Summary Of the Markets Today:

- The Dow closed up 125 points or 0.31%,

- Nasdaq closed up 2.17%,

- S&P 500 closed up 1.07%,

- Gold $2,541 up $2.00,

- WTI crude oil settled at $67 up $1.40,

- 10-year U.S. Treasury 3.661 up 0.017 points,

- USD index $101.72 up $0.09,

- Bitcoin $57,647 up $70 or 0.12%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The U.S. stock market closed higher on Wednesday after initially falling, as investors processed the August inflation report and the first presidential debate between Donald Trump and Kamala Harris. Nvidia led the tech rally, with shares surging over 8% Inflation. Inflation fell to a more than three-year low. Core inflation (excluding food and gas) rose 0.3% month-over-month, higher than the expected 0.2% The higher core inflation reading reduced expectations for a larger Fed rate cut. Odds of a 50 basis point rate cut at the next Fed meeting dropped to 15%, down from 44% a week ago. Markets now favor a smaller 25 basis point cut. Investors analyzed the Trump-Harris presidential debate, which provided limited detail on market-moving economic issues. GameStop shares fell almost 12% after missing quarterly revenue expectations. Oil prices rebounded from three-year lows, with WTI and Brent crude both rising about 2%.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Consumer Price Index for All Urban Consumers (CPI-U) rose 2.5% for the 12 months ending August 2024 (down from last month’s 2.9%), the smallest 12-month increase since February 2021. The all items less food and energy index rose 3.2% year-over-year (unchanged from last month). The energy index decreased 4.0 percent for the 12 months ending August. The food index increased 2.1% over the last year. The primary reason for the decline of the CPI-U was energy which declined 10.1% year-over-year. Over the years I have done several detailed analysis of the CPI and my conclusion is that inflation is different for each of us depending on how money is spent. The CPI shows food is up only 0.9% year-over-year – I am seeing food up 5%+ (see the table below for the 12 month change in the components of the CPI).

| Un-adjusted 12-mos. ended Aug. 2024 | |

|---|---|

| All items | 2.5 |

| Food | 2.1 |

| Food at home | 0.9 |

| Food away from home(1) | 4.0 |

| Energy | -4.0 |

| Energy commodities | -10.1 |

| Gasoline (all types) | -10.3 |

| Fuel oil | -12.1 |

| Energy services | 3.1 |

| Electricity | 3.9 |

| Utility (piped) gas service | -0.1 |

| All items less food and energy | 3.2 |

| Commodities less food and energy commodities | -1.9 |

| New vehicles | -1.2 |

| Used cars and trucks | -10.4 |

| Apparel | 0.3 |

| Medical care commodities(1) | 2.0 |

| Services less energy services | 4.9 |

| Shelter | 5.2 |

| Transportation services | 7.9 |

| Medical care services | 3.2 |

Here is a summary of headlines we are reading today:

- Oil Markets Are Ignoring Imminent Production Cuts By 3 OPEC+ Members

- China’s Carbon Trading Market to Encompass Steel and Aluminum Sectors

- Oil Prices Jump 3% as Hurricane Takes 675,000 bpd Offline in the Gulf of Mexico

- Goldman Sachs: RBOB Gasoline Sees Open Interest Surge As Storm Looms

- U.S. Inflation Cooled in August Thanks to Lower Energy Prices

- Study Claims Banks ‘Greenlaunder’ Trillions of Dollars of Fossil Fuels Funding

- S&P 500 rises, Nasdaq closes 2% higher in rebound from inflation report rout: Live updates

- Here’s the inflation breakdown for August 2024 — in one chart

- Bitcoin could soon hit six figures regardless of who wins U.S. election, investors say

- Hurricane Francine takes aim at the Louisiana coast amid fears of storm surge and flooding

- Uranium Stocks Ignite After Putin Asks Gov’t To Weigh Export Restrictions On Critical Commodities

