Summary Of the Markets Today:

- The Dow closed down 410 points or 1.01%,

- Nasdaq closed down 2.55%,

- S&P 500 closed down 1.73%,

- Gold $2,525 down $17.90,

- WTI crude oil settled at $68 down $0.97,

- 10-year U.S. Treasury 3.723 down 0.010 points,

- USD index $101.19 up $0.08,

- Bitcoin $53,725 down $2,451 or 4.36%,

- Baker Hughes Rig Count: U.S. -1 to 582 Canada unchanged to 220

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The major U.S. stock indexes erased earlier gains and declined sharply in afternoon trading. The August jobs report showed 142,000 jobs added, below expectations of 165,000. The markets believed that there were signs of continued cooling in the labor market. The weaker-than-expected jobs data shifted expectations for the Fed’s upcoming meeting with the markets believing there was Increased chances of a larger 50 basis point rate cut. Fed Governor Waller reiterated that “the time has come” to lower rates. In corporate news, Broadcom shares fell nearly 10% on weak sales forecast and other chip stocks like Nvidia also declined significantly. Overall, stocks whipsawed this week as investors assessed economic data . All three major indexes are set for significant weekly declines.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

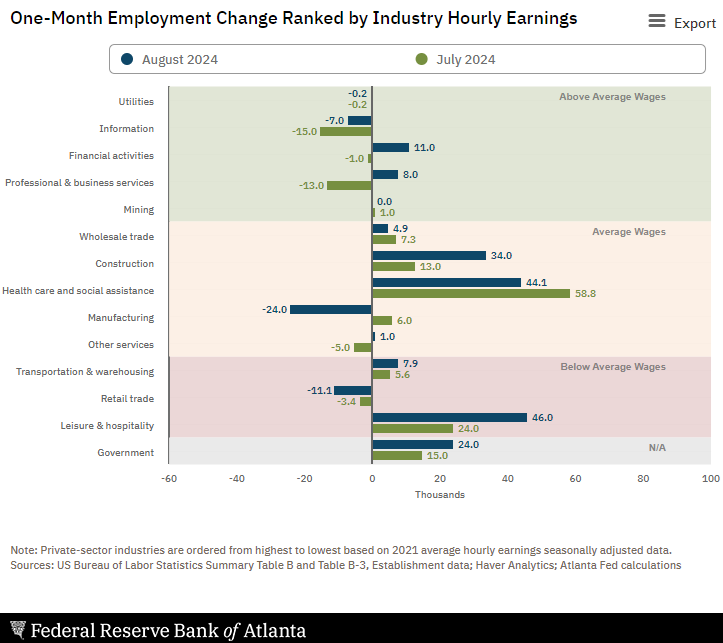

Total nonfarm payroll employment grew 142,000 in August 2024 (according to the establishment survey) with the unemployment rate declining insignificantly to 4.2% (according to the household survey). The household survey shows employment growth of 168,000 with the establishment’s growth of 142,000. I generally consider 150,000 job growth as the metric for healthy jobs growth to accommodate new workers entering the economy – and this month the household survey estimated 120,000 additional workers were added to the workforce. So jobs growth this month was more than the estimated workforce growth. Unfortunately manufacturing employment declined while health care, construction, and government were the largest employment growth sectors. No evidence in these numbers of a recession.

Here is a summary of headlines we are reading today:

- Saudi Arabia’s Economic Growth Defies Regional Instability

- U.S. Oil, Gas Drillers Ease Up As Prices Crash

- Toyota Slashes EV Production Goal Amid Global Slowdown

- Texas Denies State Funding to 1.3 GW Natural Gas Plant Project

- Why Oil Prices Fell Back Below $70

- S&P 500 tumbles Friday to post worst week since 2023, Nasdaq drops 2% for worst weekly performance since 2022: Live updates

- Here’s where the jobs are for August 2024 — in one chart

- Fed Governor Waller backs interest rate cut at September meeting, open to larger move

- Home listings are up more than 60% in some cities. Here’s where

- Bitcoin and ether head for second week of losses: CNBC Crypto World

- Oregon Reverses Liberal Drug Law After “Losing A Generation” To Addiction

- The bond market just flashed a reliable recession signal. Don’t panic.

