Summary Of the Markets Today:

- The Dow closed up 522 points or 1.26%, (Closed at 42,025, New Historic high 42,161)

- Nasdaq closed up 2.51%,

- S&P 500 closed up 1.70%, (Closed at 5,714, New Historic high 5,734)

- Gold $2,613 up $14.70,

- WTI crude oil settled at $72 up $1.10,

- 10-year U.S. Treasury 3.719 up 0.032 points,

- USD index $100.63 up $0.03,

- Bitcoin $63,258 up $1,519 or 2.46%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The Dow Jones Industrial Average closed above 42,000 for the first time in history, marking a significant milestone. The S&P 500 also surged to record highs. This rally was primarily driven by the Federal Reserve’s decision to cut interest rates by 50 basis points, the first rate cut in over four years and growing optimism that the Fed’s rate cut will lead to a “soft landing” for the US economy. Strong performance from tech stocks, particularly the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla). Positive economic data, including lower-than-expected jobless claims. The market’s reaction suggests investors are interpreting the Fed’s rate cut as a sign of confidence rather than panic about current economic conditions. Some analysts have revised their forecasts, with Bank of America now expecting further rate cuts by year-end. BMO Capital Markets raised its year-end S&P 500 target to 6,100, the highest among tracked strategists, citing surprising market strength and expectations of a soft landing.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

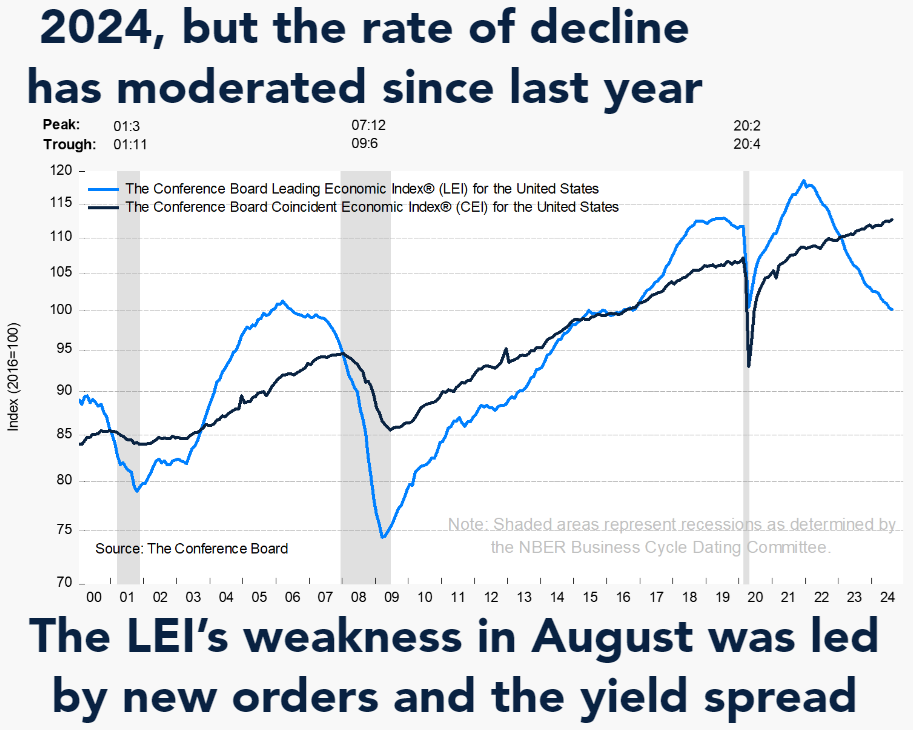

According to The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.2% in August 2024 to 100.2 (2016=100), following an unrevised 0.6% decline in July. Over the six-month period between February and August 2024, the LEI fell by 2.3%, a smaller rate of decline than the 2.7% drop over the six-month period between August 2023 and February 2024. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board perspective:

In August, the US LEI remained on a downward trajectory and posted its sixth consecutive monthly decline. The erosion continued to be driven by new orders, which recorded its lowest value since May 2023. A negative interest rate spread, persistently gloomy consumer expectations of future business conditions, and lower stock prices after the early-August financial market tumult also weighed on the Index. Overall, the LEI continued to signal headwinds to economic growth ahead. The Conference Board expects US real GDP growth to lose momentum in the second half of this year as higher prices, elevated interest rates, and mounting debt erode domestic demand. However, in the Fed’s September 2024 Summary of Economic Projections, policymakers suggested 100 basis points of interest rate cuts are likely by the end of this year, which should lower borrowing costs and support stronger economic activity in 2025.

