Summary Of the Markets Today:

- The Dow closed down 219 points or 0.54%,

- Nasdaq closed up 0.25%,

- S&P 500 closed down 0.30%,

- Gold $2,544 up $18.30,

- WTI crude oil settled at $69 down $0.04,

- 10-year U.S. Treasury 3.733 down 0.035 points,

- USD index $101.11 down $0.24,

- Bitcoin $56,071 down $1,914 or 3.30%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights

US stocks showed mixed performance on Thursday as investors processed weaker-than-expected labor market data ahead of Friday’s crucial jobs report. The market remains cautious as it awaits Friday’s August jobs report, which will be crucial for assessing the state of the economy and potential Fed actions.

Labor market data: ADP reported private payrolls grew by only 99,000 in August, the smallest monthly increase since January 2021. Slightly fewer Americans filed new unemployment claims last week. Job openings declined according to Wednesday’s government data. The weak labor data could support the case for deeper interest rate cuts by the Federal Reserve. However, it may also signal a potential recession, challenging hopes for a “soft landing”.

Federal Reserve expectations: Traders see a nearly 50-50 chance of a 0.5% rate cut at the Fed’s September meeting.

Corporate news: C3.ai shares fell 8% after weak subscription revenue. HPE stock slipped on disappointing profitability. Tesla pared earlier gains but still rose nearly 5% on plans to launch Full Self-Driving software in China and Europe.

Sector performance: Information Technology has fallen nearly 4% over the past four days. Apple is down 3% and Nvidia down nearly 9% in the same period.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Private employers added 99,000 jobs in August 2024 according to ADP. Now, it seems, that the BLS employment numbers now resemble the numbers ADP was releasing for the past year (over this past month the BLS has significantly revised their numbers downward). On the following graph, the blue line is ADP whilst the red line is the BLS’ numbers. Likely the ADP management are giving each other high fives. 99,000 is not a great number but it is not recessionary either. An adequate monthly employment growth number would be at least 150,000 to account for population growth. Nela Richardson, Chief Economist, ADP added:

The job market’s downward drift brought us to slower-than-normal hiring after two years of outsized growth. The next indicator to watch is wage growth, which is stabilizing after a dramatic post-pandemic slowdown.

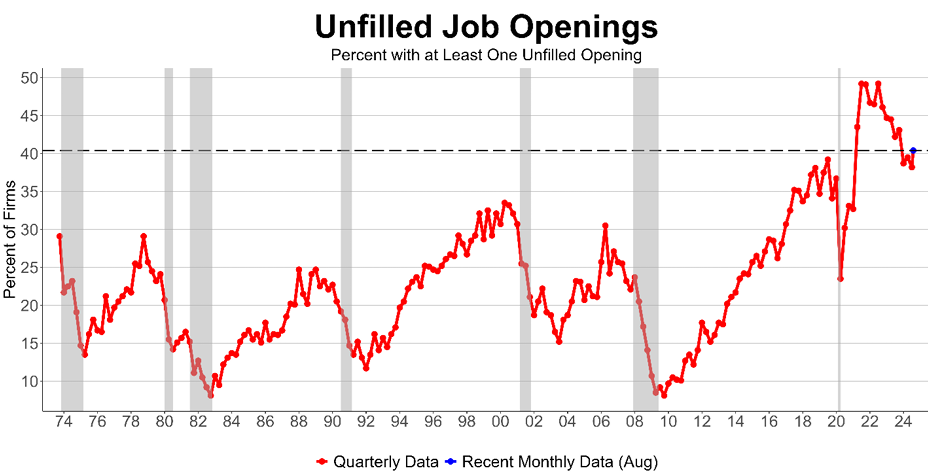

NFIB’s August 2024 jobs report found that 40% (seasonally adjusted) of small business owners reported job openings they could not fill in August, up two points from July. Labor quality as the top small business operating problem rose two points from July to 21%, the highest level reported since January of this year. NFIB Chief Economist Bill Dunkelberg stated:

Job openings on Main Street remain historically high as small business owners continue to lament the lack of qualified applicants for their open positions. Owners have grown understandably frustrated as attempts to fill their workforce repeatedly stall and cost pressures continue to rise.

