Summary Of the Markets Today:

- The Dow closed down 260 points or 0.61%,

- Nasdaq closed up 103 points or 0.56%, (Closed at 18,519, New Historic high 18,690

- S&P 500 closed down 2 points or 0.03%,

- Gold $2,755 up $5.90 or 0.22%,

- WTI crude oil settled at $72 up $1.48 or 2.08%,

- 10-year U.S. Treasury 4.236 down 0.034 points or 0.273%,

- USD index $104.31 up $0.25 or 0.24%,

- Bitcoin $66,703 down $1,601 or 2.11%, (24 Hours)

- Baker Hughes Rig Count: U.S. unchanged at 585 Canada -1 to 216

U.S. Rig Count is unchanged from last week at 585 with oil rigs down 2 to 480, gas rigs up 2 to 101 and miscellaneous rigs unchanged at 4.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

S&P 500 closed up slightly, ending a three-day losing streak. Major indexes logged weekly losses overall. Treasury yields rose. Uncertainty remains over the Federal Reserve’s next move on interest rates. November US jobs report due next Friday. Tight presidential election a week later. Earnings reports from “Magnificent Seven” tech companies next week from Alphabet, Meta, Microsoft, Apple, and Amazon. Capital One and Discover merger is expected to be completed in early 2025, subject to approvals.. Apple was downgraded by KeyBanc from Sector Weight to Underweight, citing concerns over iPhone sales and upgrades.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods in September 2024 was down 2.1% year-over-year. Manufacturing remains in a recession in the US. Although durable goods import data is not available for September, durable goods imports has averaged growth of $25 billion per month in 2024 – while domestic produced durable goods have been declining at the rate of $5 billion per month in 2024. So the bottom line is that Americans are buying durable goods – just not from US manufacturers. Having said that, the number one exporter in the US is Boeing who is having issues with quality as well as a strike.

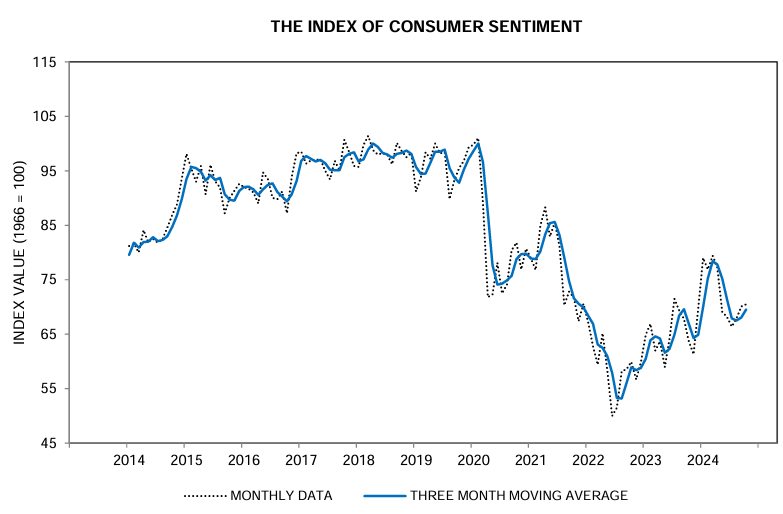

University of Michigan Consumer Sentiment lifted for the third consecutive month, inching up to its highest reading since April 2024. Surveys of Consumers Director Joanne Hsu opinion:

Sentiment is now more than 40% above the June 2022 trough. This month’s increase was primarily due to modest improvements in buying conditions for durables, in part due to easing interest rates. The upcoming election looms large over consumer expectations. Overall, the share of consumers expecting a Harris presidency fell from 63% last month to 57% in October. Sentiment of Republicans, who believe that a Trump presidency would be better for the economy, rose 8% on growing confidence that their preferred candidate would be the next president. In contrast, sentiment declined 1% for Democrats. As usual, Independents remain in between, with a 4% gain in sentiment this month. Regardless of the eventual winner, a sizable share of consumers will likely update their economic expectations based on the results of the election.

Here is a summary of headlines we are reading today:

- TSMC’s Chip Plant In Arizona Achieves Higher Yields Than Taiwan

- Oil Rig Count Dips as WTI Gains 2%

- Israel Targets Hezbollah’s Military, Political, and Economic Power in Lebanon

- Bearish Factors Build in Oil Markets Despite Middle East Tensions

- Nasdaq rises to hit new all-time high Friday as rest of market languishes: Live updates

- Alphabet’s self-driving unit Waymo closes $5.6 billion funding round as robotaxi race heats up in the U.S.

