Summary Of the Markets Today:

- The Dow closed down 92 points or 0.22%,

- Nasdaq closed down 105 points or 0.56%, (Closed at 18,608, New Historic high 18,785)

- S&P 500 closed down 19 points or 0.33%,

- Gold $2,798 up $17.10 or 0.63%,

- WTI crude oil settled at $69 up $1.71 or 2.53%,

- 10-year U.S. Treasury 4.280 up 0.006 points or 0.051%,

- USD index $104.06 down $0.25 or 0.24%,

- Bitcoin $71,820 down $3,878 or 0.54%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The major US stock indexes closed lower after fluctuating throughout the trading session. Alphabet’s (GOOG, GOOGL) strong quarterly results boosted optimism for Big Tech with Alphabet shares jumping nearly 3% Amazon (AMZN), Meta (META), and Microsoft (MSFT) saw smaller gains Investors eagerly await after-hours earnings reports from Meta and Microsoft. Fresh economic data provided mixed signals: US economic growth slowed to a 2.8% annualized rate last quarter, slightly below forecasts Consumer spending remained robust as inflation continued to fall. ADP report showed a surge in US private payroll growth for October. Reddit (RDDT) stock soared over 40% after reporting its first-ever profit as a public company and beating revenue expectations.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Private employers added 233,000 jobs in October 2024 according to ADP. The largest growth was in the services sector with the manufacturing sector losing 19,000 jobs. Even I am surprised at the high jobs growth for a variety of reasons. This boosts the chance that Friday’s jobs report from the BLS will be strong also. Nela Richardson, Chief Economist ADP opinion:

Even amid hurricane recovery, job growth was strong in October. As we round out the year, hiring in the U.S. is proving to be robust and broadly resilient.

The advance estimate of 3Q2024 Real Gross Domestic Product (GDP) came in at 2.7% growth year-over-year – down from the 2Q2024’s 3.0%. The inflation indicator (Implicit Price Deflator) moderated from 2.6% year-over-year to 2.2%. It appears that inflation in the elements that make up GDP are moderating – all whilst GDP is slowing. Remember buying anything used (most houses and cars sold are used) or imported items ares not included in GDP, and insurance and payouts in GDP is somewhat complex. But tomorrows Personal Income and Expenditures DOES include used and imported items. All this is why GDP is not an important metric for Joe and Jane Sixpack to understand how the economy is doing for them personally.

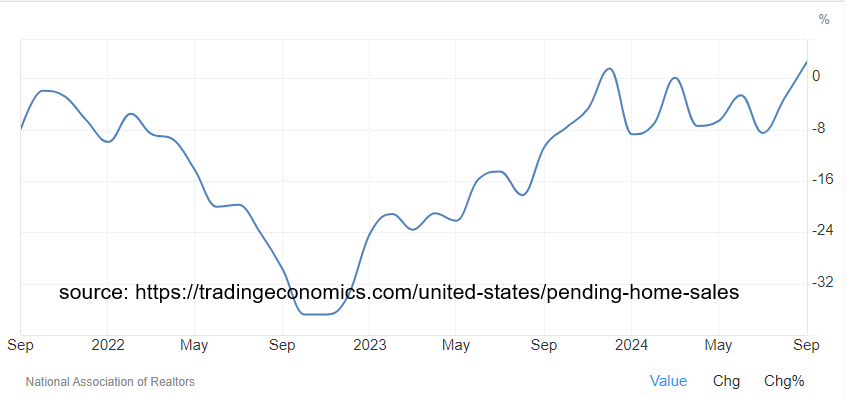

Pending home sales in September 2024 increased by 2.6% year-over-year, the first increase since March, and the fastest increase since May 2021. Literally, pending home sales since 2022 have been down 25% from the previous 10 year period. I can see no recovery for home sales without some combination of lower mortgage rates and/or home prices.

