Summary Of the Markets Today:

- The Dow closed up 410 points or 0.97%, (Closed at 42,864, New Historic high 42,900)

- Nasdaq closed up 61 points or 0.33%,

- S&P 500 closed up 35 points or 0.61%, (Closed at 5,815, New Historic high 5,822)

- Gold $2,673 up $34.20 or 1.28%,

- WTI crude oil settled at $76 down $0.27 or 0.34%,

- 10-year U.S. Treasury 4.088 up 0.006 points or 0.051%,

- USD index $102.94 down $0.05 or 0.05%,

- Bitcoin $62,955 up $2,696 or 4.49%,

- Baker Hughes Rig Count: U.S. +1 to 586 Canada -4 to 219

U.S. Rig Count is up 1 from last week to 586 with oil rigs up 2 to 481, gas rigs down 1 to 101 and miscellaneous rigs unchanged at 4.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

JPMorgan Chase and other major U.S. banks kicked off the Q3 2024 earnings season on Friday, helping push the Dow Jones Industrial Average and S&P 500 to new record highs. The Dow rose to a new all-time high. The S&P 500 closed above 5,800 for the first time. All three major indexes finished the week with gains of over 1%. JPMorgan Chase reported better-than-expected Q3 results, with earnings of $4.37 per share beating estimates of $4.021. The bank’s revenue grew to $42.65 billion, surpassing analyst expectations of $40.85 billion. JPMorgan’s shares rose nearly 5% following the earnings release. Wells Fargo also reported strong Q3 results, contributing to the positive sentiment in the financial sector. Investors are weighing recent economic data and its potential impact on Federal Reserve policy: A hot inflation print earlier in the week raised questions about the Fed’s next moves. Wholesale inflation remained unchanged, adding to the complex economic picture. The market is closely watching for signs of how the Fed’s potential rate cuts might affect bank lending margins and profits. Earnings season will continue next week with reports from major companies like Citigroup, United Airlines, ASML, Netflix, and American Express. Investors will be focusing on company forecasts and any early indications of improvement given the lower rate environment.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Producer Price Index (PPI) declined from 1.9% year-over-year to 1.8% year-over-year. The good news is that there is now disinflation in goods production but growing inflation in services. I cannot believe the spin on this data. Some say the Consumer Price Index (CPI) came in hot but the PPI came in supporting the notion that inflation was moderating. Folks, the opposite is true. To get a handle of the underlying pressures on an inflation index is to remove food and energy. For the CPI, if food and energy are excluded inflation remains little changed at 3.3% year-over-year. For the PPI, if food and energy are excluded inflation increased from 2.7% year-over-year to 2.8% (see red line on graph below). Everywhere I look – there are inflationary pressures present.

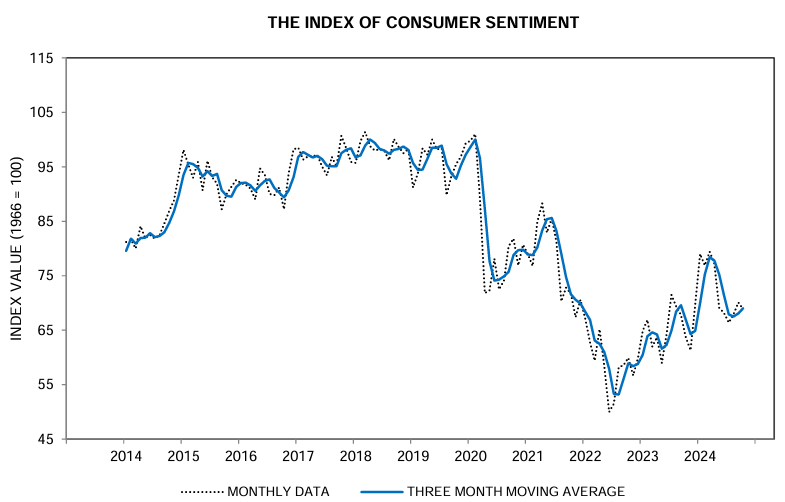

The University of Michigan’s consumer sentiment index decreased from 70.1 in September to 68.9 in October, a drop of 1.2 points. Despite the minor dip, consumer sentiment remains 8% higher than a year ago and nearly 40% above its lowest point in June 2022. This indicates a general trend of improvement in consumer outlook over the past year. Consumers continue to express frustration over high prices, even though inflation expectations have eased significantly since June 2022. The year-ahead inflation expectation rose slightly to 2.9% in October from 2.7% in September.

