Summary Of the Markets Today:

- The Dow closed up 260 points or 0.59%, (Closed at 43,989, New Historic high 44,157)

- Nasdaq closed up 17 points or 0.09%, (Closed at 19,287, New Historic high 19,319)

- S&P 500 closed up 22 points or 0.38%, (Closed at 5,973, New Historic high 6,012)

- Gold $2,694 down $11.80 or 0.43%,

- WTI crude oil settled at $70 down $1.89 or 2.61%,

- 10-year U.S. Treasury 4.304 down 0.039 points or 0.898%,

- USD index $104.35 up $0.43 or 0417%,

- Bitcoin $76,740 up $40 or 0.06%, (24 Hours) , (New Bitcoin Historic high 77,221)

- Baker Hughes Rig Count: U.S. unchanged at 585 Canada -6 to 207

U.S. Rig Count is unchanged from last week at 585 with oil rigs unchanged at 479, gas rigs unchanged at 102 and miscellaneous rigs unchanged at 4.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The S&P 500 briefly hit 6,000 for the first time, capping its best week of the year to close at a new record. The Dow Jones Industrial Average crossed 44,000 for the first time during the session. The Nasdaq Composite closed near the flatline. The strong weekly performance was driven by optimism following Donald Trump’s White House victory and the Federal Reserve’s latest interest rate cut. Nvidia officially joined the Dow Jones Industrial Average, replacing Intel. Nvidia’s stock rose 2.9% in after-hours trading on the news, while Intel fell 1.8%. Tesla shares soared over 9%, pushing the company’s market capitalization to $1 trillion. Trump Media & Technology Group stock jumped more than 10% after President-elect Trump said he would not sell his shares in the company. The US dollar and Treasury yields gave up some of their post-election gains, tempering the initial “Trump trade” rush. Disappointment over China’s new fiscal stimulus plan put some pressure on Chinese stocks and oil prices. Next week companies providing quarterly results include Live Nation (LYV), Spotify (SPOT), Home Depot (HD) and Hertz (HTZ). On Monday, November 11 the stock market will be open but the bond market closed in observance of Veterans Day.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

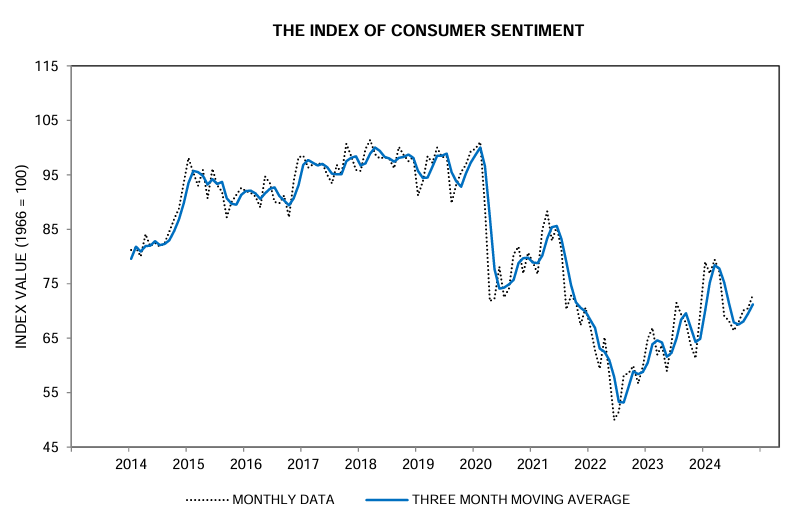

The University of Michigan Preliminary Consumer Sentiment results for November 2024:

Heading into the election, consumer sentiment improved for the fourth consecutive month, rising 3.5% to its highest reading in six months. While current conditions were little changed, the expectations index surged across all dimensions, reaching its highest reading since July 2021. Expectations over personal finances climbed 6% in part due to strengthening income prospects, and short-run business conditions soared 9% in November. Long-run business conditions increased to its most favorable reading in nearly four years. Sentiment is now nearly 50% above its June 2022 trough but remains below pre-pandemic readings. Note that interviews for this release concluded on Monday and thus do not capture any reactions to election results.

[Note: This consumer sentiment survey exemplifies why I dislike surveys – for the most part they are not representative of the population or sector the survey purportedly represents. This survey over the last 3 months attributed the rise in consumer sentiment to Kamala Harris winning the election. I hope in the future, this survey can put on political blinders, and re-examines its methodology to have a more representative sample group. As this is a preliminary survey for September – I expect a significant fall in consumer sentiment if changes are not made to its sample grouping.]

