Summary Of the Markets Today:

- The Dow closed up 244 points or 0.59%, (Closed at 41,335, New Historic high 41.578)

- Nasdaq closed down 0.23%,

- S&P 500 closed flat 0.00%,

- Gold $2,555 up $17.20,

- WTI crude oil settled at $76 up $1.43,

- 10-year U.S. Treasury 3.867 up 0.026 points,

- USD index $101.38 up $0.28,

- Bitcoin $59,482 up $379 or 0.64%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights

The Dow Jones Industrial Average closed at a new record high marking its third record close this week. Key factors were:

Nvidia Earnings

-

- Nvidia’s quarterly profit and revenue guidance topped estimates, but fell short of high expectations.

- This raised questions about whether the AI boom has peaked.

- Nvidia shares ended down around 6% despite Wall Street remaining bullish on the stock.

You will find more infographics at Statista

Economic Data

-

- Q2 GDP growth was revised up to 3% annualized, higher than the previous 2.8% estimate.

- Weekly jobless claims came in at 231,000, lower than expected.

Other Earnings

-

- Salesforce shares rose after beating earnings expectations.

- Best Buy shares jumped up to 17% on better-than-expected results.

- Dollar General shares plunged 30% after cutting its full-year outlook.

The mixed market performance reflects investors assessing Nvidia’s earnings alongside stronger-than-expected economic data, as they also consider the Federal Reserve’s future interest rate decisions.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of CEO changes at U.S. companies fell 36% to 149 in July from 234 in June. It is down 24% from 197 CEO exits recorded in the same month last year. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. stated:

The labor market is softening, and companies are finding ways to lower costs. Companies have made leadership changes in response to AI, the political landscape, and international events causing substantial impacts on business conditions.

The second estimate of real gross domestic product (GDP) increased at an annual rate of 3.1% year-over-year in the second quarter of 2024. Using a year-over-year metric, there was no change in growth between the advance and second estimates in 2Q2024. In the first quarter, real GDP increased at 2.9% year-over-year. The increase in real GDP primarily reflected increases in consumer spending, private inventory investment, and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased . The price index for gross domestic purchases increased 2.6% year-over-year in the second quarter – up from the 2.4% year-over-year in 1Q2024.

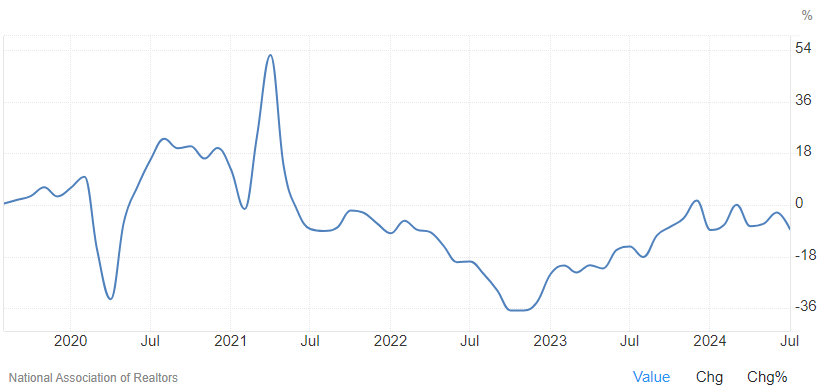

Pending home sales (a forward-looking indicator of home sales based on contract signings) slipped to 70.2 in July, the lowest reading since the index began tracking in 2001. Year over year, pending transactions were down 8.5%. An index of 100 is equal to the level of contract activity in 2001. The existing home market remains depressed – but note that it is not a component of GDP. NAR Chief Economist Lawrence Yun added:

A sales recovery did not occur in midsummer. The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election.

In the week ending August 24, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 231,500, a decrease of 4,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 236,000 to 236,250. There is little evidence of a potential recession in this data.

