The capital of South Sudan (the landlocked oil producer reeling from the fallout of a civil war in neighboring Sudan) saw a shootout on Thursday when security forces attempted to arrest the newly independent country’s former intelligence chief. We are concerned about a potential power vacuum in South Sudan, which could be further impacted by the fighting in Sudan proper. Elections in South Sudan were planned for December, and a power struggle emerged several weeks ago when President Salva Kiir’s… Read more at: https://oilprice.com/Energy/Energy-General/Shootout-in-South-Sudan-Casts-Doubt-on-Elections.html |

|

One Stock to Short as Trump Takes OfficeFor a long time, one of the most frustrating things about wind power from an investor’s perspective was that it was very hard to find ways of playing the industry, regardless of whether your views were bullish or bearish. That was because the two biggest players in the industry were (GE) and Siemens (SIE.DE or SIEGY: ADR). Both are huge conglomerates where wind power made up a fairly small percentage of their revenues and profits. That changed for Siemens to some extent in 2020 when they spun off their green energy division, and for GE earlier… Read more at: https://oilprice.com/Energy/Energy-General/One-Stock-to-Short-as-Trump-Takes-Office.html |

|

Is the Russia-Ukraine War Really Escalating?The Biden administration has had a change of heart on letting Kyiv use long-range missiles against targets on Russian soil, and Moscow’s response on Thursday was a showy one. Putin launched an experimental hypersonic ballistic missile at Ukraine, underscoring what the Kremlin views as the red line in this conflict–the red line that would put NATO at war with Russia. The experimental missile was armed with a non-nuclear hypersonic warhead and aimed at a Ukrainian defense facility. Prior to Putin’s statement, Kyiv had claimed that… Read more at: https://oilprice.com/Energy/Energy-General/Is-the-Russia-Ukraine-War-Really-Escalating.html |

|

OPEC+ Could Hold Crucial December Meeting OnlineThe OPEC+ group looks set to hold its December 1 meeting to discuss production levels online rather than in person in Vienna, delegates from the alliance told Bloomberg on Friday, noting they haven’t received yet invitations for a meeting at the OPEC headquarters in Vienna. OPEC+ is also understood to not have started – yet – any preparations regarding logistics to hold an in-person meeting at its headquarters in the Austrian capital city, according to the anonymous OPEC+ delegates who spoke to Bloomberg. OPEC+ has already postponed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Could-Hold-Crucial-December-Meeting-Online.html |

|

‘I have no money’: Thousands of Americans see their savings vanish in Synapse fintech crisisCNBC spoke to a dozen customers caught in the Synapse fintech predicament, people who are owed sums ranging from $7,000 to well over $200,000. Read more at: https://www.cnbc.com/2024/11/22/synapse-bankruptcy-thousands-of-americans-see-their-savings-vanish.html |

|

Dow rises more than 400 points for record close, Wall Street posts weekly gain: Live updatesThe major U.S. averages all headed for weekly gains. Read more at: https://www.cnbc.com/2024/11/21/stock-market-today-live-updates.html |

|

Trump hush money sentencing delayed indefinitelyA New York judge indefinitely postponed President-elect Donald Trump’s sentencing in his criminal hush money case. Read more at: https://www.cnbc.com/2024/11/22/trump-hush-money-sentencing-delayed-indefinitely.html |

|

Why X’s new terms of service are driving some users to leave Elon Musk’s platformElon Musk’s X implemented new terms of service that are driving some users off the microblogging platform. Read more at: https://www.cnbc.com/2024/11/22/why-x-new-terms-of-service-driving-some-users-to-leave-elon-musk-platform.html |

|

The case for altcoins and memes as bitcoin, now approaching $100,000, faces a potential correctionBitcoin stands to gain less from Trump 2.0 than other forms of cryptocurrency, which could keep outperforming stocks into 2025. Read more at: https://www.cnbc.com/2024/11/22/the-case-for-altcoins-and-memes-as-bitcoin-faces-a-potential-correction.html |

|

Investor focus shifts to rate cut outlook on Thanksgiving week, with Fed minutes and inflation data aheadThe interest rate outlook will come back into focus next week with key inflation data and Federal Reserve meeting minutes coming out ahead of Thanksgiving. Read more at: https://www.cnbc.com/2024/11/22/stock-market-next-week-outlook-for-nov-25-29-2024.html |

|

Bitcoin tests $100,000 heading into the weekend: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Bitwise CEO Hunter Horsley shares his thoughts on the crypto rally and whether he sees a correction coming soon. Read more at: https://www.cnbc.com/video/2024/11/22/bitcoin-tests-100000-heading-into-weekend-crypto-world.html |

|

Amazon to invest another $4 billion in Anthropic, OpenAI’s biggest rivalAmazon on Friday announced it would invest an additional $4 billion in Anthropic, the artificial intelligence startup founded by ex-OpenAI research executives. Read more at: https://www.cnbc.com/2024/11/22/amazon-to-invest-another-4-billion-in-anthropic-openais-biggest-rival.html |