- 2-year Treasury yield ends at lowest since 2022 after August payrolls miss expectations

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Saudi Arabia’s Economic Growth Defies Regional InstabilityVia Middle East Eye Saudi Arabia’s economy has powered ahead despite Israel’s war in Gaza and Houthi attacks in the Red Sea, suggesting that the kingdom’s efforts to distance itself from regional tensions are paying off, literally. “Geopolitical events in the Middle East have not had any major impact on the Saudi economy so far,” the International Monetary Fund (IMF) said in its latest report published on the kingdom’s economy. The report says that Saudi oil exports are not dependent on the Red Sea, where Iran-backed Houthis… Read more at: https://oilprice.com/Finance/the-Economy/Saudi-Arabias-Economic-Growth-Defies-Regional-Instability.html |

|

U.S. Oil, Gas Drillers Ease Up As Prices CrashThe total number of active drilling rigs for oil and gas in the United States fell again this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 1 to 582 this week, compared to 632 rigs this same time last year. The number of oil rigs stayed the same this week after staying the same in the two weeks prior. Oil rigs now stand at 483—down by 30 compared to this time last year. The number of gas rigs fell by 1 this week to 94, a loss of 19 active gas rigs from this time last year. Miscellaneous rigs… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Gas-Drillers-Ease-Up-As-Prices-Crash.html |

|

Saudi Arabia Cuts Oil PricesSaudi Arabia’s state-run oil company has cut its October pricing for its Arab Light crude oil for Asian buyers, according to a fresh price list released on Friday. Saudi Aramco has cut its Arab Light crude oil by 70 cents, the price list showed. The news comes as Brent crude prices fell even further, trading at $71.49 per barrel, a $1.20 per barrel decline (-1.65%) on the day and the lowest level in years. Saudi Aramco has also lowered the price of Arab Light to Europe and the United States. The price reduction to Asia—Saudi Aramco’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Cuts-Oil-Prices.html |

|

Why Has the Green Hydrogen Hype Faded?Green hydrogen was the buzzword on everyone’s lips a couple of years ago, but the initial hype seems to have faded away as the industry takes time to build capacity and overcome production and transportation hurdles. Several countries have set out ambitious green hydrogen production aims for the coming decades, as they strive to decarbonise hard-to-abate industries. However, as governments and the private sector increase investments in green hydrogen, the sector is taking time to develop. Researchers are constantly looking at ways to reduce… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Why-Has-the-Green-Hydrogen-Hype-Faded.html |

|

EU’s Gas Supplies Could Still Have Russian Gas Mixed InThe European Union will receive natural gas supplies that may have Russian gas mixed in, Czech energy minister Jozef Sikela told Bloomberg. Sikela has been tapped by the Czech government to be its member of the European Commission, and European Commission President Ursula von der Leyen has been said to already chosen Sikela to head the energy portfolio for the bloc. Due to contractual obligations, several eastern European states have continued to buy natural gas from Russia via a pipeline that crosses Ukraine despite the bloc’s efforts to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EUs-Gas-Supplies-Could-Still-Have-Russian-Gas-Mixed-In.html |

|

Toyota Slashes EV Production Goal Amid Global SlowdownJapan’s Toyota Motor Corporation has drastically cut its electric vehicle production target by 30% compared to previous plans, on the back of the slower EV uptake globally, Nikkei reported on Friday. Toyota, one of the world’s biggest car manufacturers, now aims at rolling out 1 million EVs in 2026, down by 30% compared to its previous target, Nikkei’s reporters have learned. The 2025 target for EV production is now at 400,000 units, according to the report. Toyota has already notified its suppliers of its decision to scale back… Read more at: https://oilprice.com/Energy/Energy-General/Toyota-Slashes-EV-Production-Goal-Amid-Global-Slowdown.html |