U.S.-based employers announced 75,891 cuts in August 2024, a 193% increase from the 25,885 cuts announced one month prior. It is up 1% from the 75,151 cuts announced in the same month in 2023. For the year, companies have announced 536,421 job cuts, down 3.7% from 557,057 announced through August of last year. Excluding the 115,762 job cuts announced in August of 2020, last month was the highest August total since 2009, when 76,456 layoffs were recorded. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. added:

August’s surge in job cuts reflects growing economic uncertainty and shifting market dynamics. Companies are facing a variety of pressures, from rising operational costs to concerns about a potential economic slowdown, leading them to make tough decisions about workforce management. Cuts are following a very similar trend from last year as ongoing pressures have challenged labor decisions.

Nonfarm business sector labor productivity increased 2.7 percent year-over-year in the second quarter of 2024 with unit labor costs growing 0.3% year-over-year. Whenever productivity grows faster than labor costs – companies are becoming more competitive internationally. Unfortunately, the methodology used for determining productivity bears little resemblance to the methodology used by industrial engineers – and my best guess is productivity gains are a result of AI gains in the service industry or in the financial sector. According to this report, manufacturing labor productivity increased only 0.4% year-over-year while unit labor costs increased a massive 4.3% year-over-year.

In the week ending August 31, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 230,000, a decrease of 1,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 231,500 to 231,750. No sign of economic slowing in these unemployment numbers.

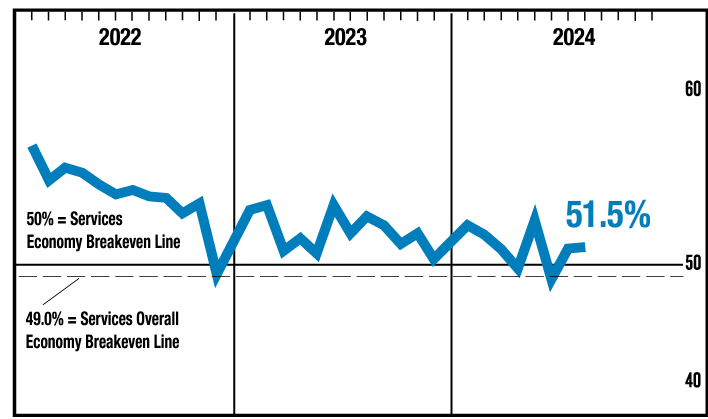

In August 2024, the Institute of Supply Management’s Services PMI® registered 51.5 percent, 0.1 percentage point higher than July’s figure of 51.4 percent. The reading in August marked the sixth time the composite index has been in expansion territory in 2024. The Business Activity Index registered 53.3 percent in August, which is 1.2 percentage points lower than the 54.5 percent recorded in July and indicated continuing expansion after one month of contraction in June. As the US is a service based economy, a reading so close to 50 (the line between expansion and contraction) means real economic growth is marginal.

Here is a summary of headlines we are reading today:

- Billions Being Pumped Into Unproven “Climate Solutions”

- U.S. Cracks Down on Russian Disinformation Campaign

- The World’s 10 Most Expensive Megaprojects

- Africa’s Largest Refinery Could Soon Be Allowed to Set Its Own Gasoline Prices

- Singapore Raises Its Clean Power Import Target as Demand Soars

- Russia Ships LNG Straight to Storage as Sanctions Bite

- Dow falls 200 points, S&P 500 posts third straight loss as growth fears plague investors: Live updates

- Friday’s jobs report for August is going to be huge. Here’s what to expect

- The Fed won’t save stocks, sell the first rate cut, says Stifel

- Family offices are about to surpass hedge funds, with $5.4 trillion in assets by 2030

- Rising NFL valuations mean massive returns for owners. Here’s how good the investment is

