Summary Of the Markets Today:

- The Dow closed down 378 points or 0.90%,

- Nasdaq closed down 513 points or 2.76%,

- S&P 500 closed down 108 points or 1.86%,

- Gold $2,757 down $44.20 or 1.59%,

- WTI crude oil settled at $71 up $1.93 or 2.81%,

- 10-year U.S. Treasury 4.282 up 0.016 points or 0.113%,

- USD index $103.90 down $0.01 or 0.01%,

- Bitcoin $69,969 down $1,973 or 2.82%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The US stock market experienced a significant decline on Thursday, led by the tech-heavy Nasdaq Composite. The S&P 500 and the Dow Jones ended October slightly in the red. Big Tech Earnings Concerns Meta and Microsoft’s earnings reports sparked worries about Big Tech prospects. Both companies beat Wall Street estimates but flagged increased spending on AI infrastructure. Concerns about pressure on profitability led to share price drops for Meta and Microsoft. This unsettled mood affected other tech giants like Amazon, Apple, and Nvidia. Amazon and Apple are set to report earnings after market close today. Bond yields surged, with the 10-year Treasury yield climbing to 4.33%. The Personal Consumption Expenditures (PCE) index showed core inflation at 2.7% annually in September, higher than expected.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

NFIB’s October jobs report found that 35% (seasonally adjusted) of small business owners reported job openings they could not fill in October, up one point from September’s lowest reading since January 2021. The percent of small business owners reporting labor quality as their top operating problem rose three points from September to 20%. NFIB Chief Economist Bill Dunkelberg added:

On Main Street, the job market remains challenging. Although the labor market appears to be softening overall, small business owners reported little success filling their plentiful vacancies in October.

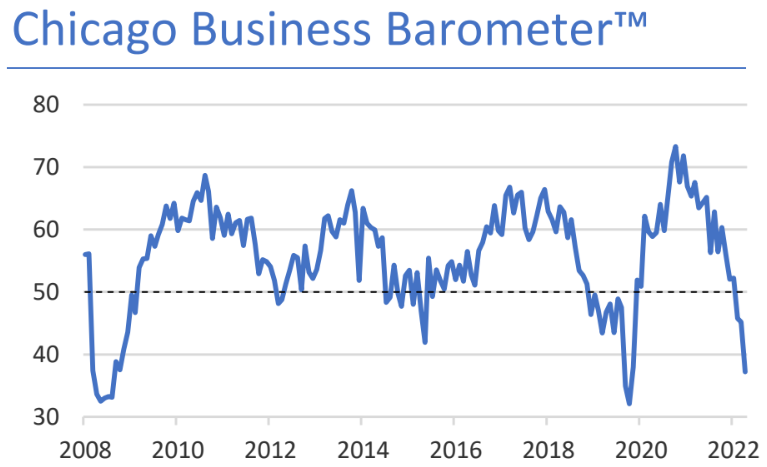

The Chicago Business Barometer™ dropped 5.0 points to 41.6 in October 2024 after edging up for two consecutive months, making the barometer the lowest since May 2024, and 1.6 points below the year-to-date average. Not sure what is going on here as I would call this a recession flag EXCEPT it is a survey – not fact but opinion.

Real Disposable Personal Income is up3.1% year-over-year (unchanged from last month) whilst Real Personal Consumption Expenditures is up 3.1% year-over-year (up from 3.0% from last month). Inflation measured by the PCE price index is 2.1% (improved from 2.3% last month) whilst the all important PCE price index less food and energy was little changed at 2.7%. This data was a touch stronger than I expected by aligns with the slight improvement in my October Economic Forecast. Also note that the inflation index used by the Federal Reserve (the one less food and energy) was little changed.

In the week ending October 26, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 236,500, a decrease of 2,250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 238,500 to 238,750. This unemployment data is not recessionary.

U.S.-based employers announced 55,597 cuts in October 2024, down 23.7% from the 72,821 cuts announced one month prior. It is 51% higher than the 36,836 cuts announced in the same month in 2023. October’s total marks the seventh time this year job cut announcements are higher than the corresponding month one year prior. These numbers are somewhat elevated and support my position that economic growth is weak.

