Summary Of the Markets Today:

- The Dow closed up 260 points or 0.62%,

- Nasdaq closed up 0.60%,

- S&P 500 closed up 0.40%, (Closed at 5,745, New Historic high 5,767)

- Gold $2,696 up $11.30,

- WTI crude oil settled at $67 down $2.39,

- 10-year U.S. Treasury 3.794 up 0.013 points,

- USD index $100.55 down $0.36,

- Bitcoin $64,793 up $1,687 or 2.67%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks rallied on Thursday, with the S&P 500 closing at a new record high. The positive momentum was driven by several key factors: The final US GDP growth report for Q2 exceeded expectations, while weekly jobless claims fell to their lowest level in four months. Micron Technology (MU) reported upbeat earnings, boosting the semiconductor sector: Micron stock: +15% PHLX Semiconductor Index (^SOX): +3.7%. Other chip stocks also gained: AMD +3.4%, Qualcomm +2.4%, Intel +1.3%. Chinese leaders announced plans to increase fiscal spending, address the property crisis, and support the stock market. This led to a significant jump in mainland Chinese stocks, with the CSI 300 (000300.SS) on track for its best week in a decade. Super Micro Computer (SMCI). The stock fell 12% following a Wall Street Journal report about a Department of Justice probe into the company, stemming from a recent Hindenburg Research short seller report. Despite the overall chip sector rally, Nvidia shares rose only 0.16%. However, this slight increase was enough to push the company back into the $3 trillion market cap club. Investors are now looking ahead to Friday’s release of the Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation metric.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods in August 2024 are up 1.5% year-over-year (down 1.1% inflation adjusted) – and little changed from the previous month. Durable goods remains a drag on the economy.

Real gross domestic product (GDP) third estimate increased at an annual rate of 3.0% in the second quarter of 2024 unchanged from the second estimate. The implicit price index (inflation) was unchanged at 2.5% year-over-year (2.8% excluding food and energy). My projection is that GDP in 3Q2024 should be little changed from these numbers.

The median number of years that wage and salary workers had been with their current employer was 3.9 years in January 2024, down from 4.1 years in January 2022 and the lowest since January 2002. These are interesting numbers but have little impact on the economy.

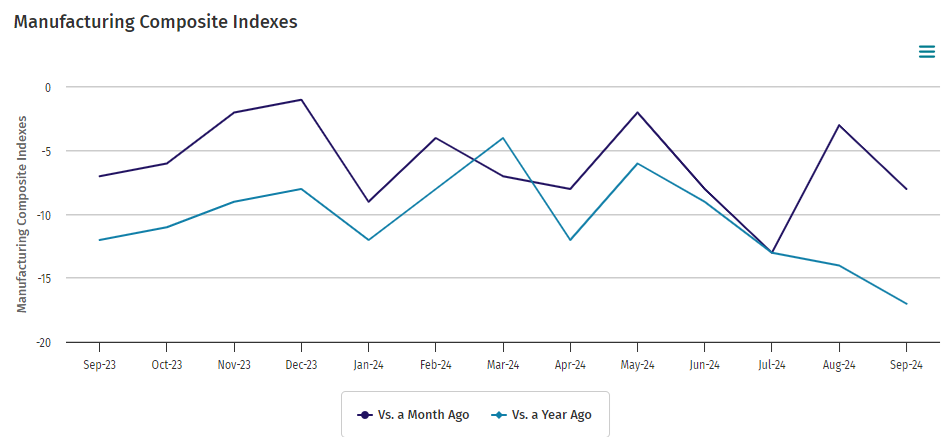

Kansas City Fed manufacturing activity declined moderately in September 2024. The month-over-month composite index was -8 in September, down from -3 in August and up from -13 in July. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing remains in a recession in the US.

