Summary Of the Markets Today:

- The Dow closed down 93 points or 0.23%,

- Nasdaq closed up 0.84%,

- S&P 500 closed up 0.45%,

- Gold $2,545 up $12.60,

- WTI crude oil settled at $66 down $2.52,

- 10-year U.S. Treasury 3.646 down 0.053 points,

- USD index $101.62 up $0.07,

- Bitcoin $57,839 up $834 or 0.46%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

U.S. stock markets experienced a mixed performance in a volatile trading session on Tuesday as investors anticipated a crucial consumer inflation report on Wednesday. This report is seen as key to determining the timing and size of potential interest rate cuts by the Federal Reserve.

JPMorgan Chase shares dropped about 5% after warning that forecasts for net interest income were too high, weighing on the Dow. Brent crude dropped below $70 per barrel, reaching its lowest level since December 2021. The decline followed OPEC’s lowered demand growth forecast for 2024 and 2025. Apple shares edged lower after losing an EU court battle over a $14 billion tax bill. Oracle stock jumped more than 10% following strong earnings, driven by cloud services demand.

Markets are also anticipating the first presidential debate between Donald Trump and Kamala Harris on tonight. The market’s volatility reflects investors’ uncertainty, balancing hopes for significant rate cuts against concerns about potential recession risks.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

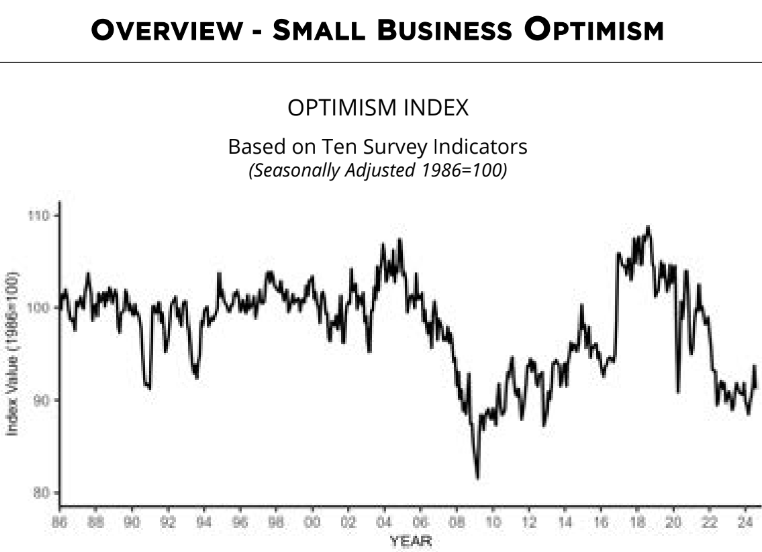

The NFIB Small Business Optimism Index fell by 2.5 points in August 2025 to 91.2, erasing all of July’s gain. This is the 32nd consecutive month below the 50-year average of 98. The Uncertainty Index rose to 92, its highest level since October 2020. Inflation remains the top issue among small business owners, with 24% of owners reporting it as their top small business operating issue, down one point from July. NFIB Chief Economist Bill Dunkelberg added:

The mood on Main Street worsened in August, despite last month’s gains. Historically high inflation remains the top issue for owners as sales expectations plummet and cost pressures increase. Uncertainty among small business owners continues to rise as expectations for future business conditions worsen.

Here is a summary of headlines we are reading today:

- WTI Oil Price Hits 3-Year Low Ahead of Trump-Harris Showdown

- Falling Chinese Steel Prices Send Ripples Through Global Markets

- Oil Prices Drop 4.5% On Record-Bearish Sentiment from Money Managers

- European Natural Gas Prices Drop as Wind Power Soars

- Futures Prices Point to Spike in U.S. Natural Gas Prices in 2025

- Two key inflation reports this week will help decide the size of the Fed’s interest rate cut

- JPMorgan Chase shares drop 5% after bank tempers guidance on interest income and expenses

- Crypto will be ‘big boon’ for financial services over time, Robinhood CEO says: CNBC Crypto World

- Jamie Dimon says ‘the worst outcome is stagflation,’ a scenario he’s not taking off the table

- Volkswagen Declares War On Unions, Scraps Three-Decade-Old Job Protections

- Americans Lost $5.6 Billion In Cryptocurrency Scams Last Year, FBI Says

- Biden’s FAA Punishes SpaceX, Delays Starship Rocket Launch By Months

- Falling oil prices and China concerns add fuel to market fears of a U.S. recession

