Summary Of the Markets Today:

- The Dow closed up 1,508 points or 3.57%, (Closed at 43,730, New Historic high 43,779)

- Nasdaq closed up 544 points or 2.95%, (Closed at 18,983, New Historic high 19,005)

- S&P 500 closed up 146 points or 2.53%, (Closed at 5,929, New Historic high 5,936)

- Gold $2,669 down $8.10 or 2.94%,

- WTI crude oil settled at $72 up $0.03 or 0.04%,

- 10-year U.S. Treasury 4.441 up 0.153 points or 3.568%,

- USD index $105.12 up $1.70 or 1.64%,

- Bitcoin $75,993 up $7,326 or 9.64%, (24 Hours) , – New Bitcoin Historic high 76,355.00

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks surged to record highs on Wednesday as investors reacted to Donald Trump’s victory in the presidential election over Kamala Harris. The decisive outcome dispelled anxieties about a potentially contested election and days of uncertainty. Key highlights: The Dow Jones Industrial Average jumped closing at a record high. The S&P 500 rose surpassing the 5,900 level for the first time. The Nasdaq Composite climbed also reaching a new record. The so-called “Trump trade” saw significant gains across various sectors: Financial stocks rallied, with the S&P Regional Banking ETF up over 11%. Tesla shares surged more than 14%, likely due to CEO Elon Musk’s support for Trump during the campaign. Bitcoin hit a record high above $75,000 before settling around $73,800. Bond yields also rose sharply, with the 10-year Treasury yield climbing, signaling expectations of higher inflation and interest rates under Trump’s policies. Beyond the presidential race, Republicans gained control of the Senate, though the House of Representatives outcome remains uncertain. Investors are now turning their attention to the Federal Reserve’s rate decision, expected on Thursday afternoon.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

There were no releases today as the USA begins recovering from a brutal election cycle. Food for thought from Statista:

You will find more infographics at Statista

Here is a summary of headlines we are reading today:

- U.S. Sanctions Target Central Asian Firms for Aiding Russia’s War Effort

- Trump’s Victory Signals a Shift in Global Power Dynamics

- Rare Earth Prices Soar as Myanmar’s Mining Operations Halt

- EIA Confirms Inventory Builds Across the Board

- Bitcoin, Treasury Yields Jump as Trump Takes White House

- Dow soars 1,500 points to record high in best day since 2022 after Trump election win: Live updates

- The Fed is expected to cut interest rates again Thursday. Here’s everything you need to know

- Trump promised no taxes on Social Security benefits. It’s too soon to plan on that change, experts say

- Mortgage rates surge higher on Trump victory, causing housing stocks to fall

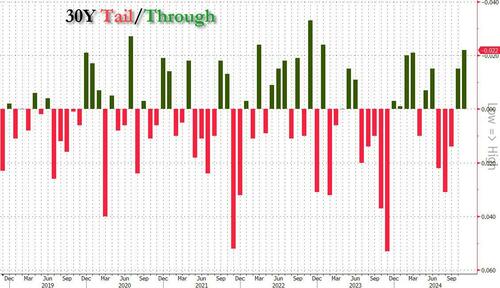

- Yields Slide After Stellar 30Y Auction, But Then Blow Out Again

- Bitcoin at record high above $75,000 is good news for Nifty bulls also. Here’s why

- 30-year bond yield closes with biggest jump since 2022 after Trump wins

- Oil prices end with a modest loss as Trump’s win lifts the dollar

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Sanctions Target Central Asian Firms for Aiding Russia’s War EffortFour entities in Central Asia have been added to the US Treasury Department’s sanctions list, accused of providing machine tools and other dual-use equipment to Russia via China in violation of US rules barring trade that can support the Kremlin’s war effort in Ukraine. The four entities, one from Kazakhstan, one from Kyrgyzstan and two from Uzbekistan, were among 275 businesses and individuals added to the sanctions list at the end of October. A Treasury Department statement outlined what it called the “Ushko Machine Tools… Read more at: https://oilprice.com/Geopolitics/International/US-Sanctions-Target-Central-Asian-Firms-for-Aiding-Russias-War-Effort.html |