Here is a summary of headlines we are reading today:

- Aston Martin’s Pre-Tax Losses Plummet by 90% in Q3

- North Korea’s Surprise Involvement in Ukraine War is Bad News for China

- Record Shale Production Helps ConocoPhillips Beat Profit Estimates

- Oil Prices Rebound, But Henry Hub Nat Gas Still Taking a Beating

- New Survey Shows Grim Outlook For Oil Markets

- Regulatory Uncertainty Casts Shadow Over U.S. LNG Industry

- IMF Cuts Middle East Growth Outlook on Oil Output Cuts and Conflicts

- Amazon shares pop on earnings beat, cloud growth

- Intel shares pop 12% on earnings beat, uplifting guidance

- Microsoft’s stock has worst day in two years after disappointing forecast

- Key inflation rate hits 2.1% in September, as expected, closing in on Fed target

- Bitcoin retreats to $70,000 to close out October: CNBC Crypto World

- Coinbase drops 15% after earnings, posts worst day in more than two years

- Stock market suffers a Halloween selloff as tech investors get the chills

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Rystad Energy’s 2024 Report: Global Energy Transformation Gains MomentumThe energy transition is gaining momentum, and the industry is accelerating toward a widespread, fundamental global evolution. Rystad Energy is proud to release its flagship annual report – Global Energy Scenarios 2024 – which concludes that the goal of limiting global warming to 1.6 degrees Celsius above pre-industrial levels is a monumental task, but still achievable. The global energy system is set for transformational change in the coming decades. Solar, wind and battery costs are continuing to drop at unprecedented speed, and capacity… Read more at: https://oilprice.com/Energy/Energy-General/Rystad-Energys-2024-Report-Global-Energy-Transformation-Gains-Momentum.html |

|

Aston Martin’s Pre-Tax Losses Plummet by 90% in Q3Aston Martin’s pre-tax loss was 90 percent lower during its latest financial period, boosted by a rise in wholesale volumes. The Warwickshire-headquartered luxury car maker has reported a pre-tax loss of £12.2m for its third quarter, down from the £117.6m loss it posted during the same three-month period in 2022. New figures filed with the London Stock Exchange also show that Aston Martin’s revenue increased by eight percent to £391.6m over the same period. In a statement, the company said that it has been battling supply… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Aston-Martins-Pre-Tax-Losses-Plummet-by-90-in-Q3.html |

|

North Korea’s Surprise Involvement in Ukraine War is Bad News for ChinaAfter weeks of headlines about Pyongyang’s decision to dispatch thousands of troops to fight alongside Russia in Ukraine, NATO and the Pentagon said this week that North Korean soldiers are in Kursk, the Russian region partly controlled by Ukrainian troops. Here’s why that’s important for China. Finding Perspective: The Pentagon said North Korea has sent more than 10,000 troops to Russia to train and fight in the Ukraine war within “the next several weeks,” while NATO Secretary-General Mark Rutte confirmed after a… Read more at: https://oilprice.com/Geopolitics/International/North-Koreas-Surprise-Involvement-in-Ukraine-War-is-Bad-News-for-China.html |

|

Nuclear Threats Boost Russia’s Military PerceptionUS News & World Report might be best known these days for its ranking of top universities and colleges. But the organization is also in the business of ranking the world’s “strongest militaries,” and its survey for 2024 has Russia occupying the top spot as the globe’s most powerful army. US News ranked militaries as part of a broader survey of the world’s “best countries.” Though supposedly possessing the strongest military establishment in the world, Russia ranked only 36th of 89 countries surveyed… Read more at: https://oilprice.com/Geopolitics/International/Nuclear-Threats-Boost-Russias-Military-Perception.html |

|

Record Shale Production Helps ConocoPhillips Beat Profit EstimatesConocoPhillips (NYSE: COP) is raising its ordinary dividend and share buyback program as its third-quarter earnings beat market expectations on the back of higher total oil and gas production and record output in the U.S. shale patch. The U.S. oil and gas producer reported on Thursday adjusted earnings per share of $1.78 for the third quarter, down from $2.16 EPS a year earlier, but above the analyst consensus estimate of $1.65 compiled by The Wall Street Journal. Higher crude oil and natural gas production helped ConocoPhillips offset the lower… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Record-Shale-Production-Helps-ConocoPhillips-Beat-Profit-Estimates.html |

