Summary Of the Markets Today:

- The Dow closed up 432 points or 1.03%,

- Nasdaq closed up 109 points or 0.60%,

- S&P 500 closed up 41 points or 0.71%, (Closed at 5,792, New Historic high 5,797)

- Gold $2,627 down $8.20 or 0.31%,

- WTI crude oil settled at $74 down $0.07 or 0.10%,

- 10-year U.S. Treasury 4.071 down 0.036 points or 0.285%,

- USD index $102.92 up $0.37 or 0.36%,

- Bitcoin $63,127 down $1,141 or 1.84%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks rose on Wednesday, with the S&P 500 and Dow Jones Industrial Average closing at new record highs. The Nasdaq Composite also gained after paring earlier losses. The market was focused on several key developments, including the US Department of Justice considering asking a judge to force Google to sell off parts of its business to address its monopoly in internet search. This news initially pressured Alphabet shares. The minutes from the Fed’s September meeting showed a “substantial majority” of officials supported the 50 basis point interest rate cut, but some favored a smaller 25 basis point cut. This suggests a slightly more hawkish sentiment than previously thought. Investors are awaiting the release of the September Consumer Price Index (CPI) report on Thursday, which will provide further insight into inflation trends and potentially influence the Fed’s future rate decisions. Market expectations for the Fed’s November meeting have shifted, with a 24% chance now priced in for no rate cut, up significantly from previous estimates.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

August 2024 sales of merchant wholesalers were up 1.1% from the revised August 2023 level. Total inventories of merchant wholesalers were up 0.6% from the revised August 2023 level. The August inventories/sales ratio for merchant wholesalers, except manufacturers’ sales branches and offices, based on seasonally adjusted data, was 1.35. The August 2023 ratio was 1.35. Employment in this sector is up 0.7% which suggests there is marginal growth In fact, using US Census own numbers – we see sales growth over 2% year-over-year – and relatively the same as the previous month. Bottom line is that there is no indication of a recession or slowing of this sector.

Here is a summary of the Participants’ Views on Current Conditions and the Economic Outlook in the minutes of the Federal Open Market Committee for the meeting held on September 17-18, 2024:

Participants expressed cautious optimism about inflation trends, noting that while inflation remains elevated, recent data suggests a sustainable return to the 2% target. Key factors influencing this outlook include diminishing pricing power among businesses and a slowdown in nominal wage growth, which is critical for controlling inflation in the services sector. Labor market conditions have eased, with a notable rise in the unemployment rate since April 2023. However, participants agreed that the labor market remains solid, with limited layoffs and manageable job vacancies. The overall economic activity is expanding at a steady pace, supported by resilient consumer spending despite some financial strains on low- and moderate-income households. Participants acknowledged risks to the economic outlook, with reduced upside risks to inflation and increased downside risks to employment. This balance of risks informed their decision to ease monetary policy by lowering the federal funds rate target range by 50 basis points to 4.75% to 5%. While some members preferred a more gradual reduction of 25 basis points, the majority agreed that this adjustment aligns with current economic indicators. Looking ahead, participants anticipate a gradual move toward a more neutral monetary policy stance as inflation trends down sustainably and employment remains near maximum levels. They emphasized that future monetary policy decisions will depend on ongoing economic developments rather than a predetermined course.

Since the meeting, there was a blowout BLS employment report which many believe is inflationary. Likely, this report will temper further federal funds rate reductions. As must know, I did not favor a reduction in the federal funds rate as I believed there remains a significant amount of inflationary pressures which have not moderated.

Here is a summary of headlines we are reading today:

- Shale Producers Prioritize Profit Over Growth

- Chevron Shuts Down Tampa Terminal As Hurricane Milton Approaches

- Exxon Gets Rare Sell Rating On Oversupply Concerns

- Russia’s Planned Idle Refining Capacity Raised by 67% for October

- Mining Giant Rio Tinto to Buy Arcadium Lithium for $6.7 Billion

- IEA: The World Is Not on Track to Triple Renewable Capacity by 2030

- Dow jumps more than 400 points to record close, S&P 500 hits all-time high: Live updates

- Fed officials were divided on whether to cut rates by half a point in September, minutes show

- What the Google break-up threat means for Alphabet’s stock

- Warren Buffett’s S&P 500 bet paid off. Experts weigh in on whether it’s still a winning strategy

- FTC gets ‘troubling reports’ of price gouging for essentials ahead of Hurricane Milton

