Summary Of the Markets Today:

- The Dow closed up 84 points or 0.20%, (Closed at 42,208, New Historic high 42,281)

- Nasdaq closed up 0.56%,

- S&P 500 closed up 0.25%, (Closed at 5,733, New Historic high 5,734)

- Gold $2,687 up $34.80,

- WTI crude oil settled at $72 up $1.17,

- 10-year U.S. Treasury 3.732 down 0.006 points,

- USD index $100.37 down $0.48,

- Bitcoin $64,378 up $991 or 1.56%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks experienced modest gains on Tuesday, with both the S&P 500 and Dow Jones Industrial Average achieving record closes. Investor sentiment was bolstered by China’s announcement of significant stimulus measures aimed at revitalizing its economy, which had a positive ripple effect on global markets. Notably, US-listed Chinese e-commerce stocks surged, with JD.com seeing a nearly 14% jump following the news. However, this optimism was tempered by a decline in US consumer confidence; the Conference Board’s index fell to 98.7 in September from 105.6 in August, missing economists’ expectations. The Federal Reserve’s recent interest rate cuts also contributed to market positivity, despite some dissent among policymakers regarding inflation risks. Fed Governor Michelle Bowman expressed concerns about potential inflationary pressures following last week’s half-point rate cut.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

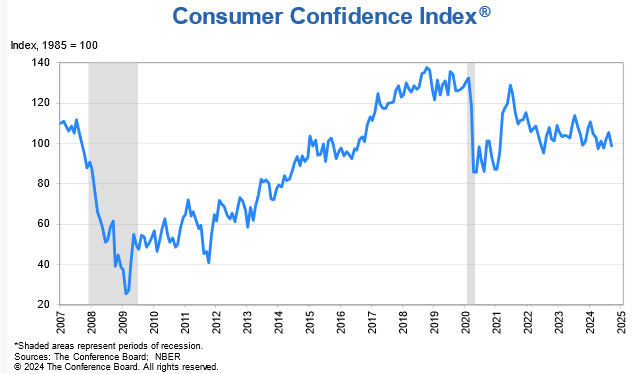

The Conference Board Consumer Confidence Index® fell in September 2024 to 98.7 (1985=100), from an upwardly revised 105.6 in August. Consumer Confidence has been little changed in the the last 2 years. Dana M. Peterson, Chief Economist at The Conference Board added:

Consumer confidence dropped in September to near the bottom of the narrow range that has prevailed over the past two years. September’s decline was the largest since August 2021 and all five components of the Index deteriorated. Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further. Consumers were also more pessimistic about future labor market conditions and less positive about future business conditions and future income. The drop in confidence was steepest for consumers aged 35 to 54. As a result, on a six-month moving average basis, the 35–54 age group has become the least confident while consumers under 35 remain the most confident. Confidence declined in September across most income groups, with consumers earning less than $50K experiencing the largest decrease. On a six-month moving average basis, consumers earning over $100K remained the most confident.

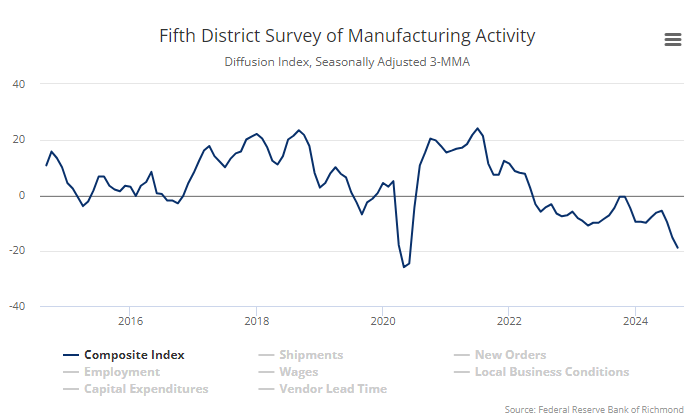

Richmond Fed manufacturing activity remained sluggish in September 2024. The composite manufacturing index edged down from −19 in August to −21 in September. Of its three component indexes, shipments decreased from −15 to −18, new orders increased from −26 to −23, and employment fell from −15 to −22. Manufacturing remains in a recession in the USA.