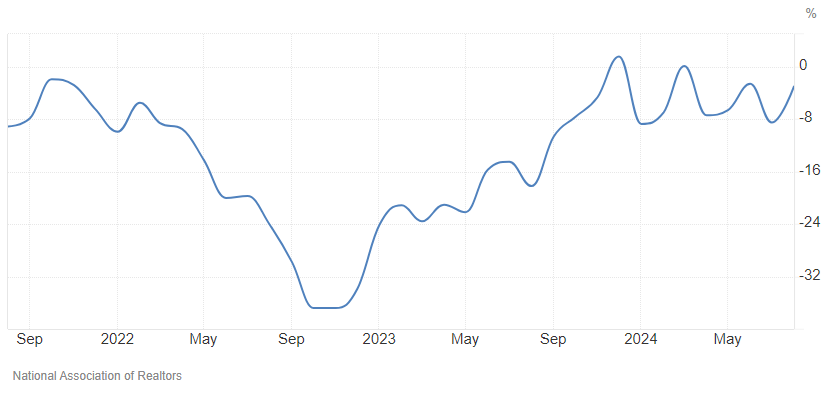

Pending home sales in August 2024 were down 3.0% year-over-year. I know everyone is thinking the federal funds rate will make houses more affordable – but house price appreciation will offset these gains. NAR Chief Economist Lawrence Yun added:

A slight upward turn reflects a modest improvement in housing affordability, primarily because mortgage rates descended to 6.5% in August. However, contract signings remain near cyclical lows even as home prices keep marching to new record highs.

In the week ending September 21, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 224,750, a decrease of 3,500 from the previous week’s revised average. The previous week’s average was revised up by 750 from 227,500 to 228,250. There is no indication of a recession or slowing economy in these numbers.

Here is a summary of headlines we are reading today:

- Ranking the World’s Financial Centers

- Russia Lowers Nuclear Threshold, Citing Western Threats

- Oil Plunges Over 2% on Rumor Saudis Ready To Increase Output

- Russia Could Scrap Gasoline Export Ban if Domestic Surplus Emerges

- The Fed slashed interest rates last week, but Treasury yields are rising. What’s going on?

- Dow jumps more than 250 points, S&P 500 closes higher to post fresh record: Live updates

- David Tepper says the Fed has to cut rates at least two or three more times to keep credibility

- Misinformation running rampant on Facebook has officials concerned about election disruptions

- Hurricane Helene is upgraded to a Category 3 as it barrels toward Florida

- Yield on 2-year Treasury logs biggest jump in five weeks after strong U.S. GDP report

- A port strike would be ill-timed, but disruption could boost these companies

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Ranking the World’s Financial CentersEstablished financial centers have lost some of their shine in the past decade, according to the Global Financial Centres Index by UK research initiative Long Finance, which has been ranking cities for the competitiveness of their financial industries since 2007. Especially London, whose competitiveness was impacted by Brexit, has lost points, but so have New York and Hong Kong. You will find more infographics at Statista Shanghai and Shenzhen are among the world’s top 10 financial centers. Chinese locations have been on a bit of a roller coaster… Read more at: https://oilprice.com/Finance/the-Economy/Ranking-the-Worlds-Financial-Centers.html |

|

Russia Lowers Nuclear Threshold, Citing Western ThreatsAt a moment the West – especially the US and UK – are still mulling whether to allow Ukraine forces to attack Russian territory using NATO-provided long-range missiles, President Vladimir Putin has just issued a hugely significant statement regarding his country’s nuclear doctrine. Putin on Wednesday very clearly lowered the threshold regarding Russian strategic forces’ use of nukes. He in a televised address to Russia’s Security Council said nuclear doctrine has been effectively revised in light of the “emergence of new sources of military… Read more at: https://oilprice.com/Geopolitics/International/Russia-Lowers-Nuclear-Threshold-Citing-Western-Threats.html |

|

Kazakhstan’s Fintech Giant Kaspi.kz Embroiled in Sanctions ControversyKazakhstan has defended the country’s second-largest lender as being “fully” compliant with sanctions against Russia after a scathing report saw around 20 percent wiped off the Nasdaq-listed Kaspi.kz’s stock price. A September 19 report published by Culper Research poured doubt on the claim by fintech giant Kaspi that it lacks exposure to sanctions-struck Russia and raised concerns about the group’s past affiliations to a relative of former President Nursultan Nazarbaev who was convicted by a Kazakh court of major embezzlement in 2022. In a September… Read more at: https://oilprice.com/Geopolitics/International/Kazakhstans-Fintech-Giant-Kaspikz-Embroiled-in-Sanctions-Controversy.html |