- Treasury yields establish fresh 2024 lows amid persistent recession worries

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

WTI Oil Price Hits 3-Year Low Ahead of Trump-Harris ShowdownOil prices tumbled over 4% today, reaching a 3-year low as trader sentiment continued to sour ahead of tonight’s highly anticipated U.S. Presidential debate between Donald Trump and Kamala Harris, with bearish sentiment sinking to multi-year lows as traders continue overreacting to any negative development and ignoring relatively healthy fundamentals. Indeed, hedge funds and other money managers have turned the most bearish on crude ever since the CFTC started to publish information on market positioning, with speculative positioning in crude… Read more at: https://oilprice.com/Energy/Oil-Prices/WTI-Oil-Price-Hits-3-Year-Low-Ahead-of-Trump-Harris-Showdown.html |

|

Experts Call for a Reality Check in Energy Policy and PlanningAuthored by Todd Snitchler via RealClearEnergy, At meetings of energy regulators, policymakers, consumer advocates, and industry this summer, the content and tone of the conversations around electric system reliability have changed dramatically. Executives from across the industry all agree that dispatchable generation is needed now and will be needed for many years to come. Most prominently, the realization and willingness to say publicly that dispatchable resources like natural gas-fired generation will be needed as the energy expansion continues… Read more at: https://oilprice.com/Energy/Energy-General/Experts-Call-for-a-Reality-Check-in-Energy-Policy-and-Planning.html |

|

Falling Chinese Steel Prices Send Ripples Through Global MarketsVia Metal Miner The Construction MMI (Monthly Metals Index) broke further out of its sideways trend, dipping by 3.61%. The main culprits driving the index down month-over-month were falling steel rebar and h-beam steel prices, compelled by weak domestic demand within China. With China’s property sector not anticipated to strengthen in the short term, steel prices could continue to witness bearish pressure. This, in turn, could impact the steel and construction industries far beyond China’s borders. H-Beam and Steel Rebar Prices Drop… Read more at: https://oilprice.com/Metals/Commodities/Falling-Chinese-Steel-Prices-Send-Ripples-Through-Global-Markets.html |

|

Russia’s Nuclear Ambitions in Central AsiaHoping to drum up some much-needed cash to help fuel the Kremlin’s war effort in Ukraine, Rosatom, Russia’s state-controlled nuclear entity, is hyping atomic energy as a “green” solution to Central Asia’s power problems. But Rosatom’s efforts to assuage Central Asian citizens on the safety and greenness of Russian nuclear solutions are undermined by reports of haphazard operational practices. The rickety electricity grid across Central Asia is struggling to meet rising demand, with even Kazakhstan, the region’s… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Russias-Nuclear-Ambitions-in-Central-Asia.html |

|

Critical Minerals: The New Battleground for Economic SupremacyAs the energy transition continues, tapping into the reserves of critical minerals and securing their supply chains is crucial. For this graphic, Visual Capitalist partnered with Appian Capital Advisory to provide visual context to the top countries for reserves, production, and processing of minerals that are vital to the energy transition. The analysis uses data from the USGS and the IEA across four minerals: lithium, cobalt, natural graphite, and rare earths. Which Countries Hold the Most Critical Minerals Reserves? South America… Read more at: https://oilprice.com/Metals/Commodities/Critical-Minerals-The-New-Battleground-for-Economic-Supremacy.html |

|

Permian Basin Gas Pipeline Capacity Set to Increase with New ProjectsNatural gas pipeline capacity in the Permian Basin is gearing up for significant gains with the upcoming launch of the Matterhorn Express Pipeline. The 2.5 billion cubic feet per day (Bcf/d) pipeline, expected to begin service this month, was developed by a joint venture including EnLink Midstream, Whitewater, Devon Energy, and MPLX, and will transport gas from the Permian Basin to Katy, near Houston, Texas. Natural gas production from the Permian Basin, the basin primarily associated with growing oil output, has more than doubled since 2018. This… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Permian-Basin-Gas-Pipeline-Capacity-Set-to-Increase-with-New-Projects.html |