- After its August selloff, the U.S. dollar may face more downside risk ahead

- 2-, 10-year Treasury yields finish at lowest levels in more than a year again after ADP payrolls report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Billions Being Pumped Into Unproven “Climate Solutions”As part of the green transition, governments worldwide are calling on companies to decarbonise their operations. This has led to a wave of investment in carbon offset schemes, carbon capture and storage (CCS) technologies and other “climate solutions” that have not yet been proven to work. Over the past half a decade, there has been great enthusiasm for the mid-term mitigation of greenhouse gas emissions, until we can achieve a global shift away from fossil fuels to renewable alternatives. However, several recent studies suggest that… Read more at: https://oilprice.com/Energy/Energy-General/Billions-Being-Pumped-Into-Unproven-Climate-Solutions.html |

|

Why Poland’s Defense Spending is SoaringAnother overnight Russian missile and drone attack on Ukraine included major strikes on the far western city of Lviv, which lies hundreds of miles from the front lines, which resulted in seven people killed, according to Ukrainian authorities. These stepped-up strikes are widely viewed as retaliation for Kiev forces’ ongoing Kursk cross-border offensive. But given that missiles rained down so close in proximity to Ukraine’s border with Poland, Polish aerial forces were scrambled during the attack. Reuters reports that Polish and allied aircraft… Read more at: https://oilprice.com/Geopolitics/International/Why-Polands-Defense-Spending-is-Soaring.html |

|

U.S. Cracks Down on Russian Disinformation CampaignThe United States accused Russia on September 4 of attempting to influence the 2024 U.S. presidential election through Kremlin-run media outlets and online platforms that are designed to trick Americans into unwittingly consuming Russian propaganda, a Justice Department news release said on September 4. The Kremlin has used media outlets such as RT, formerly Russia Today, and online platforms it backs to target U.S. voters with disinformation, the department said. RT, a major focus of the announcement, is seen as a key part of the Kremlin’s propaganda… Read more at: https://oilprice.com/Geopolitics/International/US-Cracks-Down-on-Russian-Disinformation-Campaign.html |

|

Texas Matterhorn Pipeline Starts Moving Gas Out of the PermianThe Matterhorn natural gas pipeline in Texas has begun moving small amounts of gas from the Permian basin in West Texas toward the Gulf Coast, energy executives at U.S. oil and gas company Permian Resources (NYSE:PR) have revealed. Currently under construction, the Matterhorn will move large volumes of gas that has been trapped in the Permian basin, causing prices at the Waha Hub in West Texas to turn negative. According to executives at Permian Resources, Waha gas prices should more consistently price in positive territory as more gas flows through… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Texas-Matterhorn-Pipeline-Starts-Moving-Gas-Out-of-the-Permian.html |

|

The World’s 10 Most Expensive MegaprojectsMegaprojects have been growing larger globally and many of them have recently centered on the Arab Gulf Region. Construction software company 1Build estimates that before the end of the decade, the world will see the first construction megaproject with a cost estimation exceeding $1 trillion. Right now, there are several projects underway that exceed the size of $100 billion – despite the fact that $10 billion construction proposals were considered to be megaproject just some years ago. As Statista’s Katharina Buchholz reports, out of all nine… Read more at: https://oilprice.com/Energy/Energy-General/The-Worlds-10-Most-Expensive-Megaprojects.html |

|

Libya Resumes Crude Exports as Political Deadlock EasesAn oil tanker has been approved to dock and load crude oil at Libya’s Zueitina port on Friday, engineers told Reuters as the rival governments in the east and west appear to be nearing a compromise in their dispute that has led to a crude production and export halt in the African OPEC producer. The Kriti Samaria has been allowed entry to the oil export terminal of Zueitina, where she is expected to load 600,000 barrels of crude oil. The tanker is allowed to load crude from storage tanks and will be bound for Italy with the cargo, according… Read more at: https://oilprice.com/Energy/Energy-General/Libya-Resumes-Crude-Exports-as-Political-Deadlock-Eases.html |

|

Oil Prices Rise on Large Crude Inventory DrawCrude oil prices moved higher today after the U.S. Energy Information Administration reported an estimated inventory decline of 6.9 million barrels for the week to August 30. A day earlier, the American Petroleum Institute reported its own inventory estimate, which saw these drop by a sizable 7.4 million barrels in the final week of August. Analysts polled by Reuters had expected a draw of around 1 million barrels. The EIA’s previous report pegged the decline in oil inventories at a modest 800,000 barrels, with mixed changes in fuel inventories.… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Rise-on-Large-Crude-Inventory-Draw.html |