|

21 Oil and Gas Firms Bid on New Exploration Areas in NorwayNorway’s latest license round for new acreage in the best-explored areas on the shelf has attracted bids from 21 oil and gas companies, the Norwegian Energy Ministry said on Friday. Norway holds an annual license round for exploration acreage in the best-known and mature areas on the Norwegian Continental Shelf—the so-called awards in predefined areas (APA) round. After more than 50 years of exploration activity, the APA rounds currently cover most of the area that has been open to drilling and is available on the shelf. This year,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/21-Oil-and-Gas-Firms-Bid-on-New-Exploration-Areas-in-Norway.html |

|

Bearish Sentiment Has Taken Over Oil MarketsBearish sentiment has well and truly taken over oil markets, with oil prices barely reacting to the OPEC+ decision to postpone its plan to boost production.Friday, September 6th, 2024Usually, high-impact OPEC+ decisions trigger a notable reaction in the oil markets, but not this time. Sentiment has soured so much that the oil group’s decision to postpone the return of barrels they’ve cut in 2023 barely resonated at all, reinforcing fears that next year will see balances swinging heavily towards oversupply. As ICE Brent futures hover… Read more at: https://oilprice.com/Energy/Energy-General/Bearish-Sentiment-Has-Taken-Over-Oil-Markets.html |

|

Texas Denies State Funding to 1.3 GW Natural Gas Plant ProjectTexas regulators have denied state funding to a proposed 1.3-gigawatt natural gas-fired power plant, due to the applicant failing to meet due diligence, days after shortlisting the project as eligible to receive low-interest rate loans from the Texas Energy Fund. The Public Utility Commission of Texas (PUCT) denied the application from NextEra and Aegle Power for the In-ERCOT Generation Loan Program of the newly established fund. “The application has failed the due diligence phase of the loan application process, and the project will not… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Texas-Denies-State-Funding-to-13-GW-Natural-Gas-Plant-Project.html |

|

What Will It Take for Oil Prices to Rally Back Above $71.02?Weekly Recap and Forecast: Light Crude Oil Futures Light Crude Oil futures came under significant selling pressure this week, breaching key support levels and intensifying bearish sentiment. After breaking through the $71.02-$73.44 zone, prices dipped below $69.50, marking a critical technical breakdown. This decline leaves the market vulnerable, with $63.21 now appearing as the next significant downside target on the weekly chart. OPEC+ Delays Production Hike OPEC+ added to market uncertainty by delaying its planned production increase of 180,000… Read more at: https://oilprice.com/Energy/Energy-General/What-Will-It-Take-for-Oil-Prices-to-Rally-Back-Above-7102.html |

|

Libya’s Oil Problems Are Far From OverPolitics, Geopolitics, & Conflict Libya’s exports remain blocked, and while there were some reports that some oil was getting out, it was largely for domestic use and some ships have been allowed to load from storage. The majority remains hijacked by a new push to take control by two rival governments (Benghazi and Tripoli). On Friday, the Tripoli government’s interior minister (Imad Trabelsi) let it be known that meetings had been held over the past 48 hours with “security forces” (read: various militias). That could… Read more at: https://oilprice.com/Energy/Energy-General/Libyas-Oil-Problems-Are-Far-From-Over.html |

|

Why Oil Prices Fell Back Below $70One of the biggest mistakes I have seen traders make over the years, and to be honest it is also something of which I have been guilty many times in the past, is the desire, need almost, to trade in the “logical” direction on every piece of news. Very often, though, the better trade is to fade the initial reaction when circumstances appear to change. This week, for example, reports surfaced that OPEC+ were going to postpone their scheduled crude output increases for a couple of months. Those reports came out on Thursday, but here is… Read more at: https://oilprice.com/Energy/Energy-General/Why-Oil-Prices-Fell-Back-Below-70.html |