Here is a summary of headlines we are reading today:

- Beijing and Washington Clash Over Russia Sanctions

- UK Plans New Environmental Guidance for North Sea Oil and Gas Firms

- How China is Circumventing Sanctions to Buy Iranian Oil

- CNOOC Expects Oil Prices to Remain Rangebound Between $75 and $85

- Traders Concerned About Near-Term Risks for European Gas Supply

- Dow rises 200 points for fresh record close, Nasdaq falls as Nvidia shares tumble: Live updates

- The Fed’s preferred inflation indicator is out Friday. Here’s what to expect

- Disillusioned crypto investors are struggling behind bitcoin’s ETF success

- Nvidia shares fall despite earnings beating estimates

- Bitcoin drifts back to $60,000, trimming the week’s losses: CNBC Crypto World

- Apple, Nvidia Eye Investments In OpenAI As ChatGPT Hits $100 Billion Valuation

- Treasury yields rise after latest batch of U.S. economic data

- With earnings season behind us, the stock market is aiming at new all-time highs

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Can Norway Remain Europe’s Top Gas Supplier While Meeting Climate Goals?Norway has been investing heavily both in its renewable energy infrastructure as well as continuing to produce huge quantities of oil and gas for several years. However, with greater pressure from international organisations to curb oil production, a lack of new exploration activities, and worries of a decrease in global demand for fossil fuels in the coming decades, Norway’s oil production could begin to decline from as early as 2025. Norway’s upstream regulator, the Norwegian Offshore Directorate (NOD), reported this month that it… Read more at: https://oilprice.com/Energy/Energy-General/Can-Norway-Remain-Europes-Top-Gas-Supplier-While-Meeting-Climate-Goals.html |

|

Beijing and Washington Clash Over Russia SanctionsBeijing called recent U.S. sanctions on its companies over the Ukraine war “illegal and unilateral” and “not based on facts,” as White House national-security adviser Jake Sullivan arrived in China for several days of high-level talks. Here’s what’s going on. Finding Perspective: Washington has repeatedly warned Beijing over its support for Russia’s defense industrial base and has already issued hundreds of sanctions aimed at curbing Moscow’s ability to exploit certain technologies for military purposes. The… Read more at: https://oilprice.com/Geopolitics/International/Beijing-and-Washington-Clash-Over-Russia-Sanctions.html |

|

Liberty Steel’s Polish Plant Faces BankruptcyVia Metal Miner Big changes seem on the way for the Polish steel industry. Recently, local steel news outlets reported that several companies have expressed interest in leasing Polish plate producer Huta Cz?stochowa, which Liberty Steel acquired in 2021, after a local court declared the plant bankrupt in July. Among the potential suitors for the plant is the Ukrainian metals and mining group Metinvest. “We can confirm that we were invited to consider leasing the steel plant, with the possibility of later acquiring it,” daily… Read more at: https://oilprice.com/Metals/Commodities/Liberty-Steels-Polish-Plant-Faces-Bankruptcy.html |

|

UK Plans New Environmental Guidance for North Sea Oil and Gas FirmsThe UK government plans to introduce new environmental guidance for oil and gas companies operating in the North Sea, following the landmark ruling of the Supreme Court which requires regulators to consider the Scope 3 emissions of future projects when approving them. The UK Supreme Court ruled in June that a local council unlawfully granted approval to an onshore oil drilling project as planners must have considered the emissions from the oil’s future use as fuels, in a landmark case that could upset new UK oil and gas project plans. The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Plans-New-Environmental-Guidance-for-North-Sea-Oil-and-Gas-Firms.html |

|

How China is Circumventing Sanctions to Buy Iranian OilChina’s imports of Iranian oil are poised to reach a record 1.75m b/d this month, data from Kpler show. That will surpass the previous peak of 1.66m b/d set in October 2023, according to Kpler data that extends back to January 2013, and is almost 50% higher compared with 1.24m b/d last month. Shipments into Rizhao and Dalian significantly higher m/m, said Muyu Xu, an analyst with Kpler “Chinese teapots see refining margins slightly improving, they now have stronger motivation to ramp up production and therefore need more feedstock,”… Read more at: https://oilprice.com/Energy/Oil-Prices/How-China-is-Circumventing-Sanctions-to-Buy-Iranian-Oil.html |

