Summary Of the Markets Today:

- The Dow closed up 228 points or 0.55%, (Closed at 41,563, New Historic high 41.585)

- Nasdaq closed up 1.13%,

- S&P 500 closed up 1.01%,

- Gold $2,535 down $25.30,

- WTI crude oil settled at $74 down $2.40,

- 10-year U.S. Treasury 3.909 up 0.042 points,

- USD index $101.67 up $0.33,

- Bitcoin $58,806 down $550 or 0.93%,

- Baker Hughes Rig Count: U.S. -2 to 583 Canada +1 to 220

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights

US stocks ended August on a positive note, with all three major indexes posting gains for the month despite earlier volatility. Here are the key points:

Inflation Data and Rate Cut Expectations

-

- The Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge, showed prices increased in line with expectations in July.

- Core inflation rose 0.2% month-over-month and 2.6% annually, matching June’s level.

- This data kept hopes alive for a 0.25% interest rate cut in September, as hinted by Fed Chair Jerome Powell last week.

Market Sentiment

-

- Stocks took an upbeat tone as recession fears receded and expectations grew for the Fed to begin easing monetary policy.

- Investors have moved past the focus on Nvidia’s earnings that dominated earlier in the week.

Looking Ahead

-

- September could bring more volatility, as it has historically been a weak month for stocks.

- The market will be closely watching for further signs of the Fed’s policy pivot and its impact on the economy.

Despite a bumpy August, the stock market ended the month on a high note, with inflation data supporting expectations for a Fed rate cut in September. However, investors should be prepared for potential volatility in the coming month.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Real disposable personal income (DPI), inflation adjusted personal income less personal current taxes, increased 1.1% year-over-year – up from last month’s 1.0%. Real personal consumption expenditures increased 2.7% year-over-year – down from last month’s 2.8%. The PCE price index (aka “inflation”) was unchanged at 2.5%. Excluding food and energy, the PCE price index also was unchanged at 2.6%. The bottom line is that neither consumption or inflation is changing. As I continue to state, there is ZERO evidence that the underlying inflationary forces are moderating today. Every day, consumers are getting poorer as their income is only up 1.1% year-over-year whilst their spending is up 2.8%. Wall Street is pressuring the Federal Reserve to cut rates for the benefit of traders while the real burden of inflation is being born by the working who are made poorer every day.

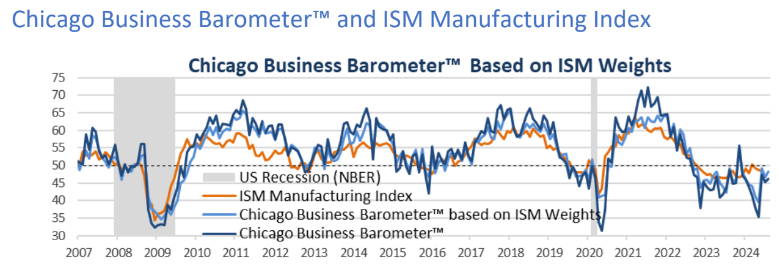

The Chicago Business Barometer moved up 0.8 points in August 2024 to 46.1. Any value below 50 shows contraction. The reason this minor indicator is important is that pundits believe it is indicative of the ISM manufacturing survey which will be released next week. The bottom line here is that manufacturing is not doing well.

Here is a summary of headlines we are reading today:

- EPA Extends Emergency Waiver for Midwest Gasoline Supply

- U.S. Oil, Gas Drilling Activity. Oil Production Slip

- Texas to Consider $5.4 Billion Loans for New Natural Gas Plants

- Libya Is Back on the Brink of Civil War

- Maduro Clings to Power in Venezuela

- Stocks close higher Friday, S&P 500 posts fourth straight winning month: Live updates

- The Fed’s favorite inflation indicator increased 0.2% in July, as expected

- FDA authorizes Novavax’s updated Covid vaccine, paving way for fall rollout

- Ether heads for over 20% loss in August, bitcoin faces fourth weekly loss in five: CNBC Crypto World

- Fewer people are purchasing homes, despite high demand—buyers are in ‘wait and see’ mode

- The Fed’s Fiat Money Is The Real Cause Of Price Inflation

- Extreme Gaslighting: Here Are 7 Signs That The Mainstream Media Is Flat Out Lying To Us About The Economy

- Social Security’s return on investment is a joke compared with state and local pension funds. Where is our money going?