|

Trump might name Kevin Warsh as Treasury chief then Fed chair later, report saysA former Fed governor himself, Warsh would move over to the central bank after current Chair Jerome Powell’s term expires. Read more at: https://www.cnbc.com/2024/11/22/trump-might-name-kevin-warsh-as-treasury-chief-then-fed-chair-later-report-says.html |

|

‘Wicked’ tallies $19 million in previews, as ‘Gladiator II’ team-up heads for $200 million opening weekend“Wicked” and “Gladiator II” arrive ahead of the Thanksgiving holiday and are expected to tally more than $200 million in combined ticket sales. Read more at: https://www.cnbc.com/2024/11/22/wicked-gladiator-ii-opening-weekend-projections.html |

|

Space vacations and retiring on Mars: SpaceX COO shares 3 visions for the company’s futureGwynne Shotwell spoke with investor Ron Baron about interstellar travel, competition among space companies and the potential for better tech regulation. Read more at: https://www.cnbc.com/2024/11/22/spacex-coo-gwynne-shotwell-shares-vision-for-companys-future.html |

|

How Elon Musk’s plan to slash government agencies and regulation may benefit his empireDonald Trump has said the Department of Government Efficiency would end government “bureaucracy,” relax “excess” regulations and cut “wasteful” expenditures. Read more at: https://www.cnbc.com/2024/11/22/musks-slash-government-agencies-and-regulation-benefit-empire.html |

|

Goldman says 2025 will be the ‘year of generating income’The Wall Street firm expects less upside for equities, and believes adding income-earning assets to a portfolio could help boost returns. Read more at: https://www.cnbc.com/2024/11/22/goldman-sachs-says-2025-will-be-the-year-of-generating-income.html |

|

McDonald’s Revamps Meal Deal As QSRs Fight Over Cash-Strapped ConsumersAbout six months ago, McDonald’s launched a meal deal targeting working-class and middle-class customers who could no longer afford soaring Big Mac prices due to the inflation storm sparked by failed ‘Bidenomics.’ The meal deal ignited a value menu war with other major quick-service restaurants. Now, the burger chain is planning a complete overhaul of its value menu in early 2025. A press release from MCD on Friday morning stated the new McValue menu, consisting of $5 meal deals, will launch on January 7.

The “highly anticipated new value platform” will … Read more at: https://www.zerohedge.com/markets/mcdonalds-revamps-meal-deal-qsrs-fight-over-cash-strapped-consumers |

|

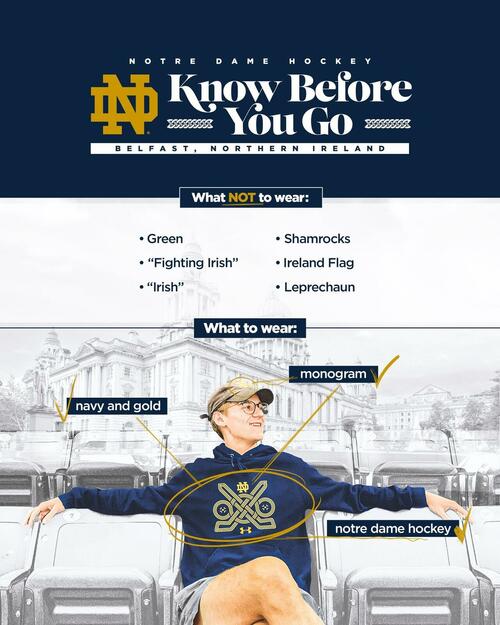

Notre Dame Apologizes After Telling Hockey Fans Not To Wear Green, Shamrocks, ‘Fighting Irish’Authored by Jennifer Kabbany via The College Fix, Leaders of the University of Notre Dame’s hockey team have apologized for telling fans not to wear the color green, Shamrocks, the words “Fighting Irish,” and other imagery to its upcoming game abroad in Belfast, Ireland.

The advice was given despite the fact that the team had made special jerseys for the game next week that have the word “Irish” literally sprawled across the chest.

|

|

Russia Confirms It Hit Ukraine With New Hypersonic ‘Oreshnik’ Missile, Capable Of Reaching Any European TargetA day after Russia’s attack on Ukraine with what were clearly big, very fast and new intermediate-range missiles, which many outlets initially reported to be an ICBM, the Kremlin is touting that it launched a cutting-edge hypersonic missile for which there is no defensive intercept capability. Russia says that Washington has now understood and been able to grasp Putin’s warnings and red lines more clearly following the missile strike a Ukrainian defense industry facility in Dnepropetrovsk Thursday morning. The new hypersonic weapon, dubbed ‘Oreshnik’ is capable of delivering a nuclear warhead. “We have no doubt that the current administration in Washington has had the opportunity to familiarize itself with this announcement and understand it,” Kremlin spokesman Dmitry Peskov told reporters. Putin had said the West’s escalation, seen this week in authorizing Ukraine’s long-range strikes on Russia with US/UK-made weapons, makes Ukraine a “global” conflict. Read more at: https://www.zerohedge.com/geopolitical/russia-confirms-it-hit-ukraine-new-hypersonic-oreshnik-missile-capable-reaching-any |