|

Oil Prices Drop 4.5% On Record-Bearish Sentiment from Money ManagersWTI crude futures fell 4.5% on Tuesday morning as hedge funds and money managers continued to sour on crude oil. Bearish Sentiment on Oil Still Yet to Hit Bottom- Hedge funds and other money managers have turned the most bearish on crude ever since the CFTC started to publish information on market positioning, with Brent and WTI net longs totaling a mere 139,242 lots in the week ended September 3. – As the oil market gathered in Singapore this week for the annual Appec conference, Trafigura head of oil trading Ben Luckock said oil would dip… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Drops-45-Percent-Amid-Record-Bearish-Sentiment-from-Money-Managers.html |

|

North American Banks Boost Fossil Fuel Funding as European Lenders RetreatRegional banks in North America have been striking more deals to lend money to the oil, natural gas, and coal industry in recent years, while many European lenders have either shrunk financing for fossil fuels or pledged to lower their exposure to the sector. As a result of the ongoing shift in financing deals in the fossil fuels sector, North American banks are not competing with European lenders for financing oil and gas anymore. Regional banks Texas Capital Bank, Truist Securities Inc, FHN Financial, Cadence Bank, BOK Financial Corp, and Canadian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/North-American-Banks-Boost-Fossil-Fuel-Funding-as-European-Lenders-Retreat.html |

|

Oil Prices Fall 3% Without Real Change in FundamentalsOil prices fell again on Tuesday—by more than 3% on the day—indicating a dramatic shift in fundamentals or some geopolitical tension in the oil-rich Middle East. Only neither of those things has happened—at least not today. By 10:30am EDT on Tuesday, the price for a barrel of Brent crude oil had fallen by $2.33 (-3.24%) to $69.51—the lowest price in years. WTI crude had fallen by $2.60 (-3.78%) per barrel to $66.11. But fundamentals have not changed to warrant such a price dip. The API hasn’t issued any figures, nor… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Fall-3-Without-Real-Change-in-Fundamentals.html |

|

Rystad: Germany Set to Generate 80% of Its Electricity With Renewables by 2030Germany’s power market is in the midst of a significant transition. Demand continues to fall despite normalizing prices, and retired coal and nuclear capacity mean the European giant is now heavily reliant on imports from its neighbors. But it’s not all bad news for the sector. Rystad Energy projections show Germany will surpass its policy goal of 80% renewable energy generation by 2030, largely thanks to the rapid capacity build-up of solar and wind. While the country’s quick adoption of renewable energy systems has helped to… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Rystad-Germany-Set-To-Generate-80-of-Electricity-With-Renewables-by-2030.html |

|

Currie Claims Fears of an Oil Market Glut Are “Completely Overplayed”Oil market participants are “dramatically overestimating” a supply glut, as Chinese demand is not as doom-and-gloom as headline figures suggest and U.S. crude oil production is basically flat this year, Jeff Currie, chief strategy officer of energy pathways at Carlyle, said on Tuesday. Fears of a major oil glut are “completely overplayed,” Currie told the Asia Pacific Petroleum Conference (APPEC) in Singapore, where executives at major oil trading houses expressed bearish views about demand and global market balances for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Currie-Claims-Fears-of-an-Oil-Market-Glut-Are-Completely-Overplayed.html |

|

European Natural Gas Prices Drop as Wind Power SoarsEuropean benchmark natural gas prices fell around noon local time on Tuesday as the region’s first colder wave brought a lot of wind and powered a higher share of electricity in key markets. The Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, were down by 2.4% at $40.17 (36.43 euros) per megawatt-hour (MWh) at 11:41 a.m. in Amsterdam. Gas prices were set for their first daily drop in four trading days amid higher wind power generation, which generally limits demand for gas for electricity. However, the first autumn… Read more at: https://oilprice.com/Energy/Energy-General/European-Natural-Gas-Prices-Drop-as-Wind-Power-Soars.html |

|

Japan Shouldn’t Ditch Coal, PM Candidate SaysJapan should prioritize economic growth to renewables and will continue to need coal-fired electricity, a candidate to lead the ruling party and become the next prime minister said on Tuesday. “Japan will need coal-fired power plants,” Takayuki Kobayashi, who is one of the candidates to lead the ruling Liberal Democratic Party, said, as carried by Bloomberg. The remarks from Kobayashi, a former economic security minister, showed the strongest support for fossil fuels among the ruling party’s candidates for PM. Japan needs energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Japan-Shouldnt-Ditch-Coal-PM-Candidate-Says.html |