|

Rare Bees Halt Zuckerberg’s Nuclear-Powered AI DreamAt an all-hands meeting last week, Mark Zuckerberg reportedly told Meta workers that plans to build an AI data center powered by nuclear energy were scrapped after rare bees were discovered on the proposed site. Meta’s proposed AI data center project with an existing nuclear power plant operator fell apart over environmental and regulatory challenges, according to a Financial Times report, citing two people familiar with the meeting. The people gave no details about which nuclear power plant Meta planned to build an AI data center in an adjacent… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Rare-Bees-Halt-Zuckerbergs-Nuclear-Powered-AI-Dream.html |

|

Trump’s Victory Signals a Shift in Global Power DynamicsEU officials are bracing themselves for Donald Trump’s return to the White House. They are preparing for the possibility of increased tensions in transatlantic trade and the likelihood that the bloc of 27 member states will have to shoulder a bigger burden of political and financial support for Ukraine. Plus there’s the fact that, in the past, Trump has preferred to deal with regional allies, such as Hungarian Prime Minister Viktor Orban, rather than the European Union as a whole. Speaking to EU officials as Trump was projected to win the U.S.… Read more at: https://oilprice.com/Geopolitics/International/Trumps-Victory-Signals-a-Shift-in-Global-Power-Dynamics.html |

|

Mexico’s New Government Presents New Set of Energy PoliciesMexico’s new government has announced that its energy policies include boosting state-owned national power company CFE while also setting rules for private electricity producers, including those generating clean energy. Speaking at a press conference alongside President Claudia Sheinbaum, energy Minister Luz Elena Gonzalez has revealed that private power producers will be able to generate renewable electricity of up to 9.55 gigawatts by 2030, when the president’s term comes to an end. According to Sheinbaum, legislation to implement the plans–including… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mexicos-New-Government-Presents-New-Set-of-Energy-Policies.html |

|

Rare Earth Prices Soar as Myanmar’s Mining Operations HaltVia Metal Miner “People are running around the world looking for rare earth elements.” This one sentence in the South China Morning Post, quoting James Chin, Professor of Asian Studies at the University of Tasmania, sums up the current rare earths situation well. Chin’s comment is even more true following the recent supply disruptions in Myanmar, which caused a rise in the global prices of rare earths. Amid the ongoing civil war in that country, a rebel group managed to take over a leading mining center in mid-October. This has… Read more at: https://oilprice.com/Energy/Energy-General/Rare-Earth-Prices-Soar-as-Myanmars-Mining-Operations-Halt.html |

|

Russia’s Crude Output In October In-line With OPEC+ TargetRussian data show the nation’s crude production in October was nearly in-line with its OPEC+ quota. The country pumped 8.973 million barrels a day of crude last month, up by ~3,000 barrels a day compared with September, and just 5,000 barrels a day above the nation’s quota for the month. Russia is currently implementing two sets of curbs to its crude output: a 500,000 barrel-a-day reduction announced early last year, a s well as a 471,000 barrel-a-day cut it promised in March that will end at the end of the current year. Back in July,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Crude-Output-In-October-In-line-With-OPEC-Target.html |

|

Europe Stocks Up On LNG Ahead of WinterFor the first time in ten months, Europe’s imports of liquefied natural gas rose in October from the previous month as it moved to fill its gas storage sites for the winter in which the transit deal for Russian pipeline gas flows via Ukraine expires. The rare October jump in LNG imports was largely due to buyers stocking up on the fuel at steady prices at the end of the summer, while Asia’s LNG imports slightly fell last month, likely due to lower Chinese purchases, per data from commodity analytics firm Kpler cited by Reuters columnist… Read more at: https://oilprice.com/Energy/Energy-General/Europe-Stocks-Up-On-LNG-Ahead-of-Winter.html |

