Summary Of the Markets Today:

- The Dow closed up 235 points or 0.58%,

- Nasdaq closed up 1.00%,

- S&P 500 closed up 0.75%,

- Gold $2,586 up $43.80,

- WTI crude oil settled at $69 up $1.92,

- 10-year U.S. Treasury 3.687 up 0.034 points,

- USD index $101.28 down $0.40,

- Bitcoin $57,730 up $126 or 0.22%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

[Publisher note: This section highlights what the markets’ believe – and much of it is opinion and may be contradicted by our review of market releases.] U.S. stocks rose on Thursday as investors processed new inflation and labor data ahead of the Federal Reserve’s upcoming interest rate decision. The August Producer Price Index (PPI) data released on Thursday indicated easing inflationary pressures. Additionally, initial jobless claims climbed more than anticipated, reaching 230,000 last week, an increase of 2,000 from the previous week. These reports led traders to increase their odds of a 25 basis point rate cut to 87%, up from 50% just days earlier. The market’s reaction suggests that investors are now leaning towards expectations of a smaller, quarter-point interest rate cut from the Federal Reserve next week, rather than a larger half-point reduction. This shift in sentiment follows the release of consumer price data on Wednesday, which showed gradual cooling of inflation. In the corporate sector, Moderna’s shares fell by 12% after the company lowered its annual revenue outlook for 2025 and announced plans to reduce its research and development budget. Meanwhile, tech stocks led the market gains, with companies like Nvidia and Meta each rising by approximately 2%.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In the week ending September 7, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 230,750, an increase of 500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 230,000 to 230,250.

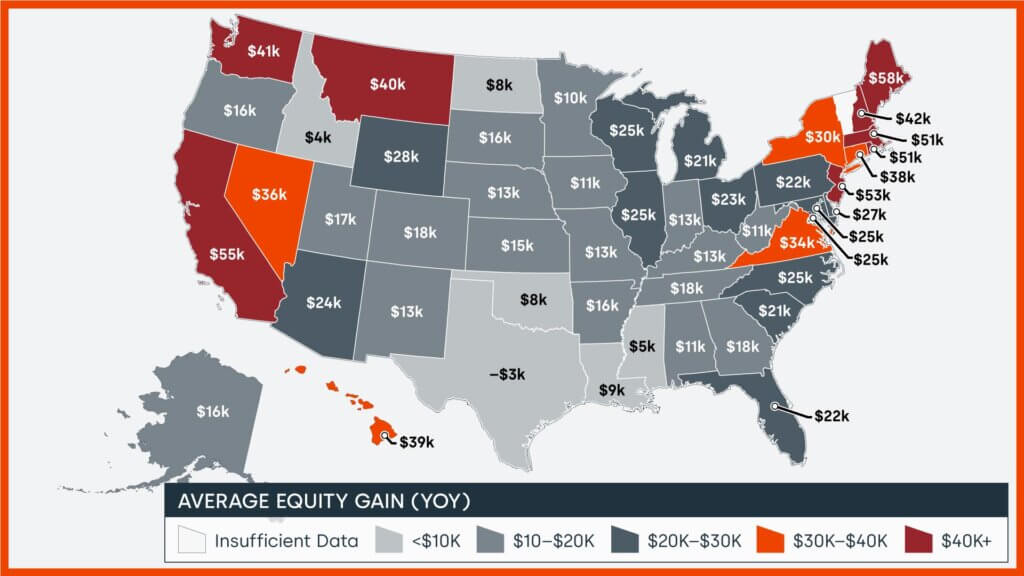

According to CoreLogic, home prices nationwide, including distressed sales, increased year over year by 4.3% in July 2024. The CoreLogic HPI Forecast indicates that home prices will rise by 2.2% on a year-over-year basis from July 2024 to July 2025.

CoreLogic’s Homeowner Equity Report (HER) for the second quarter of 2024 shows that U.S. homeowners with mortgages (which account for roughly 62% of all properties) saw home equity increase by 8.0% year over year.

The Producer Price Index for final demand increased 1.7% for the 12 months ended in August 2024 (down from 2.1% for the previous month). What is going on is that the prices for oil have decreased significantly year-over-year which is evident when one removes food, energy, and trade – which shows the year-over-year inflation rate has remained steady around 3.3% year-over-year. The Federal Reserve generally removes food and energy when they look at inflation pressures – and the current situation shows inflation pressures are not subsiding but remaining steady.

