Summary Of the Markets Today:

- The Dow closed down 325 points or 0.75%, (Closed at 43,740, New Historic high 43,278)

- Nasdaq closed down 187 points or 1.01%, (Closed at 18,316, New Historic high 18,564)

- S&P 500 closed down 45 points or 0.76%,

- Gold $2,679 up $12.80 or 0.48%,

- WTI crude oil settled at $71 down $2.88 or 3.91%,

- 10-year U.S. Treasury 4.036 up 0.037 points or 0.305%,

- USD index $103.24 down $0.06 or 0.06%,

- Bitcoin $66,971 up $1,038 or 1.55%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks closed lower on Tuesday, largely influenced by disappointing earnings from ASML Holding, which released its results a day early due to an error. This unexpected announcement led to a significant drop in ASML’s shares, which fell over 15%, impacting the broader semiconductor sector. Nvidia and AMD also experienced declines of approximately 5% each as investors reacted to the news. The Dow Jones Industrial Average decrease was primarily driven down by UnitedHealth Group, whose shares fell around 8% after missing profit guidance for 2025. In contrast, some companies reported strong earnings. Goldman Sachs saw a 45% profit surge, while Bank of America beat earnings expectations, indicating resilience in the banking sector amid a challenging market environment. Additionally, energy prices fell sharply, with oil dropping about 4% following reports that Israel might hold back on military actions against Iran, contributing to concerns over supply dynamics in the oil market.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

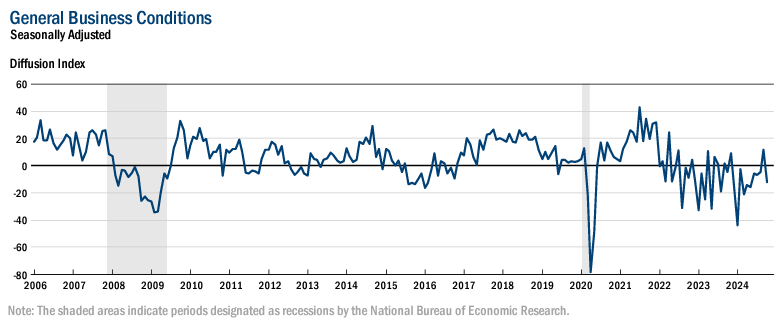

Business activity contracted modestly in New York Fed Empire State Manufacturing Survey in October 2024. After climbing into positive territory last month, the headline general business conditions index retreated twenty-three points to -11.9. New orders fell, and shipments edged lower. My position remains that manufacturing is in a recession in the US.

Here is a summary of headlines we are reading today:

- US Oil Producers Rush to Hedge

- Oil, Gas Companies Set To Spend More in 2025

- AI Chip Sales to Middle East Under Scrutiny

- Israel Walks Back from Potential Oil, Nuclear Facility Attacks

- BMW Says EU Ban on Gasoline Cars from 2035 Is “No Longer Realistic”

- Oil Prices Tumble as Demand Concerns Take Center Stage

- IEA Sees “Sizeable Surplus” in Oil Market as Demand Growth Slows

- Dow closes 300 points lower, retreating from record; Nvidia drags down Nasdaq: Live updates

- United Airlines plans $1.5 billion share buyback, forecasts fourth-quarter earnings above estimates

- Walgreens says it will close 1,200 stores by 2027, as earnings top estimates

- Bank of America tops estimates on better-than-expected trading revenue

- Healthy Returns: Covering weight loss drugs could cost Medicare $35 billion through 2034

- Lufthansa hit with record penalty after barring Jewish passengers

- The bond market may be at risk from inflationary forces beyond the Fed’s control

- 10-, 30-year U.S. government debt rallies for second day on lower oil and weak manufacturing reading