- Tesla shares close at highest in 13 months as post-earnings rally continues

- Microsoft boss gets 63% pay rise despite asking for reduction

- 10-year Treasury yield ends with biggest six-week climb in a year as consumer sentiment rises

- Here’s when Adam Silver thought Warner Bros. Discovery might lose its NBA broadcast deal

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

TSMC’s Chip Plant In Arizona Achieves Higher Yields Than TaiwanDuring a webinar on Wednesday hosted by the Potomac Institute for Policy Studies, Taiwan Semiconductor Manufacturing US President Rick Cassidy told listeners that TSMC’s Phoenix, Arizona chip factory has achieved around 4% more usable chips than its Taiwan plants. According to Bloomberg, this is a critical metric for TSMC, as its most advanced and efficient chip plants are based in Taiwan. It marks a major win for the US in reshoring chip production through the Biden administration’s 2022… Read more at: https://oilprice.com/Energy/Energy-General/TSMCs-Chip-Plant-In-Arizona-Achieves-Higher-Yields-Than-Taiwan.html |

|

New Mexico Warns That Green Goals Will Stymie Oil RevenueNew Mexico is evaluating new oil and gas drilling restrictions that have the potential to impact production and revenue in the coming years, according to a new study released this week by New Mexico’s chief economist. Proposed setbacks, aimed at limiting the proximity of wells to residential, educational, and environmental areas, could reduce future output by 5.4%, equating to about 12.5 million barrels of oil lost in the first year and over 35 million barrels by the early 2030s. This potential reduction would peak at an estimated $4.5 billion… Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-Mexico-Warns-That-Green-Goals-Will-Stymie-Oil-Revenue.html |

|

Oil Rig Count Dips as WTI Gains 2%The total number of active drilling rigs for oil and gas in the United States saw no change week, according to new data that Baker Hughes published on Friday, after falling last week. The total rig count stayed at 585, according to Baker Hughes, down more than 6% from this same time last year. The number of oil rigs fell by 2 this week to 480—down by 24 compared to this time last year. The number of gas rigs rose by 2 this week to 101, a loss of 16 active gas rigs from this time last year. Miscellaneous rigs stayed the same at 4. Meanwhile,… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Rig-Count-Dips-as-WTI-Gains-2.html |

|

FERC Grants Exxon and Qatar Three-Year Extension to Build Golden Pass LNGThe U.S. Federal Energy Regulatory Commission has granted a three-year extension to ExxonMobil and QatarEnergy to build their $10-billion Golden Pass LNG export plant in Texas, Reuters reports, citing an FERC filing. The federal regulator extended its authorization for construction after Golden Pass hit a snag earlier this year and faces delays due to the bankruptcy of Zachry Holdings, the lead construction contractor of the LNG project. These delays were the reason for FERC’s extension, according to the document seen by Reuters. In August,… Read more at: https://oilprice.com/Energy/Natural-Gas/FERC-Grants-Exxon-and-Qatar-Three-Year-Extension-to-Build-Golden-Pass-LNG.html |

|

Cepsa: Windfall Tax Would Delay Its $3.3-Billion Hydrogen PlanCepsa, Spain’s second-largest oil company, will delay its $3.25 billion (3 billion euros) investment into domestic green hydrogen projects if Spain makes the windfall tax on energy firms permanent. Cepsa is the second Spanish company to warn that it would defer investments in green hydrogen in Spain, after Repsol said earlier this week that it had decided to pause green hydrogen development projects in its home country, citing an unfavorable regulatory regime with the idea of a permanent windfall tax on energy companies. Repsol has a pipeline… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Cepsa-Windfall-Tax-Would-Delay-Its-33-Billion-Hydrogen-Plan.html |

|

South Africa Seeks Loan Guarantees for Energy Transition FundingSouth Africa is currently negotiating loan guarantees with its international partners in its $9.3-billion Just Energy Transition Partnership (JETP) program for energy investment. The International Partners Group (IPG) of South Africa’s climate pact includes the U.S., the EU, the UK, France, Germany, the Netherlands, and Denmark. But the lack of loan guarantees has so far withheld the disbursement of much of the funds of the multi-billion-dollar partnership aimed at helping South Africa reduce its reliance on coal and cut carbon emissions.… Read more at: https://oilprice.com/Energy/Energy-General/South-Africa-Seeks-Loan-Guarantees-for-Energy-Transition-Funding.html |

