Summary Of the Markets Today:

- The Dow closed down 1 points or 0.00%, (Closed at 43,729, New Historic high 43,823)

- Nasdaq closed up 286 points or 1.51%, (Closed at 19,269, New Historic high 19,302)

- S&P 500 closed up 44 points or 0.74%, (Closed at 5,973, New Historic high 5,984)

- Gold $2,712 up $36.30 or 1.33%,

- WTI crude oil settled at $72 up $0.30 or 0.43%,

- 10-year U.S. Treasury 4.332 down 0.094 points or 2.079%,

- USD index $104.35 down $0.74 or 0.07%,

- Bitcoin $76,510 up $390 or 0.51%, (24 Hours) , – New Bitcoin Historic high 76,874.36)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The S&P 500 and Nasdaq Composite reached new record highs on Thursday, driven by a tech-led rally. This came as investors processed two major events – Federal Reserve interest rate cut and Donald Trump’s election victory: Trump’s win on Wednesday had already sent stock indices to record levels, with his proposed corporate tax cuts and deregulation fueling economic optimism. Nvidia and Amazon shares reached new all-time highs The Magnificent Seven stocks (Apple, Alphabet, Microsoft, Amazon, Meta, Tesla, and Nvidia) outperformed the broader market, with their ETF rising over 8% in the past five days compared to the S&P 500’s 4.69% gain. Fed Chair Jerome Powell addressed questions about the potential impact of Trump’s election on Fed policy, stating that in the near term, the election would not affect their decisions.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

September 2024 sales of merchant wholesalers were down 0.4 percent (±0.9 percent)* from the revised September 2023 level. Total inventories of merchant wholesalers were up 0.3% from the revised September 2023 level. The September inventories/sales ratio for merchant wholesalers was 1.34. The September 2023 ratio was 1.33. Honestly, I am not sure why I consider this a significant release anymore. We need more wholesalers because companies have become only assemblers – and need to outsource more and more components. Combine this with more and more assemblers moving overseas – and this chaos makes understanding WTF is going on close to impossible.

In the week ending November 2, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 227,250, a decrease of 9,750 from the previous week’s revised average. The previous week’s average was revised up by 500 from 236,500 to 237,000. No sign of recession in these numbers.

Nonfarm business productivity is up 2.0% year-over-year with costs up 3.4%. When costs rise faster than productivity, you are becoming less competitive. And honestly, the way productivity is calculated by the BLS is incorrect anyway. It takes a detailed analysis of each persons motion in a company and not a broad brush analysis of hours to produce a product.

The Federal Reserve’s FOMC meeting concluded today with the expected 0.25 point reduction of the federal funds rate. The meeting statement:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4-1/2 to 4-3/4 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Here is a summary of headlines we are reading today:

- Duke Energy’s Hurricane Restoration Costs Could Hit $2.9 Billion

- 17 Gulf Oil Platforms Evacuated Under Approach of Hurricane Rafael

- Bank of England Cuts Interest Rates

- Weaker U.S. Fracking Drags Halliburton Earnings Below Estimates

- Big Oil CEOs Voice Concern Over Geopolitical Tensions

- Fed meeting recap: Powell ‘feeling good’ about economy, says Trump can’t legally fire him

- S&P 500, Nasdaq close at records and extend postelection rally as Fed cuts rates: Live updates

- Airbnb stock up as revenue jumps

- Rivian significantly misses Wall Street’s third-quarter revenue expectations

- Former Treasury Secretary Mnuchin says Trump’s top priorities will be tax cuts, Iran sanctions and tariffs

- The Federal Reserve cuts interest rates by a quarter point after election. Here’s what that means for you

- Interest rates cut but Bank hints fewer falls to come

- The bull market is ‘still an infant’: Why Evercore sees the S&P 500 at 6,600 by mid-2025

- Powell sends one crystal clear message to Trump: Firing me is ‘not permitted under the law’

