Summary Of the Markets Today:

- The Dow closed up 427 points or 1.02%,

- Nasdaq closed up 259 points or 1.43%,

- S&P 500 closed up 70 points or 1.23%,

- Gold $2,753 up $6.20 or 0.22%,

- WTI crude oil settled at $72 up $0.65 or 0.09%,

- 10-year U.S. Treasury 4.289 down 0.022 points or 0.164%,

- USD index $103.45 down $0.44 or 0.42%,

- Bitcoin $69,358 up $1,949 or 2.81%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks closed higher on Election Day as Americans voted in the presidential race between Kamala Harris and Donald Trump. Investors are preparing for potential market volatility, as the election outcome may not be clear for days or weeks if disputed. The dollar retreated further as traders reduced bets on a Trump win. The 10-year Treasury yield dropped 2 basis points. The Federal Reserve is expected to announce a 25 basis point rate cut on Thursday. Boeing shares fell nearly 3% despite workers ending a 7-week strike by voting for a new contract with a 38% pay hike. The S&P 500 is up over 20% year-to-date through October, its best performance in the first 10 months of an election year since at least 1950. Historically, the S&P 500 has risen in 6 of the past 10 election cycles in the month after the election and 8 of 10 cases over the following 3 months. Analysts warn of potential short-term volatility once the election outcome is known, but advise investors to focus on long-term trends.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The trade deficit has grown 35.6% year-over-year driven by falling export growth of 4.5% year-over-year and rising import growth of 8.9%. Capital goods and consumer goods drove the rise in exports. When I was younger, the saying was that the US was manufacturing nothing – it was not true then but becoming true now.

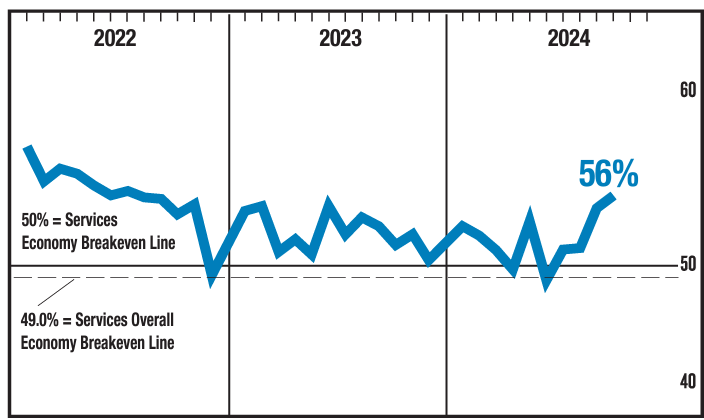

In October, the ISM Services PMI registered 56%, 1.1 percentage points higher than September’s figure of 54.9 percent. The reading in October marked the eighth time the composite index has been in expansion territory this year. The Business Activity Index registered 57.2 percent in October, 2.7 percentage points lower than the 59.9 percent recorded in September, indicating a fourth month of expansion after a contraction in June. The New Orders Index decreased to 57.4 percent in October, 2 percentage points lower than September’s figure of 59.4 percent. If I had only one index to look at to understand the economy, it would be this ISM services index even though this is a survey [I dislike most surveys]. It is showing moderate expansion.

U.S. home price growth continued to cool, slowing to 3.4% year-over-year in September 2024. Compared with the month prior, home prices rebounded to post a very slight uptick (0.02%). Taken together, home price levels have been relatively flat since late summer. Home prices are subject to the laws of supply and demand – and there are a bunch of buyers currently priced out because of high mortgage rates. So if the mortgage rates moderate – home price inflation will increase.

Here is a summary of headlines we are reading today:

- NATO Flexes Military Muscle with Extensive Drills in Northern Finland

- Australia’s Rare Earth Supply Chain Faces Major Disruptions

- Iran’s Oil Supply to China Most Expensive in Five Years As Loadings Fall

- Foreign Interference Threatens U.S. Election Integrity, Officials Warn

- Dow rallies 400 points, S&P 500 gains 1% as traders await U.S. election results: Live updates