Here is a summary of headlines we are reading today:

- Oil Prices Decline As Hurricane Risk Fades, China Demand Weakens

- U.S. Drilling Activity Still Unmoved Amid Market Uncertainty

- Oil Prices Remain Rangebound Despite Dramatic Week

- Trump Set to Renew Maximum Pressure Policy on Iran

- Dow tops 44,000 for first time, S&P 500 closes at record high to cap election week rally: Live updates

- Tesla hits $1 trillion market cap as stock rallies after Trump win

- Powell and the Fed won’t be able to avoid talking about Trump forever

- The 10-year Treasury yield has been rising. Here’s where BlackRock’s Rick Rieder sees an opportunity

- Stocks making the biggest moves midday: Tesla, Airbnb, Toast, Pinterest and more

- Yields on cash are still ‘well ahead of inflation,’ expert says. Here’s where to put your money now

- The S&P 500 breaks 6,000 and the Dow tops 44,000. Why stocks could keep climbing.

- Oil ends down on the day, up for the week on conflicting supply-demand prospects

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Will Trump’s Win Weaken Western Support for Ukraine?As congratulations poured in from leaders around the world when it became clear that Donald Trump had won the U.S. presidency for the second time, there was no sign of a message from Russian President Vladimir Putin, and his spokesman suggested one might never come. The Kremlin website, where such things are posted, was dominated by an account of Putin’s remote participation in the ceremonial launch of an atomic-powered icebreaker — a symbol of Russia’s role in the Arctic, where it competes for resources with the United States and… Read more at: https://oilprice.com/Geopolitics/International/Will-Trumps-Win-Weaken-Western-Support-for-Ukraine.html |

|

Oil Prices Decline As Hurricane Risk Fades, China Demand WeakensOil prices retreated in Friday’s session as fears of damage to oil and gas infrastructure in the U.S. Gulf by Hurricane Rafael receded. Concerns about weakening demand in China have also contributed to the oil price decline after data showed crude imports in China fell 9% in October. That marked the sixth consecutive month that imports by the world’s largest oil importer declined on a year-over-year basis. Brent crude for January delivery was down 2.7% to trade at $73.76 a barrel at 11.40 am ET while WTI crude for December delivery… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Decline-As-Hurricane-Risk-Fades-China-Demand-Weakens.html |

|

U.S. Drilling Activity Still Unmoved Amid Market UncertaintyThe total number of active drilling rigs for oil and gas in the United States saw no change again this week, according to new data that Baker Hughes published on Friday, after holding steady in the week prior. The total rig count stayed at 585, according to Baker Hughes, down more than 5% from this same time last year. The number of oil rigs stayed the same this week at 479—down by 15 compared to this time last year. The number of gas rigs also stayed the same this week at 102, a loss of 16 active gas rigs from this time last year. Miscellaneous… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Drilling-Activity-Still-Unmoved-Amid-Market-Uncertainty.html |

|

The End of ESG? Experts Predict a Shift in Corporate StrategyWith President Trump once again taking the White House, one investment bank is advising ESG fund managers to “keep their lawyers very close”, as the full scale death of ESG may very well be on the door step, according to Yahoo Finance. Aniket Shah wrote in a note this week: “We’d encourage all ESG fund managers to have a lawyer on the team, or on speed-dial.” He continued: “Antitrust risk remains high for asset managers in ESG; there haven’t been any cases yet, thus there is no legal precedent. Further, legal risks… Read more at: https://oilprice.com/Energy/Energy-General/The-End-of-ESG-Experts-Predict-a-Shift-in-Corporate-Strategy.html |

|

U.S. Apache to Exit UK North Sea Due To Windfall TaxU.S. oil producer Apache plans to cease oil production at its assets in the UK North Sea by 2030, due to the windfall tax on operators. Apache’s parent company APA Corporation said in an SEC filing that its assessment of the impact of the windfall tax, officially known as the Energy Profits Levy (EPL), resulted in findings that continued production in the UK North Sea would be uneconomical. The Labour’s Autumn Statement confirmed last week that the windfall tax on UK North Sea operators is rising to 38% from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Apache-to-Exit-UK-North-Sea-Due-To-Windfall-Tax.html |