|

OPEC+ To Delay Oil Output Hike For 2 MonthsOPEC+ has reached a deal to delay the unwinding of its production cuts that were planned to begin in October, anonymous OPEC+ sources told Bloomberg on Tuesday. The group now plans to ease output cuts beginning in December. OPEC+’s existing plan is to begin the careful process of rolling back the current voluntary production cuts starting next month, which would see 180,000 bpd added back into the market in October. OPEC+ has long maintained that its plan to roll back the cuts was a tentative one and dependent on market balance. While the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-To-Delay-Oil-Output-Hike-For-2-Months.html |

|

Africa’s Largest Refinery Could Soon Be Allowed to Set Its Own Gasoline PricesNigeria could soon let its new refinery, Africa’s biggest crude processing facility, set the price of gasoline it sells to marketers in a major shift of policy control over fuel prices, officials familiar with the plans told Bloomberg on Thursday. As of next month, the Dangote refinery – which has yet to produce gasoline – could begin setting the price of the fuel it is selling to marketers, according to Bloomberg’s anonymous sources. Nigeria has so far imported all the gasoline it consumes. The government has been subsidizing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Africas-Largest-Refinery-Could-Soon-Be-Allowed-to-Set-Its-Own-Gasoline-Prices.html |

|

Gazprom CEO Claims Oil Prices Will Soon StabilizeOil prices will soon stabilize, Gazprom Neft’s CEO Alexander Dyukov said on Thursday, despite current price woes that have cratered the price of Brent to below $74 per barrel. OPEC+ could also choose to make changes to the current production cut deal, which is set to begin the process of unwinding in October, Dyukov said but added that there was no need to rush to any decision. The current OPEC+ deal and the idea that the group could decide to add production back in as planned in October is precisely what is contributing to current oil price… Read more at: https://oilprice.com/Energy/Energy-General/Gazprom-CEO-Claims-Oil-Prices-Will-Soon-Stabilize.html |

|

Biden Unveils $7.3 Billion Investment in Rural America’s ElectricityU.S. President Joe Biden on Thursday unveiled $7.3 billion investment in clean and affordable electricity American rural communities as the president looks to help his Vice President and Democratic presidential candidate Kamala Harris to win voters in rural battleground states. President Biden’s announcement, made in Wisconsin, pledges the multi-billion investment which will be funded by the Inflation Reduction Act (IRA). The investment announced today is the largest investment in rural electrification since the New Deal and is part of President… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Unveils-73-Billion-Investment-in-Rural-Americas-Electricity.html |

|

Singapore Raises Its Clean Power Import Target as Demand SoarsSingapore will seek to import around 6 gigawatts (GW) of low-carbon electricity by 2035, up from an initial target of 4 GW, the Energy Market Authority (EMA) said on Thursday, as the country looks to decarbonize its power sector amid growing demand. “Low-carbon electricity imports are part of Singapore’s overall efforts to decarbonise the power sector, which currently accounts for about 40% of the nation’s carbon emissions,” EMA said in a media release announcing conditional licenses and approvals for more imports of clean… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Singapore-Raises-Its-Clean-Power-Import-Target-as-Demand-Soars.html |

|

Petronas Earnings Drop Amid Oil Market VolatilityPetronas, Malaysia’s state oil and gas giant, on Thursday reported a decline in its first-half profit amid continued market volatility, lower natural gas prices, and higher taxes paid. Petronas’s profit after tax fell by 19% to $7.48 billion (32.4 billion Malaysian ringgit) for the first half of 2024. Revenue increased by 2% from a year earlier thanks to favorable exchange rates. But profits were lower due to market volatility, higher taxation, and deconsolidation of subsidiaries, the company said in its interim report for H1 2024.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Petronas-Earnings-Drop-Amid-Oil-Market-Volatility.html |