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Romania Seeks Controlling Stake in Moldova’s Giurgiulesti PortThe Romanian government on August 28 approved the start of negotiations with the European Bank for Reconstruction and Development (EBRD) for the purchase of a major stake in Moldova’s Danube River port of Giurgiulesti. The port, located near Moldova’s borders with Romania and Ukraine, is 134 kilometers from the Black Sea and can be accessed by river and sea vessels. Two different port infrastructure entities operate in Giurgiulesti — Giurgiulesti State Port and Giurgiulesti International Free Port. The Moldovan government said on August 28 that… Read more at: https://oilprice.com/Geopolitics/International/Romania-Seeks-Controlling-Stake-in-Moldovas-Giurgiulesti-Port.html |

|

EPA Extends Emergency Waiver for Midwest Gasoline SupplyThe U.S. Environmental Protection Agency (EPA) has renewed for a second time an emergency waiver for the summer spec gasoline requirements in four Midwest states following the supply emergency after the shutdown of ExxonMobil’s Joliet refinery in Illinois in July and early August. The waiver for Illinois, Indiana, Michigan, and Wisconsin lifts the federal anti-smog rules that require more expensive summer gasoline to be sold in the U.S. during the hottest months of the year. The waiver, first issued on July 31 after ExxonMobil’s Joliet… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EPA-Extends-Emergency-Waiver-for-Midwest-Gasoline-Supply.html |

|

U.S. Oil, Gas Drilling Activity. Oil Production SlipThe total number of active drilling rigs for oil and gas in the United States fell again this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 2 to 583 this week, compared to 631 rigs this same time last year. The number of oil rigs stayed the same this week after staying the same in the week prior. Oil rigs now stand at 483—down by 29 compared to this time last year. The number of gas rigs fell by 2 this week to 95, a loss of 19 active gas rigs from this time last year. Miscellaneous rigs stayed… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Oil-Gas-Drilling-Activity-Oil-Production-Slip.html |

|

Drax to Pay £25 Million Following Ofgem Biomass ProbePower station operator Drax has agreed to pay £25m after an investigation by energy watchdog Ofgem found it failed to report data adequately. Drax, which receives hefty Government subsidies from burning biomass wood chips, lacked the necessary data governance and controls in place, according to Ofgem. This meant it did not give the regulator accurate and robust data on the type of wood it uses. Ofgem did not find any evidence that Drax’s biomass is not sustainable or that Drax had been issued renewables obligation certificates (ROCs)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Drax-to-Pay-25-Million-Following-Ofgem-Biomass-Probe.html |

|

Analysts Cut Oil Price Forecasts for Fourth Consecutive MonthWeaker-than-expected Chinese oil demand and high inventories globally have prompted economists and analysts in a Reuters poll to reduce their oil price forecasts for 2024 for the fourth consecutive month. The experts in the monthly Reuters poll now see Brent Crude prices averaging $82.86 per barrel this year, down from $83.66 a barrel expected in the July forecast. WTI Crude, the U.S. benchmark, is now projected to average $78.82 per barrel in 2024, down from $79.22 a barrel expected in last month’s poll. Generally, the analysts polled by… Read more at: https://oilprice.com/Energy/Oil-Prices/Analysts-Cut-Oil-Price-Forecasts-for-Fourth-Consecutive-Month.html |

|

Oil Prices Drop as OPEC+ Considers Increasing Production in OctoberOPEC+ will likely begin unwinding its production cuts in October, six OPEC+ sources told Reuters on Friday. If OPEC+ does decide to start the process of ramping up production in October, it will be largely offset by OPEC member Libya’s significant oil production losses that began this week. Brent crude reacted violently to the anonymous insider news, falling more than 1.5% in mid-day trading, although original losses were already starting to ease at the time of writing. So far, Libya’s production has seen a 700,000 bpd decline as a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Drop-as-OPEC-Looks-to-Increase-Production-in-October.html |