Here is a summary of headlines we are reading today:

- How Falling Oil Prices Could Save The Economy

- Nippon Steel’s Investment Could Revitalize U.S. Steel Industry

- Why Goldman Sachs is Still Bearish on Lithium

- Florida LNG Export Project Delayed Five Years Due to Supply Chain Issues

- Europe’s LNG Ambitions Face Reality Check

- U.S. Gasoline Prices Set to Drop Below $3 Before Election Day

- Here’s the deflation breakdown for August 2024 — in one chart

- Dow closes 200 points higher, S&P 500 posts four-day win streak as tech giants rally: Live updates

- Interest payments on the national debt top $1 trillion as deficit swells

- New high yield funds are hitting the market as Fed prepares to cut interest rates

- Trump rejects second Harris debate

- “We’re Just Giving Them Away”: EV Leases Have Plunged To As Low As $20 Per Month

- National debt forecast to treble over next 50 years

- Sell signs are all over the stock market now — but the bulls are holding out

- 30-year Treasury yield finishes just below 4% after soft bond auction

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Europe Invests Billions in Battery Recycling to Fuel EV RevolutionAutomakers, big and small, are investing heavily in the development of a wide range of electric vehicle (EV) models, as consumer interest in cleaner cars increases. Europe is expected to lead the world in EV uptake, as several countries introduce laws banning the sale of new internal combustion engine (ICE) vehicles starting next decade. However, with larger numbers of EVs, significantly more lithium-ion batteries are being produced and discarded as they reach the end of their lives. This means that governments and battery producers across the… Read more at: https://oilprice.com/Energy/Energy-General/Europe-Invests-Billions-in-Battery-Recycling-to-Fuel-EV-Revolution.html |

|

How Falling Oil Prices Could Save The EconomyOil’s recent slump to the low $70s and the brief dip into the $60s handle could open the door wider for the major economies to avoid recessions. Lower gasoline and energy prices are suppressing inflation, giving central banks more ammunition to cut interest rates faster. This, in turn, would support economies and boost the purchasing power of households. Brent oil’s slump to below $70 per barrel earlier this week may be bad news for the budgets of the OPEC+ producers seeking to manage supply and prices, but it’s generally good… Read more at: https://oilprice.com/Energy/Energy-General/How-Falling-Oil-Prices-Could-Save-The-Economy.html |

|

Elon Musks’ SpaceX Completes World’s First Private SpacewalkTwo private astronauts from a SpaceX capsule have carried out the world’s first private spacewalk, becoming the first two non-government people to conduct such a space mission. Billionaire Jared Isaacman, 41, and SpaceX engineer Sarah Gillis, 30, did the risky maneuver tethered to the Crew Dragon spacecraft in the vacuum of space hundreds of miles from Earth. while two others watched from inside. “Back at home we all have a lot of work to do, but from here, Earth sure looks like a perfect world,” Isaacman told Reuters after emerging from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Elon-Musks-SpaceX-Completes-Worlds-First-Private-Spacewalk.html |

|

Nippon Steel’s Investment Could Revitalize U.S. Steel IndustryVia Metal Miner Due to numerous obstacles, Nippon Steel’s $14.9 billion proposed acquisition of U.S. Steel has been on hold for nine months. The agreement is currently under investigation from all angles, with heavy resistance from steel industry labor unions and politicians. For manufacturers and procurement specialists involved in the metal supply chain, comprehending the details of this purchase is crucial. Why is the Deal Facing Roadblocks? The main barrier to the accord is worries about national security. U.S. Steel provides… Read more at: https://oilprice.com/Metals/Commodities/Nippon-Steels-Investment-Could-Revitalize-US-Steel-Industry.html |

|

Libya Sees Slow Recovery in Crude Oil ExportsLibya’s crude oil exports are projected to fall by at least 300,000 barrels per day (bpd) in September, despite a modest recovery in production. Analysts at FGE have reported that Libya’s crude production has risen by around 200,000 bpd since the beginning of the month, now standing between 650,000 and 700,000 bpd. However, exports from western Libya are expected to remain minimal due to force majeure at the country’s two major oil fields: El Sharara, which produces 270,000 bpd, and the 70,000 bpd El Feel field. FGE sees total… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libya-Sees-Slow-Recovery-in-Crude-Oil-Exports.html |

