Summary Of the Markets Today:

- The Dow closed down 7 points or 0.02%,

- Nasdaq closed up 33 points or 0.18%, (Closed at 18,573, New Historic high 18,621)

- S&P 500 closed down 3 points or 0.05%,

- Gold $2,762 up $22.90 or 0.84%,

- WTI crude oil settled at $72 up $1.68 or 2.38%,

- 10-year U.S. Treasury 4.208 up 0.026 points or 0.211%,

- USD index $104.11 up $0.09 or 0.09%,

- Bitcoin $67,486 down $1,755 or 0.26%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

Investors were processing a recent bond market sell-off and incoming earnings reports. Doubts are growing about the Federal Reserve’s ability to cut rates aggressively or maintain current levels in November. The 10-year Treasury yield stabilized around 4.2% after surpassing this level on Monday for the first time since July. General Motors raised its guidance for the third time this year, with shares closing up over 10%. GE Aerospace and Verizon saw share price declines following mixed Q3 reports. Anticipation is building for Tesla’s earnings report, expected on Wednesday. Gold prices reached another record high as investors sought safety amid geopolitical tensions and the upcoming U.S. presidential election.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

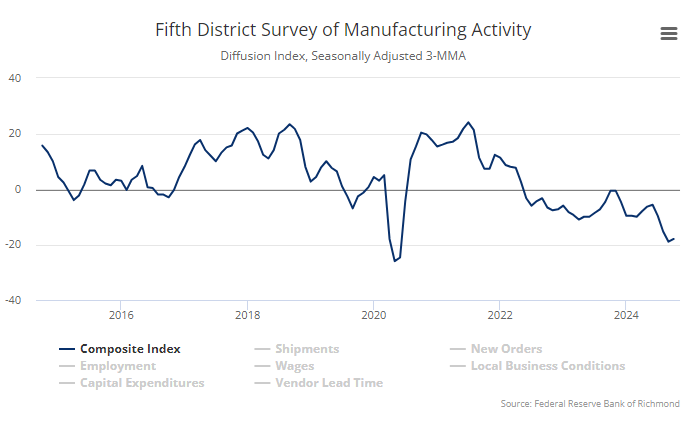

Richmond Fed manufacturing activity remained slow in October 2024. The composite manufacturing index increased from −21 in September to −14 in October. Of its three component indexes, shipments increased from −18 to −8, new orders rose from −23 to −17, and employment increased from −22 to −17. Being a negative number shows manufacturing remains in a recession.

Here is a summary of headlines we are reading today:

- U.S. Tightens Grip on Russia’s LNG Exports

- Oilfield Services Firms Sound the Alarm: Shale Spending Slows

- The Dark Side of AI-Powered Synthetic Biology

- Top U.S. LNG Exports: China’s Gas Demand Is Booming

- EU Imports of China’s EVs Surge Ahead of Tariffs

- U.S. Monitors Shadow Fleet Oil Transfers in Southeast Asia

- Paul Tudor Jones says market reckoning on spending is coming after election: ‘We are going to be broke’

- Philip Morris is a growth stock again as shares hit all-time high on Zyn demand boom

- Dow posts back-to-back loss Tuesday as Wall Street’s rally pauses: Live updates

- Peloton partners with Costco to sell Bike+ as it looks to reach young, wealthy customers

- IRS announces bigger estate and gift tax exemption for 2025

- Polymarket Is Singlehandedly Moving The Entire US Bond Market

- 10-year Treasury yield ends at roughly 3-month high as U.S. deficit concerns linger