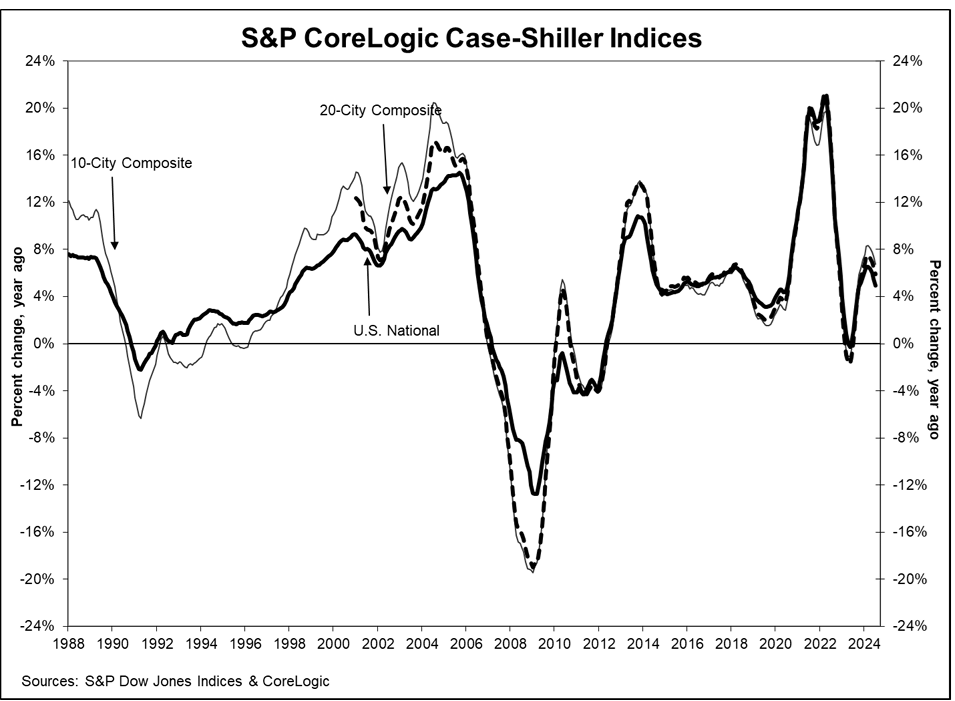

The S&P CoreLogic Case-Shiller 20-City Composite posted a year-over-year increase of 5.9% in July 2024, dropping from a 6.5% increase in the previous month. CoreLogic Chief Economist Dr. Selma Hepp explains:

With the summer characterized by broader cooling of housing demand amid high mortgage rates, home prices continued to weaken, and July monthly gains appear to be falling below the historical trend. Nevertheless, with a speedy decline in mortgage rates since August, housing market demand tracked by pending sales activity in CoreLogic data is finally showing signs of a rebound, which is expected to boost monthly price gains and return them to historical trends. Interestingly, the weakness in home prices remains in markets that have struggled with demand this year, including markets in Texas and Florida, while more expensive Western markets started to feel the pressure from rising rates in late spring. Going forward, home prices are likely to see a boost from a drop in mortgage rates and improved affordability.

Here is a summary of headlines we are reading today:

- Rising EV Charging Costs Threaten UK’s Electric Vehicle Adoption

- Saudi Aramco Looks To Raise $3 Billion from New Bond Issue

- Goldman Sees Upside for Oil Prices Amid Supply Concerns

- Coal’s Resurgence Challenges Global Energy Transition

- The U.S. Is the World’s Top Gasoline Exporter

- 81% of New Renewable Energy Capacity Added in 2023 Was Cheaper Than Fossil Fuels

- ‘Stop ripping us off’: Senate grills Novo Nordisk CEO on weight loss drug pricing

- September consumer confidence falls the most in three years

- S&P 500 rises to new record high Tuesday, posts back-to-back gains: Live updates

- ‘Childless cat lady’ is a more common lifestyle choice. Here’s what being child-free means for your money