|

Petrobras Eyes Stakes in African Oil ProjectsBrazil’s state-controlled oil giant, Petrobras, is exploring new opportunities by seeking stakes in African oil blocks from majors like ExxonMobil, Shell, TotalEnergies, and Equinor. The move reflects Petrobras’ strategy to expand beyond its traditional deep-water fields in Brazil, particularly as domestic exploration has slowed. The company is targeting ten potential projects in African countries such as Namibia, South Africa, and Angola. One key opportunity is a 40% stake in Galp Energia’s Mopane oil and gas field in Namibia, a region with promising… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Petrobras-Eyes-Stakes-in-African-Oil-Projects.html |

|

UK Says Goodbye to CoalThe UK’s last remaining coal-fired power station is to shut at the end of September, drawing to a close Britain’s 142-year reliance on the fossil fuel to produce electricity. Ratcliffe-on-Soar power station has been generating electricity since 1968 via its four coal-fired boilers, eight vast cooling towers and 199-metre tall chimney, which occupies a prominent spot in the East Midlands skyline. It is able to power about two million homes and has been the last station of its kind in the UK since September 2023, when Northern Ireland’s… Read more at: https://oilprice.com/Energy/Coal/UK-Says-Goodbye-to-Coal.html |

|

OPEC+ Confirms it Has No Specific Price Target For Crude OilDespite recent rumors, sources within OPEC+ have confirmed there’s no specific price target for crude oil, including the oft-discussed $100 per barrel. This comes in response to speculation that Saudi Arabia, a key player in the group, may allow lower prices to reclaim market share by boosting production. Anonymous OPEC+ members who spoke to Argus today quickly dismissed these claims, insisting that their strategy is driven by market fundamentals, such as the five-year average of global crude inventories, rather than a set price. A Financial Times… Read more at: https://oilprice.com/Energy/Crude-Oil/OPEC-Confirms-it-Has-No-Specific-Price-Target-For-Crude-Oil.html |

|

U.S. Energy Secretary: Hyperscalers Committed to Clean Energy for Data CentersIn an appearance on CNBC Tuesday morning, U.S. Energy Secretary Jennifer Granholm sure seemed to acknowledge that small modular reactors – one technology we have claimed will be the future of powering AI – are all but a full on “go” for the future. Granholm was asked about how data centers would be powered in the future. David Faber asked: “At the same time, we’ve been trying to, obviously, replace typical energy sources with renewables. We now have this incredible potential uptick in the need for power because of data centers and the growth… Read more at: https://oilprice.com/Energy/Energy-General/US-Energy-Secretary-Hyperscalers-Committed-to-Clean-Energy-for-Data-Centers.html |

|

Oil Plunges Over 2% on Rumor Saudis Ready To Increase OutputBrent crude and the U.S. benchmark shed well over 2% on Thursday on mainstream media rumors that Saudi Arabia is planning to unleash more oil on the market, with the Kingdom willing to give up its $100-per-barrel price target. According to a Financial Times report earlier in the day citing unnamed sources, Saudi Arabia is willing to reduce its $100 price target to pump more oil, and OPEC+ is preparing to increase output collectively in December. At 10:41 a.m. ET on Thursday, Brent crude was trading down 2.10% at $71.92, for a loss of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Plunges-Over-2-on-Rumor-Saudis-Ready-To-Increase-Output.html |

|

China to Launch New Import Terminal to Receive LNG From ExxonGuangdong Energy Group of China is set to launch next week commercial operations at a new LNG import terminal, which U.S. supermajor ExxonMobil can use under a long-term agreement, Reuters reported on Thursday, citing industry sources. The LNG receiving terminal in Huizhou in the province of Guangdong, southern China, has the capacity to handle 4 million metric tons of LNG per year and cost $1 billion to complete. The LNG import site has already received its first LNG cargo. A shipment from the United Arab Emirates (UAE) arrived in August in a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-to-Launch-New-Import-Terminal-to-Receive-LNG-From-Exxon.html |

