Summary Of the Markets Today:

- The Dow closed up 462 points or 1.06%,

- Nasdaq closed up 6 points or 0.03%,

- S&P 500 closed up 32 points or 0.53%,

- Gold $2,674 up $22.50 or 0.85%,

- WTI crude oil settled at $70 up $1.44 or 2.09%,

- 10-year U.S. Treasury 4.420 up 0.014 points or 0.318%,

- USD index $107.02 up $0.34 or 0.32%,

- Bitcoin $98,000 up $1,058 or 1.08%, (24 Hours), (New Bitcoin Historic high 98,903)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks experienced volatility on Thursday as investors reacted to NVIDIA’s earnings and Alphabet’s stock decline. NVIDIA reported strong earnings but forecasted slower revenue growth due to supply chain issues affecting its new Blackwell chip. Despite this, some analysts believe the revenue boost is merely delayed, given NVIDIA’s dominant position in AI chip-making. Nvidia’s shares closed up less than 1%. Alphabet’s stock tumbled after the Department of Justice sought to force Google to sell its Chrome browser. In other market news, Investors favored Utilities, Industrials, and Financials sectors while moving away from Big Tech. Bitcoin briefly reached a new all-time high near $99,000, approaching the $100,000 milestone. MicroStrategy shares fell over 17% after Citron Research announced a short position, despite Bitcoin’s record highs.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

CoreLogic® released its latest Single-Family Rent Index (SFRI) annual U.S. rent growth registered a 2% increase in September 2024, continuing a slowing trend that began in early 2024 but is well below the average annual rent growth of 3.5% that occurred in the decade before the pandemic. CoreLogic principal economist Molly Boesel’s view:

Single-family annual rent growth slowed in September to the lowest rate in over four years, and monthly rent growth posted a second month of below-seasonal trend growth, making it clear that single-family rent growth is decelerating. While about one-third of metros showed stronger rent growth than in the previous year, more metros showed decreases in rents than in the prior report. While a slowing in rents will be welcome news to renters, increases since 2020 are still at 32%.