|

Marathon Oil Shareholders Approve Megadeal Conoco AcquisitionShareholders in Marathon Oil have approved a ~$16 billion acquisition by ConocoPhillips, Marathon Oil said in a Thursday statement, with the deal expected to close in the fourth-quarter of this year, pending a Federal Trade Commission review, Reuters reports. Conoco and Marathon Oil struck their acquisition deal in May when Conoco agreed to take over the target company in a deal worth $22.5 billion, including the assumption of $5.4 billion in debt. Earlier this month, a Marathon Oil shareholder filed a lawsuit seeking to stop the ConocoPhillips… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Marathon-Oil-Shareholders-Approve-Megadeal-Conoco-Acquisition.html |

|

Shell To Slash Exploration Workforce by 20%: ReutersOil supermajor Shell (NYSE:SHEL) is planning to reduce its oil and gas exploration and development staff by 20%, according to an exclusive report from Reuters, citing intentions to cut costs to what has long been a wildly profitable segment of the oil giant’s business. The new cuts follow Shell’s earlier moves to reduce its workforce and costs in the renewable and low-carbon segments. According to Reuters, citing unnamed company sources, Shell is restructuring its operations, targeting exploration, well development and subsurface… Read more at: https://oilprice.com/Energy/Energy-General/Shell-To-Slash-Exploration-Workforce-by-20-Reuters.html |

|

Lukoil’s Net Profit Rises on Higher Oil SalesLukoil booked a net profit of $6.4 billion (590.2 billion Russian rubles) for the first half of 2024, up by 4.6% from a year earlier, on the back of higher sales volumes, the second-largest Russian oil producer said on Thursday. Lukoil’s net profit figure beat an average analyst estimate in a poll by the Russian news agency Interfax. Revenues from sales surged by 20% to $47.3 billion (4.333 trillion rubles) amid higher prices and increased sales. Operating profit and pre-tax profit at Lukoil also rose in the first half of the year. Despite… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lukoils-Net-Profit-Rises-on-Higher-Oil-Sales.html |

|

CNOOC Expects Oil Prices to Remain Rangebound Between $75 and $85China’s CNOOC Ltd. predicts that oil prices will remain between $75 and $85 per barrel for the second half of 2024, in line with current market trends. Brent crude is currently trading at $79.51 per barrel, up $0.86 (+1.09%) on the day. CNOOC, one of China’s leading offshore oil and gas producers, sees fossil fuels as crucial for global energy stability in the foreseeable future, despite the global push towards renewable energy sources, according to CNOOC executives. The state-owned company expects to produce between 700 million and 720 million… Read more at: https://oilprice.com/Energy/Oil-Prices/CNOOC-Expects-Oil-Prices-to-Remain-Rangebound-Between-75-and-85.html |

|

Pipeline Politics Is Forcing Kurdistan to Sell Oil at a DiscountCrude oil production in Iraq’s semi-autonomous region of Kurdistan is currently about 350,000 barrels per day (bpd), but it all goes to local buyers at steep discounts as the key export route via a pipeline to Turkey’s Mediterranean coast continues to be shut in. Kurdistan’s crude output is now around 50,000 bpd lower compared to production levels before March 2023, when the pipeline to Turkey’s Ceyhan was closed due to an international dispute, according to figures provided to Argus by Myles Caggins, a spokesperson for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Pipeline-Politics-Is-Forcing-Kurdistan-to-Sell-Oil-at-a-Discount.html |

|

China Is Rethinking Its Russian Pipeline PlansBuddies in war, Russia and China appear to be frenemies when it comes to energy. As a result, Turkmenistan may be the primary beneficiary of Beijing’s need for more natural gas. Just a few months ago, Russian and Chinese officials were saying that an agreement to build a new gas pipeline connecting the two countries, dubbed Power of Siberia 2, was imminent. Now, it appears those plans have been put on hold. A recent decision by Mongolia’s government not to include funding for pipeline construction in a five-year economic plan is widely… Read more at: https://oilprice.com/Energy/Natural-Gas/China-Is-Rethinking-Its-Russian-Pipeline-Plans.html |

|

Earnings at China’s State Majors Signal Tepid Demand for Oil ImportsChina’s biggest state-owned oil and gas corporations reported this week record-high profits, but the outperforming upstream divisions at all majors masked their weak refining businesses which reflected tepid Chinese fuel demand. China’s crude oil imports fell by 2.4% between January and July compared to the same period of 2023. Oil imports in July were down by 12% from June and by % from July 2023, raising concerns about the country’s economic health and future oil demand. The earnings reports of the top Chinese oil and gas firms, Sinopec,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Earnings-at-Chinas-State-Majors-Signal-Tepid-Demand-for-Oil-Imports.html |