- Coinbase’s big election bet is about to be tested

- Nvidia passes Apple as world’s most valuable company

- Palantir shares jump 23% to record on uplifting guidance

- Boeing machinists end strike after approving labor contract with 38% raises

- Protests Explode In Tel Aviv After Netanyahu Fires Defense Minister Gallant

- How Markets Reacted To Each US Election Since 2000

- Ukraine Announces First Direct Clashes With North Korean Troops

- 10-year Treasury yield ends lower after strong auction as investors await election results

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Budapest Declaration Sparks Debate Ahead of EU SummitHungary’s turn as the rotating president of the Council of the European Union in the second half of this year was always bound to be interesting, given that Budapest has a habit of clashing with Brussels on a number of things — not least on Russia and Ukraine. And it is fair to say that one of the highlights of this controversial presidency will come on November 7 as the Hungarian capital is hosting the summit of the European Political Community (EPC) — a political forum bringing together the leaders of almost all European states (bar Belarus,… Read more at: https://oilprice.com/Geopolitics/International/Budapest-Declaration-Sparks-Debate-Ahead-of-EU-Summit.html |

|

NATO Flexes Military Muscle with Extensive Drills in Northern FinlandThe US Army Europe and Africa on Monday launched what are being described as NATO’s largest artillery drills, dubbed Lightning Strike 24, and held in Finland’s northernmost region of Lapland. The exercise involves over 5,000 military personnel from the US and 28 Allied and partner nations, and will feature over 130 weapons systems, aimed at showing off the alliance’s field artillery capability. But ironically this comes at a moment many Western nations have complained that their artillery shell stockpiles are dwindling to due supplying them to… Read more at: https://oilprice.com/Geopolitics/International/NATO-Flexes-Military-Muscle-with-Extensive-Drills-in-Northern-Finland.html |

|

Oil Operators In GoM Begin Evacuations Ahead Newest Tropical StormOil companies are beginning to evacuate personnel ahead of Tropic Storm Rafael as Gulf energy operators hunker down for yet another high-seas spectacle. BP, Chevron, Equinor, and Shell have been down this road before, ushering non-essential personnel out of harm’s way while keeping production humming—for now. BP started shuffling personnel off platforms like Argos, Thunder Horse, and Mad Dog. Chevron, too, followed suit, relocating folks from platforms including Big Foot and Petronius. Meanwhile, Shell has taken preemptive measures,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Operators-In-GoM-Begin-Evacuations-Ahead-Newest-Tropical-Storm.html |

|

Australia’s Rare Earth Supply Chain Faces Major DisruptionsVia Metal Miner The Rare Earths MMI (Monthly Metals Index) saw its upward price action slow as prices experienced only a slight uptick of 0.38%. While upward price action for rare earths did lose steam month-over-month, prices could soon witness another bullish boost. Not only did China’s rare earth export ban go into effect as of October 1, but Australia, a large manufacturer of rare earths, is now experiencing supply chain disruptions. Australia’s Rare Earth Manufacturing Disruptions The rare earths industry in Australia has witnessed… Read more at: https://oilprice.com/Metals/Commodities/Australias-Rare-Earth-Supply-Chain-Faces-Major-Disruptions.html |

|

Orsted Raises Earnings Forecast on Strong Offshore Wind PerformanceOrsted has hiked its full-year earnings guidance as the Danish group’s offshore wind projects drove profits upward in the first nine months of the year. Full-year earnings before interest, taxation, depreciation and amortisation (EBITDA) is expected to come in at between DKK 24bn to 26bn (£2.6bn to £2.9bn), narrowed from a prior forecast of 23bn to 26bn DKK. The Danish state-backed energy group said operating profit had risen from DKK 19.4bn to DKK 23.6bn compared with the prior year. In a statement, chief executive Mads Nipper… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Orsted-Raises-Earnings-Forecast-on-Strong-Offshore-Wind-Performance.html |

|

Iran’s Oil Supply to China Most Expensive in Five Years As Loadings FallIran’s crude oil going to China these days is priced at its narrowest discount to Brent in five years as Iranian cargo loadings slumped last month amid fears that Israel would target Tehran’s energy facilities in response to the Iranian missile attack on Israel on October 1. The discount of Iran Light crude to ICE Brent has now narrowed to below $4 per barrel, from $5-$6 a barrel earlier this year, trading and refinery sources have told Reuters. The higher prices for Iran’s crude oil have been determined by lower cargo availability… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Irans-Oil-Supply-to-China-Most-Expensive-in-Five-Years-As-Loadings-Fall.html |