- Treasury yields bounce off 2024 lows after August CPI inflation report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Oil Markets Are Ignoring Imminent Production Cuts By 3 OPEC+ MembersOil prices edged higher in Wednesday’s intraday session, with Brent crude for November delivery up 2.12% to trade at $70.66/barrel at 14:46 hrs ET while WTI crude for October delivery gained 2.39% to change hands at $67.32/barrel. The reversal in the oil price selloff came amid more shutdowns by oil and gas operators in the Gulf of Mexico with hurricane Francine expected to make landfall Wednesday afternoon or evening along the Louisiana coastline. According to the Bureau of Safety and Environmental Enforcement (BSEE), energy companies have… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Markets-Are-Ignoring-Imminent-Production-Cuts-By-3-OPEC-Members.html |

|

Middle Corridor Trade Route Fuels Warehousing Boom in Central AsiaCentral Asia these days is frequently associated with shortages in a bad way – shortages of heat and electricity, of jobs and, perhaps most alarmingly, of water. But there is at least one deficit in Central Asia that can be seen as a favorable development – a shortage of warehouse space. The shortage of available storage space means that demand is high and trade is expanding. It also means warehousing costs in Uzbekistan and Kazakhstan are higher than in Dubai and most other seaport-based transit hubs. A report published by the Uzdaily… Read more at: https://oilprice.com/Geopolitics/International/Middle-Corridor-Trade-Route-Fuels-Warehousing-Boom-in-Central-Asia.html |

|

Trump Says He Might Head to Venezuela If Harris Wins Presidential ElectionDonald Trump has reportedly considered the possibility of losing the 2024 election—and if that happens, he has plans for a one-way ticket to Venezuela. According to Vanity Fair, speaking to Elon Musk on Monday, the former president said, “If something happens with this election, which would be a horror show, we’ll meet the next time in Venezuela, because it’ll be a far safer place to meet than our country. So you and I will go and we’ll have a meeting and dinner in Venezuela.” Trump’s comment about dinner in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Says-He-Might-Head-to-Venezuela-If-Harris-Wins-Presidential-Election.html |

|

China’s Carbon Trading Market to Encompass Steel and Aluminum SectorsVia Metal Miner It has been in the works for some time now. China is finally all set to add industrial metal sectors like steel and aluminum as well as cement to its national carbon trading market. According to media reports, the change will happen by the end of 2024. Essentially, this means domestic steel, aluminum and cement producers will soon have to pay more for their carbon emissions. By including these three industries, China hopes that lowering emissions will help ease the impact of a new EU carbon tariff, CBAM, which goes into effect… Read more at: https://oilprice.com/Metals/Commodities/Chinas-Carbon-Trading-Market-to-Encompass-Steel-and-Aluminum-Sectors.html |

|

Oil Prices Jump 3% as Hurricane Takes 675,000 bpd Offline in the Gulf of MexicoOil prices climbed nearly three percent on Wednesday afternoon, spurred by the fear of supply disruptions as Hurricane Francine bulldozes its way through the Gulf of Mexico, where major operators have already shut-in some production and evacuated some personnel. The price surge comes in spite of the Energy Information Administration’s (EIA) inventory report that came out earlier in the day, showing an increase in U.S. stockpiles, initially causing oil to move lower before hurricane headlines reclaimed the trading day. The fears… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Jump-3-as-Hurricane-Takes-675000-bpd-Offline-in-the-Gulf-of-Mexico.html |

|

Layoffs Loom as Volkswagen Fights for SurvivalAs discussed earlier today, Germany’s economy is slowly but surely sinking, whether or not Mario Draghi’s proposal to flood Europe in new debt is eventually accepted, and nowhere is the pain more tangible than Germany’s iconic carmaker, Volkswagen, which we reported last week was considering its first-ever factory closure amid a dire economic backdrop, and which today took the shocking – for Germany – decision to end job protections for German auto workers as part of its cost-cutting push, setting up a calamitous showdown with unions as the country’s… Read more at: https://oilprice.com/Energy/Energy-General/Layoffs-Loom-as-Volkswagen-Fights-for-Survival.html |

|

Putin Calls for Sanctions Revenge, Threatens to Cap Uranium ExportsRussian President Vladimir Putin has asked Moscow to consider limiting exports of some commodities such as uranium, nickel, and titanium in retaliation for Western sanctions, Bloomberg reported on Wednesday. “Russia is the leader in strategic raw materials reserves like uranium, titanium, nickel,” Putin said during a televised meeting with the government. Since Western sanctions limit exports of some Russian commodities like diamonds, “maybe we should also think about restrictions,” he said, adding that such limits… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Calls-for-Sanctions-Revenge-Threatens-to-Cap-Uranium-Exports.html |