|

ExxonMobil’s Guyana Oil: A Trillion-Dollar Opportunity?There are two main drivers for ExxonMobil, (XOM), in the face of crude’s relatively tight pricing band-low $70’s to low $80’s, for the most the past year. The first is the Guyana, Stabroek production ramp, and the related kerfuffle with Chevron, (CVX) over the nature of their proposed acquisition of Hess, (NYSE: HES). The second is the ongoing digestion of Pioneer assets and acceleration of Permian output toward 1.2 mm BOEPD. XOM is a huge company with a lot of irons in the fire-LNG, chemicals, carbon capture, refining, biofuels,… Read more at: https://oilprice.com/Energy/Energy-General/ExxonMobils-Guyana-Oil-A-Trillion-Dollar-Opportunity.html |

|

Texas to Consider $5.4 Billion Loans for New Natural Gas PlantsThe Public Utility Commission of Texas will review the extension of $5.38 billion worth of low-interest loans to companies planning nearly 10 gigawatts (GW) of new natural gas-fired capacity in a bid to boost generation capacity for ERCOT. The Texas regulator said that it had selected a total of 17 projects of proposed new dispatchable power generation and a total requested loan amount of $5.38 billion under the so-called In-ERCOT Generation Loan program of the Texas Energy Fund. These projects will now advance to the due diligence stage, the Commission… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Texas-to-Consider-54-Billion-Loans-for-New-Natural-Gas-Plants.html |

|

Oil Prices Set for Monthly Decline as Demand Concerns GrowUncertainty continues to dominate oil markets, although demand concerns appear to be overcoming supply shocks to push oil prices toward a monthly loss. Friday, August 30th, 2024It’s been a volatile week for oil markets, with Libya’s oil blockade sending a supply shock through markets before traders refocused on concerns around Chinese demand. At the same time, Iraq has been ratcheting up pressure on Kurdish producers to cut output, and the US has released some constructive macroeconomic data. Early on Friday morning, oil prices had swung… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Set-for-Monthly-Decline-as-Demand-Concerns-Grow.html |

|

Trump Would Repeal Many of Biden’s Clean Energy PoliciesDonald Trump would rescind many of President Joe Biden’s clean energy policies regarding emissions and power plants while speeding up approvals for “hundreds of new power plants,” if he is elected president, the Trump campaign said this week. If elected in November, Trump “will immediately stop all Biden-Harris policies that distort energy markets, limit consumer choice and drive up the costs on consumers on day one,” David Bernhardt, a former Interior Department secretary in Trump’s first term in office said… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Would-Repeal-Many-of-Bidens-Clean-Energy-Policies.html |

|

Libya Is Back on the Brink of Civil WarLibya has had the full attention of the oil markets all week, with the Haftar clan of the east blocking oil production to gain leverage over a battle to control the Central Bank, which controls the country’s oil revenues. The initial shutdown caused a surge in oil prices that were later tamed by a lower-than-expected draw on U.S. crude stockpiles in the weekly inventory report. By Thursday, Libya’s oil production was losing 700,000 barrels per day, from its 1.2 million bpd 2024 production. Output has also been either stopped or reduced… Read more at: https://oilprice.com/Energy/Energy-General/Libya-Is-Back-on-the-Brink-of-Civil-War.html |

|

How to Prepare for a Bull Market in Natural GasAnybody who has ever traded will know that nothing about markets is certain, so the idea of a predictable move is fundamentally flawed. That said, though, there are times in certain markets when it seems clear that a move in a particular direction is coming, it is just a matter of when it actually comes. That is true right now when it comes to US natural gas prices.An analysis of the most basic supply and demand factors suggests that, at some point, natural gas prices are moving higher. The July Short Term Energy Outlook (STEO) from the US Energy… Read more at: https://oilprice.com/Energy/Energy-General/How-to-Prepare-for-a-Bull-Market-in-Natural-Gas.html |

|

Maduro Clings to Power in VenezuelaPolitics, Geopolitics & Conflict While reports are circulating that Israel is claiming to have forced the collapse of the Hamas brigade in Rafah, it remains unclear if the brigade has been defeated or has simply dispersed under the Israeli barrage. On the ever-expanding Russian-Ukrainian frontline, Ukraine continued its incursion into the Russian region of Kursk, while Moscow focused its revenge on eastern Ukraine, both barraging the other’s energy infrastructure. Ukraine has set multiple Russian oil depots on fire and Russia has left… Read more at: https://oilprice.com/Energy/Energy-General/Maduro-Clings-to-Power-in-Venezuela.html |