|

Foreign Interference Threatens U.S. Election Integrity, Officials WarnU.S. intelligence and security officials have accused Russia and Iran of ramping up cyberattacks and disinformation campaigns to sow discord as Americans head to the polls on November 5 to vote in a tense presidential election. Russia-linked influence actors “are manufacturing videos and creating fake articles to undermine the legitimacy of the election, instill fear in voters regarding the election process, and suggest Americans are using violence against each other due to political preferences,” said a statement issued by the Office of the Director… Read more at: https://oilprice.com/Geopolitics/International/Foreign-Interference-Threatens-US-Election-Integrity-Officials-Warn.html |

|

Geopolitical Risks Boost Oil Hedging to Record HighsTraders and investors traded record-high numbers of options and futures contracts in October, seeking to profit from the oil market volatility and protect themselves against price slumps or spikes. Oil options are contracts that give the holder the right, but not the obligation, to buy or sell oil at a set price if it moves beyond that price within a set timeframe. As war risks increased following Iran’s missile attack on Israel in early October, markets were awaiting the Israeli response for most of last month and were frantically… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Geopolitical-Risks-Boost-Oil-Hedging-to-Record-Highs.html |

|

Russia’s Oil Revenues Plunged 29% in October as Crude Prices FellLower oil prices and subsidies for domestic refiners resulted in a 29% annual plunge in Russia’s oil revenues in October, Bloomberg’s estimates based on official government data showed on Tuesday. In October, international oil prices and the price of Russia’s flagship crude, Urals, slumped compared to the same month of 2023. This eroded Russian revenues as the price of the Urals grade averaged $63.57 a barrel, compared to $83.18 a barrel in October last year. The revenues from oil for the state were also impacted by the government… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Oil-Revenues-Plunged-29-in-October-as-Crude-Prices-Fell.html |

|

Chevron to Boost Exploration in West AfricaUnlike the other supermajors, U.S. oil and gas giant Chevron is buying into offshore blocks offshore Angola and Nigeria in West Africa, looking to revive exploration in what it describes as an under-explored oil province. The producers, Africa’s top two, have seen their oil output slump in recent years, due to underinvestment and majors selling off assets in these countries. Chevron, however, insists that the offshore waters still have a lot of resources which it could tap and develop. The region of West Africa is “such a hydrocarbon-rich… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-to-Boost-Exploration-in-West-Africa.html |

|

Oil Markets on Edge Ahead of Tight U.S. Presidential ElectionThe U.S. presidential election promises to dominate global news coverage for the next 24 hours, and oil markets will be watching developments closely after both WTI and Brent banked gains from the OPEC+ decision on Monday. – The stormy political landscape in the US stands in stark contrast with Europe where several windless days have led to a rebound in natural gas prices, sending TTF futures back to €41 per MWh ($14 per mmBtu).- In Germany alone, gas-fired generation accounted for more than 60% of the country’s energy mix due to… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-on-Edge-Ahead-of-Tight-US-Presidential-Election.html |

|

Shell Turns Germany’s Top Refinery GreenShell is gearing up to transform its largest German oil refinery, Rheinland, turning the crude-centric Wesseling site into a base-oil powerhouse. The overhaul, set to kick off next quarter, signals a major shift as Shell pivots from conventional oil refining toward high-grade lubricants. Goodbye crude processing at Wesseling—by 2025, that unit’s history. Instead, Shell’s revamp will see the site repurposed to produce Group III base oils, which are vital for premium lubricants in engines and transmissions. Why the change? Simple:… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Turns-Germanys-Top-Refinery-Green.html |

|

Marathon Petroleum Tops Estimates Despite Earnings SlumpMarathon Petroleum Corp (NYSE: MPC) beat the analyst consensus for its third-quarter earnings by a mile, despite the expected slump in profits due to plunging refining margins. All U.S. refiners were expected to report much lower profits for the third quarter compared to a year earlier, as refining margins slumped to multi-year lows amid tepid fuel demand and increased global fuel supply. On Tuesday, Marathon Petroleum joined the other major U.S. refiners, Valero Energy and Phillips 66, in reporting better-than-expected Q3 earnings even… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Marathon-Petroleum-Tops-Estimates-Despite-Earnings-Slump.html |