Here is a summary of headlines we are reading today:

- Hess Beats Q3 Earnings Estimates On Robust Guyana Output

- U.S. Governors Demand Power Price Overhaul As Costs Balloon 10 Fold

- Mapping the Flow of Goods Through the Taiwan Strait

- Oil Steady After EIA Confirms Draw in Crude, Gasoline Inventories

- The West Needs Incentives to Cut Russian Nuclear Fuel Dependence

- Microsoft beats on top and bottom lines, driven by better-than-expected cloud growth

- Meta beats on top and bottom lines but misses user growth expectations

- Super Micro shares plunge 33% as auditor resigns after raising concerns months earlier

- Reddit shares close up 42% on profitability, rosy guidance

- Inflation is cooling, yet many Americans are still living paycheck to paycheck

- U.S. economy grew at a 2.8% pace in the third quarter, less than expected

- Here’s why some NBA teams show their games on TV for free, while others charge fans hundreds of dollars

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Kazakhstan Seeks New Markets as Exports to China SlowExports of Kazakhstan’s key agricultural product – wheat – have plunged by almost 40 percent during the first eight months of 2024 over the previous year’s total for the same period. The price of Kazakh wheat is being undercut by Russia. Kazakh farmers exported just over 3 million tons of wheat during the January-August timeframe, Vice Minister of Trade and Integration Kairat Torebayev announced at a government meeting. The lower export volume is due in part to a comparatively modest harvest. But Torebayev added that… Read more at: https://oilprice.com/Geopolitics/International/Kazakhstan-Seeks-New-Markets-as-Exports-to-China-Slow.html |

|

Israel’s Actions In Gaza And Lebanon Draw International ScrutinyIsrael’s wars in the Gaza Strip and Lebanon have strained its relations with Europe, its traditional ally. European countries have criticized Israel for its devastating yearlong war in the Palestinian enclave and its destructive aerial bombardment and ground invasion of Lebanon.There have been growing calls for an arms embargo on Israel, sanctions on far-right members of the Israeli government, and requests to review the European Union’s trade deal with Israel.Pier Camillo Falasca, senior fellow at the Euro-Gulf Information Centre think… Read more at: https://oilprice.com/Geopolitics/International/Israels-Actions-In-Gaza-And-Lebanon-Draw-International-Scrutiny.html |

|

Hess Beats Q3 Earnings Estimates On Robust Guyana OutputLeading U.S. shale operator, Hess Corp. (NYSE:HES), has posted yet another impressive earnings report, with its stake in prolific Guyana helping it exceed estimates. Hess reported Q3 2024 non-GAAP EPS of $2.14, beating the Wall Street consensus by $0.37 while revenue of $3.2B (+12.7% Y/Y) beat by $160M. The company’s profits, however, fell slightly due to lower oil and gas prices: net income during the quarter clocked in at $498 million, or $1.62 per share, compared with net income of $504 million, or $1.64 per share, in the third quarter… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hess-Beats-Q3-Earnings-Estimates-On-Robust-Guyana-Output.html |

|

Eurozone Economy Exceeds Expectations with Strong Q3 GrowthThe eurozone grew twice as fast as economists expected in the third quarter, new figures show, as Germany managed to skirt a recession. New ‘flash’ figures released by Eurostat showed that the bloc grew 0.4 per cent between July and September, accelerating from 0.2 per cent in the second quarter. The figures showed that the French economy saw an Olympics boost in the period while Germany, the bloc’s largest economy, outperformed expectations with quarterly growth of 0.2 per cent. Most economists had expected it to shrink 0.2 per… Read more at: https://oilprice.com/Finance/the-Economy/Eurozone-Economy-Exceeds-Expectations-with-Strong-Q3-Growth.html |

|

U.S. Governors Demand Power Price Overhaul As Costs Balloon 10 FoldFive U.S. governors have demanded PJM Interconnection, the largest power grid operator in the U.S., revise its pricing system after its recent capacity auction delivered a staggering increase in power plant costs—up nearly 10-fold from last year—but PJM says the green transition is to blame. The auction, meant to secure enough electricity supply for 65 million people across 13 states, sent shockwaves through the market as PJM revealed the steep price tag for meeting rising demand amid dwindling supply. Households and businesses in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Governors-Demand-Power-Price-Overhaul-As-Costs-Balloon-10-Fold.html |

|

Chinese EV Market Poised for Year-End Sales SurgeDespite a massive price war and European nations doing their best to create a trade war, the Chinese EV market still looks like it will easily be crowned the best electric auto market in the world heading into the final months of 2024. China’s major EV makers ended Q3 stronger than last year, with solid deliveries reducing the need for discounts, according to a new report from Bloomberg. Now, analysts predict a sales surge in Q4. EV and hybrid sales are booming, driven by expanded subsidies, boosting stock prices and Tesla’s best Chinese… Read more at: https://oilprice.com/Energy/Energy-General/Chinese-EV-Market-Poised-for-Year-End-Sales-Surge.html |