Here is a summary of headlines we are reading today:

- U.S. Oil Drilling Activity Inches Up

- Tripling Renewable Energy Capacity by 2030 Will Require $1.5 Trillion Per Year

- Will Tesla’s Cybercab Revolutionize Transportation? Analysts Weigh In

- Spanish Power Giant Iberdrola Doubles UK Investment to $31 Billion

- China Starts Tracking Ship Emissions Data

- Geopolitical Risk and Hurricane Milton Push Oil Prices Toward a Weekly Gain

- The Federal Reserve may have pretty much just hit its 2% inflation target

- Dow jumps 400 points to a record on Friday, S&P 500 closes above 5,800 for the first time: Live updates

- Jamie Dimon says geopolitical risks are surging: ‘Conditions are treacherous and getting worse’

- Stock market next week: Earnings season ramps up with more big bank results

- Bitcoin bounces back to $62,000 as economic outlook remains in focus: CNBC Crypto World

- Nation’s Largest Generic Drug Maker To Pay $450 Million To Resolve Kickback, Price-Fixing Claims

- 2-year Treasury yield ends at lowest level in a week after flat producer-price report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Iran’s Oil Exports: On a Slow Boat to NowhereIran’s crude oil exports have dramatically slowed in October as the country braces for possible retaliation following its October 1 missile attack on Israel. With Israeli strikes on Iranian oil facilities a topic of discussion, Iran’s exports dropped to around 600,000 barrels per day in the first 10 days of the month—about a third of recent months’ volumes. Typically, 5-8 tankers would load during this period, but this month only 3-4 vessels were loaded, according to Vortexa oil risk analyst Armen Azizian. Iran has moved several empty tankers… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Irans-Oil-Exports-On-a-Slow-Boat-to-Nowhere.html |

|

U.S. Oil Drilling Activity Inches UpThe total number of active drilling rigs for oil and gas in the United States rose this week, according to new data that Baker Hughes published on Friday. The total rig count rose by 1 this week to 586, compared to 622 rigs this same time last year. The number of oil rigs rose by 2 this week to 481—down by 20 compared to this time last year. The number of gas rigs fell by 1 this week to 101, a loss of 16 active gas rigs from this time last year. Miscellaneous rigs stayed the same at 4. Meanwhile, U.S. crude oil production rose in the week… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Drilling-Activity-Inches-Up.html |

|

Tripling Renewable Energy Capacity by 2030 Will Require $1.5 Trillion Per YearThe world’s progress to reach the goal of tripling renewables capacity by 2030 is falling short and needs another tripling, of investments, from $570 billion in 2023 to $1.5 trillion every year between 2024 and 2030, the International Renewable Energy Agency (IRENA) said in a new report on Friday. Despite the significant acceleration of renewable capacity installations, the current pace of growth and progress is still falling short of targets, IRENA said. According to the current plans and targets of individual countries, the goals set would… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tripling-Renewable-Energy-Capacity-by-2030-Will-Require-15-Trillion-Per-Year.html |

|

Houthi Havoc: Oil Flows Shift as Ships Avoid Red SeaCrude oil and oil product flows through the Bab el-Mandeb Strait have sharply declined in 2024, dropping by over 50% compared to last year, according to the U.S. Energy Information Administration (EIA) in a new report released on Friday. This chokepoint, located at the southern entrance of the Red Sea, plays a critical role in global energy trade. Disruptions here can cause substantial delays in supply chains, leading to higher shipping costs and spikes in global energy prices. Tensions in the region has been high since earlier this year, with… Read more at: https://oilprice.com/Energy/Energy-General/Houthi-Havoc-Oil-Flows-Shift-as-Ships-Avoid-Red-Sea.html |

