Summary Of the Markets Today:

- The Dow closed up 288 points or 0.69%,

- Nasdaq closed up 145 points or 0.80%,

- S&P 500 closed up 23 points or 0.41%,

- Gold $2,744 down $5.40 or 0.19%,

- WTI crude oil settled at $69 up $0.16 or 0.23%,

- 10-year U.S. Treasury 4.380 up 0.096 points or 0.762%,

- USD index $104.31 up $0.34 or 0.32%,

- Bitcoin $69,204 down $1,460 or 2.11%, (24 Hours)

- Baker Hughes Rig Count: U.S. unchanged at 585 Canada -3 to 213

U.S. Rig Count is down 33 rigs from last year’s count of 618 with oil rigs down 17, gas rigs down 16 and miscellaneous rigs unchanged.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks rebounded on Friday as investors processed a disappointing jobs report and positive earnings from major tech companies. The economy added only 12,000 jobs in October, falling significantly short of expectations. Amazon shares surged over 6% after reporting strong earnings and triple-digit revenue growth in its cloud unit’s AI business. Intel stock jumped more than 3% following better-than-expected Q3 revenue and a positive Q4 forecast. Apple shares declined slightly due to weaker-than-expected Q4 service revenue and China revenue. The positive earnings from Amazon and Intel helped alleviate concerns about Big Tech’s prospects. The jobs report is the last major economic data before the Fed’s policy decision on November 7. Market expectations for the upcoming meeting remained largely unchanged, with traders estimating a 99% probability of a quarter-point interest rate reduction. Despite Friday’s recovery, all three major indexes were on track to register losses for the week.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

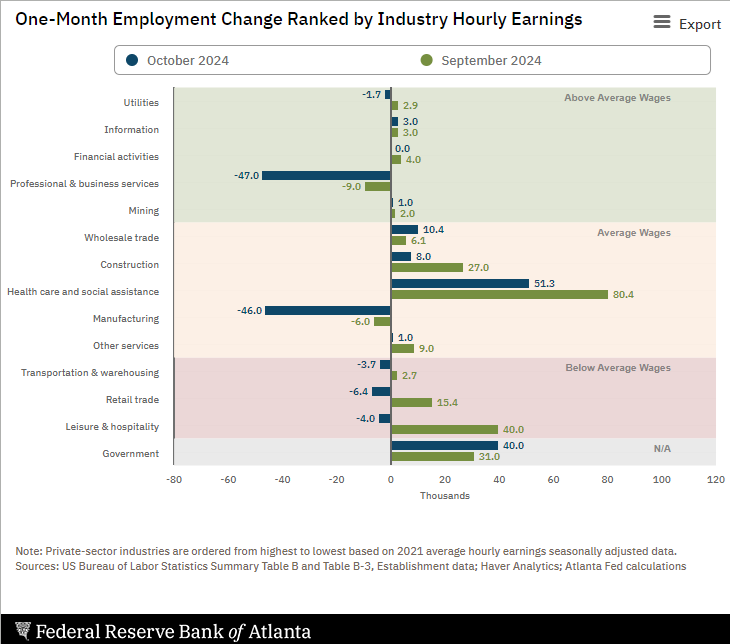

The October 2024 Jobs report was bad. Payroll employment increased by only 12,000 and the unemployment rate unchanged at 4.1%. Part of the reason the unemployment rate was unchanged is that the household survey (which provides the headline unemployment rate) reduced the size of the workforce by 220,000, lowered the amount of employed by 368,000, and then removed 428,000 from the workforce. Remember the household survey is a poll of 60,000 households done monthly by the BLS. Note that the Establishment Survey produces the headline 12,000 jobs growth which is totally inconsistent with Household Surveys employment decline of 368,000. The October 2024 BLS jobs report was weak due to several key factors:

- Hurricane impacts: Hurricanes Helene and Milton affected employment, particularly in Florida and North Carolina, though the exact impact was difficult to quantify.

- Boeing strike: A significant labor strike at Boeing resulted in approximately 44,000 job losses in the manufacturing sector.