The September 2024 Philly Fed Manufacturing Business Outlook Survey showed that the general activity rose from -7.0 to 1.7 while the indexes for new orders and shipments declined and turned negative. To me, new orders and shipments mean that the manufacturing sector is in a recession.

Existing-home sales declined 4.2% year-over-year in August 2024. The median existing-home price for all housing types in August was $416,700, up 3.1% from one year ago ($404,200). NAR Chief Economist Lawrence Yun added:

Home sales were disappointing again in August, but the recent development of lower mortgage rates coupled with increasing inventory is a powerful combination that will provide the environment for sales to move higher in future months. The home-buying process, from the initial search to getting the house keys, typically takes several months.

In the week ending September 14, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 227,500, a decrease of 3,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 230,750 to 231,000. No evidence of a recession in these numbers.

According to CoreLogic, Single-family rental prices increased 2.8% year over year in July 2024, down slightly from last month. Rental prices for low-end properties dropped -0.2%, while high-end properties saw rental prices increase 2.9% year over year. The perspective of Molly Boesel, principal economist for CoreLogic:

On the surface, single-family rent growth in July could be characterized as ‘average,’ with the annual and monthly national changes roughly equal to long-term levels. However, a deeper look reveals that rent changes slowed at the lowest end of the market, dropping 0.2% in July from a year earlier. While this drop might be due to a strong year-ago comparison, it is most likely a welcome relief to renters looking for rentals in the lower-priced end of the market.

Here is a summary of headlines we are reading today:

- How Renewables Could Slash Oil and Gas Production Emissions by 80%

- Biden’s Tariff Crackdown Upends Amazon and Walmart’s China Strategy

- UK Cracks Down on Iranian Oil Tycoon’s London Entity

- Rystad: Platform Electrification Could Slash Upstream Emissions by 86%

- Saudi Arabia’s Crude Oil Exports Slumped to an 11-Month Low in July

- European Carmakers Call for Urgent Action as EV Sales Crash

- The Fed has set out on a ‘recalibration’ of policy. Here’s what Powell’s new buzzword means

- Dow jumps 500 points, S&P 500 closes above 5,700 for the first time a day after Fed slashes rates: Live updates

- August home sales drop more than expected, as prices set a new record

- UAW warns of potential strikes at Ford, Stellantis a year after unprecedented work stoppages

- Bitcoin pops to $63,000 as investors digest long-awaited rate cut: CNBC Crypto World

- Oil Rally, Fueled By Fed, CTAs And Record Shorts, Has Room For More Gains

- Interest rates held at 5% but ‘on the path down’

- Why a recession still worries this stock-market veteran, despite the Fed’s rate cut

- Treasury yields end at highest levels in up to 2 weeks after jobless claims, Philadelphia Fed’s factory gauge

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Fire at Greek Refinery: Crude Unit DownA fire broke out at Greece’s Agioi Theodoroi oil refinery on September 17, disrupting operations at one of its two key crude processing units. The facility, operated by Motor Oil Hellas, is Greece’s second-largest refinery, processing around 175,000 barrels per day. Despite the damage, the refinery is operating at over 50% capacity due to its complex configuration, according to company sources. The fire, which saw multiple fire crews, helicopters, and emergency vehicles respond, led to localized evacuations and disrupted transportation in the area,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fire-at-Greek-Refinery-Crude-Unit-Down.html |