|

Slow Sales Force Stellantis to Hit Brakes on SUV ProductionSigns from the auto industry continue to look grim. Tuesday it was Ford guiding expectations below Wall Street’s estimates and yester it’s Stellantis announcing it is pausing production of its Durango and Grand Cherokee models due to “slow sales”. Manufacturing facilities at FCA’s large Detroit Assembly Complex – Jefferson will be paused for a week, Motor 1 reported. Stellantis told its workers there would be a ‘temporary shutdown’ and ‘subsequent layoffs’ as a result. Mopar Insiders first posted the “Important Notice of Layoff” memo, which said:… Read more at: https://oilprice.com/Energy/Energy-General/Slow-Sales-Force-Stellantis-to-Hit-Brakes-on-SUV-Production.html |

|

Oil Prices Rebound, But Henry Hub Nat Gas Still Taking a BeatingU.S oil and gas prices have taken divergent trajectories, with oil prices rebounding while natural gas prices have continued to fall in Thursday’s session. Oil and gas prices crashed on Monday, with benchmark crude oil futures falling to their biggest one-day decline in more than two years after Israel launched limited attacks on Iran that disappointed markets, followed by Tehran stating it would not retaliate with a direct response. However, oil prices have pared back some of the losses with nearly a percentage point in gains. Brent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Rebound-But-Henry-Hub-Nat-Gas-Still-Taking-a-Beating.html |

|

Rosneft to Resume Output at Idled Black Sea Refinery in NovemberRosneft plans to resume crude processing at its Tuapse oil refinery on Russia’s Black Sea coast in November, after idling it for a month because of poor refining margins, industry sources told Reuters on Thursday. The export-oriented refinery has halted crude processing since October 1 because of low refining margins, industry sources told Reuters in early October. In November, the refinery is expected to resume operations and process into fuels as much as 480,000 metric tons of crude oil, traders told Reuters. The Tuapse refinery… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rosneft-to-Resume-Output-at-Idled-Black-Sea-Refinery-in-November.html |

|

New Survey Shows Grim Outlook For Oil MarketsA Reuters poll released Thursday paints a lackluster future for oil in 2025, with a cocktail of sluggish demand growth and supply glut concerns pulling prices down. Analysts now see Brent crude averaging $80.55 per barrel this year and $76.61 in 2025— a steady downgrade from earlier projections. The pessimistic shift stems from a trio of factors. China’s lukewarm demand, despite its role as the world’s top oil consumer, casts a long shadow. Meanwhile, oil supplies from key producers are poised to swell, especially with OPEC+ eyeing… Read more at: https://oilprice.com/Energy/Crude-Oil/New-Survey-Shows-Grim-Outlook-For-Oil-Markets.html |

|

Canadian Natural Resources Q3 Profit Slips as Oil and Gas Prices FallCanada’s largest oil and gas producer, Canadian Natural Resources (NYSE: CNQ), reported lower adjusted net earnings from operations for the third quarter compared to a year earlier amid plunging natural gas prices in North America and lower international crude oil prices. Canadian Natural said on Thursday that its adjusted net earnings from operations for the third quarter stood at US$1.5 billion (C$2.1 billion), down compared with US$2 billion (C$2.85 billion) for the third quarter of 2023. The oil and gas producer attributed the decline… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadian-Natural-Resources-Q3-Profit-Slips-as-Oil-and-Gas-Prices-Fall.html |

|

Panama Canal Bets on Asian Demand to Boost Flailing LNG TrafficAfter a year of traffic restrictions and upended global trade flows due to geopolitical shifts, the Panama Canal – the fastest route for American LNG to Asia – is introducing a new long-term booking system, hoping to attract larger volumes of U.S. LNG traffic. “In the case of LNG, we lost 65% (of traffic), which is the traffic that now goes through Cape Horn, compared to what we had last year, two years ago,” Panama Canal administrator, Ricaurte Vásquez Morales, told Reuters in an interview in Panama City. The Panama… Read more at: https://oilprice.com/Energy/Energy-General/Panama-Canal-Bets-on-Asian-Demand-to-Boost-Flailing-LNG-Traffic.html |