|

Futures Prices Point to Spike in U.S. Natural Gas Prices in 2025The benchmark natural gas prices in the United States could be set for a jump next year, according to the futures curve of the Henry Hub contract. The forward strip of the Henry Hub futures prices suggests that U.S. natural gas prices could average $3.20 per million British thermal units (MMBtu) next year, according to LSEG data reported by Reuters columnist Gavin Maguire. This would compare to an average price of $2.22 of the benchmark U.S. natural gas price so far this year. The futures prices indicate that next year U.S. natural gas prices could… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Futures-Prices-Point-to-Spike-in-US-Natural-Gas-Prices-in-2025.html |

|

Equinor Makes Natural Gas Discovery in the Norwegian SeaNorway’s Equinor has made a natural gas and condensate discovery in the Norwegian Sea, close to a field currently under development, the Norwegian Offshore Directorate said on Tuesday. Equinor and its partners in a production license in the Haltenbanken Vest Unit in the Norwegian Sea proved gas and condensate, a type of very light oil, in a development well drilled as part of the previously discovered Lavrans field. Preliminary estimates place the size of the discovery in the range of 2-4 million standard cubic meters of recoverable oil equivalent,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Equinor-Makes-Natural-Gas-Discovery-in-the-Norwegian-Sea.html |

|

Two key inflation reports this week will help decide the size of the Fed’s interest rate cutThe Bureau of Labor Statistics will first release the consumer price index Wednesday and then the producer price index Thursday, both measuring August prices. Read more at: https://www.cnbc.com/2024/09/10/weeks-two-key-inflation-reports-to-help-decide-size-of-feds-rate-cut.html |

|

JPMorgan Chase shares drop 5% after bank tempers guidance on interest income and expensesJPMorgan Chase shares plummeted after the bank said estimates for net interest income next year were too high. Read more at: https://www.cnbc.com/2024/09/10/jpmorgan-chase-shares-drop-nearly-7percent-after-bank-tempers-guidance-on-net-interest-income.html |

|

Economic ‘misery index’ that’s predicted every election winner since 1980 looking good for Harris, but it’s closeThe “misery index” is the addition of the unemployment rate to the annualized inflation rate in the U.S. Read more at: https://www.cnbc.com/2024/09/10/misery-index-looks-good-for-kamala-harris-in-presidential-race.html |

|

New Starbucks CEO Brian Niccol outlines priorities to end coffee chain’s slumpStarbucks named Brian Niccol its CEO in August, trusting him to turn around the coffee chain’s slumping sales. Read more at: https://www.cnbc.com/2024/09/10/new-starbucks-ceo-brian-niccol-outlines-plans-for-business.html |

|

The utilities sector is up 20% in 2024. Analysts love these dividend-paying namesUtilities are outpacing technology in 2024, benefiting from their role in the expansion of artificial intelligence and a growing need for electrical power. Read more at: https://www.cnbc.com/2024/09/10/utilities-are-is-up-20percent-in-2024-analysts-love-these-dividend-payers.html |

|

Federal Reserve unveils toned-down banking regulations in victory for Wall StreetBank CEOs led by JPMorgan Chase CEO Jamie Dimon have lambasted the proposed Basel Endgame regulation since it was unveiled last year. Read more at: https://www.cnbc.com/2024/09/10/federal-reserve-unveils-new-banking-regulation-in-wall-street-victory.html |

|

Crypto will be ‘big boon’ for financial services over time, Robinhood CEO says: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Steven Lubka, head of private clients at Swan Bitcoin, discusses how each potential outcome in the U.S presidential election could influence crypto prices. Read more at: https://www.cnbc.com/video/2024/09/10/crypto-big-boon-financial-services-over-time-robinhood-ceo-says-cnbc-crypto-world.html |

|

Presidential debate live updates: DJT stock price surges before Trump and Harris showdownFormer President Donald Trump and Vice President Kamala Harris will debate for the first — and possibly only — time before Election Day. Read more at: https://www.cnbc.com/2024/09/10/presidential-debate-live-updates-trump-harris.html |