- Milton Could Trigger $175 Billion Worst-Case Damage Scenario

- FOMC Minutes Show Fed Considerably More Divided Over Size Of Rate Cut

- This is your brain on screens: Phones and computers are creating a FOMO epidemic

- Hurricane Milton is upending cruise itineraries: What travelers need to know in such stormy situations

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Shale Producers Prioritize Profit Over GrowthThe US presidential election is looming, but the shale oil industry is unlikely to be significantly impacted by the outcome, according to a new analysis by Rystad Energy. Despite the rhetoric and policy platforms from the two candidates, Vice President Kamala Harris and former President Donald Trump, the tight oil sector is expected to continue its steady growth, driven more by market forces and company strategy than by government policy. The industry’s focus on profitability and shareholder returns, rather than chasing production growth, means… Read more at: https://oilprice.com/Energy/Crude-Oil/Shale-Producers-Prioritize-Profit-Over-Growth.html |

|

Experts Warn of Economic Fallout from Middle East WarThe prospect of an all-out war in the Middle East increased after Iran launched a massive missile attack on Israel on October 1. Israel has threatened retaliation, fueling concerns of a disruption to the flow of oil and gas from the energy-rich region.Global oil prices have already soared 9 percent since Iran’s attack, which came amid Israel’s yearlong war in the Gaza Strip and its invasion of southern Lebanon earlier this month.A full-scale conflict between Israel and Iran could upend the international energy supply and send shock waves throughout… Read more at: https://oilprice.com/Geopolitics/International/Experts-Warn-of-Economic-Fallout-from-Middle-East-War.html |

|

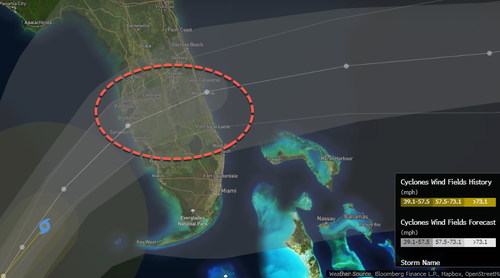

Chevron Shuts Down Tampa Terminal As Hurricane Milton ApproachesChevron Corp. (NYSE:CVX) has shut down its Tampa bulk terminal as Hurricane Milton barrels towards the U.S. coastline. The hurricane is expected to double its wind field by the time it makes landfall in the U.S. early Thursday, with up to 15ft (4.5 meters) of storm surge along the Florida coast including the cities of Tampa, St Petersburg, and Sarasota. Described as the “storm of a century”, Milton turned northeast overnight about 300 miles (480 km) southwest of Tampa, aiming for heavily populated and highly vulnerable communities.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Shuts-Down-Tampa-Terminal-As-Hurricane-Milton-Approaches.html |

|

Harris Energy Policies Under Fire in Crucial Swing StateAuthored by The Empowerment Alliance via RealClearPennsylvania, The Commonwealth of Pennsylvania is ground zero for selecting the next president of the United States. We know that energy affordability is a key issue to voters in making this decision. Data compiled by The Empowerment Alliance (TEA) shows that Pennsylvania has 3.2 million American Energy Patriots, or about 38% of its 8.8 million registered voters. We define those voters as people who prioritize energy affordability in their voting decisions. They will support candidates who champion… Read more at: https://oilprice.com/Energy/Natural-Gas/Harris-Energy-Policies-Under-Fire-in-Crucial-Swing-State.html |

|

Exxon Gets Rare Sell Rating On Oversupply ConcernsExxon Mobil Corp. (NYSE:XOM) was up slightly in Thursday’s trading session after analysts at BNP Paribas Exane downgraded its shares to Underperform from Neutral with a $105 price target, good for 14% downside from the current price. The downgrade marks the first Sell equivalent rating XOM has received in more than a year, with analysts predicting a further decline in crude oil prices. Previously, XOM stock posted gains for seven straight sessions. “Substantial excess OPEC+ capacity is hanging over the sector like the Sword of Damocles,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Gets-Rare-Sell-Rating-On-Oversupply-Concerns.html |