|

World’s Largest Oil Traders Seeks Foray into MetalsVitol Group, the world’s largest independent oil trader, is hedging its bets and seeks to expand into metals crucial for the energy transition, including copper, iron ore, and aluminum, CEO Russell Hardy told the Financial Times Commodities Asia Summit in Singapore. “The petroleum, the oil business, we still think it will reach a peak at some point, about 10 years ahead from where we are today,” Hardy said. In view of the expected peak in oil demand and the surge in electrification, Vitol will seek where its edge in metals trading… Read more at: https://oilprice.com/Metals/Commodities/Worlds-Largest-Oil-Traders-Seeks-Foray-into-Metals.html |

|

Iraq’s Parliament to Discuss New Bill on Oil ExportsThe federal Parliament of Iraq is set to discuss next week the new bill on oil exports, a Kurdish MP told Kurdistan24, adding he was optimistic an agreement with all parties, including the Shiite ones, can be reached. The federal government of Iraq and the semi-autonomous region of Kurdistan have been at odds about Kurdistan’s oil exports and revenues for a decade now. Kurdistan’s oil production of about 450,000 barrels per day (bpd) has been shut-in for a year and a half now, after a legal decision in March 2023 and a row on who and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraqs-Parliament-to-Discuss-New-Bill-on-Oil-Exports.html |

|

Oil Prices Remain Rangebound Despite Dramatic WeekDespite a whirlwind news week that saw Donald Trump regain the U.S. presidency and a hurricane hit the Gulf of Mexico, oil prices have been largely rangebound this week.Friday, November 8th, 2024The US presidential election has dominated global newsfeeds this week, triggering widespread speculation on how a new Trump administration would implement its election promises in the first weeks and months of its tenure. Meanwhile, Hurricane Rafael, potentially the last hurricane of this Atlantic season, has temporarily shut down some 400,000 b/d of production… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Remain-Rangebound-Despite-Dramatic-Week.html |

|

Oil Markets Uncertain as Supply Optimism Battles Demand DoubtsOil prices navigated a turbulent terrain this week, caught between bullish supply signals and bearish demand concerns. From the fallout of the U.S. presidential election to shifting OPEC+ strategies and China’s demand struggles, the crude market reflected the clash of forces shaping global energy. Traders faced renewed uncertainty as supply-side factors collided with weakening demand forecasts, creating a push-and-pull that has kept prices volatile. OPEC+ Delays Planned Production Increase OPEC+ provided supportive news for oil prices by… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Uncertain-as-Supply-Optimism-Battles-Demand-Doubts.html |

|

How Will President Trump Use Oil Sanctions?Politics, Geopolitics & Conflict While President-elect Donald Trump is said to have plans to target Iran’s oil exports with tougher sanctions, criticizing the current administration for not enforcing existing sanctions, it will likely have a much larger impact on prices at home because China will retaliate, for one. It would not be necessary to slap new sanctions on Iran; rather simply to more strictly enforce the existing sanctions, which would take nearly 1 million bpd of oil off the market and upset the fragile supply-demand setup… Read more at: https://oilprice.com/Energy/Energy-General/How-Will-President-Trump-Use-Oil-Sanctions.html |

|

A Post-Election Oil Trade Is Taking ShapeSo now we know. The next President of the United States will, for a second time, be Donald Trump. That result has prompted an enormous amount of analysis as to what we can expect from a second Trump term, but for readers here, the most important question is probably what impact the result will have on oil prices, and, more importantly, how to trade any opinion on that that we might have. What many would think was the most predictable, and most obvious trade happened early on Wednesday morning as the final results came in and it became increasingly… Read more at: https://oilprice.com/Energy/Energy-General/A-Post-Election-Oil-Trade-Is-Taking-Shape.html |

|

Will Iraq Be the Next Domino to Fall in the Middle East Conflict?While all attention has been on what many think are pivotal U.S. elections this week, and what that might mean for the Israel-Gaza conflict, Iran and China, Iraq risks falling apart at the seams, and could be the next domino to fall if the Middle East conflict is not handled correctly by all involved external actors. Iraq has unwittingly become a staging ground for attacks on both Israel and Iran. And the Iraqi Kurds, who have all but lost their battle for independent oil, will be called upon once again to deploy their impressive Peshmerga… Read more at: https://oilprice.com/Energy/Energy-General/Will-Iraq-Be-the-Next-Domino-to-Fall-in-the-Middle-East-Conflict.html |