|

Why Goldman Sachs is Still Bearish on LithiumGoldman analysts Trina Chen and Joy Zhang explained in a client note Thursday that reports of Chinese battery giant Contemporary Amperex Technology (CATL) cutting lithium production at a major mine in Jiangxi province could produce a “near-term” price floor amid a multi-year bear market, temporarily alleviating oversupply concerns for the critical battery metal. However, they emphasized that the overall outlook for the lithium cycle remains deeply “negative.” “While there is lack of clarity on the quantification of production cut, we estimate… Read more at: https://oilprice.com/Metals/Commodities/Why-Goldman-Sachs-is-Still-Bearish-on-Lithium.html |

|

Scotland’s Only Oil Refinery Set to Close in 2025The Grangemouth refinery, Scotland’s only crude processing facility, is set to close in the second quarter of 2025, its owners confirmed on Thursday, as the refinery has been struggling to compete with the new complex facilities in Asia, Africa, and the Middle East. The Grangemouth refinery, which was opened by the predecessor of BP in 1924, expanded its production into petrochemicals in the 1950s. However, the facility with a refining capacity of 150,000 barrels per day (bpd) has been unable to compete with the massive new refineries… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Scotlands-Only-Oil-Refinery-Set-to-Close-in-2025.html |

|

Florida LNG Export Project Delayed Five Years Due to Supply Chain IssuesThe U.S. Federal Energy Regulatory Commission (FERC) has extended with five years the September 19, 2024 deadline for Texas-based firm Eagle LNG Partners to build and put into operation a small-scale LNG export facility near Jacksonville, Florida. Eagle LNG Partners has proposed to build and operate an LNG terminal and export facility on the north bank of the St. Johns River in Jacksonville. The original FERC authorization had a deadline of September 19, 2024 for the project to begin operations. However, due to supply chain hurdles and higher… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Florida-LNG-Export-Project-Delayed-Five-Years-Due-to-Supply-Chain-Issues.html |

|

UBS: Francine May Have Disrupted 1.5 Million Barrels of U.S. CrudeAnalysts at Wall Street bank UBS estimate that hurricane Francine may have disrupted up to 1.5 million barrels of U.S. crude production in total, according to a Thursday report from CNBC. Oil prices have reversed course over the past two days, with Brent crude for November delivery trading at $71.77/barrel on Thursday’s session at 10.30 am ET from Tuesday’s two-year low of $69.00/barrel while WTI crude for October was trading at $68.62/barrel from $65.56. “Hurricane Francine has likely disrupted about 1.5mn barrels of US oil production,… Read more at: https://oilprice.com/Energy/Energy-General/UBS-Francine-May-Have-Disrupted-15-Million-Barrels-of-US-Crude.html |

|

Uzbekistan Leverages Russia’s Need for Allies, Secures Discounted GasRussian Prime Minister Mikhail Mishustin’s two-day visit to Uzbekistan highlights the limits of the Kremlin’s geopolitical leverage these days. Mishustin arrived with high hopes of drawing Uzbekistan closer into Russia’s orbit, but he left with little of substance. Uzbekistan and other Central Asian states have walked a fine line since Russia launched its unprovoked invasion of Ukraine in early 2022, striving to remain on the sidelines of the conflict without riling the Kremlin and provoking Russian leader Vladimir Putin into… Read more at: https://oilprice.com/Energy/Natural-Gas/Uzbekistan-Leverages-Russias-Need-for-Allies-Secures-Discounted-Gas.html |

|

Saudi Arabia Set To Boost Crude Oil Supply to China in OctoberSaudi Arabia is expected to increase its crude oil supply to China in October after the world’s top crude exporter cut the prices of the oil it sells in Asia, trade sources told Reuters on Thursday. The Kingdom is set to ship a total of 46 million barrels of its crude to China next month, up from an estimated 43 million Saudi barrels expected to land in the world’s largest crude importer in September. China’s biggest state refiners Sinopec and PetroChina have asked for more supply from Saudi Arabia loading for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Set-To-Boost-Crude-Oil-Supply-to-China-in-October.html |

|

Europe’s LNG Ambitions Face Reality CheckEurope may have already seen peak LNG demand and a large part of its expanding LNG import infrastructure could become stranded assets by the end of the decade, the Institute for Energy Economics and Financial Analysis (IEEFA) said in a report on Thursday. Total LNG imports in Europe fell by 20% year-over-year in the first half of 2024, according to IEEFA’s analysis. The institute includes the EU, the UK, Norway, and Turkey in the term ‘Europe’. EU import fell by 11% in the first half of 2024 compared… Read more at: https://oilprice.com/Energy/Natural-Gas/Europes-LNG-Ambitions-Face-Reality-Check.html |

