Summary Of the Markets Today:

- The Dow closed up 126 points or 0.30%,

- Nasdaq closed up 259 points or 1.45%,

- S&P 500 closed up 55 points or 0.97%,

- Gold $2,641 down $25.40 or 0.95%,

- WTI crude oil settled at $74 down $3.22 or 4.17%,

- 10-year U.S. Treasury 4.026 down 0.002 points or 0.020%,

- USD index $102.50 up $0.03 or 0.03%,

- Bitcoin $62,239 down $997 or 1.44%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks closed higher across the board on Tuesday, with tech stocks leading the gains. The S&P 500 closed near its previous record high. Key factors driving the market performance included Chipmaker Nvidia which led the bounce back in tech stocks. Other “Magnificent Seven” tech giants like Amazon, Apple, and Alphabet also finished firmly in positive territory. Oil prices retreated as Middle East tensions somewhat cooled. The pullback in surging oil prices helped shift investor focus back to interest rates and the US economy. Investors turned their attention to monetary policy, with Federal Reserve officials making comments about the economic outlook. Markets are still adjusting expectations after hopes for large interest rate cuts were dampened. China’s failure to announce another large stimulus package surprised investors and put pressure on oil prices. This led to a slump in Hong Kong stocks as the stimulus-fueled rally in Chinese equities fizzled out.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

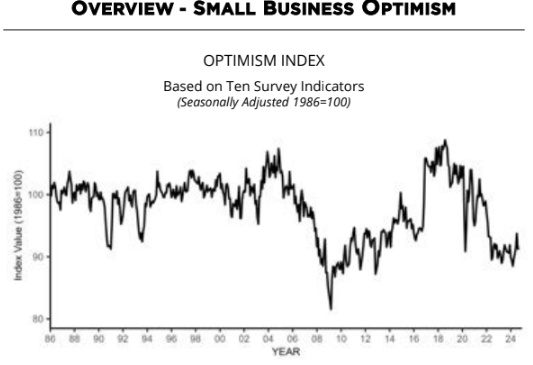

The NFIB Small Business Optimism Index rose by 0.3 points in September 2024 to 91.5. This is the 33rd consecutive month below the 50-year average of 98. NFIB Chief Economist Bill Dunkelberg stated:

Small business owners are feeling more uncertain than ever. Uncertainty makes owners hesitant to invest in capital spending and inventory, especially as inflation and financing costs continue to put pressure on their bottom lines. Although some hope lies ahead in the holiday sales season, many Main Street owners are left questioning whether future business conditions will improve.

August 2024 imports were up 6.8% year-over-year, exports up 5.8% year-over-year – and the resulting trade deficit up 18.1% year-over-year. The overall trade deficit is trending up because imports are increasing after a relative lull last year.

Here is a summary of headlines we are reading today:

- EU Unveils New Sanctions to Counter Russian Hybrid Warfare

- Tensions Rise as Ukraine Ends Russian Gas Transit Agreement

- U.S. Set Record-Highs in Natural Gas Power Generation This Summer

- Oil Prices Under Pressure as Supply Disruptions Fail to Materialize

- Oil Prices Tumble 4% as Demand Fears Override Middle East Risk

- Kinder Morgan Shuts Tampa Terminals Ahead of Hurricane Milton

- Hurricane Milton could cause as much as $175 billion in damage, according to early estimates

- S&P 500 jumps nearly 1%, Dow adds 100 points as cooler oil prices lift stocks: Live updates

- The bull market turns two soon. History shows it should keep going, but some investors are wary

- FTX cleared to repay nearly all customers 119% of allowed bankruptcy claims: CNBC Crypto World

- Tampa Bay hasn’t been hit directly by a major hurricane since 1921. Milton may be the one

- “Something Went Totally Nuts” At BLS But Labor Market Indicator Still Strongly Suggests Recession