|

Russia’s Gazprom Boosts 2024 Investments to $16.9 BillionGazprom is raising its investment plan for 2024 by 4% to $16.9 billion (1.642 trillion Russian rubles), thanks to rising exports and domestic supply, the Russian gas giant said after approving its new financial plan for the year. Previously, Gazprom was targeting investments of a total of $16.5 billion (1.574 trillion rubles) for 2024. The Russian company continues to develop key projects, including such aimed at boosting natural gas supply to China, Famil Sadygov, Deputy Chairman of the Management Committee at Gazprom, said in a statement carried… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Gazprom-Boosts-2024-Investments-to-169-Billion.html |

|

Mapping the Flow of Goods Through the Taiwan StraitWith China continuing to conduct military drills near Taiwan, as well as recently reaffirming that use of force will always remain an option to bring Taiwan under its control, concerns have grown over how potential Chinese actions in the region could impact global trade through the Taiwan Strait. This graphic, via Visual Capitalist’s Kayla Zhu, visualizes the share of exports and imports that move through the Taiwan Strait, broken down by the G7 and BRICS countries. The data comes from the Center for Strategic and International Studies (CSIS) and… Read more at: https://oilprice.com/Geopolitics/International/Mapping-the-Flow-of-Goods-Through-the-Taiwan-Strait.html |

|

Investment Giants Form $50-Billion AI and Power PartnershipGlobal investment firm KKR and private-equity giant Energy Capital Partners on Wednesday announced a $50 billion strategic partnership to invest in data centers and power generation to support the growth of artificial intelligence (AI). Energy Capital Partners, the largest private owner of power generation and renewables in the United States, will collaborate with KKR to speed up the development of data center infrastructure and power generation and transmission infrastructure to back the rapid expansion of AI and cloud computing globally. The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Investment-Giants-Form-50-Billion-AI-and-Power-Partnership.html |

|

Oil Steady After EIA Confirms Draw in Crude, Gasoline InventoriesCrude oil prices remained largely unchanged today, after the U.S. Energy Information Administration reported an inventory draw of a modest half a million barrels for the week to October 25. At the time of writing, Brent crude was trading at $72.25 per barrel, with WTI at $68.29 per barrel. The change in oil stocks compared with a build of 5.5 million barrels for the previous week, which pressured oil prices additionally at the time. The American Petroleum Institute, meanwhile, on Tuesday reported estimated inventory draws across crude and fuels,… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Steady-After-EIA-Confirms-Draw-in-Crude-Gasoline-Inventories.html |

|

Vietnamese EV Maker Gets $1 Billion in Funding Led by UAEVietnam’s electric vehicle manufacturer VinFast Auto is expected to receive at least $1 billion in overseas funding led by Emirates Driving Company (EDC), Abu Dhabi’s leading driver training and road safety institute, Bloomberg reported on Wednesday, quoting a source with knowledge of the agreement. VinFast and its parent company, Vingroup, earlier this week signed strategic partnerships with companies in the Middle East during an official visit of Vietnamese Prime Minister Pham Minh Chinh to the United Arab Emirates (UAE). The memoranda… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Vietnamese-EV-Maker-Gets-1-Billion-in-Funding-Led-by-UAE.html |

|

Oil Traders Uncertain as OPEC+ Weighs December SurpriseOil traders can’t seem to agree on where OPEC+ will steer production next, and it’s anyone’s guess if the cartel’s December hike is still on the table. OPEC+ has touted plans for a boost, but the group’s go-to mantra—adjusting output based on market ‘realities’—is giving traders pause. According to a Bloomberg poll published on Wednesday, 16 of 30 traders are betting that OPEC+ will hold off on the planned increase, deferring to Saudi Arabia’s top-down approach, where the Kingdom’s Energy Minister, Prince Abdulaziz bin Salman, wields… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Traders-Uncertain-as-OPEC-Weighs-December-Surprise.html |