|

Traders Concerned About Near-Term Risks for European Gas SupplyThe futures curve of Europe’s benchmark natural gas prices suggests that traders are now more concerned about immediate supply risks than the upcoming winter heating season. The premium of the October contract to the front-month September futures contract has been smaller this year compared to last year, Bloomberg notes. The narrower premium signals that supply concerns at the end of the summer, due to maintenance in Norway and the Russia-Ukraine war, are now the center of traders’ attention, rather than the next winter season. Europe… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Traders-Concerned-About-Near-Term-Risks-for-European-Gas-Supply.html |

|

China Invested $676 Billion in Its Energy Transition Last YearChina invested a total of $676 billion in its energy transition last year, the Chinese authorities said on Thursday in a white paper on the country’s renewable energy market and energy pathways forward. China led global investments in low-carbon energy in 2023, China’s State Council Information Office said in the white paper “China’s Energy Transition”. Since 2013, China has been responsible for over 40% of the annual additions to global renewable energy capacity. Last year, China’s newly installed renewables capacity… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Invested-676-Billion-in-Its-Energy-Transition-Last-Year.html |

|

Houthis to Allow Salvage Crews to Access the Oil Tanker They Hit in the Red SeaThe Iran-aligned Houthis have agreed to allow salvage crews including rescue ships and tugboats to access an oil tanker that the Houthis hit with a missile in the Red Sea earlier this month. “Several countries have reached out to ask Ansarullah (the Houthis), requesting a temporary truce for the entry of tugboats and rescue ships into the incident area,” Iran’s mission to the United Nations in New York said, as carried by Reuters. The Houthi movement has agreed to this request, “in consideration of humanitarian and environmental… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Houthis-to-Allow-Salvage-Crews-to-Access-the-Oil-Tanker-They-Hit-in-the-Red-Sea.html |

|

Dow rises 200 points for fresh record close, Nasdaq falls as Nvidia shares tumble: Live updatesInvestors looked to recover from declines seen in the previous session and shake off a pullback in Nvidia. Read more at: https://www.cnbc.com/2024/08/28/stock-market-today-live-updates-.html |

|

The Fed’s preferred inflation indicator is out Friday. Here’s what to expectThe Commerce Department at 8:30 a.m. ET will release its personal consumption expenditures price index. Read more at: https://www.cnbc.com/2024/08/29/the-feds-preferred-inflation-indicator-is-out-friday-what-to-expect.html |

|

Intel CEO Gelsinger says he respects ‘skepticism’ from investors as chipmaker’s struggles persistCEO Pat Gelsinger acknowledged investors’ concerns about the chipmaker at an event on Thursday. Read more at: https://www.cnbc.com/2024/08/29/intel-intc-gelsinger-skepticism-activist-layoffs.html |

|

OpenAI and Anthropic agree to let U.S. AI Safety Institute test and evaluate new modelsThe U.S. AI Safety Institute on Thursday announced it had come to a testing and evaluation agreement with OpenAI and Anthropic. Read more at: https://www.cnbc.com/2024/08/29/openai-and-anthropic-agree-to-let-us-ai-safety-institute-test-models.html |

|

Disillusioned crypto investors are struggling behind bitcoin’s ETF successCrypto investors are having a mild existential crisis as demand for the young asset class dries up in the midst of a bull market. Read more at: https://www.cnbc.com/2024/08/29/disillusioned-crypto-investors-are-struggling-behind-bitcoins-etf-success.html |

|

JD Vance urges billionaire Peter Thiel to back Trump campaign: ‘Get off the sidelines’Thiel previously said he would not donate to a super PAC supporting Trump this year. in 2022, Thiel gave $15 million to help get Sen. JD Vance elected in Ohio. Read more at: https://www.cnbc.com/2024/08/29/trump-jd-vance-peter-thiel.html |

|

Affirm shares surge 34% and head for best day in three years after earnings beatAffirm shares soared Thursday after the provider of buy now, pay later loans reported better-than-expected quarterly results. Read more at: https://www.cnbc.com/2024/08/29/affirm-shares-surge-33percent-and-head-for-best-day-in-three-years.html |