- Downward revisions: Previous months’ job figures were revised downward significantly. August’s numbers were adjusted from 159,000 to just 78,000, while September’s were revised from 254,000 to 223,000. This resulted in a total downward revision of 112,000 jobs

- Broad-based weakness: Several sectors experienced job losses or minimal growth:

- Manufacturing shed 46,000 jobs

- Temporary help services lost 49,000 jobs

- Leisure and hospitality declined by 4,000 jobs

- Retail trade and transportation/warehousing also reported slight losses

- Slower overall trend: Even before October, job creation in 2024 had been averaging about 200,000 per month, which was already about 60,000 less than the same period in 2023.

- Economic deceleration: The weak report may indicate a broader economic slowdown, with some pundits blaming the Federal Reserve’s interest rate hikes aimed at controlling inflation.

While some of these factors, like the hurricanes and the Boeing strike, are temporary, the broad-based weakness across sectors and the significant downward revisions to previous months could suggest underlying softness in the job market. Honestly, raising the federal funds rate has little to do with the soft numbers as there was a lot of money available. Goods production is escaping the high cost of doing business in the US with imports rising and domestic production falling. In addition, the Bureau of Labor Statistics (BLS) does not explicitly count or exclude unauthorized immigrants in its employment surveys. However, the household survey, which is part of the BLS jobs report, does include unauthorized immigrants in its data collection. With over 10 million illegals in the country recently – how does this affect the jobs report data?

Construction spending during September 2024 was 4.6% above the September 2023 (down from 4.8% last month). Spending on private construction was up 3.8% year-over-year (up from 3.7% last month) and spending on public construction was up 7.0% year-over-year (down from 8.5% last month). Construction spending is one of the bright spots in the economy but growth has been declining in 2024.

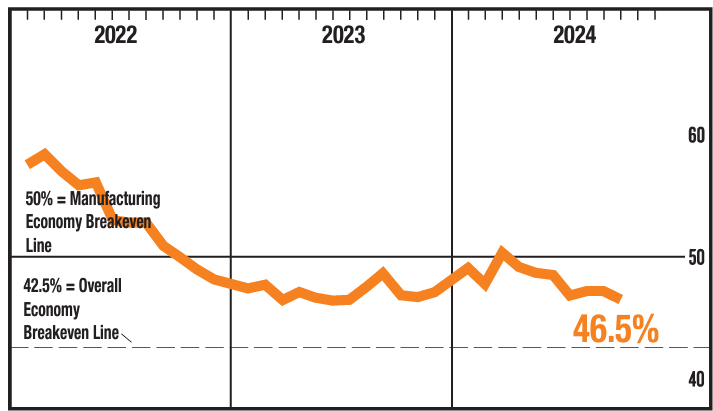

The ISM Manufacturing PMI® registered 46.5% in October 2024, 0.7 percentage point lower compared to the 47.2 percent recorded in September. This is the lowest Manufacturing PMI reading in 2024. The overall economy continued in expansion for the 54th month after one month of contraction in April 2020. (A Manufacturing PMI above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory, registering 47.1 percent, 1 percentage point higher than the 46.1 percent recorded in September. Manufacturing contraction is accelerating and pretty soon made in USA labels will be hard to find.

Here is a summary of headlines we are reading today:

- Interest Rates and Weak Demand Cloud European Steel Market

- U.S. Drilling Activity Going Nowhere Baker Hughes Data Shows

- Exxon Completes Sale of French Refinery to Trafigura-Led Buyer

- Oil Markets on Edge After a Volatile Week

- A Mixed Earnings Season for Oil and Gas Giants

- Stocks climb to start November as traders look past weak jobs report: Live updates

- Here’s where the jobs are for October 2024 – in one chart

- IRS announces 401(k) contribution limits for 2025

- Election next week holds big implications for stock market, especially the control of Congress

- Super Micro’s 44% plunge this week wipes out stock’s gains for the year

- Bitcoin slips below $70,000 after notching 12% gain in October: CNBC Crypto World

- Record numbers of wealthy Americans are making plans to leave the U.S. after the election