|

China Reaches Key Clean Energy TargetIraq-Kurdistan Row Escalates Amidst Worsening OPEC+ Compliance- The political standoff between Iraq and the Kurdish Regional Government took a new twist this week after industry associations of oil producers claimed crude production in the semi-autonomous region has reached 350,000 b/d. – Kurdish production is the main reason why Iraq cannot meet its OPEC+ output quota of 3.99 million b/d, increasingly angering other members of the oil group as the total Iraqi supply remains around 4.25 million b/d. – Baghdad warned Erbil that unless the KRG cuts… Read more at: https://oilprice.com/Energy/Energy-General/China-Reaches-Key-Clean-Energy-Target.html |

|

Demand Concerns Counter Libya Outages in Volatile Week for Oil PricesThis week, crude oil prices experienced significant volatility driven by a mix of geopolitical tensions, supply disruptions, and economic concerns. The market’s direction was heavily influenced by events in the Middle East, fluctuations in U.S. economic data, and ongoing issues in Libya, culminating in a mixed outlook by week’s end. Mideast Tensions and Libyan Supply Disruptions Early in the week, crude oil prices surged by over 1% as tensions in the Middle East escalated, with fears that the ongoing conflict in Gaza might disrupt regional oil… Read more at: https://oilprice.com/Energy/Energy-General/Demand-Concerns-Counter-Libya-Outages-in-Volatile-Week-for-Oil-Prices.html |

|

Stocks close higher Friday, S&P 500 posts fourth straight winning month: Live updatesTraders digested the release of the personal consumption expenditures price index for July. Read more at: https://www.cnbc.com/2024/08/29/stock-market-today-live-updates.html |

|

The Fed’s favorite inflation indicator increased 0.2% in July, as expectedThe PCE price index was expected to rise 0.2% in July and 2.5% from a year ago, according to the Dow Jones consensus. Read more at: https://www.cnbc.com/2024/08/30/pce-inflation-july-2024.html |

|

Intel working with bankers to present board with strategic options, sending shares up 8%The advisors are likely to present their findings to Intel’s full board in September, with a variety of options including M&A on the table. Read more at: https://www.cnbc.com/2024/08/30/intel-working-with-bankers-to-present-board-with-strategic-options.html |

|

Vance grilled on high cost of Trump’s new IVF planVance was grilled about how Donald Trump would pay for his new plan to make the government or private insurers cover in vitro fertilization costs. Read more at: https://www.cnbc.com/2024/08/30/trump-ivf-plan-vance-harris-election.html |

|

FDA authorizes Novavax’s updated Covid vaccine, paving way for fall rolloutThe decision comes only a week after it approved a new round of messenger RNA shots from Pfizer and Moderna, which both target an offshoot of JN.1 called KP.2. Read more at: https://www.cnbc.com/2024/08/30/fda-authorizes-novavax-protein-covid-vaccine.html |

|

Where are low-cost airlines cutting back now? New planesSome discount and low-cost airlines are looking to put off big expenses on Read more at: https://www.cnbc.com/2024/08/30/where-are-low-cost-airlines-cutting-back-now-new-planes.html |

|

Alibaba shares rise after it completes three-year regulatory overhaulAlibaba has completed a three-year regulatory “rectification” process after an antitrust fine it received in 2021, China’s market regulator said Friday. Read more at: https://www.cnbc.com/2024/08/30/alibaba-shares-jump-as-it-completes-three-year-regulatory-overhau.html |

|

Ether heads for over 20% loss in August, bitcoin faces fourth weekly loss in five: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Alex Thorn, the head of firmwide research at Galaxy Digital, discusses crypto’s weak performance in August and where markets could be headed in September. Read more at: https://www.cnbc.com/video/2024/08/30/ether-heads-over-20-percent-loss-august-bitcoin-faces-fourth-weekly-loss-in-five-cnbc-crypto-world.html |

|

Lululemon cuts guidance, misses sales estimates after botched product launchLululemon’s growth in its largest market, the Americas, has slowed from the highs it saw last year as it contends with product rollout challenges. Read more at: https://www.cnbc.com/2024/08/29/lululemon-lulu-earnings-q2-2024.html |