- Benchmark 10-year Treasury yield closes above 4% for a second day

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

EU Unveils New Sanctions to Counter Russian Hybrid WarfareAmbassadors from the 27 European Union member states on October 2 agreed to a new sanctions mechanism targeting Russian hybrid actions. Broadly, “hybrid” here means actions carried out on behalf of a state to undermine the functioning of another country, so, for example, trying to impact elections or targeting critical infrastructure. It is expected that the new measures will be formally agreed by the bloc’s finance ministers when they assemble in Luxembourg on October 8. The new sanctions regime is, according to the EU diplomats I have spoken… Read more at: https://oilprice.com/Geopolitics/International/EU-Unveils-New-Sanctions-to-Counter-Russian-Hybrid-Warfare.html |

|

Vitol to Send Venezuelan Crude Oil To Indian RefinersIndian refiners are expecting tankers of Venezuelan crude from Vitol, media reported on Tuesday, after Indian Oil Corp (IOC) and Mangalore Refinery and Petrochemicals (MRPL) purchased 2 million barrels of Venezuelan crude for November delivery. This is part of a broader trend, as India continues to increase imports from Venezuela after the U.S. Treasury allowed transactions under specific conditions despite ongoing sanctions targeting President Nicolas Maduro’s regime. Indian Oil Corp, the country’s largest refiner, is set to receive 1.2 million… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Vitol-to-Send-Venezuelan-Crude-Oil-To-Indian-Refiners.html |

|

Political Turmoil in EU as EV Tariff Battle Divides Member StatesAuthored by Mike Shedlock via MishTalk.com, Unlike US auto manufacturers, Germany’s counterparts did not want tariffs on China’s EV. Germany lost the vote in the European Council… EU Votes for Tariffs on Chinese EVs This story may seem counteractive but Germany does not want the EU to place tariffs on Chinese EVs. This is because Germany is still dependent on its internal combustion engines for exports and China will undoubtedly retaliate. TheDriven reports EU Votes for China EV Tariffs Despite Protests from Germany and Others. Euronews… Read more at: https://oilprice.com/Energy/Energy-General/Political-Turmoil-in-EU-as-EV-Tariff-Battle-Divides-Member-States.html |

|

Armenian-Azerbaijani Peace Talks Hit a SnagAfter several months of incremental progress that raised hopes a durable settlement was at hand, the Armenian-Azerbaijani peace process appears to have entered another retrograde phase. Recent comments by Azerbaijani President Ilham Aliyev suggest that Baku has pressed pause on negotiations. In an October 4 speech made in Jabrayil, a city that Azerbaijan regained control of in 2020, Aliyev cautioned Armenia against trying to rearm with the aim of reversing Yerevan’s loss of Nagorno-Karabakh. “Let them not forget the history of the Second… Read more at: https://oilprice.com/Geopolitics/International/Armenian-Azerbaijani-Peace-Talks-Hit-a-Snag.html |

|

Tensions Rise as Ukraine Ends Russian Gas Transit AgreementUkrainian Prime Minister Denys Shmyhal on October 7 told Slovakian counterpart Robert Fico that Kyiv will not extend a gas-transit deal with Russia when it expires at year’s end, a move likely to increase tensions between the EU and NATO member and Ukraine, which aspires to join both organizations. “Ukraine once again says it will not continue the transit agreement with Russia after it expires,” Shmyhal told a joint news conference with Fico in the border city of Uzhhorod in western Ukraine on October 7. “Ukraine’s strategic goal is to deprive… Read more at: https://oilprice.com/Energy/Natural-Gas/Tensions-Rise-as-Ukraine-Ends-Russian-Gas-Transit-Agreement.html |

|

Republicans Most Trusted on Energy Policy as U.S. Election Nears—But BarelyEnergy has become a hot-button issue as voters prepare to head to the polls, with Republicans gaining a narrow upperhand. According to a recent Rasmussen poll, 82% of likely U.S. voters see energy policy as an important factor in the upcoming election. With rising fuel costs and the future of domestic energy production hanging in the balance, this topic could prove even more pivotal. The poll indicates that Republicans hold an edge over Democrats when it comes to trust on energy issues. The poll surveyed 1,044 likely U.S. voters, conducted on September… Read more at: https://oilprice.com/Energy/Energy-General/Republicans-Most-Trusted-on-Energy-Policy-as-US-Election-NearsBut-Barely.html |

|

U.S. Set Record-Highs in Natural Gas Power Generation This SummerLow natural gas prices, hotter summer weather, and new generation capacity sent U.S. natural gas-fired power generation to a new all-time high this summer, on some days of which gas-fired electricity made up nearly half of total power output. This summer’s record-high was hit on August 2, when America’s natural gas-fired power plants generated more than 7 million megawatt hours (MWh) of electricity, the U.S. Energy Information Administration said on Tuesday. The record on that day beat by 6.8% the previous summer’s record… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Set-Record-Highs-in-Natural-Gas-Power-Generation-This-Summer.html |