|

How Renewables Could Slash Oil and Gas Production Emissions by 80%Converting upstream oil and gas production facilities to run on electricity powered by renewables or natural gas that would otherwise be flared could cut more than 80% of associated emissions, according to new research from Rystad Energy. Fully electrified rigs and other assets on the Norwegian Continental Shelf emit 1.2 kilograms of carbon dioxide per barrel of oil equivalent (kg of CO2 per boe) produced, an 86% drop from the 8.4 kg of CO2 per boe emitted by the same assets before electrification. Norway is in a prime position that is almost unique… Read more at: https://oilprice.com/Energy/Crude-Oil/How-Renewables-Could-Slash-Oil-and-Gas-Production-Emissions-by-80.html |

|

Biden’s Tariff Crackdown Upends Amazon and Walmart’s China StrategyUnder mounting pressure from Chinese retail giants like Shein and Temu, American behemoths Amazon and Walmart have been cooking up a scheme to dodge tariffs and slash costs – but a new move by the Biden administration might just rain on their parade. For months, these U.S. retailers have been quietly plotting to overhaul their business models, aiming to ship more goods directly from Chinese factories straight to your doorstep. By doing so, they’d cut out pricey U.S. warehouses and stores, all while skirting hefty tariffs using a little-known loophole… Read more at: https://oilprice.com/Geopolitics/International/Bidens-Tariff-Crackdown-Upends-Amazon-and-Walmarts-China-Strategy.html |

|

The Politics Behind EU SanctionsOn September 11, the European Union approved the rollover of the asset freezes and visa bans that the bloc has imposed since February 2022, mainly on Russians, for undermining the territorial integrity of Ukraine. But with the six-month prolongation, there were also two deletions to the blacklist of over 2,300 people and companies: Nikita Mazepin, a former Formula One driver and son of the Russian oligarch Dmitry Mazepin; and Violetta Prigozhina, mother of the late Russian oligarch and Wagner mercenary leader Yevgeny Prigozhin. Deep Background:… Read more at: https://oilprice.com/Geopolitics/International/The-Politics-Behind-EU-Sanctions.html |

|

Shell’s Planned Sale Of Rosneft’s Refinery In Germany Hits A WallShell Plc’s (NYSE:SHEL) planned sale of a stake in the Schwedt refinery in Germany is facing delays due to pending lawsuits by third parties, Reuters has reported. Shell’s planned sale of its 37.5% stake in the refinery to Britain’s Prax Group, was expected to close in the first half of 2024; however, the deal has hit a snag after Berlin stripped majority owner Rosneft of its control, but not its shares, and put it under a trusteeship shortly after Russia invaded Ukraine in 2022. The lawsuits include an attempt by Rosneft to prevent the sale… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shells-Planned-Sale-Of-Rosnefts-Refinery-In-Germany-Hits-A-Wall.html |

|

UK Cracks Down on Iranian Oil Tycoon’s London EntityThe British government has targeted a London-based entity of Iranian oil trading empire led by Hossein Shamkhani, as it steps up efforts to stop those sidestepping oil-trading restrictions. Last month, Bloomberg revealed Shamkhani’s role in Iranian and Russian oil trading. Shamkhani’s father, Ali, served as a naval commander for the Islamic Revolutionary Guard Corps, as defence minister and then as Secretary of Iran’s Supreme National Security Council. The publication has highlighted that London-based Nest Wise is a prominent entity… Read more at: https://oilprice.com/Energy/Crude-Oil/UK-Cracks-Down-on-Iranian-Oil-Tycoons-London-Entity.html |

|

Citi: Oil Market Deficit Will Support Brent Prices In Q4Wall Street analysts at Citi have predicted that a deficit in the oil markets driven by OPEC’s recent decision to delay tapering in oil production cuts as well as the ongoing suspension of Libyan oil exports will temporarily offer support for Brent prices in the $70-$75/barrel range in Q4 2024, as reported by Reuters. However, Citi has warned of “renewed price weakness” in 2025, with Brent on a path to $60 per barrel thanks to a surplus of one million barrels per day. Oil prices have rallied over the past week, with dated Brent for… Read more at: https://oilprice.com/Energy/Oil-Prices/Citi-Oil-Market-Deficit-Will-Support-Brent-Prices-In-Q4.html |