|

Biggest Russian Refinery Raises Crude Oil Processing by 4%Russia’s biggest crude processing facility by production, the Omsk refinery, increased its crude processing by 4% between January and September compared to the same period last year, according to the refinery owner Gazprom. The Omsk refinery is located 2,700 kilometers (1,700 miles) east of Moscow and is owned by Gazprom’s oil unit Gazprom Neft. The facility raised its supply of gasoline to the domestic market by 5% and increased diesel supply by 10%, according to a statement from the refinery cited by Reuters. Last year, the Omsk refinery… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biggest-Russian-Refinery-Raises-Crude-Oil-Processing-by-4.html |

|

Will Tesla’s Cybercab Revolutionize Transportation? Analysts Weigh InTesla’s shares stumbled in early trading after the company’s long-awaited robotaxi event in Burbank, California. The event showcased the robotaxi Cybercab, the futuristic-looking Robovan concept, and the latest version of the humanoid robot, Optimus. Just hours after the event, some top Wall Street analysts began weighing in, praising the impressive lineup of new innovative products that will revolutionize transportation and other areas of the economy but noting a lack of technical details. A team of Goldman analysts led by Mark Delaney and… Read more at: https://oilprice.com/Energy/Energy-General/Will-Teslas-Cybercab-Revolutionize-Transportation-Analysts-Weigh-In.html |

|

Japan Considers Quadrupling LNG Buying for EmergenciesJapan is discussing quadrupling LNG purchases for its emergency reserves as part of a plan to boost energy security, a senior official at Japan’s industry ministry has told Reuters. “From the mid- to late-2020s, we will try to secure at least one cargo per month throughout a year – that is, at least 12 cargoes per year,” Yuya Hasegawa, director of the energy resources development division at the Ministry of Economy, Trade and Industry (METI), told Reuters. Currently, Japan buys on average three cargoes of LNG per year for its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Japan-Considers-Quadrupling-LNG-Buying-for-Emergencies.html |

|

Oil Prices Under Pressure Despite Major Upside RiskOil markets have been on edge all week, dealing with rumors of an imminent Israeli attack on Iranian oil infrastructure and the potential of a major hurricane-related outage in the U.S. Ultimately, Israel’s attack failed to materialize and Hurricane Milton’s impact on U.S. oil output was limited. Friday, October 11th, 2024Oil markets were anticipating an Israeli retaliatory strike on Iran all week and as time progressed and nothing happened, some of that disappointment nudged Brent futures lower, settling this week just below the $79… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-Despite-Major-Upside-Risk.html |

|

Spanish Power Giant Iberdrola Doubles UK Investment to $31 BillionSpanish utility giant Iberdrola plans to double its UK investments to $31.3 billion (24 billion British pounds) by 2028, Europe’s biggest electricity company said in a statement. Iberdrola, one of the biggest utilities and renewable energy developers in Europe and the Americas, previously planned to invest $15.7 billion (12 billion pounds) in the UK between 2024 and 2028. Now the company plans to double that investment “given Britain’s significant power demand growth prospects and the energy policies set out to promote Net Zero,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spanish-Power-Giant-Iberdrola-Doubles-UK-Investment-to-31-Billion.html |

|

Platts Survey: OPEC+ Oil Production Drops by 500,000 BpdA halt in Libya’s oil production and improved compliance from OPEC’s second-largest producer Iraq pushed the total output of the OPEC+ group down by around 500,000 barrels per day (bpd) in September, according to the Platts OPEC+ survey from S&P Global Commodity Insights. The OPEC+ alliance collectively pumped 40.23 million bpd last month, down by 500,000 bpd from August, according to the survey, which also showed that the oil production from the OPEC+ producers with quotas under the agreement still exceeded the collective target,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Platts-Survey-OPEC-Oil-Production-Drops-by-500000-Bpd.html |

|

Indian State Refiner Looks to Raise $3.3 Billion for New RefineryIndian state-owned refiner Chennai Petroleum Corporation Limited is holding discussions with banks to obtain a loan of $3.33 billion (280 billion Indian rupees) that would help it build a refinery in southern India, sources with knowledge of the plans told Bloomberg. Chennai Petroleum – whose 52% majority shareholder is India’s biggest refiner, state-held Indian Oil Corporation – has proposed to build a refinery worth a total of $3.9 billion (330 billion rupees) in the state of Tamil Nadu in the south. National Iranian Oil Company… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indian-State-Refiner-Looks-to-Raise-33-Billion-for-New-Refinery.html |