|

The West Needs Incentives to Cut Russian Nuclear Fuel DependenceThe Western countries will need additional incentives and sanctions on Russia to reduce their dependence on the Russian supply of nuclear fuel, according to French company Orano, one of the top Western suppliers of enriched uranium. “To entirely disconnect from Russia, we need new capacities, and industrial groups will only invest if they have long-term contracts,” Orano’s CEO Nicolas Maes told the Financial Times in an interview published on Wednesday. France’s Orano and Urenco, a consortium created in 1970 by the governments… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-West-Needs-Incentives-to-Cut-Russian-Nuclear-Fuel-Dependence.html |

|

Gazprom Unit Sues Industrial Gases Giant Linde for $884 MillionA unit of Russian gas giant Gazprom is suing Linde, the world’s largest industrial gases company, in an $884 million (85.7 billion Russian rubles) claim over Linde’s withdrawal from a gas processing plant in east Russia. The subsidiary of Gazprom, which operates the new Amur Gas Processing Plant, has filed the claim at the Arbitration Court of the Amur Region in Russia, Reuters reported on Wednesday, citing court documents it had seen. Following the Russian invasion of Ukraine, Germany-based Linde said in 2022 that it would withdraw… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gazprom-Unit-Sues-Industrial-Gases-Giant-Linde-for-884-Million.html |

|

Chinese Oil Major to Explore Iraqi FieldChina’s CNOOC has inked a deal for exploration at an oil field in central Iraq, the company said today. The deposit, Block 7, will be managed by a fully owned subsidiary of the Chinese company, CNOOC Africa Holding, with the first phase of the work planned to take three years, Reuters reported. The deal follows CNOOC’s winning bid for Block 7 following a tender that the Iraqi government carried out earlier this year, where Chinese energy majors were the big winners, winning a total of four bids for nine oil and gas deposits. Chinese… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Oil-Major-to-Explore-Iraqi-Field.html |

|

Microsoft beats on top and bottom lines, driven by better-than-expected cloud growthMicrosoft reported better-than-expected results for the fiscal first quarter as Azure topped estimates. Read more at: https://www.cnbc.com/2024/10/30/microsoft-msft-q1-earnings-report-2025.html |

|

Meta beats on top and bottom lines but misses user growth expectationsMeta reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2024/10/30/meta-q3-earnings-report-2024.html |

|

Starbucks CEO pledges to fundamentally change strategy as sales fall for third straight quarterInvestors will be expecting to hear more details about CEO Brian Niccol’s strategy to revive the company’s U.S. business. Read more at: https://www.cnbc.com/2024/10/30/starbucks-sbux-q4-2024-earnings.html |

|

Meta’s Reality Labs posts $4.4 billion loss in third quarterMeta’s Reality Labs unit, which develops augmented and virtual reality technologies, logged an operating loss of $4.4 billion in the third quarter. Read more at: https://www.cnbc.com/2024/10/30/metas-reality-labs-posts-4point4-billion-loss-in-third-quarter.html |

|

Inflation report Thursday expected to show the Fed is getting closer to its goalThe annual pace of price increases is getting ever closer to the Federal Reserve’s 2% target. Read more at: https://www.cnbc.com/2024/10/30/inflation-report-thursday-expected-to-show-the-fed-is-getting-closer-to-its-goal.html |

|

Super Micro shares plunge 33% as auditor resigns after raising concerns months earlierErnst & Young resigned over accounting and governance concerns at the buzzy AI firm, which has faced regulatory scrutiny before. Read more at: https://www.cnbc.com/2024/10/30/super-micro-auditor-resigns-after-raising-concerns-months-earlier.html |

|

Eli Lilly’s Zepbound and Mounjaro are no longer in shortage. Here’s where their sales still disappointedEli Lilly blamed the misses on drug wholesalers cutting inventory of Zepbound and Mounjaro. Read more at: https://www.cnbc.com/2024/10/30/why-sales-of-eli-lillys-zepbound-and-mounjaro-fell-short.html |

|

Ray Dalio concerned about America postelection: ‘Both candidates worry me’Dalio, the founder of investment firm Bridgewater Associates, spoke at the Future Investment Initiative conference in Saudi Arabia on Wednesday. Read more at: https://www.cnbc.com/2024/10/30/ray-dalio-is-concerned-about-america-post-election-both-candidates-worry-me.html |