- US accuses Visa of debit card monopoly

- Oil ends higher after back-to-back losses as China announces stimulus measures

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Rising EV Charging Costs Threaten UK’s Electric Vehicle AdoptionAs if the EV boom needed another nail its in coffin, the UK has now produced figures showing that driving and electric vehicle is “up to twice as expensive” as driving a regular gas powered car. Data from the app ZapMap has confirmed that operating an electric vehicle (EV) can cost over 24p per mile, compared to 12.5p per mile for a diesel vehicle, according to Yahoo Finance and The Telegraph. And charging an EV at a rapid or ultra-rapid roadside station can reach up to 80p per kilowatt hour. According to calculations by The Times, a typical… Read more at: https://oilprice.com/Energy/Energy-General/Rising-EV-Charging-Costs-Threaten-UKs-Electric-Vehicle-Adoption.html |

|

OPEC Says Phasing Out Oil Is Just A FantasyOPEC’s latest World Oil Outlook (WOO) 2024 makes it clear: peak oil demand is not on the horizon. Despite ongoing discussions around transitioning to renewable energy, OPEC forecasts global oil demand to grow significantly, reaching over 120 million barrels per day (mb/d) by 2050. This projection is driven by strong demand from non-OECD countries, which are expected to see the majority of growth. “What the Outlook underscores is that the fantasy of phasing out oil and gas bears no relation to fact,” OPEC said in its WOO forward. From… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Says-Phasing-Out-Oil-Is-Just-A-Fantasy.html |

|

TAPI Pipeline Revival: A Turning Point in Central Asian Dynamics?Central Asian countries are taking steps to broaden relations with their southern neighbor, the Taliban-led Afghanistan, despite the hard-line group’s increasingly restrictive policies, particularly toward women. Kyrgyzstan removed the Taliban from its list of terrorist organizations earlier this month, Turkmenistan resumed work with Afghanistan on a major gas-pipeline project, and Uzbekistan signed $2.5 billion worth of cooperation agreements with Kabul during the Uzbek prime minister’s high-profile visit to Afghanistan in August.… Read more at: https://oilprice.com/Energy/Energy-General/TAPI-Pipeline-Revival-A-Turning-Point-in-Central-Asian-Dynamics.html |

|

Saudi Aramco Looks To Raise $3 Billion from New Bond IssueSaudi Aramco, the world’s largest oil company, is looking to raise up to $3 billion from U.S.-dollar denominated Islamic bonds, Reuters reported on Tuesday, quoting sources with direct knowledge of the plans. Aramco, which is also the world’s single biggest crude oil exporter, plans to issue Islamic bonds, the so-called sukuk, in two tranches—five-year notes and ten-year notes. The Saudi oil giant aims to raise up to $3 billion from the bond sale, according to the sources. Today Aramco announced in a regulatory filing with… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Looks-To-Raise-3-Billion-from-New-Bond-Issue.html |

|

Will China’s New Stimulus Package Be Enough?China has unveiled its largest set of economic stimulus measures since the pandemic in an attempt to kickstart growth in the world’s second largest economy. The People’s Bank of China (PBoC) announced today it had cut its benchmark interest rate by 50 basis points, as well as the amount banks must hold as cash reserves, known as reserve requirement ratios (RRR) – by 20 basis points. Interest rates on existing mortgages will be reduced by 50 basis points on average, a move targeted to help homeowners. The PBoC also introduced… Read more at: https://oilprice.com/Finance/the-Economy/Will-Chinas-New-Stimulus-Package-Be-Enough.html |

|

Blackouts Plague Tajikistan as Energy Promises Fall ShortTajik officials have backed off comments that the energy situation in the country is improving, admitting that electricity rationing is being introduced a month earlier than usual this year. Electricity rationing has turned into an annual routine in the tightly controlled former Soviet republic over the past three decades. It is usually introduced in late October or early November. But the Barqi Tojik state energy holding announced over the weekend that rationing will be introduced as of September 22 due to “the upcoming longer and more severe… Read more at: https://oilprice.com/Energy/Energy-General/Blackouts-Plague-Tajikistan-as-Energy-Promises-Fall-Short.html |

|

Goldman Sees Upside for Oil Prices Amid Supply ConcernsGoldman Sachs expects Brent crude oil prices to see some upside in the fourth quarter, potentially reaching $77 per barrel. The bank’s outlook is driven by several key factors, including a recent interest rate cut by the Federal Reserve and strong U.S. economic data. Additionally, Hurricane Helene’s formation reminds markets that hurricanes still have the power to disrupt oil supply. Despite Brent crude rallying 4% last week due to escalating conflict in the Middle East, the market experienced a selloff on Monday following more peaceful signals… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-Sees-Upside-for-Oil-Prices-Amid-Supply-Concerns.html |