|

Jamie Dimon says ‘the worst outcome is stagflation,’ a scenario he’s not taking off the tableThe CEO of the biggest U.S. bank says he sees a raft of inflationary forces on the horizon, including higher deficits and increased infrastructure spending. Read more at: https://www.cnbc.com/2024/09/10/jamie-dimon-says-the-worst-outcome-is-stagflation-a-scenario-hes-not-taking-off-the-table.html |

|

Oracle is designing a data center that would be powered by three small nuclear reactorsOracle co-founder Larry Ellison did not disclose the location of the data center or the future reactors. Read more at: https://www.cnbc.com/2024/09/10/oracle-is-designing-a-data-center-that-would-be-powered-by-three-small-nuclear-reactors.html |

|

Why a Disney vacation may have gotten too pricey for the average American familyDisney said its parks and experiences segment felt pressure due to lower consumer demand and inflation in its Q3 2024 earnings. Read more at: https://www.cnbc.com/2024/09/10/why-disney-vacation-may-be-getting-too-pricey-for-average-american-family.html |

|

Car giants are being forced to confront some hard truths over the EV transitionEuropean car giants are struggling to come to terms with a perfect storm of challenges on the path to full electrification. Read more at: https://www.cnbc.com/2024/09/10/autos-car-giants-forced-to-confront-hard-truths-over-ev-transition.html |

|

AI-powered search startup Glean doubles valuation in new funding round led by AltimeterAI-powered search startup Glean said Tuesday it has raised $260 million in a Series E funding round that values the tech company at $4.6 billion. Read more at: https://www.cnbc.com/2024/09/10/ai-powered-search-startup-glean-doubles-valuation-in-new-funding-round.html |

|

Volkswagen Declares War On Unions, Scraps Three-Decade-Old Job ProtectionsAs discussed earlier today, Germany’s economy is slowly but surely sinking, whether or not Mario Draghi’s proposal to flood Europe in new debt is eventually accepted, and nowhere is the pain more tangible than Germany’s iconic carmaker, Volkswagen, which we reported last week was considering its first-ever factory closure amid a dire economic backdrop, and which today took the shocking – for Germany – decision to end job protections for German auto workers as part of its cost-cutting push, setting up a calamitous showdown with unions as the country’s most important industry fights for its future. This morning, the world’s largest automaker by sales canceled several agreements linked to a three-decades-old pact that was supposed to safeguard employment until 2029, VW said. Guarantees will effectively run out by the middle of next year. According to Bloomberg, “ending job security commitments at a company synonymous with engineering prowess signals how far Europe’s biggest economy has fallen behind on competitiveness.” Read more at: https://www.zerohedge.com/markets/volkswagen-declares-war-unions-scraps-three-decade-old-job-protections |

|

Americans Lost $5.6 Billion In Cryptocurrency Scams Last Year, FBI SaysAuthored by Chase Smith via The Epoch Times, Americans lost more than $5.6 billion to cryptocurrency fraud in 2023, a significant increase from previous years, according to a new report from the FBI.

The FBI’s Internet Crime Complaint Center (IC3) received more than 69,000 complaints involving cryptocurrency fraud, representing a 45 percent increase in losses compared to the previous year, the Sept. 9 report said. While these cryptocurrency-related complaints accounted for 10 percent of the total number of financial fraud complaints, they made up nearly half of all financial losses reported to the FBI.

|

|

Biden’s FAA Punishes SpaceX, Delays Starship Rocket Launch By MonthsDoes the Biden Administration have it in for Elon Musk? … Absolutely. The radical leftists in the Biden administration have ramped up their weaponization of federal agencies against Musk’s companies, retaliating as the world’s richest man and top Trump supporter champions free speech on X during this crucial election cycle. Musk has made it his mission to ensure the Deep State’s censorship machine has tentacles partially or entirely removed from the X platform. Democrats are furious about this (crying about the proliferation of ‘hate speech’ under the guise of trying to re-control the platform) as their dying legacy corporate media allies have severe problems in narrative control. In continued federal action against Musk, the Federal Aviation Administration has delayed SpaceX’s Starship launch by two months. This is longer than what was previously discussed between the space company and federal regulators regarding a mid-September launch.