|

BP Warns Weak Refining and Oil Trading Will Hurt Q3 EarningsWeak refining margins and weaker oil trading results are expected to dent BP’s third-quarter profit, the UK-based supermajor warned on Friday. BP is yet another oil major to flag weakness in their refining business for the past quarter, following warnings from Shell and ExxonMobil. Compared to the second quarter, BP expects its Q3 results to have been dented by weaker realized refining margins and a weak oil trading result. The lower refining margins are expected to hit earnings by between $400 million and $600 million, the company said in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Warns-Weak-Refining-and-Oil-Trading-Will-Hurt-Q3-Earnings.html |

|

China Starts Tracking Ship Emissions DataChina has started collecting emissions data from ships, Bloomberg has reported, citing unnamed sources. According to the report, the first targets of the emission-tracking initiative are owners of tankers and container vessels calling at Chinese ports. Bloomberg’s sources did not specify any shipowner names or which ports are collecting the emission information. The report also noted that China’s move comes after the European Union proposed the inclusion of certain classes of ships in its emissions-tracking regulation. The EU launched… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Starts-Tracking-Ship-Emissions-Data.html |

|

Shell Suffers Setback in Venture Global LNG SagaShell suffered a setback in its stated quest to hold Venture Global accountable for failure to deliver contracted volumes of LNG, when a court denied the supermajor access to commissioning documentation on Venture’s Calcasieu Pass facility. Shell and half a dozen other European energy majors had requested commissioning documents about Venture Global’s LNG facility from the Federal Energy Regulatory Commission and the commission granted access to some of them. However, an administrative judge that the FERC appointed to handle the case… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Suffers-Setback-in-Venture-Global-LNG-Saga.html |

|

Geopolitical Risk and Hurricane Milton Push Oil Prices Toward a Weekly GainCrude oil prices have been on a retreat towards the end of the week but still look set to book another weekly gain, supported by the situation in the Middle East and worry about the security of supply. In a fresh update, Reuters reported that Gulf states were lobbying with Washington to convince Israel not to target Iranian oil sites on fears that this would prompt retaliatory attacks by Iran-affiliated groups on those Gulf states’ own oil infrastructure. “The Iranians have stated: ‘If the Gulf states open up their airspace to Israel,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Geopolitical-Risk-and-Hurricane-Milton-Push-Oil-Prices-Toward-a-Weekly-Gain.html |

|

The Federal Reserve may have pretty much just hit its 2% inflation targetIn fact, economists at Goldman Sachs think the Fed may already be there. Read more at: https://www.cnbc.com/2024/10/11/the-federal-reserve-may-have-pretty-much-just-hit-its-2percent-inflation-target.html |

|

Dow jumps 400 points to a record on Friday, S&P 500 closes above 5,800 for the first time: Live updatesAll the major averages are headed for a winning week. Read more at: https://www.cnbc.com/2024/10/10/stock-market-today-live-updates.html |

|

Prosecutors seek years in prison for Trump Media insider trading Shvartsman brothersThree men convicted of insider trading related to a company’s planned merger with Trump Media are awaiting sentences in New York federal court. Read more at: https://www.cnbc.com/2024/10/11/trump-media-insider-trading-shvartsman-sentencing-.html |

|

Ride-sharing giants Uber, Lyft jump after Tesla’s ‘toothless taxi’ fails to excite investorsTesla’s hyped robotaxi unveiling posed a threat to Uber’s ride-sharing aspirations, but it has turned into a boon for the stock instead. Read more at: https://www.cnbc.com/2024/10/11/ridesharing-giants-uber-lyft-jump-after-teslas-toothless-taxi-fails-to-excite-investors.html |

|

Jamie Dimon says geopolitical risks are surging: ‘Conditions are treacherous and getting worse’JPMorgan Chase CEO Jamie Dimon sees risks climbing around the world amid widening conflicts in the Middle East. Read more at: https://www.cnbc.com/2024/10/11/jpms-dimon-says-geopolitical-risks-treacherous-and-getting-worse.html |

|

Stock market next week: Earnings season ramps up with more big bank resultsThird-quarter numbers could determine what’s next for stocks at a time when the Dow and S&P 500 are at all-time highs. Read more at: https://www.cnbc.com/2024/10/11/stock-market-next-week-outlook-for-october-14-18-2024.html |