|

Soaring Chinese Crude Futures Attract High Middle East VolumesSoaring crude futures prices on the Shanghai International Energy Exchange (INE) have opened the arbitrage for traders to deliver in November what could be this year’s highest volumes of crude from the Middle East to the Chinese exchange, trade sources have told Reuters. The prices of the November futures contract on the INE have soared in recent weeks, moving above the international benchmark Brent Crude whose futures are traded on the Intercontinental Exchange (ICE). The higher prices of the Chinese futures have opened the arbitrage window… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Soaring-Chinese-Crude-Futures-Attract-High-Middle-East-Volumes.html |

|

Orsted’s Offshore Wind Projects Drive GrowthOrsted has hiked its full-year earnings guidance as the Danish group’s offshore wind projects drove profits upward in the first nine months of the year. Full-year earnings before interest, taxation, depreciation and amortisation (EBITDA) is expected to come in at between DKK 24bn to 26bn (£2.6bn to £2.9bn), narrowed from a prior forecast of 23bn to 26bn DKK. The Danish state-backed energy group said operating profit had risen from DKK 19.4bn to DKK 23.6bn compared with the prior year. In a statement, chief executive Mads… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Orsteds-Offshore-Wind-Projects-Drive-Growth.html |

|

Election Day 2024 live updates: Trump and Harris prepare for presidential race resultsAfter weeks of barnstorming swing states, Donald Trump and Kamala Harris take a step back and leave the election to voters. Read more at: https://www.cnbc.com/2024/11/05/presidential-election-2024-results-live-updates.html |

|

Dow rallies 400 points, S&P 500 gains 1% as traders await U.S. election results: Live updatesThe S&P 500 rose Tuesday as traders awaited the results from a high-stakes U.S. presidential election. Read more at: https://www.cnbc.com/2024/11/04/stock-market-today-live-updates.html |

|

Trump says he will give RFK Jr. a major health role if he wins the White House. Here’s what that means for patients, drugmakersSome health experts say Kennedy, even in an informal role, could potentially lead to real consequences for patients, drugmakers and the nation’s public health. Read more at: https://www.cnbc.com/2024/11/05/what-trumps-health-pick-rfk-jr-could-mean-for-patients-drugmakers.html |

|

Coinbase’s big election bet is about to be testedCoinbase emerged as a top corporate donor this election cycle, backing candidates the company viewed as supporting its pro-crypto agenga. Read more at: https://www.cnbc.com/2024/11/05/coinbases-big-election-bet-is-about-to-be-tested.html |

|

Nvidia passes Apple as world’s most valuable companyNvidia shares have nearly tripled this year as demand continues to swell for the company’s graphics processing units. Read more at: https://www.cnbc.com/2024/11/05/nvidia-passes-apple-as-worlds-most-valuable-company-.html |

|

The trader guide to the election: Which stocks Wall Street expects to benefit under Trump or HarrisElection Day is here, and investors are on edge. Read more at: https://www.cnbc.com/2024/11/05/the-trader-guide-to-the-election-which-stocks-wall-street-expects-to-benefit-under-trump-or-harris.html |

|

Gender? Economy? Experts weigh in on which factor is most likely to flip the presidential raceCNBC senior economics reporter Steve Liesman sat down with four polling experts for an in-depth look into the data to see which ones could turn the election. Read more at: https://www.cnbc.com/2024/11/05/gender-economy-experts-weigh-in-what-could-flip-the-presidential-race.html |

|

Palantir shares jump 23% to record on uplifting guidancePalantir shares soared to a record on Tuesday after the software company reported better-than-expected results and issued uplifting guidance. Read more at: https://www.cnbc.com/2024/11/05/palantir-shares-jump-23percent-to-record-on-uplifting-guidance.html |

|

Boeing machinists end strike after approving labor contract with 38% raisesThe vote is the third time since September that Boeing’s machinists are considering a new labor deal. Read more at: https://www.cnbc.com/2024/11/04/striking-boeing-machinists-vote-new-contract.html |

|

Netanyahu fires Gallant as Israel’s defense ministerGallant will be replaced by Foreign Minister Israel Katz, Netanyahu said in a statement issued on the day the world’s attention was focused on the United States election. Read more at: https://www.cnbc.com/2024/11/05/netanyahu-fires-gallant-as-israels-defense-minister.html |