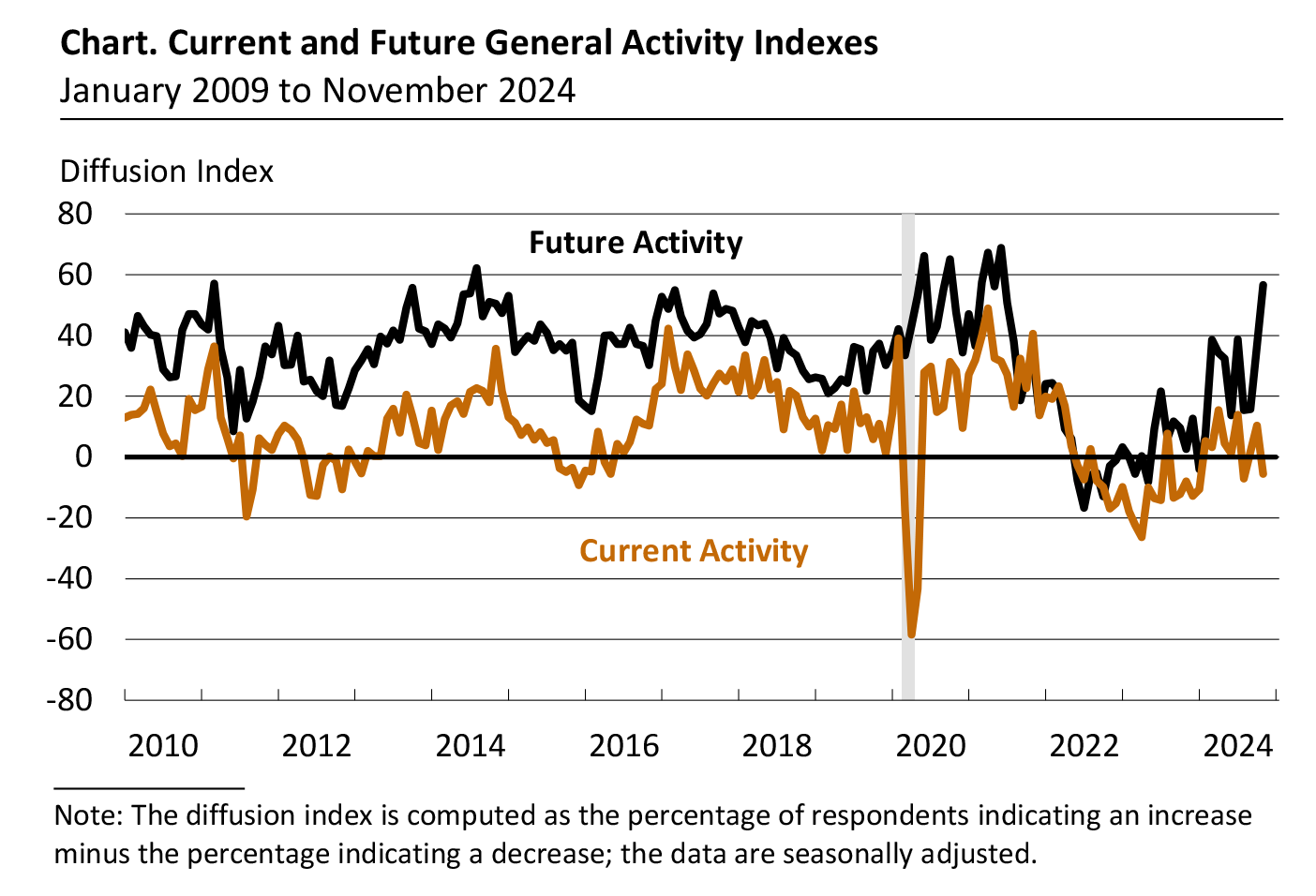

The Philly Fed November Manufacturing Business Outlook Survey’s indicator for current general activity turned negative, while the indexes for new orders and shipments declined but remained positive. The diffusion index for current general activity fell from 10.3 to -5.5, its second negative reading since January (see Chart below). The manufacturing sector remains in a recession in the US.

Existing-home sales was up 2.9% from one year ago – which is the first year-over-year increase in more than three years. The median existing-home sales price ascended 4.0% from October 2023 to $407,200. The inventory of unsold existing homes is now 4.2 months’ supply at the current monthly sales pace. The folks at the National Association of Realtors thinks this is a sign of growing housing demand. I think we need to wait a few months before believing this.

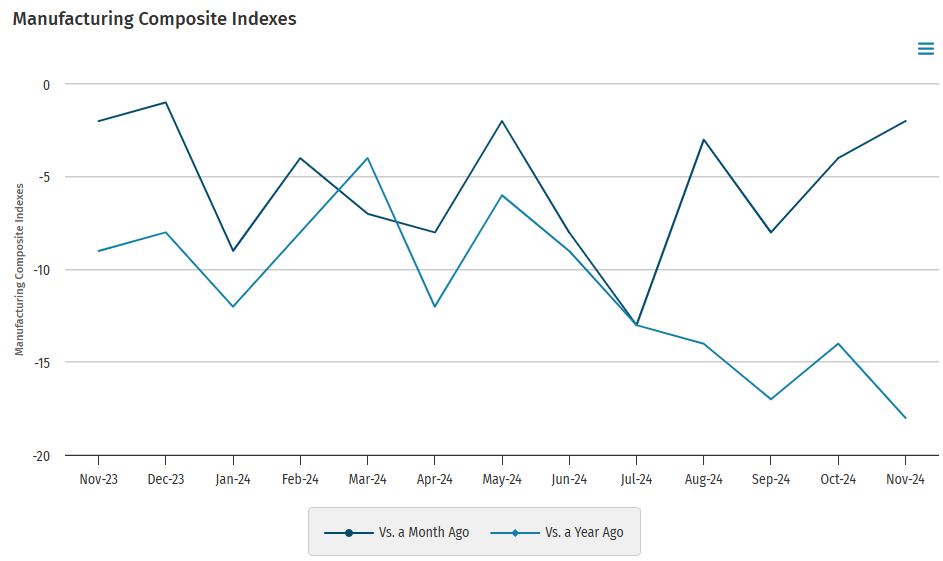

The Kansas City Manufacturing Survey shows the month-over-month composite index was -2 in November 2024, up from -4 in October and -8 in September. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The manufacturing sector remains in a recession in the US.