|

Rystad: Platform Electrification Could Slash Upstream Emissions by 86%Oil and gas companies can slash emissions from producing facilities by as much as 86% by electrifying the platforms to run on renewables electricity or natural gas that would be flared otherwise, Rystad Energy said in a new report. Producing assets in the Norwegian Continental Shelf have seen their associated emissions drop by 86% when fully electrified compared to before the electrification, according to the Norway-based energy research company. Rystad Energy’s research showed that the electrified assets offshore Norway emit 1.2 kilograms… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rystad-Platform-Electrification-Could-Slash-Upstream-Emissions-by-86.html |

|

Chevron CEO: Biden’s LNG Moratorium Fails on All FrontsChevron CEO Mike Wirth delivered a dire warning at Tuesday’s Gastech conference in Houston, criticizing the Biden-Harris administration’s radical energy policies—specifically the moratorium on new liquefied natural gas export permits. He warned these policies have driven up prices and “undermined energy security” for America’s key allies. Wirth said “attacks on natural gas” and a moratorium on new LNG export permits at terminals along the Gulf Coast had put “politics over progress” and would derail climate efforts, such as the transition… Read more at: https://oilprice.com/Energy/Natural-Gas/Chevron-CEO-Bidens-LNG-Moratorium-Fails-on-All-Fronts.html |

|

ING Stops Funding Pure-Play Upstream Firms With New Oil and Gas FieldsThe largest bank in the Netherlands, ING, is further restricting its energy financing by halting all new general financing to so-called pure-play upstream oil and gas companies that continue to develop new oil and gas fields. ING, which has already announced some financing restrictions to fossil fuels in recent years, unveiled new steps in its policy for energy financing in its annual Climate Progress Update 2024 published on Thursday. “We will stop all new general financing to so-called pure-play upstream oil & gas companies that continue… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ING-Stops-Funding-Pure-Play-Upstream-Firms-With-New-Oil-and-Gas-Fields.html |

|

Saudi Arabia’s Crude Oil Exports Slumped to an 11-Month Low in JulySaudi Arabia exported 5.74 million barrels per day (bpd) of crude oil in July, down by 306,000 bpd from June, and the lowest export level since August 2023, the latest data from the Joint Organizations Data Initiative (JODI) showed on Thursday. Saudi Arabia, the world’s top crude oil exporter, typically lowers its crude oil exports in the summer as it uses more crude domestically for direct burn at power plants. Electricity demand in the desert in the summer months is soaring amid scorching temperatures. Saudi Arabia saw its direct… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabias-Crude-Oil-Exports-Slumped-to-an-11-Month-Low-in-July.html |

|

Germany Needs New Natural Gas Capacity to Meet Its Coal Phase-Out TargetGermany needs to soon move to award tenders for new natural gas capacity that would replace coal plants if Europe’s biggest economy is to meet its target to phase out coal in power generation by the end of the decade, German energy giant Uniper says. Earlier this year, Germany decided that it would tender 10 gigawatts (GW) of new natural gas-fired capacity from power plants that could be converted to hydrogen in the 2030s, as part of plans to ensure stable electricity supply as wind and solar power generation and installations grow. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Needs-New-Natural-Gas-Capacity-to-Meet-Its-Coal-Phase-Out-Target.html |

|

European Carmakers Call for Urgent Action as EV Sales CrashBattery electric vehicle (BEV) registrations in the European Union tumbled by 44% in August from a year earlier as all new car sales slumped by 18%, the European Automobile Manufacturers’ Association, ACEA, said on Thursday, calling for urgent action to reverse this year’s trend of declining EV sales. ACEA data showed that registrations of BEVs plunged by 43.9% to 92,627 units in August 2024, compared to 165,204 BEVs registered in the same month last year. The total market share of BEVs dipped to 14.4% from 21% a year earlier. “This… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Carmakers-Call-for-Urgent-Action-as-EV-Sales-Crash.html |