|

The next U.S. president could face a tax battle in 2025 — here’s what it means for investorsThe next U.S. president could face a tax battle in 2025 over expiring tax breaks enacted by former President Donald Trump. Here’s what it means for investors. Read more at: https://www.cnbc.com/2024/11/05/trumps-tax-cuts-expire-after-2025-investors.html |

|

The presidential election is prompting some Americans to ‘doom spend,’ report findsSome Americans are “doom spending” as a coping mechanism for worries about the presidential election and inflation, according to a new survey. Read more at: https://www.cnbc.com/2024/11/05/presidential-election-prompts-some-americans-to-doom-spend-report-finds.html |

|

Bolster your portfolio for any Election Day outcomeIncome investors should soon find out how their portfolio may — or may not — be affected by the election. Read more at: https://www.cnbc.com/2024/11/05/bolster-your-portfolio-for-any-election-day-outcome.html |

|

Protests Explode In Tel Aviv After Netanyahu Fires Defense Minister GallantUpdate(1508ET): Israeli hardline minister Ben Gvir has hailed Netanyahu’s firing of Defense Minister Yoav Gallant, saying the prime minister “did well to remove” him. But protests have exploded in Tel Aviv and elsewhere, including a growing demonstration outside Netanyahu’s house in Caesarea. A FOX correspondent on the ground has shown they are already huge in the late nighttime hours, and growing…

A White House statement issued very quickly on the heels of the news, which pushed oil down, said:

“A White House National Security Council spokesperson hails outgoing Defense Minister Yoav Gallant and says the Biden administration will continue to collaborate with his successor but avoids directly criticizing Prime Minister Benjamin Netanyahu’s decision to fire him in the first White House reaction to the move,” Times of Israel writes. “Minister Gallant has been an important partner on all matters related to the defense of Israel. As close partners, we will continue to work collaboratively wit … Read more at: https://www.zerohedge.com/energy/netanyahu-fires-israels-defense-minister-confused-algos-dump-oil |

|

US Soldier Injured Earlier This Year On Gaza Pier DiesAuthored by Dave DeCamp via AntiWar.com, A US Army soldier who was injured earlier this year while working on the US-constructed temporary pier off Gaza has died due to his wounds, CNN reported on Monday. Sgt. Quandarius Davon Stanley, 23, was one of three US soldiers injured while working on the pier in May. At the time, the Pentagon said two suffered very minor injuries while the other was hurt severely enough to be evacuated for medical care.

Sgt. Quandarius Davon Stanley. US Army/FOX/Getty Images The Pentagon insisted the injuries were “non-combat … Read more at: https://www.zerohedge.com/geopolitical/us-soldier-injured-earlier-year-gaza-pier-dies |

|

How Markets Reacted To Each US Election Since 2000With just hours left until the close of polls (and today’s cash market), we share some observations from DB looking at how markets have reacted to the six previous elections and what was going on at the time. As DB’s Henry Allen notes, the reactions vary considerably: of the six elections since 2000, the S&P 500 was up in three cases by the end of November, and down in the other three. 10yr Treasury yields were down in four and up in two. It’s worth bearing in mind that markets already account for expectations. So in 2008, there was little direct reaction, as Obama’s victory was widely expected. By contrast in 2016, Trump’s surprise victory was a big shock that led to a major rise in Treasury yields. In addition, other events are happening at the same time. Markets were buoyant after 2020, but that was supported by Pfizer’s vaccine announcement the following week. In 2012, markets struggled as fears grew about the US fiscal cliff and Greece’s situation during the sovereign crisis. And back in 2008, markets plummeted amidst the Global Financial Crisis. So the election isn’t the only variable, and this week there’ll be a lot of focus on Thursday’s Fed decision as well, 2020 (Biden vs Trump)Markets rally after election, initially on prospect of divided government with the Georgia Senate races pending, whilst vaccine news provides a further boost. In 2020, the outcome was initially uncertain on the night, as President Trump outperformed the polls and his margins with Biden were tighter than expected. But it soon became apparent that Biden w … Read more at: https://www.zerohedge.com/markets/how-markets-reacted-each-us-election-2000 |

|

Ukraine Announces First Direct Clashes With North Korean TroopsThe US and South Korea now say many thousands of North Korean troops are on the front lines, potentially engaging Ukrainian forces, with most of them located in Russia’s Kursk oblast, which has been under Ukrainian troop presence since the August cross-border offensive. “More than 10,000 North Korean soldiers are currently in Russia, and we assess that a significant portion of them are deployed to front-line areas, including Kursk,” spokesman for South Korea’s defense ministry, Jeon Ha-kyou, told a briefing.