|

Israel Targets Hezbollah’s Military, Political, and Economic Power in LebanonIsrael’s weekslong aerial bombardment and ground invasion of Lebanon has targeted the leadership and military capabilities of Hezbollah. Now, Israel has expanded its targets and hit civilian infrastructure, including banks, affiliated with Hezbollah, an armed group and political party that controls much of southern Lebanon. Experts say Israel’s aim is to erode Hezbollah not just as a military power but also a political and economic force in Lebanon. Hezbollah is a U.S.-designated a terrorist organization, although the EU has only blacklisted… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Israel-Targets-Hezbollahs-Military-Political-and-Economic-Power-in-Lebanon.html |

|

Geopolitical Uncertainty Is Pushing Oil Prices HigherOil prices are set to post a weekly gain as geopolitical uncertainty remains a central focus of oil traders, but a strong dollar and a large U.S. inventory build are holding Brent and WTI back.Friday, October 25th, 2024The elevation of the Israel-Iran conflict into the main oil market narrative for October is by no means over, the closer we get to the US presidential elections the wilder speculation will get regarding future escalation scenarios. At the same time, Brent and WTI will only post minor week-over-week increases, trending around… Read more at: https://oilprice.com/Energy/Energy-General/Geopolitical-Uncertainty-Is-Pushing-Oil-Prices-Higher.html |

|

Why Crude Oil Options Are SoaringCrude Oil Options Skyrocket as Markets Still Unable to Read the Middle East – Open interest held in ICE Brent options surpassed the threshold of 4 million contracts for the first time on record, the equivalent of 4 billion barrels, as investors seek to hedge their geopolitical exposure. – The widespread expectation that Israel would seek to retaliate vis-à-vis Iran around the time of the US presidential elections, potentially leading to a sudden price spike should international waterways be restricted afterward. – The fundamentals of the… Read more at: https://oilprice.com/Energy/Energy-General/Why-Crude-Oil-Options-Are-Soaring.html |

|

EU and China Continue Talks on EV Tariffs AlternativeThe European Union and China agreed on Friday to continue discussions on a possible alternative to the EU import tariffs on China-made electric vehicles, a week before the levies are set to come into force, the European Commission said. The European Commission’s Executive Vice-President and Commissioner for Trade, Valdis Dombrovskis, initiated a video call today with Chinese Minister of Commerce, Wang Wentao, to discuss the EU investigation on imports of battery electric vehicles (BEVs) from China and ongoing negotiations about price undertakings.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-and-China-Continue-Talks-on-EV-Tariffs-Alternative.html |

|

Bearish Factors Build in Oil Markets Despite Middle East TensionsLight Crude oil (WTI) prices saw significant volatility this week as a combination of geopolitical risks, weak demand from China, and rising U.S. production created a two-sided market. Despite the price swings, crude managed to hold relatively stable, as fears of potential supply disruptions offset bearish factors like increased inventories and lackluster demand growth. Key factors that shaped crude oil prices over the past week are highlighted, alongside potential influences on market trends in the coming days. Middle East Tensions Create Supply… Read more at: https://oilprice.com/Energy/Energy-General/Bearish-Factors-Build-in-Oil-Markets-Despite-Middle-East-Tensions.html |

|

Leaked Documents Allegedly Map Out Israeli Plans to Attack IranPolitics, Geopolitics, & Conflict For several weeks, we have heard that South Sudan is gearing up to restart oil exports through civil-war-torn Sudan proper, after pipelines were ruptured during fighting between the Sudanese army and paramilitary forces in a war that has been ongoing for some 18 months. This week, South Sudanese officials said oil would start flowing in a matter of days, with Reuters reporting that Sudanese engineers will be arriving in South Sudan this weekend to formalize a restart plan that could see up to 150,000 barrels… Read more at: https://oilprice.com/Energy/Energy-General/Leaked-Documents-Allegedly-Map-Out-Israeli-Plans-to-Attack-Iran.html |