- Amazon shares jump 7%, approach record after earnings beat

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Interest Rates and Weak Demand Cloud European Steel MarketVia Metal Miner Steelmakers in Western Europe are trying to push through increases for their hot rolled coil, though sources noted that it was hard to determine where steel prices were at present. Reports indicate that mills are now seeking about €600 ($650) EXW per metric ton, reflecting an increase from deals that were as low as €520-530 in late September. However, those prices also reflect a 25% decrease from the €800 ($865) mills sought in January. One trader acknowledged mills wanting to seek increases, telling MetalMiner, “I… Read more at: https://oilprice.com/Metals/Commodities/Interest-Rates-and-Weak-Demand-Cloud-European-Steel-Market.html |

|

Imperial Oil Books Lower Q3 Earnings as Crude Prices DropCanadian producer Imperial Oil reported on Friday a decline in third-quarter earnings amid lower crude prices and refinery activity, which more than offset the highest Q3 production in more than 30 years. Imperial Oil’s net income came in at US$888.6 million (C$1.237 billion) for the third quarter, down from US$1.15 billion (C$1.601 billion) for the same period last year. Imperial Oil, majority owned by U.S. supermajor ExxonMobil, said that its upstream production averaged 447,000 gross oil-equivalent barrels per day, the highest third quarter… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Imperial-Oil-Books-Lower-Q3-Earnings-as-Crude-Prices-Drop.html |

|

U.S. Drilling Activity Going Nowhere Baker Hughes Data ShowsThe total number of active drilling rigs for oil and gas in the United States saw no change this week, according to new data that Baker Hughes published on Friday, after holding steady in the week prior. The total rig count stayed at 585, according to Baker Hughes, down more than 5% from this same time last year. The number of oil rigs fell by 1 this week to 479—down by 17 compared to this time last year. The number of gas rigs rose by 1 this week to 102, a loss of 16 active gas rigs from this time last year. Miscellaneous rigs stayed the… Read more at: https://oilprice.com/Energy/Energy-General/US-Drilling-Activity-Going-Nowhere-Baker-Hughes-Data-Shows.html |

|

Slovakia State Firm Denies EU Gas Deal With Azerbaijan Is ImminentSlovakia’s state-owned gas buyer SPP said on Friday that Europe is not on the verge of reaching a deal to replace pipeline Russian gas with Azerbaijan’s gas. Europe is scrambling to replace supply from Russia from January 1 because the remaining pipeline gas flows from Russia to the EU via the Ukraine transit route are set to stop from December 31 when the five-year transit deal with Ukraine expires. Ukraine has already said on several occasions that it would not extend the current gas transit deal. Russia has signaled willingness… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Slovakia-State-Firm-Denies-EU-Gas-Deal-With-Azerbaijan-Is-Imminent.html |

|

OPEC Lifts October Production Ahead of Planned Production HikesOPEC’s production increased by 370,000 barrels per day in October, a new Bloomberg survey has found. OPEC’s October production increase—thanks to Libya’s political resolution and its resultant 500,000 barrel-per-day output boost—adds another layer of complexity to the group’s ongoing struggle to manage global oil markets. Libya’s output recovery led OPEC to raise its production to nearly 30 million barrels daily, even as Iraq, Iran, and Saudi Arabia lowered their output. The backdrop of the group’s… Read more at: https://oilprice.com/Energy/Crude-Oil/OPEC-Lifts-October-Production-Ahead-of-Planned-Production-Hikes.html |

|

Cap-and-Trade Showdown: Will U.S. Voters Pull the Plug?Washington state’s carbon market may be a goner. Voters could axe the cap-and-invest program that’s raised over $2 billion since 2023, sending chills through states eyeing similar moves. Launched under the Climate Commitment Act (CCA), this market requires Washington’s biggest polluters to buy emissions allowances. The controversial program has found itself the subject of a ballot initiative in the upcoming election that some hope will send it packing. Washington’s CCA, launched in 2023, sets a cap on the state’s carbon… Read more at: https://oilprice.com/Energy/Energy-General/Cap-and-Trade-Showdown-Will-US-Voters-Pull-the-Plug.html |