|

Russia Expects Strong Global Oil Demand Growth Through to 2050Russia expects global oil demand to grow by at least 5% from current levels to 2050, with demand growth of up to 7 million barrels per day (bpd) by 2030, Russia’s First Deputy Energy Minister Pavel Sorokin said on Thursday. Russia is ready to provide additional crude volumes when needed, Sorokin said on the sidelines of an energy forum in Russia. By 2030, global oil consumption is set to rise by between 5 million bpd and 7 million bpd, or 4.5% to 5.5% higher compared to today’s demand, according to the Russian official. Russia aims… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Expects-Strong-Global-Oil-Demand-Growth-Through-to-2050.html |

|

Exxon Proposes $10 Billion Investment in Nigeria’s Deepwater OilU.S. supermajor ExxonMobil has proposed an investment of $10 billion in Nigeria’s deepwater oil resource development, Stanley Nkwocha, spokesman and senior special assistant to the Nigerian President, said in a statement on Thursday. Nigeria’s Vice President Kashim Shettima “welcomed ExxonMobil’s proposed $10 billion investment in Nigeria’s deep-water oil operations, describing it as a clear testament to the administration’s economic reforms and investment-friendly policies,” says the statement. Shettima on Wednesday… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Proposes-10-Billion-Investment-in-Nigerias-Deepwater-Oil.html |

|

Russia Could Scrap Gasoline Export Ban if Domestic Surplus EmergesRussia could lift its ban on gasoline exports if a fuel surplus emerges on the domestic market, Russian Deputy Prime Minister Alexander Novak said on the sidelines of an energy forum in Russia on Thursday. In the middle of August, the Russian government said that Moscow is extending its ban on gasoline exports from October to the end of December 2024, as it seeks to keep domestic supply stable amid seasonal demand and scheduled repairs at refineries. The key priority of the government now is to meet domestic gasoline demand, Novak said… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Could-Scrap-Gasoline-Export-Ban-if-Domestic-Surplus-Emerges.html |

|

Russia Claims OPEC+ Is Not Discussing Any Changes to Oil Its Production PlanThe OPEC+ alliance is not discussing any proposals of changes to its current oil production plan, which envisages the group starting to add supply to the market in December, Russia’s Deputy Prime Minister Alexander Novak said on Thursday. OPEC+ initially planned to begin unwinding part of the 2.2 million barrels per day (bpd) of crude production cuts from October this year. However, after oil prices crashed in late August and early September, OPEC+ delayed the start of the unwinding of the cuts by two months until December 2024.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Claims-OPEC-Is-Not-Discussing-Any-Changes-to-Oil-Its-Production-Plan.html |

|

Belgium Seeks EU Ban on Russian LNGBelgium is seeking a ban on Russian LNG imports into the European Union as the current sanctions regime cannot halt rising imports at EU import terminals, Belgian Energy Minister, Tinne Van der Straeten, has told the Financial Times. Belgium – alongside the Netherlands, Spain, and France – has been one of the top importers of Russian LNG in recent months, especially after the Russian invasion of Ukraine and the cutoff of many EU gas customers from Russian pipeline gas. Now Belgium sees the recent EU attempts to reduce Russian LNG revenues… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Belgium-Seeks-EU-Ban-on-Russian-LNG.html |

|

Saudi Arabia Scraps $100 Oil Price Target to Boost Market ShareSaudi Arabia is willing to endure short-term oil price and revenue pain as it is making a U-turn in policy and going to take back market share and ditching its unofficial $100 oil price target, the Financial Times reported on Thursday, quoting sources with knowledge of the latest Saudi thinking. The world’s top crude exporter and leader of OPEC, Saudi Arabia, and its allies in the OPEC+ group have been withholding oil supply for over a year, in a bid to balance the market and prop up prices. The OPEC+ alliance initially planned to begin unwinding… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Scraps-100-Oil-Price-Target-to-Boost-Market-Share.html |