|

Strict ESG Rules Undermine Europe’s Industry CompetitivenessThe European Union has the world’s most rigorous Environmental, Social and Governance (ESG) regulations and the most ambitious decarbonization and net-zero targets. But the EU’s approach to ESG rules and reporting has too many sticks and few carrots for businesses. European companies are suffocating under numerous EU directives and national laws in bureaucracy that are undermining Europe’s competitiveness in many industries, including in green and climate technology. The ESG rive has been much stronger in Europe than in the United States,… Read more at: https://oilprice.com/Energy/Energy-General/Strict-ESG-Rules-Undermine-Europes-Industry-Competitiveness.html |

|

Goldman Sachs: RBOB Gasoline Sees Open Interest Surge As Storm LoomsTropical Storm Francine churned off the Texas Gulf Coast early Tuesday with sustained winds of 65 mph. The storm is expected to strengthen into a hurricane later today as it traverses northeast toward the Gulf Coast and becomes a looming threat for dozens of offshore oil and gas platforms and inland refineries. “The storm is starting to get its act together,” AccuWeather hurricane expert Alex Dasilva told USA Today, adding that warm waters across the Gulf served as “rocket fuel” for the storm. The latest weather models expect Francine to… Read more at: https://oilprice.com/Energy/Gas-Prices/Goldman-Sachs-RBOB-Gasoline-Sees-Open-Interest-Surge-As-Storm-Looms.html |

|

U.S. Inflation Cooled in August Thanks to Lower Energy PricesFalling oil and gasoline prices, along with the rest of the energy complex, helped to slow down the annual rate of inflation in August. According to AAA data, gasoline prices averaged $3.253 per gallon on Wednesday, down from $3.445 a month ago and $3.832 a year ago. According to Bureau of Labor Statistics data released Wednesday, the gasoline index declined 0.6% last month, compared to a rise of 0.1% in the prior month, with gas prices falling 10.3% on an annualized basis while the energy index dropped 4%. Consequently, falling energy prices have… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Inflation-Cooled-in-August-Thanks-to-Lower-Energy-Prices.html |

|

Oil Moves Lower as EIA Confirms Small Crude, Gasoline BuildCrude oil prices went down today after the Energy Information Administration reported an estimated inventory build of 800,000 barrels for the week to September 6. This compared with a draw of 6.9 million barrels for the previous week, which however failed to move prices in a positive direction as it got drowned by pessimism about demand. On Tuesday, the American Petroleum Institute estimated oil inventories had shed 2.79 million barrels in the week to September 6. In fuels, the EIA also estimated inventory builds for the week. In gasoline, the… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Moves-Lower-as-EIA-Confirms-Small-Crude-Gasoline-Build.html |

|

Saudi Aramco Boosts Cooperation With Chinese Petrochemical GiantsThe world’s biggest crude oil exporter and largest oil company, Saudi Aramco, has signed additional agreements with China’s Rongsheng Petrochemical and Hengli Group to advance talks on cooperation in the refining and petrochemical sectors in China and Saudi Arabia. Aramco signed a Development Framework Agreement with Rongsheng regarding the potential joint development of an expansion of Saudi Aramco Jubail Refinery Company (SASREF) facilities, the Saudi oil giant said on Wednesday. The agreement is a follow-up of an April cooperation… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Boosts-Cooperation-With-Chinese-Petrochemical-Giants.html |

|

Rising Oil Supply Emerges as Top Concern for Crude TradersRising global oil supply appears to be on top of the list of concerns for oil trading giants and industry analysts, according to the speakers at the Asia Pacific Petroleum Conference (APPEC) in Singapore this week. Many participants in the event expressed more concern about upcoming supply than about slowing demand. While recognizing that demand has undershot expectations this year, renowned analysts and the top executives at oil traders fear a growing oversupply next year. The OPEC+ group plans to unwind its ongoing production cuts gradually over… Read more at: https://oilprice.com/Energy/Energy-General/Rising-Oil-Supply-Emerges-as-Top-Concern-for-Crude-Traders.html |

|

Libya’s Oil Exports Crashed by 81% Amid Political StandoffAmid the ongoing political standoff between rival governments, Libya’s crude oil exports plummeted to 194,000 barrels per day (bpd) last week, an 81% plunge compared to the previous week, according to data from Kpler cited by Reuters. Last week, the average export levels were way off the 1 million bpd in exports in the previous weeks, the data showed on Wednesday. Libya’s National Oil Corporation (NOC) has canceled some cargoes, although it has not declared force majeure on all exports from the country. NOC has declared force majeure… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-Oil-Exports-Crashed-by-81-Amid-Political-Standoff.html |