|

Exxon Completes Sale of French Refinery to Trafigura-Led BuyerExxonMobil has completed the sale of the Fos-sur-Mer refinery in France, its only processing facility in the Mediterranean region, to a consortium composed of Entara and Trafigura, the buyers said on Friday. The deal includes the Toulouse and Villette-de-Vienne terminals, operated by Exxon’s local unit Esso. The consortium, Rhône Energies, has committed to a long-term agreement with Esso SAF to continue to supply to its downstream business in the region. With the sale of the 140,000 barrels per day refinery, Exxon is thus reducing its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Completes-Sale-of-French-Refinery-to-Trafigura-Led-Buyer.html |

|

Oil Markets on Edge After a Volatile WeekOil markets are on edge at the end of what has been a very volatile week for both Brent and WTI. Recent reports of an Iranian retaliation to Israel’s latest strike have pushed oil prices higher but demand concerns are capping any gains.Friday, November 1st, 2024No sooner had OPEC+ depressed market sentiment by admitting a potential rollover of its cuts into 2025, Iran reemerged as the main talking point of the markets. Having downplayed the Israeli retaliatory strike, the oil markets are now anticipating an Iranian attack on Israel, using… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-on-Edge-After-a-Volatile-Week.html |

|

Big Oil Needs to Borrow to Cover Dividends and Share BuybacksBig Oil Needs to Borrow to Finance Own Share Buybacks – Oil majors have been reporting lower Q3 profits, suggesting that the era of windfall revenues is coming to an end, with the average quarter-on-quarter dip for the five leading companies averaging 12%. – ExxonMobil, Chevron, Shell, TotalEnergies, and BP will earn a combined $24.4 billion in Q3, which leaves all companies except Shell unable to cover their dividends and share buybacks with free cash flow. – The need to borrow in order to cover buybacks isn’t necessarily a problem for US… Read more at: https://oilprice.com/Energy/Energy-General/Big-Oil-Needs-to-Borrow-to-Cover-Dividends-and-Share-Buybacks.html |

|

Oil Prices Volatility Spikes as Demand Concerns Clash With GeopoliticsVolatility in the Light Crude Oil Market: A Week in Review This week, crude oil (WTI) prices experienced substantial volatility, with light crude gapping sharply lower on Monday before clawing back the losses and edging marginally higher as of Friday. A confluence of factors—including demand signals, geopolitical uncertainties, and OPEC+ policy considerations—drove these price movements. Demand Concerns Dominate Monday’s Steep Decline The week began with a steep drop in crude prices as traders reacted to ongoing concerns about demand.… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Volatility-Spikes-as-Demand-Concerns-Clash-With-Geopolitics.html |

|

A Mixed Earnings Season for Oil and Gas GiantsPolitics, Geopolitics & Conflict LIbya’s Akakus Oil Company said on Monday that production at the Sharara oilfield (the country’s largest) had hit 285,000 bpd, representing a 10,000-bpd increase in a week’s time after being shuttered over political horse-jockeying over the now-tentatively resolved Central Bank scandal. A drone strike on a Russian special forces academy in Chechnya is being attributed by the media to Ukraine; however, we do not have confirmation that Kyiv was behind the attack. It is equally possible that this… Read more at: https://oilprice.com/Energy/Energy-General/A-Mixed-Earnings-Season-for-Oil-and-Gas-Giants.html |

|

Why the Energy Sector May be a Post-Election Safe HavenAs readers here will know all too well, energy markets are notoriously volatile. The commodities that underlie them and therefore the stocks in the sector are subject to multiple influences such as the geopolitics of the Middle East, the prospects for global growth, and the conflict between declining sentiment around fossil fuels but increasing demand for them as energy needs explode. None of those things is exactly stable, so investing in the energy sector has become something not for those faint of heart. It could well be, though, that the approaching… Read more at: https://oilprice.com/Energy/Energy-General/Why-the-Energy-Sector-May-be-a-Post-Election-Safe-Haven.html |