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Tightens Grip on Russia’s LNG ExportsThe U.S. is stepping up efforts to curb Russia’s LNG exports as part of its broader strategy to cut off funds supporting Moscow’s war in Ukraine. According to Geoffrey Pyatt, U.S. Assistant Secretary for Energy Resources, the aim is clear: reduce Russia’s revenue from oil and gas. This push has included sanctions on Russia’s Arctic LNG 2 plant, which has been particularly effective in stopping tankers from reaching foreign ports due to fears of U.S. retaliation. Located in the Gydan Peninsula in the Arctic, the Arctic LNG 2 project was considered… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Tightens-Grip-on-Russias-LNG-Exports.html |

|

Oilfield Services Firms Sound the Alarm: Shale Spending SlowsOil companies are growing increasingly cautious on spending on production growth amid concerns about an oversupplied market and oil prices lower than at last year’s levels. That’s one of the messages from SLB, the world’s biggest oilfield services provider, which flagged continued softness in the short-cycle market, especially in U.S. shale, in its Q3 results release. Offshore and other long-cycle spending, which tends to be more resilient to oil price fluctuations, remains relatively strong. But U.S. activity and spending are… Read more at: https://oilprice.com/Energy/Energy-General/Oilfield-Services-Firms-Sound-the-Alarm-Shale-Spending-Slows.html |

|

Can Europe Counter Russia’s Election Meddling?It’s election season in Eastern Europe, and for the Kremlin — bogged down in Ukraine and desperately in need of allies — the stakes are higher than ever. Moldova is holding a presidential election and referendum on October 20 that could help secure the country’s future in the EU. Romania has just banned a pro-Kremlin rabble-rouser from running in its November presidential election. And the pro-Kremlin, far-right Revival party in Bulgaria is expected to win a sizable presence in parliament after upcoming elections. So what is the Kremlin — and… Read more at: https://oilprice.com/Geopolitics/International/Can-Europe-Counter-Russias-Election-Meddling.html |

|

The Dark Side of AI-Powered Synthetic BiologyScience fiction films are replete with human space travelers visiting far-away planets that have atmospheres suitable for those humans to breath. Thus, the bother of wearing a space suit or other protective gear is dispensed with, and the encounters with alien races, both hostile and friendly, can proceed without such cumbersome gear mucking up the works. In addition, these planets often have plants and animals that are strikingly similar to those found on Earth. The problem with this all-too-frequent occurrence in science fiction stories is that… Read more at: https://oilprice.com/Geopolitics/International/The-Dark-Side-of-AI-Powered-Synthetic-Biology.html |

|

Aramco CEO: Global South Will Drive Oil Demand for DecadesSpeaking on the sidelines of the Singapore International Energy Week conference, Saudi Aramco CEO Amin Nasser said he was “fairly bullish” on China’s oil demand, especially after Beijing rolled out a series of stimulus measures to revive the world’s second-largest economy. “We see more demand for jet fuel and naphtha, especially for liquid-to-chemical projects,” Nasser said on the sidelines, adding, “A lot of it is happening in China mainly because of the growth in chemical needs. Especially for the transition, for the electric vehicles, for the… Read more at: https://oilprice.com/Energy/Crude-Oil/Aramco-CEO-Global-South-Will-Drive-Oil-Demand-for-Decades.html |

|

Russia’s Crude Oil Exports Hit Four-Month HighRussian crude oil exports by sea continue to rise as heavy domestic refinery maintenance leaves more crude available for export. Russia exported on average 3.47 million barrels per day (bpd) of crude in the four weeks to October 20, up by 140,000 bpd compared to the four-week average to October 13, tanker-tracking data monitored by Bloomberg showed on Tuesday. The four-week average to October 20 was the highest export level for Russia since the end of June, according to the data reported by Bloomberg’s Julian Lee. At the same time, refining… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Crude-Oil-Exports-Hit-Four-Month-High.html |

|

Top U.S. LNG Exports: China’s Gas Demand Is BoomingChinese demand for natural gas is set to jump by more than 50% by 2040, from 400 billion cubic meters (bcm) now to more than 600 bcm, according to an executive at the top U.S. LNG exporter, Cheniere Energy. “There’s no doubt that gas demand growth in China, in absolute terms, is substantially driven by energy demand, policies like coal-to-gas-switch as well as a huge infrastructure build-up,” Yingying Zhou, director LNG origination at Cheniere, said at the Asia Gas Markets conference on Tuesday, as carried by Reuters. Cheniere… Read more at: https://oilprice.com/Energy/Natural-Gas/Top-US-LNG-Exports-Chinas-Gas-Demand-Is-Booming.html |