|

South Sudan Considers New Pipeline Route to Boost Oil ExportsSouth Sudan and China National Petroleum Corporation (CNPC) are discussing the idea to build an alternative oil pipeline from the landlocked African country to Djibouti via Ethiopia to boost export capabilities, the presidency has said. The statement came during the visit of South Sudan’s President Salva Kiir to China and the CNPC offices to discuss reforms in South Sudan’s oil sector, “including improving oil production through establishing a new refinery and building distribution networks.” Kiir also took part in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Sudan-Considers-New-Pipeline-Route-to-Boost-Oil-Exports.html |

|

Russia Ships LNG Straight to Storage as Sanctions BiteRussia has started shipping LNG from its flagship Arctic LNG 2 project—but not to customers. The shipments have been made from the Arctic project to floating storage units either in Russia or in European waters, as potential customers are unwilling to buy LNG from the facility, which has seen tightened Western sanctions in the past months, the Financial Times reported on Thursday, citing data from ship-tracking providers. Located in the Gydan Peninsula in the Arctic, Arctic LNG 2 was considered key to Russia’s efforts to boost its global… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Ships-LNG-Straight-to-Storage-as-Sanctions-Bite.html |

|

Dow falls 200 points, S&P 500 posts third straight loss as growth fears plague investors: Live updatesStocks struggled Thursday as investors dumped risk assets, and concerns mounted over the outlook for the U.S. economy. Read more at: https://www.cnbc.com/2024/09/04/stock-market-today-live-updates.html |

|

Friday’s jobs report for August is going to be huge. Here’s what to expectThe Wall Street consensus is for nonfarm payrolls growth of 161,000 for August and a slight decline in the unemployment rate to 4.2%. Read more at: https://www.cnbc.com/2024/09/05/fridays-jobs-report-for-august-is-going-to-be-huge-heres-what-to-expect.html |

|

Why the LA Rams are worth $2 billion more than the LA ChargersThe Rams have a recent Super Bowl to their name and the Chargers don’t, but the gap in value is about much more than performance. It’s about stadium economics. Read more at: https://www.cnbc.com/2024/09/05/los-angeles-rams-vs-chargers-value.html |

|

JPMorgan top economist says the Fed should cut rates by a half point this monthJPMorgan chief U.S. economist Michael Feroli believes there is a strong case for the Federal Reserve to speed up the pace of rate cuts. Read more at: https://www.cnbc.com/2024/09/05/jpmorgan-top-economist-says-the-fed-should-cut-rates-by-a-half-point-this-month.html |

|

The Fed won’t save stocks, sell the first rate cut, says Stifel“Fed cuts are a red herring,” Stifel strategists said. “We have our doubts about the currently widespread belief that ‘Fed Cuts = Buy Stocks.’” Read more at: https://www.cnbc.com/2024/09/05/the-fed-wont-save-stocks-sell-the-first-rate-cut-says-stifel.html |

|

Port union voices unanimous support for strike, escalating U.S. supply chain fearsThe risk of East Coast and Gulf Coast port workers going on strike is rising, with billions in trade for industries from energy to autos likely to be upended. Read more at: https://www.cnbc.com/2024/09/05/port-union-voices-full-support-for-strike-raising-us-economic-fears.html |

|

Trump adopts Elon Musk plan for government reform, lays out economic blueprint ahead of debate with HarrisDonald Trump is set to debate Kamala Harris on ABC News on Sept. 10 where the economy will likely be a key focus. Read more at: https://www.cnbc.com/2024/09/05/trump-elon-musk-harris-election-government-efficiency-agency.html |

|

Super PAC backing Kamala Harris to accept crypto donations: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Nemil Dalal, product lead of the Coinbase Developer Platform, discusses Coinbase’s first AI-to-AI crypto transaction. Read more at: https://www.cnbc.com/video/2024/09/05/super-pac-backing-kamala-harris-to-accept-crypto-donations-cnbc-crypto-world.html |

|

Family offices are about to surpass hedge funds, with $5.4 trillion in assets by 2030The number of single-family offices is expected to rise from 8,000 to 10,720 by 2030, according to Deloitte Private. Read more at: https://www.cnbc.com/2024/09/05/family-offices-hedge-funds-5-trillion-assets.html |