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Azerbaijan Accused of Exploiting COP29 for Political GainFeeling excluded from directly participating in the upcoming COP29 climate conference starting November 11 inBaku, Armenian environmental organizations have issued a statement urging participants to speak up about Azerbaijan’s rights and environmental protection records. The statement, issued by the Yerevan-based non-governmental organization Ecolur and signed by over 50 other Armenian entities, accuses the Azerbaijani government of using COP29 to craft a “greenwashing” narrative designed to obscure rights abuses and conceal alleged… Read more at: https://oilprice.com/Energy/Energy-General/Azerbaijan-Accused-of-Exploiting-COP29-for-Political-Gain.html |

|

New UK Sanctions Target Russia’s Supply Chain and Global InfluenceBritain on November 7 announced its largest package of Russia sanctions in one year and a half, slapping punitive measures on 56 people and entities linked to Moscow’s war machine, including mercenary groups active in Africa and an individual accused of involvement in a 2018 Novichok attack. The announcement comes as British Prime Minister Keir Starmer is preparing to discuss moves to counter Russian malign activities in Europe with other European leaders at a summit in Budapest on November 7 and reaffirm London’s ironclad support for Ukraine,… Read more at: https://oilprice.com/Energy/Energy-General/New-UK-Sanctions-Target-Russias-Supply-Chain-and-Global-Influence.html |

|

Duke Energy’s Hurricane Restoration Costs Could Hit $2.9 BillionNorth Carolina giant electric utility, Duke Energy Corp. (NYSE:DUK), has provided estimates that the total cost to restore facilities damaged by Hurricanes Debby, Milton and Helene could fall in the range of $2.4 billion to $2.9 billion. According to CEO Lynn Good, tens of thousands of the company’s customers were left without power after Helene ripped away transmission lines and power poles, but the company managed to restore 5.5 million outages during the “historic storm season”. Duke Energy made the announcement during the company’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Duke-Energys-Hurricane-Restoration-Costs-Could-Hit-29-Billion.html |

|

17 Gulf Oil Platforms Evacuated Under Approach of Hurricane RafaelBased on data from offshore operator reports submitted to the Bureau of Safety and Environmental Enforcement (BSEE) 11:30 a.m. CDT on Thursday, 17 Gulf of Mexico platforms have been evacuated, or nearly 5% of the 371 platforms in the region. “Personnel have been evacuated from one non-dynamically positioned (DP) rig, equivalent to 16.6% of the six rigs of this type currently operating in the Gulf. Rigs can include several types of offshore drilling facilities including jackup rigs, platform rigs, all submersibles, and moored semisubmersibles,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/17-Gulf-Oil-Platforms-Evacuated-Under-Approach-of-Hurricane-Rafael.html |

|

How Natural Gas is Enabling the Renewable Energy BoomAuthored by Robin Gaster via RealClearEnergy, Solar and wind are rolling out rapidly in the U.S. They account for about 19 percent of energy generation today, and could reach more than 40% by 2030. This clean energy will rapidly replace coal, and many expect it will simply replace natural gas as well. But that’s a mistake: In fact, solar and wind will depend on gas for decades to come. Today, solar and wind are relatively low cost, and prices will likely fall further. But they are not like fossil fuels—they are what’s known as… Read more at: https://oilprice.com/Energy/Energy-General/How-Natural-Gas-is-Enabling-the-Renewable-Energy-Boom.html |

|

India Coal Giant Reliance Power Challenges Clean Energy Bidding BanIndia’s Reliance Power, a subsidiary of the Reliance Group, has announced that it will legally challenge a three-year ban by state-owned Solar Energy Corporation of India Limited (SECI) from participating in its clean energy project tenders. According to SECI, Reliance Power, a coal power generator, was banned after its endorsement of a bank guarantee was found to be fake. However, Reliance Power has defended itself by saying it’s simply a victim of fraud. “The Company and its subsidiaries acted bonafidely and have been a victim of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Coal-Giant-Reliance-Power-Challenges-Clean-Energy-Bidding-Ban.html |