|

Groundhog Day for OPECBoth the API and EIA agree: U.S. crude oil inventories shrunk last week – by millions of barrels. U.S. crude oil inventories are down based on five-year averages. Globally, demand is exceeding supply too, but as driving season comes to a close, that could be about to end, leaving OPEC+ in a bit of a sticky situation. It’s reminiscent of a decade ago when OPEC refused to cut production in hopes that falling prices would squeeze out higher-cost U.S. shale. OPEC chose not to cede market share to the United States by withholding production… Read more at: https://oilprice.com/Energy/Energy-General/Groundhog-Day-for-OPEC38549.html |

|

Germany Says China’s Emission Reductions Are Crucial for Global GoalsThe pace at which China will reduce its greenhouse gas emissions will be critical to reaching the global targets to fight climate change, Germany’s climate envoy has said. “What China decides to do in its NDC is probably the most important thing to keeping that 1.5-degree target in sight,” Jennifer Morgan, Germany’s State Secretary and Special Envoy for International Climate Action, said, as carried by Bloomberg. Germany has recently established a Climate and Transformation Dialogue with China to work on ways to accelerate… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Says-Chinas-Emission-Reductions-Are-Crucial-for-Global-Goals.html |

|

Germany Rejects Carbon Credit Certificates Over Alleged China FraudThe German Environment Agency on Friday said it had rejected carbon credit certificates from eight projects over concerns about fraudulent emission-reduction reporting and certification in China. The so-called Upstream Emission Reduction (UER) projects are being used by oil companies to meet the European Union’s regulations and targets of reducing greenhouse gas emissions. Companies earn green credits by funding emission-reduction initiatives in oil production, such as a halt to gas flaring. The German Environment Agency, UBA, has been investigating… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Rejects-Carbon-Credit-Certificates-Over-Alleged-China-Fraud.html |

|

S&P 500 tumbles Friday to post worst week since 2023, Nasdaq drops 2% for worst weekly performance since 2022: Live updatesThe S&P 500 fell Friday and notched its worst week since March 2023. Read more at: https://www.cnbc.com/2024/09/05/stock-market-today-live-updates.html |

|

Here’s where the jobs are for August 2024 — in one chartHealth care and hospitality were key drivers for a job market that has cooled off in recent months. Read more at: https://www.cnbc.com/2024/09/06/heres-where-the-jobs-are-for-august-2024-in-one-chart.html |

|

Fed Governor Waller backs interest rate cut at September meeting, open to larger moveWaller on Friday backed an interest rate cut at the upcoming policy meeting, noting the importance of supporting a weakening jobs picture. Read more at: https://www.cnbc.com/2024/09/06/fed-governor-waller-backs-interest-rate-cut-at-september-meeting.html |

|

Why muni bonds could offer extra yield for long-term investorsJohn Flahive, head of fixed income at BNY Mellon Wealth Management, spoke with CNBC about opportunities in municipal bonds. Read more at: https://www.cnbc.com/2024/09/06/why-muni-bonds-could-offer-extra-yield-for-long-term-investors.html |

|

Trump hush money sentencing postponed past Election Day, judge rulesFormer President Donald Trump will not be sentenced in his New York criminal hush money case until after the Nov. 5 presidential election, a judge ruled. Read more at: https://www.cnbc.com/2024/09/06/trump-hush-money-case-sentencing-election-merchan.html |

|

Home listings are up more than 60% in some cities. Here’s whereNationwide, active listings in August were up 36% compared with the same month last year, according to a new report from Realtor.com. Read more at: https://www.cnbc.com/2024/09/06/home-listings-up-big-in-some-cities.html |

|

Masimo CEO shared confidential information with investor ahead of public release, court filing showsCourt documents unsealed on Friday show Masimo CEO Joe Kiani shared material non-public information with an investor in March just before it was released. Read more at: https://www.cnbc.com/2024/09/06/masimo-ceo-shared-confidential-information-ahead-of-release-documents.html |

|

Bitcoin and ether head for second week of losses: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Hong Fang of OKX breaks down crypto’s recent slide and whether institutional investors are sticking to the sidelines. Read more at: https://www.cnbc.com/video/2024/09/06/bitcoin-and-ether-head-for-second-week-of-losses-cnbc-crypto-world.html |