|

Rio Tinto Expands into Lithium Market with $6.7 Billion AcquisitionRio Tinto is set to acquire the chemical producer Arcadium Lithium in a $6.7bn (£5.12bn) deal. The multinational mining behemoth announced the all-cash transaction this morning and called the acquisition of the global business a “significant step forward”. It amounts to $5.85 per share, and a premium of 90 per cent on Arcadium’s closing price of $3.08 per share on 4 October, Rio Tinto said. Arcadium’s capabilities include lithium chemical manufacturing and extraction processes, hard-rock mining, conventional brine… Read more at: https://oilprice.com/Metals/Commodities/Rio-Tinto-Expands-into-Lithium-Market-with-67-Billion-Acquisition.html |

|

Israel Considers Iran Energy Strikes Despite U.S. ObjectionsA number of days have passed with no Israeli retaliation against Iran for its Oct. 1st major attack which saw nearly 200 ballistic missiles pummel the Tel Aviv area, including hits on important Israeli air bases. A lot of back-and-forth and contradictory reports later, and with the US side reportedly trying to ‘talk Netanyahu down’, Israel is saying that strikes on Iran’s energy facilities are still definitely on the table: US OFFICIALS TO NBC – ISRAEL IS CONSIDERING STRIKING ENERGY FACILITIES IN IRAN The news wire sent crude prices spiking, as… Read more at: https://oilprice.com/Geopolitics/International/Israel-Considers-Iran-Energy-Strikes-Despite-US-Objections.html |

|

India’s Jindal Power Abandons Crude Processing Deal With PdVSAIndia’s giant power company, Jindal Power Ltd, has exited a deal that would have seen it operate Petroleos de Venezuela’s (PdVSA) key installations for processing heavy crude oil for export, Bloomberg has reported. In May, Jindal entered into a joint venture with PdVSA in the Petrocedeno project located in the oil-rich Orinoco Belt. The $300 million deal to renovate and upgrade equipment was Jindal’s first foray into the oil sector. The collapse of the deal is illustrative of the challenges Venezuela faces in trying to revive… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Jindal-Power-Abandons-Crude-Processing-Deal-With-PdVSA.html |

|

Oil Slides as EIA Confirms Large Crude Inventory BuildCrude oil prices moved lower today after the U.S. Energy Information Administration reported an inventory increase of 5.8 million barrels for the week to October 4. The change in inventory levels compared with a build of 3.9 million barrels for the previous week. It also follows an estimated inventory increase of a sizable 10.9 million barrels, as reported by the American Petroleum Institute on Tuesday. The build estimate pressured oil prices which were already wobbly after traders’ expectations of further Chinese stimulus got betrayed by… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Slides-as-EIA-Confirms-Large-Crude-Inventory-Build.html |

|

Russia’s Planned Idle Refining Capacity Raised by 67% for OctoberRussia has raised the refining capacity volumes it expects to be idle this month by 67% compared to an earlier plan, due to scheduled maintenance at major refineries, Reuters estimates showed on Wednesday. In October, Russia expects to have 4.0 million metric tons of refining capacity offline, per Reuters’s calculations based on figures provided by industry sources. While that’s lower than the idle capacity in September, at 4.5 million tons, it is still higher than previously planned. Previously postponed maintenance at Rosneft’s… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Planned-Idle-Refining-Capacity-Raised-by-67-for-October.html |

|

India’s Coal Power Output Falls for Consecutive Months for First Time Since 2020Heavy monsoon rainfall has lowered India’s power demand growth in the past two months and led to the first time since the pandemic when coal-fired power generation fell year-over-year in two consecutive months. Electricity demand typically moderates during the monsoon season in India which is between June and September. This year, the excessive rainfalls also helped hydropower generation, further lowering demand for coal-fired electricity. The power generated from India’s coal plants declined by 5.8% in September versus a year earlier,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Coal-Power-Output-Falls-for-Consecutive-Months-for-First-Time-Since-2020.html |

|

Rollout of Charging Points in the U.S. Is Far Slower Than Surging EV SalesWhile electric vehicle registrations in the United States have surged by 142% since the beginning of 2023, the pace at which public charging point installations are growing has been just 22%, risking undermining the current momentum of EV sales in America. As of September 2024, registrations of electric vehicles in the United States hit 3.5 million units, per data from the Alternative Fuels Data Center (AFDC) cited by Reuters’s columnist Gavin Maguire. That’s a surge of 142% since the beginning of 2023. But the number of public EV charging… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rollout-of-Charging-Points-in-the-US-Is-Far-Slower-Than-Surging-EV-Sales.html |