|

A “Picks and Shovels” Stock to Buy Ahead of EarningsOne of my favorite investing strategies is the “picks and shovels” approach. If you are a long-time reader of my work, I am sure you will have seen me talk about it before, but for those who don’t know, “picks and shovels” refers to the time of the various gold rushes in America, when thousands flocked to places where gold had been found. Some of the prospectors did hit it big, but most didn’t. However, all of them, the winners and the losers, bought the equipment they needed to search for the yellow metal: picks,… Read more at: https://oilprice.com/Energy/Energy-General/A-Picks-and-Shovels-Stock-to-Buy-Ahead-of-Earnings.html |

|

No Peace in the Middle East Without A Post-War Leadership Pathway for GazaThe Middle East conflict continues along its same path, with new talks on a Gaza ceasefire taking place later this week with the U.S. and Israel in Doha. Nothing is likely to come of these talks. Israel shows no signs of backing down, continuing to pound Lebanon and Gaza with little discretion. There is a political vacuum with regard to the Palestinian leadership, with Hamas said to be courting the Russians to sway the Palestinian Authority (led by Mahmoud Abbas) to come to the table to form a unity government. There can be no ceasefire (let… Read more at: https://oilprice.com/Energy/Energy-General/No-Peace-in-the-Middle-East-Without-A-Post-War-Leadership-Pathway-for-Gaza.html |

|

Biden Administration Approves Its First Lithium Mining ProjectThe Biden Administration has granted a final federal permit to a lithium-boron project in Nevada in the first such project approved by the Administration as part of its efforts to support America-produced lithium and reduce dependence on Chinese supply, the project developer said on Friday. The U.S. Bureau of Land Management has issued the federal permit for the Rhyolite Ridge Lithium-Boron Project, proposed by Australian firm Ioneer Ltd in Esmeralda County, Nevada. This is also the first lithium mine fully permitted to be built in more than 20… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Administration-Approves-Its-First-Lithium-Mining-Project.html |

|

Nasdaq rises to hit new all-time high Friday as rest of market languishes: Live updatesThe Nasdaq Composite rose on Friday, hitting a fresh all-time high during the session. Read more at: https://www.cnbc.com/2024/10/24/stock-market-today-live-updates.html |

|

Jeff Bezos killed Washington Post endorsement of Kamala Harris, paper reportsThe Washington Post planned to endorse Kamala Harris over Donald Trump before owner Jeff Bezos, the Amazon founder, decided again it, the newspaper reported. Read more at: https://www.cnbc.com/2024/10/25/jeff-bezos-killed-washington-post-endorsement-of-kamala-harris-.html |

|

Abercrombie ex-CEO Mike Jeffries pleads not guilty in sex crimes caseFormer Abercrombie & Fitch CEO Mike Jeffries, his partner Matthew Smith and associate James Jacobson face sex trafficking and interstate prostitution charges. Read more at: https://www.cnbc.com/2024/10/25/abercrombie-ceo-jeffries-sex-crime-arraignment-plea.html |

|

Alphabet’s self-driving unit Waymo closes $5.6 billion funding round as robotaxi race heats up in the U.S.Alphabet-owned driverless vehicle unit Waymo just closed a $5.6 billion funding round to expand its robotaxi service across the U.S. Read more at: https://www.cnbc.com/2024/10/25/alphabets-self-driving-unit-waymo-closes-5point6-billion-funding-round.html |

|

Wall Street braces for a big week ahead of the election, with megacap tech earnings, key data on tapEarnings results from five of the Magnificent Seven companies are due out, as are the September jobs report and key inflation data. Read more at: https://www.cnbc.com/2024/10/25/stock-market-next-week-outlook-for-october-28-november-1-2024.html |

|

Tesla shares close at highest in 13 months as post-earnings rally continuesFollowing Tesla’s best day on the market since 2013, the stock rose more than 3% on Friday, closing at its highest since September 2023. Read more at: https://www.cnbc.com/2024/10/25/tesla-shares-rise-to-highest-in-over-a-year-after-q3-earnings.html |

|

This is why David Einhorn thinks Peloton could be worth five times what it is nowDavid Einhorn’s Greenlight Capital had a $6.8 million stake in Peloton as of June 30, and he thinks the company could be worth five times its current value. Read more at: https://www.cnbc.com/2024/10/25/david-einhorn-thinks-peloton-could-be-worth-31-a-share.html |