In the week ending November 16, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 217,750, a decrease of 3,750 from the previous week’s revised average. The previous week’s average was revised up by 500 from 221,000 to 221,500. The current data is showing an accelerating economy.

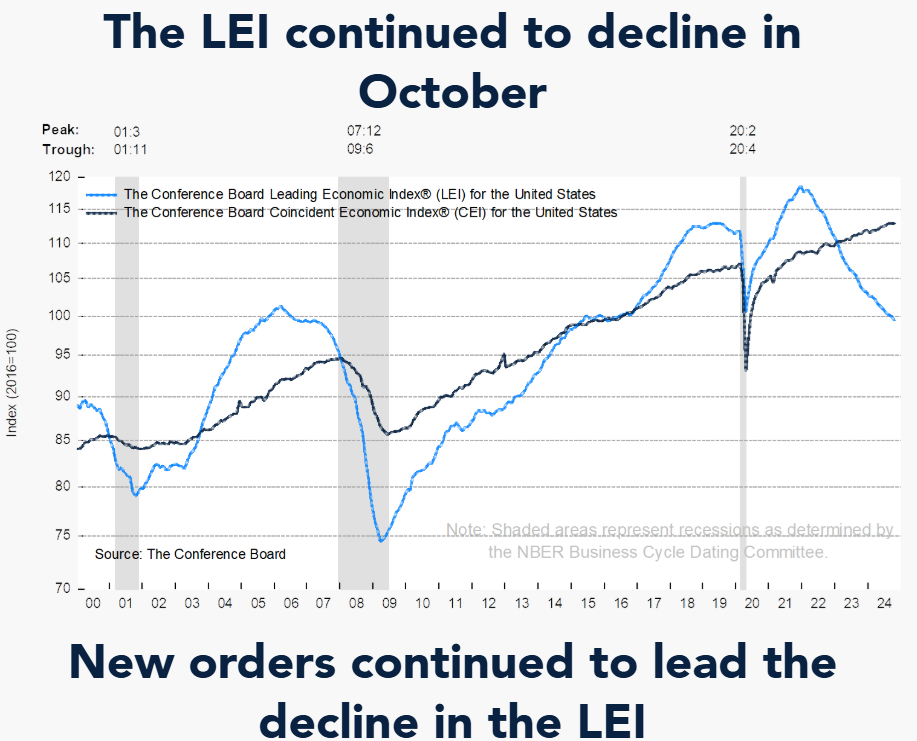

The Conference Board Leading Economic Index® (LEI) for the US declined by 0.4% in October 2024 to 99.5 (2016=100), following a 0.3% decline in September (revised up from a 0.5% decline). You all know the story of the boy who cried wolf. Well The Conference Board has been saying the economy is going to fall into the toilet for the last 2 years – and this only suggests that the underlying methodology in the LEI is not representative of the current economy. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board opinion:

The largest negative contributor to the LEI’s decline came from manufacturer new orders, which remained weak in 11 out of 14 industries. In October, manufacturing hours worked fell by the most since December 2023, while unemployment insurance claims rose and building permits declined, partly reflecting the impact of hurricanes in the Southeast US. Additionally, the negative yield spread continued to weigh on the LEI. Apart from possible temporary impacts of hurricanes, the US LEI continued to suggest challenges to economic activity ahead.

Here is a summary of headlines we are reading today:

- China’s Solar Dominance Fuels Asia’s Green Energy Shift

- Kenya Cancels Adani Energy, Airport Deals Amid U.S. Indictment

- Exxon Mobil To Launch Offshore Cyprus Gas Drilling in 2025

- Russia’s Gas Exports via Ukraine Remain Stable Despite OMV Dispute

- Lower Oil Prices Boost China’s Crude Imports in November

- U.S. LNG Exports to Europe Set to Surge as European Gas Prices Soar

- Dow closes more than 450 points higher as investors snap up stocks tied to the economy: Live updates

- Alphabet shares slide 6% following DOJ push for Google to divest Chrome

- Snowflake rockets 32%, its best day ever, after earnings beat

- Trump and Fed Chair Powell could be set on a collision course over interest rates