|

Russia Budgets for Lower Oil Prices for LongerRussia is preparing for lower oil revenues resulting from depressed prices along with a more relaxed tax regime, Bloomberg has reported, citing a draft three-year budget. Per that document, oil revenues in Russia would decline by 14% over the next three years—provided international oil prices remain weak. For 2025, the document sees oil revenues of some $120 billion, or 10.94 trillion rubles, which would be a decline of 3.3% from this year. That modest decline would then extend into 2026 and 2027, by which year oil revenues would fall to… Read more at: https://oilprice.com/Energy/Crude-Oil/Russia-Budgets-for-Lower-Oil-Prices-for-Longer.html |

|

Libya’s Oil Exports Crash to 400,000 Bpd as Political Row Stalls OutputCrude oil exports from Libya have crumbled to around 400,000 barrels per day (bpd) this month from 1 million bpd in August as the political standoff in OPEC’s North African producer continues, Reuters reported on Tuesday, citing data from ports and ship-tracking services. Most of Libya’s oil exports this month were headed to nearby Italy and Greece, while some cargoes traveled to China and Canada, according to data from oil analytics firm Kpler and port agents quoted by Reuters. Libya’s National Oil Corporation (NOC) has… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-Oil-Exports-Crash-to-400000-Bpd-as-Political-Row-Stalls-Output.html |

|

Coal’s Resurgence Challenges Global Energy TransitionDespite efforts to decarbonize the economy, global coal consumption surpassed 164 exajoules for the first time in 2023. The fossil fuel still accounts for 26% of the world’s total energy consumption. In this graphic, Visual Capitalist’s Bruno Venditti shows global coal consumption by region from 1965 to 2023, based on data from the Energy Institute. China Leads in Coal Consumption China is by far the largest consumer of coal, accounting for 56% of the global total, with 91.94 exajoules in 2023. It is followed by India, with 21.98 exajoules,… Read more at: https://oilprice.com/Energy/Coal/Coals-Resurgence-Challenges-Global-Energy-Transition.html |

|

The U.S. Is the World’s Top Gasoline ExporterThe United States is exporting gasoline more than any other nation in the world, supplying more than 16% of all exports of the fuel globally, the U.S. Energy Information Administration (EIA) said in an analysis on Tuesday. Last year, U.S. motor gasoline exports (finished gasoline plus gasoline blending components) averaged 900,000 barrels per day (bpd). This is equivalent to about 10% of domestic consumption and enough to fill up the tanks of over 1.5 million SUVs per day, assuming an average tank size of 24 gallons, the EIA noted. Although China… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-US-Is-the-Worlds-Top-Gasoline-Exporter.html |

|

Oil Prices Surge on Supply Uncertainty, Demand Optimism, and Geopolitical RiskOil prices continued to rally on Tuesday morning, with Brent breaking past $75 as another hurricane threatened production in the Gulf of Mexico, China implemented its stimulus measures, and Israel targeted Hezbollah with strikes in Lebanon. – Crude oil inventories in Cushing, Oklahoma, the delivery point for the NYMEX WTI future contract, have been unprecedentedly low recently, sitting near the lowest in a decade for this time of the year.- The launch of the Trans Mountain Expansion pipeline with a nameplate capacity of 590,000 b/d of… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Surge-on-Supply-Uncertainty-Demand-Optimism-and-Geopolitical-Risk.html |

|

81% of New Renewable Energy Capacity Added in 2023 Was Cheaper Than Fossil FuelsDespite cost increases in recent years, renewables remain cost-competitive to fossil fuels as 81% of renewable capacity additions last year were cheaper than their fossil fuel alternatives, the International Renewable Energy Agency (IRENA) said in a new report on Tuesday. Last year, a record 473 gigawatts (GW) of renewable capacity was added globally, of which 81% had lower costs than their fossil fuel-fired alternatives. “With a spectacular decline in costs to around four US cents per kilowatt hour in just one year, solar PV’s global… Read more at: https://oilprice.com/Latest-Energy-News/World-News/81-of-New-Renewable-Energy-Capacity-Added-in-2023-Was-Cheaper-Than-Fossil-Fuels.html |