|

Trump Set to Renew Maximum Pressure Policy on IranDonald Trump plans to renew the so-called ‘maximum pressure’ campaign against Iran, to further isolate Tehran and hamper its ability to support its proxies in the Middle East, The Wall Street Journal reported, quoting sources briefed on the president-elect’s early plans. During his first term in office, Trump tore up the so-called Iran nuclear agreement, formally known as the Joint Comprehensive Plan of Action (JCPOA), and re-imposed sanctions on Iran’s oil industry and exports. President Joe Biden and his Administration,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Set-to-Renew-Maximum-Pressure-Policy-on-Iran.html |

|

The World’s Largest Oil Producer Slips Into a Net Debt Position1. Saudi Aramco Debt Becomes New Reality as Revenues Dip – Saudi Aramco reported a free cash flow of $21.99 billion in Q3 2024, suggesting that the world’s largest oil producer may have been pushed into a net debt position for the first time in two years. – Even though Saudi Aramco’s net income fell by 15% year-over-year to $27.6 billion, the state oil firm kept its $31 billion dividends intact as Riyadh uses hard-earned oil income to finance its ambitious diversification drive. – Speculation is rife that OPEC+ could extend its current… Read more at: https://oilprice.com/Energy/Energy-General/The-Worlds-Largest-Oil-Producer-Slips-Into-a-Net-Debt-Position.html |

|

$12-Billion Angola LNG Project Plans Expansion as Gas Supply RisesExpected additional natural gas supplies over the next year have prompted the consortium operating the decade-old Angola LNG project to consider expansion with a new processing unit, company executives have told Reuters. The Angola LNG project was commissioned more than 10 years ago after $12 billion of investments by a large group of companies. This sum is one of the largest ever single investments in the Angolan oil and gas industry. Angola LNG is the result of a partnership between Angola’s state firm Sonangol, Chevron, TotalEnergies,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/12-Billion-Angola-LNG-Project-Plans-Expansion-as-Gas-Supply-Rises.html |

|

Dow tops 44,000 for first time, S&P 500 closes at record high to cap election week rally: Live updatesThe S&P 500, Nasdaq and Dow all set intraday record highs on Friday. Read more at: https://www.cnbc.com/2024/11/07/stock-market-today-live-updates.html |

|

Tesla hits $1 trillion market cap as stock rallies after Trump winShares of Tesla climbed in afternoon trading Friday, pushing the electric vehicle maker’s market cap past $1 trillion. Read more at: https://www.cnbc.com/2024/11/08/tesla-hits-1-trillion-market-cap-as-stock-rallies-after-trump-win.html |

|

Powell and the Fed won’t be able to avoid talking about Trump foreverThe Fed chair dodged question after question at his news conference Thursday about his thoughts on President-elect Donald Trump. Read more at: https://www.cnbc.com/2024/11/08/powell-and-the-fed-wont-able-to-avoid-talking-about-trump-forever.html |

|

Toyota says California-led EV mandates are ‘impossible’ as states fall short of goalCARB’s regulations call for 35% of 2026 model year vehicles, which will begin to be introduced next year, to be zero-emission vehicles (ZEV). Read more at: https://www.cnbc.com/2024/11/08/toyota-california-ev-mandates-impossible.html |

|

The 10-year Treasury yield has been rising. Here’s where BlackRock’s Rick Rieder sees an opportunityYou can find solid yield without having to move into lower quality – and without exposing yourself to too much rate sensitivity. Read more at: https://www.cnbc.com/2024/11/08/blackrocks-rick-rieder-sees-an-opportunity-for-attractive-yield.html |

|

Trump criminal election case paused as special counsel Jack Smith weighs fate of prosecutionPresident-elect Donald Trump is charged in the case by special counsel Jack Smith with crimes related to trying to undo his defeat in the 2020 election. Read more at: https://www.cnbc.com/2024/11/08/special-counsel-jack-smith-seeks-pause-in-trump-criminal-case-to-assess-unprecedented-circumstance.html |

|

Justice Department brings charges in thwarted Iranian plot to assassinate TrumpIran’s government directed three people to “target our citizens, including President-elect Trump,” U.S. Attorney Damian Williams said. Read more at: https://www.cnbc.com/2024/11/08/justice-department-brings-charges-in-thwarted-iranian-plot-to-assassinate-trump.html |

|

Philadelphia Phillies capital raise values the team at around $3 billionThe Philadelphia Phillies recently raised close to $500 million in capital from three new investors, according to two people familiar with the deal. Read more at: https://www.cnbc.com/2024/11/08/philadelphia-phillies-raise-capital-valuation.html |