|

The Fed slashed interest rates last week, but Treasury yields are rising. What’s going on?Despite a 50 basis point rate reduction, Treasury yields have been moving higher, particularly at the long end of the curve. Read more at: https://www.cnbc.com/2024/09/26/the-fed-slashed-interest-rates-last-week-but-treasury-yields-are-rising-whats-going-on-.html |

|

Dow jumps more than 250 points, S&P 500 closes higher to post fresh record: Live updatesStocks rose Thursday, regaining their footing after a mixed session, following the release of upbeat U.S. economic data. Read more at: https://www.cnbc.com/2024/09/25/stock-market-today-live-updates.html |

|

Eric Adams indictment unsealed: New York mayor charged in campaign contribution schemeThere are multiple federal investigations into New York City Mayor Eric Adams, members of his administration and people connected to the Democrat. Read more at: https://www.cnbc.com/2024/09/26/new-york-city-mayor-eric-adams-indicted-in-federal-court.html |

|

CNBC Sport: Why television executives are freaking out over 2029The NFL’s 11-year, $111 billion media rights deal is the biggest in the U.S. It has an out clause after the 2028-29 season that could upend modern media. Read more at: https://www.cnbc.com/2024/09/26/cnbc-sport-television-executives-freak-out-over-2029.html |

|

These real estate stocks top Bank of America’s buy listBank of America lays out its top picks in the real estate sector. Read more at: https://www.cnbc.com/2024/09/26/these-real-estate-stocks-top-bank-of-americas-buy-list.html |

|

David Tepper says the Fed has to cut rates at least two or three more times to keep credibilityAppaloosa Management’s David Tepper said the macro setup for U.S. stocks makes him nervous as the Fed eases policy in a good economy like it did in the 1990s. Read more at: https://www.cnbc.com/2024/09/26/david-tepper-says-the-fed-has-to-cut-rates-at-least-two-or-three-more-times-to-keep-credibility.html |

|

Misinformation running rampant on Facebook has officials concerned about election disruptionsAfter Meta’s layoffs and deprioritizing of news and political content, local election officials say they’re in a precarious spot heading into the elections. Read more at: https://www.cnbc.com/2024/09/26/facebooks-misinformation-problem-has-local-election-officials-on-edge.html |

|

Trump ally Matt Gaetz says House Ethics panel issued subpoena for him in sex, drug probeFlorida Republican Rep. Matt Gaetz, a close Donald Trump ally, said he will no longer comply with an ethics investigation into sex and drug use allegations. Read more at: https://www.cnbc.com/2024/09/26/matt-gaetz-house-ethics-subpoena-sex-drugs-investigation.html |

|

Survey: 73% of Amazon workers are considering quitting after 5-day in-office mandateNearly 3 in 4 Amazon workers say they’re considering looking for a new job following CEO Andy Jassy’s recent memo announcing a full-time return-to-office. Read more at: https://www.cnbc.com/2024/09/26/73percent-of-amazon-workers-considering-quitting-after-5-day-rto-mandate.html |

|

Trademark dispute emerges over Tiger Woods’ new logoTigeraire, a company that makes cooling products for athletes, said Sun Day Red and Tiger Woods have “unlawfully hijacked” Tigeraire’s design. Read more at: https://www.cnbc.com/2024/09/26/trademark-dispute-emerges-over-tiger-woods-new-logo-.html |

|

Hurricane Helene is upgraded to a Category 3 as it barrels towards FloridaHelene is the eighth named storm of the Atlantic hurricane season. NOAA has predicted an above-average Atlantic hurricane season because of record-warm ocean temperatures. Read more at: https://www.cnbc.com/2024/09/25/helene-becomes-a-hurricane-and-is-expected-to-intensify-as-it-moves-toward-florida-.html |

|

Hoda Kotb announces she is leaving NBC’s ‘TODAY’ showVeteran journalist and “TODAY” fourth-hour host Hoda Kotb announced she will be leaving the show early next year. Read more at: https://www.cnbc.com/2024/09/26/hoda-kotb-leaving-nbc-today-show.html |