- US Bitcoin ETF Assets Break Above $100 Billion

- Gary Gensler to step down as SEC chair, in a move that has crypto bulls ‘glad’

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Solar Dominance Fuels Asia’s Green Energy ShiftIf you’re trying to implement green energy solutions in Asia, chances are you’re going to need to rely on China one way or another. Southeast Asia’s demand for renewable energy is rising, driven by tech manufacturing and data center growth, according to Nikkei. Solarvest, the region’s leading renewable energy provider, plans to capitalize on this boom by increasing imports from China, according to a local manager. That manager told Nikkei: “We aim to invest more in the next couple of years. Buying equipment and components from Chinese… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Chinas-Solar-Dominance-Fuels-Asias-Green-Energy-Shift.html |

|

Russia’s Revised Nuclear Doctrine Raises Global AlarmSince Moscow launched its all-out invasion of Ukraine in February 2022, Kyiv has complained that it is defending itself with one arm tied behind its back in the face of Russia’s full might. While Western partners like the United States provided billions of dollars in weapons, Ukraine was prevented from using them to strike deep into Russian territory, where Moscow’s war machine largely sat out of harm’s way. That all changed on November 19, the 1,000th day of the war, when Moscow claimed Ukraine had fired U.S.-made longer-range missiles inside… Read more at: https://oilprice.com/Geopolitics/International/Russias-Revised-Nuclear-Doctrine-Raises-Global-Alarm.html |

|

Central Asian Nations Forge Green Trade Route at COP29While discussions on containing global warming have bogged down inside the blue zone at the COP29 climate summit in Baku, Caspian Basin and Central Asian states have been busy on the sidelines looking for ways to boost “green” trade. The Middle Corridor, an emerging trade route linking China and Europe via the Caucasus and Central Asia, has been a major topic of discussion on the fringes of COP29. In the spirit of the climate gathering, participants say they are intent on developing a sustainable “green” energy corridor,… Read more at: https://oilprice.com/Energy/Energy-General/Central-Asian-Nations-Forge-Green-Trade-Route-at-COP29.html |

|

Kenya Cancels Adani Energy, Airport Deals Amid U.S. IndictmentKenya’s President William Ruto has canceled multimillion-dollar energy and airport expansion deals with Indian industrial conglomerate Adani Group shortly after Gautam Adani, founder and chairman of Adani, and other executives were indicted in New York on Wednesday for their alleged roles in a multi-million-dollar bribery and fraud scheme involving a major solar power project. In a state of the nation address, Ruto said the decision was made “based on new information provided by our investigative agencies and partner nations”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kenya-Cancels-Adani-Energy-Airport-Deals-Amid-US-Indictment.html |

|

Ofgem Orders Energy Provider to Compensate Customers for Billing ErrorsThe energy regulator Ofgem has told provider E.ON Next to pay up £14.5m for failing to provide final bills and refunds to its customers. E.ON failed to provide customers energy bills or give them back money owed on credit balances for prepayment meters. This comes after an investigation by Ofgem found that nearly 250k prepayment meter accounts had been affected between early 2021 and late 2023. The failures were the result of an error within E.ON’s billing system, which E.ON Next self-reported to Ofgem. In an announcement to markets… Read more at: https://oilprice.com/Energy/Energy-General/Ofgem-Orders-Energy-Provider-to-Compensate-Customers-for-Billing-Errors.html |

|

Exxon Mobil To Launch Offshore Cyprus Gas Drilling in 2025Exxon Mobil Corp. (NYSE:XOM) will drill a well off Cyprus in January in pursuit of natural gas, a senior executive told Reuters on Thursday. “We’ve spent the last two years collecting very detailed, three dimensional seismic data … We’ve identified several large prospects, and the next stage is to bring in a drilling rig and to test those,” said John Ardill, Vice-president for global exploration at ExxonMobil. “We’ll spud our first well in mid-January, so we are very excited about that,” he told a conference in Nicosia. Back in July, China-based… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Mobil-To-Launch-Offshore-Cyprus-Gas-Drilling-in-2025.html |