|

Stocks making the biggest moves midday: Tesla, Airbnb, Toast, Pinterest and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2024/11/08/stocks-making-the-biggest-moves-midday-tsla-abnb-tost-pins.html |

|

Universal Music Group will move to U.S. exchange in 2025, Ackman saysAntisemitic violence in Amsterdam following a soccer match prompted Bill Ackman’s decision to move his publicly traded company and UMG out of the Netherlands. Read more at: https://www.cnbc.com/2024/11/08/ackman-seeks-us-listing-for-universal-music-group-in-2025.html |

|

What Trump’s win could mean for student loan forgivenessThe Biden administration’s work to cancel student loan debt for tens of millions of Americans will likely come to an end with the election of Donald Trump. Read more at: https://www.cnbc.com/2024/11/07/student-loan-forgiveness-trump-win.html |

|

Yields on cash are still ‘well ahead of inflation,’ expert says. Here’s where to put your money nowEven with a new interest rate cut announced by the Federal Reserve, experts say investors can still expect competitive returns on cash. Read more at: https://www.cnbc.com/2024/11/08/yields-on-cash-well-ahead-of-inflation-expert-says-how-to-invest-now.html |

|

Here’s why ETFs often have lower fees than mutual fundsFees are one of the few things people can control relative to investing. Read more at: https://www.cnbc.com/2024/11/08/heres-why-etfs-often-have-lower-fees-than-mutual-funds.html |

|

Which Auto Brands Survive The EV Apocalypse?The once-lucrative European auto market is an utter disaster after numerous brands, including Volkswagen, Mercedes, Aston Martin, BMW, and Stellantis, have warned about a downturn and EV programs hemorrhaging cash while China eats their lunch with cheap EVs. Providing more insight into the downturn, Autoblog’s Stephen Fogel penned a note with commentary on each auto brand and his thoughts on whether they will survive the ‘EV Apocaplyse.’

“The path to electrification is a very difficult one, for both legacy automakers and EV startups. The recent plateauing of EV demand has put additional pressure on manufacturers … Read more at: https://www.zerohedge.com/markets/which-auto-brands-survive-ev-apocalypse |

|

Trump Returning To White House With A Bigger MandateAuthored by Ivan Pentchoukov and Janice Hisle via The Epoch Times, President-elect Donald Trump will reclaim the presidency next year with a wide-ranging agenda for America and a significant electoral mandate to implement his plans. Having already won 295 Electoral College votes by the afternoon of Nov. 6, Trump was on track to capture the national popular vote and sweep all seven battleground states. The president-elect was ahead by nearly 4.7 million votes in the national vote as of 11:16 p.m. on Nov. 6 – a 3.3 percentage point margin. He is on track to best his own national totals from 2016 and 2020, having made significant gains in broad swaths of the country, notably in safe blue states, including New Jersey, Illinois, Minnesota, New Hampshire, and Maine. Vice President Kamala Harris, Trump’s Democratic opponent, conceded the election in a speech in Washington on the afternoon of Nov. 6. A spokesman for the Trump campaign said Harris called Trump to congratulate him earlier in the day and that “both leaders agreed on the importance of unifying the country.” Trump’s commanding performance was buttressed by that of the Republican Party, which recaptured the U.S. Senate and was well on its way to winning the House of Representatives. As … Read more at: https://www.zerohedge.com/political/trump-returning-white-house-bigger-mandate |

|

Judge Strikes Down Federal Rule Protecting Illegal Immigrants Married To US CitizensAuthored by Caden Pearson via The Epoch Times, A Texas federal judge on Thursday struck down a Department of Homeland Security’s (DHS) rule that allows illegal immigrant spouses of U.S. citizens to apply for residency.

The ruling sets aside a “parole in place” process announced in August that would have meant the illegal immigrant spouses of U.S. citizens could apply for legal status and temporarily remain in the United States. If approved, they could then pursue a green card and, eventually, U.S. citizenship, if they met certain eligibility criteria. The criteria included having lived in the United States continuously for at least 10 years, having no disqualifying criminal history, and being married to a U.S. citizen by June 1 … Read more at: https://www.zerohedge.com/political/judge-strikes-down-federal-rule-protecting-illegal-immigrants-married-us-citizens |

|

Lukashenko Says Trump Will Deserve Nobel Prize If He Ends Ukraine WarBelarusian President Alexander Lukashenko has issued a formal congratulations to Donald Trump for his victory in the US presidential election, following some rare positive remarks also made by Russia’s Vladmir Putin. Lukashenko signaled his support and openness to seeking the end of the Ukraine war by favorable negotiated settlement. “If he [ends the war], we’ll petition for the Nobel Prize. He’ll be rewarded for doing a good deed,” Lukashenko was quoted as saying in state-run Belta.