|

UAE’s ADNOC to Supply Gas to Germany From Its New LNG ProjectAbu Dhabi’s national oil company ADNOC signed on Wednesday a long-term supply agreement for its Ruwais LNG project currently under development and will deliver 1 million tons of the super-chilled fuel to German company SEFE for 15 years. The deal signed today converts the previous Heads of Agreement between ADNOC and German state firm SEFE announced in March into a definitive agreement. The liquefied natural gas that will be delivered to SEFE will primarily be sourced from the Ruwais LNG project, with deliveries expected to start in 2028… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UAEs-ADNOC-to-Supply-Gas-to-Germany-From-Its-New-LNG-Project.html |

|

EIA Confirms Inventory Builds Across the BoardCrude oil prices were under pressure this morning after the U.S. Energy Information Administration reported an inventory build of 2.1 million barrels for the week to November 1. This compared with a modest inventory draw of half a million barrels for the previous week and a crude oil inventory build for the week to November 1 as estimated by the American Petroleum Institute on Tuesday. At the time of writing, Brent crude was trading at $75.07 a barrel, and WTI was trading at $71.70 a barrel, both down from opening, as Republican candidate Donald… Read more at: https://oilprice.com/Energy/Energy-General/EIA-Confirms-Inventory-Builds-Across-the-Board.html |

|

Senegal Set to Ship Its First LNG in Early 2025West African country Senegal is on track to see the first LNG shipment from a major gas and LNG project operated by BP early next year, Senegal’s Deputy Energy Minister Cheikh Niane told Bloomberg on Wednesday. The Greater Tortue Ahmeyim (GTA) continues to be “on track” per the latest timeline, and the first gas extraction is expected this year, Niane told Bloomberg on the sidelines of the ADIPEC energy industry event in Abu Dhabi. The Greater Tortue Ahmeyim LNG export project offshore Mauritania and Senegal is being developed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Senegal-Set-to-Ship-Its-First-LNG-in-Early-2025.html |

|

Bitcoin, Treasury Yields Jump as Trump Takes White HouseUS Treasury yields jumped and Bitcoin surged to a new record as markets reacted to Donald Trump’s victory in the presidential election. Republicans have taken back control of the Senate, while Trump is due to return to the White House after winning the crucial battleground of Pennsylvania. Trump declared victory in a speech in Florida after having earlier won the key swing states of North Carolina and Georgia. The win was officially called by media outlets later in the morning. Walking up to the stage at 2.25am local time to a raucous ovation… Read more at: https://oilprice.com/Finance/the-Markets/Bitcoin-Treasury-Yields-Jump-as-Trump-Takes-White-House.html |

|

Slumping Wind Generation Prompts Emergency in Europe as Power Prices SurgeFalling wind power generation has tightened power markets in Europe this week, with Wednesday electricity prices in Germany hitting their highest since the peak of the energy crisis in 2022. Wind speeds in the UK and Germany have slumped this week in the so-called ‘Dunkelflaute’ period in which there is a lull in wind speeds. This has sent power prices in northwestern European countries surging and nations have had to rely more on fossil fuels such as natural gas to meet demand. The UK saw on Tuesday just 4% of its electricity demand… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Slumping-Wind-Generation-Prompts-Emergency-in-Europe-as-Power-Prices-Surge.html |

|

World’s Top Oil Traders Buy Up Fuel From Africa’s Biggest RefineryThe large commodity trading firms Vitol and Trafigura, as well as supermajor BP, are the biggest and dominant buyers of fuels lifted from the Dangote refinery in Nigeria, Africa’s newest and largest crude processing facility, Bloomberg reported on Wednesday, citing data from Geneva-based oil and gas analytics firm Precise Intelligence. The Dangote refinery began the production of fuels in January 2024, marking the start-up of the plant that has seen years of delays. The plant began to ramp up processing rates in the middle of this… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Worlds-Top-Oil-Traders-Buy-Up-Fuel-From-Africas-Biggest-Refinery.html |