|

U.S. and Canada to Discuss Claims Over Oil-Rich Arctic SeabedThe United States and Canada are expected to announce they have agreed to begin negotiations over overlapping territorial claims in the Arctic, an area that has drawn increased interest from China and Russia, Bloomberg reported on Tuesday, citing an anonymous source with knowledge of the matter. The United States and Canada are disputing the Arctic seabed in parts of the Beaufort Sea which is believed to hold huge oil reserves. The two neighbors and allies have overlapping claims over the seabed north of Alaska, Yukon, and Northwest Territories.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-and-Canada-to-Discuss-Claims-Over-Oil-Rich-Arctic-Seabed.html |

|

UAE Renewable Energy Giant to Buy $1.4-Billion Firm From BrookfieldMasdar, the renewables energy giant of the United Arab Emirates (UAE), on Tuesday announced a planned acquisition of renewable power developer Saeta Yield from Brookfield in a deal valuing the target company at $1.4 billion. Saeta, owned by Brookfield Renewable, develops, owns, and operates renewable power assets in the Iberian Peninsula. The transaction consists of a portfolio of 745 megawatts (MW) of predominantly wind assets – 538 MW of wind assets in Spain, 144 MW of wind assets in Portugal, and 63 MW solar PV assets in Spain – and includes… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UAE-Renewable-Energy-Giant-to-Buy-14-Billion-Firm-From-Brookfield.html |

|

‘Stop ripping us off’: Senate grills Novo Nordisk CEO on weight loss drug pricingSen. Bernie Sanders argues that Novo Nordisk charges Americans substantially higher prices for its drugs than it does for patients in other countries. Read more at: https://www.cnbc.com/2024/09/24/novo-nordisk-ceo-to-testify-at-senate-over-weight-loss-drug-prices.html |

|

September consumer confidence falls the most in three yearsThe Conference Board’s consumer confidence index slid to 98.7, down from 105.6 in August, the biggest one-month decline since August 2021. Read more at: https://www.cnbc.com/2024/09/24/september-consumer-confidence-falls-the-most-in-three-years.html |

|

Justice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’Visa and MasterCard have surged in the past two decades, reaching a combined $1 trillion market cap. That has attracted unwanted attention from regulators. Read more at: https://www.cnbc.com/2024/09/24/doj-accuses-visa-of-debit-network-monopoly-that-impacts-price-of-nearly-everything.html |

|

S&P 500 rises to new record high Tuesday, posts back-to-back gains: Live updatesThe S&P 500 hit a fresh record on Tuesday despite a softer-than-expected consumer confidence reading that pressured stocks earlier in the session. Read more at: https://www.cnbc.com/2024/09/23/stock-market-today-live-updates.html |

|

Three stocks including McDonald’s have formed the bullish ‘golden cross’ stock pattern during market breakoutThe “golden cross” pattern occurs when an asset’s 50-day moving average rises above the longer-term 200-day moving average, signaling a potential rally ahead. Read more at: https://www.cnbc.com/2024/09/24/three-stocks-including-mcdonalds-have-formed-the-bullish-golden-cross-stock-pattern-during-market-breakout.html |

|

Elliott to call for Southwest special meeting ‘as soon as next week’Elliott Management said Tuesday it will call a special meeting at Southwest Airlines as soon as next week. Read more at: https://www.cnbc.com/2024/09/24/elliott-to-call-for-southwest-special-meeting-as-soon-as-next-week.html |

|

U.S. Steel CEO defends planned sale to Japan’s Nippon, believes deal will close on its meritsU.S. Steel CEO David Burritt said the sale to Nippon would strengthen national, economic and job security. Read more at: https://www.cnbc.com/2024/09/24/us-steel-ceo-defends-planned-sale-to-japans-nippon-believes-deal-will-close-on-its-merits.html |

|

Nvidia shares pop as CEO may be done selling shares after hitting preset plan limitThe 61-year-old executive adopted a trading plan for the sale of up to six million Nvidia shares, and he has hit that threshold months ahead of schedule. Read more at: https://www.cnbc.com/2024/09/24/nvidia-shares-pop-as-ceo-may-be-done-selling-shares-after-hitting-preset-plan-limit.html |