|

Cheniere Energy Q3 Earnings Dip on Lower LNG and Gas PricesThe biggest U.S. LNG exporter, Cheniere Energy Inc (NYSE: LNG), reported on Thursday a decline in third-quarter revenues and profits amid decreased market volatility and lower international LNG and natural gas prices. Cheniere Energy booked $3.763 billion in total revenues for Q3, down from $4.159 billion for the same period last year. LNG revenues dropped to $3.554 billion from $3.974 billion, amid “significant declines of historic volatility in international gas prices and moderated and sustained spot prices in the current periods relative… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Cheniere-Energy-Q3-Earnings-Dip-on-Lower-LNG-and-Gas-Prices.html |

|

Regulatory Uncertainty Casts Shadow Over U.S. LNG IndustryAuthored by Tristan Abbey via RealClearEnergy, It should go without saying that natural gas in normal conditions doesn’t liquify itself. It’s a shame the Biden-Harris administration acts as if it does. When the gas comes out of the ground it must be captured immediately, transported by pipeline to a processing plant, processed, fed into another pipeline, and transported to a liquefaction facility, where it is super-cooled to 260 degrees below zero (Fahrenheit) and becomes a liquid. But that’s only half the deal. After it is liquified,… Read more at: https://oilprice.com/Energy/Natural-Gas/Regulatory-Uncertainty-Casts-Shadow-Over-US-LNG-Industry.html |

|

TotalEnergies Misses Profit Forecast on Weak Refining and Low Oil PricesWeak refining margins, lower LNG production, and declining oil prices weighed on the third-quarter earnings of TotalEnergies (NYSE: TTE), which came below expectations. TotalEnergies reported on Thursday an adjusted net income of $4.1 billion for the third quarter, down by 13% from the second quarter, and down from $6.45 billion a year earlier. The earnings, TotalEnergies’s lowest quarterly profit in three years, missed the analyst estimate of $4.27 billion. After the results were published, TotalEnergies shares slumped by 2.5% in Paris and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Misses-Profit-Forecast-on-Weak-Refining-and-Low-Oil-Prices.html |

|

IMF Cuts Middle East Growth Outlook on Oil Output Cuts and ConflictsEconomic growth in the Middle East and North Africa is expected to remain sluggish at 2.1% this year, amid ongoing conflicts and prolonged OPEC+ oil production cuts, the International Monetary Fund (IMF) said on Thursday, slashing its GDP growth view by 0.6 percentage point compared to an April forecast. High uncertainty over economic growth in the MENA region in the near and medium term persists, with key risks including escalating conflicts, increased geo-economic fragmentation, and commodity price volatility, the IMF said in its latest regional… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IMF-Cuts-Middle-East-Growth-Outlook-on-Oil-Output-Cuts-and-Conflicts.html |

|

Amazon shares pop on earnings beat, cloud growthAmazon reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2024/10/31/amazon-amzn-q3-earnings-report-2024.html |

|

Apple to report earnings as investors worry about ‘mixed’ iPhone demandIt’s the end of Apple’s fiscal year, and the first quarter with some sales from the September launch of the iPhone 16. Read more at: https://www.cnbc.com/2024/10/31/apple-aapl-q4-earnings-report-2024.html |

|

Intel shares pop 12% on earnings beat, uplifting guidanceIntel reported better-than-expected revenue following a quarter filled with challenges. Read more at: https://www.cnbc.com/2024/10/31/intel-intc-q3-earnings-report-2024.html |

|

S&P 500 and Nasdaq suffer their worst day in over a month, led lower by tech: Live updatesTraders reviewed results from Microsoft and Meta Platforms and looked toward the latest jobs report. Read more at: https://www.cnbc.com/2024/10/30/stock-market-today-live-updates.html |

|

Microsoft’s stock has worst day in two years after disappointing forecastMicrosoft’s stock fell more than 6% on Thursday after guidance fell short of analysts’ estimates. Read more at: https://www.cnbc.com/2024/10/31/microsoft-stock-has-worst-day-in-two-years-on-disappointing-forecast.html |

|

Key inflation rate hits 2.1% in September, as expected, closing in on Fed targetThe personal consumption expenditures price index was expected to increase 0.2% in September and 2.1% from a year ago. Read more at: https://www.cnbc.com/2024/10/31/pce-inflation-september-2024-.html |

|

Super Micro’s $50 billion stock collapse underscores risk of AI hypeSince being added to the S&P 500 in March, Super Micro has lost about two-thirds of its value and now faces the risk of Nasdaq delisting. Read more at: https://www.cnbc.com/2024/10/31/super-micros-50-billion-stock-collapse-underscores-risk-of-ai-hype.html |