According to a new SpaceX update:

|

|

“I’ve Never Seen Anything Like That”: Jeff Currie Claims Fears Of An Oil Market Glut Are “Completely Overplayed”By Charles Kennedy of OilPrice.com

Oil market participants are “dramatically overestimating” a supply glut, as Chinese demand is not as doom-and-gloom as headline figures suggest and U.S. crude oil production is basically flat this year, Jeff Currie, chief strategy officer of energy pathways at Carlyle, said on Tuesday. Fears of a major oil glut are “completely overplayed,” Currie told the Asia Pacific Petroleum Conference (APPEC) in Singapore, where executives at major oil trading houses expressed bearish views about demand and global market balances for this year and next. According to Currie, Chinese “weaknesses in demand are being deeply exaggerated by base effects and by destocking.” “The key issue there is, the market is dramatically overestimating tha … Read more at: https://www.zerohedge.com/energy/ive-never-seen-anything-jeff-currie-claims-fears-oil-market-glut-are-completely-overplayed |

|

State pension set to rise by £460 next yearThe latest figure comes as the government faces a backlash over cutting winter fuel payments for most pensioners. Read more at: https://www.bbc.com/news/articles/c9wjz7jzqd0o |

|

GB News owner buys Spectator magazine for £100mThe right-leaning political magazine has been sold to the hedge fund tycoon Sir Paul Marshall. Read more at: https://www.bbc.com/news/articles/cn8l35xl1l2o |

|

Sony reveals much more expensive and powerful PlayStation 5 ProUK gamers will have to shell out £699.99 when the upgraded console launches on 7 November. Read more at: https://www.bbc.com/news/articles/cx29r65ygdqo |

|

Oil prices fall on demand concerns, Brent below $70, near 3-year lowThe main international oil contract, Brent crude, fell below $70 per barrel on Tuesday for the first time since December 2021 amid concerns about slowing economic growth depressing fuel demand. Brent crude slumped 3.7 percent in afternoon trading to $69.15 per barrel while the main US contract, West Texas Intermediate (WTI), tumbled 4.1 percent to $65.90. lul/zap/rl/gv Read more at: https://economictimes.indiatimes.com/markets/commodities/brent-crude-falls-below-70-per-barrel-for-first-time-since-december-2021/articleshow/113234143.cms |

|

Kumar Mangalam Birla raises stake in Vi, buys 1.86 crore sharesKumar Mangalam Birla, chairman of the Aditya Birla Group, has increased his stake in Vodafone Idea by purchasing 1.86 crore shares. His investment vehicle also acquired 30 lakh shares. This move comes as Vodafone Idea seeks to raise Rs 25,000 crore in debt and Rs 24,000 crore in equity funding. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/kumar-mangalam-birla-raises-stake-in-vi-buys-1-86-crore-shares/articleshow/113236464.cms |

|

FPIs stay positive on consumption theme, increase allocation to automobiles, consumer servicesThe collective weight of the consumption-related sectors including automobiles, consumer durables, consumer services, FMCG, and telecommunications in the portfolios of foreign portfolio investors (FPIs) reached a record high 25.5% at the end of August 2024, according to data from NSDL. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fpis-stay-positive-on-consumption-theme-increase-allocation-to-automobiles-consumer-services/articleshow/113233400.cms |

|

Falling oil prices and China concerns add fuel to market fears of a U.S. recessionConcerns about China’s economy have dulled the outlook for energy demand — contributing to a drop in U.S. and global oil prices to their lowest levels in over two years on Tuesday, while exacerbating U.S. recession fears in some parts of the financial market. Read more at: https://www.marketwatch.com/story/falling-oil-prices-and-china-concerns-add-fuel-to-market-fears-of-a-u-s-recession-2039d55f?mod=mw_rss_topstories |

|

Apple’s AirPods-as-hearing-aid play is a $13 billion market opportunity that can help — but not transform — hearing-loss careNew AirPods functionality could ease stigma for those with hearing loss. Read more at: https://www.marketwatch.com/story/apples-airpods-as-hearing-aid-play-is-a-13-billion-market-opportunity-that-can-help-but-not-transform-hearing-loss-care-ffe16e5a?mod=mw_rss_topstories |

|

Treasury yields establish fresh 2024 lows amid persistent recession worriesU.S. government debt rallied on Tuesday, sending yields to their lowest levels of the year, as recession fears persisted ahead of Wednesday’s release of the August consumer-price index report. Read more at: https://www.marketwatch.com/story/ten-year-treasury-yields-nudge-up-from-15-month-lows-as-traders-eye-inflation-report-c650bbc6?mod=mw_rss_topstories |