|

Reddit shares close up 42% on profitability, rosy guidanceReddit shares popped Wednesday, one day after the company reported rosy third-quarter results. Read more at: https://www.cnbc.com/2024/10/30/reddit-shares-soar-35percent-on-profitability-rosy-guidance-.html |

|

The Trump-linked stocks set to make wild moves as election approachesThese stocks have already seen wild swings — and the volatility could just be getting started. Read more at: https://www.cnbc.com/2024/10/30/the-trump-linked-stocks-set-to-make-wild-moves-as-election-approaches.html |

|

‘Inflation is like a regressive tax,’ economist says — only one group can ‘easily afford’ holiday spending this yearIf the thought of holiday spending makes you wince, you’re not alone. Only one group can easily afford this year’s costs, a report finds. Read more at: https://www.cnbc.com/2024/10/30/only-high-earners-can-easily-afford-holiday-spending-this-year.html |

|

Inflation is cooling, yet many Americans are still living paycheck to paycheckThe rate of inflation has come down from pandemic era highs. But many Americans are still waiting to feel financial relief. Read more at: https://www.cnbc.com/2024/10/30/many-americans-are-still-living-paycheck-to-paycheck-report-finds.html |

|

U.S. economy grew at a 2.8% pace in the third quarter, less than expectedGross domestic product was expected to increase at a 3.1% annualized pace in the third quarter. Read more at: https://www.cnbc.com/2024/10/30/us-gdp-q3-2024.html |

|

Hamas Rejects Ceasefire Proposal That Would Keep Israeli Troops In GazaVia Middle East Eye Hamas has rejected a ceasefire proposal that would have brought the release of a small number of Israeli captives and a 30-day cessation of hostilities, but no withdrawal of Israeli forces from the Gaza Strip. Sources close to the Palestinian group told Middle East Eye that they had officially dismissed the proposal put forward by Qatar, Egypt and the US, despite reports in Israeli media that it was still under consideration. Hamas has been adamant that any ceasefire deal must eventually lead to the total withdrawal of Israeli forces from the Gaza Strip.

Israel Defense Forces (IDF) handout photo, via AFP Egypt and Qatar have been acting as mediators between Israel and Hamas for months. In November, a prisoner swap deal led to the release of about 100 Israeli captives in exchange for about … Read more at: https://www.zerohedge.com/geopolitical/hamas-rejects-ceasefire-proposal-would-keep-israeli-troops-gaza |

|

Central Bank Digital Currency (CBDC) Projects Are Foundering In Five-Eye Nations. What Gives?Authored by Nick Corbishley via NakedCapitalism.com, Canada and Australia shelve plans for retail CBDCs while the US could soon become the first country to explicitly ban the central bank from issuing a CBDC.

As we warned in May 2022, a financial revolution is quietly sweeping the world (or at least trying to) that has the potential to reconfigure the very nature of money, making it programmable, far more surveillable and centrally controlled. To quote Washington DC-based blogger and analyst NS Lyons, “if not deliberately and carefully constrained in advance by law,… CBDCs have the potential to become even more than a technocratic central planner’s dream. They could represent the sing … Read more at: https://www.zerohedge.com/personal-finance/central-bank-digital-currency-cbdc-projects-are-foundering-five-eye-nations-what |

|

It Is Beginning To Look Like A Debt EmergencyBy Benjamin Picton, Senior Macro Strategist at Rabobank Meditations In An Emergency It’s now less than a week to go until the USA decides who is going to be their next President. The state of the political discourse recalls the ‘dramatic crossroads’ meme, where the respective labels attached to the sunny uplands and the grim castle of doom is a Rorschach test to confirm our political priors. I’ve chosen my words deliberately to say that the USA will be deciding on their next President – rather than the next ‘leader of the free world’ – because one of the options on the table is a more isolationist approach to trade and foreign policy where the USA may decline to perform the leadership role, instead prodding oftentimes recalcitrant allies into shouldering more of the global security burden. That could draw the curtain on the ‘Team America World Police’ neocon phase, or even Woodrow Wilson’s “making the world safe for democracy” idyll, if you prefer to cast your view further back. What’s now clear is that the bond market and the DXY is becoming sensitized to the potential implications of another Trump win. US 10-year yields were down almost 3bps overnight, but are up more than 55bps since the Fed cut rate in mid-September. Americans who had been holding out for rate cuts before they went house shopping are again contending with mortgage rates beginning with a 7-handle, because US mortgages tend to be priced off the long end of the … Read more at: https://www.zerohedge.com/markets/it-beginning-look-debt-emergency |