|

Hurricane Rafael Threatens U.S. Gulf of Mexico Oil ProductionTropical storm Rafael has strengthened to hurricane intensity in recent hours and is still set to continue its path toward the U.S. Gulf of Mexico, where oil and gas producers have shut-in production at platforms and evacuated personnel to shore. The late-season hurricane could threaten about 4 million barrels per day (bpd) of oil production in the Gulf of Mexico, according to modeling data by energy analytics provider Earth Science Associates. The current projected path of the hurricane could pass through the Gulf of Mexico on a trajectory that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hurricane-Rafael-Threatens-US-Gulf-of-Mexico-Oil-Production.html |

|

Libya Set to Announce First Oil Bid Round Since 2011Beleaguered North African oil producer Libya is set to announce within months its first oil and gas exploration bid round since the civil war began in 2011, Libyan Oil Minister Khalifa Abdul Sadiq told Bloomberg in an interview. OPEC member Libya plans to offer blocks both onshore and offshore in the tender expected by the end of 2024 or in early 2025, the official told Bloomberg. The blocks up for grabs are located in the Sirte, Murzuq, and Ghadames basins, Sadiq added. Libya’s previous oil and gas exploration tender was held as far back… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libya-Set-to-Announce-First-Oil-Bid-Round-Since-2011.html |

|

Dow soars 1,500 points to record high in best day since 2022 after Trump election win: Live updatesStocks rallied Wednesday, with some major benchmarks hitting record highs, as Donald Trump won the 2024 presidential election. Read more at: https://www.cnbc.com/2024/11/05/stock-market-today-live-updates.html |

|

Election live updates: Harris arrives at Howard University for concession speech, Biden congratulates TrumpDonald Trump won a decisive victory in the U.S. presidential race, defeating Kamala Harris and surprising even his closest allies. Read more at: https://www.cnbc.com/2024/11/06/trump-live-updates-markets-and-world-leaders-react-to-americas-president-elect.html |

|

Trump’s victory spells doom for his criminal cases — but he’s not off the hook for $570 million in civil finesPresident-elect Donald Trump’s election victory means he will likely be able to delay, or end, all the criminal proceedings that have been lodged against him. Read more at: https://www.cnbc.com/2024/11/06/trump-election-criminal-civil-cases-jackp-smith.html |

|

House majority still in play as Republicans eye a red sweepPresident-elect Donald Trump won the presidential race against Vice President Kamala Harris and Republicans flipped Senate control. Read more at: https://www.cnbc.com/2024/11/06/house-control-majority-republicans-red-sweep-democrats.html |

|

The big Trump losers: These stocks could have an overhang for a whileNot every sector is poised to get a lift from Donald Trump’s election. Wall Street weighs in on some of the biggest losers. Read more at: https://www.cnbc.com/2024/11/06/the-big-trump-losers-these-stocks-could-have-an-overhang-for-a-while.html |

|

The Fed is expected to cut interest rates again Thursday. Here’s everything you need to knowMarkets are pricing in a near-certainty that the FOMC will lower its benchmark rate by a quarter percentage point. Read more at: https://www.cnbc.com/2024/11/06/the-fed-is-likely-cutting-rates-again-thursday-everything-you-need-to-know.html |

|

Stellantis to indefinitely lay off 1,100 workers at Jeep plant in OhioAutomaker Stellantis announced plans Wednesday to cut a manufacturing shift and indefinitely lay off roughly 1,100 workers at a Jeep plant in Ohio. Read more at: https://www.cnbc.com/2024/11/06/stellantis-layoff-jeep-ohio.html |

|

Trump promised no taxes on Social Security benefits. It’s too soon to plan on that change, experts sayEven with Trump win and a Republican majority, plans to nix taxes on Social Security benefits may still face hurdles. Read more at: https://www.cnbc.com/2024/11/06/trump-promised-no-taxes-on-social-security-benefits-here-what-experts-say.html |