|

U.S. Gasoline Prices Set to Drop Below $3 Before Election DayThe national average price of gasoline is set to fall below the $3 per gallon mark by the end of October, ahead of the presidential election in early November, analysts say. The end of the summer driving season, lower international crude prices, and gas stations starting to sell the cheaper winter-type gasoline are all set to combine and lower the prices at the pump for the American consumer, possibly weeks ahead of the presidential election. The national average price as of Thursday, September 12, stood at $3.242 a gallon, according… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Prices-Set-to-Drop-Below-3-Before-Election-Day.html |

|

China Urges EV Makers To Keep Key Tech at HomeChinese authorities have asked local carmaking companies to make sure key electric vehicle technology stays home even as they expand their manufacturing capacity across the world. The government is recommending carmakers to produce the key parts of the cars domestically and then export the so-called knock-down kits to the factories abroad where the vehicles would be assembled, Bloomberg reported earlier today, citing unnamed sources in the know. Chinese EV makers do indeed have ambitious expansion plans as the domestic market becomes too small… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Urges-EV-Makers-To-Keep-Key-Tech-at-Home.html |

|

IEA Slashes Oil Demand Growth ForecastThe International Energy Agency (IEA) said on Thursday that global oil demand growth has markedly decelerated and is set for just 900,000 barrels per day (bpd) in 2024 due to rapidly slowing Chinese consumption. The Agency cut its growth estimate by 70,000 bpd from last month’s assessment. Global oil demand growth in the first half of 2024 was only 800,000 bpd year-on-year, the lowest pace of growth since 2020, the IEA said in its closely-watched Oil Market Report out today. The main driver of the sluggish growth has been “a… Read more at: https://oilprice.com/Energy/Crude-Oil/IEA-Slashes-Oil-Demand-Growth-Forecast.html |

|

Here’s the deflation breakdown for August 2024 — in one chartConsumer prices are falling in pockets of the U.S. economy, in categories such as cars, household furniture and certain groceries. Read more at: https://www.cnbc.com/2024/09/12/cpi-deflation-august-2024.html |

|

Dow closes 200 points higher, S&P 500 posts four-day win streak as tech giants rally: Live updatesWall Street is coming off a choppy session after a late-day advance in tech shares helped the major benchmarks rebound from their lows. Read more at: https://www.cnbc.com/2024/09/11/stock-market-today-live-updates.html |

|

Three key questions that will shape whether Coach and Michael Kors owners will mergeTapestry and Capri, the owners of Coach and Michael Kors, respectively, are in court this week over a federal antitrust challenge of their planned merger. Read more at: https://www.cnbc.com/2024/09/12/tapestry-capri-antitrust-trial-key-questions-about-merger.html |

|

Interest payments on the national debt top $1 trillion as deficit swellsThe August shortfall popped by $380 billion, a dramatic reversal from the $89 billion surplus for the same month a year prior. Read more at: https://www.cnbc.com/2024/09/12/interest-payments-on-the-national-debt-top-1-trillion-as-deficit-swells.html |

|

New high yield funds are hitting the market as Fed prepares to cut interest ratesColumbia Threadneedle is the latest firm to launch actively managed ETFs focused on high yield bonds. Read more at: https://www.cnbc.com/2024/09/12/new-high-yield-funds-are-hitting-the-market-as-fed-prepares-to-cut-interest-rates.html |

|

Microsoft hires former GE CFO Carolina Dybeck Happe as new operating chiefCarolina Dybeck Happe is joining Microsoft’s top leadership ranks after helping GE to bring its aviation and energy businesses public. Read more at: https://www.cnbc.com/2024/09/12/microsoft-hires-former-ge-cfo-carolina-dybeck-happe-as-new-operating-chief.html |

|

Ajit Jain, Buffett’s insurance leader for nearly 40 years, dumps more than half of Berkshire stakeThe 73-year-old vice chairman of insurance operations sold 200 Berkshire Class A shares on Monday for roughly $139 million. Read more at: https://www.cnbc.com/2024/09/12/ajit-jain-dumps-more-than-half-of-his-berkshire-hathaway-stake.html |