|

Oil Prices Under Pressure as Supply Disruptions Fail to MaterializeOil prices tumbled early on Tuesday morning, with traders refocusing on fundamentals despite the continued geopolitical risk and threats of a full-blown war in the Middle East.- China’s announcement of more economic stimulus to the country’s ailing real estate sector was well-timed, ahead of a week-long public holiday, however as normal business activity recovers in the country, the market faces further disappointment.- Following the Tuesday briefing held by China’s National Development and Reform Commission, the country’s… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-as-Supply-Disruptions-Fail-to-Materialize.html |

|

Oil Prices Tumble 4% as Demand Fears Override Middle East RiskOil prices slumped by more than 4% early on Tuesday as traders have yet to see an actual supply disruption in the Middle East while focusing on China’s underwhelming demand again. Both benchmarks, WTI Crude and Brent Crude, were down by about 3% as of 9:30 a.m. EDT on Tuesday. The U.S. benchmark fell below $75 per barrel, and the Brent price was down to the $78 a barrel handle, after breaking above $80 on Monday in an 11% total gain in oil prices since Iran fired missiles on Israel a week ago. The war premium has started to evaporate, especially… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Tumble-4-as-Demand-Fears-Override-Middle-East-Risk.html |

|

Ukraine Strikes Key Crimean Oil Terminal in Overnight RaidUkraine says it successfully hit a major oil terminal in Crimea in an overnight drone and missile operation. The impacted oil terminal is in Feodosia, on the south coast of the Crimean peninsula, and is believed to be a key Russian military supply hub. It is also the biggest petroleum transhipment hub in the region. “At night, a successful strike was carried out on the enemy’s offshore oil terminal in temporarily occupied Feodosia, Crimea,” the Ukrainian military announced Monday. It further described the strike on the key facility as part… Read more at: https://oilprice.com/Energy/Crude-Oil/Ukraine-Strikes-Key-Crimean-Oil-Terminal-in-Overnight-Raid.html |

|

Russia Considers Diesel Export Ban for Non-ProducersRussian oil companies and officials have discussed the possible ban on diesel exports for firms not producing diesel, due to rising prices and the risk of oil companies not getting their state subsidies, Russia’s Interfax news agency reported on Tuesday, quoting unnamed sources. Currently, Russia has a ban on gasoline exports only, until the end of the year. As of October 1, winter diesel fuel is included in the wholesale diesel price, which has raised prices and created a risk that oil refiners may not get in full their so-called damper… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Considers-Diesel-Export-Ban-for-Non-Producers.html |

|

Libya’s Oil Production Rises to 1.13 Million BpdLibya’s production of crude oil and condensates has reached 1,133,133 barrels per day (bpd), the National Oil Corporation said on Tuesday, several days after output resumed in the OPEC member. Over the past 24 hours, Libya also produced 206,666 barrels of gas equivalent, following the end of the political stalemate that had halted output for more than a month. Libya expects to reach the oil and gas production levels from before the blockade within the next few days, the National Oil Corporation (NOC) said today. Libya, which pumped about… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-Oil-Production-Rises-to-113-Million-Bpd.html |

|

Kinder Morgan Shuts Tampa Terminals Ahead of Hurricane MiltonPipeline and liquids and dry bulk terminals operator Kinder Morgan plans to shut on Tuesday its terminals and fuel racks in and around Tampa as Florida is preparing for category 5 Hurricane Milton to make landfall late on Wednesday. “We will continue to monitor the storm’s path and make any adjustments as needed,” Kinder Morgan said in a statement carried by Argus. On Monday, Milton strengthened to a Category 5 hurricane and Florida’s Gulf Coast has ordered evacuation as the storm is expected to make landfall late on Wednesday… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kinder-Morgan-Shuts-Tampa-Terminals-Ahead-of-Hurricane-Milton.html |