|

The sneaky way Big Tech is acquiring AI unicorns without buying the companiesGoogle, Microsoft, Amazon and others have been quietly poaching coveted talent from AI startups, without actually acquiring the companies. Read more at: https://www.cnbc.com/2024/08/30/how-google-microsoft-and-amazon-are-raiding-ai-startups-for-talent.html |

|

Warren Buffett leads Berkshire Hathaway to new heights at age 94“It’s been a matter of a well thought out strategy prosecuted for seven decades with discipline, consistency, and unusual insight,” Oaktree’s Howard Marks said. Read more at: https://www.cnbc.com/2024/08/30/warren-buffett-leads-berkshire-hathaway-to-new-heights-at-age-94.html |

|

Fewer people are purchasing homes, despite high demand—buyers are in ‘wait and see’ modeDespite a pent-up demand for homes, the number of pending home sales has hit a new low. Read more at: https://www.cnbc.com/2024/08/30/fewer-people-are-purchasing-homes-despite-high-demand.html |

|

Elon Musk’s X can proceed to trial in case against Media Matters after Texas judge denies dismissal requestA federal judge in Texas has ruled against Media Matters and its request to dismiss a lawsuit filed by Elon Musk’s X Read more at: https://www.cnbc.com/2024/08/29/judge-rules-against-media-matters-request-to-dismiss-lawsuit-by-x.html |

|

The Fed’s Fiat Money Is The Real Cause Of Price InflationBy Tom Mullen of Mises Wire During election years, incumbent presidents are routinely blamed for every societal ill during the previous four years. And almost nothing is riper for the picking than a significant rise in consumer prices. According to the Bureau of Labor Statistics (BLS), prices are currently increasing at a rate of 3 percent year over year and peaked at 8 percent during President Biden’s term in 2022. That is significantly higher “inflation,” as the BLS defines it, than American consumers have experienced in decades. But as economically harmful as many of President Biden’s policies may have been, no president can cause prices in general to rise. Neither can Congress or “greedy corporations.” Incidentally, “inflation” as an economic term originally meant the creation of new money and credit, not rising prices. Those wishing to confuse the public on which is the cause and which the effect has gradually redefined inflation as rising prices. Check any hard copy Merriam-Webster dictionary printed in the 20th century and see for yourself. Only the Federal Reserve can cause a general rise in prices and only when it creates new US dollars that didn’t previously exist (inflation). To further deflect the blame for rising prices away from the culprit, the public is constantly given other reasons for this phenomenon. Each one of them can be eliminated using a priori reasoning. For example, energy policy is often blamed. … Read more at: https://www.zerohedge.com/markets/feds-fiat-money-real-cause-price-inflation |

|

Zelensky Fires Air Force Commander After Ukraine F-16 Was Downed By Friendly FirePresident Zelensky has fired Ukraine’s longtime Air Force commander Mykola Oleshchuk, according to a just published official government decree issued Friday night (local). The major surprise development comes the day after the Ukrainian government belatedly confirmed that on Monday a US-made F-16 fighter jet was destroyed or crashed amid a major Russian missile and drone assault on the country. The Wall Street Journal had called the crash and death “a major blow for Kyiv” following President Biden’s somewhat reluctant greenlight given for European allies to begin transferring the F-16s last year.

The newly sacked Commander of the aerial forces of the Ukrainian Armed Forces Mykola Oleschuk That aircraft downing, which is surrounded in ambiguity given Kiev initially claimed that it was not shot down, but that it crashed – killed the man … Read more at: https://www.zerohedge.com/geopolitical/zelensky-sacks-air-force-commander-following-reports-f-16was-downed-friendly-fire |

|

Extreme Gaslighting: Here Are 7 Signs That The Mainstream Media Is Flat Out Lying To Us About The EconomyAuthored by Michael Snyder via The Economic Collapse blog, How many times have you heard the mainstream media tell you that the economy is doing just great in recent months? Personally, I have seen the word “booming” used over and over again to describe the economy, and it makes me sick. The level of gaslighting that we are witnessing right now is off the charts. Millions of Americans are sleeping in their vehicles, thousands of businesses are failing all over the nation, and most of the country now believes that the American Dream is no longer attainable.