|

Study Claims Banks ‘Greenlaunder’ Trillions of Dollars of Fossil Fuels FundingTrillions of U.S. dollars are being “greenwashed” by banks extending loans and credit lines to subsidiaries of fossil fuel companies in secrecy jurisdictions, thus helping hide the true scale of banking support for oil, gas, and coal, a new study by NGO Tax Justice Network showed on Wednesday. The report, produced in collaboration with the organization Banking on Climate Chaos, found that funds are being strategically channeled through “secrecy jurisdictions”, tax havens, which allow companies to obscure their activities… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Study-Claims-Banks-Greenlaunder-Trillions-of-Dollars-of-Fossil-Fuels-Funding.html |

|

S&P 500 rises, Nasdaq closes 2% higher in rebound from inflation report rout: Live updatesThe S&P 500 and 30-stock Dow slipped Wednesday as investors digested the August consumer inflation report. Read more at: https://www.cnbc.com/2024/09/10/stock-market-today-live-updates.html |

|

Here’s the inflation breakdown for August 2024 — in one chartThe consumer price index rose by 2.5% in August, on an annual basis. It was the lowest reading since February 2021. Read more at: https://www.cnbc.com/2024/09/11/heres-the-inflation-breakdown-for-august-2024-in-one-chart.html |

|

House Speaker Johnson pulls government funding bill after GOP support collapsesThe House bill would fund the government through March and require people to show proof of citizenship to register to vote, a measure backed by Donald Trump. Read more at: https://www.cnbc.com/2024/09/11/house-speaker-johnson-pulls-government-funding-bill-after-gop-support-collapses.html |

|

Norfolk Southern board probe focusing on CEO’s relationship with chief legal officerThe focus on Nabanita Nag, the chief legal officer at the railroad, has not been reported, and comes as CEO Alan Shaw is expected to resign. Read more at: https://www.cnbc.com/2024/09/11/norfolk-southern-nsc-alan-shaw-probe-relationship-lawyer.html |

|

Financials have been on fire lately. These stocks are expected to fly higher from hereThese financial stocks can run even further from here after the sector’s breakout year. Read more at: https://www.cnbc.com/2024/09/11/financials-have-been-on-fire-lately-these-stocks-are-expected-to-fly-higher-from-here.html |

|

Bitcoin could soon hit six figures regardless of who wins U.S. election, investors sayDespite the increasingly partisan sentiment in the crypto industry, bitcoin will thrive regardless of who wins the U.S. presidential election in November. Read more at: https://www.cnbc.com/2024/09/11/bitcoin-may-soon-hit-six-figures-regardless-of-election-investors-say.html |

|

Trump Media shares sink to new post-merger low after presidential debateRepublican nominee Donald Trump is the majority owner of Trump Media, which operates the social media platform Truth Social and trades as DJT on the Nasdaq. Read more at: https://www.cnbc.com/2024/09/11/djt-trump-media-stock-debate-harris.html |

|

Trump tariffs will fuel supply chain inflation and consumers will pay the price, trade experts warnDonald Trump doubled down on new tariffs during Tuesday’s presidential debate, but trade experts say consumers should be worried about paying the price. Read more at: https://www.cnbc.com/2024/09/11/trump-trade-policies-will-fuel-freight-rates-consumers-pay-price.html |

|

Homebuyers have a fresh ‘bargaining chip’ to play, following new rules for how real estate agents are paidA rule change on how agents get paid gives buyers a new edge when making offers. Read more at: https://www.cnbc.com/2024/09/11/new-agent-pay-rules-give-buyers-a-fresh-bargaining-chip.html |

|

Avoid ‘knee-jerk reactions’ to candidates’ proposed tax increases, financial advisors say. Here’s whyWith the election ramping up, investors may feel stressed by the flurry of tax policy proposals. Here’s why you should avoid an emotional decision. Read more at: https://www.cnbc.com/2024/09/11/proposed-tax-increases-election.html |

|

Trump says Harris debate was ‘rigged,’ ABC should lose license, but ‘we did great’Donald Trump said he was leaning against doing a second debate against Vice President Kamala Harris after their showdown Tuesday night on ABC News. Read more at: https://www.cnbc.com/2024/09/11/trump-harris-debate-rigged-abc-should-lose-license.html |

|

‘Hellish’ scene unfolds as wildfire races toward California mountain communityThe Bridge Fire, which has burned 73 square miles as of late Tuesday with no containment, is one of three major wildfires burning in Southern California. Read more at: https://www.cnbc.com/2024/09/11/wildfire-races-toward-southern-california-mountain-community.html |