|

Pennsylvania News Station Apologizes For Showing Presidential Election ‘Results’Authored by Paul Joseph Watson via Modernity.news, A news station in Pennsylvania was forced to apologize for flashing up the US presidential election results in the state as part of a “test” that wasn’t supposed to be seen by viewers. WNEP, an ABC affiliate, flashed up the results for Pennsylvania during its broadcast of the Formula 1 race in Mexico City and they were on screen for several minutes. You’ll never guess who “won”. Kamala Harris, of course, beating Trump by 52 per cent to 47 per cent of the vote.

According to the test run, Kamala received 3,293,712 votes compared to Trump’s 2,997,793. After viewers expressed confusion at what they were witnessing, the news station was forced to explain what happened. … Read more at: https://www.zerohedge.com/political/pennsylvania-news-station-apologizes-showing-presidential-election-results |

|

‘We earn £100,000. We are not worse off after the Budget’People tell the BBC how much they earn and what they made of the Budget. Read more at: https://www.bbc.com/news/articles/cwyv8y68e25o |

|

Warning ‘pain’ of tax hikes to hit jobs and pay risesThe chancellor says businesses will “contribute more” as she raises employer National Insurance to 15%. Read more at: https://www.bbc.com/news/articles/c4g7x6p865zo |

|

How the Budget will affect you and your moneyThe chancellor has delivered a packed Budget, so here’s how it affects you and your money. Read more at: https://www.bbc.com/news/articles/cx25w7qpr0yo |

|

Block deal alert: Madhuri Madhusudan Kela picks stake in debutant Godavari Biorefineries below issue priceAce investor Madhuri Kela bought 5 lakh shares in Godavari Biorefineries via a block deal at Rs 335.66 apiece. The stock listed at a 12% discount but recovered to close at Rs 342.85. Godavari Biorefineries is one of India’s largest ethanol producers. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/block-deal-alert-madhuri-madhusudan-kela-picks-stake-in-debutant-godavari-biorefineries-below-issue-price/articleshow/114784415.cms |

|

Mutual funds will now have to deploy NFO proceeds within 30 days, says SebiThe Investment Committee may extend the timeline by 30 business days, providing recommendations to ensure timely deployment and ongoing monitoring. Upon receiving reasons for delays, the Committee should assess the root cause before approving any partial or full extension. Read more at: https://economictimes.indiatimes.com/mf/mf-news/mutual-funds-will-now-have-to-deploy-nfo-proceeds-within-30-days-says-sebi/articleshow/114778936.cms |

|

Ahead of IPO, Swiggy commands a GMP of 4% over issue priceSwiggy’s IPO is set to launch on November 6, with bidding open until November 8. The company has seen declining grey market demand, pricing the IPO between Rs 371-390 per share. The GMP has dropped from Rs 25-30 to Rs 18, suggesting investors are currently willing to pay about Rs 415 for a share. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/swiggy-sees-declining-demand-in-grey-market-as-gmp-drops-30-ahead-of-ipo/articleshow/114769165.cms |

|

Here’s why some NBA teams show their games on TV for free, while others charge fans hundreds of dollarsNBA owners have very different ideas about the benefits of showing their teams’ games for free. Read more at: https://www.marketwatch.com/story/heres-why-some-nba-teams-show-their-games-on-tv-for-free-while-others-charge-fans-hundreds-of-dollars-31bceb6e?mod=mw_rss_topstories |

|

Harris improves her odds over Trump, according to these economic indicatorsThose betting on Trump may want to consider the latest economic data, which indicate Harris could benefit from material tailwinds that become a decisive factor in a close race. Read more at: https://www.marketwatch.com/story/harris-improves-her-odds-over-trump-according-to-these-economic-indicators-a97198f5?mod=mw_rss_topstories |

|

Why Apple shareholders may want the Tim Cook era to come to a closeDoes Apple’s current leadership possess the necessary vision and agility to manage a challenging AI future? Read more at: https://www.marketwatch.com/story/why-apple-shareholders-may-want-the-tim-cook-era-to-come-to-a-close-dc73319e?mod=mw_rss_topstories |