|

Trump’s Opportunity to Reset U.S.-Iran RelationsDonald Trump is back and so is the “maximum pressure” campaign against Iran to “drastically throttle” Iran’s oil sales to kill Tehran’s nuclear program and its ability to fund regional proxies. But Trump aide Brian Hook who ran the anti-Iran campaign in Trump’s first term claimed Trump has “no interest in regime change.” That may be true but Iran, and everyone else, probably doesn’t believe it. The Trump 47 officials may soon learn that 2025 is not 2018 and, while Iran was on the ropes as Trump’s… Read more at: https://oilprice.com/Geopolitics/Middle-East/Trumps-Opportunity-to-Reset-US-Iran-Relations.html |

|

World’s Largest Climate Fund Sees Few Investment OpportunitiesAlterra, the world’s largest private climate investment fund of $30 billion launched by the United Arab Emirates (UAE) last year, sees a lack of investment opportunities in the energy transition and has only spent a small part of its money, the fund’s chief executive Majid Al Suwaidi told Bloomberg. There aren’t attractive investment deals in the clean energy sector right now, especially in emerging and developing markets, the executive told Bloomberg, declining to go into details how much the fund has spent over the past year.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Worlds-Largest-Climate-Fund-Sees-Few-Investment-Opportunities.html |

|

Trump’s Energy Picks Signal Policy ShiftBy Ed Crooks of Wood Mackenzie “Personnel is policy.” That aphorism about the realities of US presidential government was coined by Scot Faulkner, who was director of personnel for Ronald Reagan’s triumphant election campaign in 1980. What he meant was that, while US presidents can do almost anything, they can’t do everything. The day-to-day business of the administration is carried on by appointed officials. And if presidents want to make real progress towards their policy objectives, they need to make sure that their officials… Read more at: https://oilprice.com/Energy/Energy-General/Trumps-Energy-Picks-Signal-Policy-Shift.html |

|

Russia’s Gas Exports via Ukraine Remain Stable Despite OMV DisputeRussian natural gas flows to Europe via Ukraine have remained stable this week despite the fact that Gazprom cut off supply to Austria’s OMV over the weekend. Gazprom is sending 42.4 million cubic meters of gas to Europe via Ukraine on Thursday, Reuters quoted the Russian gas giant as saying. This volume has not changed since early last week when Austrian energy company OMV said it would seek enforcement of the award it won against Gazprom in an arbitration dispute over Russian gas supply. Nominations from companies in Austria and Slovakia… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Gas-Exports-via-Ukraine-Remain-Stable-Despite-OMV-Dispute.html |

|

Indonesia Pledges to Retire All Coal Power Plants Within 15 YearsIndonesia, which depends heavily on coal-fired power generation, plans to phase out all coal-fired and fossil-fueled power plants within the next 15 years, the country’s new President Prabowo Subianto said at the G20 summit in Brazil. “Indonesia is rich in geothermal resources, and we plan to phase out coal-fired and all fossil-fueled power plants within the next 15 years,” the president said in his address at the summit. At the same time, the biggest economy in Southeast Asia plans to install more than 75 gigawatts (GW) of renewable… Read more at: https://oilprice.com/Energy/Energy-General/Indonesia-Pledges-to-Retire-All-Coal-Power-Plants-Within-15-Years.html |

|

Lower Oil Prices Boost China’s Crude Imports in NovemberChina is set to import this month the highest crude oil volumes since August, as oil prices slumped amid demand concerns in early September when most November cargoes were likely contracted. The world’s top crude oil importer is estimated to import about 11.4 million barrels per day (bpd) of crude, Reuters columnist Clyde Russell reports, citing tanker-tracking and port data compiled by LSEG Oil Research and commodity analysts Kpler. If these estimates pan out, China would have imported in November the highest crude volumes since the August… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lower-Oil-Prices-Boost-Chinas-Crude-Imports-in-November.html |

|

Outage Forces Part of BP’s Indonesia LNG Plant OfflineAn outage has forced the third train of BP’s Tangguh LNG project offline, Indonesia’s upstream regulator said on Thursday, amid rising LNG demand as Europe and Asia stock up for the winter. A trip at the third train at BP’s facility in West Papua occurred earlier this week, with operations due to restart from Saturday, Hudi Suryodipuro, a spokesperson for Indonesian regulator SKK Migas, told Reuters on Thursday. “After repairs by the BP team and startup was carried out, a leak was found in the actuator which required repair… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Outage-Forces-Part-of-BPs-Indonesia-LNG-Plant-Offline.html |