|

Harris raised over $300 million in August, extending cash windfallMoney has been pouring into the Democratic presidential campaign since President Joe Biden stepped aside from the 2024 election in July. Read more at: https://www.cnbc.com/2024/09/05/harris-raised-over-300-million-in-august-extending-cash-windfall.html |

|

Rising NFL valuations mean massive returns for owners. Here’s how good the investment isThe returns NFL owners have seen on their initial investments dwarf the gains of traditional stocks over matching time periods. Read more at: https://www.cnbc.com/2024/09/05/rising-nfl-valuations-massive-returns-for-owners.html |

|

CNBC’s Official NFL Team Valuations 2024: Here’s how the 32 franchises stack upCNBC ranks the 32 NFL teams on overall franchise value, calculated by CNBC senior sports reporter Michael Ozanian. How does your football team stack up? Read more at: https://www.cnbc.com/2024/09/05/official-nfl-team-valuations-2024.html |

|

Prosecutors oppose Hunter Biden entering special plea in criminal tax caseHunter Biden, the son of U.S. President Joe Biden, was convicted in June of crimes related to buying a handgun while being a user and addict of illegal drugs. Read more at: https://www.cnbc.com/2024/09/05/hunter-biden-plea-tax-case-trial.html |

|

John Mearsheimer & Ron Paul Invade Washington, Blast Permanent War State: “Social Engineering At The End Of A Rifle Barrel”John Mearsheimer & Ron Paul Invade Washington, Blast Permanent War State: “Social Engineering At The End Of A Rifle Barrel”The man who for decades had been an almost lone Congressional advocate of non-interventionism in American foreign policy is former Congressman Ron Paul. When he ran for president in 2008, he took what the late Justin Raimondo called “libertarian realism” to the masses in the famous moment wherein he tangled with Rudy Giuliani on the GOP debate stage. Paul described that “blowback” resulting from Washington militarism and adventurism abroad was a contributing cause of 9/11. But for a population fed on a steady diet of the world-saving messianism of Wilsonian internationalism, in which America’s mystic destiny is to “make the world safe for democracy” (to quote Raimondo)—Rep. Paul’s policy positions were deemed somehow ‘too radical’ for American voters to swallow at the time (or rather, the mainstream gatekeeping pundits assured their viewers of his “fringe” views). Fast forward to well over another decade of the Read more at: https://www.zerohedge.com/geopolitical/john-mearsheimer-ron-paul-invade-washington-blast-permanent-war-state-social |

|

Wait, What? Prosecutors Urge Hunter Biden Judge To Reject Plea DealUpdate (1505ET): It would appear that Hunter Biden doesn’t have a nicely arranged plea deal with the DOJ after all – as prosecutors have urged the judge in the case to reject his proposal to plead guilty. Of note, Hunter is attempting to plead guilty via an “Alford plea,” which would have to be approved by the prosecution and higher-ups at the DOJ. It appears they were caught off guard.

Developing… … Read more at: https://www.zerohedge.com/political/hunter-biden-flips-11th-hour-guilty-plea-14m-criminal-tax-evasion-case |

|

Fed. Judge Slams New Mexico Officials For Discriminating Against Election WatchdogVia Headline USA, A federal judge said far-left New Mexico election regulators and prosecutors had discriminated against a nonprofit group in refusing access to voter registration rolls.

Maggie Toulouse Oliver / PHOTO: AP Albuquerque-based U.S. District Court Judge James Browning ruled that state election regulators engaged in viewpoint-based discrimination and free speech violations in denying the Voter Reference Foundation access to voter data and by referring the matter to state prosecutors. Browning previously ruled that New Mexico authorities violated public disclosure provisions of the National Voter Registration Act by refusing to provide voter rolls to the same foundation, overriding a provision of a state law tha … Read more at: https://www.zerohedge.com/political/fed-judge-slams-new-mexico-officials-discriminating-against-election-watchdog |