|

EIA Slashes Forecasts of Oil Demand Growth and Oil Prices in 2025Global oil demand is set to grow next year at a lower rate than previously expected, the U.S. Energy Information Administration (EIA) said in its Short-Term Energy Outlook (STEO) for October, as it slashed its Brent oil price forecasts for 2025 due to lower expected demand increase. The EIA now expects global oil demand to grow by 1.3 million barrels per day (bpd) in 2025, due to downgraded forecasts of consumption in developed economies in the OECD. In the September STEO, the EIA had projected global consumption of liquid fuels would increase… Read more at: https://oilprice.com/Energy/Energy-General/EIA-Slashes-Forecasts-of-Oil-Demand-Growth-and-Oil-Prices-in-2025.html |

|

Mining Giant Rio Tinto to Buy Arcadium Lithium for $6.7 BillionRio Tinto will buy Arcadium Lithium in an all-cash deal valuing the target company at $6.7 billion, as one of the world’s largest miners is boosting its position as a global leader in energy transition commodities. Rio Tinto and Arcadium Lithium plc on Wednesday announced a definitive agreement under which Rio Tinto will acquire Arcadium in an all-cash transaction for US$5.85 per share. The price in the transaction represents a premium of 90% to Arcadium’s closing price of $3.08 per share on 4 October 2024 and values Arcadium’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mining-Giant-Rio-Tinto-to-Buy-Arcadium-Lithium-for-67-Billion.html |

|

IEA: The World Is Not on Track to Triple Renewable Capacity by 2030Despite the surge in renewable energy additions, the world is not yet on track to reach the goal of tripling renewables capacity by 2030, according to the Renewables 2024 report published by the International Energy Agency (IEA) on Wednesday. Global renewable capacity is expected to grow by 2.7 times by 2030, surpassing countries’ current ambitions by nearly 25%. But it still falls short of tripling, said the agency advocating for a swift move away from fossil fuels. While climate and energy security policies have boosted the attractiveness… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-The-World-Is-Not-on-Track-to-Triple-Renewable-Capacity-by-2030.html |

|

Dow jumps more than 400 points to record close, S&P 500 hits all-time high: Live updatesWall Street is coming off a strong session as tech stocks outperformed, and oil prices eased off their highs. Read more at: https://www.cnbc.com/2024/10/08/stock-market-today-live-updates.html |

|

Fed officials were divided on whether to cut rates by half a point in September, minutes showThe Federal Reserve on Wednesday releases minutes from its Sept. 17-18 policy meeting. Read more at: https://www.cnbc.com/2024/10/09/fed-officials-were-divided-on-whether-to-cut-rates-by-half-a-point-in-september-minutes-show.html |

|

Nvidia shares are up 25% in the last month, rallying near a record ahead of tech earningsNvidia shares have surged 25% over the last month, with analysts maintaining a bullish outlook as earnings season approaches. Read more at: https://www.cnbc.com/2024/10/09/nvidia-stock-up-25percent-in-a-month-as-stock-closes-in-on-new-record.html |

|

OpenAI says bad actors are using its platform to disrupt elections, but with little ‘viral engagement’OpenAI said in a report that it continues to see threat actors attempt to use its products, like ChatGPT, to influence election outcomes. Read more at: https://www.cnbc.com/2024/10/09/openai-says-more-cyber-actors-using-its-platform-to-disrupt-elections.html |

|

Ozempic underworld: Inside the black market of obesity drugsA CNBC investigation into illegal weight loss drugs reveals a marketplace where criminals brazenly counterfeit the drugs or ship the real product from overseas. Read more at: https://www.cnbc.com/2024/10/09/ozempic-underworld-black-market-obesity-drugs.html |

|

AI startup Writer, currently fundraising at a $1.9 billion valuation, launches new model to compete with OpenAIAI startup Writer, which is currently fundraising at a $1.9 billion valuation, launches a new model to compete with OpenAI. Read more at: https://www.cnbc.com/2024/10/09/ai-startup-writer-launches-new-model-to-compete-with-openai.html |

|

What the Google break-up threat means for Alphabet’s stockWall Street analysts weighed in on the DOJ’s antitrust case against Google. Read more at: https://www.cnbc.com/2024/10/09/what-the-google-break-up-threat-means-for-alphabets-stock.html |

|

Warren Buffett’s S&P 500 bet paid off. Experts weigh in on whether it’s still a winning strategyInvesting in an S&P 500 index fund can let you take a set-it-and-forget-it approach. But some experts say you could be missing an opportunity to diversify. Read more at: https://www.cnbc.com/2024/10/09/warren-buffetts-sp-500-bet-paid-off-some-experts-say-it-may-be-time-to-diversify.html |