|

Hurricane Francine takes aim at the Louisiana coast amid fears of storm surge and floodingHurricane Francine barreled toward Louisiana on Wednesday as residents made last-minute trips in the morning rain to stock up on final supplies. Read more at: https://www.cnbc.com/2024/09/11/hurricane-francine-takes-aim-at-louisiana-coast.html |

|

Menacing Hurricane Francine Sparks Short Cover In WTI As Oil Production Shut-Ins SoarUpdate (1502ET): West Texas Intermediate futures jumped as much as 3%, the biggest gain in two weeks. This temporarily halted a nearly 19% decline since mid-August as short covering kicked in after Gulf of Mexico oil production was partially shuttered ahead of Hurricane Francine, which is set to make landfall near the southeastern Louisiana coast as a high-end Category 1 storm later today.

Short covering in WTI futures was primarily due to oil companies shutting down about 40% of Gulf crude output ahead of the storm. In recent days, Exxon Mobil, Shell, and other offshore drillers have evacuated crews and suspended operations.

|

|

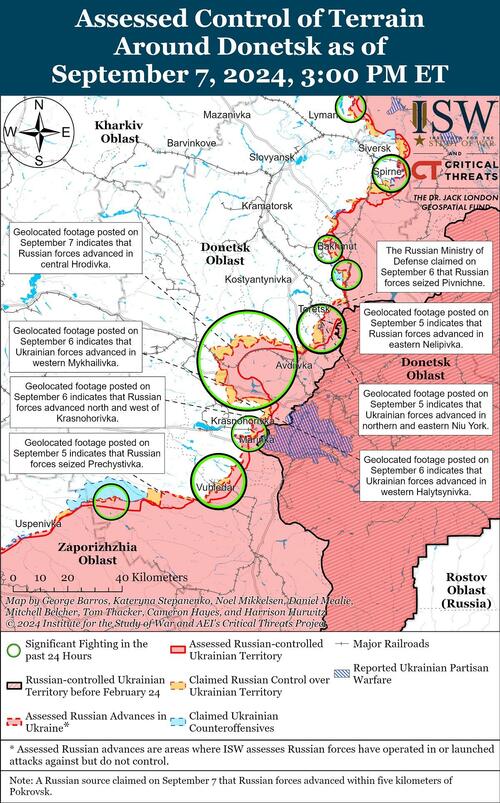

If Russia Takes Pokrovsk The Rest Of Eastern Ukraine Will FallAfter many months of propaganda from the western media asserting that Russia’s military capacity had been shattered by the brutal “meat grinder” of the Ukraine front, it appears that the Kremlin is actually accelerating their offensive with more troops and artillery than ever. And, they are poised to take all of the Donbas and large portions of Eastern Ukraine if they succeed in the pivotal city of Pokrovsk. For the majority of the war Pokrovsk has acted as the logistical hub and rear operations base for Ukraine’s eastern defensive lines. It sits astride both a key railroad juncture and the highway to Ukraine’s fourth-largest metro, Dnipro. The city’s defensive positions are a final obstacle to Russia’s access to most of the region. If Pokrovsk falls Russian forces will be able to easily flank entrenched troops in the north and south of the country.

The loss of the primary rail lines and highway routes in and out of Pokrovsk would cut resources to Ukrainian unit … Read more at: https://www.zerohedge.com/geopolitical/if-russia-takes-pokrovsk-rest-eastern-ukraine-will-fall |

|

Conservative Billionaire Wants To ‘Crush’ Leftist MediaAuthored by Dmytro “Henry” Aleksandrov via Headline USA, Leonard Leo, a conservative billionaire activist who was responsible for the driving force behind the conservative movement to reshape the American legal system, recently started a $1 billion campaign to “crush liberal dominance” in American corporations, mass media and the entertainment industry.