|

Oil Gains as China Lifts Crude Import QuotaOil prices are on the rise, with West Texas Intermediate (WTI) at $71.78 per barrel and Brent crude at $75.53 on Tuesday morning. Both key benchmarks gained more than 1.5% on the day, helped by economic optimism out of China and lingering concerns about potential disruptions from the ongoing conflict in the Middle East. On Tuesday, China’s commerce ministry said that the country would lift its total crude oil import quota for private importers for 2025 by 6%—to 5.14 million bpd, per Reuters calculations. This would see 257 million metric… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Gains-as-China-Lifts-Crude-Import-Quota.html |

|

Oil Prices Are Rising on Renewed Optimism Over Chinese DemandOil prices are on the rise again, this time driven by renewed optimism over Chinese crude demand.- Europe is considering its options to tighten sanctions vis-à-vis Russian LNG imports into Europe, having banned LNG transshipment operations from 2025 onwards, whilst gas importers keep on buying more.- Thanks to higher utilization rates and the recent (surreptitious) launch of Arctic LNG 2, Russia increased its total LNG exports by 5% year-over-year in January-September 2024, to 24.4 million tonnes.- The share of Russian LNG in the European… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Are-Rising-on-Renewed-Optimism-Over-Chinese-Demand.html |

|

EU Imports of China’s EVs Surge Ahead of TariffsChina shipped in September the second-highest number of electric vehicles to the European Union on record, as the EU prepares to slap hefty import tariffs on Chinese EVs due to unfair subsidizing. Last month, the EU imported a total of 60,517 EVs from China, the second-highest number on record, following the October 2023 record-high of 67,455 Chinese EVs imported into the EU, right after the block announced it would investigate China’s subsidies, Bloomberg reported on Tuesday, citing customs data. Early this month, the European Commission… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Imports-of-Chinas-EVs-Surge-Ahead-of-Tariffs.html |

|

Goldman Remains Bearish on NatGas Despite Colder Winter ForecastsMild weather across the Lower 48 has capped natural gas demand, keeping futures locked in a bearish sideways trend, unable to breach the $3 per million British thermal units level. Goldman’s Thomas Evans published a note on Monday about the US NatGas market, pointing out that October’s unusually warm weather in the Lower 48 has led to the third-lowest Heating Degree Days (HDDs) for October since 1963. “The big picture since the start of last week is that not much has changed except that we’ve rolled one week forward with warmer forecasts for start… Read more at: https://oilprice.com/Energy/Natural-Gas/Goldman-Remains-Bearish-on-NAtural-Gas-Despite-Colder-Winter-Forecasts.html |

|

China Raises Crude Import Quota for Private RefinersChina has raised by 6% the total import quota for private importers for next year, to about 5.14 million barrels per day (bpd), the commerce ministry of the world’s top crude oil importer said on Tuesday. The combined import quota for non-state-owned companies was raised to 257 million metric tons, or 5.14 million bpd per Reuters calculations, from 243 million tons in quotas allocated to private refiners for this year. Private refiners in China need to be granted crude import quotas to be able to import oil to process at their refineries.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Raises-Crude-Import-Quota-for-Private-Refiners.html |

|

EU’s Reliance on Russian LNG Is GrowingRussian LNG accounted for 20% of the EU’s liquefied natural gas imports in the first nine months of 2024, compared to 14% for the same period last year, amid markedly lower EU imports of the super-chilled fuel, a new report by the EU Agency for the Cooperation of Energy Regulators (ACER) showed on Tuesday. While the Russian LNG share of the EU’s total LNG imports grew, it was a share of a smaller pie. In the third quarter of 2024 alone, EU imports of LNG slumped by 23% compared to a year earlier, ACER, the EU regulator, said in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EUs-Reliance-on-Russian-LNG-Is-Growing.html |