|

Economist Jeffrey Sachs Reveals How Neocons Subverted Russia’s Financial Stabilization In Early 1990sAuthored by Jeffrey Sachs and Matt Taibbi via Racket News, Editor’s note: thanks in large part to Ryan Grim, whose new “Drop Site” Substack can be found here, I rarely recommend subscribing to other sites, but am happy to support Drop Site, which Ryan co-founded with Jeremy Scahill and other Intercept veterans — an Intercept-in-exile. Through them I had an opportunity to interview economist Jeffrey Sachs, and read the eye-opening essay below. In a moment you’ll receive a companion piece that explains what was stunning to me, as a resident of Russia when “Shock Therapy” economic policies credited to Sachs were being applied. Below, Sachs reveals: we never even tried to end the Cold War. How the Neocons Subverted Russia’s Financial Stabilization in the Early 1990s by Jeffrey Sachs In 1989 I served as an advisor to the first post-communist government of Poland, and helped t … Read more at: https://www.zerohedge.com/political/true-shock-economist-jeffrey-sachs-reveals-secret-heart-us-russian-relations |

|

John Lewis brings back ‘never knowingly undersold’The U-turn comes as the High Street retailer tries to revive its fortunes and win back customers. Read more at: https://www.bbc.com/news/articles/c62r9371jddo |

|

UK competition watchdog launches Oasis tickets probeThe Competition and Markets Authority is investigating if Ticketmaster breached consumer protection law. Read more at: https://www.bbc.com/news/articles/cvg3l5j8r8lo |

|

Why this US jobs report matters and what to watchThe report is a key gauge of the US economy – a top issue in the presidential election. Read more at: https://www.bbc.com/news/articles/clyne60ln20o |

|

Bajaj Housing looks well placed to benefit from rising housing demandBajaj Housing Finance plans to raise Rs 6,560 crore via a share issue and offer for sale. Promoter Bajaj Finance will reduce its stake from 100% to 88.7%. BHFL, a fast-growing mortgage lender with robust financials, seeks to leverage increasing mortgage demand. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bajaj-housing-looks-well-placed-to-benefit-from-rising-housing-demand/articleshow/113100307.cms |

|

Tech View: Nifty trajectory looks choppy, support at 25,000-24,900. Here’s how to trade on FridayOn Thursday, Nifty ended slightly lower, forming a small red candle and closing 53.60 points down at 25,145. The short-term trend remains choppy, with key support at 25,000-24,900 and immediate resistance at 25,300, according to Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-trajectory-looks-choppy-support-at-25000-24900-heres-how-to-trade-on-friday/articleshow/113097495.cms |

|

Adani Enterprises’ Rs 400 crore NCD issue oversubscribed by over 200%. Should you apply?Adani Enterprises’ Rs 400 crore debenture issue, launched on Wednesday, saw a 221% oversubscription on its second day, driven by strong retail interest. The non-convertible debentures offer annual yields between 9.25% and 9.90%, closing on September 17. The issue will help repay existing debt and fund general corporate purposes. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/adani-enterprises-rs-400-crore-ncd-issue-oversubscribed-by-over-200-should-you-apply/articleshow/113096346.cms |

|

After its August selloff, the U.S. dollar may face more downside risk aheadThe U.S. dollar has held its ground this week after a sharp decline in August that sent the dollar index to its worst month since November — but strategists at BofA Global Research believe its recent weakness will lead to further downside for the greenback over the next few months. Read more at: https://www.marketwatch.com/story/after-its-august-selloff-the-u-s-dollar-may-face-more-downside-risk-ahead-6e01111c?mod=mw_rss_topstories |

|

2-, 10-year Treasury yields finish at lowest levels in more than a year again after ADP payrolls reportYields on two- and 10-year U.S. government debt closed at their lowest levels in more than a year again on Thursday, after private-sector hiring data pointed to further signs of a slowing labor market. Read more at: https://www.marketwatch.com/story/treasury-yields-hold-near-lowest-levels-in-more-than-a-year-ahead-of-jobs-data-bef1797e?mod=mw_rss_topstories |

|

Trump calls for slashing corporate tax rate — for domestic producers onlyFormer President Donald Trump, in a speech Thursday, proposed lowering the corporate tax rate to 15% “solely for companies that make their product in America,” amending a previous proposal to lower the rate for all U.S. corporations. Read more at: https://www.marketwatch.com/story/trump-calls-for-slashing-corporate-tax-rate-for-domestic-producers-only-1ff7e379?mod=mw_rss_topstories |