|

Boeing faces strike threat as workers vote on new contractA strike could hurt Boeing’s chances of increasing production of its best-selling planes. Read more at: https://www.cnbc.com/2024/09/12/boeing-workers-vote-labor-deal.html |

|

EToro reaches $1.5 million settlement with the SEC: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Thomas Perfumo of Kraken discusses whether the U.S. election is driving crypto prices. Read more at: https://www.cnbc.com/video/2024/09/12/etoro-reaches-1point5-million-settlement-with-the-sec-cnbc-crypto-world.html |

|

Trump rejects second Harris debateRepublican presidential nominee Donald Trump said there will not be another debate against his Democratic rival, Vice President Kamala Harris. Read more at: https://www.cnbc.com/2024/09/12/trump-rejects-second-harris-debate.html |

|

JD Vance repeats inflated immigration figures rejected by expertsDonald Trump running mate JD Vance made the claim on CNBC while speaking against the notion that increased immigration has helped the U.S. labor market. Read more at: https://www.cnbc.com/2024/09/12/vance-immigration-claim-harris-trump.html |

|

Bipartisan group of lawmakers wants to eliminate Social Security rules affecting public employees. What could happen nextIndividuals who have pension income may see their Social Security benefits reduced. Some Washington lawmakers are pushing to change that. Read more at: https://www.cnbc.com/2024/09/12/congress-wants-to-nix-gpo-wep-rules-reducing-social-security-benefits.html |

|

Data-Center Power Needs Pushing Oracle To Consider Next-Gen Nuclear, Larry Ellison SaysOracle chairman Larry Ellison announced this week that AI’s growing electricity demand is pushing Oracle to consider next-gen nuclear power. During an earnings call, Ellison said the company is designing a data center that will need over a gigawatt of electricity, which would be supplied by three small nuclear reactors, according to CNBC. Ellison revealed that Oracle’s planned data center would be powered by small modular nuclear reactors, which already have building permits. He didn’t disclose the location but highlighted the growing energy demand that data centers would need on the earnings call. The reactors in question, under 300 megawatts, promise faster deployment of carbon-free energy. Though promising, small modular reactors are not expected to be commercialized in the U.S. until the 2030s. As we noted this summer, Sam Altman-backed nuclear startup Oklo is a Zero Hedge favorite and remains on pace to launch its first reactor by 2027. Read more at: https://www.zerohedge.com/markets/data-center-power-needs-pushing-oracle-consider-next-gen-nuclear-power-larry-ellison-says |

|

Harris Claimed No US Troops In Combat Zones During Trump DebateAuthored by Dave DeCamp via AntiWar.com, During Tuesday night’s presidential debate, Vice President Kamala Harris falsely claimed that no US troops are currently deployed in combat zones as she traded barbs with former President Donald Trump about foreign policy issues. “As of today, there is not one member of the United States military who is in active duty in a combat zone in any war zone around the world, the first time this century,” Harris said. US troops are deployed in Iraq and Syria under the anti-ISIS coalition and actively participate in combat operations. Less than two weeks ago, seven US troops were wounded in a raid against a suspected ISIS hideout in Iraq. US troops have also been injured in recent weeks by drone and rocket attacks on US bases in Iraq and Syria, which significantly ramped up last year in response to US support for Israel’s onslaught in Gaza. Back in January, three US Army Reserve soldiers from Georgia were killed by a drone attack on Tower 22, a secretive U … Read more at: https://www.zerohedge.com/military/harris-claims-no-us-troops-combat-zones-during-trump-debate |

|

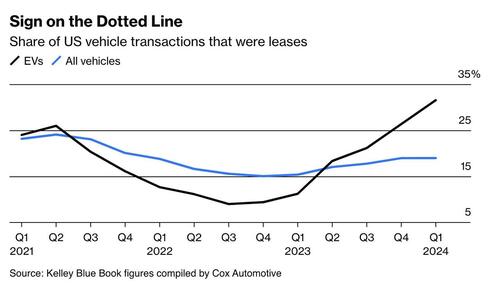

“We’re Just Giving Them Away”: EV Leases Have Plunged To As Low As $20 Per MonthThanks to tax incentive loopholes, the price of EV leases have plunged to as low as just $20 per month in some areas of the county. Leases have become the customer’s method of choice for taking home EVs since sale prices have become too expensive, according to a new report from Bloomberg. Average monthly payments for new vehicles in the U.S. rose to $735 in the first quarter of 2024, while lease payments dropped to $595, according to Experian.