|

Trump floats expanded R&D business tax credits, says he would appoint ‘manufacturing ambassador’Donald Trump’s proposals come ahead of Vice President Kamala Harris’ speech where she is expected to unveil new economic proposals. Read more at: https://www.cnbc.com/2024/09/24/trump-manufacturing-ambassador-tax-credit-harris-election-economy.html |

|

Trump Media looks to snap sell-off amid DJT post-lockup trading frenzyDonald Trump, the majority owner of Trump Media shares and the biggest draw on Truth Social, said he is not selling his $1.5 billion DJT stake. Read more at: https://www.cnbc.com/2024/09/24/djt-trump-media-stock-selloff-lockup.html |

|

‘Childless cat lady’ is a more common lifestyle choice. Here’s what being child-free means for your moneyChild-free couples often have different goals when it comes to financial planning, estate planning and long-term care. Read more at: https://www.cnbc.com/2024/09/24/what-a-sink-dink-or-dinky-lifestyle-means-for-your-money.html |

|

Take a look inside a $1.1 million ‘zero emissions’ homeFederal officials are trying to boost the energy efficiency of residential and commercial real estate. Read more at: https://www.cnbc.com/2024/09/24/take-a-look-inside-a-1point1-million-zero-emissions-home.html |

|

Caroline Ellison faces sentencing in FTX fraud case after testifying against SBF: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Paul Tuchmann of Wiggin and Dana breaks down the precedent Caroline Ellison’s sentencing could set, and whether Sam Bankman-Fried’s appeal stands a chance. Read more at: https://www.cnbc.com/video/2024/09/24/caroline-ellison-faces-sentencing-ftx-fraud-case-testifying-sbf-crypto-world.html |

|

Artificial Intelligence: Our Days (Probably) Aren’t NumberedArtificial Intelligence: Our Days (Probably) Aren’t NumberedAuthored by Art Carden via The American Institute for Economic Research, Maybe it’s a law of history: every innovation faces opposition. The early nineteenth-century Luddites wrecked textile machinery because it took their jobs. Our innate suspicion extends to trade, too, which is, after all, just another technology for turning one thing into another. Apartheid-era white South Africans opposed efforts to modify the Colour Bar because they feared that African workers would take their jobs and reduce them to “uncivilized” standards of living. Protectionists want to shield their fellow Americans from foreign competition. Read more at: https://www.zerohedge.com/technology/artificial-intelligence-our-days-probably-arent-numbered |

|

Netanyahu Vows Attacks On Lebanon Won’t Stop As Hezbollah Escalates With Deepest Strike Inside IsraelUpdate(1500ET): Sky News and others are reporting that for the first time of the conflict, Hezbollah has launched a drone attack on a navy base which lies south of Haifa. The Atlit navy base which was targeted lies 80 kilometers from the Lebanese border. This is an attack significantly deep into Israel and reveals an extended range of Hezbollah missiles. Likely as things slide further, and with Israel keeping up its intense airstrikes on Lebanon, Hezbollah missiles will begin reaching further and further. Israeli Prime Minister Benjamin Netanyahu has said late in the day Tuesday (local time) on X: “We will continue striking Hezbollah. Anyone who has a missile in their living room and a rocket in their garage will not have a home.” Israel’s military has been repeatedly claiming that Hezbollah is storming missiles, drones, and ammunition inside people’s homes in the south of Lebanon. “Our war is not with you, our war is with Hezbollah,” he warned in the message emphasizing that Israel won’t stop its strikes.

|

|

Would-Be Trump Assassin Ryan Routh’s Son Arrested On Child Pornography ChargesThe son of attempted Trump assassin Ryan Routh has been arrested in North Carolina on child pornography charges. Oran Routh, who was interviewed by mainstream news outlets just after his father’s attempt on Donald Trump’s life and stated he and his father both hated the former president, has been charged with possession of an SD card holding “hundreds of files” of child sexual abuse materials.