|

Denmark Delays Hydrogen Pipeline to GermanyDenmark looks to commission a cross-border green hydrogen pipeline to Germany in 2031, three years later than the previous timeline, the Danish government said on Tuesday. Denmark has been working with local transmission system operator Energinet to have the timeline to commissioning shortened to 2031, from 2032 as Energinet’s latest plan says, according to a statement from the Danish Ministry of Climate, Energy, and Utilities. Energinet has been cooperating with Gasunie on the development of the Danish-German hydrogen network as part of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Denmark-Delays-Hydrogen-Pipeline-to-Germany.html |

|

U.S. Natural Gas Consumption SoarsNatural gas-fired power generation in the United States has soared to a record high so far this year, driving up global gas demand. U.S. power producers generated a total of 55.6 million megawatt hours (MWh) from gas-fired power plants between January and September, according to data from LSEG quoted by Reuters’s columnist Gavin Maguire. This is up by 5% compared to the same period of last year. It’s also the highest power generation from natural gas since at least 2021. Moreover, the share of natural gas in the U.S. power generation… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Natural-Gas-Consumption-Soars.html |

|

Hurricane Milton could cause as much as $175 billion in damage, according to early estimatesThat would be on top of the carnage already left behind by Hurricane Helene, posing a potential record-breaking path of wreckage. Read more at: https://www.cnbc.com/2024/10/08/hurricane-milton-could-cause-as-much-as-175-billion-in-damages-according-to-early-estimates.html |

|

S&P 500 jumps nearly 1%, Dow adds 100 points as cooler oil prices lift stocks: Live updatesThe three major indexes finished Monday’s session in the red on higher yields and oil prices. Read more at: https://www.cnbc.com/2024/10/07/stock-market-today-live-updates.html |

|

Harris is borrowing from ‘Republican playbook’ as she leads Trump in new national pollPollster Frank Luntz cited a new poll showing Kamala Harris leading Donald Trump for the first time since Joe Biden dropped out of the presidential race. Read more at: https://www.cnbc.com/2024/10/08/harris-republican-trump-polls-frank-luntz-.html |

|

Trump Media stock soars nearly 19% as DJT extends longest rally since JuneTrump Media, majority-owned by Republican nominee Donald Trump, operates the Truth Social platform and trades as DJT on the Nasdaq. Read more at: https://www.cnbc.com/2024/10/08/djt-trump-media-stock-surge.html |

|

The bull market turns two soon. History shows it should keep going, but some investors are waryHistory indicates that this bull market could have more room to rally, but investors say it’s not quite that simple. Read more at: https://www.cnbc.com/2024/10/08/the-bull-market-turns-two-soon-history-shows-it-should-keep-going-but-some-investors-are-wary.html |

|

BetMGM wagers that new technology, football can lead to a resurgenceBetMGM is trying to regain lost ground in both sports gambling and online casino games. Read more at: https://www.cnbc.com/2024/10/08/betmgm-wagers-that-new-technology-football-can-lead-to-a-resurgence.html |

|

GM ditching ‘Ultium’ name for batteries, tech amid EV changesGM confirmed the change ahead of an investor event in which it is expected to tout the flexibility of the company to produce both traditional vehicles and EVs. Read more at: https://www.cnbc.com/2024/10/08/gm-ditching-ultium-name-for-batteries-tech-amid-ev-changes.html |

|

States sue TikTok over app’s effects on kids’ mental healthMore than half of American teens ages 13 to 17 use TikTok, the short-form video social media app owned by ByteDance, a Chinese company. Read more at: https://www.cnbc.com/2024/10/08/tiktok-sued-dc-addiction-virtual-currency.html |

|

FTX cleared to repay nearly all customers 119% of allowed bankruptcy claims: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Asymmetric’s Joe McCann discusses the catalysts driving bitcoin, which has been stuck in a tight range since the start of Q4. Read more at: https://www.cnbc.com/video/2024/10/08/ftx-cleared-repay-nearly-all-customers-119percent-allowed-claims-crypto-world.html |

|

Spirit Halloween to open 10 new ‘Spirit Christmas’ stores catering to holiday shoppersSpirit Halloween’s usual trick-or-treat and go is no longer, as the company announced it will open “Spirit Christmas” locations through the holiday season. Read more at: https://www.cnbc.com/2024/10/08/spirit-halloween-to-open-10-new-spirit-christmas-stores.html |

|

Tampa Bay hasn’t been hit directly by a major hurricane since 1921. Milton may be the oneFlorida’s Gulf Coast braced Tuesday for the impact of Hurricane Milton’s winds and expected massive storm surge. Read more at: https://www.cnbc.com/2024/10/08/florida-gulf-coast-braces-for-hurricane-milton.html |