|

What Trump’s Re-election Means for Global TradeTrump will claim that tariffs can stop China ripping off Americans and bring jobs back home, but in reality they will only make his country poorer, says Harrison Griffiths Well, he’s done it again. Donald Trump is set to return to the White House after pulling off a now-characteristic upset in last night’s presidential election. As the triumphant drumbeats of his supporters and shellshocked meltdowns of his opponents begin to mellow over the next week or so, the real work begins to understand what the policy outlook of Trump’s… Read more at: https://oilprice.com/Finance/the-Economy/What-Trumps-Re-election-Means-for-Global-Trade.html |

|

Angola Plans New Multi-Year Auction To Boost Oil ProductionAs Angola is looking to increase its production and attract more investments, the African oil producer plans to launch additional multi-year oil and gas licensing rounds from 2026, an official at the country’s regulator told Reuters on Thursday. Angola has already offered 50 onshore and offshore blocks for exploration as part of the 2019-2025 multi-year bid rounds. Now it is working on additional multi-year licensing rounds for 2026 and beyond. “We have already started to work on a plan for after 2025 and are currently executing our… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Angola-Plans-New-Multi-Year-Auction-To-Boost-Oil-Production.html |

|

Bank of England Cuts Interest RatesThe Bank of England has cut interest rates by 25 basis points but signalled that it would take a “gradual” approach to further rate cuts as the impact of the Budget filters through the economy. Eight members of the Bank’s Monetary Policy Committee (MPC) voted to cut rates for the second time this year, with only Catherine Mann dissenting. It means that the benchmark Bank Rate stands at 4.75 per cent, down from a peak of 5.25 per cent. The Bank cut interest rates for the first time since the pandemic back in August. … Read more at: https://oilprice.com/Energy/Energy-General/Bank-of-England-Cuts-Interest-Rates.html |

|

Weaker U.S. Fracking Drags Halliburton Earnings Below EstimatesHalliburton Company (NYSE: HAL) missed analyst estimates for its third-quarter earnings as weaker North American revenues combined with the impact of an August cyberattack and hurricanes in the U.S. Gulf of Mexico dragged profits down. Halliburton, one of the world’s top three oilfield services providers and leader in the U.S. fracking services market, reported on Thursday adjusted net income per share of $0.73, below the analyst consensus estimate of $0.75. “We experienced a $0.02 per share impact to our adjusted earnings from lost… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Weaker-US-Fracking-Drags-Halliburton-Earnings-Below-Estimates.html |

|

Saudi Arabia Bets $10B on Green HydrogenSaudi Arabia is reportedly preparing to unleash $10 billion in investments to gain exposure to one of the more debatable aspects of the energy transition: green hydrogen. The news comes amid a slew of green hydrogen project cancelations and revisions. Bloomberg reported recently that Saudi Arabia’s Public Investment Fund will be pouring at least $10 billion into green hydrogen, with a view to expanding the amount depending on demand, according to unnamed sources. Speaking of demand, another Middle Eastern green hydrogen hopeful, Emirati Masdar,… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabia-Bets-10B-on-Green-Hydrogen.html |

|

Largest UK North Sea Oil Producer Raises Output GuidanceHarbour Energy, the largest oil producer in the UK North Sea, lifted on Thursday its full-year production guidance for 2024 to reflect the contribution of the upstream assets of Wintershall Dea, which it acquired earlier this year. In early September, Harbour Energy completed the acquisition of the Wintershall Dea asset portfolio, comprising substantially all of Wintershall Dea AG’s upstream assets, in a deal worth $11 billion. At the time, Harbour Energy guided for 2024 production of between 250,000 barrels of oil equivalent per day (boepd)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Largest-UK-North-Sea-Oil-Producer-Raises-Output-Guidance.html |