The evidence includes graphic descriptions of the videos and a chat from July in which Oran Routh allegedly responded to someone advertising the content for sale. According to ABC News, investigators found the child pornography files when they searched the home of Oran Routh in Guilford County, North Carolina this past weekend. The search was “in connection with an investigation unrelated to child exploitation.”

|

|

“Slitting The Master’s Throat”: Fired Machete-Wielding Professor Leads Protesters In Chilling ChantAuthored by Jonathan Turley, We previously discussed Shellyne Rodríguez , the machete-wielding former Hunter College professor. Rodríguez is back with a large following shown in a video with protesters chanting with her about “slitting the throats of the masters. ”We previously discussed a videotape of Rodríguez trashing a pro-life student display in New York. Before attacking the table, she told the students, “You’re not educating s–t […] This is f–king propaganda. What are you going to do, like, anti-trans next? This is bulls–t. This is violent. You’re triggering my students.”

The vi … Read more at: https://www.zerohedge.com/political/slitting-masters-throat-fired-machete-wielding-professor-leads-protesters-chilling-chant |

|

US accuses Visa of debit card monopolyThe Department of Justice said Visa’s actions had slowed competition and raised prices across the economy. Read more at: https://www.bbc.com/news/articles/c05gn932y38o |

|

China probes Calvin Klein over Xinjiang cottonBeijing says it suspects US brands are discriminating against Chinese cotton after allegations of forced labour. Read more at: https://www.bbc.com/news/articles/c20pxwwqqzwo |

|

Ex-Harrods boss saw ‘abhorrent’ behaviour by FayedBut James McArthur says he was not aware of sexual abuse at Harrods, including a police investigation. Read more at: https://www.bbc.com/news/articles/cy807zg8nxyo |

|

KRN Heat Exchanger IPO: GMP soars over 100% ahead of issue opening tomorrowKRN Heat Exchanger IPO GMP Today: KRN Heat Exchanger IPO opens for subscription on September 25. The issue has a GMP of Rs 240, indicating a 110% premium. The IPO price band is Rs 220. The allotment of the issue is divided among QIBs (50%), retail investors (35%), and non-institutional investors (15%). Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/krn-heat-exchanger-ipo-gmp-soars-over-100-ahead-of-issue-opening-tomorrow/articleshow/113628155.cms |

|

MCX revises futures & options transaction charges. New rates effective from October 1MCX revised transaction fees for futures and options contracts, effective October 1, 2024. The new fees are Rs 2.10 per lakh for futures and Rs 41.80 per lakh for options. MCX offers trading in commodity derivatives across bullion, industrial metals, energy, and agricultural commodities. Read more at: https://economictimes.indiatimes.com/markets/options/mcx-revises-futures-options-transaction-charges-new-rates-effective-from-october-1/articleshow/113640896.cms |

|

BofA buys shares worth Rs 6.4 crore in this smallcap stock via block dealBofA bought 6.7 lakh shares in Exxaro Tiles Limited through a block deal at Rs 96.22 per share. Setu Securities Pvt Ltd also bought shares in the company. Exxaro Tiles is a Gujarat-based manufacturer of vitrified tiles. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bofa-buys-shares-worth-rs-6-4-crore-in-this-smallcap-stock-via-block-deal/articleshow/113639110.cms |

|

‘I’m overwhelmed’: I inherited $185,000. With the Fed lowering rates, should I park it in 5% CDs or high-yield savings accounts?“My brother got a better interest rate because he acted fast, and here I am twiddling my thumbs, overwhelmed with banks.” Read more at: https://www.marketwatch.com/story/im-overwhelmed-i-inherited-185-000-with-the-fed-lowering-rates-should-i-park-it-in-5-cds-or-high-yield-savings-accounts-e692a391?mod=mw_rss_topstories |

|

Oil ends higher after back-to-back losses as China announces stimulus measuresOil futures on Tuesday posted their first gain in three sessions after China announced a range of stimulus measures aimed at boosting the economy of the world’s largest crude importer. Read more at: https://www.marketwatch.com/story/oil-prices-rise-more-than-2-after-china-announces-stimulus-measures-6b81f3eb?mod=mw_rss_topstories |

|

‘She’s the queen of CDs’: My mother-in-law, 83, opened 12 CDs at different financial institutions. Should I intervene?“Given her advanced age and risk aversion, I question whether pursuing these interest rates and promotional offers is truly worthwhile.” Read more at: https://www.marketwatch.com/story/shes-the-queen-of-cds-my-mother-in-law-83-opened-12-cds-at-different-financial-institutions-should-i-intervene-b89a1258?mod=mw_rss_topstories |