|

OpenAI CEO Sam Altman says new AI model is taking a while because ‘we can’t ship’ as quickly as hopedOpenAI CEO Sam Altman said that GPT-5, the company’s next probable large AI model, likely won’t come this year. Read more at: https://www.cnbc.com/2024/10/31/openais-sam-altman-says-new-ai-model-taking-a-while-hard-to-ship.html |

|

Comcast is exploring separation of cable networks businessNBCUniversal’s cable networks portfolio includes Bravo, E!, Syfy, Oxygen True Crime, USA Network, as well as news networks MSNBC and CNBC. Read more at: https://www.cnbc.com/2024/10/31/comcast-is-exploring-separation-of-cable-business.html |

|

Bitcoin retreats to $70,000 to close out October: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Crypto World’s MacKenzie Sigalos reports from Money 20/20 on the growing adoption of stablecoins, and Coinbase’s Faryar Shirzad explains why the company is committing money to the 2026 midterms. Read more at: https://www.cnbc.com/video/2024/10/31/bitcoin-retreats-to-70000-to-close-out-october-crypto-world.html |

|

Boeing strike will dent last jobs report before electionSome 44,000 U.S. workers, most at Boeing, were on strike during the jobs report tally, according to the U.S. Labor Department. Read more at: https://www.cnbc.com/2024/10/31/boeing-strike-will-dent-last-jobs-report-before-election.html |

|

Starbucks’ plan to return to its roots involves 200,000 SharpiesStarbucks CEO Brian Niccol is betting that more personal touches in its cafes will win back customers. Read more at: https://www.cnbc.com/2024/10/31/starbucks-plan-to-return-to-its-roots-involves-200000-sharpies.html |

|

Coinbase drops 15% after earnings, posts worst day in more than two yearsCoinbase slid a day after reporting weak earnings and gave a tepid revenue outlook. Read more at: https://www.cnbc.com/2024/10/31/crypto-market-today.html |

|

Modern Monetary Magic At WorkAuthored by Ed Yardeni & Eric Wallerstein via YardeniQuickTakes.com, Republican Everett Dirksen was the Senate Minority Leader during the 1960s. Cautioning that federal spending had a way of getting out of control, Dirksen reportedly observed, “A billion here, a billion there, and pretty soon you’re talking real money.” Proponents of Modern Monetary Theory (MMT) have been claiming in recent years that the US federal government can run large budget deficits to fund social welfare programs without any serious adverse economic or financial consequences.

MMT’s claim that a government that borrows in its own currency can finance its spending at will with more debt lost credibility as inflation soared in 2022 and 2023. But now it seems to be working. As much as we dislike MMT, we have to admit that tremendous fiscal stimulus by the current administrati … Read more at: https://www.zerohedge.com/economics/modern-monetary-magic-work |

|

‘Homes Are Still Overpriced, Unaffordable’ As Fed-Cut Sparks Mortgage-Rate Melt-UpThis wasn’t supposed to happen… Treasury yields have taken off rather dramatically since The Fed slashed rates by 50bps in mid-September…

…as the market seems to be screaming ‘policy error’ rather loud (or political pandering if you squint a little). But it’s not just Wall Street that is questioning The Fed’s actions, Main Street is hurting even more as mortgage rates have soared back near recent highs – crushing the optimism that The American Dream is back for some. As The Fed telegraphed its rate-cut (and then unleashed it), mortgage applications suddenly soared (after stagnating at multi-decade lows for months) amid optimism that the housing market was back and affordability might shift back into realm of possibility for many… Read more at: https://www.zerohedge.com/markets/home-are-still-overpriced-unaffordable-fed-cut-sparks-mortgage-rate-melt |

|

Lawsuit Over $1 Million Giveaways On Hold After Musk’s Legal ManeuverAuthored by Zachary Stieber and Sam Dorman via The Epoch Times, A lawsuit brought against Elon Musk over his randomly selected $1 million giveaways to registered voters has been placed on hold after lawyers for the billionaire removed the case to federal court.