|

U.S. Monitors Shadow Fleet Oil Transfers in Southeast AsiaThe United States is monitoring ship-to-ship transfers involving tankers from shadow fleets in Southeast Asia, which pose safety and environmental hazards, Geoffrey Pyatt, U.S. Assistant Secretary for Energy Resources, told Bloomberg on Tuesday. “A significant consideration for the maritime states of Southeast Asia is the risks that come from some of these shadow fleet operations, where you have older vessels, often with questionable insurance coverage and uncertain safety records,” Pyatt told Bloomberg on the sidelines of an energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Monitors-Shadow-Fleet-Oil-Transfers-in-Southeast-Asia.html |

|

Court Decision Averts Shutdown of U.S. Oil and Gas in the Gulf of MexicoA federal judge has given the National Marine Fisheries Service five more months to complete a new biological opinion on protecting species in the U.S. Gulf of Mexico, averting what the oil industry had warned was a potential halt of new and existing oil and natural gas production and activity in the region. Earlier this year, District Judge Deborah Boardman of the U.S. District Court in Maryland vacated, with effect from December 20, 2024, the so-called biological opinion of the National Marine Fisheries Service (NMFS), which is legally needed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Court-Decision-Averts-Shutdown-of-US-Oil-and-Gas-in-the-Gulf-of-Mexico.html |

|

Paul Tudor Jones says market reckoning on spending is coming after election: ‘We are going to be broke’Hedge fund manager Paul Tudor Jones told CNBC that government spending could cause a major sell-off in the bond market. Read more at: https://www.cnbc.com/2024/10/22/paul-tudor-jones-says-market-reckoning-coming-after-election-on-spending-we-are-going-to-be-broke.html |

|

Philip Morris is a growth stock again as shares hit all-time high on Zyn demand boomThe company’s stock was tracking for a record close and clinched a fresh intraday record. Read more at: https://www.cnbc.com/2024/10/22/philip-morris-is-a-growth-stock-again-as-shares-hit-all-time-high-on-zyn-demand-boom.html |

|

Dow posts back-to-back loss Tuesday as Wall Street’s rally pauses: Live updatesThe S&P 500 and the Dow slid on Tuesday as a back-up in interest rates overshadowed a solid start to earnings reporting season. Read more at: https://www.cnbc.com/2024/10/21/stock-market-today-live-updates.html |

|

Amazon-backed Anthropic debuts AI agents that can do complex tasks, racing against OpenAI, Microsoft and GoogleAnthropic, the Amazon-backed AI startup founded by former OpenAI research executives, announced AI agents that can use a computer to complete complex tasks. Read more at: https://www.cnbc.com/2024/10/22/anthropic-announces-ai-agents-for-complex-tasks-racing-openai.html |

|

This tax-free income play is set up for a strong year-end performance, says UBSThe combination of higher yields and the expected cooling supply post-election should help municipal bonds’ strong performance later this year, per UBS. Read more at: https://www.cnbc.com/2024/10/22/this-tax-free-income-play-is-set-for-a-strong-year-end-performance-says-ubs.html |

|

Former Abercrombie CEO Mike Jeffries charged with sex trafficking, interstate prostitutionAbercrombie & Fitch and its former CEO Mike Jeffries were sued last year for allegedly operating a sex trafficking ring that targeted would-be male models. Read more at: https://www.cnbc.com/2024/10/22/former-abercrombie-ceo-mike-jeffries-arrested-in-sex-trafficking-case.html |

|

Peloton partners with Costco to sell Bike+ as it looks to reach young, wealthy customersPeloton has been working to grow sales and stem its losses and has had to work harder to accomplish both of those goals as customer acquisition costs rise. Read more at: https://www.cnbc.com/2024/10/22/peloton-costco-partner-to-sell-bike-for-2024-holiday.html |

|

Starboard Value’s Jeff Smith says Salesforce has ‘a lot more to go’ and can increase profitabilitySalesforce has become more profitable in the past few years, but one activist investor says there’s more for the software company to do. Read more at: https://www.cnbc.com/2024/10/22/starboard-values-jeff-smith-sees-salesforce-has-a-lot-more-to-go.html |