|

Russian and Western Nuclear Industries Remain InterdependentThe nuclear energy industries in Russia and the West have remained interdependent after the Russian invasion of Ukraine, which partly explains Europe’s unwillingness to impose sanctions on Russia’s nuclear sector, the World Nuclear Industry Status Report showed on Thursday. “Despite repeated calls—notably by the European Parliament—the nuclear sector remained exempt from sanctions—a clear indication of dependency on Russia in the field,” according to the annual industry report which assesses nuclear energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-and-Western-Nuclear-Industries-Remain-Interdependent.html |

|

Saudi Aramco Awards $2 Billion Deal for Offshore Field ExpansionSaudi Aramco has awarded a $2-billion contract to Saipem as part of the capacity expansion of the huge Marjan offshore field in Saudi Arabia, the Italian engineering group said in a statement. The new contract is part of an existing long-term agreement between Saipem and the world’s largest oil company. Saipem’s scope of work involves the engineering, procurement, construction and installation of wellhead platforms’ topsides, wellhead platforms’ jackets, tie-in platform jacket and topside, rigid flowlines, submarine composite… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Awards-2-Billion-Deal-for-Offshore-Field-Expansion.html |

|

The Fed has set out on a ‘recalibration’ of policy. Here’s what Powell’s new buzzword meansAsset prices soared as investors took Powell at his word that the outsized rate cut wasn’t in response to a substantial economic weakening. Read more at: https://www.cnbc.com/2024/09/19/the-fed-has-set-out-on-a-recalibration-of-policy-heres-what-powells-new-buzzword-means.html |

|

Dow jumps 500 points, S&P 500 closes above 5,700 for the first time a day after Fed slashes rates: Live updatesStocks jumped Thursday, with the Dow Jones Industrial Average and S&P 500 rising to new all-time highs. Read more at: https://www.cnbc.com/2024/09/18/stock-market-today-live-updates.html |

|

August home sales drop more than expected, as prices set a new recordThe median price of an existing home sold in August was $416,700, up 3.1% from August 2023. Read more at: https://www.cnbc.com/2024/09/19/august-home-sales-drop-more-than-expected-as-prices-set-a-new-record.html |

|

Market bull Tom Lee hesitant to jump into this post-Fed rallyTom Lee is not sold on the stock market’s rally after the Federal Reserve cut interest rates. Read more at: https://www.cnbc.com/2024/09/19/market-bull-tom-lee-hesitant-to-jump-into-this-post-fed-rally.html |

|

Volatility looms as election season heats up. Fortify your portfolio against autumn market shocksThursday’s relief rally notwithstanding, a turbulent period probably awaits investors as the year winds down. Read more at: https://www.cnbc.com/2024/09/19/fortify-your-portfolio-against-fall-market-shocks.html |

|

UAW warns of potential strikes at Ford, Stellantis a year after unprecedented work stoppagesThe UAW has announced a strike deadline at a Ford tool and die plant that supports F-150 production as well as strike authorization voting at Stellantis. Read more at: https://www.cnbc.com/2024/09/19/uaw-warns-of-potential-strikes-at-ford-stellantis.html |

|

Trump Media hits new post-merger low as DJT sale restrictions set to liftDonald Trump, the majority shareholder of Trump Media and the biggest name on Truth Social, said he has no plans to sell his DJT stock when the lockup ends. Read more at: https://www.cnbc.com/2024/09/19/djt-trump-media-stock-lockup.html |

|

NC GOP Gov. nominee Mark Robinson denies making racist and sexually graphic posts on porn forumMark Robinson, who has weathered numerous scandals over his controversial remarks, has garnered praise from Republican presidential nominee Donald Trump. Read more at: https://www.cnbc.com/2024/09/19/mark-robinson-minisoldr-porn-racist-north-carolina-gov.html |

|

Elon Musk’s X and Starlink face nearly $1 million in daily fines for alleged ban evasion in BrazilX and Starlink face daily fines of $5 million reals (about $920,000) for alleged ban evasion maneuvers by X in Brazil. Read more at: https://www.cnbc.com/2024/09/19/elon-musks-x-and-starlink-face-daily-fines-in-brazil-for-ban-evasion.html |