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

US Oil Producers Rush to HedgeUS oil producers have taken advantage of the recent surge in crude prices, locking in future sales to safeguard their revenue. Rising tensions between Iran and Israel sent US crude prices soaring in early October, jumping from $71 per barrel on September 26 to almost $81 on October 7 after a prolonged slump. The sudden spike sparked a flurry of hedging activity, with companies rushing to secure favorable prices through futures contracts, swaps, and options. Hedging protects producers against potential price drops by locking in prices for future… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Oil-Producers-Rush-to-Hedge.html |

|

NATO Grapples with Russian Airspace Violations and Defense PosturingNATO’s defense ministers (and possibly a few leaders) will meet on October 17-18 in what will be new Secretary-General Mark Rutte’s first proper meeting as the head of the organization. It’s also the first time the defense ministers of the military alliance’s four “Indo-Pacific partners” — Australia, Japan, New Zealand, and South Korea — join for a session with their 32 NATO counterparts. It does signal the push, largely from the United States, to focus more on the growing influence and threats posed by China. While Beijing isn’t officially branded… Read more at: https://oilprice.com/Geopolitics/International/NATO-Grapples-with-Russian-Airspace-Violations-and-Defense-Posturing.html |

|

Japan’s TEPCO Looks to Make Hydrogen with Geothermal PowerTokyo Electric Power Co. Holdings (TEPCO) is making strides in the renewable energy sector by planning to produce hydrogen using geothermal power in Indonesia. In a partnership with Indonesian state-run oil company Pertamina, TEPCO will install hydrogen production equipment at a geothermal power plant in eastern Indonesia. This initiative, set to kick off as early as 2027, is part of a broader strategy to tap into the growing demand for low-emission energy sources. Meanwhile, major Japanese construction firm Obayashi is also jumping into the hydrogen… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Japans-TEPCO-Looks-to-Make-Hydrogen-with-Geothermal-Power.html |

|

Oil, Gas Companies Set To Spend More in 2025Producers of crude oil and natural gas will invest more in their business next year amid a stumbling transition away from hydrocarbons. The development may come as a surprise in the context of ever more transition commitments on the part of governments, but it simply proves one thing: while there is demand, there will be supply. Investments in oil and gas among the 23 biggest producers in the world are set to climb by over 60% by next year, compared to the trough of 2020 and the pandemic lockdowns. The forecast comes from Wood Mackenzie, which… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Gas-Companies-Set-To-Spend-More-in-2025.html |

|

AI Chip Sales to Middle East Under ScrutinyNvidia shares, which hit record highs on Monday, are now sliding in premarket trading in New York after a Bloomberg report revealed that US officials are considering restricting the sale of the chipmaker’s advanced AI chips to specific countries. The report cites sources familiar with continuing talks within the Biden administration, which have discussed this new possible strategy in creating a ceiling on export licenses under the guise of ‘national security’ risks. They said the possible limation of these AI chips is centered around oil/gas-rich… Read more at: https://oilprice.com/Geopolitics/International/AI-Chip-Sales-to-Middle-East-Under-Scrutiny.html |

|

EU Imposes New Sanctions on Iran for Missile Transfers to RussiaForeign ministers from the European Union have approved new sanctions against seven individuals and seven entities linked to Iran after Kyiv’s Western allies accused Tehran of sending ballistic missiles to Russia to aid in its full-scale invasion of Ukraine. The sanctions, reported in an exclusive by Radio Farda last week, target companies and individuals accused of being involved in the transfer of the weapons to Russia, including the country’s flagship carrier Iran Air, as well as airlines Saha Airlines and Mahan Air. Individuals sanctioned include… Read more at: https://oilprice.com/Geopolitics/International/EU-Imposes-New-Sanctions-on-Iran-for-Missile-Transfers-to-Russia.html |

|

Rosatom Eyes Massive Expansion by 2045Russia’s state nuclear energy corporation, Rosatom, is set to present its long-term strategic development plan in 2025, mapping out its vision through 2045. This announcement came from Rosatom CEO Alexei Likhachev during a meeting with President Vladimir Putin. The timing coincides with the 80th anniversary of Russia’s nuclear industry. The plan outlines ambitious goals for expanding nuclear power generation across the country, targeting the addition of 28.5 GW of new capacity by 2042. These additions will primarily feature advanced nuclear reactors… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rosatom-Eyes-Massive-Expansion-by-2045.html |