This has driven more EV buyers to opt for leases, which made up 32% of EV transactions in Q1, up from 11% a year ago, per Cox Automotive. EV leases are $88 cheaper per month on average compared to new electric vehicle loans. Bloomberg Read more at: https://www.zerohedge.com/markets/were-just-giving-them-away-ev-leases-have-plunged-low-20-month |

|

Iran Insists It Did Not Send Russia Ballistic MissilesVia Middle East Eye Faced with furious US accusations that Iran has supplied Russia with ballistic missiles, Iranian officials in public and private are strenuously denying the claims. A senior Iranian diplomat, speaking to Middle East Eye on condition of anonymity, said Russia has indeed requested military assistance from Iran since the Russian invasion of Ukraine began in February 2022. “On multiple occasions, Russia has requested military assistance, including ballistic missiles, from Iran. Yet, at the highest levels, Iranian officials have categorically rejected these requests and firmly declined Moscow’s appeals,” the diplomat said.

West Asia News Agency/Handout via REUTERS On Tuesday, US Secretary of State A … Read more at: https://www.zerohedge.com/geopolitical/iran-insists-it-did-not-send-russia-ballistic-missiles |

|

National debt forecast to treble over next 50 yearsAn ageing population, climate change and geopolitical tensions all add pressure to the public finances, a report says. Read more at: https://www.bbc.com/news/articles/cewlwkg82ggo |

|

Scotland’s only oil refinery confirmed to close next yearPetroineos said the closure of Grangemouth was due to it being unable to compete with more modern foreign sites. Read more at: https://www.bbc.com/news/articles/cvg3gwkkk4mo |

|

Microsoft lays off more gaming staff in new cutsThe Xbox owner announces 650 jobs will go after cutting almost 2,000 earlier this year. Read more at: https://www.bbc.com/news/articles/cq82852kkz8o |

|

These 12 midcap stocks hit fresh 52-week highs; rallied up to 27% in a monthHitting a 52-week high signals a stock’s peak performance over the past year, offering traders and investors crucial information for decision-making. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-12-midcap-stocks-hit-fresh-52-week-highs-rallied-up-to-27-in-a-month/slideshow/113298001.cms |

|

Berkshire Hathaway’s Ajit Jain sells more than half his stake in co for $139 million: ReportBerkshire Hathaway’s Vice Chairman Ajit Jain has sold more than half of his stake in the company, garnering $139 million, according to a media report. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/berkshire-hathaways-ajit-jain-sells-more-than-half-his-stake-in-co-for-139-million-report/articleshow/113297850.cms |

|

Breakout Stocks: How to trade Zomato, FDC and IndiGo tomorrowIndian market which started on a muted note on Thursday tracking mixed global cues recouped losses and hit fresh record highs. The S&P BSE rallied more than 1,300 points while the Nifty50 closed above 25,300 levels.The S&P BSE Sensex hit a record high of 83,116 while the Nifty50 touched a record high of 25433 on Thursday. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-zomato-fdc-and-indigo-hit-fresh-record-highs-what-should-traders-do/market-summary/slideshow/113292210.cms |

|

Sell signs are all over the stock market now — but the bulls are holding outKey indicators are mixed and market swings are more volatile. Read more at: https://www.marketwatch.com/story/stock-market-sell-signs-are-everywhere-now-but-the-bulls-are-staying-strong-ca1e33a8?mod=mw_rss_topstories |

|

Small-cap stocks beating S&P 500 this quarter as investors expect Fed rate cutsU.S. small-cap stocks are beating the S&P 500 in the third quarter, even after being more badly battered than large-cap equities in September. Read more at: https://www.marketwatch.com/story/small-cap-stocks-beating-s-p-500-this-quarter-as-investors-expect-fed-rate-cuts-4ba8352f?mod=mw_rss_topstories |

|

30-year Treasury yield finishes just below 4% after soft bond auctionYields on U.S. government debt ticked slightly higher on Thursday but remained near some of the lowest levels of the year after a $22 billion sale of 30-year bonds was met with below-average bidding from nondealers. Read more at: https://www.marketwatch.com/story/treasury-yields-just-above-lows-of-the-year-ahead-of-producer-prices-and-jobless-data-66982d48?mod=mw_rss_topstories |