Getty Images The Pentagon has said the same with spokesman Pat Ryder having stated Monday, “All indications are that they will provide some type of combat or combat support capability.” He added: “We would fully expect that the Ukrainians would do what they need to do to defend themselv … Read more at: https://www.zerohedge.com/geopolitical/ukraine-announces-first-direct-clash-north-korean-troops |

|

Treasury should have told us about overspend by law, says OBRRichard Hughes, chair of the Office for Budget Responsibility, says officials have questions to answer as to why details of an overspend were not shared. Read more at: https://www.bbc.com/news/articles/cn9xjw4rw10o |

|

PM responds to Sir Alan Bates after repeated requestsSir Alan wrote to the PM twice in the past month, urging him to ensure victims receive full financial redress by March next year. Read more at: https://www.bbc.com/news/articles/c7v372zyz98o |

|

Shoppers warned over luxury advent calendar scamsThe consumer group Which? is urging shoppers looking for a good deal to beware of fake offers. Read more at: https://www.bbc.com/news/articles/cdxvkkjd9vko |

|

Swiggy raises Rs 5,085 crore from anchor investors ahead of IPO openingSwiggy IPO: Food delivery giant Swiggy has raised ₹5,085 crore from anchor investors ahead of its IPO, which opens tomorrow. The company has fixed the price band at ₹371-390 per share. Swiggy plans to use the IPO proceeds for investment in its subsidiary Scootsy, technology, and brand marketing. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/swiggy-raises-rs-5085-crore-from-anchor-investors-ahead-of-ipo-opening/articleshow/114990246.cms |

|

Oil India Q2 Results: Profit rises five-fold to Rs 1,834 crore, revenue declines 7%The company’s revenue declined 7% year-on-year to Rs 5,519 crore in the July-September period. Profit before exceptional items and tax fell 10% to Rs 2,305 crore for the quarter. The company had provided for an exceptional item of Rs 2,363 crore in the year-ago quarter. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/oil-india-q2-results-profit-rises-five-fold-to-rs-1834-crore-revenue-declines-7/articleshow/114988102.cms |

|

GAIL Q2 Results: PAT rises 11% YoY to Rs 2,672 croreGAIL reported an 11% increase in standalone net profit for Q2 FY25, reaching Rs 2,672 crore. Revenue from operations saw a 3% rise, reaching Rs 32,931 crore. The company achieved an EBITDA of Rs 3,937 crore with margins at 11.6%. GAIL recorded its highest-ever half-yearly EBITDA, PBT, and PAT in H1 FY25. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/gail-q2-results-profit-up-10-to-rs-2690-crore-revenue-flat/articleshow/114984182.cms |

|

Swing-state voters want to know: What’s going on with Social Security?Social Security’s trust fund is expected to be depleted in 2033. Where is the solution? Read more at: https://www.marketwatch.com/story/social-securitys-trust-fund-is-expected-to-be-depleted-in-2033-where-is-the-solution-357c5e65?mod=mw_rss_topstories |

|

10-year Treasury yield ends lower after strong auction as investors await election resultsLong-dated Treasury yields erased their rise to end lower Tuesday following an auction of 10-year notes that met solid demand as investors awaited the outcome of the U.S. presidential election. Read more at: https://www.marketwatch.com/story/treasury-yields-move-higher-as-traders-brace-for-u-s-election-f2879927?mod=mw_rss_topstories |

|

‘I know it’s awkward to give advice to wealthy people’: My wife, 50, has terminal cancer. Our estate is worth $18 million. How do we prepare?“We have two children ages 19 and 21, with one starting law school and the younger planning on medical school.” Read more at: https://www.marketwatch.com/story/i-know-its-awkward-to-give-advice-to-wealthy-people-my-wife-50-has-terminal-cancer-our-estate-is-worth-18-million-how-do-we-prepare-693d4817?mod=mw_rss_topstories |