|

VanEck announces venture fund targeting crypto and AI startups: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Wyatt Lonergan of VanEck Ventures explains why a new fund is targeting early-stage crypto and AI startups. Read more at: https://www.cnbc.com/video/2024/10/09/vaneck-announces-venture-fund-targeting-crypto-ai-startups-crypto-world.html |

|

FTC gets ‘troubling reports’ of price gouging for essentials ahead of Hurricane MiltonAs Hurricane Milton approaches landfall in the U.S., the Biden administration is warning consumers of the risk of fraud and price gouging. Read more at: https://www.cnbc.com/2024/10/09/milton-price-gouging-fraud-a-top-priority-for-justice-ftc.html |

|

Tornadoes, heavy rain hit Florida as Hurricane Milton heads for landfall as Category 4Milton continues to fluctuate in intensity as it approaches Florida’s west coast and it is expected to make landfall as a Category 4 hurricane. Read more at: https://www.cnbc.com/2024/10/09/live-updates-hurricane-milton-closes-in-on-florida.html |

|

Photos show Florida preparations and evacuations ahead of Hurricane MiltonLocal authorities said Wednesday that Floridians only have a few hours left to evacuate ahead of Milton, which is currently a Category 4 hurricane. Read more at: https://www.cnbc.com/2024/10/09/photos-show-hurricane-milton-preparations-evacuations.html |

|

DOJ indicates it’s considering Google breakup following monopoly rulingThe Department of Justice late Tuesday indicated that it was considering a possible breakup of Google as an antitrust remedy. Read more at: https://www.cnbc.com/2024/10/08/doj-indicates-its-considering-google-breakup-following-monopoly-ruling.html |

|

Milton Could Trigger $175 Billion Worst-Case Damage ScenarioAs of Wednesday afternoon, Milton, a dangerous Category 4 hurricane, is set to make landfall on Florida’s Central Gulf Coast near the Tampa region later tonight or early Thursday morning. The storm’s path can potentially cause more than $50 billion in damage, with some estimates as high as $175 billion – or about the amount of funds the Biden-Harris team sent to Ukraine since the start of the war. Depending on which research firm is providing the storm damage estimates, this once-in-a-century storm has the potential to generate a catastrophic storm surge of up to 15 feet and winds topping 150 mph. This storm is shaping up to be a very costly event for insurers and the government. “While too early to make insured loss estimates, a major hurricane impact in one of Florida’s most heavily populated regions could result in mid-double-digit billion dollar loss,” a team of analysts led by Yaron Kinar from Jefferies wrote in a note to clients.

Kinar said, “A 1-in-100 year event is estimated by s … Read more at: https://www.zerohedge.com/weather/milton-landfall-tampa-would-trigger-worst-case-scenario-175-billion-damage |

|

Kamala Harris Admits She Won’t Do Anything Different From BidenAuthored by Steve Watson via Modernity.news, In her first live appearance on… anything besides the debate, Kamala Harris again floundered and handed the Trump campaign a huge gift.

Harris appeared on The View, obviously expecting a completely easy ride. But somehow she even managed to look bad here too. Harris was asked if she would change any one thing Biden had done as president, and she actually said that she couldn’t think of anything AT ALL. “There is not a thing that comes to mind. And I’ve been a part of most of the decisions that have had an impact,” she answered. But it was even worse than this sounds. Harris was also asked “What do you think would be the biggest specific difference between your presidency and a Biden presidency?” Harris responded, “We’re obviously two different people.” Oh really?< … Read more at: https://www.zerohedge.com/political/kamala-harris-admits-she-wont-do-anything-different-biden |

|

FOMC Minutes Show Fed Considerably More Divided Over Size Of Rate CutSince the last FOMC meeting on September 18th, bonds have suffered a bloodbath while gold, stocks, and the dollar are all up modestly…

Source: Bloomberg Despite the apparent dovish pivot, the market’s expectations for rate-cuts (this year and next) has plunged dramatically…