|

Big Oil CEOs Voice Concern Over Geopolitical TensionsWhen it comes to the price of oil, geopolitical volatility is usually a tailwind. However, when it comes to what big oil CEOs worry about the most, these conflicts – including the ongoing ones in the Middle East – are top of the list, according to a new report from Bloomberg. Oil executives are meeting at the region’s largest energy conference amid high market volatility, the report says. Rising tensions between Israel and Iran, an OPEC member, have traders wary of possible supply disruptions, while China’s weak economy is slowing oil… Read more at: https://oilprice.com/Energy/Crude-Oil/Big-Oil-CEOs-Voice-Concern-Over-Geopolitical-Tensions.html |

|

Turbine Maker Nordex Sees ‘Large Enough’ U.S. Onshore Wind Market Despite TrumpDespite Donald Trump’s victory in the U.S. presidential election, America’s onshore wind will remain a key and “large enough” market, according to Germany-based wind turbine manufacturer Nordex. “We expect the fundamental growth drivers for onshore wind to remain intact over the long term as current developments, such as the boom in artificial intelligence, are expected to further increase demand for energy,” Nordex told Reuters when asked to comment on the U.S. election result. To date, Nordex has installed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Turbine-Maker-Nordex-Sees-Large-Enough-US-Onshore-Wind-Market-Despite-Trump.html |

|

Italy Urges EU to Revise Plans for Gasoline Car Ban in 2035One of Europe’s biggest economies and car markets, Italy, has renewed its push to seek a revision of the European Union’s plans to ban the sales of new combustion-engine cars from 2035, a draft document seen by Bloomberg showed on Thursday. Italy and the Czech Republic have teamed up to call on EU officials to reconsider the timeline of a review of the regulation to 2025 instead of 2026. The two EU member states are also calling on the EU to recognize a “broader array” of solutions apart from battery electric vehicles (BEVs)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Italy-Urges-EU-to-Revise-Plans-for-Gasoline-Car-Ban-in-2035.html |

|

Fed meeting recap: Powell ‘feeling good’ about economy, says Trump can’t legally fire himThe Federal Reserve cut interest rates by a quarter point at the conclusion of its two-day November meeting. Read more at: https://www.cnbc.com/2024/11/07/fed-meeting-live-updates-traders-anticipate-november-rate-cut.html |

|

Powell says he would not resign as Fed chief if Trump asked for his resignationWhen asked whether he would resign if asked by Trump, the Fed chair simply said: “No.” Read more at: https://www.cnbc.com/2024/11/07/powell-trump.html |

|

DoubleLine’s Gundlach says expect higher rates if Republicans also win the HouseDoubleLine ‘s Jeffrey Gundlach said interest rates could shoot higher if the Republicans ends up controlling the House and securing a governing trifecta. Read more at: https://www.cnbc.com/2024/11/07/doublelines-gundlach-says-expect-higher-rates-if-republicans-also-win-the-house.html |

|

S&P 500, Nasdaq close at records and extend postelection rally as Fed cuts rates: Live updatesStocks gained after a huge market rally following Donald Trump’s decisive victory in the presidential election. Read more at: https://www.cnbc.com/2024/11/06/stock-market-today-live-updates.html |

|

Trump trades: Using the 2016 Trump rally stocks as a playbook for what to buy nowCNBC analyzed what did well after the 2016 presidential election, searching for hints of what could be coming. Read more at: https://www.cnbc.com/2024/11/07/trump-trades-using-2016-trump-rally-as-a-playbook-for-what-to-buy-now.html |

|

Airbnb stock up as revenue jumpsAirbnb reported third-quarter earnings on Thursday that showed revenue up 10% year-over-year. Read more at: https://www.cnbc.com/2024/11/07/airbnb-abnb-q3-earnings-report-2024.html |

|

Lucid slightly tops Wall Street’s third-quarter expectations amid widening lossesThe company’s net loss for the third quarter widened to $992.5 million compared with a loss of $630.9 million a year earlier. Read more at: https://www.cnbc.com/2024/11/07/lucid-lcid-results-q3-2024.html |

|

Rivian significantly misses Wall Street’s third-quarter revenue expectationsRivian Automotive missed Wall Street’s third-quarter expectations, including a massive difference in revenue of $116 million. Read more at: https://www.cnbc.com/2024/11/07/rivian-rivn-earnings-q3-2024.html |