Philadelphia County Court of Common Pleas Judge Angelo Foglietta on Oct. 31 said he was placing the case on hold after Musk’s lawyers late Wednesday removed it to the U.S. District Court for the Eastern District of Pennsylvania. Foglietta said during a hearing at Philadelphia’s City Hall that he was divested of jurisdiction because of the move. Musk celebrated the result with a post on his socia … Read more at: https://www.zerohedge.com/political/lawsuit-over-1-million-giveaways-hold-after-musks-legal-maneuver |

|

A Negative Jobs Print?We will provide a more detailed jobs report preview tonight, but following a catastrophic JOLTS report yesterday and a stellar weekly jobs report today, there appears to be a crescendo of confusion over what to expect tomorrow, with some saying a blowout number is coming while others are bracing for a negative print. So here is a quick take on what may be coming. October’s US non-farm payrolls will hit the wires tomorrow morning, just 4 days days ahead of the US presidential election. As SocGen’s Albert Edwards notes, amid scepticism about the recent strength of the data, a shockingly weak ‘payback’ month will make news headlines and likely affect the election outcome. It all started with Fed Governor Waller who two weeks ago first warned of a huge one-time drop in this month’s jobs report:

… Read more at: https://www.zerohedge.com/economics/negative-jobs-print |

|

Rachel Reeves doesn’t mind if you don’t like her BudgetThe Budget is about the long game on the economy and Reeves believes the current pain is a price worth paying. Read more at: https://www.bbc.com/news/articles/c39nvkl47k9o |

|

Workers warned Budget tax rises will hit their wagesEconomists say tax rises in the Budget will mean employers have less to give as pay rises. Read more at: https://www.bbc.com/news/articles/cgj72wxw8jxo |

|

UK borrowing costs at highest for a year after BudgetAnalysts say the rise in borrowing costs is a sign the markets aren’t happy about the increase in government spending. Read more at: https://www.bbc.com/news/articles/cx2n0eeep90o |

|

Tech View: Nifty forms red candle on daily chart, suggesting weakness. What traders should do on FridayNifty opened flat and traded within a narrow range, closing negatively at 24,205, noted Hrishikesh Yedve from Asit C. Mehta Investment Intermediates. He highlighted that the Nifty Smallcap 100 index outperformed the benchmarks, gaining around 1.15% Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-red-candle-on-daily-chart-suggesting-weakness-what-traders-should-do-on-friday/articleshow/114818133.cms |

|

Brigade Hotel Ventures files DRHP for Rs 900 crore IPOBrigade Hotel Ventures has filed a DRHP to raise Rs 900 crore via IPO, targeting debt repayment, acquisitions, and expansion of its hotel portfolio across India. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/brigade-hotel-ventures-files-rs-900-crore-ipo/articleshow/114812534.cms |

|

Matrimony.com Rs 72 crore share buyback offer now open, closes acceptance on November 6Matrimony.com’s Rs 72 crore share buyback is open for eligible shareholders from October 30 to November 6. Only shareholders on record as of October 25 are eligible. The deadline to submit bids is November 6, with settlement by November 12. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/matrimony-com-rs-72-crore-share-buyback-offer-now-open-closes-acceptance-on-november-6/articleshow/114814014.cms |

|

Echoes of U.K.’s 2022 bond crisis weigh on Treasury market ahead of U.S. electionA selloff in the U.K. bond market on Thursday, triggered by concerns about planned government borrowing, sent the country’s yields higher in a manner slightly reminiscent of the 2022 gilt crisis and has begun to weigh on the minds of some Treasury-market participants. Read more at: https://www.marketwatch.com/story/echoes-of-u-k-s-2022-bond-crisis-weigh-on-treasury-market-ahead-of-u-s-election-2c1a38a8?mod=mw_rss_topstories |

|

Stock market suffers a Halloween selloff as tech investors get the chillsA confluence of frightful factors sank stocks on the final day of October. Read more at: https://www.marketwatch.com/story/stock-market-suffers-a-halloween-selloff-as-tech-investors-get-the-chills-e3a7274d?mod=mw_rss_topstories |

|

Oil prices end higher as risk of Iranian strike on Israel growsOil futures finished higher on Thursday, contributing to a gain for the month, as traders weighed the growing risk of an Iranian attack on Israel that would further fuel tensions in the oil-rich Middle East. Read more at: https://www.marketwatch.com/story/oil-prices-find-footing-on-strong-u-s-fuel-demand-f97648cf?mod=mw_rss_topstories |