|

Bitcoin pops to $63,000 as investors digest long-awaited rate cut: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Crypto World travels to Washington, D.C. to talk to attend a pro-crypto rally, and talk to executives from Coinbase as they urge lawmakers to pass crypto regulation. Read more at: https://www.cnbc.com/video/2024/09/19/bitcoin-pops-to-63000-as-investors-digest-long-awaited-rate-cut-cnbc-crypto-world.html |

|

Why Caitlin Clark and other WNBA stars make modest salaries even as the sport boomsWNBA salaries are so low that many athletes play a second season overseas in the offseason. But a new $2.2 billion media rights deal may change everything. Read more at: https://www.cnbc.com/2024/09/19/why-wnba-salaries-are-lower-than-other-leagues.html |

|

Why Adrian Wojnarowski left $20 million on the table by leaving ESPN: ‘Time isn’t in endless supply’The NBA scoopster is calling it quits to take a job with his alma mater, St. Bonaventure. It’ll likely mean less money and fewer 2 a.m. texts from agents. Read more at: https://www.cnbc.com/2024/09/19/why-adrian-wojnarowski-left-espn.html |

|

Largest port on U.S. East Coast, New York/New Jersey, begins prepping for what could be first union strike since 1977A deadline of Oct. 1 for a new deal between port workers and ownership is approaching, and after talks broke down during the summer, tensions are high. Read more at: https://www.cnbc.com/2024/09/19/largest-port-on-east-coast-begins-preparations-for-a-strike.html |

|

House Passes Bill To Deport Illegal Immigrants Convicted Of Sex OffensesAuthored by Zachary Stieber via The Epoch Times, The U.S. House of Representatives on Sept. 18 passed a bill that would authorize deportation of illegal immigrants who have been convicted of a sex offense such as soliciting a minor to engage in sexual conduct.

Members voted 266–158 to send the bill introduced by Rep. Nancy Mace (R-S.C.) to the Senate. All Republicans who lodged a vote were in favor of the bill, while 51 Democrats voted in favor and 158 voted against. Known as the Violence Against Women by Illegal Aliens Act, the bill would add to federal immigration law that any illegal immigrant who has been convicted of or has admitted to carrying out sex offenses such as possession of child pornography and soliciting … Read more at: https://www.zerohedge.com/political/house-passes-bill-deport-illegal-immigrants-convicted-sex-offenses |

|

Most Intense Israeli Bombing Since Gaza War’s Start Rocks LebanonUpdate(1519ET): The evening hours (local time) have seen a “major intensification of bombing” by Israel’s military in southern Lebanon targeting Hezbollah positions, Reuters is reporting based on Lebanese security officials. The officials called it “the most intense bombing since the start of the war in Gaza” and the IDF has since confirmed striking at least 30 Hezbollah launch locations and “terrorist infrastructure sites” on Thursday. Israel’s miliary said it hit “approximately 150 launcher barrels that were ready to fire projectiles toward Israeli territory.” Within hours prior to the intensified Israeli bombing campaign, the IDF confirmed that two Israeli soldiers were killed near the border with Lebanon. Israeli media indicated one was killed by a drone launched from Lebanon and the other by a Hezbollah anti-tank missile.

* * * Israel’s military has just announced that IDF chief Lt. Gen. Herzi Halevi has “approved operational plans as … Read more at: https://www.zerohedge.com/geopolitical/israel-unleashes-heavy-strikes-south-lebanon-after-war-plans-approved |

|

Oil Rally, Fueled By Fed, CTAs And Record Shorts, Has Room For More GainsOil is up more than $6 from its nadir last week with the latest leg higher helped by the risk-on tone across global markets.

Today’s rally is, as Bloomberg’s Alex Longley writes, the latest in a bumper run of intraday price volatility for crude, with average daily swings in August and September being the highest since early this year. Against that backdrop, money managers had been positioned net short in Brent crude for the first time ever. With the Fed’s interest rate cuts assuaging concerns in financial markets, that left oil prices ripe for a rally. Read more at: https://www.zerohedge.com/markets/oil-rally-fueled-fed-ctas-and-record-shorts-has-room-more-gains |

|

Party Of Joy? More Than 1-In-4 Democrats Think US Would Be Better If Trump Had Been KilledAuthored by Steve Watson via Modernity.news, A new poll conducted after the second assassination attempt against Donald Trump has found that more than a quarter of Democrats believe the country would be better off if the shooters had succeeded.