Read more at: https://www.zerohedge.com/economics/extreme-gaslighting-here-are-7-signs-mainstream-media-flat-out-lying-us-about-economy |

|

‘No’: Harris Says She Won’t Change US Policy On Arming IsraelUS Vice President Kamala Harris’ much anticipated CNN interview which aired Thursday night is only likely to anger her hardcore Progressive base and pro-Palestinian activists, given she pledged to continue to Biden administration’s arming of Israel. Harris emphasized when asked that she won’t change the regular US weapons shipments going to Tel Aviv, amid calls to end them completely over alleged war crimes in the Gaza Strip, and as the reported Palestinian death toll has soared past 40,000 killed. Much of her on the spot commentary was but a rehashing of things she said before the Democratic National Convention: “I’m unequivocal and unwavering in my commitment to Israel’s defense and its ability to defend itself, and that’s not going to change,” Harris told CNN’s Dana Bash.

Read more at: https://www.zerohedge.com/geopolitical/no-harris-says-she-wont-change-us-policy-arming-israel |

|

Workers’ rights to four-day week could be strengthenedEmployees could get greater powers to work their contracted hours over fewer days. Read more at: https://www.bbc.com/news/articles/c4gl5w83z7do |

|

‘We were fined £50 each over £3 extra train fare’Ticket inspectors are urged to treat fare dodgers differently from people who make genuine mistakes. Read more at: https://www.bbc.com/news/articles/c0l841xeyklo |

|

Mining boss opposes staff leaving office for coffeeManaging director of Mineral Resources Chris Ellison wants to “hold staff captive all day long”. Read more at: https://www.bbc.com/news/articles/cdey4zzl529o |

|

Unicommerce Esolutions Q1 results: PAT jumps 31% YoY to Rs 3.5 crore, revenue up 9%Unicommerce Esolutions reported a net profit of Rs 3.5 crore for the quarter ended June 30, 2024, which was up by 31% from Rs 2.7 crore reported by the company in the year ago period. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/unicommerce-esolutions-q1-results-pat-jumps-31-yoy-to-rs-3-5-crore-revenue-up-9/articleshow/112929042.cms |

|

FirstCry Q1 results: Cons loss narrows YoY to Rs 57 crore, revenue jumps 17%Brainbees Solutions, owner of FirstCry, reported a narrower net loss of Rs 57 crore for the quarter ended June 30, 2024, compared to Rs 90 crore a year ago. Revenue rose 17% to Rs 1,652 crore, while EBITDA saw a significant 106% increase. Annual unique transacting customers grew by 15%, and the company expanded its offline presence. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/firstcry-q1-results-cons-loss-narrows-yoy-to-rs-57-crore-revenue-jumps-17/articleshow/112928055.cms |

|

Gold ticks lower as dollar, yields firm after inflation reportGold softened on Friday as the dollar and Treasury yields firmed after U.S. inflation data matched expectations, but the bullion is set for weekly and monthly gains as a September interest rate cut by the U.S. Federal Reserve remains in play. Read more at: https://economictimes.indiatimes.com/markets/commodities/gold-ticks-lower-as-dollar-yields-firm-after-inflation-report/articleshow/112930496.cms |

|

Social Security’s return on investment is a joke compared with state and local pension funds. Where is our money going?Social Security should be invested like every other rational pension fund across America and around the world. Read more at: https://www.marketwatch.com/story/social-securitys-return-on-investment-is-a-joke-compared-with-state-and-local-pension-funds-where-is-our-money-going-3ac03eeb?mod=mw_rss_topstories |

|

‘I’m conflicted’: I have two sons — one is a hard worker with kids and the other is a ‘carefree’ actor. Should I leave the ‘family man’ more money in my will?“The money could be going to my grandkids.” Read more at: https://www.marketwatch.com/story/im-conflicted-about-the-resentment-this-could-cause-i-have-one-son-whos-a-hard-worker-with-kids-the-other-is-a-struggling-actor-should-i-leave-the-family-man-more-money-fbcad67c?mod=mw_rss_topstories |

|

Why Libya could bolster OPEC+ plans for oil productionOil prices fell in August, raising uncertainty over whether major oil producers will gradually pare back voluntary crude production cuts as planned starting on Oct. 1. Read more at: https://www.marketwatch.com/story/why-libya-could-bolster-opec-plans-for-oil-production-dc16cc94?mod=mw_rss_topstories |