|

Israel Walks Back from Potential Oil, Nuclear Facility AttacksA full two weeks have passed since Iran’s October 1st ballistic missile attack on Israel, which involved some 200 projectiles, many of which caused destruction on the ground (though Israel has been tight-lipped on the extent of it). The big question has remained: when will Israel retaliate and what form will it take? The Biden administration has over the last many days reportedly been urging for Israel to avoid hitting nuclear sites as well as energy sites. But there have been conflicting reports. For example on Monday, Harper’s Magazine editor… Read more at: https://oilprice.com/Energy/Crude-Oil/Israel-Walks-Back-from-Potential-Oil-Nuclear-Facility-Attacks.html |

|

BMW Says EU Ban on Gasoline Cars from 2035 Is “No Longer Realistic”Germany’s car manufacturing giant BMW is warning that an EU ban on the sale of gasoline and diesel cars from 2035 is “no longer realistic” amid slow EV sales as the European auto industry will see a “massive shrinking” with such a ban. European carmakers are already struggling with their EV sales as subsidies in many countries are coming to an end and Chinese low-cost vehicle makers are gaining market share. Last year, the EU member states approved an emissions regulation under which the bloc will end sales of new… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BMW-Says-EU-Ban-on-Gasoline-Cars-from-2035-Is-No-Longer-Realistic.html |

|

Oil Prices Tumble as Demand Concerns Take Center StageOil prices fell early on Tuesday morning as fears faded of Israel striking Iranian oil facilities and traders refocused on growing demand concerns.- The September monthly average refining margin fell to its lowest for the month since 2020, indicating that the downstream supercycle that was boosted by COVID-related disruptions and Russia sanctions is now ending.- Disappointing diesel demand remains a headache for refiners as US product supply of distillate fuel oil dipped 6% year-over-year in 2024 to date amidst declining manufacturing activity… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Tumble-as-Demand-Concerns-Take-Center-Stage.html |

|

India Plans $109 Billion of Grid Investments to Boost RenewablesIndia plans a massive upgrade and expansion of its power transmission system, expecting investment opportunities of $109 billion to support the integration of renewable energy sources and storage solutions, the power ministry has said. India’s new National Electricity Plan (Transmission) envisages the addition of hundreds of thousands of kilometers of transmission lines, transformation capacity, and inter-regional transmission capacity by 2032. India aims to have 500 gigawatts (GW) of renewable energy capacity installed by 2030 and more than… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Plans-109-Billion-of-Grid-Investments-to-Boost-Renewables.html |

|

EU Energy Minister Debate Russian Gas Flows as Ukraine Transit Deal Nears EndEuropean Union energy ministers are discussing the flows of natural gas from Russia to the EU as the transit deal via Ukraine is nearing its end. The ministers are also talking about the issue of Russia’s LNG shipments to the bloc, which have been rising in recent months. The EU’s latest package of sanctions against Russia over its invasion of Ukraine included in June a ban on reloading services of Russian LNG in EU territory for the purpose of transshipment operations to third countries, after a transition period of 9 months.… Read more at: https://oilprice.com/Energy/Energy-General/EU-Energy-Minister-Debate-Russian-Gas-Flows-as-Ukraine-Transit-Deal-Nears-End.html |

|

Russian Refinery Maintenance Pushes Oil Exports to 3-Month HighRussia’s crude oil exports by sea rose to their highest level in three months in the four weeks to October 13, as seasonal refinery maintenance cut domestic crude processing rates, tanker-tracking data monitored by Bloomberg showed on Tuesday. The four-week average exports from Russia’s oil export terminals inched up by 7,000 barrels per day (bpd) to 3.33 million bpd in the four weeks to October 13, compared to the previous four-week average, according to the data reported by Bloomberg’s Julian Lee. The higher exports were largely… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Refinery-Maintenance-Pushes-Oil-Exports-to-3-Month-High.html |