|

CDC says 75 people affected in E. coli outbreak linked to McDonald’s Quarter PoundersIt is the latest tally of people affected since the agency announced the outbreak on Tuesday, initially citing 49 cases and one death across 10 states. Read more at: https://www.cnbc.com/2024/10/25/mcdonalds-e-coli-outbreak-cdc-updates-case-count.html |

|

Why Ripple’s Chris Larsen is spending millions to back the Harris campaign: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Chris Larsen, co-founder of Ripple, discusses his millions of dollars in donations to back Vice President Kamala Harris’ presidential bid. Read more at: https://www.cnbc.com/video/2024/10/25/ripple-chris-larsen-spending-millions-harris-campaign-crypto-world.html |

|

Biden’s latest student debt plan would create forgiveness path for borrowers facing financial ruinThe Biden administration introduced a proposal to deliver student loan forgiveness to millions of people experiencing devastating financial hardship. Read more at: https://www.cnbc.com/2024/10/25/biden-student-debt-financial-disaster-loan-cancellation.html |

|

This is ‘the biggest difference’ in today’s housing market, according to hosts of ‘Property Brothers’Though the housing market faces underlying supply constraints, a home purchase is still a good investment, say co-hosts of the TV show “Property Brothers.” Read more at: https://www.cnbc.com/2024/10/25/the-housing-shortage-is-the-biggest-difference-in-the-housing-market.html |

|

A key change to 529 plans this year is already triggering parents to save more for collegeThis year, in part because of the added flexibility, more parents are utilizing 529 college savings plans. Read more at: https://www.cnbc.com/2024/10/25/parents-are-saving-more-for-college-thanks-to-529-to-roth-rollovers.html |

|

This biotech stock is breaking out after an 8-month standoff between the bulls and bearsCarter Worth breaks down the charts on Viking Therapeutics. Read more at: https://www.cnbc.com/2024/10/25/this-biotech-stock-is-breaking-out-after-an-8-month-standoff-between-the-bulls-and-bears.html |

|

Texas AG Ken Paxton Files Criminal Referral Outlining Act Blue Illegal Campaign Finance ActivityAuthored by Sundance via The Conservative Treehouse, Many people might think that Attorney General Ken Paxton filing a letter of notice for criminal referral to the U.S Dept of Justice is an act of futility, because the DOJ is not going to investigate or indict criminal conduct by leftist political operatives. However, there is a strategic process to follow, particularly if the Texas AG is likely to become the next U.S. Attorney General.

In a way this Read more at: https://www.zerohedge.com/political/texas-ag-ken-paxton-files-criminal-referral-outlining-act-blue-illegal-campaign-finance |

|

Goldman Says “Short CTA/Positioning Unwinds” Behind NatGas Futs SpikeA few days after Goldman’s Thomas Evans advised clients to “keep pressing shorts” on natural gas through December, the NatGas futures market in New York exploded Thursday, spiking up to 10%. Another Goldman analyst wrote on Friday morning that the magnitude of this surge signals “short CTA/positioning unwinds.” The price surge may have been sparked by a new cold weather forecast for the Lower 48 and or reports of multiple outages stretching from Norway to the US, heightening concerns about a market tightening ahead of the Northern Hemisphere winter. On Thursday, NatGas futures spiked as much as 10%. From the low of about $2.25 per million British thermal to start the week, prices have surged 15% to as high as $2.57. Prices are still locked in a multi-year lateral base, with $3 marking a critical level to watch for a potential breakout.

Goldman’s Tallulah Adams told clients that yesterday’s rally … Read more at: https://www.zerohedge.com/commodities/goldman-says-short-ctapositioning-unwinds-behind-natgas-futs-spike |

|

Trump’s Attorneys Seek Election Case Dismissal, Say Special Council Appointment UnconstitutionalAuthored by Sam Dorman via The Epoch Times, Former President Donald Trump’s attorneys argued in a new filing on Oct. 24 that Special Counsel Jack Smith’s superseding indictment should be dismissed since his appointment was unconstitutional.