|

What Trump’s win could mean for student loan forgivenessThe Biden administration’s work to cancel student loan debt for tens of millions of Americans will likely come to an end with the election of Donald Trump. Read more at: https://www.cnbc.com/2024/11/07/student-loan-forgiveness-trump-win.html |

|

Former Treasury Secretary Mnuchin says Trump’s top priorities will be tax cuts, Iran sanctions and tariffsTax cuts are ‘a signature part of his program,’ Mnuchin said in a “Squawk Box” interview. Read more at: https://www.cnbc.com/2024/11/07/mnuchin-says-trumps-top-priorities-will-include-tax-cuts-and-tariffs.html |

|

The Federal Reserve cuts interest rates by a quarter point after election. Here’s what that means for youThe second interest rate cut in a row will affect consumer borrowing costs. Here’s what it means for your credit card, mortgage rate, car loan and savings. Read more at: https://www.cnbc.com/2024/11/07/federal-reserve-cuts-rates-after-election-what-that-means-for-you.html |

|

The president’s influence on the U.S. economy may be greatly exaggerated, according to expertsIn a Gallup survey, 99% of voters said the economy was at least somewhat important in influencing their choice for president. Read more at: https://www.cnbc.com/2024/11/07/heres-how-much-control-the-president-has-over-the-us-economy.html |

|

How Trump’s victory could change abortion rights in AmericaTrump could further restrict or effectively ban abortion on the federal level through methods that won’t require Congress to pass new legislation. Read more at: https://www.cnbc.com/2024/11/07/how-trumps-victory-could-change-abortion-rights-in-america.html |

|

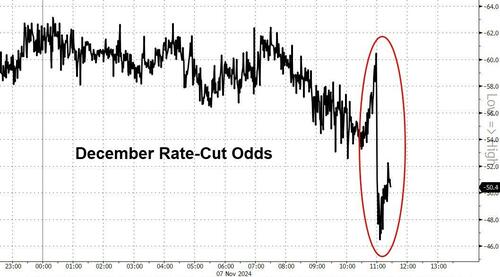

Bitcoin, Bullion, & Big-Tech Bid As ‘Hawkish’ Powell Pushes Bond Yields, Rate-Cut Odds LowerA relatively hawkish Fed statement – removing language that it has “gained greater confidence that inflation is moving sustainable toward 2 percent” – was met with a ‘meh’ response by the market, but once Fed Chair Powell started speaking it was clear that the uber-dovish rate-cut trajectory that so many hoped for was a thing of the past… for now.

Rate-cut expectations for December stumbled notably…

Read more at: https://www.zerohedge.com/market-recaps/bitcoin-bullion-big-tech-bid-hawkish-powell-pushes-bond-yields-rate-cut-odds-lower |

|

“Plan In Motion”: Steve Madden Execs Reveal Major Shift From China Ahead of Trump’s ReturnDuring multiple campaign rallies this past election cycle, President-elect Donald Trump suggested the possibility of a 10% or higher tariff on Chinese goods imported into the United States, which he argued would eliminate the country’s trade deficit. US companies with supply chains heavily exposed to China have taken note of Trump’s victory, and some are already implementing plans to shift manufacturing out of China. On an earnings call on Thursday, Steven Madden executives made it very clear that they understand the changing trade landscape around China and what it means when Trump returns to the White House on Jan. 20.

Execs at the fashion-forward footwear and accessories company noted that heavily exposed supply chains to China would be rerouted out of the world’s second-largest economy – in a move considered ‘friend-shoring.’ During the call, a Ci … Read more at: https://www.zerohedge.com/markets/plan-motion-steven-madden-execs-plan-major-shift-china-ahead-trumps-return |

|

10 Big Losers That Weren’t On The BallotAuthored by Joe Strader via AmericanThinker.com, Yes, the Democrats lost, but it was much bigger than that.