|

Super Micro shares tumble 12% after DOJ reportedly opens probe into companySuper Micro shares tumbled Thursday after a report that the Department of Justice opened a probe into the company. Read more at: https://www.cnbc.com/2024/09/26/super-micro-shares-tumble-12percent-after-doj-reportedly-opens-probe-into-company.html |

|

Trump Pushes Narrative That Iran Is Trying To Kill HimAuthored by Dave DeCamp via AntiWar.com, On Wednesday, former President Donald Trump pushed a narrative being spread by US intelligence officials that Iran is trying to kill him even though there’s no evidence of Iranian involvement in either attempt on his life. Trump’s campaign said they were briefed on the alleged Iranian threat by officials from the Office of the Director of National Intelligence, which is led by Avril Haines. “Big threats on my life by Iran. The entire US Military is watching and waiting. Moves were already made by Iran that didn’t work out, but they will try again,” Trump wrote on X after the briefing. “Not a good situation for anyone. I am surrounded by more men, guns, and weapons than I have ever seen before.” The claim that Iran is plotting to kill Trump was first made by a CNN report back in July, following the assassination attempt by Thomas Matthew Crooks, who was shot and killed by the Secret Service. The report acknowledged there was no evidence Crooks was linked to Iran, which was reaffirmed on Tuesday by intelligence officials speaking to The New York Times, who stressed there was no Iran connection to the July shooting. … Read more at: https://www.zerohedge.com/geopolitical/trump-pushes-narrative-iran-trying-kill-him |

|

US, UK Send Hundreds Of Troops To Cyprus For Lebanon ContingenciesEarlier this week amid escalation between Israel and Hezbollah, and with increasing airstrikes hitting Beirut – resulting in commercial air traffic at Beirut’s international airport coming to a total halt – the Pentagon said it is sending more US troops to the region. At least some of them have already arrived in Cyprus, CNN has reported. Dozens of American troops are there, with Pentagon press secretary Maj. Gen. Pat Ryder having confirmed that the US has sent “a small number of US military personnel forward” to the region “out of an abundance of caution.” Close US ally the United Kingdom has ordered a surge of hundreds to Cyprus alongside the US troops.

Read more at: https://www.zerohedge.com/geopolitical/us-uk-send-hundreds-troops-cyprus-lebanon-contingencies |

|

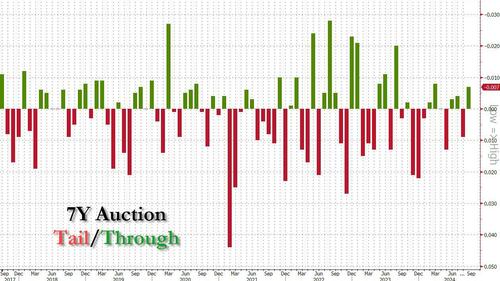

Solid 7Y Auction Stops Through Despite Drop In Foreign BuyersAfter two coupon auctions which stopped on the screws, moments ago we had a belly-busting 7Y auction which was also the strongest auction of the week. The Treasury sold $44 billion in 7Y paper in a solid auction, pricing at a high yield of 3.668%, down from 3.770% last month, and stopping through the When Issued 3.67% by 0.7bps, a reversal to the 0.9bps tail last month.

The bid to cover was 2.628, up from 2.50 in August, and above the six auction average of 2.54, otherwise it was almost smack in the middle of the very narrow range centered around 2.50 over the past decade. The internals were average, with Indirects taking down 70.8%, the lowest since June if just above the six-auction average of 70.1%. And with the Directs take downjumping to 20.3%, from 11.2%, Dealers were left holding just 8.9%, a drop from 13.7% last month, and one of the lowest on record. Read more at: https://www.zerohedge.com/economics/solid-7y-auction-stops-through-despite-drop-foreign-buyers |

|

Mark Cuban: “The Mainstream Media Truly Leans Right”While we could write pages of sarcastic and pointed commentary surrounding the fact that Democrats (the politicians and their proxies… and narrative-repeating useful-idiots) turned the gaslighting-amplifier up to ’11’ in recent weeks (since Kamala went from worst VP approval ever to the great white/black/Asian hope to save democracy), we have decided to allow one of those ‘proxies’ to summarize the farce in six simple words. Billionaire tech chap Mark Cuban sauntered on to CNBC’s morning show set this morning to remind America just how bad Trump is and just how awesome the ‘new’ Kamala is. CNBC’s Joe Kernen brought up the reality check that Harris went from the worst (VP ever) to the first (choice for all leftists) thanks to the media’s incessant pumping:

Cuban’s response was, umm… surprising… as he explained how it’s amazing that Harris is polling so well given the bias in the media Read more at: https://www.zerohedge.com/political/mark-cuban-mainstream-media-truly-leans-right |

|

Musk hits back after being shunned from UK summitThere is concern about his social media posts about the UK during last month’s riots, the BBC understands. Read more at: https://www.bbc.com/news/articles/c756d56d2dro |

|

Labour’s plan to build 1.5m homes – can it be delivered?Are planning reforms and social housing enough to meet the government’s ambitious plan? Read more at: https://www.bbc.com/news/articles/cvgw7x4y5rzo |

|

Firm says £1bn plant will transform UK recyclingThe former paper mill will be one of the UK’s largest cardboard and tissue production facilities. Read more at: https://www.bbc.com/news/articles/c3rl8e7er4po |

|

Sebi chief Buch hopes corp bond mkt grows as rapidly as equitiesSebi chairperson Madhabi Puri Buch expressed optimism about the growth of the corporate bond market, driven by technology and transparency. She highlighted healthy primary market activity but noted a lack of secondary market engagement. Buch also addressed recent allegations against her and discussed upcoming regulations and initiatives at an Amfi event in Mumbai. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-chief-buch-hopes-corp-bond-mkt-grows-as-rapdily-as-equities/articleshow/113710356.cms |

|

Tech view: Nifty gives decisive breakout, aiming for 26,900 level. How to trade tomorrowCall options saw the highest open interest at strike prices of 26,250 and 26,300, whereas put options had the highest open interest at 26,200 followed by 26,100. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-gives-decisive-breakout-aiming-for-26900-level-how-to-trade-tomorrow/articleshow/113705201.cms |

|

Sebi cuts listing time to T+3 working days for public issue of debt securitiesSebi on Thursday decided to reduce the timeline for listing of public issue of debt securities to three working days from six days at present, to facilitate faster access to funds. This new timeline will be optional for the first year and mandatory thereafter. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-cuts-listing-time-to-t3-working-days-for-public-issue-of-debt-securities/articleshow/113704718.cms |

|

Yield on 2-year Treasury logs biggest jump in five weeks after strong U.S. GDP reportThe benchmark 10-year Treasury yield ended at its highest level since early September as investors awaited Friday’s inflation data. Read more at: https://www.marketwatch.com/story/treasury-yields-hold-near-3-week-highs-as-traders-eye-barrage-of-economic-updates-eff1a92c?mod=mw_rss_topstories |

|

This company had $1 billion in quarterly AI bookings — and it’s not a chip makerAccenture’s stock rallied toward a six-month high Thursday, after the management consultant got back to beating earnings expectations and continued to tout itself as a play on the boom in generative artificial intelligence. Read more at: https://www.marketwatch.com/story/this-company-had-1-billion-in-quarterly-ai-bookings-and-its-not-a-chip-maker-8d16225e?mod=mw_rss_topstories |

|

A port strike would be ill-timed, but disruption could boost these companiesA strike at U.S. East Coast and Gulf ports would be ill-timed for the holiday season and could cause a spike in rail congestion, but the disruption could spell opportunities for some companies. Read more at: https://www.marketwatch.com/story/a-port-strike-would-be-ill-timed-but-disruption-could-boost-these-companies-aee3e2ce?mod=mw_rss_topstories |

Illustrative US Army photo: A US CH-47 helicopter over CyprusThis is to prepare for a range of contingencies which could include warships going to the Lebanese coast to conduct …

Illustrative US Army photo: A US CH-47 helicopter over CyprusThis is to prepare for a range of contingencies which could include warships going to the Lebanese coast to conduct …