|

Yelp disables comments on the McDonald’s that hosted Trump after influx of one-star reviewsAfter ex-President Donald Trump visited a Pennsylvania McDonald’s, Yelp put an “unusual activity alert” on the location’s page due to dozens of unusual reviews. Read more at: https://www.cnbc.com/2024/10/22/yelp-disables-comments-on-the-mcdonalds-trump-visited.html |

|

IRS announces bigger estate and gift tax exemption for 2025The IRS has announced a higher estate and gift tax exemption for 2025. Here’s what wealthy families need to know. Read more at: https://www.cnbc.com/2024/10/22/irs-estate-gift-tax-changes-2025.html |

|

IRS announces new federal income tax brackets for 2025The IRS has announced higher federal income tax brackets and standard deductions for 2025. Here’s what taxpayers need to know. Read more at: https://www.cnbc.com/2024/10/22/irs-2025-federal-income-tax-brackets.html |

|

The IRS unveils higher capital gains tax brackets for 2025The IRS has unveiled higher long-term capital gains brackets for 2025. Here’s what investors need to know. Read more at: https://www.cnbc.com/2024/10/22/irs-2025-capital-gains-brackets.html |

|

Here’s when exchange-traded funds really flex their ‘tax magic’ for investorsExchange-traded funds can reduce investors’ tax bills. But those tax savings benefit certain types of investors more than others. Read more at: https://www.cnbc.com/2024/10/22/when-exchange-traded-funds-really-flex-their-tax-magic-for-investors.html |

|

Is AI Smarter Than A 1-Year-Old? Can You Train AI With AI?Authored by Mike Shedlock via MishTalk.com, The answers, as most will quicky access, are no and no. So, how much of the AI hype is real?

AI Can’t Teach AI New Tricks Wall Street Journal writer Andy Kessler has a great observation today: AI Can’t Teach AI New Tricks

|

|

Polymarket Is Singlehandedly Moving The Entire US Bond MarketOnline betting exchange Polymarket has not only taken the attention space by storm, rapidly becoming one of the most downloaded Apple apps…

… it is also quickly becoming a key driver behind the world’s largest and most liquid bond market. According to Bloomberg’s Masaki Kondo, Polymarket has become instrumental in setting at least the near-term price signals not only for the $28 trillion marketable US Treasury markets, but also for FX markets: that’s because both Treasuries and the Mexican peso appear to be pricing in a rising probability of Donald Trump winning the US presidential election, as indicated by Polymarket, while ignoring traditional polls which for the most part still show Kamala in the lead. As Bloomberg chart below shows, the benchmark 10Y yield has been closely tracking the spread in the perceived odds of a vote victory between Trump and Kamala Harris. This difference has now sur … Read more at: https://www.zerohedge.com/markets/polymarket-singlehandedly-moving-entire-us-bond-market |

|

Beauty Slowdown Hits L’Oreal As Sales Miss On China Consumer WoesADR Shares of French cosmetics giant L’Oréal fell nearly 5% after third-quarter sales missed analysts’ expectations, as tracked by Bloomberg. The slowdown in sales was primarily attributed to worsening consumer sentiment in China. L’Oréal – home to brands including Giorgio Armani Beauty, L’Oréal Paris, Maybelline New York, Garnier, NYX Professional Makeup, and many more — booked sales of 10.28 billion euros ($11.12 billion) for the third quarter. Like-for-like sales increased 3.4%, missing the Bloomberg Consensus estimate of 5.88%. “As anticipated, global beauty market growth has been normalizing throughout the year. In the developed markets, this has been driven by a gradual easing in pricing after two years of strong inflation; despite that, underlying market trends remain robust in Europe, and North America – as well as in emerging markets. The situation in the Chinese ecosystem has become even more challenging, but we believe in the future of this market and hope that the governmental stimulus will help improve consumer confidence,” L’Oréal CEO Nicolas Hieronimus wrote in a statement. Read more at: https://www.zerohedge.com/markets/beauty-slowdown-hits-loreal-sales-miss-china-consumer-woes |

|

Moderator Admits Questions Are All “Pre Determined” At Kamala’s Fake Town HallAuthored by Steve Watson via Modernity.news, Kamala Harris held a “town hall” meeting Monday, giving those in attendance a chance to ask questions and testing her mettle when it comes to being put on the spot.