But of Trump, the Belarusian strongman described, “They shot him, they pressured him, they wanted to put him in jail, but he bulldozed through.” The backdrop to the remarks wherein Lukashenko hailed Trump was certainly Read more at: https://www.zerohedge.com/geopolitical/lukashenko-says-trump-will-deserve-nobel-prize-if-he-ends-ukraine-war |

|

Watchdog to review police handling of Al Fayed abuse claimsThe Independent Office for Police Conduct will review two cases the Met Police investigated. Read more at: https://www.bbc.com/news/articles/cr5mrp9g2n0o |

|

Trump tariffs could cost UK £22bn of exportsThe UK could face a £22bn hit to its exports if Donald Trump carries out his tariff threats, researchers say. Read more at: https://www.bbc.com/news/articles/cz9x32eeegko |

|

Bolt drivers win right to holiday and minimum wageThousands of drivers on ride-hailing and food delivery app Bolt have won a legal claim to be classed as workers. Read more at: https://www.bbc.com/news/articles/c7047kz0vr0o |

|

PFC Q2 Results: Profit rises nearly 9% to Rs 7,215 crState-owned Power Finance Corporation (PFC) on Friday posted nearly 9 per cent rise in consolidated net profit at Rs 7,214.90 crore for September quarter mainly on the back of higher revenues. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/pfc-q2-results-profit-rises-nearly-9-to-rs-7215-cr/articleshow/115085082.cms |

|

Crypto’s $135 million campaign undefeated in 48 races so farThe cryptocurrency industry spent $135 million in the 2024 election cycle, backing over 50 candidates, all of whom won. The industry’s biggest bet was in Ohio, where it helped Republican Bernie Moreno defeat Democrat Sherrod Brown, signaling anti-crypto risks. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/cryptos-135-million-campaign-undefeated-in-48-races-so-far/articleshow/115090056.cms |

|

Welspun Corp Q2 Results: Profit falls 27% to Rs 283 cr; board approves over Rs 2,000 cr investmentsWelspun Corp on Friday reported around 27 per cent fall in consolidated net profit at Rs 282.96 crore for September quarter, mainly on account of fall in income. It had posted Rs 386.57 crore net profit for July-September 2023, the company said in an exchange filing. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/welspun-corp-q2-results-profit-falls-27-to-rs-283-cr-board-approves-over-rs-2000-cr-investments/articleshow/115087275.cms |

|

Treasury volatility gauge plunges as bond traders navigate election, the FedYields on U.S. government debt finished mixed on Friday amid lower volatility as traders absorbed the election of Donald Trump as U.S. president and the Federal Reserve’s 25-basis-point interest-rate cut. Read more at: https://www.marketwatch.com/story/treasury-volatility-gauge-plunges-after-market-navigates-election-and-fed-38bb3d93?mod=mw_rss_topstories |

|

The S&P 500 breaks 6,000 and the Dow tops 44,000. Why stocks could keep climbing.The S&P 500 on Friday was trading above 6,000 for the first time in history, while the Dow Jones Industrial Average was soaring above 44,000 after Donald Trump’s election and the Federal Reserve’s interest-rate cut lifted the large-cap benchmark index to a fresh record. Read more at: https://www.marketwatch.com/story/the-s-p-500-breaks-above-6-000-for-the-first-time-why-u-s-stocks-may-have-more-upside-ahead-96a06d09?mod=mw_rss_topstories |

|

Oil ends down on the day, up for the week on conflicting supply-demand prospectsOil futures finished lower on Friday, with China’s latest round of stimulus measures failing to lift expectations for energy demand in the face of President-elect Donald Trump’s support for more U.S. oil production. Read more at: https://www.marketwatch.com/story/oil-prices-fall-after-china-stimulus-disappoints-6bc3b1a1?mod=mw_rss_topstories |

Kremlin.ruAmong the more interesting statements was Lukashenko’s observation that “America was ready to elect a Black president, but America is not ready to elect a woman.”

Kremlin.ruAmong the more interesting statements was Lukashenko’s observation that “America was ready to elect a Black president, but America is not ready to elect a woman.”