|

IEA Sees “Sizeable Surplus” in Oil Market as Demand Growth SlowsThe oil market faces a sizeable surplus next year amid ample supply and slowing demand growth, the International Energy Agency (IEA) said on Tuesday as it further lowered its demand growth estimate for 2024. Global oil demand is set to increase by just 862,000 barrels per day (bpd) this year, amid decelerating consumption growth in China, the agency said in its closely-watched Oil Market Report today. The latest estimate is a downgrade from the 903,000 bpd growth in global oil demand expected in last month’s report. Demand is set to grow… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Sees-Sizeable-Surplus-in-Oil-Market-as-Demand-Growth-Slows.html |

|

TotalEnergies Warns Low Refining Margins Will Hit Q3 EarningsTotalEnergies has become the latest supermajor to flag weak refining margins as the key drivers of expected lower third-quarter results. The downstream earnings of TotalEnergies are expected “to sharply decrease given much lower refining margins” in Europe and in the rest of the world, the French oil and gas giant said in a preview of its Q3 earnings to be published on October 31. The European Refining Margin Marker (ERM) – the market indicator for European refining representative of the company’s European refining system… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Warns-Low-Refining-Margins-Will-Hit-Q3-Earnings.html |

|

Dow closes 300 points lower, retreating from record; Nvidia drags down Nasdaq: Live updatesAll three major averages slid on Tuesday. Read more at: https://www.cnbc.com/2024/10/14/stock-market-today-live-updates.html |

|

Goldman Sachs beats on profit and revenue as stock trading and investment banking boost resultsWall Street trading and investment banking has helped the big banks this quarter, and Goldman Sachs results showed why they are a leader in those areas. Read more at: https://www.cnbc.com/2024/10/15/goldman-sachs-gs-earnings-q3-2024.html |

|

United Airlines plans $1.5 billion share buyback, forecasts fourth-quarter earnings above estimatesUnited Airlines said it authorized a $1.5 billion share buyback, its first share repurchase since before the pandemic. Read more at: https://www.cnbc.com/2024/10/15/united-airlines-ual-3q-2024-earnings.html |

|

Trump Media shares halted after sudden DJT stock plungeTrading in Trump Media shares was briefly halted due to volatility, after the Truth Social owner’s stock suddenly plunged in price. Read more at: https://www.cnbc.com/2024/10/15/trump-media-shares-halted-after-sudden-djt-stock-plunge.html |

|

Earnings guide: Here’s what to expect from the ‘Mag 7’ ahead of third-quarter earningsMegacap tech has powered the two-year bull market. But the stocks have come under pressure as Wall Street wonders whether they have more room to run. Read more at: https://www.cnbc.com/2024/10/15/earnings-guide-what-to-expect-from-mag-7-in-third-quarter-earnings.html |

|

Trump’s coin sale misses early targets as crypto project’s website crashesFormer President Donald Trump’s launch of the token sale for his crypto project on Tuesday was plagued by problems. Read more at: https://www.cnbc.com/2024/10/15/trumps-coin-sale-misses-early-targets-as-crypto-website-crashes.html |

|

Walgreens says it will close 1,200 stores by 2027, as earnings top estimatesThe drugstore chain Walgreens said it plans to close roughly 1,200 stores over the next three years, which includes 500 closures in fiscal 2025 alone. Read more at: https://www.cnbc.com/2024/10/15/walgreens-wba-earnings-q4-2024.html |

|

Bank of America tops estimates on better-than-expected trading revenueBank of America benefited from its Wall Street trading and banking divisions in the third quarter, just as rival JPMorgan Chase did. Read more at: https://www.cnbc.com/2024/10/15/bank-of-america-bac-earnings-q3-2024.html |

|

Trump-backed crypto token launches, but questions around its utility remain: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Kathleen Breitman of Tezos discusses the launch of the Trump-backed crypto project, World Liberty Financial. Plus, Carlos Domingo of Securitize details a new partnership to allow conversions of USDC on BlackRock’s BUIDL platform. Read more at: https://www.cnbc.com/video/2024/10/15/trump-backed-crypto-token-launches-questions-around-utility-remain-crypto-world.html |

|

Boeing to raise as much as $25 billion to shore up balance sheetThe equity or debt raise of up to $25 billion would be over three years Boeing said. Read more at: https://www.cnbc.com/2024/10/15/boeing-equity-debt-raise.html |