|

Airlines, theme parks, cruise lines warn travelers about Hurricane Milton disruptionsAirlines canceled hundreds of flights, theme parks prepare to close ahead of Hurricane Milton. Read more at: https://www.cnbc.com/2024/10/08/hurricane-milton-airlines-theme-parks-cruise-lines-prepare.html |

|

Harris seeks to convert economic tailwinds into votes as election enters homestretchVice President Kamala Harris enters the final month of the presidential election with a surprisingly strong jobs report and booming stock market behind her. Read more at: https://www.cnbc.com/2024/10/08/harris-jobs-gdp-markets-economic-upswing-trump.html |

|

DeSantis, Dark Brandon, And CNN Hit Kamala With Laser Eyes Over Hurricane ‘Phone Call’ StuntAfter completely biffing her 60 Minutes interview (after which the network edited out her word salad), Vice President Kamala Harris has come under fire for accusing Florida Gov. Ron DeSantis of “political gamesmanship” after reports emerged that he didn’t take her calls ahead of Hurricane Milton. When asked about the alleged snub, Harris said DeSantis was being selfish and “utterly responsible” for not taking her call.

In a Monday evening interview with Fox News, DeSantis said he’s “leveraging all resources available, including from the federal government” to prepare for the storm that’s headed straight for T … Read more at: https://www.zerohedge.com/political/desantis-dark-brandon-and-cnn-hit-kamala-laser-eyes-over-hurricane-phone-call-stunt |

|

SEC, DOJ Raise Objections To EV Maker Fisker’s Bankruptcy ProceedingsAuthored by Chase Smith via The Epoch Times, Electric vehicle (EV) manufacturer Fisker Inc. is under investigation by the U.S. Securities and Exchange Commission (SEC) and faces formal objections from the U.S. Department of Justice (DOJ) over its Chapter 11 bankruptcy proceedings. The company filed for bankruptcy earlier this year after halting production in March.

Recent filings in the U.S. Bankruptcy Court for the District of Delaware indicate that these legal challenges could affect Fisker’s restructuring and liquidation plans. The SEC initiated a probe into Fisker’s activities before its bankruptcy filing in June, focusing on potential violations of federal securities laws, acco … Read more at: https://www.zerohedge.com/technology/sec-doj-raise-objections-ev-maker-fiskers-bankruptcy-proceedings |

|

VICE Co-Founder Admits Woke Journalism Destroyed Brand: ‘What The F**k Is This?’‘VICE co-founder Shane Smith admitted in an interview with legendary music producer and ‘Tetragrammaton’ host Rick Rubin that his the once-high flying digital media empire–once valued at $5.7 billion – collapsed partly due to leaning heavily into “woke” content.

RICK RUBIN: Is there any point in the VICE story where you feel like VICE sold out? SHANE SMITH: I wouldn’t necessarily say sold out because we were always independent, we always sold pieces of it. RICK RUBIN: But from a content perspective, did you ever pander your content away from what you actually liked? SHANE SMITH: The problem with content, and what people don’t understand, is the same thing with TV: people don’t put content on that they like because they like it; they put content on that rates. So, to go back to around 2017, at the peak of the HBO era – because all of our big clients, like Google and the studios, and everybody was out in LA. I moved to LA and so I sort of stepped back from day-to-day but I kept doing news. And VICE – the other channels, not the news, and VICE started moving – ’cause we always say ‘give the company over to the interns,’ like every five years. And VICE started moving into this sort of weird woke era or whatever … Read more at: https://www.zerohedge.com/political/vice-co-founder-admits-woke-journalism-destroyed-brand-what-fk |

|

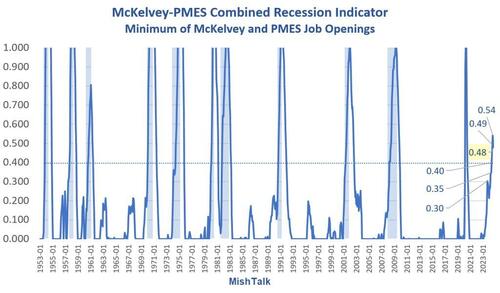

“Something Went Totally Nuts” At BLS But Labor Market Indicator Still Strongly Suggests RecessionAuthored by Mike Shedlock via MishTalk.com, McKelvey-PMES Recession Indicator Weakens Slightly but Signal Still FirmThe McKelvey-PMES recession indicator dipped a bit in September but the signal still implies recession.