|

U.S. LNG Exports to Europe Set to Surge as European Gas Prices SoarAs Europe’s benchmark natural gas prices have hit a one-year high, their premium over with the U.S. benchmark gas price has widened well above 2024 averages, signaling that U.S. LNG exporters will likely further boost deliveries to Europe to take advantage of the widening spread. Currently, the price of the U.S. benchmark, Henry Hub, is about 80% lower compared to the Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, according to data cited by Reuters columnist Gavin Maguire. The wide premium of European prices… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-LNG-Exports-to-Europe-Set-to-Surge-as-European-Gas-Prices-Soar.html |

|

Saudi Aramco Plans Regular Debt IssuesSaudi Aramco plans to regularly tap the bond market for debt issuance as it looks to optimize capital structure and widen its investor base, Ziad Al-Murshed, chief financial officer of the world’s biggest oil firm, told Bloomberg in an interview. “You’ll see us do a couple of things. One is, just take on more debt compared to use of equity,” Al-Murshed told Bloomberg. “It’s nothing to do with the dividend, it is optimizing our capital structure so that we end up with a lower weighted average cost of capital.”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Plans-Regular-Debt-Issues.html |

|

Dow closes more than 450 points higher as investors snap up stocks tied to the economy: Live updatesStocks rose Thursday as investors bought the dip in Nvidia shares that followed its earnings Wednesday night. Read more at: https://www.cnbc.com/2024/11/20/stock-market-today-live-updates.html |

|

Trump AG pick Matt Gaetz says he’s withdrawingMatt Gaetz said he is withdrawing his name from consideration as President-elect Donald Trump’s pick for U.S. attorney general. Read more at: https://www.cnbc.com/2024/11/21/trump-ag-pick-matt-gaetz-says-hes-withdrawing.html |

|

Bluesky CEO Jay Graber says X rival is ‘billionaire proof’Bluesky CEO Jay Graber told CNBC that the social media app’s open design could thwart potential acquisition efforts. Read more at: https://www.cnbc.com/2024/11/21/bluesky-ceo-jay-graber-says-x-rival-is-billionaire-proof.html |

|

Citadel’s Ken Griffin says Trump’s tariffs could lead to crony capitalism“I am gravely concerned that the rise of tariffs puts us on a slippery slope towards crony capitalism,” the billionaire investor said. Read more at: https://www.cnbc.com/2024/11/21/citadels-ken-griffin-says-trumps-tariffs-could-lead-to-crony-capitalism.html |

|

There’s still plenty of ‘meat on the bone’ in municipal bonds, Vanguard portfolio manager saysVanguard launched two new active ETFs focused on tax-free municipal bonds on Thursday. Read more at: https://www.cnbc.com/2024/11/21/plenty-of-meat-on-the-bone-in-muni-bonds-vanguard-portfolio-manager-says.html |

|

SEC Chair Gary Gensler will step down Jan. 20, make way for Trump replacementPresident-elect Donald Trump has not announced his pick, but the expectation is that the next chair will be friendlier to Wall Street and cryptocurrencies. Read more at: https://www.cnbc.com/2024/11/21/sec-chair-gensler-will-step-down-jan-20-making-way-for-trump-replacement.html |

|

Alphabet shares slide 6% following DOJ push for Google to divest ChromeAlphabet shares fell Thursday following news that the Department of Justice is proposing Google divest its Chrome browser to end its search monopoly. Read more at: https://www.cnbc.com/2024/11/21/alphabet-shares-slide-6percent-following-doj-push-for-google-to-divest-chrome.html |

|

CNBC’s Inside India newsletter: Gautam Adani’s U.S. fraud charges could have wider repercussions for IndiaU.S. prosecutors allege that Gautam Adani, the second most-wealthy Indian man, personally met with Indian government officials to further their “bribery scheme.” Read more at: https://www.cnbc.com/2024/11/21/cnbcs-inside-india-newsletter-gautam-adanis-us-fraud-charges-could-have-wider-repercussions-for-india.html |