|

Top 10 people most likely to reach trillionaire statusAt least a half-dozen companies have hit the $1 trillion mark and now the question is: Who could be the first individual person to become a trillionaire? Read more at: https://www.cnbc.com/2024/09/06/top-10-people-most-likely-to-reach-trillionaire-status.html |

|

The Kansas City Chiefs are the NFL’s current dynasty — here’s why they are worth less than teams that regularly miss the playoffsThe Kansas City Chiefs, despite having won three of the last five Super Bowls, are only the 18th most valuable team in the league at $6.07 billion. Read more at: https://www.cnbc.com/2024/09/06/kansas-city-chiefs-valuation-playoffs-super-bowl.html |

|

The Green Bay Packers are the one NFL team owned by its fans. Here’s how it worksThe Green Bay Packers, No. 12 on CNBC’s Official 2024 NFL Team Valuations list, are the only publicly owned NFL team. Read more at: https://www.cnbc.com/2024/09/06/green-bay-packers-stock-ownership-team-valuation.html |

|

Eighty-eight corporate leaders endorse Harris in new letter, including CEOs of Yelp, BoxThe letter is meant as a political show of force for Kamala Harris in a tight race with Donald Trump. The first presidential debate is less than a week away. Read more at: https://www.cnbc.com/2024/09/06/harris-endorsed-trump-murdoch-yelp-snap-ripple.html |

|

Oregon Reverses Liberal Drug Law After “Losing A Generation” To AddictionIn fact, the state’s decision to recriminalize drugs is just the first of many needed actions, says State House Republican leader Jeff Helfrich. The new law, reversing the 2020 decriminalization, took effect Sunday, according to the NY Post and Fox News. The new law, HB 4002, introduces stricter penalties for selling drugs in public and classifies personal drug possession as a misdemeanor. Addiction and drug-related deaths surged after Oregon’s 2020 decriminalization, which was approved by 58% of voters. Helfrich said on Fox this week: “You saw overdose deaths, you saw drug usage on the street, crime, homelessness all soared after Democrats put this policy in place. And they could have stopped it, but they didn’t.” “Unfortunately, because we decriminalized it for those few years, we’ve lost a generation, I believe, of people because of these drugs. And you don’t get to have those times anymore,” he continued. Read more at: https://www.zerohedge.com/markets/oregon-reverses-liberal-drug-law-after-losing-generation-addiction |

|

Elon Musk: Trump Must Win, Civilization Is On The LineAuthored by Steve Watson via Modernity,news, X owner Elon Musk urged Thursday that he believes Donald Trump must win the election in order to save civilisation.

“I have never been materially active in politics before, but this time I think civilization as we know it is on the line,” Musk posted. He added, “If we want to preserve freedom and a meritocracy in America, then Trump must win.”

Read more at: https://www.zerohedge.com/political/elon-musk-trump-must-win-civilization-line |

|

“It’s Not In The Bag”: Kamala Harris Trailing Biden, Hillary Clinton Vs. Trump At This Stage Of The RaceDespite her recent surge in momentum – which as we noted earlier this week (and since 2016) is due to massive oversampling, Vice President Kamala Harris finds herself in a tougher position than her Democratic predecessors – Joe Biden in 2020 and Hillary Clinton in 2016 – in terms of how she’s doing vs. Donald Trump at this stage in the race. Polling data reveals that Harris’s lead over Trump in national polls is slimmer than those held by Biden and Clinton at comparable points in their respective campaigns, The Hill reports.

According to the latest data from FiveThirtyEight, Harris currently holds 47 percent support against Trump’s 44 percent, a narrow 3-point lead with just 62 days left before Election Day. Comparati … Read more at: https://www.zerohedge.com/political/its-not-bag-kamala-harris-trailing-biden-hillary-clinton-stage-race |

|

Pennsylvania’s Radical Leftist Court Delivers Another Win To Election-Meddling DemocratsAuthored by Luis Cornelio via HeadlineUSA.com, A Pennsylvania appeals court ruled that county officials must count the provisional ballots of individuals claiming their mail-in ballots were rejected, expanding an infamous practice known as ballot curing.