|

Gap beats earnings and revenue estimates, hikes profit margin outlook as results are posted earlyGap beat earnings and revenue estimates, as it posted its fiscal second-quarter results early. Read more at: https://www.cnbc.com/2024/08/29/gap-q2-earnings-shares-halted-after-apparent-early-release.html |

|

Nvidia shares fall despite earnings beating estimatesNvidia shares fell on Thursday despite its fiscal second-quarter results beating estimates. Read more at: https://www.cnbc.com/2024/08/29/nvidia-nvda-shares-fall-after-earnings-beat-estimates.html |

|

Bitcoin drifts back to $60,000, trimming the week’s losses: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Rajarshi Gupta, head of machine learning at Coinbase, discusses the company’s plan to use AI to fight downtime during periods of market volatility. Read more at: https://www.cnbc.com/video/2024/08/29/bitcoin-drifts-back-to-60000-trimming-the-weeks-losses-cnbc-crypto-world.html |

|

‘Vigorous give and take’: U.S. security advisor discusses economic curbs in rare trip to ChinaU.S. national security advisor Jake Sullivan said he raised concerns about the country’s focus on economic security in meetings with Chinese officials. Read more at: https://www.cnbc.com/2024/08/29/chinas-xi-jinping-meets-with-us-national-security-advisor-jake-sullivan.html |

|

Dell attempts to sell cybersecurity firm SecureWorks again, sources tell ReutersDell explored a sale of SecureWorks in 2019, part of an effort to trim Dell’s debt pile, Reuters reported at the time. Read more at: https://www.cnbc.com/2024/08/29/dell-attempts-to-sell-cybersecurity-firm-secureworks-again-sources-tell-reuters.html |

|

Apple, Nvidia Eye Investments In OpenAI As ChatGPT Hits $100 Billion ValuationUpdate: Bloomberg now reports that Nvidia has discussed investing in Microsoft-backed OpenAI through a new funding round. This comes one hour after WSJ reported that Apple was also discussing investing in Sam Altman’s chatbot startup.

* * * Less than one day after the Wall Street Journal reported that venture capital firm Thrive Capital would invest at least a billion dollars in Microsoft-backed OpenAI at (or around) $100 billion valuation, new reports indicate that Apple is also in talks to invest in the chatbot startup.

WSJ reports that the world’ … Read more at: https://www.zerohedge.com/technology/apple-eyes-investment-openai-chatgpt-hits-100-billion-valuation |

|

First US-Made F16 Jet Downed In Ukraine During Combat, Pilot KilledUS and Ukrainian officials have revealed to The Wall Street Journal that a F-16 fighter jet has crashed during combat in Ukraine’s skies – a significant first – which comes just weeks after an initial batch of some one dozen of the American-made aircraft were transferred to Kiev’s armed forces. “The pilot, Oleksiy Mes, died while helping to repel a massive Russian missile attack on Monday, the officials said,” WSJ writes. “Initial reports indicate the jet wasn’t shot down by enemy fire, U.S. officials said.”

Illustrative photo: Ukrainian pilots complete F-16 training in the United States, Getty Images That missile and drone attack had been one of the largest since the war’s start in Feb. 2022, targeting 15 out of Ukraine’s 24 oblasts, and taking out vita … Read more at: https://www.zerohedge.com/geopolitical/first-us-made-f16-jet-downed-ukraine-during-combat-pilot-killed |

|

Peter Schiff: Fed’s Pivot Is MisguidedVia SchiffGold.com, In this episode, Peter analyzes the Fed’s conference in Jackson Hole and the pivot Jerome Powell signaled in figure monetary policy. He also dives into the hot political topics from this week, namely, the Democratic National Convention and RFK Jr.’s endorsement of Donald Trump for President. Despite what Powell says, Peter is convinced there’s not sufficient evidence to support rate cuts in September:

The Fed’s dual mandate to fight both inflation and unemployment is proving problematic, since improving on … Read more at: https://www.zerohedge.com/markets/peter-schiff-feds-pivot-misguided |

|

AI SPAC iLearningEngines Plunges 55% After Hindenburg Alleges “Artificial Partners And Artificial Revenue”Shares of SPAC iLearningEngines, Inc. are down more than 50% heading into the cash open after short seller Hindenburg Research alleged that the artificial intelligence company has “artificial partners and artificial revenue”. In the short seller’s second report this week, following its piece on Super Micro Computer, the firm headed by Nathan Anderson said that iLearningEngines “was borderline insolvent when it merged with a desperate SPAC sponsor that was quickly running out of time to get a deal done.” The report focuses on an unnamed “Technology Partner” crucial to AILE’s business, stating “nearly all of company’s revenue and expenses (~96% of revenue and ~100% of CoGs in 2022) seem to be run through an undisclosed related party, an unnamed ‘Technology Partner’.” The company then told the SEC the technology partner was not a related party in a comment letter, Hindenburg says. It alleges that it “unmasked” the partner to be a related party…one which, at one point, shared a listed address with AILE’s CEO’s home residence. Read more at: https://www.zerohedge.com/markets/ai-spac-ilearningengines-plunges-more-50-after-hindenburg-alleges-artificial-partners-and |

|

Weekend strikes by LNER train drivers called offSome 450 train drivers had been due to walk out this weekend before the dispute was resolved. Read more at: https://www.bbc.com/news/articles/cy4lwde3l73o |

|

Fuel duty cut could be scrapped, says RACThe motoring group claims retailers not drivers have benefitted from lower tax on petrol and diesel. Read more at: https://www.bbc.com/news/articles/cm2nrneym82o |

|

Over 2,000 workers apply for Tata Steel redundancyTata asked staff to express interest in taking voluntary redundancy as part of a cut of 2,800 jobs. Read more at: https://www.bbc.com/news/articles/cj62d26r58zo |

|

Need to create balance between tech and human touch in mutual fund space: Nilesh Shah“I have to create a balance where I am able to cater to both. Not everyone has a smartphone. Everyone is not legitimately smart. There exists both– India as well as Bharat. My technology should be such that it can work on both sides,” Shah, who was participating in a panel discussion at the Global Fintech Fest 2024 here, said. Read more at: https://economictimes.indiatimes.com/mf/mf-news/need-to-create-balance-between-tech-and-human-touch-in-mutual-fund-space-nilesh-shah/articleshow/112902885.cms |

|

Top 10 MF schemes of 2024 and their star stocks, do you own any?ETMarkets’ latest MF analysis reveals CY24’s top 10 mutual fund schemes and their standout stocks, showcasing successful investment strategies and promising sectors for investors. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/top-10-mf-schemes-of-2024-and-their-star-stocks-do-you-own-any/slideshow/112891470.cms |

|

Quant Mutual Fund dominates list of schemes with negative returns in one monthThe first eight funds in the list of losers were from Quant Mutual Fund. Quant ELSS Tax Saver Fund lost 1.08% in the last one month period. Quant Value Fund lost around 1.03% in the said period. Quant Large Cap Fund and Quant Mid Cap Fund lost 0.97% and 0.91% respectively. Read more at: https://economictimes.indiatimes.com/mf/analysis/quant-mutual-fund-dominates-list-of-schemes-with-negative-returns-in-one-month/articleshow/112895245.cms |

|

Treasury yields rise after latest batch of U.S. economic dataBond yields were down slightly Thursday morning as traders awaited a report on the U.S. jobs market. Read more at: https://www.marketwatch.com/story/treasury-yields-ease-ahead-of-latest-u-s-jobless-claims-report-ea2d4558?mod=mw_rss_topstories |

|

The ‘Low-Wage 100’ spend more on share buybacks that enrich executives than on their businesses. Lawmakers are taking note.A new report on the 100 S&P 500 companies with the lowest median pay finds the buyback machine is still in overdrive. Read more at: https://www.marketwatch.com/story/the-low-wage-100-spend-more-on-share-buybacks-that-enrich-executives-than-on-their-businesses-lawmakers-are-taking-note-e9515a44?mod=mw_rss_topstories |

|

With earnings season behind us, the stock market is aiming at new all-time highsElection year and seasonal trading patterns favor the bulls. Read more at: https://www.marketwatch.com/story/with-earnings-season-behind-us-the-stock-market-is-aiming-at-a-breakout-d552592d?mod=mw_rss_topstories |