|

Buying a home? Here are some key steps to consider from top-ranked advisorsIf you plan to buy a home, you need to take proper steps to prepare for the purchase. Here’s how to get there and what to consider, according to experts. Read more at: https://www.cnbc.com/2024/10/15/buying-a-home-here-are-key-steps-to-consider-from-top-ranked-advisors.html |

|

How a rare type of mortgage is landing homebuyers a 3% rateU.S. homebuyers are looking into mortgage assumption as a way to secure a sub-3% mortgage rate. Read more at: https://www.cnbc.com/2024/10/15/rare-mortgage-type-lower-rates.html |

|

Healthy Returns: Covering weight loss drugs could cost Medicare $35 billion through 2034Medicare coverage of the drugs would up federal spending by $35 billion from 2026 to 2034. Meanwhile, CNBC tests Abbott’s continuous glucose monitor Lingo. Read more at: https://www.cnbc.com/2024/10/15/healthy-returns-medicare-weight-loss-drug-coverage-could-cost-34-billion.html |

|

Rickards: This Is What Will Destroy The DollarAuthored by James Rickards via DailyReckoning.com, Janet Yellen gave a speech on Sept. 26 at the 2024 U.S. Treasury Market Conference in New York. The speech was largely about risks in the banking system and the market for U.S. Treasury debt. In a pre-speech interview with Politico, Yellen was asked about risks related to a smooth presidential transition in this election cycle. While that may seem like a straightforward question, it contained a particular bias that somehow Donald Trump, win or lose, might make the presidential transition difficult. Difficulties could arise if Trump loses and claims the election was “rigged” or if Trump wins and radical groups like antifa commence violent protests. My estimate is that the former is unlikely, and the latter is far more likely but Trump haters in the media will take the opposite view. Yellen replied, “It really is essential to our having a democratic system and a democratic government, and one of the tremendous strengths of our financial system is that it is based on strong institutions and the rule of law.” While this statement may seem reasonable on its face, it was Yellen’s thinly disguised way of saying that Donald Trump’s actions on Jan. 6, 2021, and possible similar acts on Jan. 6, 2025, are a threat to the “rule of law” and therefore a danger to the stability of the financial system. There are many forces at work in this statement by Yellen. In the first instance, this is an example of the Biden-Harris adminis … Read more at: https://www.zerohedge.com/precious-metals/rickards-what-will-destroy-dollar |

|

Cold Blob Invades Central & Eastern US As Proper Autumn Arrives For MillionsA cold front swept across the north-central US through the eastern half of the US late weekend into the early part of the new week. For readers based in the east and central US, Brrr! It’s a chilly morning as fall-like weather roars in, and it could get even chillier into Wednesday. “Below average temperatures forecast across the central and eastern United States, while summer-like warmth remains over portions of Texas today and the northern Plain by Wednesday,” NWS’ Weather Prediction Center wrote on X.

X user MyRadar Weather shows the cold blob of Canadian air descending into parts of the central and eastern US.

|

|

Peter Schiff: FEMA Makes Hurricanes WorseVia SchiffGold.com, In this week’s episode, Peter offers an important reminder: the government has a strong incentive to bend the truth with their data, especially when we’re less than a month out from an election. Beyond this, Peter spends time discussing the proliferation of free market ideas on X, declares Grover Cleveland to be the last good Democratic president, and explains the broken window fallacy in light of Hurricane Milton. With last week’s jobs numbers still in the news cycle, Peter reiterates why they’re unreliable. Bidenomics shills like Paul Krugman are sorely mistaken:

The data doe … Read more at: https://www.zerohedge.com/markets/peter-schiff-fema-makes-hurricanes-worse |

|

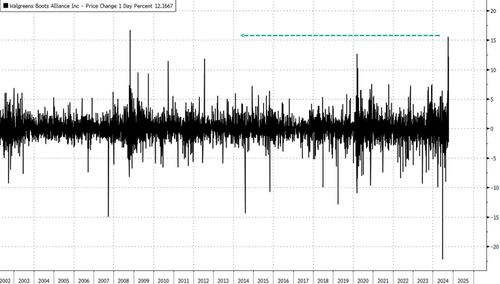

Walgreens Jumps Most In Years After Better-Than-Expected Earnings, Outlook, & Widespread Store ClosuresWalgreens shares in New York surged the most in 16 years on Tuesday after the struggling pharmacy chain delivered an unexpectedly optimistic forecast for 2025. Simultaneously, Walgreens announced plans to shutter over a thousand stores nationwide as its turnaround plan gains steam.