|

Snowflake rockets 32%, its best day ever, after earnings beatSnowflake reported better-than-expected results on the top and bottom lines. Read more at: https://www.cnbc.com/2024/11/20/snowflake-shares-pop-14percent-on-earnings-and-revenue-beat.html |

|

Nvidia shares fluctuate as investors digest third-quarter earningsDespite nearly doubling sales year on year, Nvidia’s third-quarter results show a slowdown from previous quarters. Read more at: https://www.cnbc.com/2024/11/21/nvidia-nvda-stock-slumps-despite-q3-earnings-beat.html |

|

Rep. Marjorie Taylor Greene tapped to work with Elon Musk and Vivek Ramaswamy as new DOGE subcommittee chairGreene’s group will share the DOGE acronym with the entity commissioned by President-elect Donald Trump and led by billionaires Elon Musk and Vivek Ramaswamy. Read more at: https://www.cnbc.com/2024/11/21/marjorie-taylor-greene-elon-musk-ramaswamy-doge.html |

|

Trump and Fed Chair Powell could be set on a collision course over interest ratesThough Powell became Fed chair in 2018, after Trump nominated him for the position, the two clashed often about the direction of interest rates. Read more at: https://www.cnbc.com/2024/11/21/trump-and-fed-chair-powell-could-be-set-on-a-collision-course-over-rates.html |

|

Americans say this is the No. 1 threat to their retirement savings—here are 2 ways to prepareHere’s what Americans say poses the biggest threat to their retirement income and two ways to plan for it, according to a retirement expert. Read more at: https://www.cnbc.com/2024/11/21/how-to-boost-your-retirement-income-according-to-expert.html |

|

Gensler Announces He Is Stepping Down As SEC Chair On Day Bitcoin Hits All Time HighThe most corrupt and incompetent – not to mention most hacked – SEC chair in history, Gary Gensler, is finally out. Gensler, whose departure we previewed last week, announced his plan to step down as chair of the US Securities and Exchange Commission on January 20, when Donald Trump is set to be sworn in as president.

Officially, Gensler’s five-year term on the commission does not run out until 2026, but it has become customary for SEC chairs, and especially corrupt and incompetent ones who follow the rules of their political masters, to move on as when the presidency changes hands. “It has been an honor of a lifetime to serve w/ them on behalf of everyday Americans & ensure that our capital mkts remain … Read more at: https://www.zerohedge.com/markets/gensler-announces-he-stepping-down-sec-chair-day-bitcoin-hits-all-time-high |

|

US Bitcoin ETF Assets Break Above $100 BillionAuthored by Alex O’Donnell via CoinTelegraph.com, Bitcoin exchange-traded funds now collectively manage approximately $104 billion, and are on track to surpass gold ETFs in net assets.

United States Bitcoin (BTC) exchange-traded funds (ETFs) broke $100 billion in net assets for the first time on Nov. 21, according to data from Bloomberg Intelligence. Bitcoin has dominated the ETF landscape since spot BTC ETFs launched in January. Investor interest accelerated after crypto-friendly President-elect Donald Trump prevailed on Nov. 5 in the US elections. Read more at: https://www.zerohedge.com/crypto/us-bitcoin-etf-assets-break-above-100-billion |

|

As Biden Escalates, Half Of Ukrainians Want Negotiated End To War – ASAPWith the Russian army relentlessly seizing more territory while mounting casualties, power outages, and aggressive conscription tactics make life miserable for everyone, half of Ukrainians have had enough: They now want their government to pursue a deal that ends the war as soon as possible. According to the latest Gallup polls, 52% of Ukrainians agreed with the statement “Ukraine should seek to negotiate an ending to the war as soon as possible.” That’s substantially more than the 38% who said the country should “continue fighting until it wins the war.” These are huge shifts in sentiment from polls taken in 2022. Then, 73% of Ukrainians were gung-ho about fighting to victory, while only 22% were eager for a speedy, negotiated end to the conflict. Read more at: https://www.zerohedge.com/geopolitical/biden-escalates-half-ukrainians-want-negotiated-end-war-asap |