|

World War III Is a Proxy WarWorld War III is a proxy war, almost in its entirety. And Russia’s proxies are no longer simply its “non-state” (formerly Wagner) mercenaries, which Putin now fully controls. Now, it’s North Korea, which is desperate for the leverage it can win by being one of Putin’s puppets. The origins of the narrative that places North Korean troops in Ukraine, fighting for Russia, are found in South Korean intelligence. While there have been wild estimations of how many North Korean troops have been sent to Russia (first… Read more at: https://oilprice.com/Energy/Energy-General/World-War-III-Is-a-Proxy-War.html |

|

Exxon Beats Profit Estimates as Production Hits 40-Year HighExxonMobil (NYSE: XOM) reported on Friday third-quarter earnings above expectations as its liquids production hit a 40-year high, offsetting lower oil and gas realizations and weak refining margins. As expected, Exxon’s Q3 profit dropped from a year earlier, amid lower crude oil and natural gas prices and a weak refining sector globally. But the earnings beat the Wall Street view as production in Guyana, the Permian, and from the Pioneer assets rose. Exxon booked earnings of $8.61 billion for the third quarter, down by 5% year-over-year.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Beats-Profit-Estimates-as-Production-Hits-40-Year-High.html |

|

Chevron Tops Q3 Earnings Forecast as Its U.S. Oil Output Jumps to RecordChevron Corporation (NYSE: CVX) booked consensus-beating earnings for the third quarter, driven by a record quarterly U.S. production and Permian oil and gas output. Chevron reported on Friday adjusted earnings of $4.5 billion for Q3, down from $5.7 billion from a year earlier, due to lower margins on refined product sales, lower realizations amid lower oil and gas prices, and the absence of prior-year favorable tax items. The adjusted earnings per share came in at $2.51 for the third quarter of 2024, down from $3.05 for the same period last year,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Tops-Q3-Earnings-Forecast-as-Its-US-Oil-Output-Jumps-to-Record.html |

|

Stocks climb to start November as traders look past weak jobs report: Live updatesStocks climbed to kick off November as Amazon led big technology stocks into the green and traders looked past a disappointing jobs report. Read more at: https://www.cnbc.com/2024/10/31/stock-market-today-live-updates.html |

|

Here’s where the jobs are for October 2024 – in one chartThe jobs report for October came in much weaker than expected, and employment growth across different industries painted a mixed picture for the U.S. economy. Read more at: https://www.cnbc.com/2024/11/01/heres-where-the-jobs-are-for-october-2024-in-one-chart.html |

|

IRS announces 401(k) contribution limits for 2025The IRS has announced higher 401(k) contribution limits for 2025. Here’s what savers need to know. Read more at: https://www.cnbc.com/2024/11/01/401k-contribution-limits-2025.html |

|

Google employees pressure costumed execs at all-hands meeting for clarity on cost cutsFollowing comments on Google’s earnings call about continuing cuts, employees wanted answers at the company’s latest all-hands meeting. Read more at: https://www.cnbc.com/2024/11/01/google-employees-pressure-execs-at-all-hands-for-clarity-on-cost-cuts.html |

|

Election next week holds big implications for stock market, especially the control of CongressThe Nov. 5th election is set to remove a critical overhang for markets. Read more at: https://www.cnbc.com/2024/11/01/stock-market-next-week-outlook-for-november-4-8-2024.html |

|

Super Micro’s 44% plunge this week wipes out stock’s gains for the yearSuper Micro investors have been fleeing for the exits this week after the company lost its second auditor in less than two years. Read more at: https://www.cnbc.com/2024/11/01/super-micros-44percent-plunge-this-week-wipes-out-stocks-gains-for-the-year.html |

|

Bitcoin slips below $70,000 after notching 12% gain in October: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Kevin Lehtiniitty of Borderless.xyz shares his outlook for the crypto market and the broader industry in 2025. Read more at: https://www.cnbc.com/video/2024/11/01/bitcoin-slips-below-70000-after-notching-12percent-gain-in-october-cnbc-crypto-world.html |

|

Elon Musk $1 million voter lottery suit sent back to state courtTesla CEO Elon Musk and his America PAC have backed Donald Trump in the presidential election against Kamala Harris. Read more at: https://www.cnbc.com/2024/11/01/elon-musk-1-million-voter-lottery-suit-sent-back-to-state-court.html |