Fourth-quarter earnings were 39 cents, beating the Bloomberg consensus of 36 cents. This indicates that the struggling drugstore chain is executing on its aggressive cost-cutting measures in an ambitious turnaround plan after years of pain. Here’s a snapshot of the quarterly results (courtesy of Bloomberg):

|

|

National Insurance fears spark business backlashThe government is facing criticism by businesses over a potential tax rise that would fall on employers. Read more at: https://www.bbc.com/news/articles/crm2remkekdo |

|

What is NI and how much do workers and employers pay?Two National Insurance cuts came info effect in 2024, but many people are still paying more in tax. Read more at: https://www.bbc.co.uk/news/explainers-63635185 |

|

Lufthansa hit with record penalty after barring Jewish passengersThe German airline has agreed to pay $4m to resolve claims it discriminated against Jewish passengers. Read more at: https://www.bbc.com/news/articles/c3dv3l5pvy3o |

|

Is Sebi’s new asset class a game-changer for Indian investors?Sebi’s new asset class caters to investors with ₹10-50 lakhs, offering complex strategies like long-short equity and inverse ETFs previously limited to wealthier individuals. It aims to fill the gap between mutual funds and high-entry barrier investment options, promising better risk-adjusted returns but also carries higher costs and performance uncertainty. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/is-sebis-new-asset-class-a-game-changer-for-indian-investors/articleshow/114243392.cms |

|

Iron & Steel, Housing Finance, and PSU Banks among most undervalued PSU sectors: Value StocksValue Stocks research found that 16 out of 26 PSU subgroups are undervalued. Iron & Steel, Housing Finance, and PSU Banks are highlighted as undervalued sectors with attractive investment opportunities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/iron-steel-housing-finance-and-psu-banks-among-most-undervalued-psu-sectors-value-stocks/articleshow/114245515.cms |

|

PMS Tracker: HNIs manage to eke out double-digit returns in 2 fundsIn September, at least two PMS schemes significantly outperformed benchmarks, achieving double-digit returns of up to 12%. According to data from PMS Bazaar, Pace Financial’s Tresor SKG India Value Fund was the top performer, delivering a monthly return of 12%, followed by Molecule Ventures’ Quant Fund with a return of 10.28%. Other notable winners included Sundaram’s SISOP Fund, Emkay’s Golden Decade of Growth, Wryght’s Alpha Fund, and InCred’s Healthcare Portfolio. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/pms-tracker-hnis-manage-to-eke-out-double-digit-returns-in-2-funds/articleshow/114241785.cms |

|

Charles Schwab is profiting from customers who want professional help with their investingThe brokerage said it is seeing increased inflows into its wealth-management offerings. Read more at: https://www.marketwatch.com/story/charles-schwab-customers-want-professional-help-investing-and-the-brokerage-is-profiting-8574f28c?mod=mw_rss_topstories |

|

The bond market may be at risk from inflationary forces beyond the Fed’s controlInvestors remain nervous about upside risks to inflation, such as the outcome of the Nov. 5 presidential election, that haven’t been priced into the bond market — and which policymakers may not be able to do much about. Read more at: https://www.marketwatch.com/story/the-bond-market-may-be-at-risk-from-inflationary-forces-beyond-the-feds-control-435fd907?mod=mw_rss_topstories |

|

10-, 30-year U.S. government debt rallies for second day on lower oil and weak manufacturing readingLong-term Treasury yields fell for a second day on Tuesday as traders reacted to a weaker-than-expected manufacturing reading from the New York Fed and new developments from the Middle East that pushed oil prices lower. Read more at: https://www.marketwatch.com/story/ten-year-treasury-yield-dips-from-11-week-highs-as-bonds-return-from-break-1a269c9c?mod=mw_rss_topstories |