Source: Bloomberg This should not come as a huge surprise as Powell’s raison d’etre for major rate cuts evaporated as U … Read more at: https://www.zerohedge.com/markets/fomc-20 |

|

Analyzing Agency REITsAuthored by Michael Lebowitz via RealInvestmentAdvice.com, Numerous reader requests following our article, Agency REITs For A Bull Steepener, prompted us to write this follow-up with more detail about how to analyze agency REITs. This article doesn’t recommend specific agency REITs, but it does lay out some of the fundamental basics of the largest publicly traded agency REITs. In doing so, this analysis and the prior article provide a solid foundation for further evaluating agency REITs. Before diving in, it’s worth noting that most agency REITs offer preferred shares. While we do not discuss them in this article, preferred shares may also prove rewarding and less risky in the current bull-steepening interest rate environment. (Disclosure: RIA Advisors has a position in NLY and REM in its client portfolios.) Managing A REITAn agency REIT is only as good as its portfolio management team. As we wrote in Agency REITs For A Bull Steepener, the portfolio management team has to buy rewarding assets and issue appropriate liabilities to fund the investments, but it must also constantly hedge the portfolio for interest rate and mortgage spread risk. Furthermore, they actively trade derivatives to transform the terms and conditions of their liabilities. Due to the leverage employed by the agency REITs, a firm making poor hedging decision … Read more at: https://www.zerohedge.com/markets/analyzing-agency-reits |

|

Budget plan to spend billions more won’t stop tax risesReeves is planning to change borrowing rules to free up billions more in spending for big projects in the upcoming Budget. Read more at: https://www.bbc.com/news/articles/c30lrpyr676o |

|

Indian tycoon Ratan Tata dies aged 86His death was announced by the Tata Group, the multi-billion-dollar conglomerate he led for more than two decades. Read more at: https://www.bbc.com/news/articles/cjd5835mp4ko |

|

Dead postmistress’ plea to end compensation delayBosses did not appreciate the effects of the Horizon scandal on the business in 2019, chief executive Nick Read has conceded. Read more at: https://www.bbc.com/news/articles/cm24r00146po |

|

UBS buys 81 lakh shares of IDFC for Rs 88 crore via block deal ahead of stock’s suspension from ThursdayUBS bought 81 lakh shares in IDFC Limited for Rs 88 crore. IDFC Limited will be suspended from trading on Thursday, the record date for its merger with IDFC First Bank. Post-merger, IDFC First Bank’s weightage in Bank Nifty will increase, attracting $39 million in passive funds. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ubs-buys-81-lakh-shares-of-idfc-for-rs-88-crore-via-block-deal-ahead-of-stocks-suspension-from-thursday/articleshow/114090141.cms |

|

Tech view: Nifty faces resistance at 25,250, short-term trend still positive. How to trade tomorrowA small negative candle with long upper shadow indicates rejection of bulls. Nifty’s short-term trend remains positive, but weakness is likely near recent lows. Resistance at 25,250. Highest OI on the call side at 25,100 and 25,000, on the put side at 25,000 and 24,900 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-faces-resistance-at-25250-short-term-trend-still-positive-how-to-trade-tomorrow/articleshow/114082618.cms |

|

Nomura initiates coverage on these 3 AMC companies, signals upside potential up to 21%Nomura initiated coverage on HDFC AMC, Nippon Asset Management, and UTI AMC with buy and neutral ratings, respectively. Target prices were set at Rs 5,000, Rs 785, and Rs 1,300, respectively. Nomura expects Indian AMCs to maintain their valuation premium due to higher growth potential and better profitability. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nomura-initiates-coverage-on-these-3-amc-companies-signals-upside-potential-up-to-21/articleshow/114081474.cms |

|

This is your brain on screens: Phones and computers are creating a FOMO epidemicThe more we get lost the digital world, the less satisfied and more isolated we become. Read more at: https://www.marketwatch.com/story/how-phones-and-computers-are-bombarding-our-brains-and-creating-a-fomo-epidemic-2fbda8a0?mod=mw_rss_topstories |

|

Hurricane Milton is upending cruise itineraries: What travelers need to know in such stormy situationsExperts say having travel insurance is the best way to guarantee you have smooth sailing. Read more at: https://www.marketwatch.com/story/hurricane-milton-is-upending-cruise-itineraries-what-travelers-need-to-know-in-such-stormy-situations-44ca63e2?mod=mw_rss_topstories |

|

Palantir nears $100 billion market cap as one of the largest software companiesPalantir joined the S&P 500 last month, and its stock ranks third by year-to-date performance among current members. Read more at: https://www.marketwatch.com/story/palantir-nears-100-billion-market-cap-as-one-of-the-largest-software-companies-be258b68?mod=mw_rss_topstories |