Not really. It was all fake and scripted. The reality of the situation was unintentionally exposed by Maria Shriver, the moderator of the event in Royal Oak, Michigan. Shriver had to inform an audience member that they couldn’t actually ask any real questions at Kamala’s town hall because they were all scripted and handed to Harris beforehand.

|

|

Reeves welcomes IMF’s improved growth forecastThe global financial institution predicts stronger UK growth of 1.1% this year and 1.5% next year. Read more at: https://www.bbc.com/news/articles/c3vkv9qwl5do |

|

Water bills set to rise more than expectedThe regulator will allow higher bills to fund growing costs and investment, the BBC understands. Read more at: https://www.bbc.com/news/articles/c8elewdzy59o |

|

UK borrowing rises ahead of BudgetOfficial data shows borrowing – the difference between spending and tax take – reached £16.6bn last month. Read more at: https://www.bbc.com/news/articles/c981857nl79o |

|

Sebi issues framework on associations b/w mkt intermediaries, unauthorised financial advisorsMarkets regulator Sebi on Tuesday came out with a framework on associations between market intermediaries and unauthorised financial advisors, especially with regard to specified digital platforms. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-issues-framework-on-associations-b/w-mkt-intermediaries-unauthorised-financial-advisors/articleshow/114469511.cms |

|

Mahindra Finance Q2 Results: Net profit soars 36% to Rs 390 crore, NII rises 19%Mahindra Finance reported a 36% rise in consolidated net profit for the September quarter, achieving Rs 390 crore. Standalone net profit grew by 57%, totaling Rs 369 crore. Although vehicle finance slowed, the gross loan book grew by 20%. Stage-3 assets improved to 3.8% from 4.3% year-on-year. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/mahindra-finance-q2-results-net-profit-soars-36-to-rs-390-crore-nii-rises-19/articleshow/114472637.cms |

|

Godavari Biorefineries collects Rs 166 crore from anchor investors ahead of IPOGodavari Biorefineries Ltd raised over Rs 166 crore from anchor investors including HDFC Mutual Fund and Goldman Sachs prior to its IPO. The IPO, including a fresh issue of Rs 325 crore and an Offer-for-Sale of 65.27 lakh shares, is expected to total Rs 555 crore. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/godavari-biorefineries-collects-rs-166-crore-from-anchor-investors-ahead-of-ipo/articleshow/114472530.cms |

|

Verizon earnings imply Apple’s iPhone 16 didn’t have the most ‘auspicious start’Verizon’s third quarter didn’t include too many days of iPhone 16 sales, but the company’s low upgrade rate is still worth keeping an eye on. Read more at: https://www.marketwatch.com/story/verizon-earnings-imply-apples-iphone-16-didnt-have-the-most-auspicious-start-b1f4b5ec?mod=mw_rss_topstories |

|

A messy election could end market’s era of ‘American exceptionalism’“We can envision a post-election scenario where uncertainty rises and trust in U.S. institutions declines,” Macquarie strategist Thierry Wizman said. Read more at: https://www.marketwatch.com/story/a-messy-election-could-end-markets-era-of-american-exceptionalism-3a547bf3?mod=mw_rss_topstories |

|

10-year Treasury yield ends at roughly 3-month high as U.S. deficit concerns lingerLong-dated Treasury yields finished at their highest levels since late July again on Tuesday, as U.S. deficit concerns weighed on investors and traders. Read more at: https://www.marketwatch.com/story/ten-year-treasury-yield-close-to-three-month-peak-amid-u-s-deficit-concerns-1dd107a1?mod=mw_rss_topstories |