The Napolitan News Service poll of 1000 registered voters was conducted Monday and Tuesday, and contained the question “While it is always difficult to wish ill of another human being, would America be better off if Donald Trump had been killed last weekend?” Only 69 percent of respondents said ‘no’. Seventeen percent answered ‘yes’, while 14 percent said they were ‘not sure’. The poll found that 92 percent of Republicans agree the country would be in a worse s … Read more at: https://www.zerohedge.com/political/party-joy-more-1-4-democrats-think-us-would-be-better-if-trump-had-been-killed |

|

Bates wants subpostmaster claims settled by MarchThe campaigner says it is time for a commitment for certain claims to be paid out over the next six months. Read more at: https://www.bbc.com/news/articles/cz04ry51rzvo |

|

Interest rates held at 5% but ‘on the path down’Economists are betting on rates being held in September with a cut to come in November instead. Read more at: https://www.bbc.com/news/articles/cgq8ydy8e79o |

|

When will interest rates go down again?Bank of England interest rates affect the mortgage, loan and savings rates for millions of people. Read more at: https://www.bbc.co.uk/news/business-57764601 |

|

Radhakishan Damani sells 1 lakh shares in VST Industries for Rs 4.4 crore via block dealAce investor Radhakishan Damani has sold 1 lakh shares in VST Industries for Rs 4.4 crore via a block deal. The shares were sold at Rs 439.05 each, slightly above the previous closing price. Following this sale, Damani’s stake in VST Industries has reduced to 2.82% from 3.47%. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/radhakishan-damani-sells-100000-shares-in-vst-industries-for-rs-4-4-crore-via-block-deal/articleshow/113499866.cms |

|

Sebi modifies framework for valuation of AIFs’ investment portfolioMarkets regulator Sebi on Thursday tweaked the framework for valuing the investment portfolios of Alternative Investment Funds (AIFs) whereby securities — other than unlisted, non-traded, or thinly-traded securities — will now be valued in line with mutual fund rules. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-modifies-framework-for-valuation-of-aifs-investment-portfolio/articleshow/113497916.cms |

|

Expanding network, strong balance sheet augur well for Karur Vysya BankKarur Vysya Bank (KVB) stock has outperformed BSE Bankex despite sector pressures. KVB has strong retail and commercial loan growth, low loan-deposit ratio, and high liquidity coverage ratio. Analysts have raised one-year price targets by over 8%. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/expanding-network-strong-balance-sheet-augur-well-for-karur-vysya-bank/articleshow/113499177.cms |

|

Why a recession still worries this stock-market veteran, despite the Fed’s rate cutDavid Rosenberg: Best bets are long-term Treasury bonds and gold, plus utilities, real estate, financials and dividend-paying growth stocks. Read more at: https://www.marketwatch.com/story/fed-rate-cut-has-delayed-but-not-derailed-recession-this-stock-market-veteran-warns-heres-what-you-should-buy-now-06ff4b14?mod=mw_rss_topstories |

|

Trump’s cap for credit-card interest rates wouldn’t pass Congress, analyst saysRepublican presidential nominee Donald Trump on Wednesday promised to cap interest rates for credit cards, but a veteran analyst predicts the plan wouldn’t get the congressional approval that it needs to become reality. Read more at: https://www.marketwatch.com/story/trumps-cap-for-credit-card-interest-rates-wouldnt-pass-congress-analyst-says-ca2b506e?mod=mw_rss_topstories |

|

Treasury yields end at highest levels in up to 2 weeks after jobless claims, Philadelphia Fed’s factory gaugeTwo-, 10- and 30-year Treasury yields finished higher for a third straight session on Thursday after fresh U.S. economic data indicated that the labor market and factory sector were continuing to hold up. Read more at: https://www.marketwatch.com/story/treasury-yields-nudge-lower-as-investors-assess-speed-of-fed-rate-cuts-0bf25b5f?mod=mw_rss_topstories |