The filing was a motion requesting that Chutkan allow Trump to submit another motion to dismiss based on the legality of Smith’s appointment. Trump is seeking not only dismissal of the superseding indictment but also an injunction preventing Smith from “spending additional public funds” while violating the Constitution. Read more at: https://www.zerohedge.com/political/trumps-attorneys-seek-election-case-dismissal-say-special-council-appointment |

|

NYSE Extending Trading On ARCA Equities Exchange To 22 Hours A DaySo much for Robinhood having a monopoly on overnight trading… The New York Stock Exchange said in a press release today that it plans on extending weekday trading on its NYSE ARCA Equities Exchange to 22 hours a day. “NYSE Group’s NYSE Arca is a fully electronic exchange that ranks as the top U.S. exchange for listing and trading exchange-traded funds,” the release notes. “All U.S.-listed stocks, ETFs and closed-end funds would be available for trading on NYSE Arca during the 22-hour weekday sessions.” “The extended trading would take place from 1:30 am to 11:30 pm Eastern Time on all weekdays, excluding holidays, subject to regulatory approval,” the release says, noting that the NYSE will “also seek support for extended trading from the U.S. securities information processors”.

Kevin Tyrrell, Head of Markets, New … Read more at: https://www.zerohedge.com/markets/nyse-extending-trading-arca-equities-exchange-22-hours-day |

|

UK pledges thousands of new jobs in freeports planCritics have said freeports do not boost actual job numbers, but move investment to a different area instead. Read more at: https://www.bbc.com/news/articles/c0j8w73pdn8o |

|

Microsoft boss gets 63% pay rise despite asking for reductionSatya Nadella asked for a reduction because of cyber attacks the firm suffered – but still saw his earnings increase massively. Read more at: https://www.bbc.com/news/articles/cwy1lkp71n2o |

|

Thames Water secures £3bn loan to survive into 2025The UK’s biggest utility company agrees a lifeline to help it last until next October. Read more at: https://www.bbc.com/news/articles/c704wzx38p1o |

|

Tech View: Minor pullback rally likely in Nifty, crucial resistance at 24,750. How to trade on MondayTejas Shah, Technical Research Analyst at JM Financial & BlinkX, noted that Nifty has support at 24,100 and 24,000, with immediate resistance at 24,450-500 and a key resistance at 24,700-750 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-minor-pullback-rally-likely-in-nifty-crucial-resistance-at-24750-how-to-trade-on-monday/articleshow/114587510.cms |

|

Shriram Finance Q2 Results: Net profit jumps 18% to Rs 2,071 crore; Rs 22 per share dividend declaredShriram Finance Q2 Results: Shriram Finance on Friday reported a profit after tax (PAT) growth of 18.3% at Rs 2,071.26 crores as against Rs 1,750.84 crores recorded in the same period of the previous year. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/shriram-finance-q2-results-net-profit-jumps-18-to-rs-2071-crore-rs-22-per-share-dividend-declared/articleshow/114584008.cms |

|

NSE IPO hinges on Sebi approval: Ashish Kumar ChauhanThe National Stock Exchange of India Ltd., which has encountered delays in its initial public offering since its initial filing in 2016, requires approval from the Securities and Exchange Board of India to reapply, Chauhan stated in a Bloomberg Television interview on Friday. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/nse-ipo-hinges-on-sebi-approval-ashish-kumar-chauhan/articleshow/114575933.cms |

|

These stock-market secrets and tips keep this celebrated day-trader in the gameSuccessful trading isn’t about finding the perfect system. It’s more about knowing yourself, says Shay Huang, a.k.a. ‘Humbled Trader.’ Read more at: https://www.marketwatch.com/story/you-are-never-bigger-than-the-market-day-trading-celebrity-humbled-trader-reveals-her-stock-market-secrets-e99d3b97?mod=mw_rss_topstories |

|

10-year Treasury yield ends with biggest six-week climb in a year as consumer sentiment risesU.S. government debt sold off on Friday, giving the 10-year yield its biggest six-week advance in about a year, after data showed consumer sentiment rose this month. Read more at: https://www.marketwatch.com/story/treasury-yields-ease-but-still-on-track-for-a-big-weekly-rise-89a3d657?mod=mw_rss_topstories |

|

Here’s when Adam Silver thought Warner Bros. Discovery might lose its NBA broadcast dealOf the negotiations, Silver said: “It wasn’t a longtime relationship with the people currently running Warner Bros. Discovery.” Read more at: https://www.marketwatch.com/story/heres-when-adam-silver-thought-warner-bros-discovery-might-lose-its-nba-broadcast-deal-3db88741?mod=mw_rss_topstories |