100 percent of the time, with no false positives or negatives, under current conditions, the economy has been in recession. The odds are not 100 percent because the NBER sets recession dates, not these charts. What is the McKelvey Recession Indicator?Take the current value of the 3-month unemployment rate average, subtract the 12-month low, and if the difference is 0.30 percentage point or more, then a recession has started. Edward McKelvey, a senior economist at Goldm … Read more at: https://www.zerohedge.com/economics/something-went-totally-nuts-bls-labor-market-indicator-still-strongly-suggests-recession |

|

HS2 may now run to central London, minister saysThe Transport Secretary says it would make “no sense” to have the line terminate in west London. Read more at: https://www.bbc.com/news/articles/crm2843glmjo |

|

TikTok sued for ‘wreaking havoc’ on teen mental healthA bipartisan group of 14 attorneys general accuse the company of using addictive features to hook children. Read more at: https://www.bbc.com/news/articles/c20m4k56relo |

|

China hits back at EU with brandy taxThe tax on brandy imports is being seen by critics as a retaliatory move for recent EU tariffs on Chinese-made electric cars. Read more at: https://www.bbc.com/news/articles/cn8jz39xl19o |

|

Tech view: Nifty shows signs of bounce back, in process to form double bottom. How to trade tomorrowNifty shows signs of an upside bounce, forming a double bottom pattern around 24,700 levels. A move above 25,000 could lead to 25,400-25,500 resistance levels. Analysts suggest a ‘buy on dips’ strategy as long as support at 24,690 holds. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-shows-signs-of-bounce-back-in-process-to-form-double-bottom-how-to-trade-tomorrow/articleshow/114049562.cms |

|

India’s Adani Green units plan to raise up to $1 billion in dollar bonds, bankers sayFour subsidiaries of India’s Adani Green Energy plan to raise up to $1 billion by issuing U.S. dollar-denominated bonds, two merchant bankers involved in the deal said on Tuesday. Read more at: https://economictimes.indiatimes.com/markets/bonds/indias-adani-green-units-plan-to-raise-up-to-1-billion-in-dollar-bonds-bankers-say/articleshow/114053137.cms |

|

Sebi outlines specific due diligence of investors, investments of AIFsSebi has instructed Alternative Investment Funds to carry out due diligence on investors and investments to ensure compliance with laws and prevent illegal activities. This includes special checks for investments from countries bordering India and contributions over 50 percent. AIFs must report the status of existing investments by April 7, 2025. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-outlines-specific-due-diligence-of-investors-investments-of-aifs/articleshow/114052120.cms |

|

Why stock investors shouldn’t worry about 10-year Treasury yield ruining 2024 rally yetThe benchmark 10-year Treasury yield, which finished above 4% for a second straight day on Tuesday, appears to be falling short of the levels needed to take the steam out of the 2024 U.S. stock rally. Read more at: https://www.marketwatch.com/story/why-stock-investors-shouldnt-worry-about-10-year-treasury-yield-ruining-2024-rally-yet-3e6eecc2?mod=mw_rss_topstories |

|

Benchmark 10-year Treasury yield closes above 4% for a second dayLong-term U.S. government debt continued to sell off on Tuesday, pushing 10-and 30-year yields further into the highest closing levels since late July, as market participants continued to price in economic strength and some chance of no action on interest rates by the Federal Reserve next month. Read more at: https://www.marketwatch.com/story/benchmark-treasury-yields-dip-but-hold-above-4-9deb687a?mod=mw_rss_topstories |

|

Oil futures drop over 4% on talk of Lebanon-Israel ceasefireA rally in oil took a pause on Tuesday, sending prices down by more than 4%, as the militant group Hezbollah reportedly said it supports efforts by Lebanon for a ceasefire with Israel, helping to ease tensions in the oil-rich Middle East. Read more at: https://www.marketwatch.com/story/brent-falls-below-80-as-oil-rally-pauses-traders-awaitisraeli-response-to-iranian-missile-attack-bb51be6f?mod=mw_rss_topstories |