The Commonwealth Court overturned a Butler County judge’s ruling that officials did not have to count the provisional ballots of individuals whose naked ballots were rejected, reported the Penn Capital-Star on Thursday. N … Read more at: https://www.zerohedge.com/political/pennsylvanias-radical-leftist-court-delivers-another-win-election-meddling-democrats |

|

Owner of OnlyFans paid $631m as subscriptions riseLeonid Radvinsky’s huge earnings were revealed in the online platform’s latest accounts. Read more at: https://www.bbc.com/news/articles/c1m01dp3507o |

|

First-class stamp price to rise to £1.65The company says the price rise is needed as it faces “very real and urgent” financial challenges. Read more at: https://www.bbc.com/news/articles/cvge8yn77rzo |

|

Selena Gomez joins billionaire celebrity rich listThe celebrity joins the billionaire ranks thanks to her Rare Beauty make-up business. Read more at: https://www.bbc.com/news/articles/cx2l7v200d1o |

|

SpiceJet restructures $97 million dues to Carlyle Aviation into equity and debenturesSpiceJet announced that Carlyle Aviation Partners will convert part of their debt into equity, restructuring aircraft lease obligations. Carlyle may also invest in SpiceXpress & Logistics. The airline is seeking to raise Rs 2,500 crore through a share sale to institutional investors amid financial struggles and operational challenges. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/spicejet-restructures-97-million-dues-to-carlyle-aviation-into-equity-and-debentures/articleshow/113134782.cms |

|

Peak XV Partners sells 22 pc stake in Indigo Paints for Rs 1,557 crore; Morgan Stanley, HDFC MF among buyersPeak XV Partners, formerly Sequoia Capital India and SEA, sold over 22% stake in Indigo Paints for Rs 1,557 crore to investors including Morgan Stanley, Mercer, and HDFC MF. The shares were sold via open market transactions. Following the sale, Indigo Paints’ shares fell by 4.19% on the NSE. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/peak-xv-partners-sells-22-pc-stake-in-indigo-paints-for-rs-1557-crore-morgan-stanley-hdfc-mf-among-buyers/articleshow/113134592.cms |

|

What are Sebi’s UBO norms for FPIs and what needs to be done to save licence?According to ET Now sources, the upcoming SEBI deadline for UBO compliance is expected to affect only a small number of FPIs. The report highlighted that even non-compliant FPIs can continue operations beyond the September 9th deadline by paying a 5% penalty. Additionally, these FPIs will be granted an extra six months to achieve compliance after paying the penalty. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/what-are-sebis-ubo-norms-for-fpis-and-what-needs-to-be-done-to-save-licence/articleshow/113128767.cms |

|

The bond market just flashed a reliable recession signal. Don’t panic.The Treasury market’s yield curve uninverted for first time since July 2022. Read more at: https://www.marketwatch.com/story/the-bond-market-just-flashed-a-reliable-recession-signal-dont-panic-2a7e68f8?mod=mw_rss_topstories |

|

2-year Treasury yield ends at lowest since 2022 after August payrolls miss expectationsTreasury yields finished broadly lower on Friday after August’s nonfarm payrolls report came in below expectations and a key Federal Reserve official said he is open to the possibility of bigger-than-usual rate cuts. Read more at: https://www.marketwatch.com/story/bond-yields-dip-heading-into-crucial-u-s-jobs-report-4756b488?mod=mw_rss_topstories |

|

‘I’m sick of dating losers’: Are single Americans looking for love online — or money? It’s hard to tell the difference.Tinder, Hinge, The League and Raya are marketing tools for status-conscious Americans, and it’s a crowded space. Read more at: https://www.marketwatch.com/story/i-want-to-meet-someone-rich-are-dating-apps-a-hotbed-of-status-conscious-singletons-looking-for-wealthy-partners-c5dbfa87?mod=mw_rss_topstories |