|

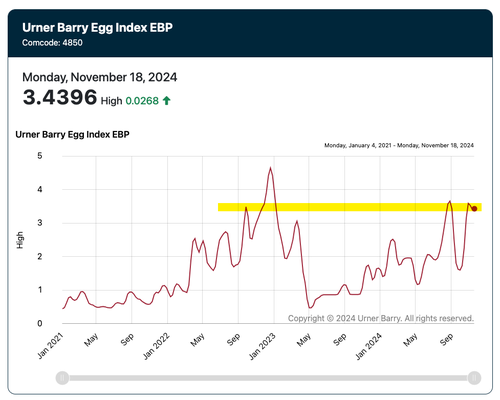

Egg Prices Surge Again As Grocers Face Shortages Amid Bird Flu OutbreakWholesale egg prices via the Urner Barry Egg Index are nearing record highs (again) as the highly pathogenic avian Influenza, also known as bird flu, hits egg production at commercial farms.

The Washington Post reports that consumers are growing increasingly frustrated with DC-area grocery stores, where signs read: “Temporarily out of eggs.”

|

|

People told to shop around as energy bills riseSomeone paying by direct debit and using a typical amount of energy will pay £21 more a year from January. Read more at: https://www.bbc.com/news/articles/cz6jvl9w7p6o |

|

Two detained over Gatwick Airport ‘suspect package’An explosive ordnance disposal team was deployed after a suspected prohibited item was found. Read more at: https://www.bbc.com/news/articles/ced94pggwxpo |

|

Spain fines budget airlines including Ryanair €179mThe government says charging for hand luggage and printing boarding passes at the airport are “abusive practices”. Read more at: https://www.bbc.com/news/articles/c8jy2dpv722o |

|

Sebi asks MIIs to resolve whistleblower complaints in 60 days, outlines guidelines on governanceSebi has introduced new guidelines to enhance accountability and governance in stock exchanges and other MIIs. These guidelines include resolving whistleblower complaints within 60 days, adopting RegTech and SupTech, and establishing SOPs for disciplinary actions against KMPs. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-asks-miis-to-resolve-whistleblower-complaints-in-60-days-outlines-guidelines-on-governance/articleshow/115573362.cms |

|

Japanese retail funds start pulling out of Indian stocks for 1st time since 2018Japanese retail investors have pulled back from Indian funds for the first time in six years, leading to significant outflows from Indian markets. This shift, combined with record inflows into US funds, signals a cooling of foreign investor sentiment towards India. The weakening yen and rising appeal of US assets have contributed to this trend. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/japanese-retail-funds-start-pulling-out-of-indian-stocks-for-1st-time-since-2018/articleshow/115566562.cms |

|

Sebi clears Roshni Nadar’s family share transfer in HCL Tech, aimed at smooth successionSebi has granted Roshni Nadar an exemption from making an open offer for her proposed acquisition of shares in HCL Tech’s promoter entities. This move facilitates smoother succession planning within the Nadar family. The transaction is a non-commercial transfer between immediate relatives, exempting it from the open offer requirement. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-clears-roshni-nadars-family-share-transfer-in-hcl-tech-aimed-at-smooth-succession/articleshow/115569577.cms |

|

2-year Treasury yield has 8th straight week of gains on improved U.S. outlookTreasury yields finished mixed on Friday, as the 2-year rate continued to rise on growing confidence about the U.S. outlook while long-dated rates fell on worse-than-expected eurozone data. Read more at: https://www.marketwatch.com/story/u-s-treasury-yields-drop-after-weak-eurozone-activity-data-d821c247?mod=mw_rss_topstories |

|

U.S. oil prices score a more than 6% weekly gain on supply risks tied to the Russia-Ukraine warOil futures settled higher on Friday, with the U.S. crude benchmark up by more than 6% for the week as traders monitor escalating tensions between Ukraine and Russia, which is among the world’s biggest oil producers. Read more at: https://www.marketwatch.com/story/oil-prices-slip-as-weak-european-data-trumps-concerns-about-russia-and-ukraine-0a419d33?mod=mw_rss_topstories |

|

‘I’m at a loss’: My boyfriend of nearly 10 years is naming his elderly parents as beneficiaries and giving them power of attorney. Am I right to be upset?“I own the house we live in and he pays me a small amount of rent every month to help cover my mortgage and utilities.” Read more at: https://www.marketwatch.com/story/im-at-a-loss-my-boyfriend-of-nearly-10-years-is-naming-his-elderly-parents-as-his-powers-of-attorney-and-his-beneficiaries-am-i-right-to-be-upset-1901219e?mod=mw_rss_topstories |