Leonard Leo / PHOTO via @RealDreamz2020 (Twitter) Leo, who became famous for helping to make the Supreme Court conservative during Donald Trump’s first presidential term, said his non-profit group, the Marble Freedom Trust, is prepared to make the government and the private sectors conservative. “We need to crush liberal dominance where it’s most insidious, so we’ll direct resources to build talent and c … Read more at: https://www.zerohedge.com/political/conservative-billionaire-wants-crush-leftist-media |

|

Uranium Stocks Ignite After Putin Asks Gov’t To Weigh Export Restrictions On Critical CommoditiesUranium stocks jumped in the early US cash session after Russian President Vladimir Putin instructed the government to review possible measures to restrict exports of strategic raw materials, such as nickel, titanium, and uranium, in retaliation for Western sanctions. “Russia is the leader in reserves of a number of strategic raw materials, namely natural gas that is nearly 22% of the world’s reserves, gold at nearly 23%, and diamonds at nearly 55%. Mikhail Vladimirovich [Prime Minister Mishustin], I have a request for you to look, please, at some types of goods that we supply in large quantities to the world market. Supplies of a number of goods are limited to us, but maybe we should also think about certain restrictions; uranium, titanium, nickel. Just do not do anything to our detriment,” Putin told several cabinet ministers on Wednesday, as the Russian news agency Interfax reported. Putin said, “Strategic reserves are being created in some countries, and some other measures are being taken,” adding, “In general, if this will not harm us, then we could think – I am not saying that we need to do this tomorrow – think about certain restrictions on deliveries to the foreign market, not only of the goods that I have named, but also of some others.” Read more at: https://www.zerohedge.com/commodities/uranium-stocks-ignite-after-putin-asks-govt-weigh-export-restrictions-critical |

|

Chancellor warns hard decisions ahead in BudgetRachel Reeves says tough choices will have to be made over tax, spending and welfare. Read more at: https://www.bbc.com/news/articles/c2045wpddy2o |

|

Aim for no-fault eviction ban to be in place by summerThe plans would also ban bidding wars and prevent landlords from blocking tenants on benefits or with children. Read more at: https://www.bbc.com/news/articles/cz9wd5dvknxo |

|

Firm wins trademark case against easyJet ownerThe airline’s owner says he will appeal against the ruling, which found there was no infringement Read more at: https://www.bbc.com/news/articles/c4glnvn1l9do |

|

Promoter entity Proximus Opal to sell 6% stake in Route Mobile via OFS; floor price set at Rs 1,635/shareThe upcoming share sale starts on Thursday for non-retail investors, with retail investors getting their chance on Friday. Proximus Opal currently holds a majority stake in Route Mobile. This offering aims to comply with SEBI’s regulations on minimum public shareholding. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/promoter-entity-proximus-opal-to-sell-6-stake-in-route-mobile-via-ofs-floor-price-set-at-rs-1635/share/articleshow/113263174.cms |

|

Sebi tweaks framework on margin trading facilitiesTo promote ease of doing business, markets regulator Sebi on Wednesday allowed securities funded through cash collateral to be considered as maintenance margin for margin trading facility (MTF). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-tweaks-framework-on-margin-trading-facilities/articleshow/113264874.cms |

|

Commodity Talk: MCX crude oil contracts down 10% amid current turmoil. Is it time to sell on rise?Prices are likely to find support around Rs 5,500 on MCX and $65 on NYMEX WTI. However, while potential OPEC+ production cuts and a possible 25 bps rate cut may provide temporary relief, overall market fundamentals suggest continued downward pressure. Ample supply and weak demand growth projections are expected to keep prices low in the near term. Read more at: https://economictimes.indiatimes.com/markets/expert-view/commodity-talk-mcx-crude-oil-contracts-down-10-amid-current-turmoil-is-it-time-to-sell-on-rise/articleshow/113257698.cms |

|

Children’s Place shares nearly double on profit surpriseChildren’s Place Inc.’s stock soared 90% as a rare gainer Wednesday after the retailer topped analyst expectations with its first adjusted profit in two years. Read more at: https://www.marketwatch.com/story/childrens-place-shares-nearly-double-on-profit-surprise-e331cab2?mod=mw_rss_topstories |

|

Treasury yields bounce off 2024 lows after August CPI inflation reportTreasury yields rose from their lowest levels of the year after Wednesday’s data showed a key component of the August consumer-price index coming in higher than expected, reducing the likelihood of a big interest-rate cut by the Federal Reserve next week. Read more at: https://www.marketwatch.com/story/treasury-yields-hit-fresh-2024-lows-ahead-of-cpi-inflation-report-783ea9cc?mod=mw_rss_topstories |

|

Atlanta Fed President Raphael Bostic broke trading rules, watchdog findsAtlanta Federal Reserve President Raphael Bostic broke rules on investing “multiple” times from 2018 to 2023, an agency watchdog said, but it found no evidence he profited from confidential information. Read more at: https://www.marketwatch.com/story/atlanta-fed-president-raphael-bostic-broke-trading-rules-watchdog-finds-f7f96aa5?mod=mw_rss_topstories |