|

Bitcoin bounces back to $62,000 as economic outlook remains in focus: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Jeremy Allaire, CEO of Circle, provides an update on the company’s plans to go public and its strategy in a lower-rate environment. Read more at: https://www.cnbc.com/video/2024/10/11/bitcoin-bounces-back-economic-outlook-in-focus-crypto-world.html |

|

Wells Fargo shares jump after earnings top Wall Street expectationsThe San Francisco-based lender posted $11.69 billion in net interest income, a 11% decrease from the same quarter last year. Read more at: https://www.cnbc.com/2024/10/11/wells-fargo-wfc-q3-2024-earnings.html |

|

JPMorgan Chase shares pop 5% after topping estimates on better-than-expected interest incomeJPMorgan said profit fell 2% from a year earlier to $12.9 billion, while revenue climbed 6% to $43.32 billion. Read more at: https://www.cnbc.com/2024/10/11/jpmorgan-chase-jpm-earnings-q3-2024.html |

|

Social Security payroll tax limit increases for 2025. Here’s how that may affect youThe Social Security Administration has announced a higher threshold for earnings subject to Social Security payroll taxes. Here’s what workers need to know. Read more at: https://www.cnbc.com/2024/10/11/social-security-payroll-tax-limit-2025.html |

|

Tesla shares drop 9% after Cybercab robotaxi reveal ‘underwhelmed’ investorsTesla shares tumbled on Friday after the company’s long-awaited robotaxi event failed to impress investors. Read more at: https://www.cnbc.com/2024/10/11/tesla-tsla-stock-drops-in-premarket-after-cybercab-robotaxi-reveal.html |

|

Working moms are still more likely to handle child care. It costs them $20,000 a year in lost wages, reports showDespite women’s stride in the workplace over the years, as they approach their 30s and 40s, their share of the labor force shrinks. Here’s why. Read more at: https://www.cnbc.com/2024/10/11/why-women-in-their-30s-and-40s-step-out-of-the-labor-force.html |

|

WNBA to expand Finals to 7 games, add to regular season next yearThe WNBA is changing its Finals series to seven games and adding four games to its regular season starting next year. Read more at: https://www.cnbc.com/2024/10/11/wnba-finals-to-be-7-games-in-2025-season.html |

|

Iran Issues Secret Warning To US Allies Across Middle EastAfter Wednesday’s phone call involving President Biden, Vice President Harris, and Israeli Prime Minister Benjamin Netanyahu – the US and Israel have moved closer on achieving consensus regarding Israel’s planned retaliation against Iran. There have been reports that Netanyahu is now seeking the approval of his security cabinet, however regional media says that no big resolutions have been reached. The expected big counterstrikes have yet to come, despite Iran firing some 200 ballistic missiles at Israel on October 1st. But The Wall Street Journal has described Iran’s “secret warning” conveyed to other Middle East regional countries this week as it braces for Israel’s potential retaliation.

Read more at: https://www.zerohedge.com/geopolitical/iran-issues-secret-warning-us-allies-across-middle-east |

|

‘I Got A Dad, And He Ain’t You’: Response To Obama’s Condescending Remarks Goes ViralProminent black Trump booster Rob Smith has responded to the former president’s condescending screed over ‘brothas’ who are afraid to vote for Kamala Harris. In a now-viral reply, Smith tells Obama: “There is no amount of lecturing or bullying or shaming that you can do that is going to make me change that decision [to vote for Trump]. Watch:

Even CNN slammed Obama!

Read more at: https://www.zerohedge.com/political/not-acceptable-obama-scolds-black-brothers-not-backing-harris-blames-sexism |

|

Univision Host Denies Kamala Teleprompter Claim, Which Explains This Rambling AnswerUpdate (1115ET): Univision’s Enrique Acevedo has refuted claims that Harris used a teleprompter during her Town Hall event. “The prompter displayed my introduction (in Spanish) and then it switched to a timer. Any claim to the contrary is simply untrue,” he replied to journalist Benny Johnson.