|

What Trump’s election to the White House could mean for EVsRepublicans, led by Trump, have largely condemned EVs, claiming they are being forced upon consumers and that they will ruin the U.S. auto industry. Read more at: https://www.cnbc.com/2024/11/06/trump-reelection-what-it-means-for-evs.html |

|

Mortgage rates surge higher on Trump victory, causing housing stocks to fallLennar, D.R. Horton and PulteGroup were all down Wednesday. Retailers Home Depot and Lowe’s were also lower. Read more at: https://www.cnbc.com/2024/11/06/mortgage-rates-surge-on-trump-victory-housing-stocks-to-plummet.html |

|

Jeff Bezos, Sam Altman, Tim Cook and other tech leaders congratulate Trump on election winLeaders including Jeff Bezos, Sam Altman and Tim Cook congratulated the president-elect and said they looked forward to working with his administration. Read more at: https://www.cnbc.com/2024/11/06/trump-2024-election-win-tech-ceos-give-their-congratulations.html |

|

Here’s what President-elect Trump’s tariff plan may mean for your walletPresident-elect Donald Trump proposed sweeping new tariffs on the campaign trail that may raise prices for consumers and trigger job loss, economists said. Read more at: https://www.cnbc.com/2024/11/06/here-what-president-elect-trumps-tariff-plan-may-mean-for-your-wallet.html |

|

German Chancellor Olaf Scholz fires Finance Minister Christian Lindner, leaving ruling coalition in disarrayThe three-year-old union between Scholz’s Social Democratic Party (SPD), the Greens and Lindner’s Free Democratic Party (FDP) has been on shaky ground for some time. Read more at: https://www.cnbc.com/2024/11/06/german-chancellor-olaf-scholz-fires-finance-minister-christian-lindner.html |

|

Biden-Harris DoJ Reportedly Winding Down Trump Criminal CasesSpecial Counsel Jack Smith, overseeing two federal cases against former President Donald Trump, has considered a possible pathway to end the cases, according to two sources familiar with the matter who spoke to NBC News. This news from the MSM outlet comes hours after Trump won the US presidential election. Here’s more from NBC News:

The outlet continued:

|

|

Yields Slide After Stellar 30Y Auction, But Then Blow Out AgainWith global markets in chaos in the aftermath of the Trump victory – and what appears to be a Republican sweep – and bond yields soaring by the most since the covid crisis, some were worried that today’s 30Y auction would be a historic disaster and may even fail, as technically improbable as that may be. In the end, with 30Y yields blowing out by more than 20bps, the biggest rout since 2020, such fair proved to be groundless because today’s sale of $25BN in 30Y paper ended up being very solid for the most part. The auction, the last of the quarterly refunding trio, priced at a high yield of 4.608%, up from 4.389% last month and the highest since May’s 4.635%, but stopped through the When Issued 4.638% by 2.2bps, the biggest stop through since Dec 2020, although a lot of that has to do with the massive concession into today’s auction.

The bid to cover was a remarkable 2.642, up huge from 2.495 in October, above the 2.40 recent average, and the highest since Jan 2018. The internals however were more problematic, with Indirects aw … Read more at: https://www.zerohedge.com/markets/yields-slide-after-stellar-30y-auction-then-blow-out-again |

|

Kamala Concedes In Phone Call To Trump, Campaign Manager Says “Unfathomably Painful”Vice President Kamala Harris has called President-Elect Donald Trump to concede the election and congratulate him on beating her like Doug Emhoff’s ex-girlfriend.