|

IRS unveils IRA contribution limits for 2025The IRS has announced IRA contribution limits for 2025. Here’s what investors need to know. Read more at: https://www.cnbc.com/2024/11/01/ira-contribution-limits-2025.html |

|

Jobless rate ticks higher in October for white Americans, bucking the broader trendThe unemployment rate for white workers crept higher in October, running counter to the overall trend. Read more at: https://www.cnbc.com/2024/11/01/jobless-rate-ticks-higher-in-october-for-white-americans-bucking-the-broader-trend.html |

|

Record numbers of wealthy Americans are making plans to leave the U.S. after the electionAttorneys and advisors to family offices and high-net-worth families said they’re seeing record demand from clients looking for second passports or long-term residencies abroad. Read more at: https://www.cnbc.com/2024/11/01/wealthy-americans-plans-leaving-united-states.html |

|

‘All hell has broken loose’: Inside Elon Musk’s high-stakes pro-Trump door-knocking effortMore than a half-dozen operatives and canvassers connected to America PAC described an inordinate number of suspect entries and having to canvass during Hurricane Helene. Read more at: https://www.cnbc.com/2024/11/01/inside-elon-musks-high-stakes-pro-trump-door-knocking-effort.html |

|

Amazon shares jump 7%, approach record after earnings beatAmazon’s latest upbeat results were driven by growth in cloud and digital advertising. Read more at: https://www.cnbc.com/2024/11/01/amazon-shares-jump-after-q3-earnings-beat.html |

|

Newly Obtained Transcript Implicates Local Snipers In Butler Security FailuresAuthored by Ken Silva via Headline USA, There were two snipers posted inside the second floor of the AGR building used by alleged gunman Thomas Crooks to shoot at Donald Trump. Both failed to spot Crooks before his assassination attempt.

Read more at: https://www.zerohedge.com/political/newly-obtained-transcript-implicates-local-snipers-butler-security-failures |

|

Refugees Of California Leftism Could Deliver Nevada To TrumpIf swing-state Nevada goes for Donald Trump in 2024, a decisive role may be played by a critical but widely under-examined constituency: ex-Californians who fled spiraling West Coast leftism and are now nudging Nevada rightward, Politico reports. Early voting data from Nevada has already sent Republican hopes of securing the state’s six electoral votes soaring. Through Thursday — the penultimate day of early voting — the number of registered Republicans who’ve cast a ballot exceeds the Democrats’ tally by 47,300, or 5.1 percent. That’s a complete turning of the tables, as it’s usually Democrats who’ve banked a majority of the votes before Election Day. The GOP has built that lead not through the mail, but by a level of Republican in-person turnout that veteran Nevada political reporter and full-on leftist Jon Ralston has called “startling.”

|

|

Zelensky Hints Poland Is Cowardly, Claims “They Didn’t Even Dare” Shoot Down Russian MissilesBy Remix News Volodymyr Zelensky accused Poland of finding more reasons not to help Ukraine on key issues, including refusing to shoot down Russian missiles or hand over MiG fighter jets to Kyiv. His choice of words, which hints at cowardice on Poland’s part, is likely to further inflame tensions between the two countries, which have been steadily growing apart.

The Ukrainian leader used words like “scared” while speaking about Poland and other NATO countries during a meeting with the heads of the territorial communities and oblasts of Zakarpattia. In addition, he singled out Poland, saying they “didn’t even dare” shoot down Russian missiles. “NATO countries are afraid to make decisions on their own. We have good relations with Poland – Polish citize … Read more at: https://www.zerohedge.com/markets/zelensky-hints-poland-cowardly-claims-they-didnt-even-dare-shoot-down-russian-missiles |

|

Obama FBI Ran Off-The-Books ‘Honeypot’ Operation On Trump Campaign In 2015: WhistleblowerA whistleblower has told the House Judiciary Committee that the Obama FBI launched an off-the-books operation targeting Donald Trump and his campaign as soon as he announced his bid for the White House in 2015.