|

The Officer Who Killed Ashli Babbitt Had Long History Of Disciplinary & Training Problems; ReportAuthored by Jonathan Turley, I have previously written about the dubious investigations of the shooting of Ashli Babbitt on Jan. 6th and the alleged violation of the standards for the use of lethal force by the officer who shot her. I strongly disagreed with the findings of investigations by the Capitol Police and the Justice Department in clearing Captain Michael Byrd, who shot the unarmed protester. Now, Just the News has an alarming report of the record of Byrd that only magnifies these concerns. Read more at: https://www.zerohedge.com/political/officer-who-killed-ashli-babbitt-had-long-history-disciplinary-training-problems-report |

|

Gary Gensler to leave role as SEC chairmanDonald Trump revealed plans to sack Mr Gensler on “day one” of his new administration. Read more at: https://www.bbc.com/news/articles/c20nyxperjpo |

|

Leasehold reforms set out amid concerns over delaysCampaigners say the overhaul is welcome but will not come fast enough to help existing leaseholds. Read more at: https://www.bbc.com/news/articles/c0k8y5k77gdo |

|

Public sector pay deals help drive up UK borrowingBorrowing was £17.4bn last month, the second highest October figure since monthly records began in 1993. Read more at: https://www.bbc.com/news/articles/c4gx70djyg7o |

|

Enviro Infra Engineers offers exposure to country’s high-potential water management sectorEnviro Infra Engineers plans to raise Rs 650 crore through an IPO. The funds will be used for project funding, debt repayment, and working capital. The company has a strong order book and in-house capabilities. While it has negative OCF, this is expected to improve with project execution. The government’s focus on water infrastructure provides a positive outlook for the company. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/enviro-infra-engineers-offers-exposure-to-countrys-high-potential-water-management-sector/articleshow/115533784.cms |

|

Ahead of IPO, Enviro Infra Engineers mobilises Rs 195 cr from anchor investorsEnviro Infra Engineers, which is involved in the development of turnkey projects of sewage treatment plants and sewerage system, on Thursday collected around Rs 195 crore from anchor investors, a day before its initial share sale opening for public subscription. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/ahead-of-ipo-enviro-infra-engineers-mobilises-rs-195-cr-from-anchor-investors/articleshow/115533682.cms |

|

Tech view: Nifty weakens but holds key support, relief rally possible above 23,200. How to trade tomorrowNifty opened flat but closed lower on Thursday. The volatility index India VIX surged. The index formed a red candle on the daily chart, indicating weakness. The 50-weekly SMA at 23,300 is a key support level. A short-term relief rally is possible if the index holds above 23,200. The highest OI on the call side is at 23,350 and 23,400, while on the put side, it’s at 23,350 and 23,300. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-index-weakens-but-holds-key-support-relief-rally-possible-above-23200-how-to-trade-tomorrow/articleshow/115529519.cms |

|

Are traders setting the stage for another bruising unwind of the yen carry trade?Futures traders are piling back into bets against the Japanese yen. That’s making one longtime market watcher nervous that investors could see a repeat of the vicious unwind of the yen carry trade that rattled global markets on Aug. 5. Read more at: https://www.marketwatch.com/story/are-traders-setting-the-stage-for-another-bruising-unwind-of-the-yen-carry-trade-8b8fc73a?mod=mw_rss_topstories |

|

Here’s how much money sports gamblers are betting every month — and their favorite sports to wager onA detailed look at sports gambling numbers, six years after it was legalized Read more at: https://www.marketwatch.com/story/heres-how-much-money-sports-gamblers-are-betting-every-month-and-their-favorite-sports-to-wager-on-e71da13e?mod=mw_rss_topstories |

|

Gary Gensler to step down as SEC chair, in a move that has crypto bulls ‘glad’Crypto bulls have been cheering after U.S. Securities and Exchange Commission Chair Gary Gensler announced he will leave his post on Jan. 20, exiting the Wall Street watchdog as President-elect Donald Trump is inaugurated. Read more at: https://www.marketwatch.com/story/gary-gensler-to-step-down-as-sec-chair-as-bitcoin-surges-toward-100k-64e6289a?mod=mw_rss_topstories |