A crestfallen Wolf Blitzer delivers the news:

Harris campaign manager, meanwhile, sent a letter to staff in which she said “losing is unfathomably painful. It is hard. This will take a long time to process. … Read more at: https://www.zerohedge.com/political/kamala-concedes-phone-call-trump-campaign-manager-says-unfathomably-painful |

|

China Hopes For ‘Peaceful Coexistence’ – Voices Caution, After Trump VictoryUpdate(1419): Beijing’s reaction to Trump’s victory was characteristically guarded and cautious on Wednesday, with a statement expressing hope the future Trump White House will continue to handle China-US relations in accordance with the “principles of mutual respect and peaceful coexistence.” This presents the possibility of a new beginning in China-US relations “if the chance that has been offered is not wasted” – according to the Ministry of Foreign Affairs. “The presidential election of the United States is its internal affair. We respect the choice of the American people,” spokesperson Mao Ning said. Reporters in the briefing pressed her on policy changes, especially related to tariffs, but she didn’t speculate:

Trump has been making pretty serious threats on this just in the last days ahead of the vote…

|

|

US shares and Bitcoin hit record high on Trump winThe result could have a far-reaching implications for tax and trade policy, as well as economies around the world. Read more at: https://www.bbc.com/news/articles/c6246e3w935o |

|

Asda to cut 475 jobs and reduce hybrid workingThe retailer says it is restructuring the business amid a challenging market. Read more at: https://www.bbc.com/news/articles/c624dd6g3lmo |

|

Warning millions will struggle to pay water bill risesA proposed average rise of 21% over five years will cause ‘intolerable strain’, a consumer group warns. Read more at: https://www.bbc.com/news/articles/ce9gve1grjmo |

|

HZL OFS attracts bids worth Rs 3,400 cr from institutional investors, govt to exercise greenshoe optionThe government’s offer-for-sale for more than 4.75 crore Hindustan Zinc Ltd (HZL) shares to institutional investors over-subscribed on Wednesday, with institutional buyers putting bids worth close to Rs 3,400 crore. On the first day of the two-day OFS, bids came in for over 6.69 crore shares, which is 1.41 times the total of 4.75 crore shares on offer for institutional buyers. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/hzl-ofs-attracts-bids-worth-rs-3400-cr-from-institutional-investors-govt-to-exercise-greenshoe-option/articleshow/115023394.cms |

|

How to trade eClerx, Piramal Pharma, Deepak Fertilizer in next sessionIndian market closed in the green for the second consecutive day in a row on Wednesday tracking positive global cues. The BSE Sensex index rose more than 900 points to close above 80,300 levels while Nifty50 reclaimed 24,400 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-to-trade-eclerx-services-piramal-pharma-amp-deepak-fertilizers-on-thursday/market-summary/slideshow/115016713.cms |

|

Bitcoin at record high above $75,000 is good news for Nifty bulls also. Here’s whyAs Donald Trump inches closer to victory in the US presidential election, Bitcoin prices surged past $75,000, signaling a risk-on sentiment in the market. This surge coincided with a correction in the Indian stock market, with the MSCI India ETF dropping over 8%. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/bitcoin-at-record-high-above-75000-is-good-news-for-nifty-bulls-also-heres-why/articleshow/115014979.cms |

|

Older voters came out in droves — but they were just as split as the rest of the countryOlder voters have always been influential and dependable voters and that was no different this election season. Read more at: https://www.marketwatch.com/story/older-voters-came-out-in-droves-but-they-were-just-as-split-as-the-rest-of-the-country-0356a2c6?mod=mw_rss_topstories |

|

30-year bond yield closes with biggest jump since 2022 after Trump winsU.S. government debt aggressively sold off on Wednesday, pushing the 30-year yield up by the most in two years, as traders factored in the likely trade and deficit policies of a second Trump administration. Read more at: https://www.marketwatch.com/story/bond-yields-rise-on-likely-trump-win-and-possible-red-wave-b2a32976?mod=mw_rss_topstories |

|

Oil prices end with a modest loss as Trump’s win lifts the dollarOil futures finished lower Wednesday, but pared much of the earlier losses that pulled U.S. prices briefly below $70 a barrel, as traders weighed the potential impact of former President Donald Trump’s win in Tuesday’s presidential election. Read more at: https://www.marketwatch.com/story/oil-prices-retreat-after-trump-win-sends-dollar-soaring-8dec27fb?mod=mw_rss_topstories |