Which would explain this rambling answer to Joe Biden’s downfall:

And this one:

|

|

Nation’s Largest Generic Drug Maker To Pay $450 Million To Resolve Kickback, Price-Fixing ClaimsTeva Pharmaceuticals USA Inc. and Teva Neuroscience Inc. (collectively, Teva) have agreed to pay $450 million to resolve allegations that they violated the Anti-Kickback Statute (AKS) and the False Claims Act (FCA), according to the U.S. Department of Justice (DOJ). Teva is an Israeli company, with U.S. headquarters in Parsippany, New Jersey, and is the largest generic drug manufacturer in the United States, according to the DOJ. The settlement amount was based on Teva’s ability to pay, the DOJ said. As Chase Smith details below, via The Epoch Times, the settlement addresses two alleged kickback schemes. Read more at: https://www.zerohedge.com/political/nations-largest-generic-drug-maker-pay-450-million-resolve-kickback-price-fixing-claims |

|

Talks over £1bn UK port expansion ongoing after rowReports have suggested the plan was at risk after Transport Secretary Louise Haigh’s comments. Read more at: https://www.bbc.com/news/articles/cj9jp3ey0exo |

|

Firms ‘pausing’ hiring and investing ahead of BudgetA leading business group says firms are delaying decisions, wanting “more clarity” over the government’s policies. Read more at: https://www.bbc.com/news/articles/c89l52pwwllo |

|

Tesla shares slide after Cybercab robotaxi revealedElon Musk revealed a prototype of the long-awaited robotaxi at a Hollywood film studio – but investors aren’t wowed. Read more at: https://www.bbc.com/news/articles/cm29x5ke9jdo |

|

Hyundai India IPO could trigger a sector-wide positive re-rating for auto stocksHyundai Motor India’s upcoming IPO, valued at ₹27,870 crore, is set to be the largest public offering in the sector and is expected to attract substantial global interest and foreign capital. Analysts believe this could lead to a sector-wide re-rating for the auto industry. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/hyundai-india-ipo-could-trigger-a-sector-wide-positive-re-rating-for-auto-stocks/articleshow/114143565.cms |

|

Tech View: Nifty forms high wave type candle on weekly chart. Here’s how to trade next weekNifty formed a small negative candle, indicating continued narrow range movement. The underlying trend remains choppy. Support at 24,920 and 24,750. Resistance at 25,000-050 and 25,250-275. Bears are in control, using pullback rallies to create short positions. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-high-wave-type-candle-on-weekly-chart-heres-how-to-trade-next-week/articleshow/114150268.cms |

|

Sudarshan Chemical Industries acquires Germany-based world’s second biggest pigment company Heubach GroupSudarshan Chemical Industries announced the acquisition of Heubach Group for Rs 1,180 crore. Shares surged 20% on the news. Heubach Group is the world’s second-biggest pigment company. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sudarshan-chemical-industries-acquires-germany-based-worlds-second-biggest-pigment-company-heubach-group/articleshow/114150091.cms |

|

2-year Treasury yield ends at lowest level in a week after flat producer-price reportTreasury yields finished mostly lower on Friday after September’s producer-price report came in unchanged, but closed higher on a weekly basis as a result of unexpectedly strong nonfarm-payrolls data for last month. Read more at: https://www.marketwatch.com/story/treasury-yields-rise-ahead-of-ppi-report-d3e9ac21?mod=mw_rss_topstories |

|

Oil prices score back-to-back weekly gains on Middle East fearsOil futures saw a modest decline on Friday, but scored back-to-back weekly gains as investors weighed the threat of a wider Middle East conflict that could threaten crude flows from the region. Read more at: https://www.marketwatch.com/story/oil-prices-set-for-weekly-gain-on-middle-east-fears-e490d826?mod=mw_rss_topstories |

|

Here’s how stocks have performed under Biden and Harris vs. under TrumpDuring the homestretch of the tight presidential race, the campaigns of Democratic nominee Kamala Harris and Republican rival Donald Trump are likely to offer up hyperbole about each candidate’s track record on economic issues. So what does the market itself say? Read more at: https://www.marketwatch.com/story/heres-how-stocks-have-performed-under-biden-and-harris-vs-under-trump-1339db74?mod=mw_rss_topstories |

Gulf Cooperation Council (GCC) flags in Kuwait, via AFP”Tehran is threatening in secret diploma …

Gulf Cooperation Council (GCC) flags in Kuwait, via AFP”Tehran is threatening in secret diploma …