There are other important losses that will impact future elections.

|

|

Polymarket Vindicated After Trump Landslide As France Moves To Ban Betting PlatformThe 2024 election was truly a contest between traditional polling and betting markets; so-called nominative opinion polls cast through betting websites such as Peter Thiel-backed Polymarket. and Kalshi, where decentralized groups of individuals were able to wager on various contests in a hyper-efficient free market (notwithstanding regulators’ best efforts to limit access).

The day before the election, Bloomberg wrote: Election Gambling Markets Face Their Moment of Truth

|

|

US cuts interest rates as Trump election raises uncertaintyDonald Trump’s plans for tax cuts and tariffs raise questions about much further the Fed might cut. Read more at: https://www.bbc.com/news/articles/cn4v7vwgqj0o |

|

Interest rates cut but Bank hints fewer falls to comeInterest rates were cut to 4.75% but the Bank expects inflation to creep higher after last week’s Budget. Read more at: https://www.bbc.com/news/articles/c789n4l2xpgo |

|

Sainsbury’s and M&S warn Budget may push up pricesA number of major firms have warned over the impact of higher National Insurance costs. Read more at: https://www.bbc.com/news/articles/c238g1x9l00o |

|

Tech view: Nifty forms long negative candle, minor dips towards 23,800 expected. How to trade tomorrowAccording to Nagaraj Shetti of HDFC Securities, the short-term market outlook remains uncertain due to ongoing volatility. A substantial upward rally is unlikely until the Nifty crosses the 24,500 mark, with potential support around the 23,800 level on the downside. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-long-negative-candle-minor-dips-towards-23800-expected-how-to-trade-tomorrow/articleshow/115056954.cms |

|

IHCL Q2 Results: Net profit up 226% to Rs 583 crore, revenue up 27%Tata-backed IHCL reported a 226% YoY profit surge to Rs 583 crore for Q2, with revenues up 27.4% to Rs 1826 crore. The company will manage The Claridges, New Delhi from April 2025. H1 revenues grew 16.4%, profit up 103%. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/ihcl-q2-results-net-profit-up-226-to-rs-583-crore-revenue-up-27/articleshow/115058201.cms |

|

NHPC Q2 results: PAT falls 41% YoY to Rs 909 crore, revenue up 4%NHPC Ltd reported a 41% YoY decline in net profit to Rs 909 crore for Q2 FY24, compared to Rs 1546 crore last year. Revenue rose 4% to Rs 3052 crore, while EBITDA grew 2%, with improved margins of 58.9%. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/nhpc-q2-results-pat-falls-41-yoy-to-rs-909-crore-revenue-up-4/articleshow/115058327.cms |

|

Airbnb is seeing ‘strong demand trends’ — with these caveatsAirbnb Inc. on Thursday reported third-quarter sales and other demand metrics that were above Wall Street’s estimates, and the lodging platform said it was “seeing strong demand trends” for the fourth quarter despite a sales outlook that didn’t totally clear analysts’ expectations. Read more at: https://www.marketwatch.com/story/airbnb-is-seeing-strong-demand-trends-with-these-caveats-2bad9f8d?mod=mw_rss_topstories |

|

The bull market is ‘still an infant’: Why Evercore sees the S&P 500 at 6,600 by mid-2025The stock-market rally still has room to run, as Donald Trump’s stunning comeback for the White House and a potential Republican sweep in Congress may propel the S&P 500 to 6,600 by mid-2025, according to Evercore ISI Research. Read more at: https://www.marketwatch.com/story/the-bull-market-is-still-an-infant-why-evercore-sees-the-s-p-500-at-6-600-by-mid-2025-c2e80aeb?mod=mw_rss_topstories |

|

Powell sends one crystal clear message to Trump: Firing me is ‘not permitted under the law’When questioned if he would leave his post if asked by Trump, he answered simply, “No.” Read more at: https://www.marketwatch.com/story/powell-sends-one-crystal-clear-message-to-trump-firing-me-is-not-permitted-under-the-law-1e18d0cf?mod=mw_rss_topstories |