The operation, ordered by then-FBI Director James B. Comey, predicated the Crossfire Hurricane operation. According to an FBI agent involved in the clandestine criminal investigation, Comey sent two female FBI undercover agents to infiltrate Trumps 2016 campaign at high levels, who were directed to act as “honeypots” while traveling with Trump and his campaign staff on the trail, the Washington Times reports.

|

|

Stamp duty change expected to spark homebuying rushNationwide predicts a fifth of first time buyers will pay the tax going forward, affecting activity. Read more at: https://www.bbc.com/news/articles/cq52z84v0gyo |

|

Investors’ reaction to Budget ‘very different’ to TrussTreasury secretary speaks out to reassure the markets after a rise in the cost of government borrowing. Read more at: https://www.bbc.com/news/articles/cx2n0eeep90o |

|

Rachel Reeves doesn’t mind if you don’t like her BudgetThe Budget is about the long game on the economy and Reeves believes the current pain is a price worth paying. Read more at: https://www.bbc.com/news/articles/c39nvkl47k9o |

|

Muhurat Trading Day: Sensex closed positive 8 of 10 times on this dayMuhurat trading during Diwali is seen as a symbol of new beginnings and prosperity. Investors believe that trades made during this time will bring good returns. The Sensex has shown positive growth, and experts predict continued growth amidst market volatility. Nifty is expected to aim for 28,400 by Diwali 2025 despite moderating corporate earnings. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/muhurat-trading-day-sensex-closed-positive-8-of-10-times-on-this-day/articleshow/114844252.cms |

|

Tech View: Nifty forms red candle on daily chart, suggesting weakness. What traders should do on FridayNifty opened flat and traded within a narrow range, closing negatively at 24,205, noted Hrishikesh Yedve from Asit C. Mehta Investment Intermediates. He highlighted that the Nifty Smallcap 100 index outperformed the benchmarks, gaining around 1.15% Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-red-candle-on-daily-chart-suggesting-weakness-what-traders-should-do-on-friday/articleshow/114818133.cms |

|

Brigade Hotel Ventures files DRHP for Rs 900 crore IPOBrigade Hotel Ventures has filed a DRHP to raise Rs 900 crore via IPO, targeting debt repayment, acquisitions, and expansion of its hotel portfolio across India. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/brigade-hotel-ventures-files-rs-900-crore-ipo/articleshow/114812534.cms |

|

Hoping for a weight-loss pill? It could get closer to reality next week.Viking Therapeutics Inc.’s stock rose 2% Friday as excitement continued to build about data on its oral weight-loss drug the company will present at the upcoming Obesity Week event. Read more at: https://www.marketwatch.com/story/hoping-for-a-weight-loss-pill-it-could-be-closer-to-reality-next-week-89ce915a?mod=mw_rss_topstories |

|

This surprising investment strategy could boost your retirement nest egg—but proceed with cautionMost people want to play it safe with their retirement nest egg — but they could also lose ground that way. Read more at: https://www.marketwatch.com/story/play-it-safe-in-retirement-why-taking-on-more-investment-risk-isnt-as-crazy-as-it-sounds-ac0e1045?mod=mw_rss_topstories |

|

Oil prices lifted by report Iran may be planning another major strike on IsraelOil futures finished higher on Friday, finding support after a news report that Iran may be planning another major strike on Israel. Read more at: https://www.marketwatch.com/story/oil-prices-lifted-by-report-iran-may-be-planning-another-major-strike-on-israel-badb69d4?mod=mw_rss_topstories |

Footage shows the ‘bullseye’ shot that would-be assassin Thomas Crooks hoped to take on former President Donald Trump a moment before he turned his head at a July 2024 rally in Butler, Pa. / IMAGE: @MarioNawfal via Twitter; graphic editing by Ben Sellers, Headline USAEver since then, excuses have been made for the failure of the local snipers, Greg Nicol and Mike Murcko.

Footage shows the ‘bullseye’ shot that would-be assassin Thomas Crooks hoped to take on former President Donald Trump a moment before he turned his head at a July 2024 rally in Butler, Pa. / IMAGE: @MarioNawfal via Twitter; graphic editing by Ben Sellers, Headline USAEver since then, excuses have been made for the failure of the local snipers, Greg Nicol and Mike Murcko.